SaaS Customer Pricing Simulator: Optimization Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

SAAS EXCEL DESCRIPTION

Any SaaS operator will be asking their finance team, revenue director, or CFO what to price the product at. There is a lot of nuance and a lot of factors that go into informing a subscription price. This model will help.

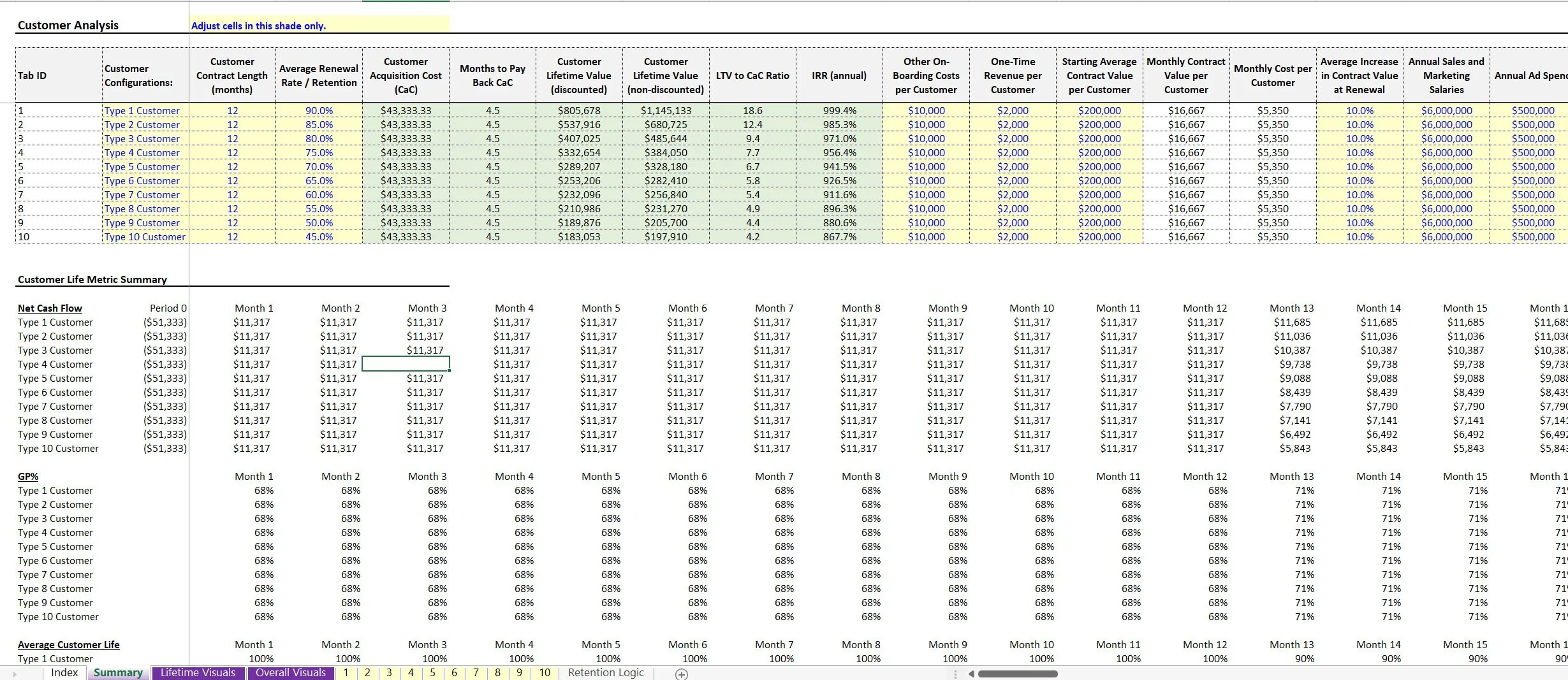

This is a general use SaaS analysis tool that has enough configurable inputs to fit regular month-to-month SaaS business or enterprise SaaS organizations. This can handle any term lengths for customers as well.

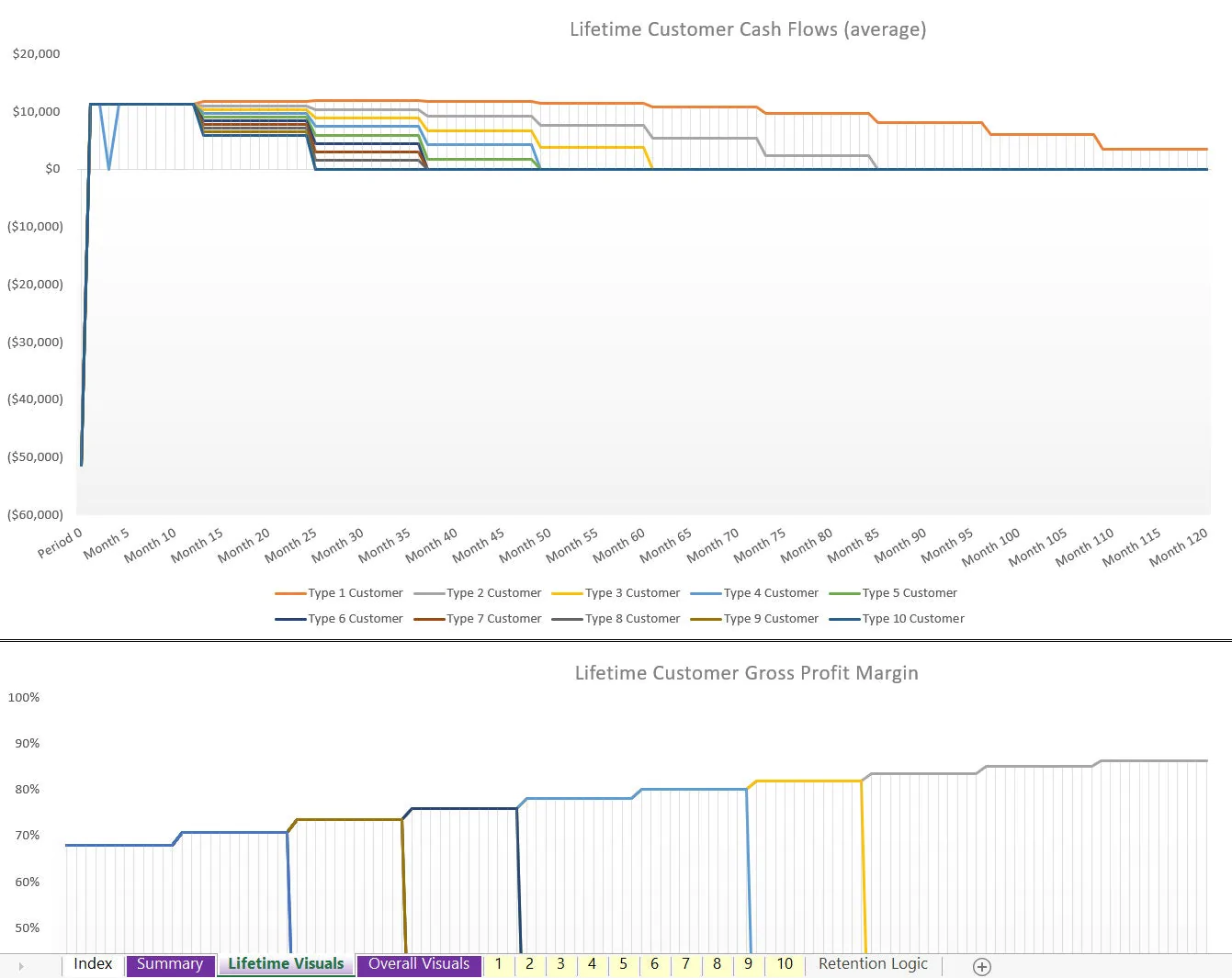

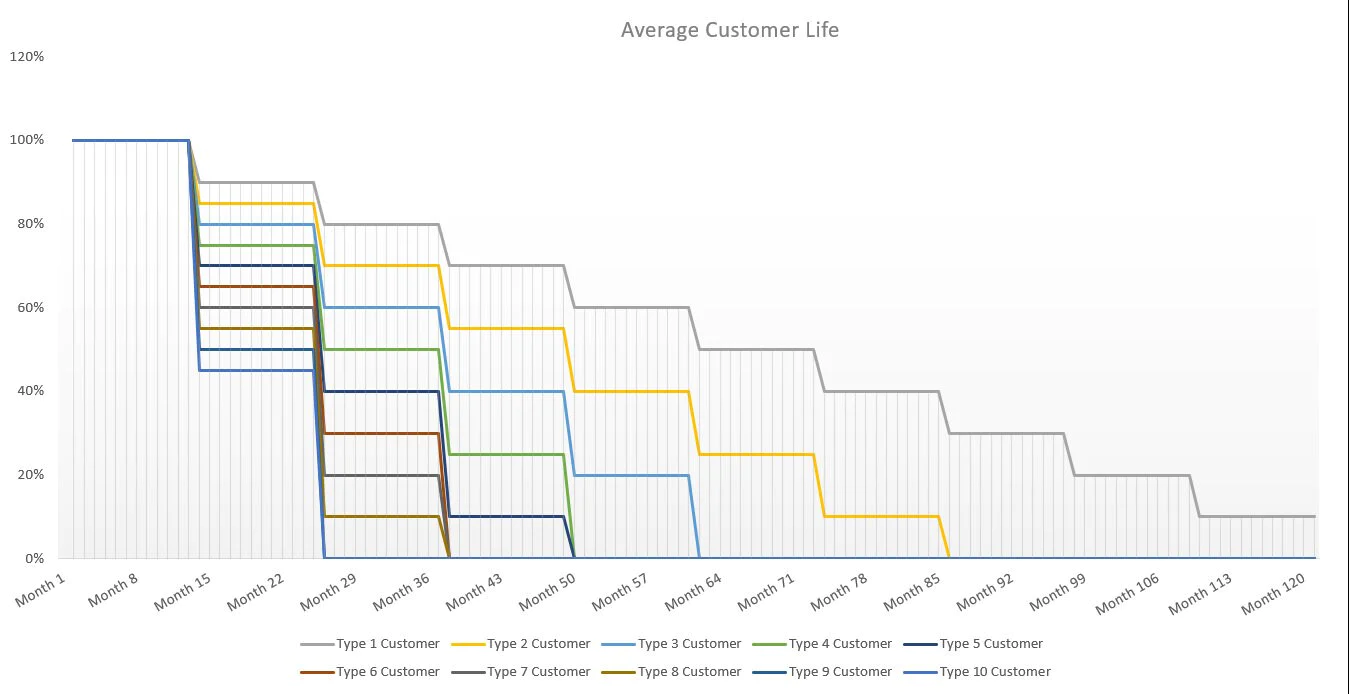

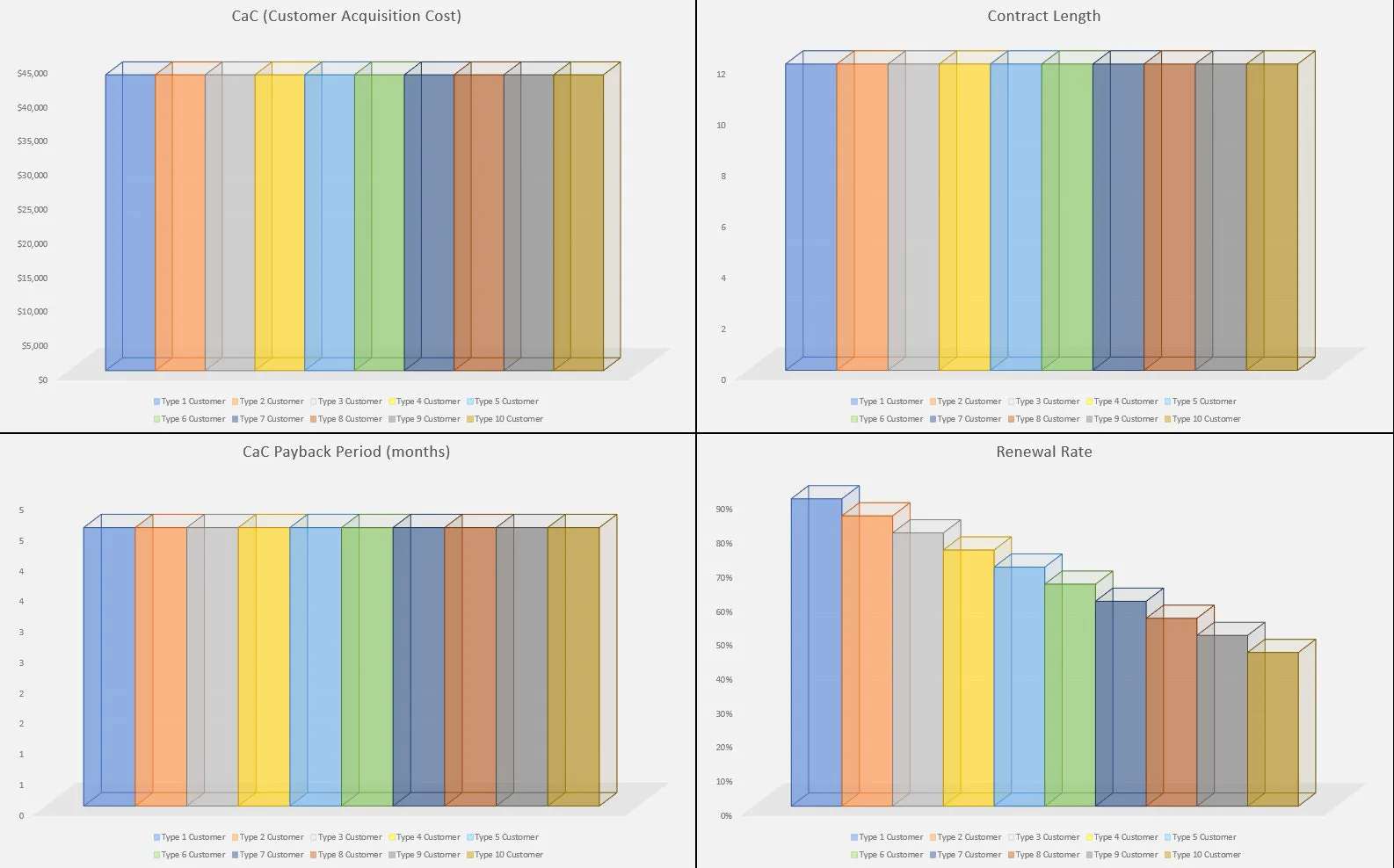

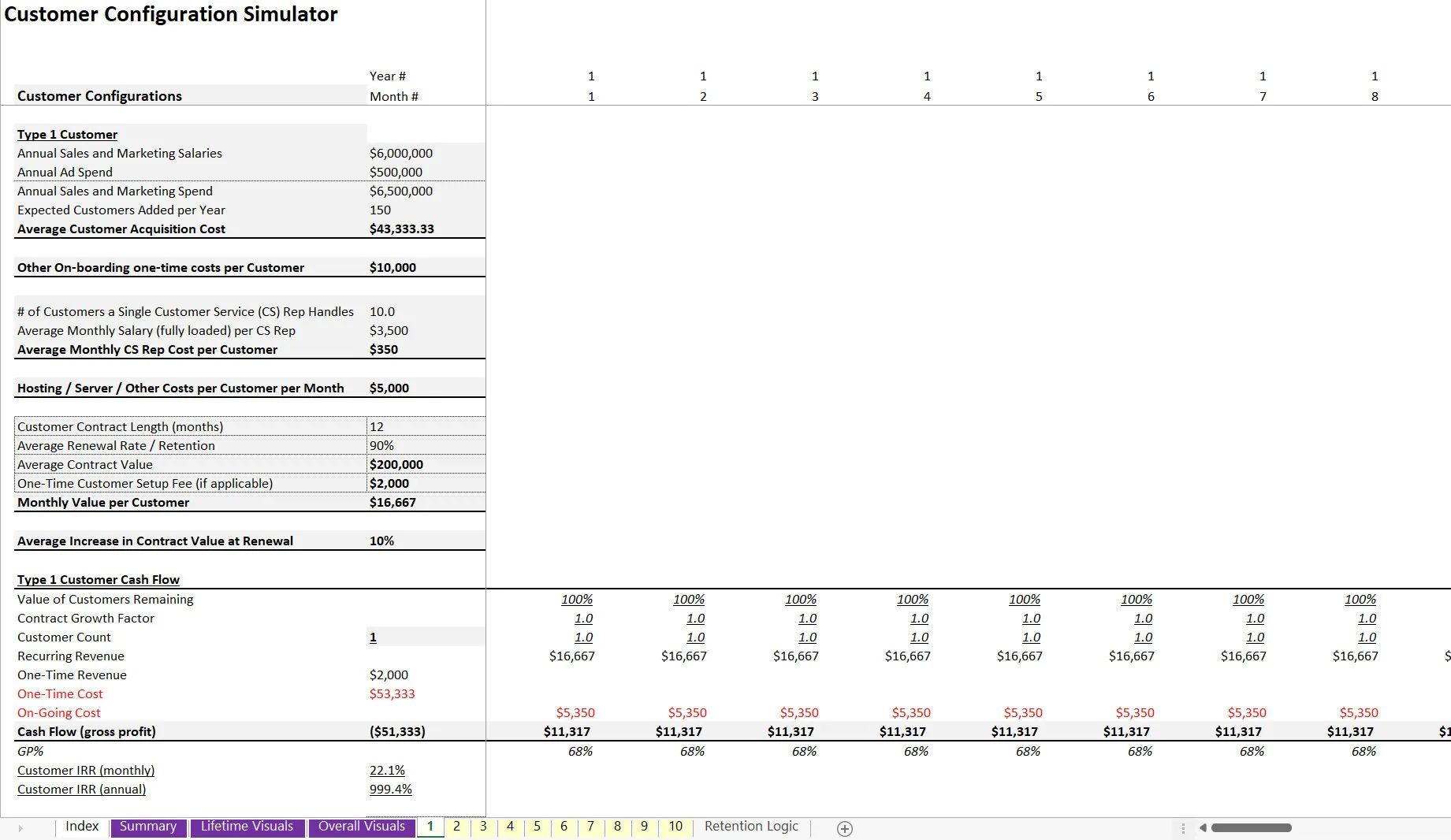

It is very good at showing gross profit per customer over time as well as total customer lifetime cash flows. The purpose is to configure up to 10 ideal customers based on inputs like Contract value, contract retention, average value per contract, contract length (months), customer acquisition cost, improvement on contract value at renewal, on-going service costs, one time setup fees and costs in order to show valuable metrics about an ideal customer.

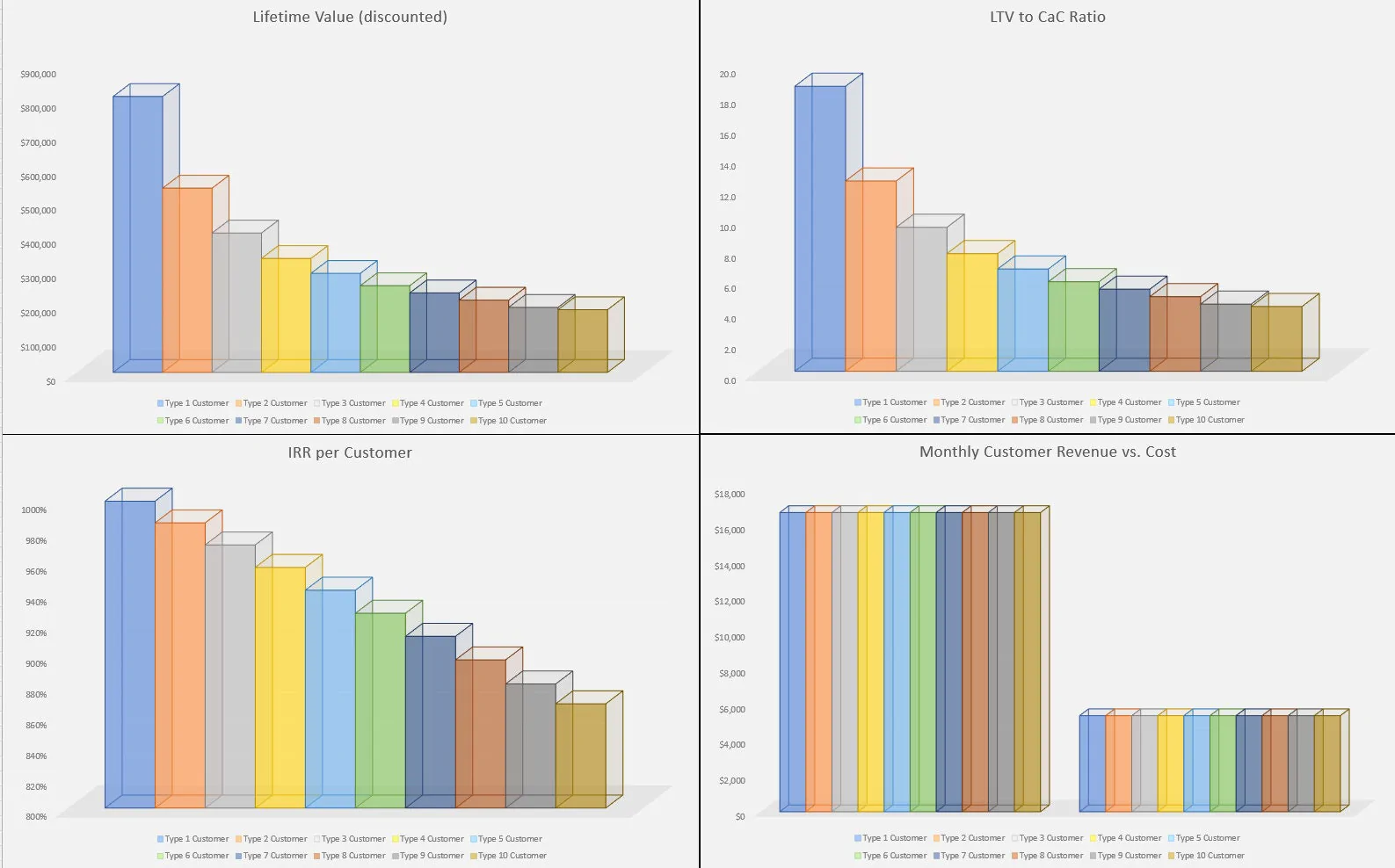

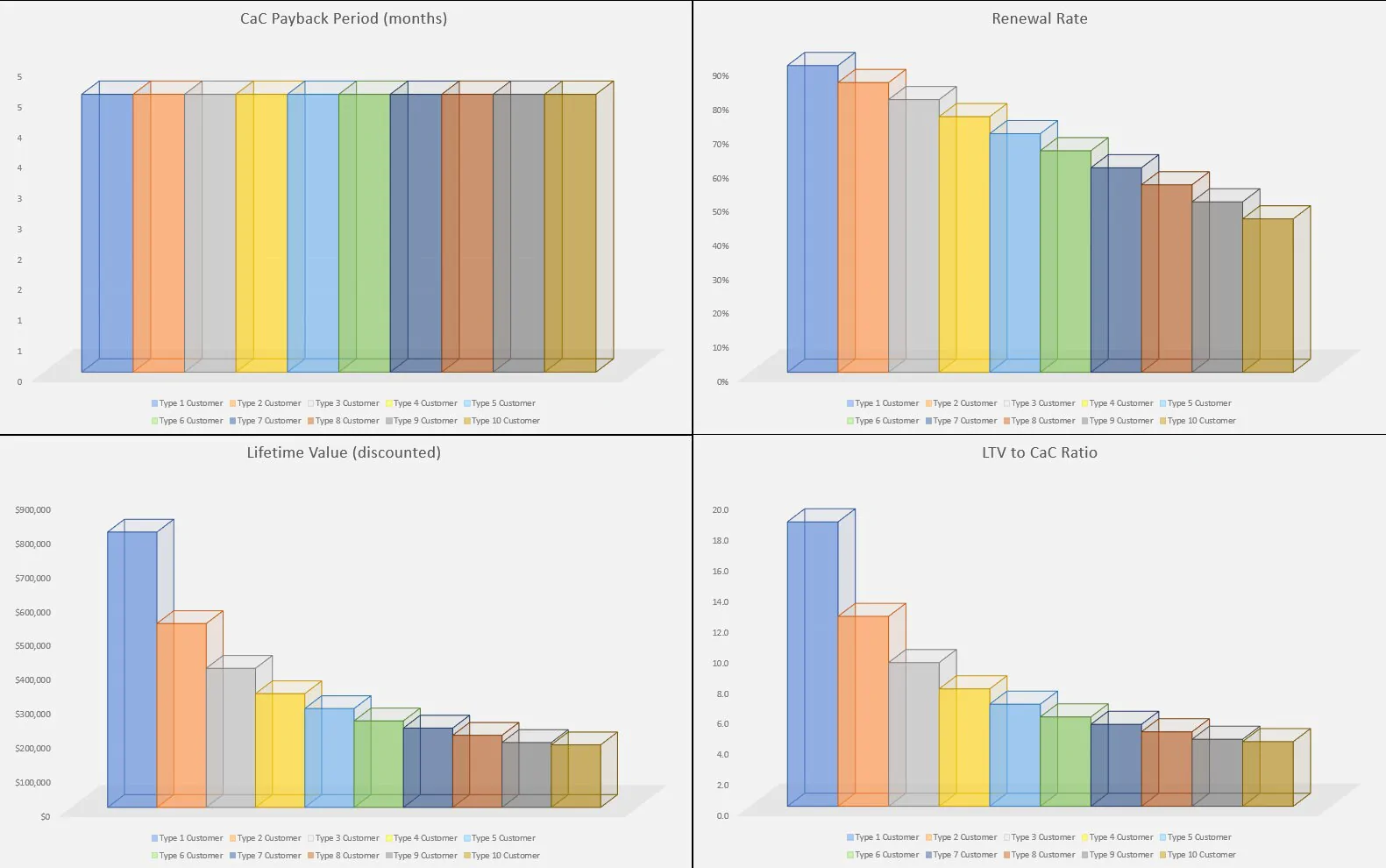

This tool is great for sensitivity analysis as well if you want to isolate one of the above variables and keep all the rest the same and see what that does to customer lifetime value, CaC payback, LTV to CaC ratio, and IRR.

Yes, IRR was built into this (monthly and annual) and this can be done because each customer can be distilled down to net cost to acquire and future cash flows per the retention / contract period.

Based on this, you can simply run an IRR calc. And that becomes a good metric to compare various customer configurations by. Initial acquisition costs and on-going costs to service each contracted are broken down into more bottom-up assumptions for more accurate calculations.

For example, you can define things like ad spend in period, sales and marketing spend in period, and measure that against expected customers added in period to get the CaC. Awesome visuals will show the final key metric outputs per customer type (up to 10). Video Instructions included (link in file)

This simulator empowers you to visualize and analyze the financial dynamics of various customer types, making it easier to pinpoint the most lucrative segments. With detailed metrics on customer lifetime value, payback periods, and renewal rates, you can make data-driven pricing decisions that align with your strategic goals.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in SaaS, Integrated Financial Model Excel: SaaS Customer Pricing Simulator: Optimization Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping