Car Wash Financial Model: 5 Years and Seasonality Logic (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

CAR WASH EXCEL DESCRIPTION

Recent Updates: Added 3-statement integration (Income Statement, Balance Sheet, Cash Flow Statement) ; Cap Table ; CapEx with depreciation ; Improved global control assumptions.

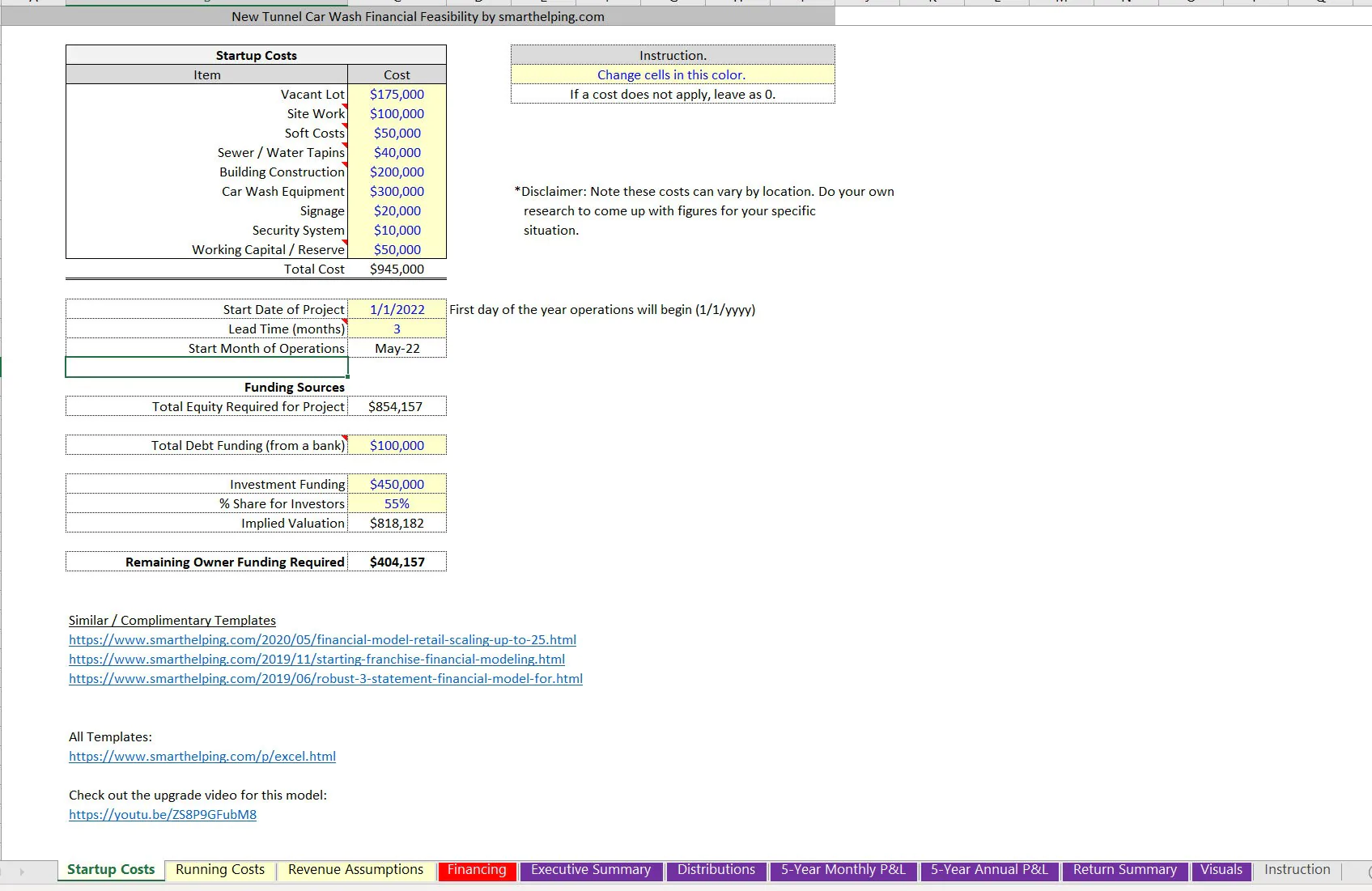

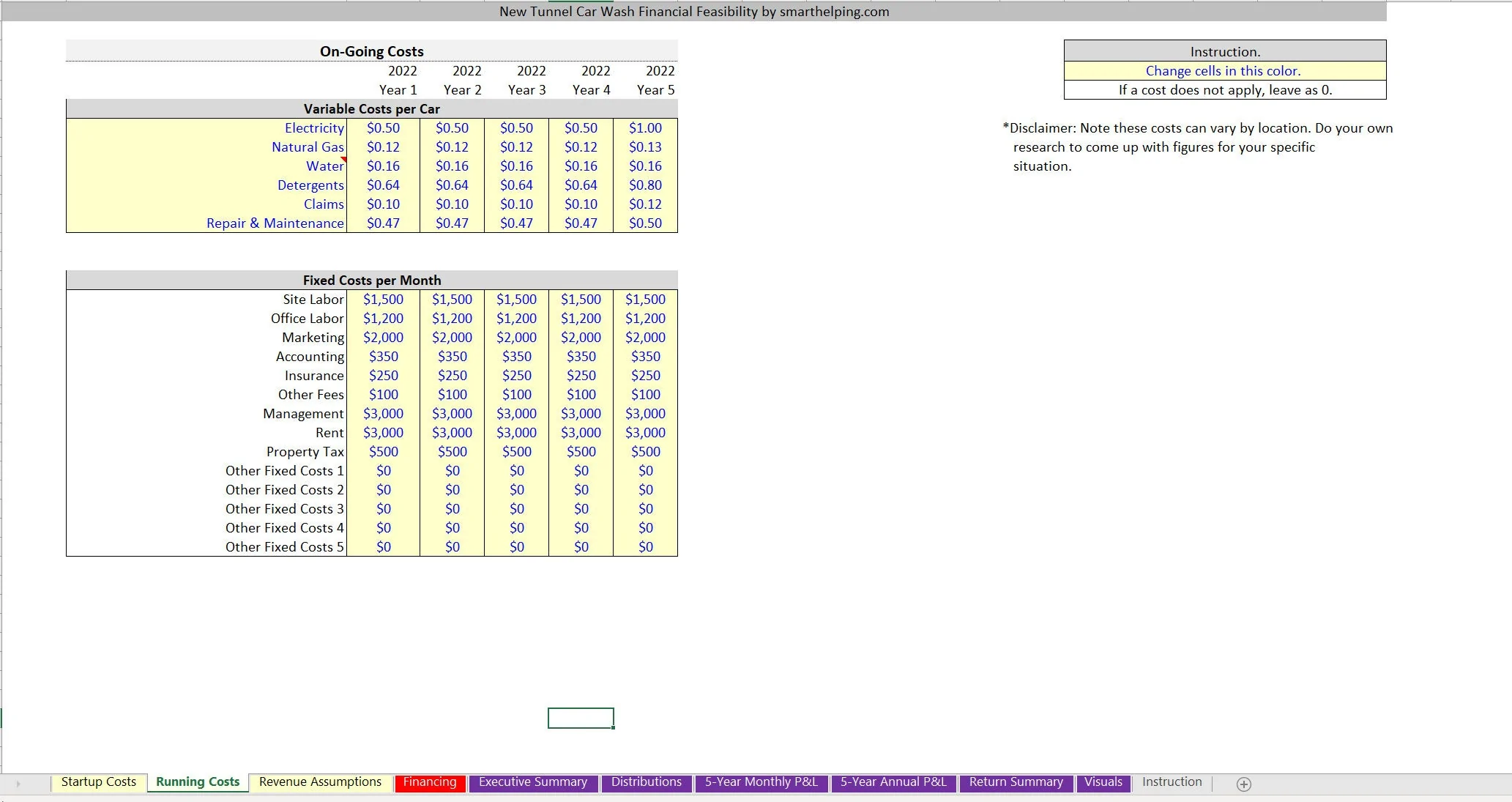

This is a seasonality driven financial model for starting up and operating a car wash tunnel. It could also fit a car wash that has bays but the startup costs would be named differently.

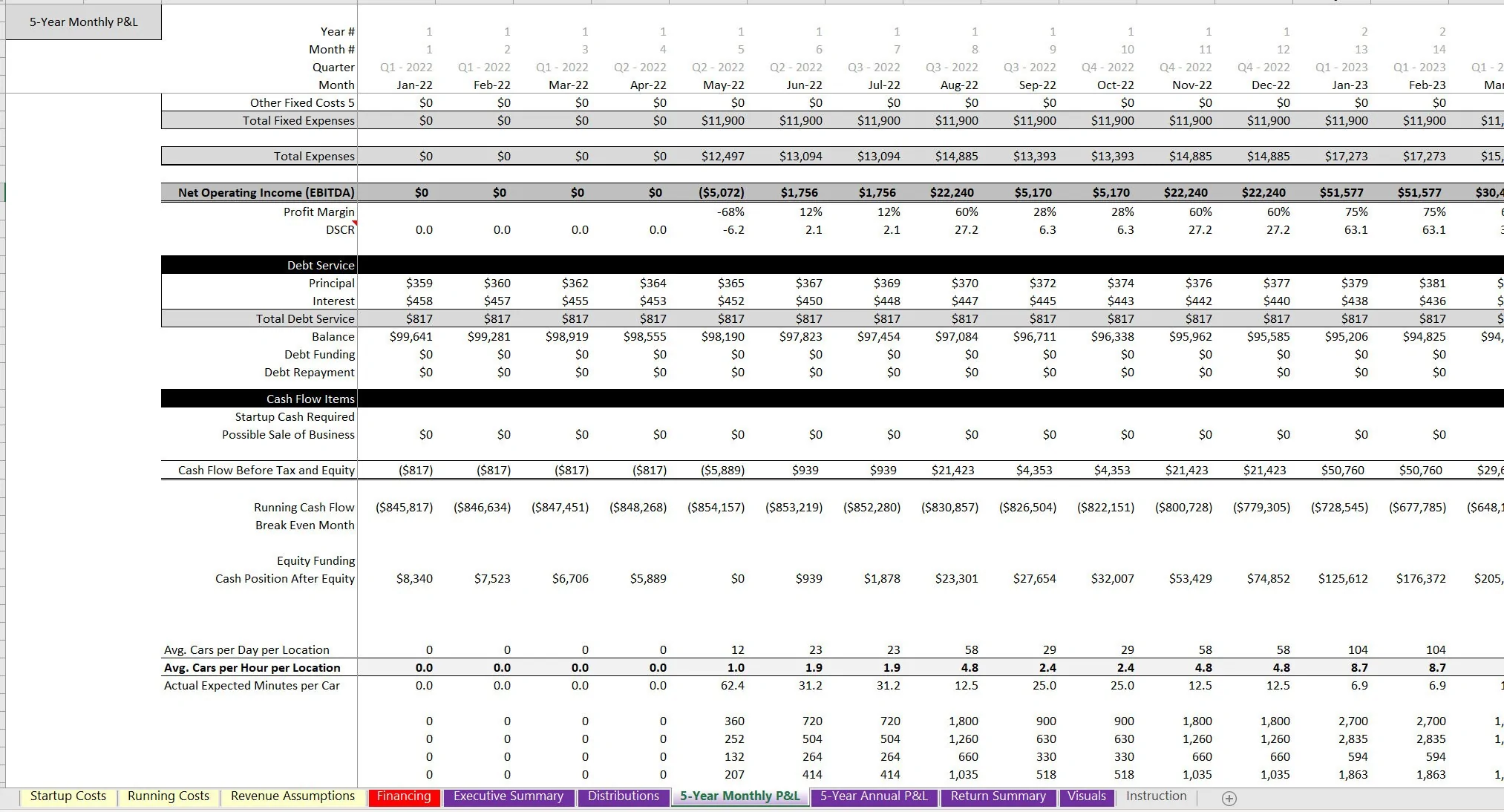

All the logic still would apply correctly for revenue, operating, exit. The model starts off with a definition of the start year of the forecast, the startup costs, how much lead time is needed from the start of construction to opening, as well as any funding from debt and/or investments (that part you would come back to after filling out the rest of the model once you know minimum equity requirements).

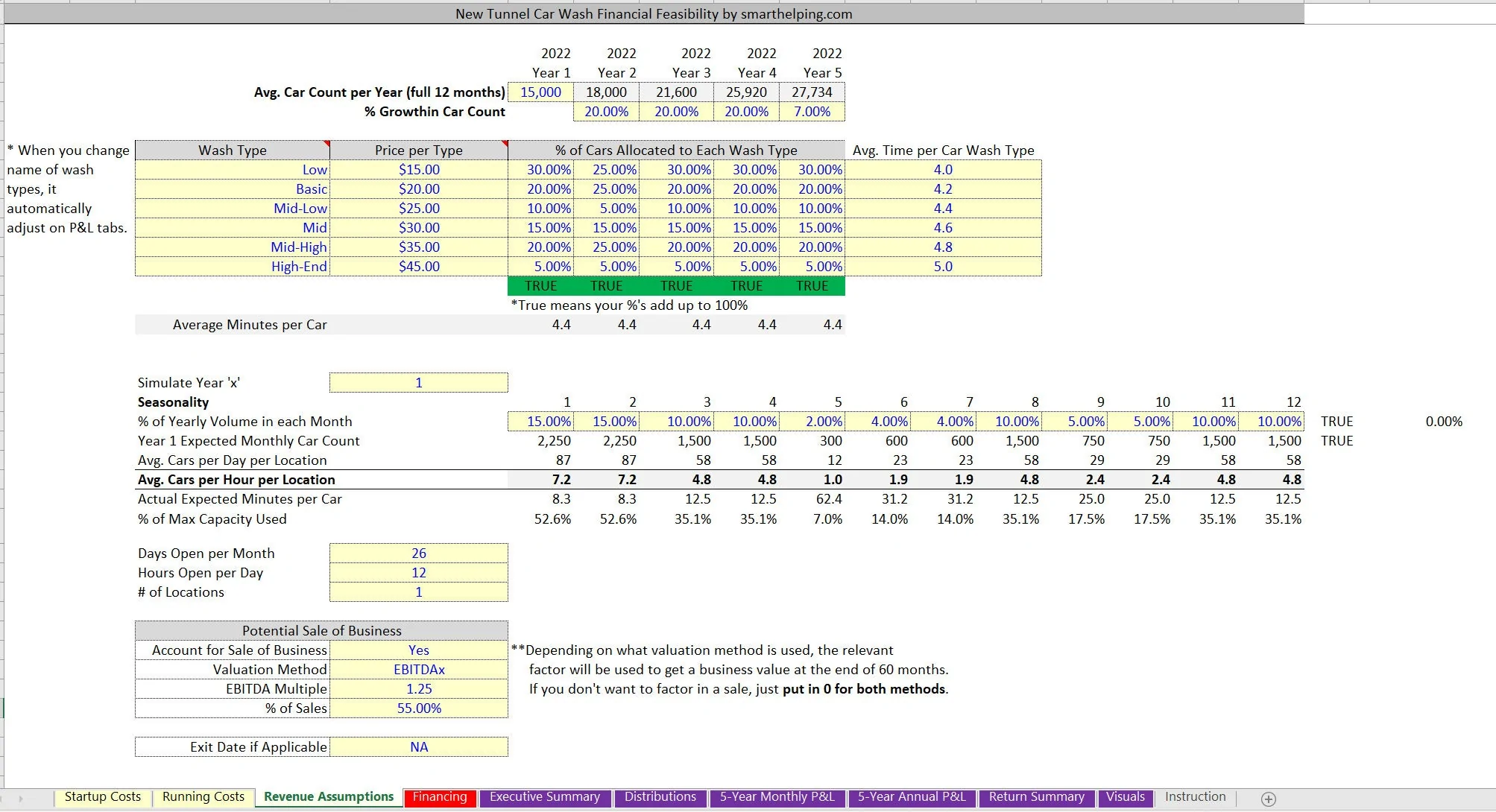

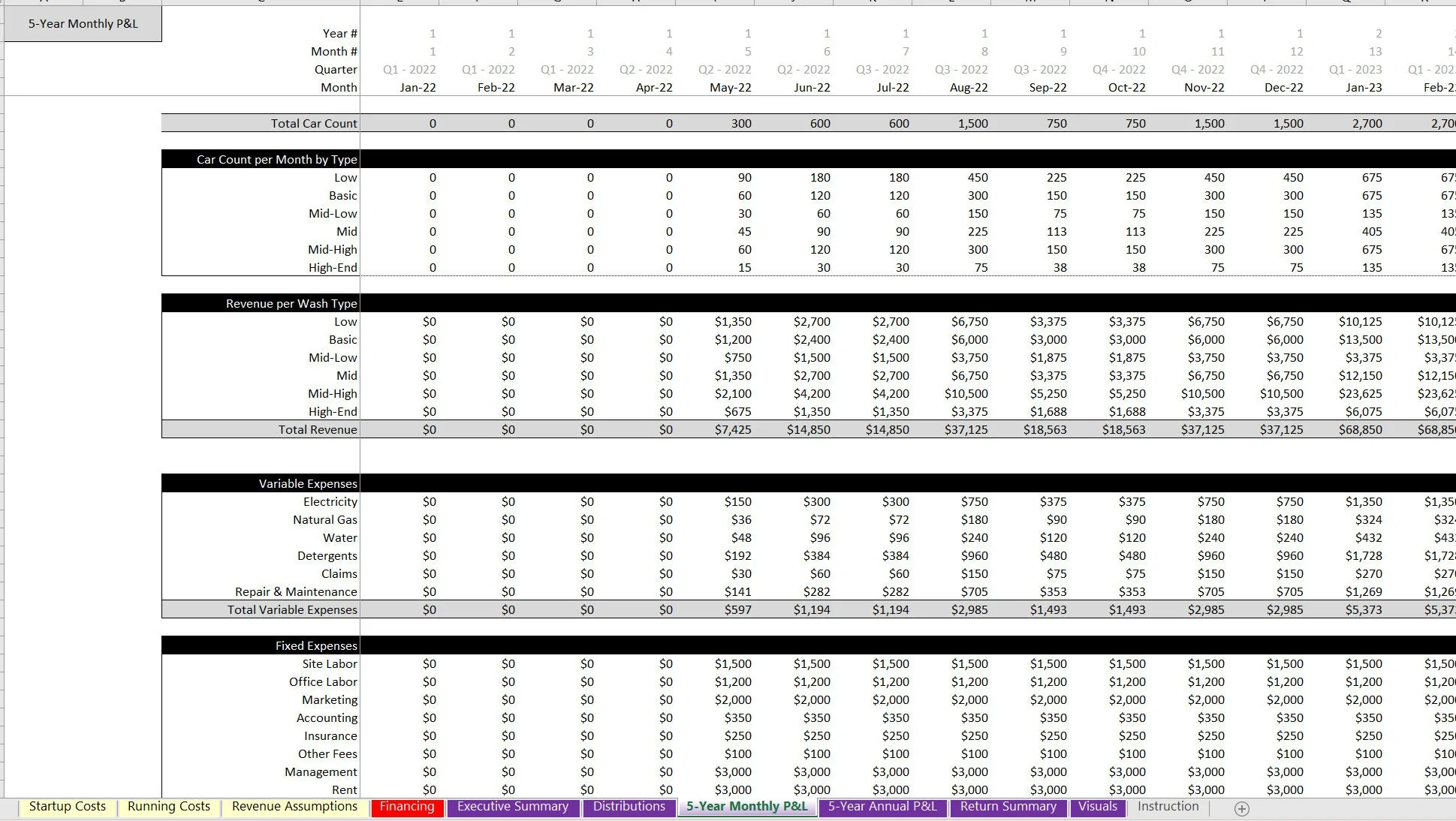

The revenue logic is the most intuitive and important part of the entire model. The user can define their expected annual car count and the annual growth of that over five years. The elegant logic comes in on a schedule where the user can configure the percentage of expected annual car counts that come in each month.

In order to easily check and make sure the inputs are reasonable, there are calculations that drive down to the expected cars per day per month and the average minutes per car that would result from the defined seasonality rates and car count growth. It is a great way to ensure that your forecast is in line with reality. It is possible to account for multiple locations in this model as well, but the model would assume the startup costs for all locations happen up front.

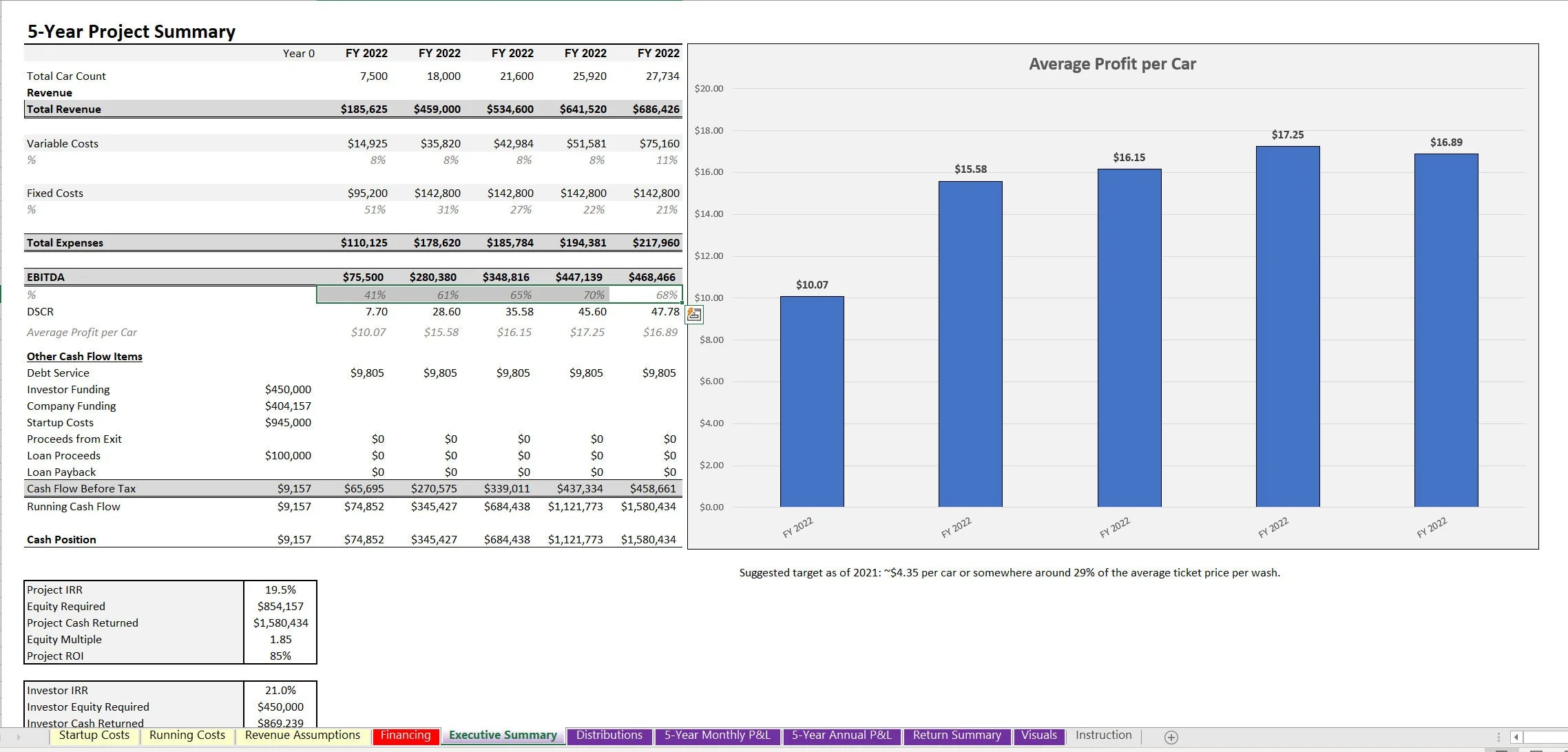

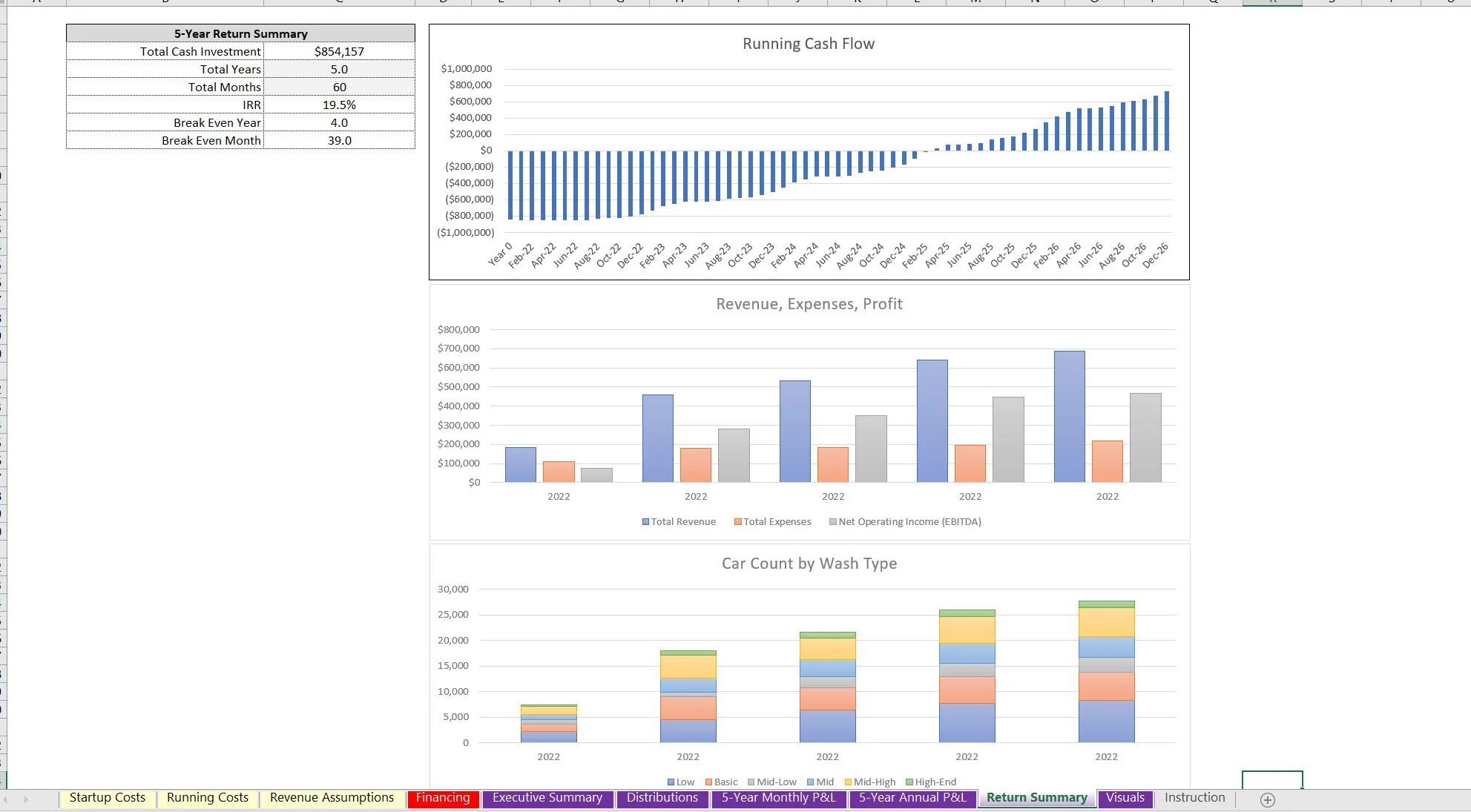

In order to get a proper terminal value of the business and perform a DCF Analysis for the investor pool / owner pool / project as a whole, the business valuation is based on either an annualized EBITDA multiple or an annualized revenue multiple (user selection). Plenty of nice visualizations of the financial forecast make things digestible and there are monthly and annual pro forma details as well as high level annual summaries for quicker overviews of the forecast.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Car Wash, Integrated Financial Model Excel: Car Wash Financial Model: 5 Years and Seasonality Logic Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping