Ad Network: Startup Model and DCF Analysis (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

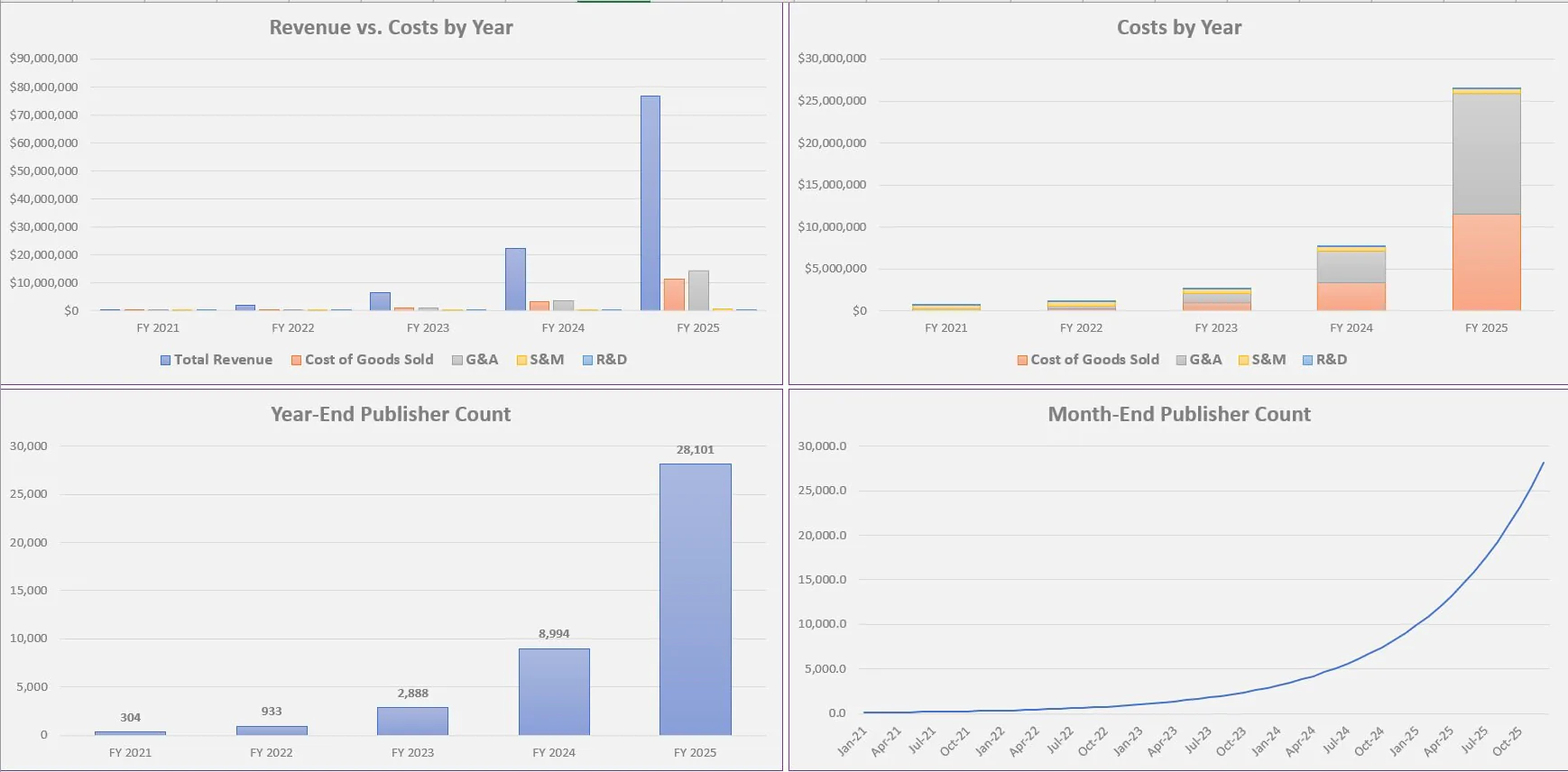

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

An ad network connects publishers and advertisers. Think Google Adwords and Adsense. The idea is that publishers create content and people view that content. At the same time, advertisers are out there and want to promote products and services or ideas.

A good spot to put these promotions of products and services is where there is content that may have something to do with the product. An ad network connects these two groups in exchange for a fee. The purpose of the ad network is to make it easy for advertisers to pay publishers for space that gets their products and services viewed.

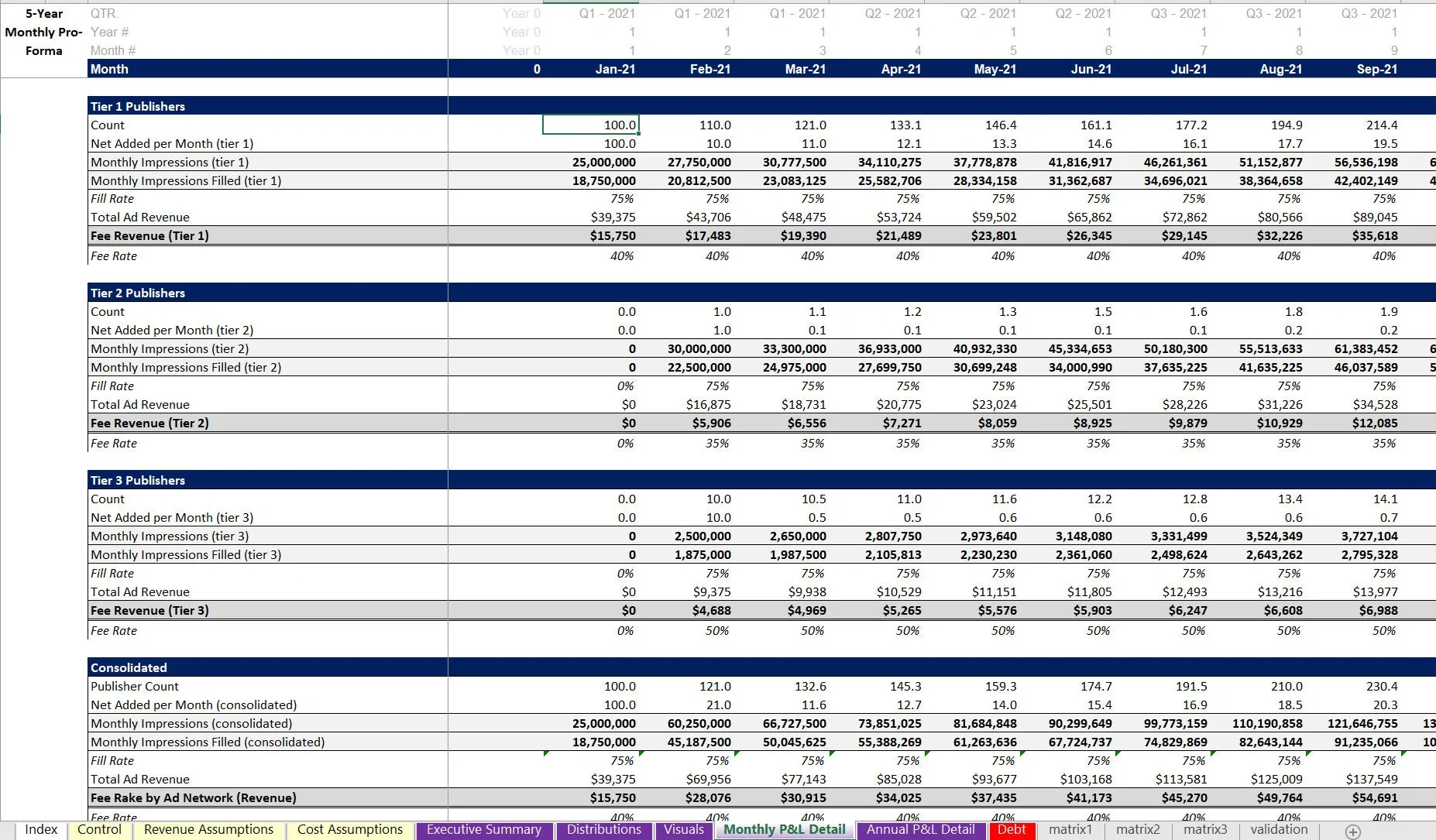

In this sense, the publisher gets to monetize their content they have been creating. A supply and demand dynamic happens and what this financial model focuses on is the supply side in terms of the number of publishers and how many impressions they are creating.

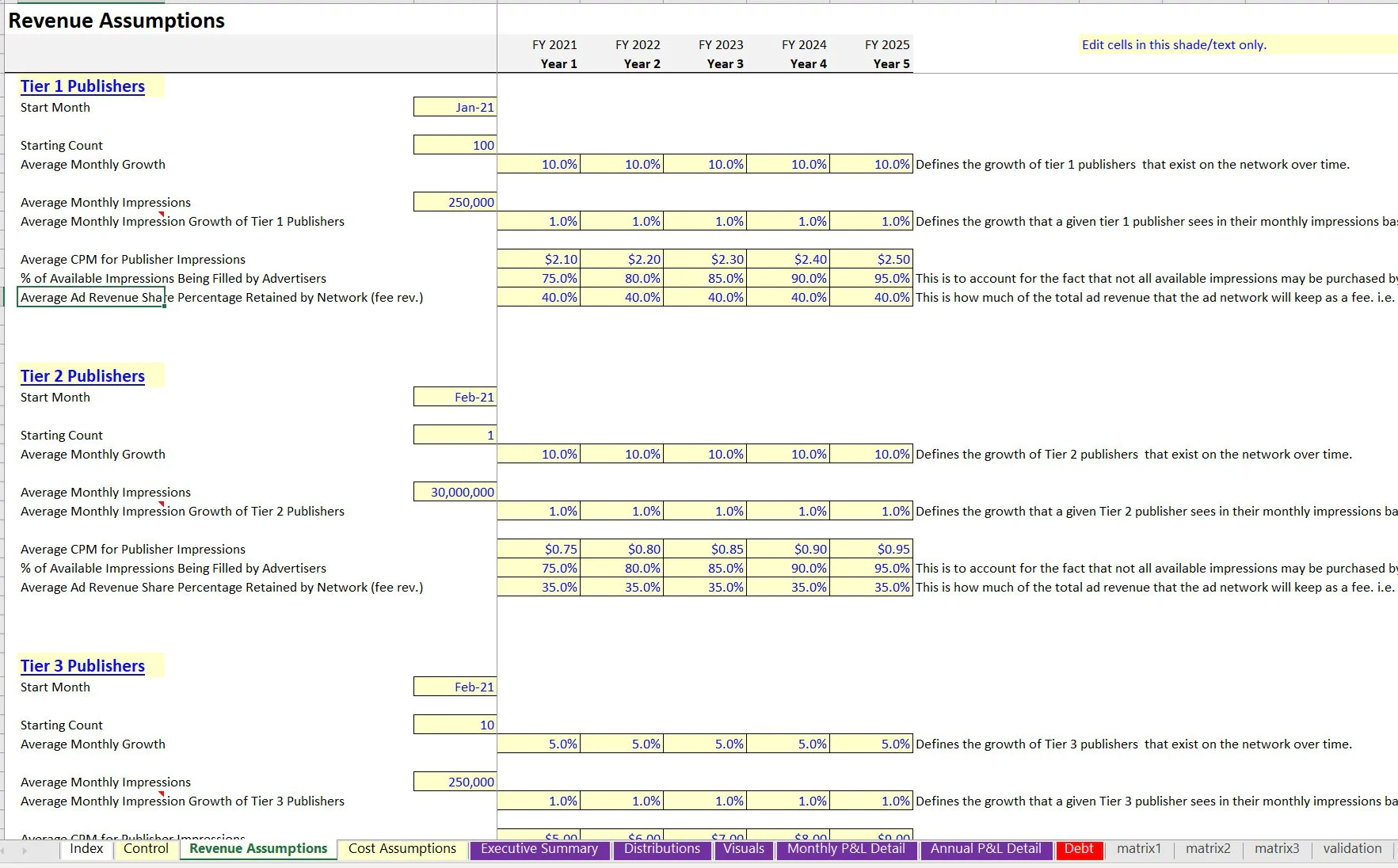

Then, a percentage of total impressions that get monetized (filled) is a primary input. Various content and types of publishers have different pricing and various revenues per 1,000 views. So, this model is driven by three primary types of publishers.

Each has a configuration for the following:

• Start Month

• Starting Count of Publishers

• Average Monthly Growth of Publishers

• Average Monthly Impressions

• Average Monthly Impression Growth of Publishers

• Average CPM for Publisher Impressions

• % of Available Impressions Being Filled by Advertisers

• Average Ad Revenue Share Percentage Retained by Network (fee rev.)

Note, this doesn't have to be an online ad network. It could be live TV, billboard space, or what have you. All of these things have different pricing levels for the amount of views and so you are given up to three configurations that can be accounted for. Operating expenses are defined generically as well as cost of goods sold.

This is structured similar to what you would see from a SaaS company, but flexible enough for a wide range of uses.

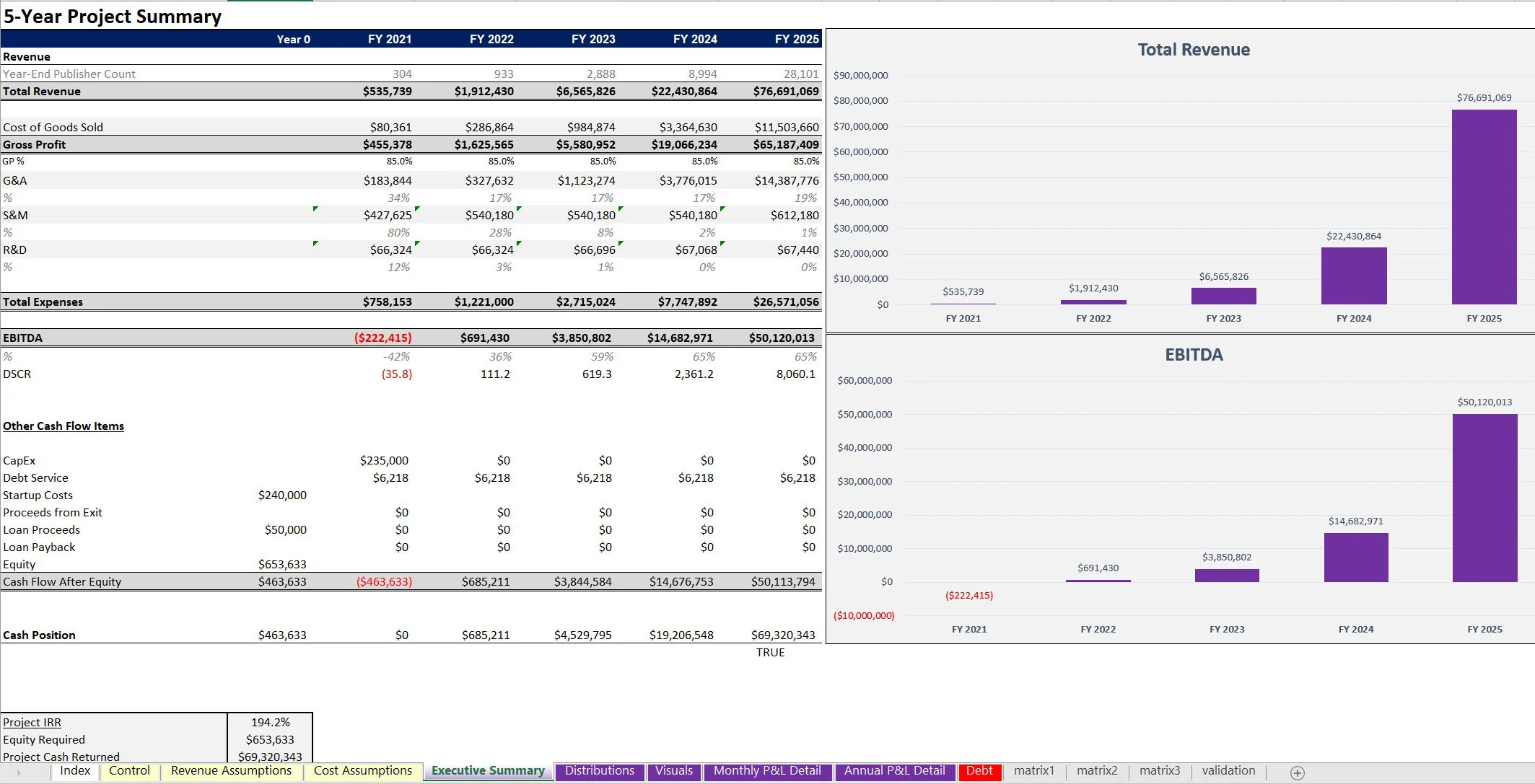

Final outputs include:

• Monthly and Annual P&L / cash flow detail (granular)

• Annual P&L summary (high level financial items)

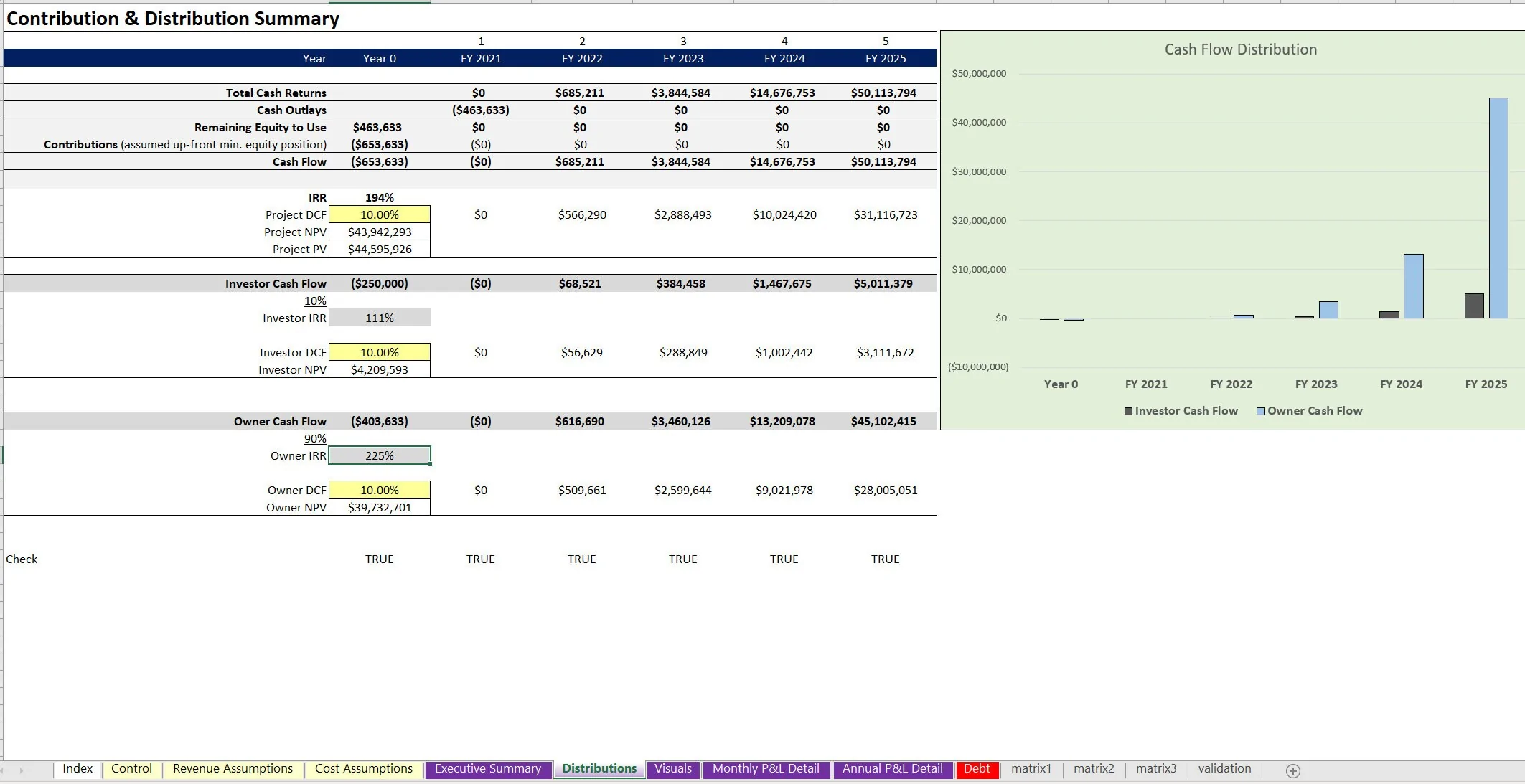

• Contributions / distribution and DCF Analysis for project / Owner / Investor

Also, there is functionality for an exit per revenue multiple and return metrics include IRR, Equity Multiple, and ROI. Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Ad Network: Startup Model and DCF Analysis Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping