Real Estate Model: 100% Leverage Scenario Feasibility (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Advanced real estate strategy underwriting template.

- Learn and study the financial feasibility of 100% leverage acquisitions.

REAL ESTATE EXCEL DESCRIPTION

This is one of my favorite types of models because it is teaching and demonstrating a complex strategy and at the same time providing a way to quantify and run financial feasibility scenarios on that strategy. Seasoned real estate investing pros and beginners can both gain lots of value with this template.

First, we'll talk about the general strategy and then get into the model assumptions and how to use it.

General Strategy:

This was made for specific situations where a buyer is looking at purchasing multiple properties from someone with the use of seller financing. You negotiate pricing and terms with the seller and one key agreement is that they give one or more of the properties to you free and clear with a title. The total price is still what the seller wants and your mortgage payments on that will be reflected, but the caveat is they give you some of the properties over, so you own them outright.

You are still putting a down payment in this situation, however now that you own one or more of the properties free and clear, you can go get that property appraised and refinance it with a traditional mortgage through the bank. By getting those refinance proceeds to equal roughly what your down payment was on the initial purchase, 100% leverage has effectively been achieved. You could also do it for simply higher leverage situations (90%+ or even have a situation where you make some money on the acquisition).

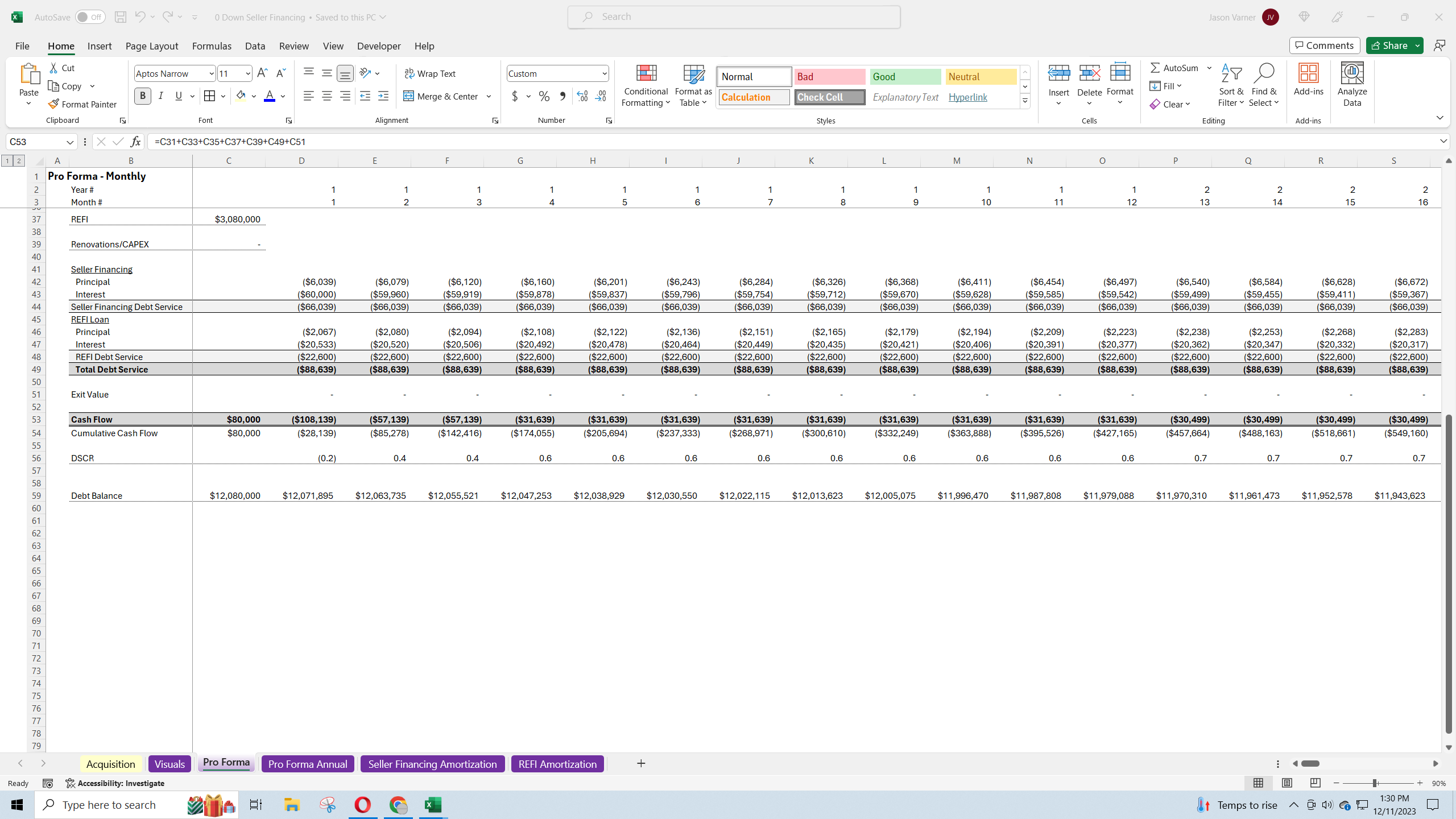

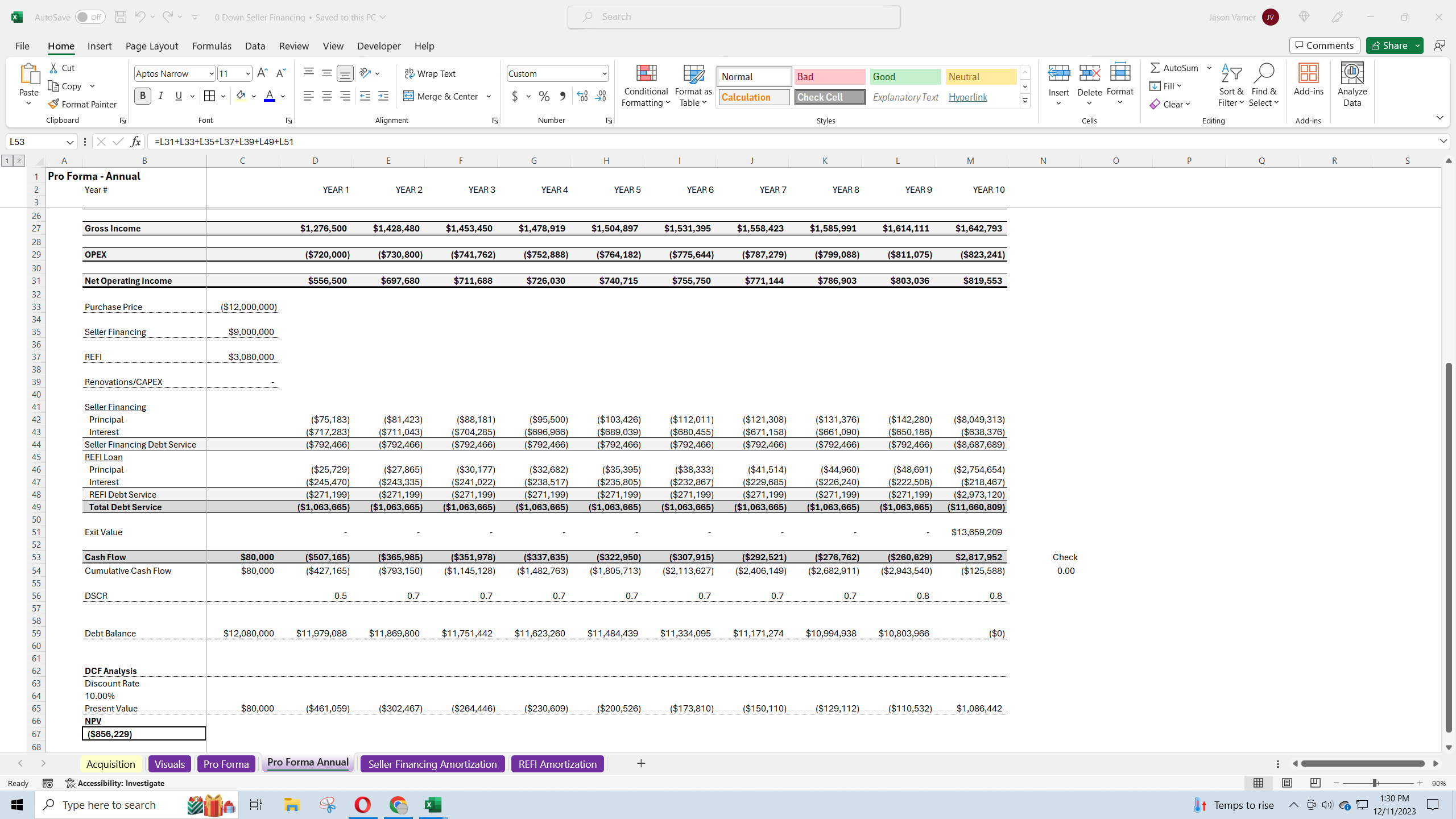

The risk here is in the total debt service you have to pay every month. It is important to make sure the expected net operating income from all the properties is enough to cover the seller financing and traditional mortgages. Then, at some point you can flip the properties for a big gain on sale without ever having to invest any actual cash or very little.

Template Features:

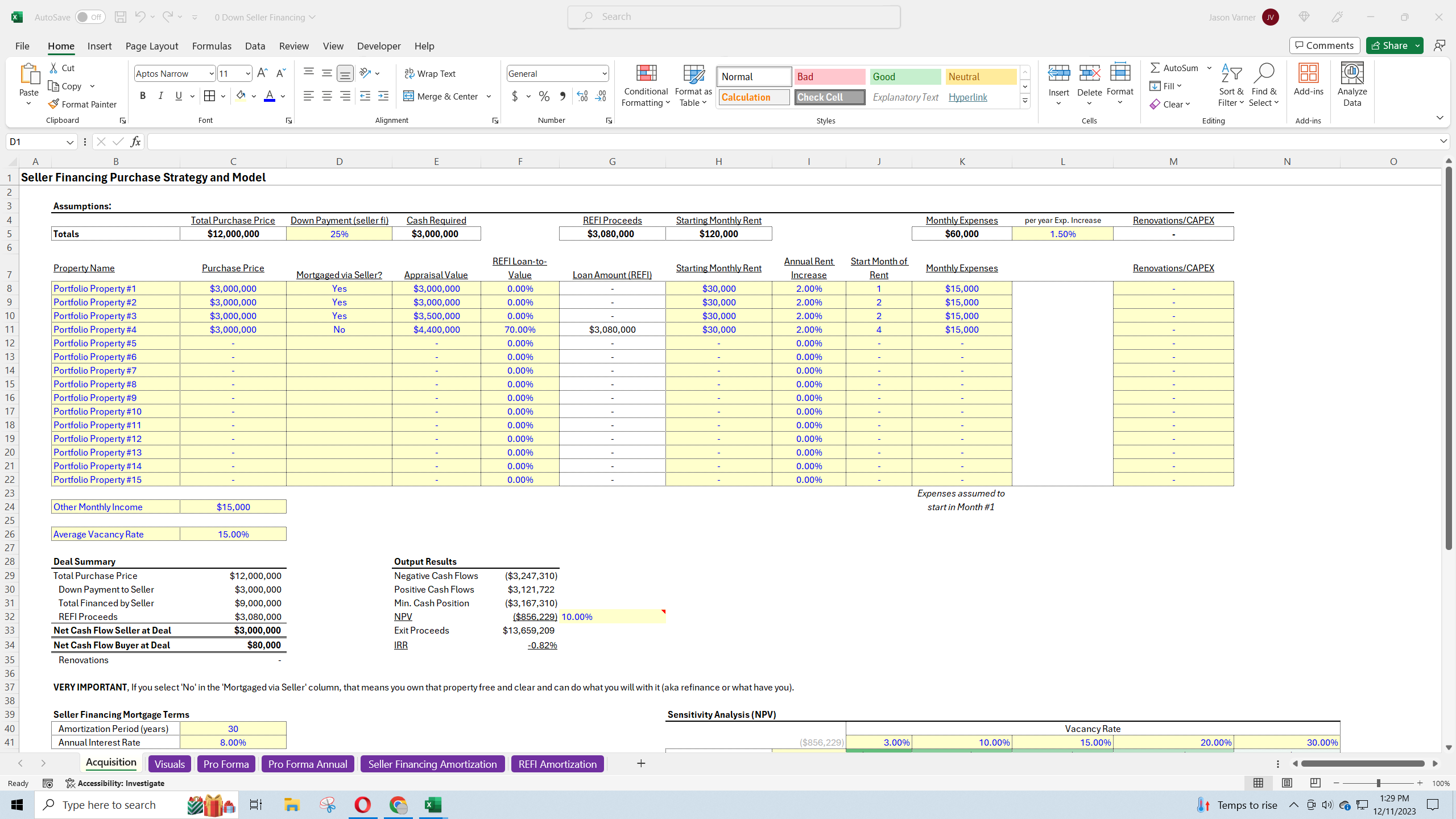

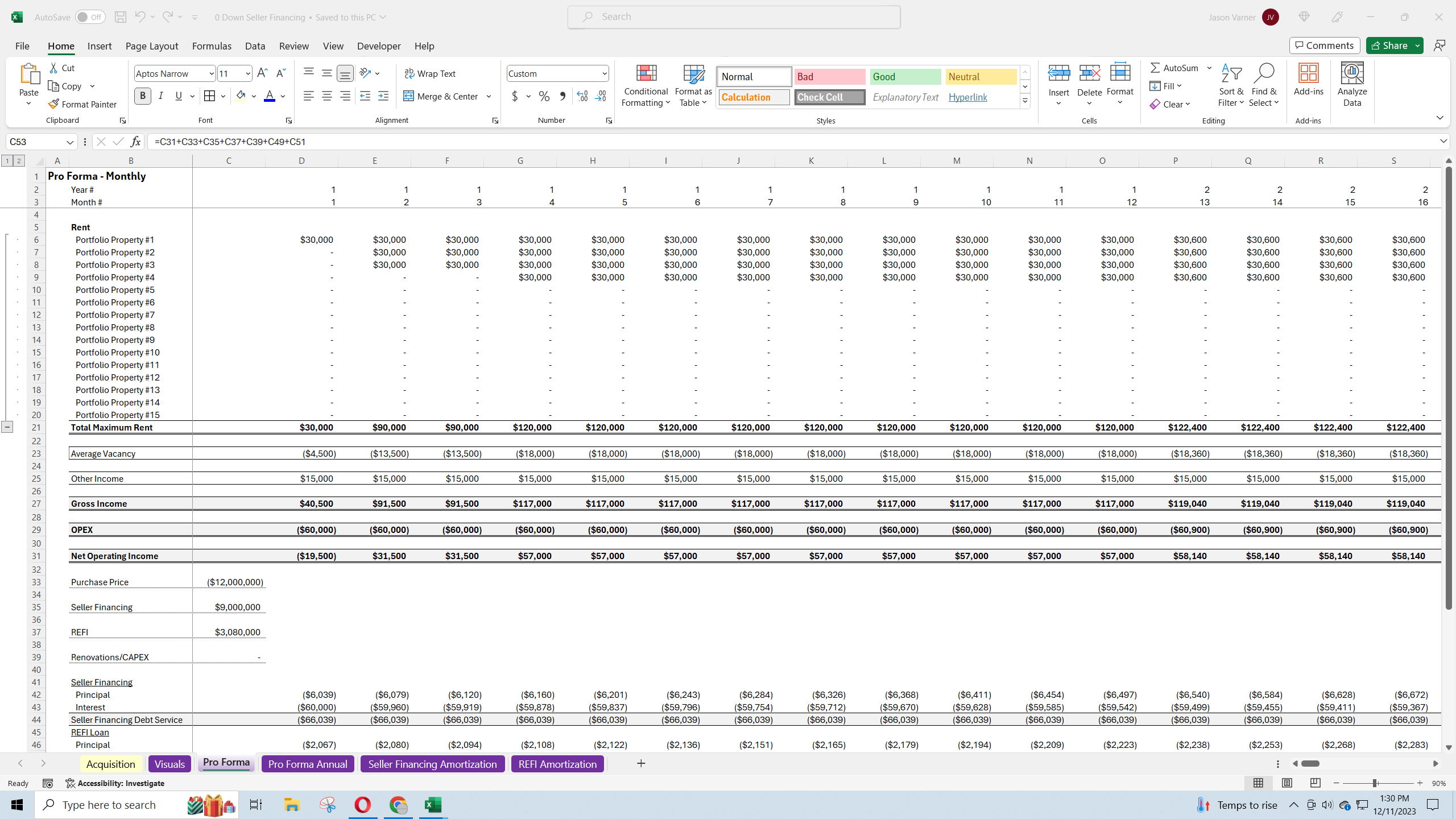

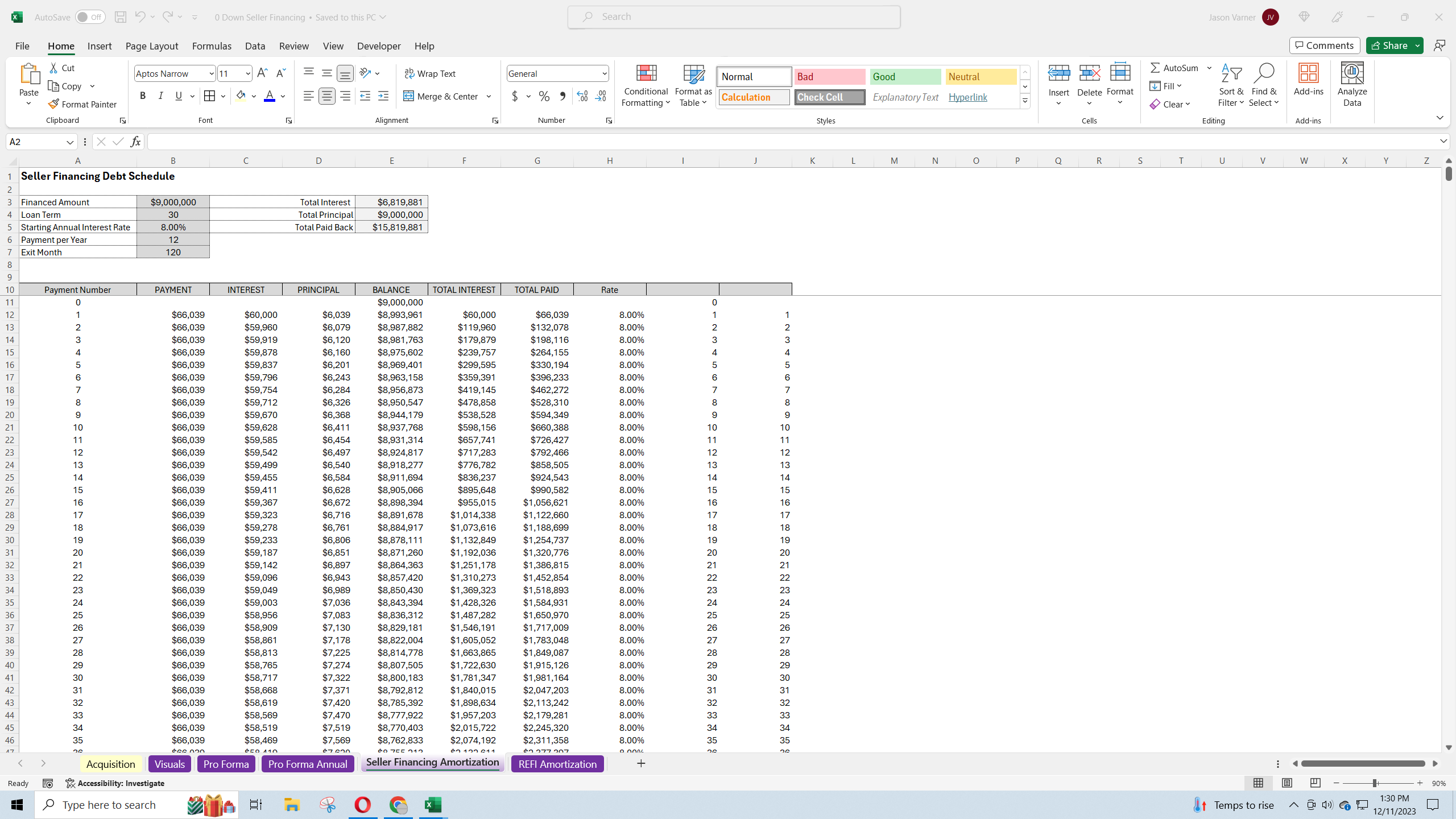

Leverage can be used in this aggressive way to boost IRR / general returns, but it is quite risky. To help get a better understanding of those risks, this financial model was made. The user can enter up to 15 properties for a portfolio purchase and designate which ones are seller-financed vs being transferred outright as well as the initial purchase price for the entire portfolio and down payment.

Then, the user can define the appraisal value for properties being transferred outright and the LTV rate for the refinance. This will show the user how much the net position is on acquisition.

To understand the future cash flows, there is a monthly and annual pro forma that populates for up to 120 months. This is driven off of the expected rental income per property less the expected operating costs per property, less debt service. You can assign an overall expected vacancy, exit cap rate, and exit month as well as all the terms for the loans.

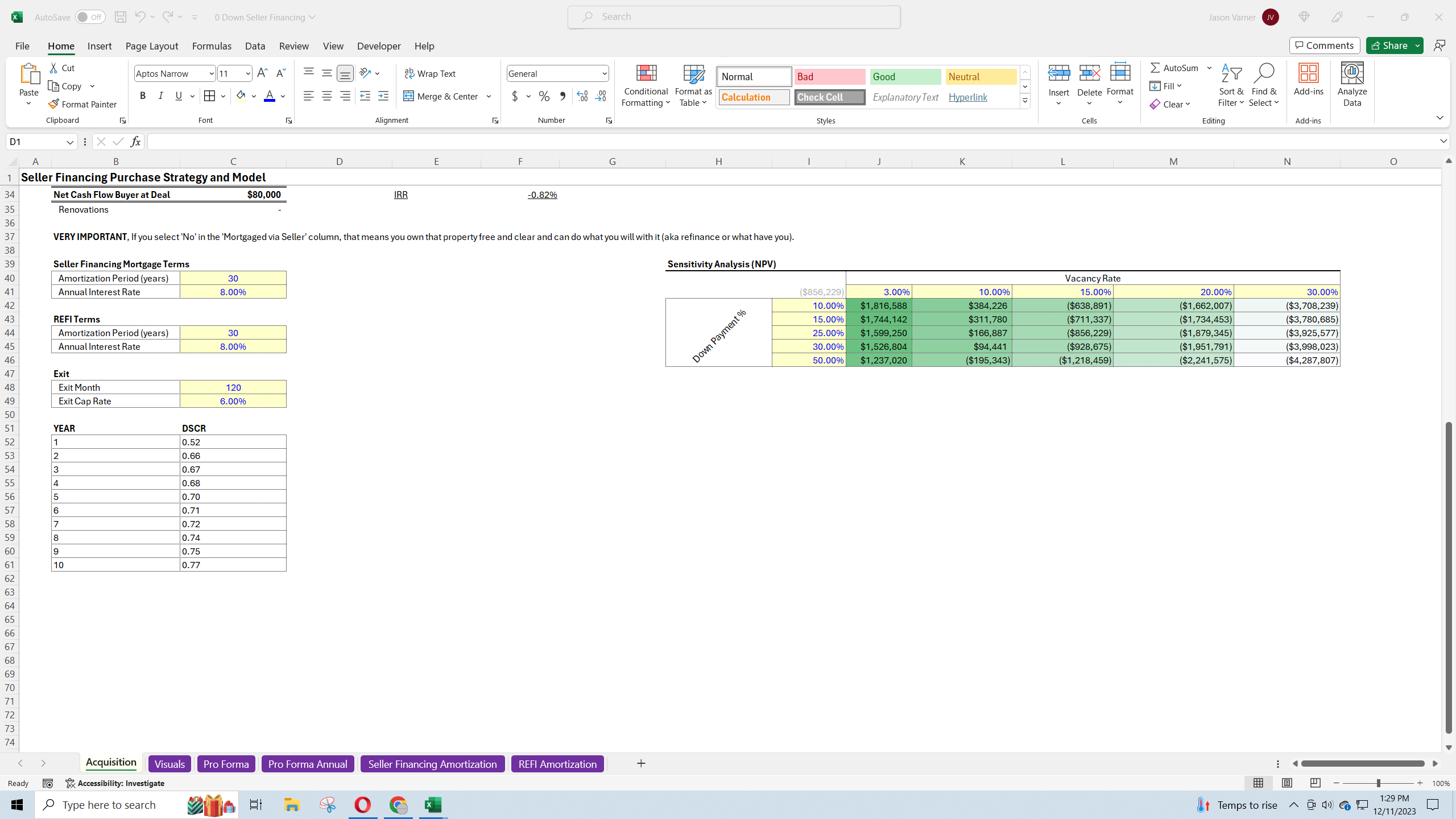

I built in a data table to show resulting net present values (NPV) based on sensitizing the occupancy rate and down payment percentage. This will tell you at what point the cash flows are negative and not feasible.

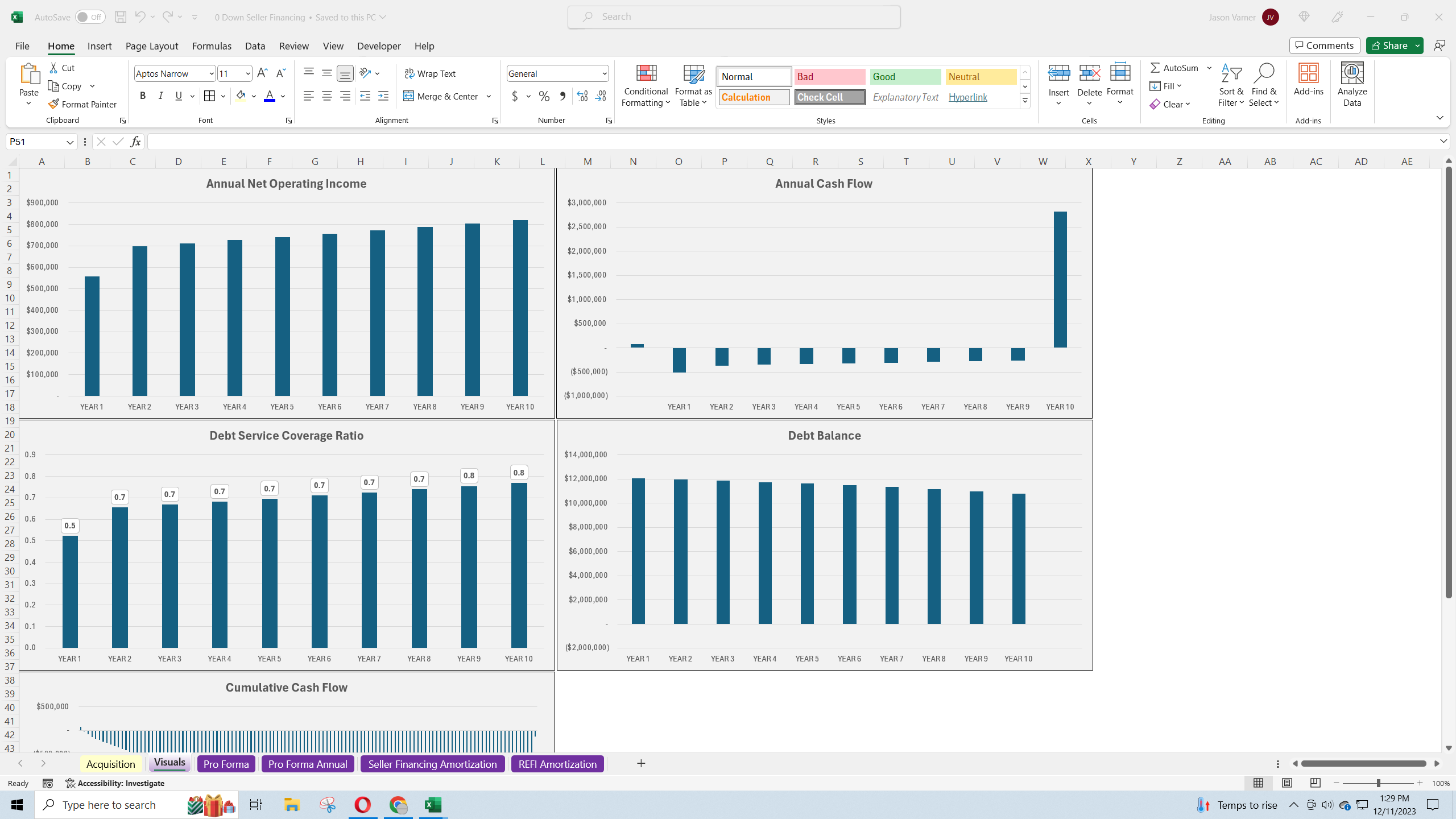

Finally, I've included a visualizations tab to make it easier to understand the model scenario.

Instructional video is included in the file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate Excel: Real Estate Model: 100% Leverage Scenario Feasibility Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping