Travel Agency Financial Forecast & Analysis Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Startup financial model forecasting framework.

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

A good forecasting template for an online travel agency (OTA) website business startup should be comprehensive, adaptable, and user-friendly. Here's a breakdown of the components that such a template should include:

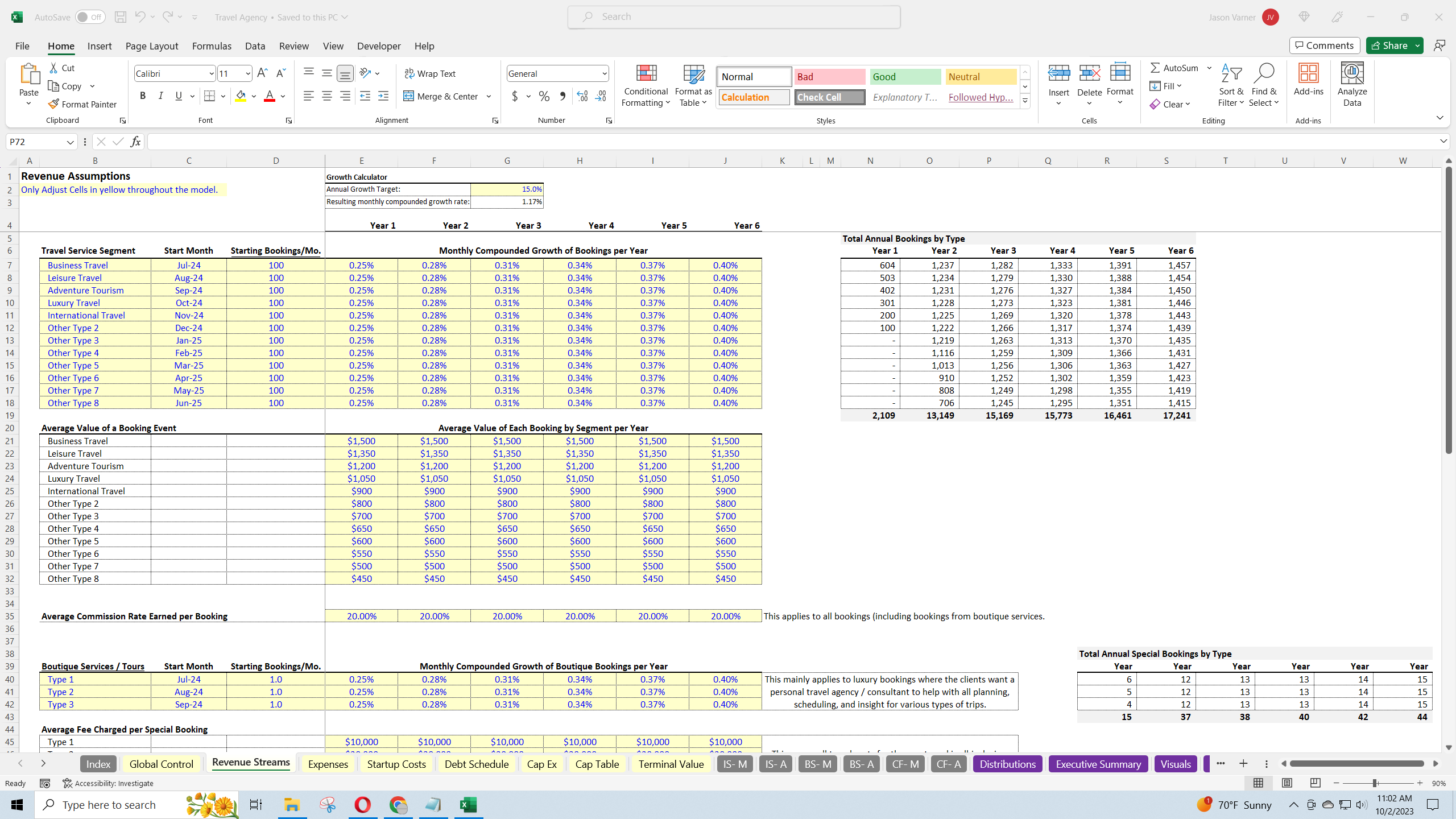

1. Revenue Forecast:

a. Commission-based Revenue:

Number of bookings (hotels, flights, tours, etc.)

Average value of a given booking type

Average commission rate per booking type

This financial model allows for up to 12 booking types.

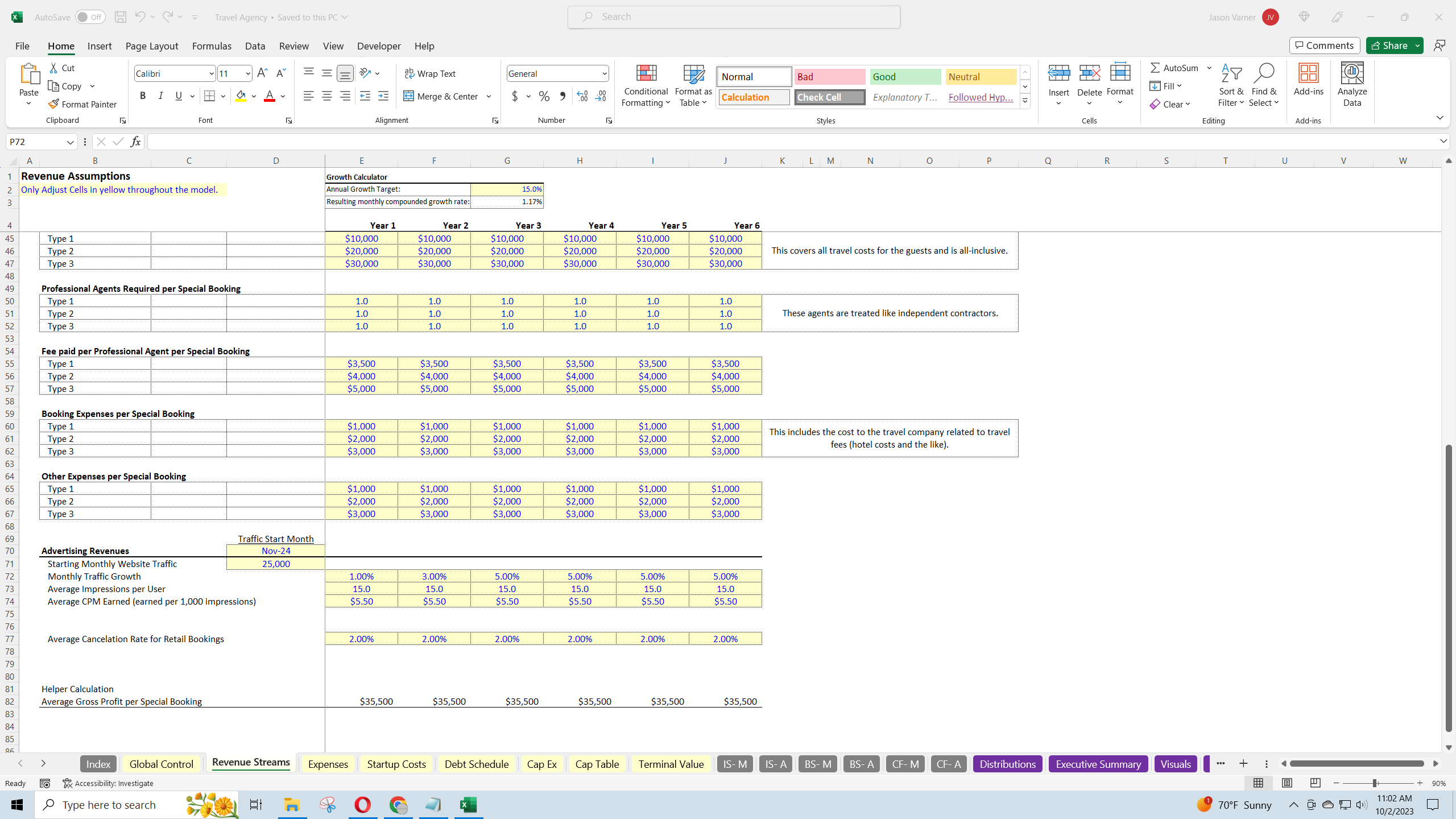

b. Advertising Revenue:

Monthly website visitors

Monthly views per visitor (average)

Cost-per-thousand-impressions (CPM) rates

This model has assumptions for all of these ad revenue inputs.

c. Markup-based Travel Revenue:

Total fee charged per booking.

Variable costs per booking.

The difference in the above two result in the gross profit per booking. The financial model here has 3 travel categories to configure.

Variable Costs:

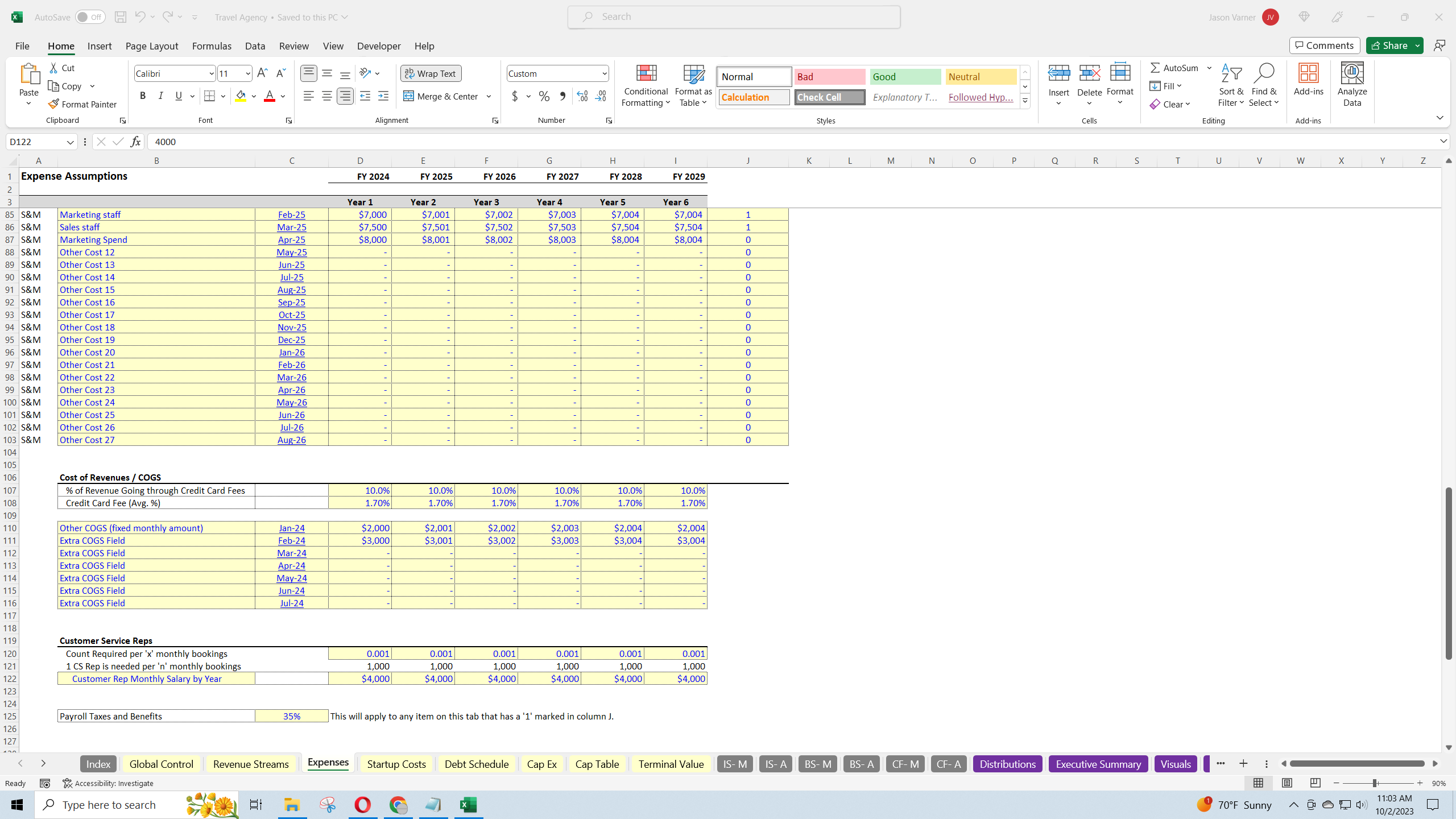

The primary costs that change directly with revenue and booking volume are customer service reps and credit card fees. The more online bookings you have, the more CS reps will be required. There is other cost of goods sold inputs that can be used in order to drive website hosting / server costs. Those are based on a defined monthly cost that can change per year.

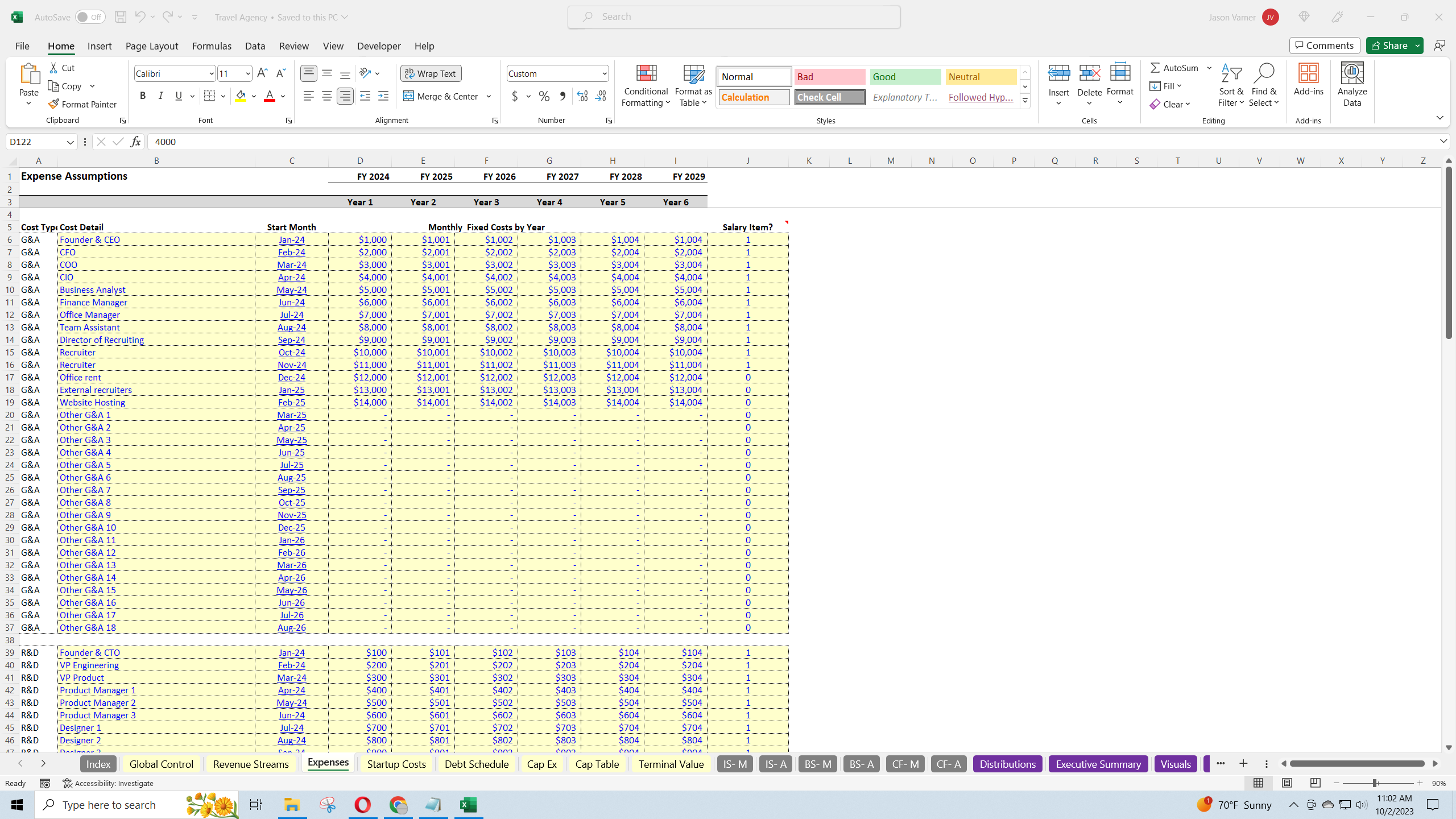

Fixed Operating Costs:

To account for things like legal fees, manager salaries, directors, and other costs that are generally fixed, but may change once per year, there is a complete fixed costs schedule that has a section for General and Administrative, Sales and Marketing, and Research and Development. In each section, the user can define the start month of the cost, the monthly cost (adjustable per year), and the cost description. There is also an input at the end of each row that lets the user mark if a cost item is subject to payroll taxes and benefits.

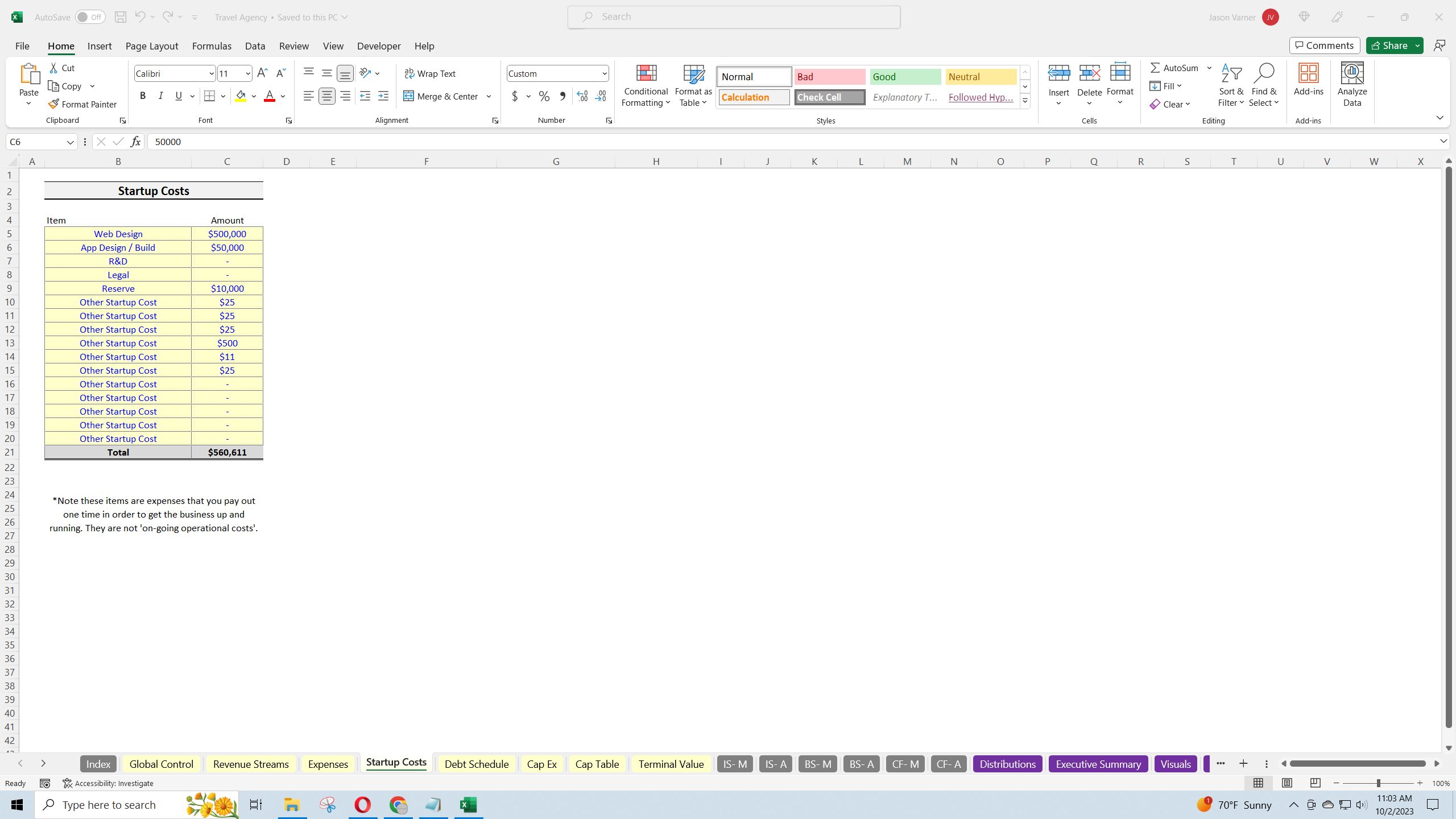

There is also a one-time startup cost input section and a capex table input section.

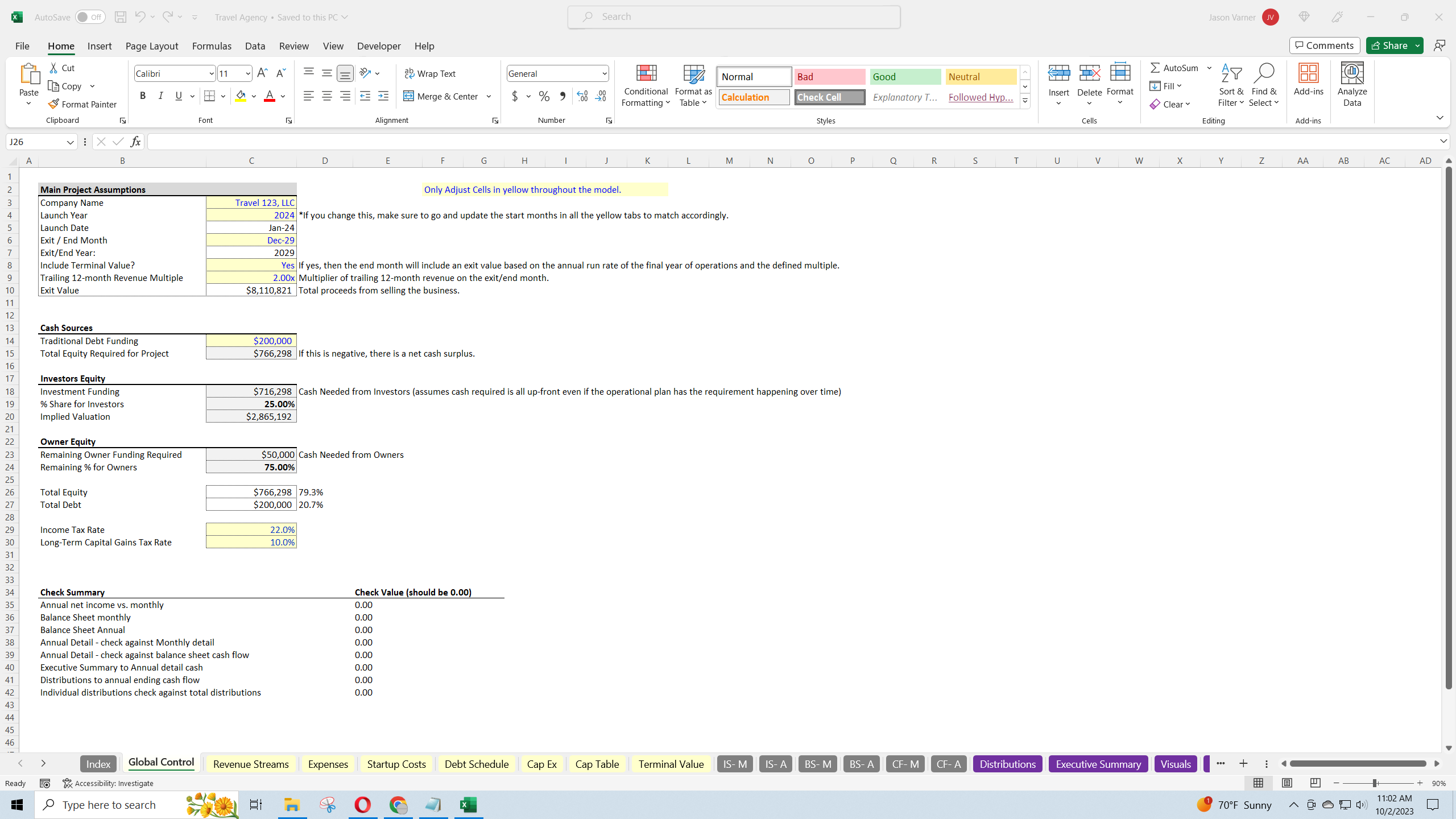

All of the above assumptions are distilled down to monthly and annual financial statements (Income Statement, Balance Sheet, Statement of Cash Flows) In order to perform a proper DCF Analysis, you can choose to include a terminal value and if that is marked as 'Yes' then the user defines a trailing 12-month sales multiple, which drives the exit value.

There is a cap table to account for funding from outside and/or inside investors, their resulting share of the company, and their IRR. I also included a global IRR for the project. The model itself solves for the minimum equity investment required based on all the startup costs and operating burn.

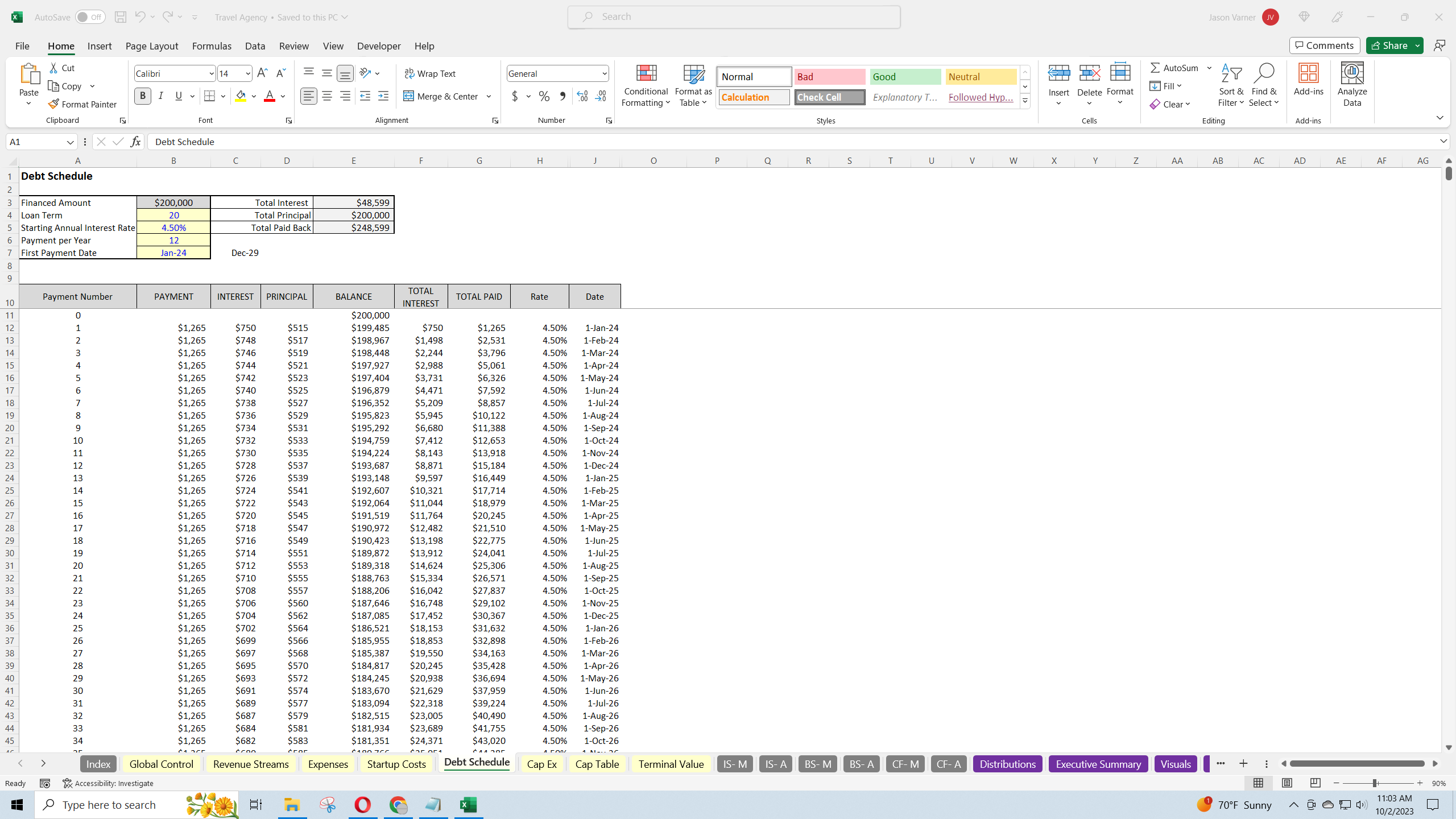

Finally, you will be able to enter debt assumptions as well, which is structured as a regular P+i loan (like an SBA loan).

Enjoy the financial simulation!

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Travel Agency Financial Forecast & Analysis Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping