Property Management Projection Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Cash Flow Forecast

- Cohort Modeling

- Dynamic Fee Options

REAL ESTATE EXCEL DESCRIPTION

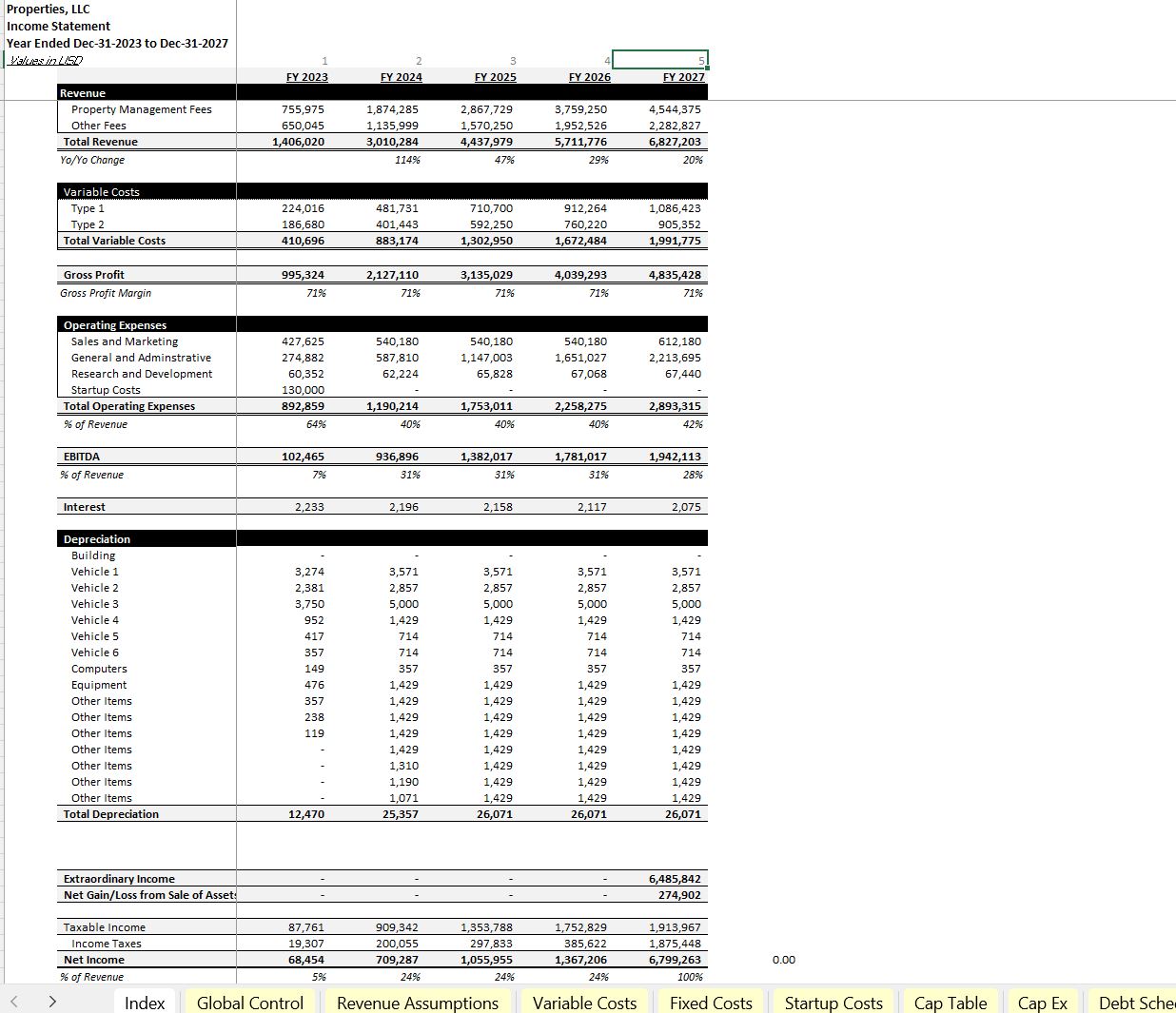

Running a property management company is very similar to B2B SaaS. There are some caveats with the way you can structure your fees for providing property management services, but it is a true marriage of SaaS and Real Estate. This financial model makes it easy to create a cash flow forecast as well as conduct all sorts of feasibility analysis based on assumption configurations / pricing strategies, volume of new property owners signing on, and their attributes (average rent, rent growth of your customers).

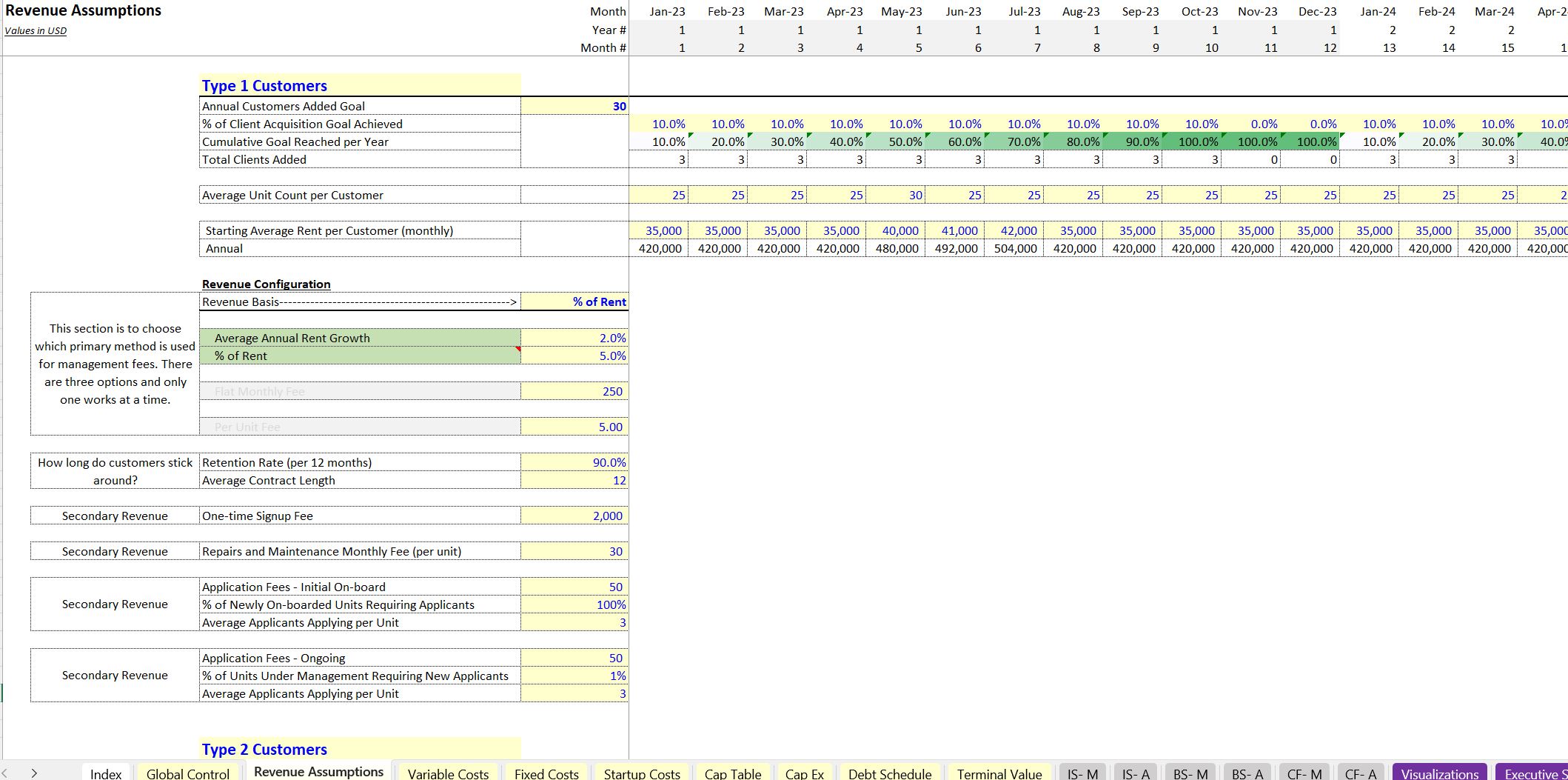

The model goes out for up to a 5-year period and the revenue assumptions have monthly granularity. I let the user define an annual new customer goal and the percentage of that goal that is estimated to be achieved each month. You don't necessarily have to make each year 100% either, that annual goal could be what you hope to gain by year 5 and so the earlier years maybe you achieve 30% or 50% of that or what have you. The model is really flexible for defining how new customer growth happens.

Some more assumptions the user can define per month include the average number of units per new property owner and the average monthly rent per new property owner. This will drive revenues and variable costs.

I built in three options for how you collect revenue and they are mutually exclusive. They are:

• % of gross monthly rents

• Flat fee per unit

• Flat monthly fee

The most common revenue logic I see is a percentage of monthly rents (make sure in your contracts you stipulate it is of total potential rent so even if tenants don't pay, you are still getting paid for tenant).

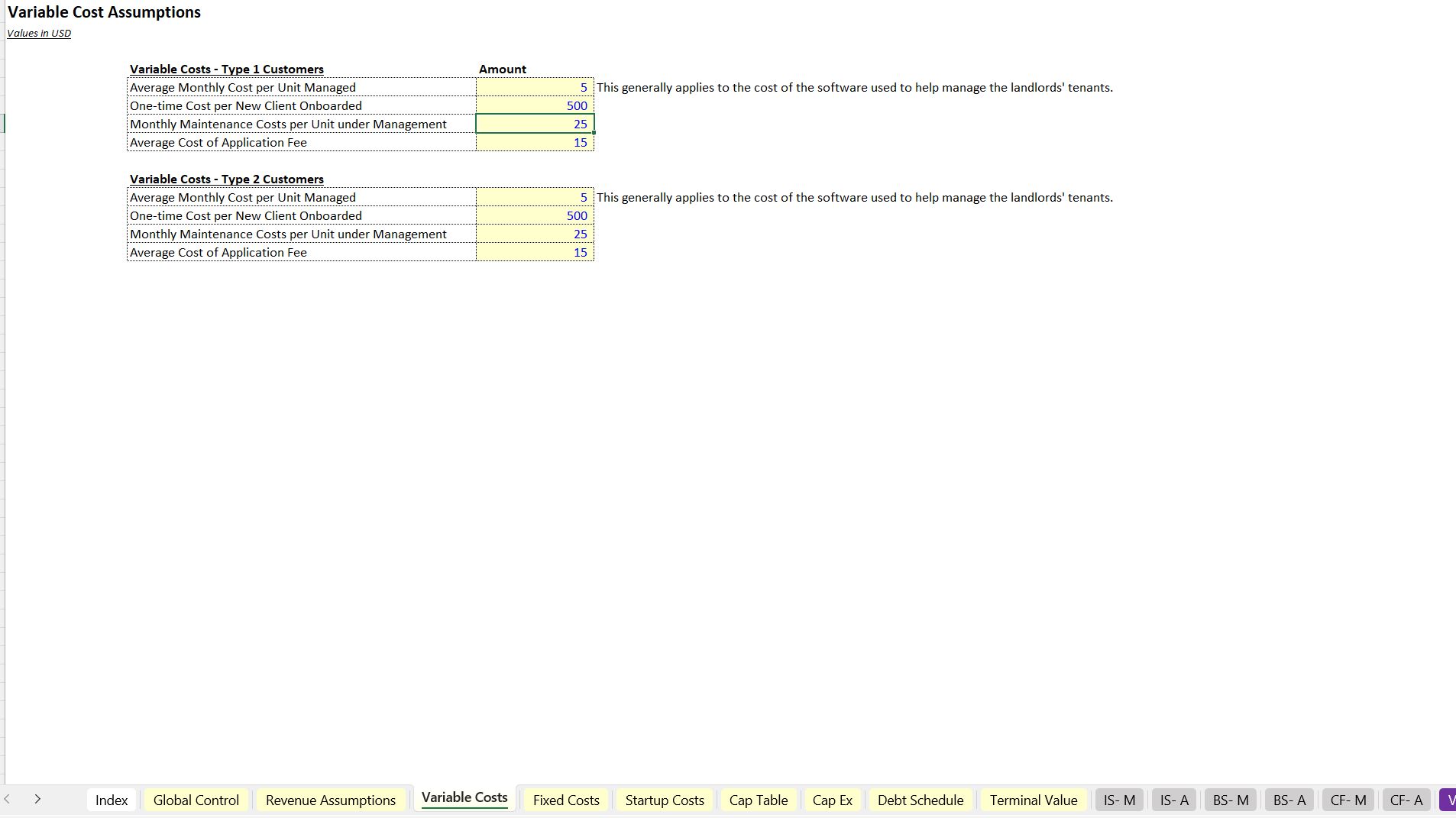

There are other revenue streams beyond the base property management fee that can be configured as well. You can charge a one-time setup fee per new customer on-board, a monthly repair and maintenance fee (dollar value per unit), and application fees. Since there will be related variable costs to those revenue streams, the related cost can also be defined for each on a per unit basis.

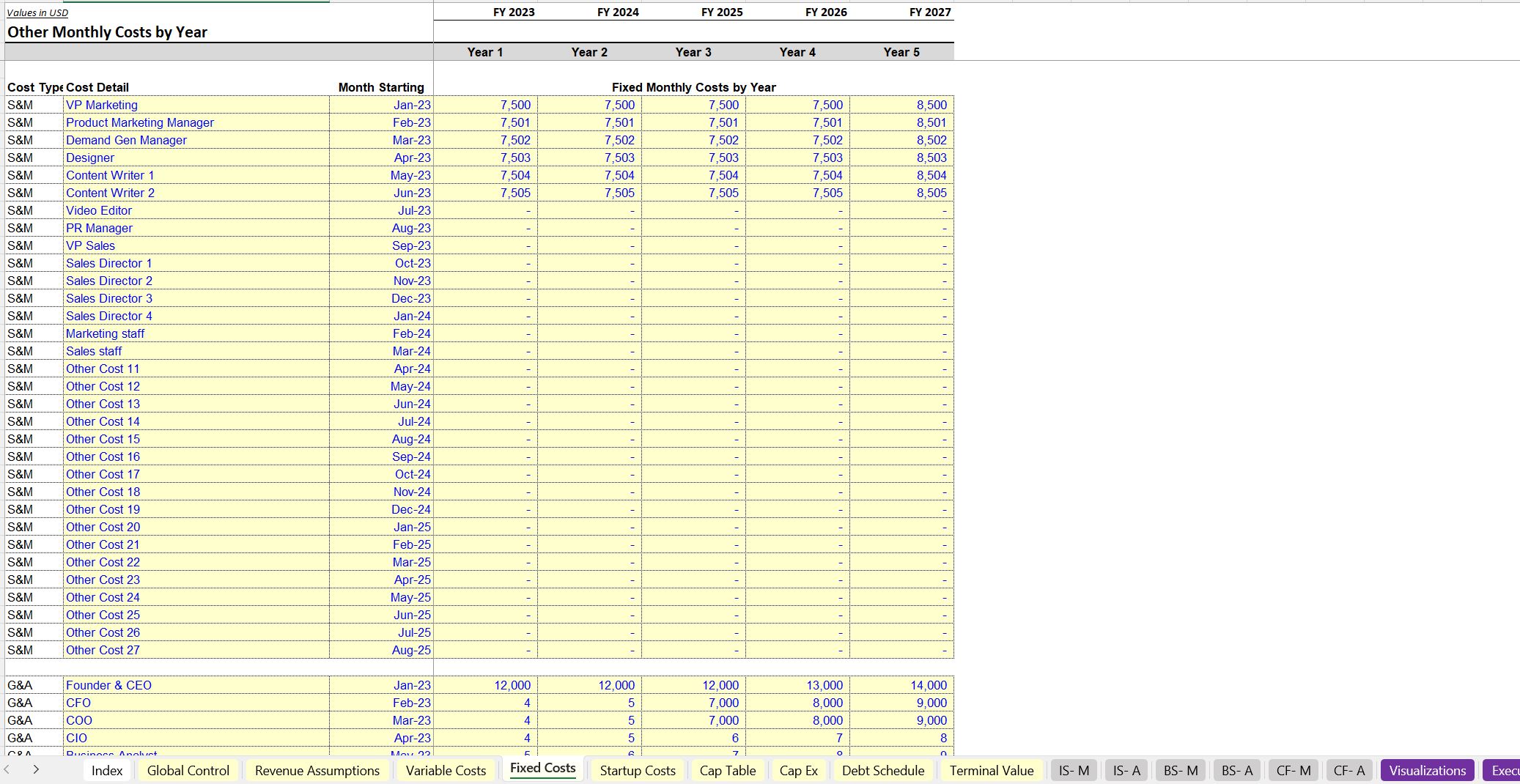

You also have fixed monthly expenses for general operations that can be defined by their monthly amount in each of the 5 years. The start month is also editable.

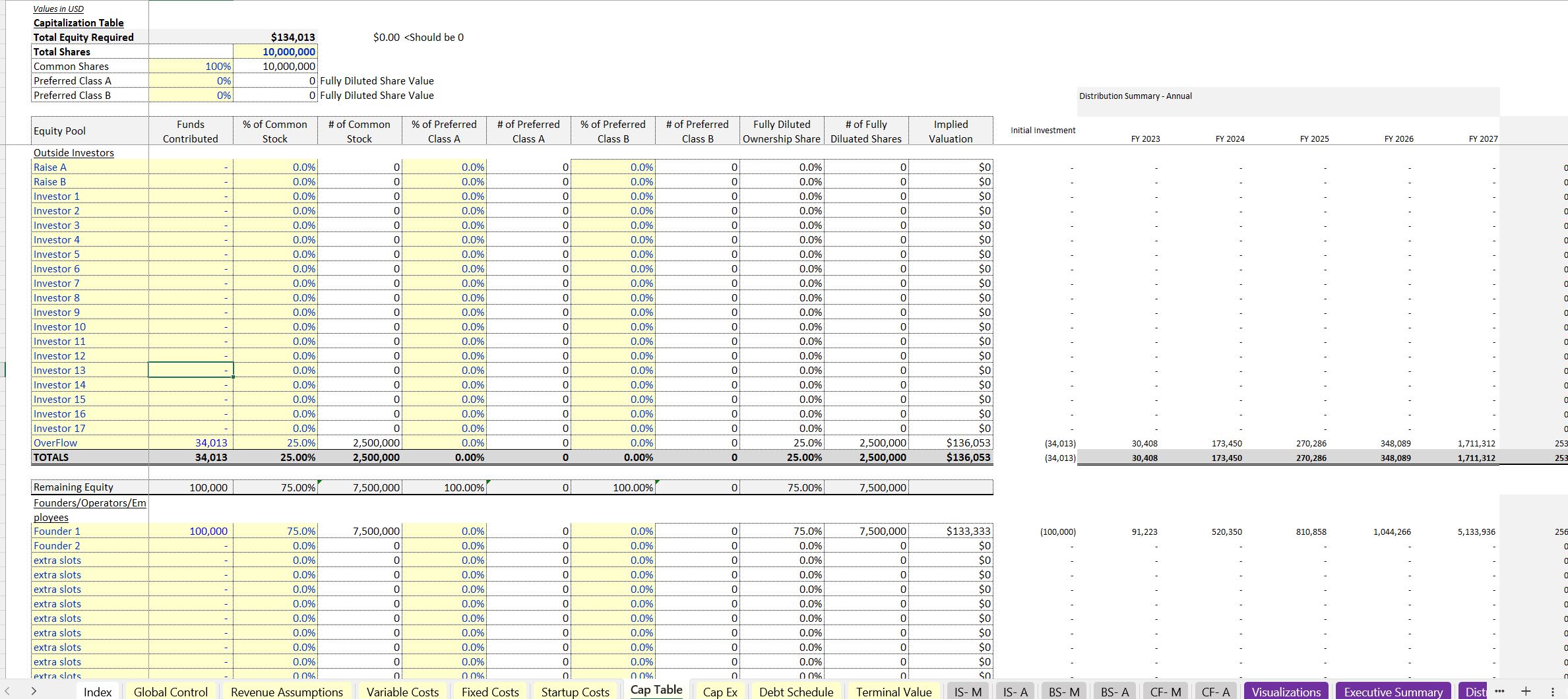

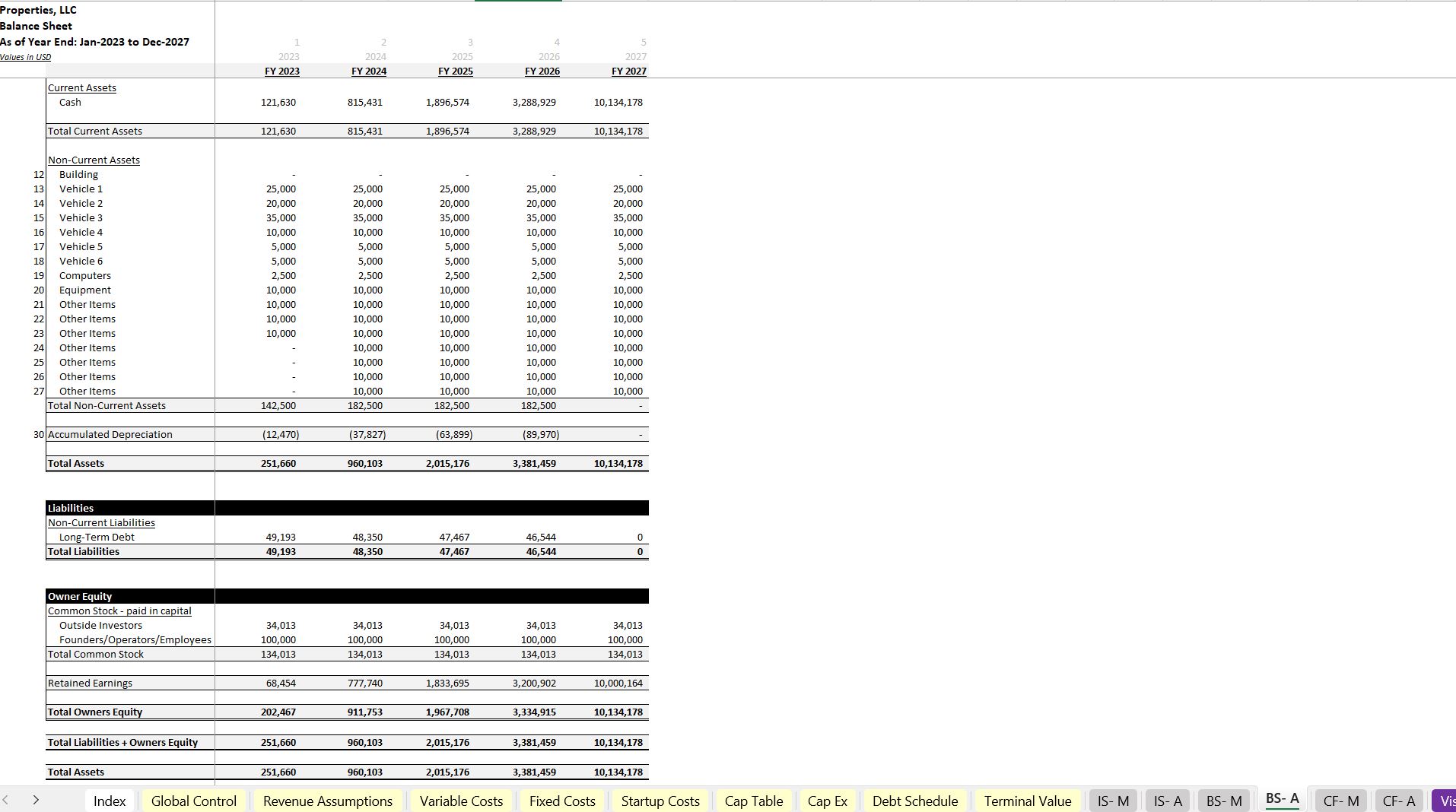

Output reports include monthly and annual financial statements (Income Statement, Balance Sheet, Cash Flow Statement) as well as a DCF Analysis, IRR, and the resulting minimum equity investment required based on all the assumptions (startup costs / net burn). You also get plenty of visualizations, a monthly and annual pro forma detail that drives down to cash flow.

I used cohort modeling techniques in order to provide the most accurate financial forecast based on the defined assumptions that you enter.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Property Management Projection Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping