Manufacturing Sales Model: Driven off Customer Repurchase Logic (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

MANUFACTURING EXCEL DESCRIPTION

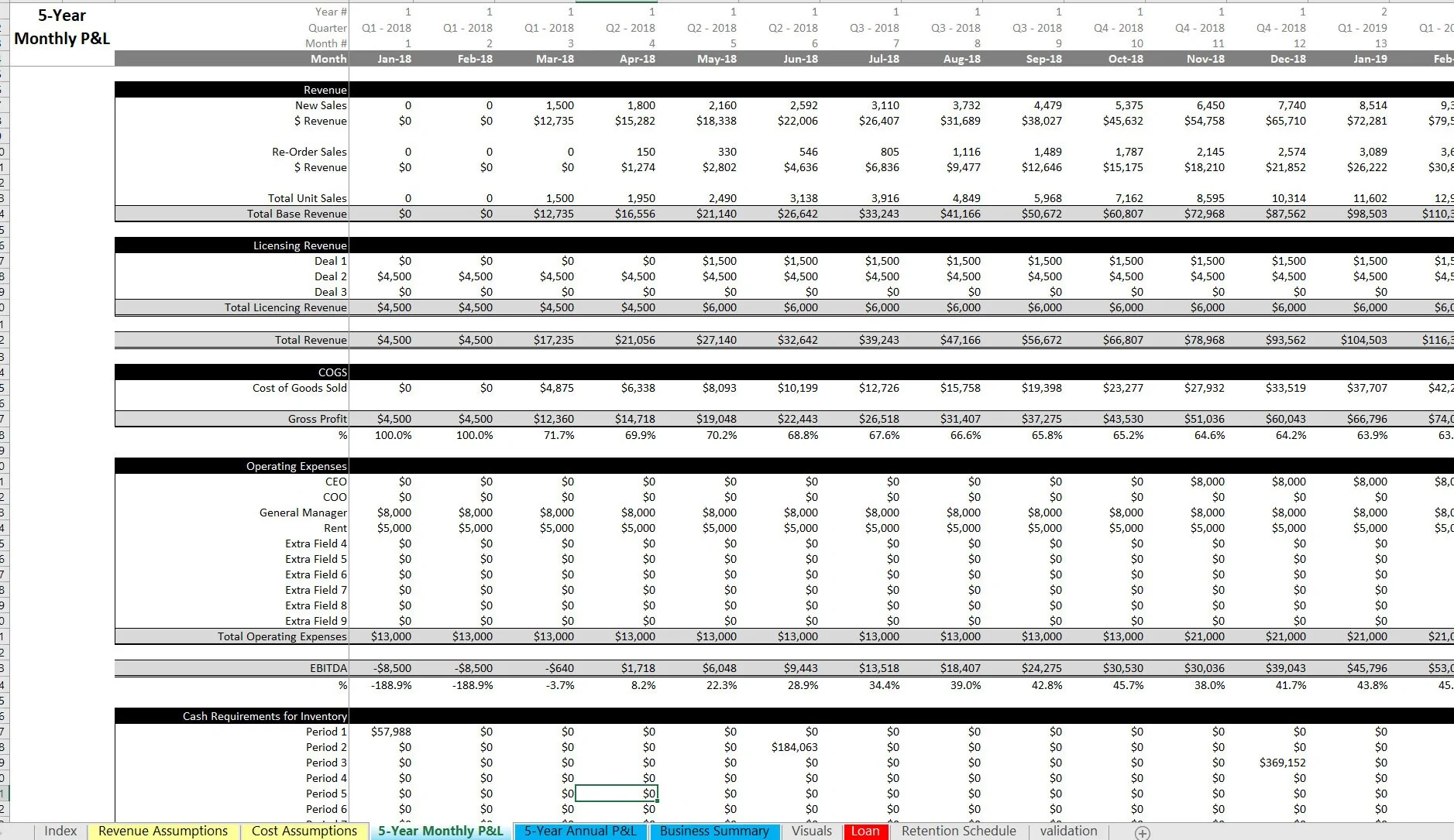

There are all sorts of ways to plan out how revenue growth may happen. This model focuses on new customers and the value of those customers repurchases over time in order to come up with an aggregate expected monthly and annual revenue number. This is not a perfect science because nobody knows what the future holds, but you can test assumptions to see what needs to be true in order to hit certain revenue targets.

The main user of this financial model is any manufacturing business that wants to model revenues based on logic specific to customer retention and re-purchase assumptions.

This is one of the only models I have built outside of SaaS where the revenue from selling a product is based on how much the customer spends initially and then the percentage of that initial spend that happens afterwards for up to a defined period of time in months.

For example, you can say after the initial purchase, customers will spend on average 20% of that initial amount per month for 7 more months. A dynamic matrix was built to handle this in monthly cohorts.

The initial purchases are based on a starting defined unit sales and an expected growth in unit sales per month in each of the five years. There is also a defined average selling price per unit.

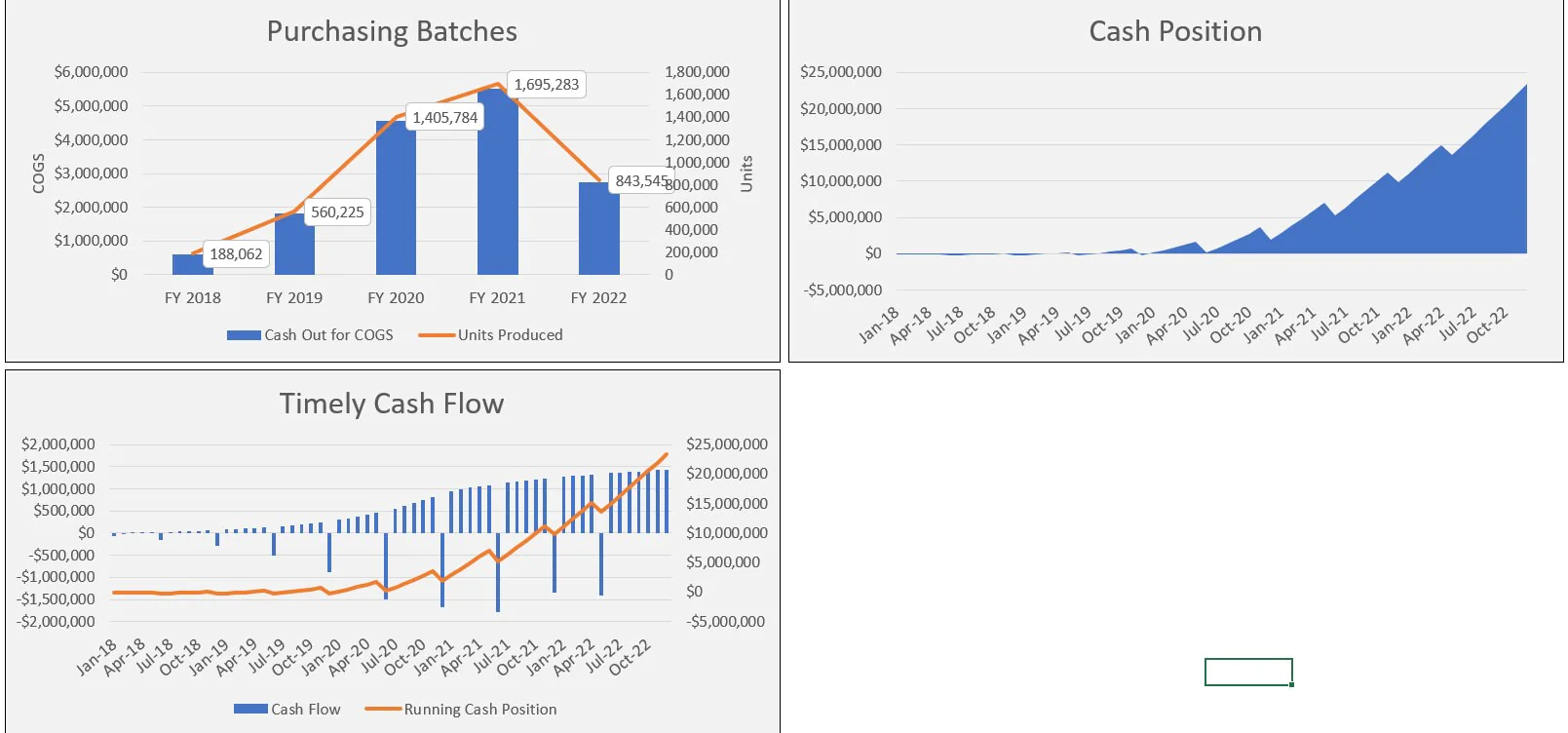

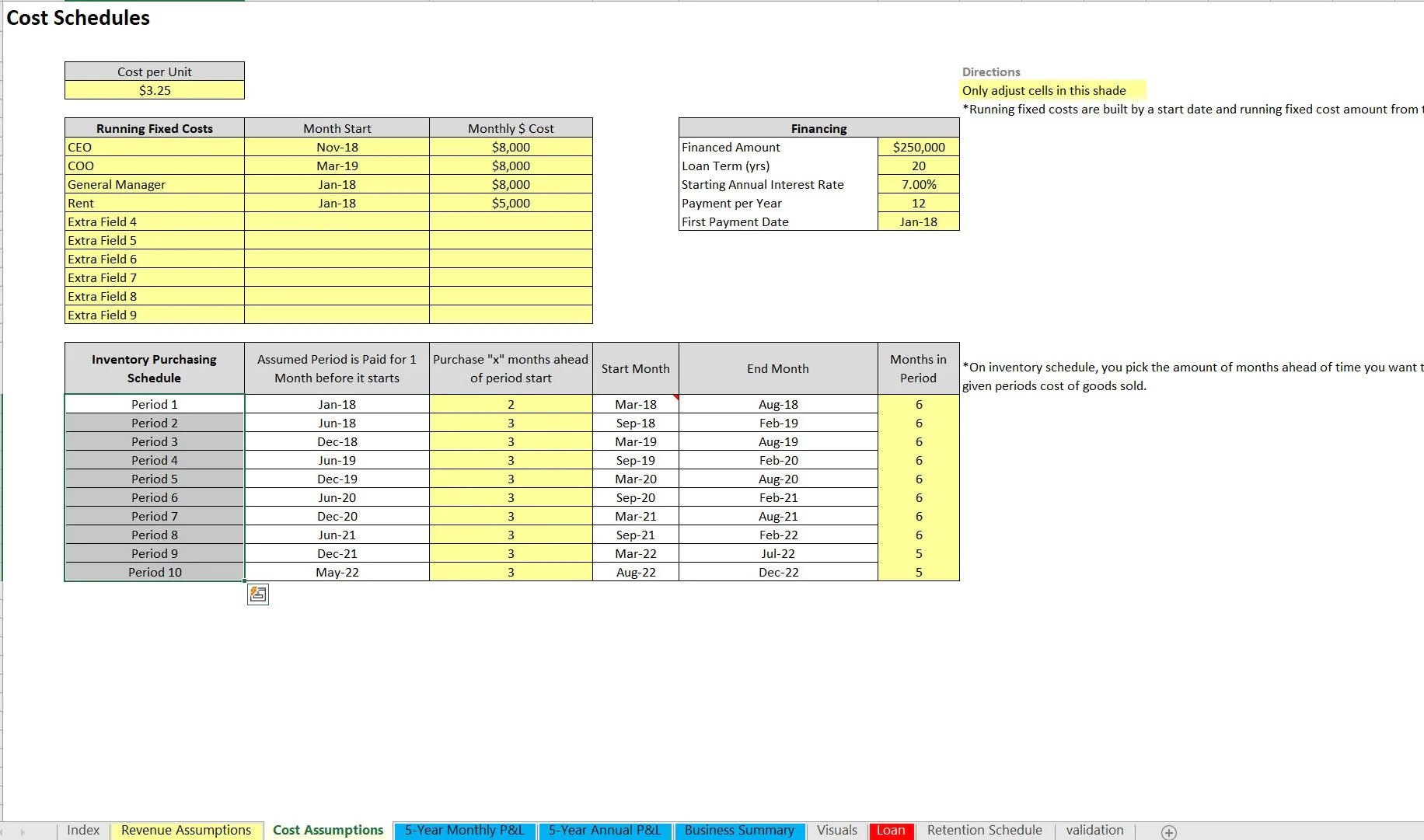

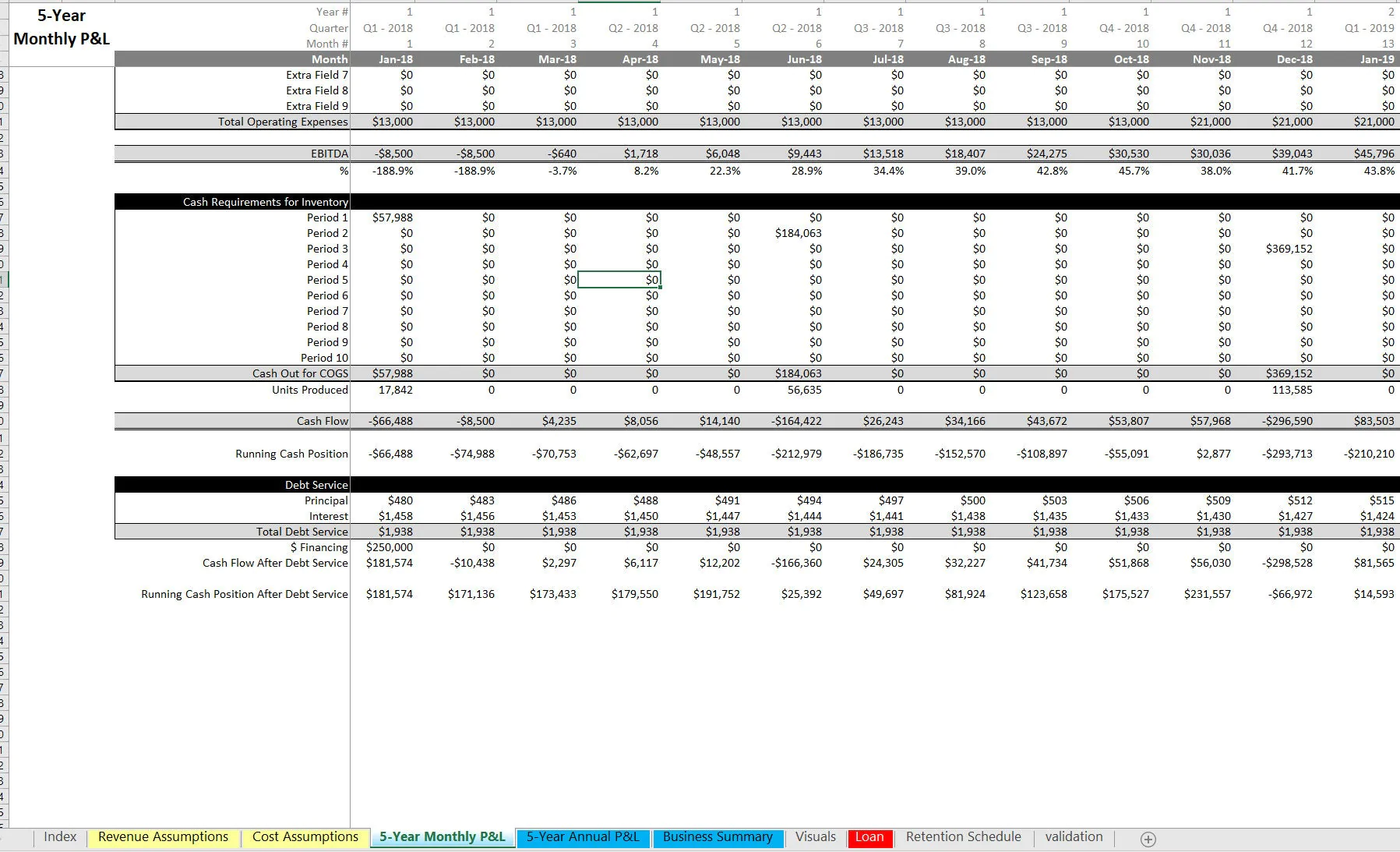

For costs, there is a defined cost per unit and inventory scheduling to account for proper purchases in batches with up to 10 batch purchases that can happen over the course of the financial model.

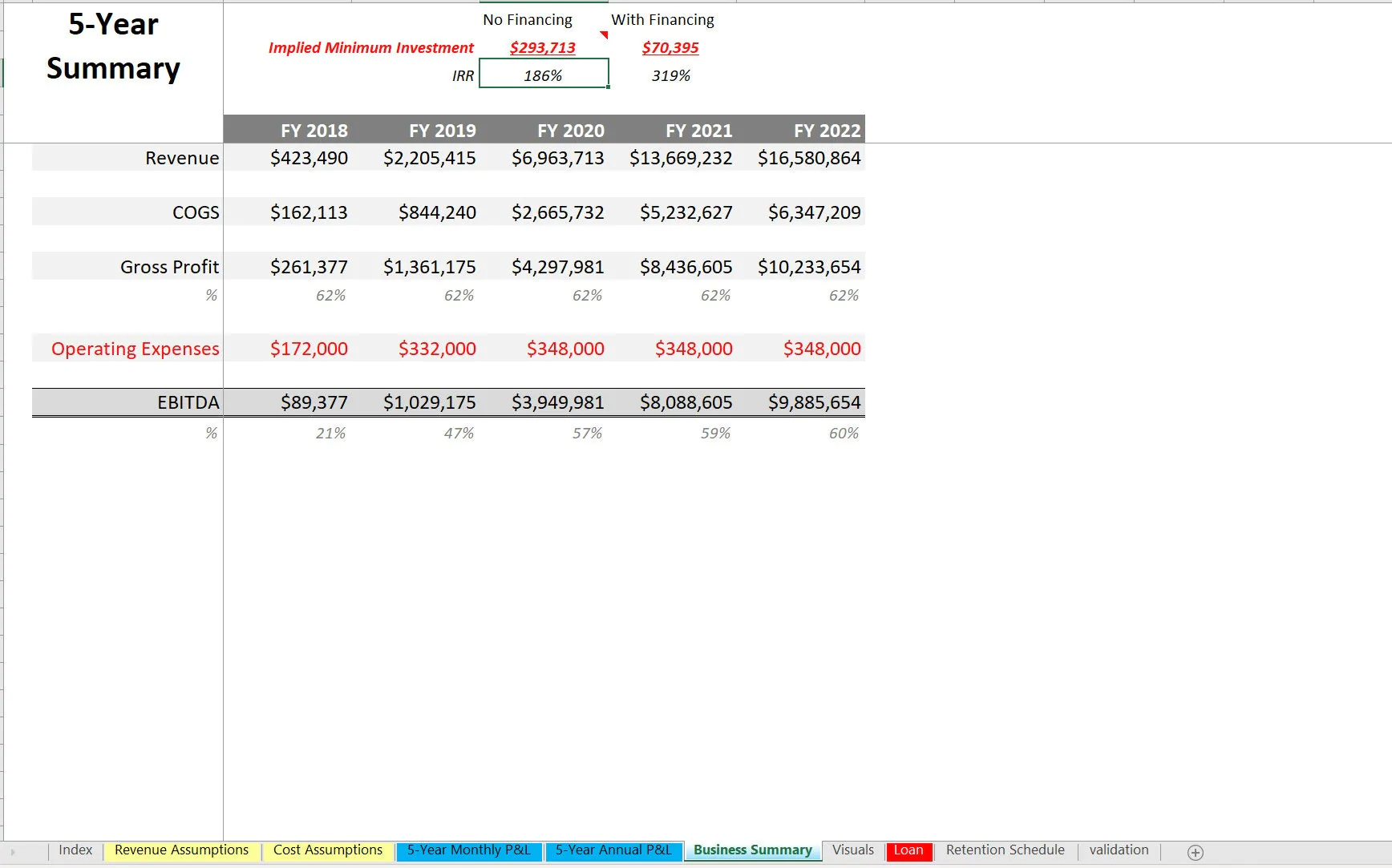

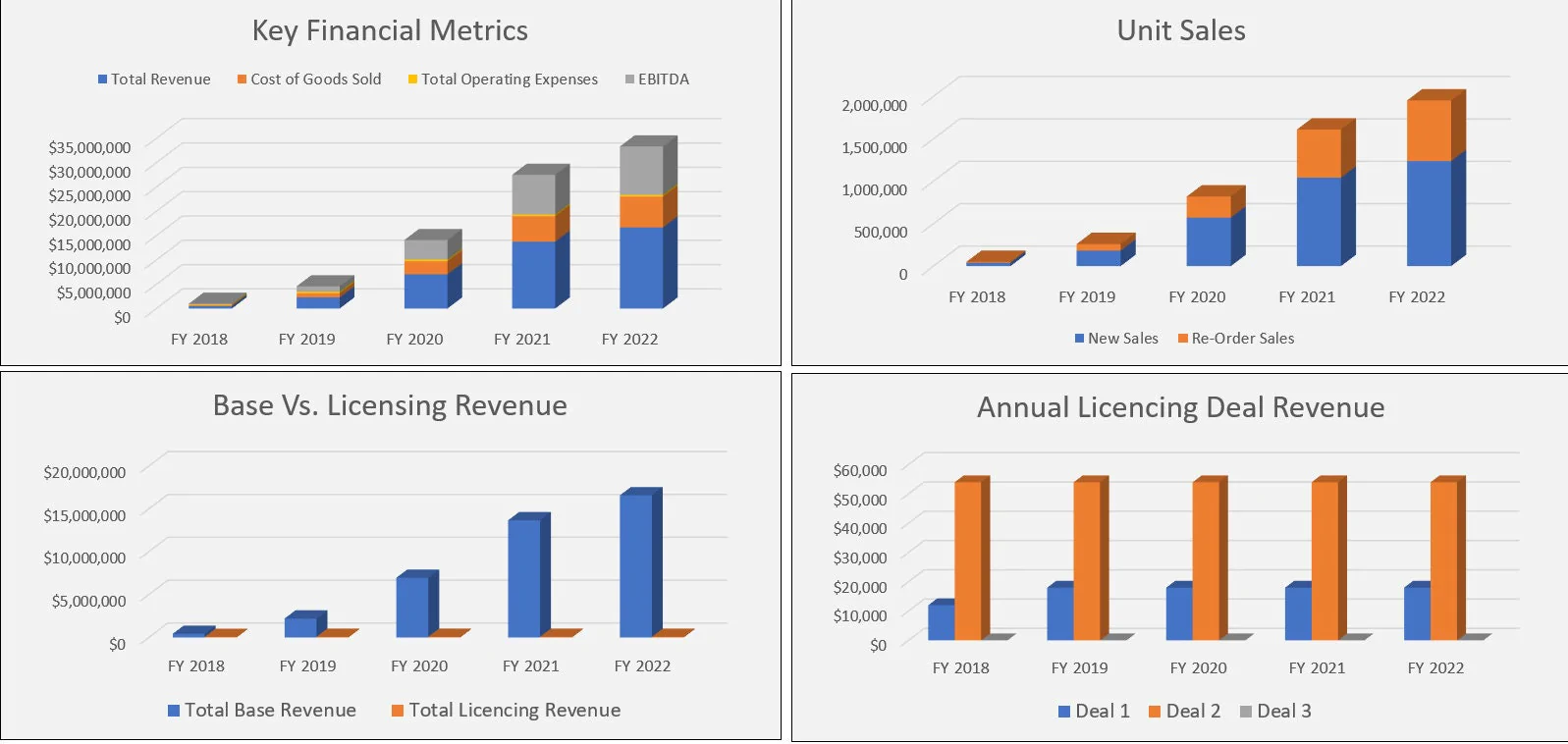

Final reports include a monthly and annual pro forma detail and cash flow summary as well as 5 year annual financial summary. There are plenty of visualizations to make the forecast more digestible.

Also note, the user can input logic for debt financing for some of the initial investment required. A final leveraged and unleveraged IRR is also displayed.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Manufacturing, Integrated Financial Model Excel: Manufacturing Sales Model: Driven off Customer Repurchase Logic Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping