Golf Course Club & Membership Only Financial Planning (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

GOLF EXCEL DESCRIPTION

Starting up a membership-only golf course is the dream of many. It takes a lot of money and these types of courses are known to be really nice. If you are looking into starting up such a business, the first thing to do is start planning out the capital requirements and expected cash flows / return on investment that may be possible based on various assumptions.

A golf course that runs on membership fees alone will need to make sure the initial investment can be paid back reasonably based on the expected membership fees. Note that you will need to cap your memberships.

Here are the specific assumptions this financial model has to help you achieve a good financial analysis:

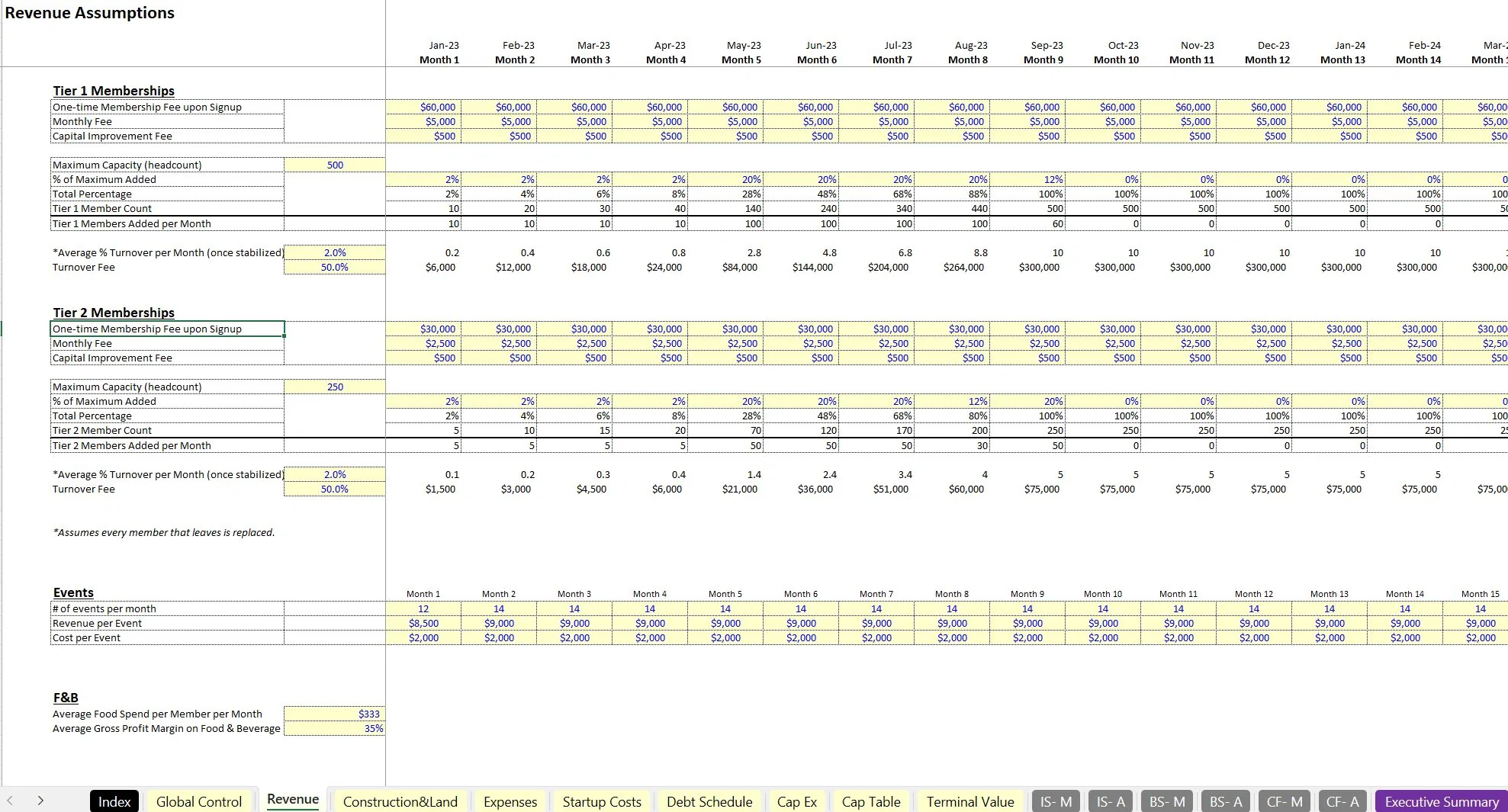

Revenue Sources:

• One-time Membership Fee upon Signup

• Monthly Fee

• Capital Improvement Fee

• One-time events (define revenue/cost/count per month)

• Food and Beverage Sales (define average spend per month per members and average gross margins)

Capacity Drivers:

• Two membership type configurations

• Maximum Capacity (headcount)

• % of Maximum Added

• Members Added per Month

• Average % Turnover per Month (once stabilized)

• Turnover Fee

Most of the above assumptions can be altered monthly over a 60 month timeline.

A couple notes on the above. Individuals will buy a membership and once they buy this, the only way out is to sell. When they do sell, they only keep a certain percentage of the proceeds and the rest goes to the golf course. This helps deter attrition. As a member, a monthly fee is required and that fee will depend on the quality of the course.

Other Assumptions:

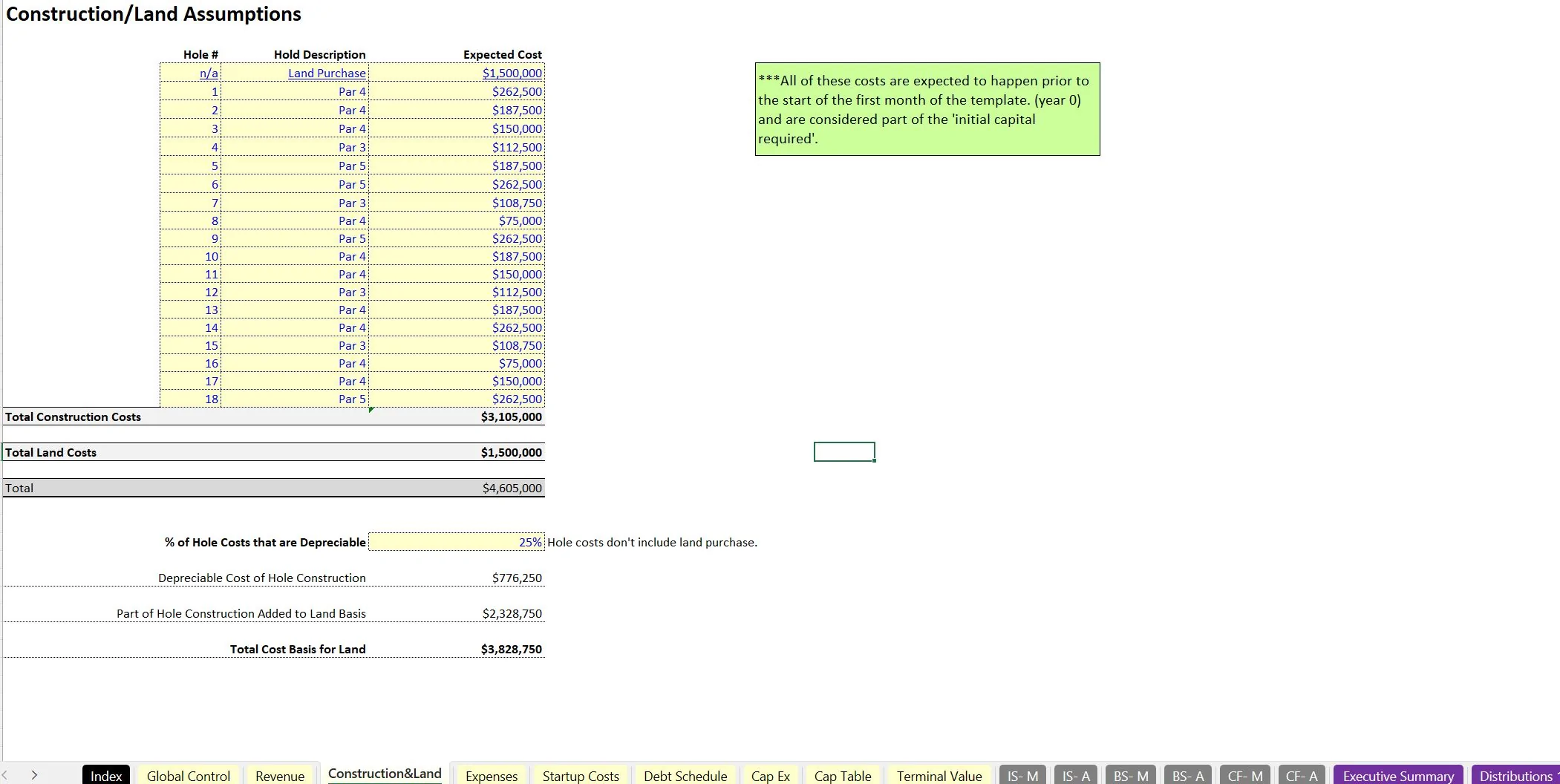

• Hole construction cost schedule

• Other Capex Items

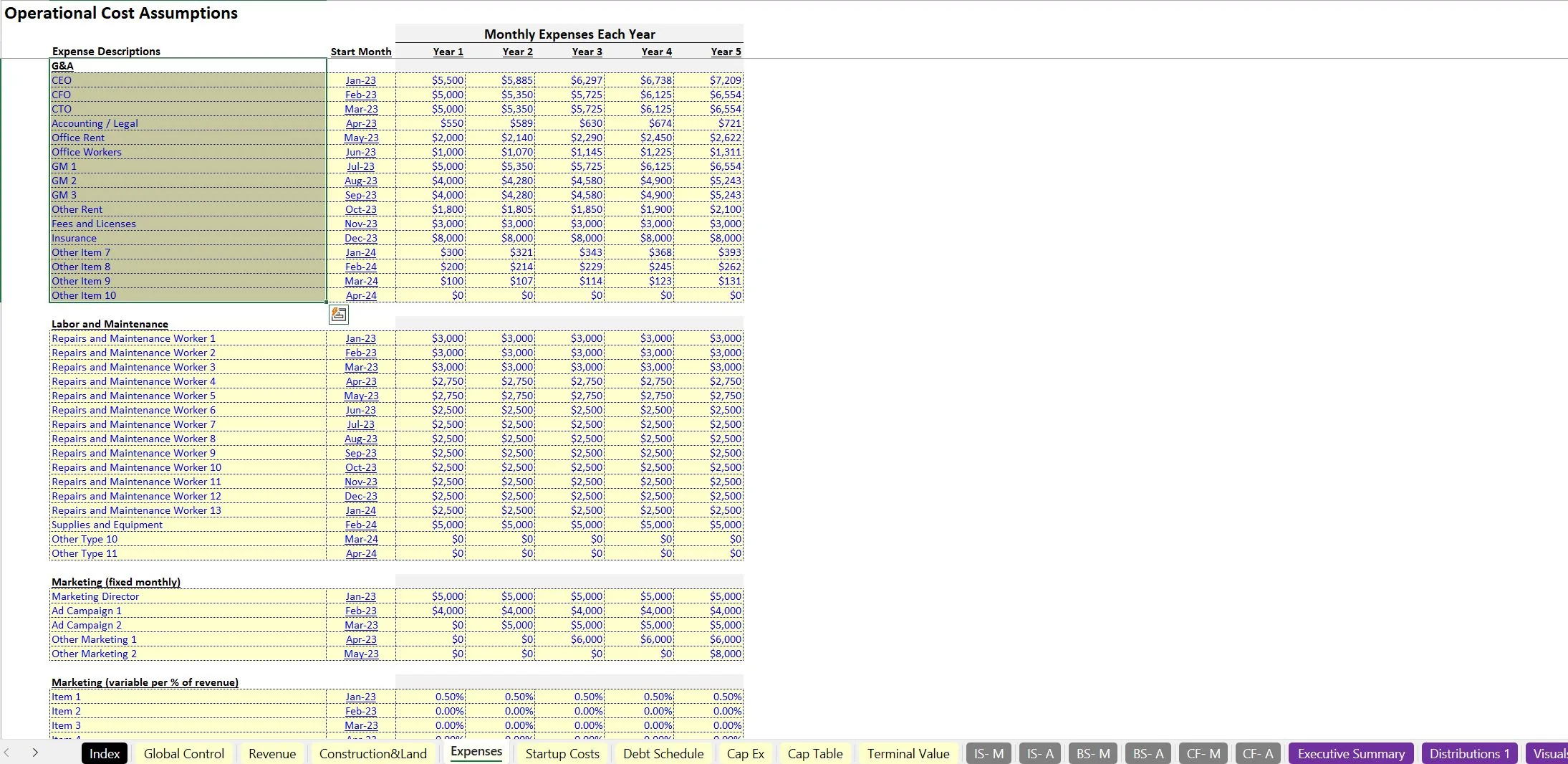

• Fixed cost schedule

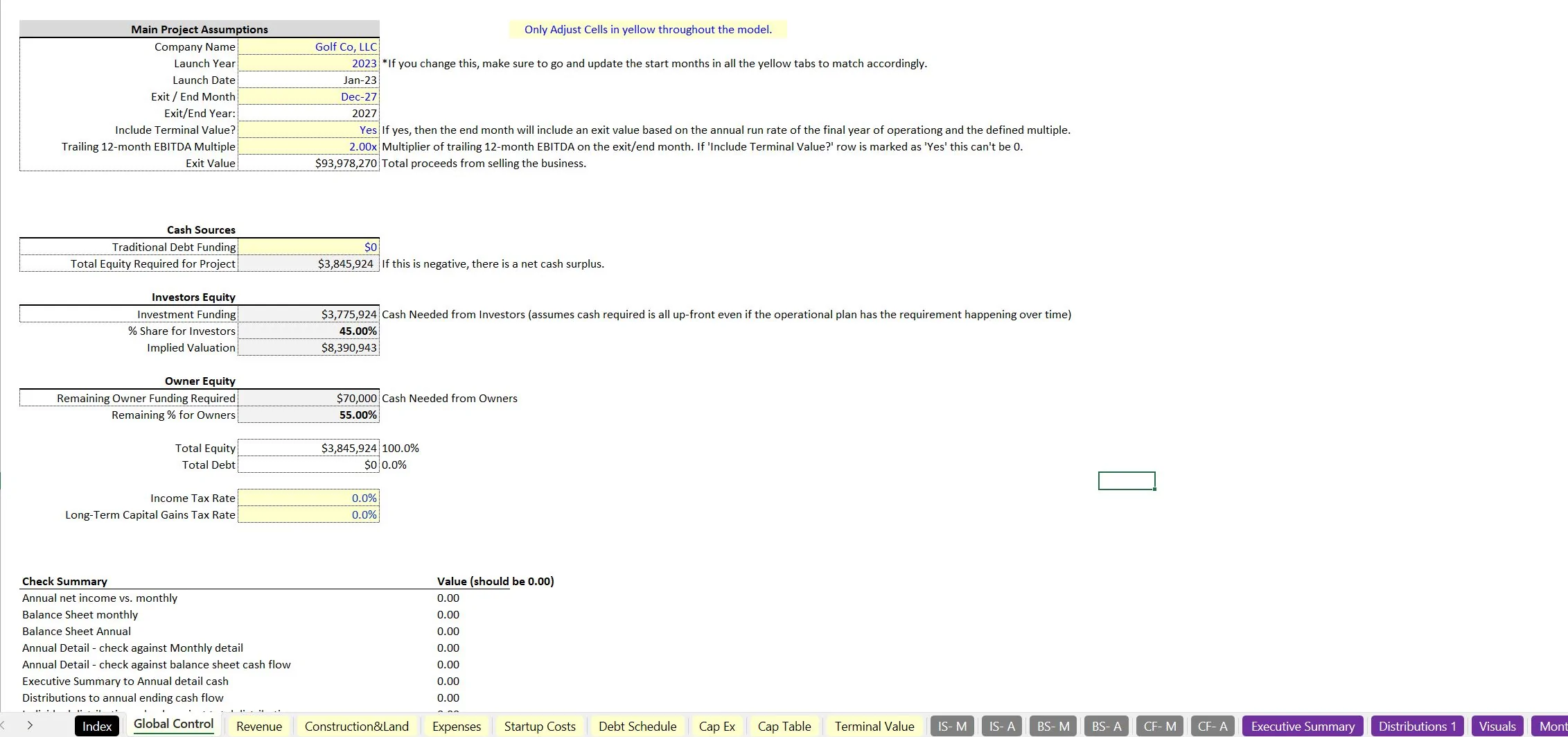

• Exit multiple (select to show an exit value or not)

• Other one-time startup costs

Final Outputs:

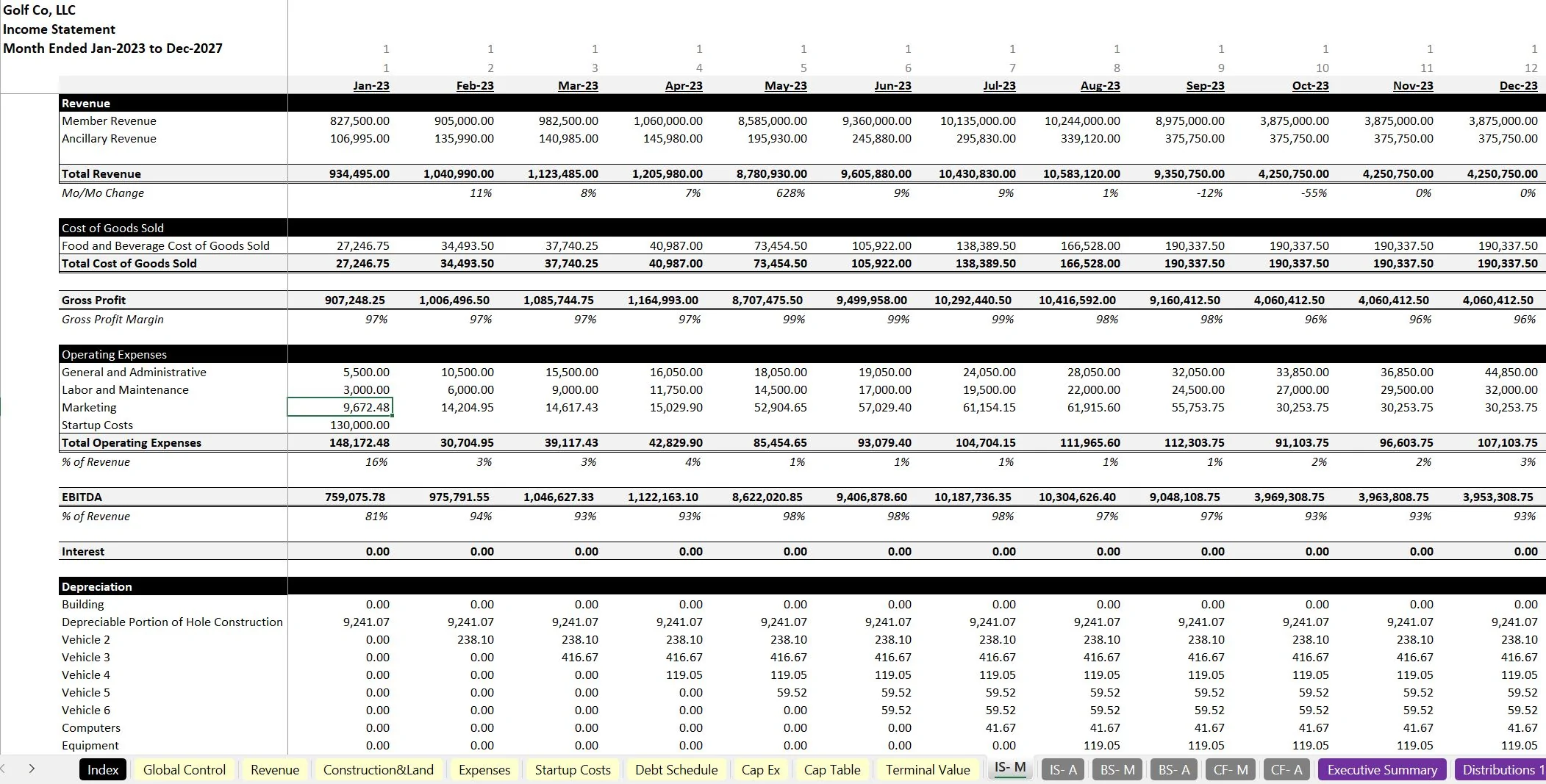

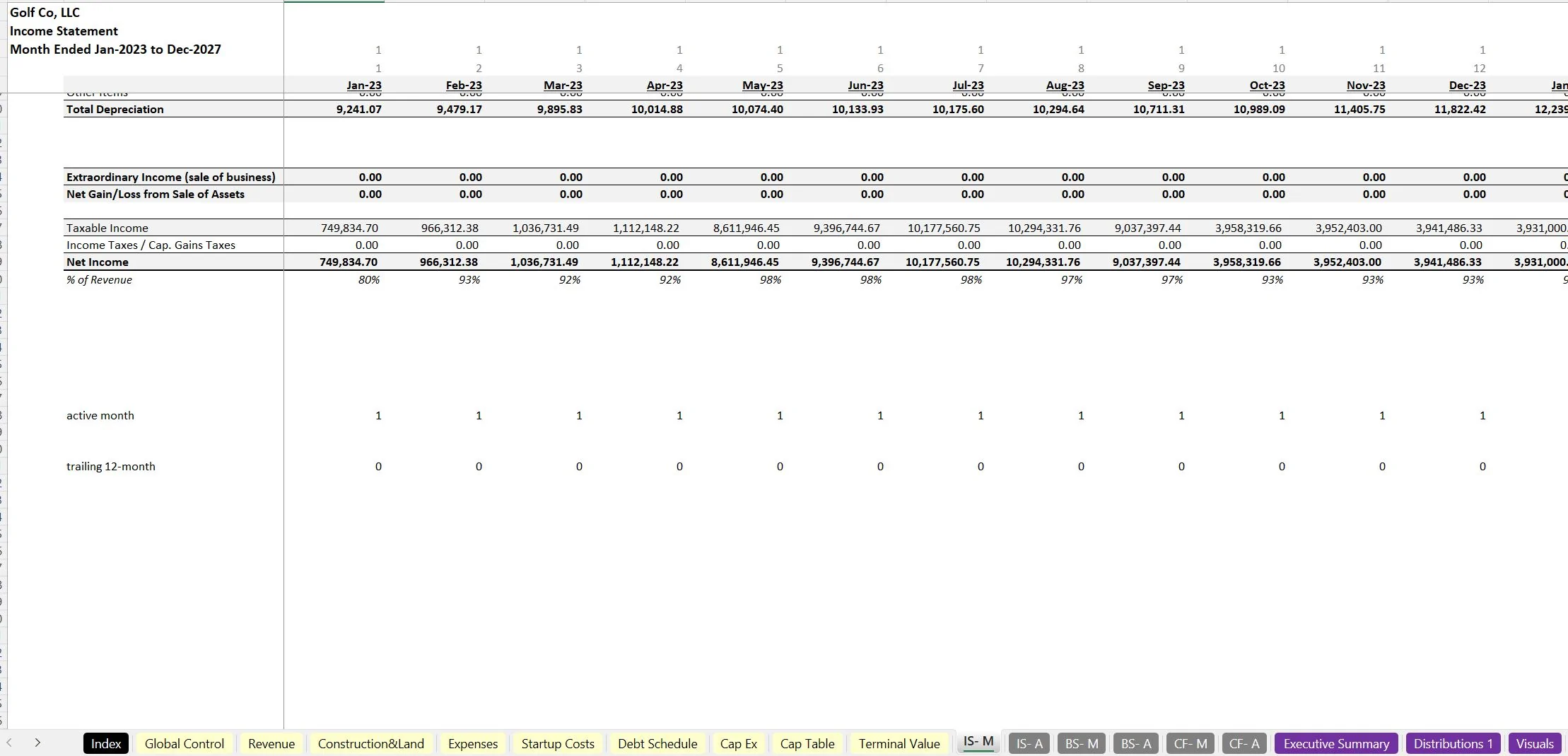

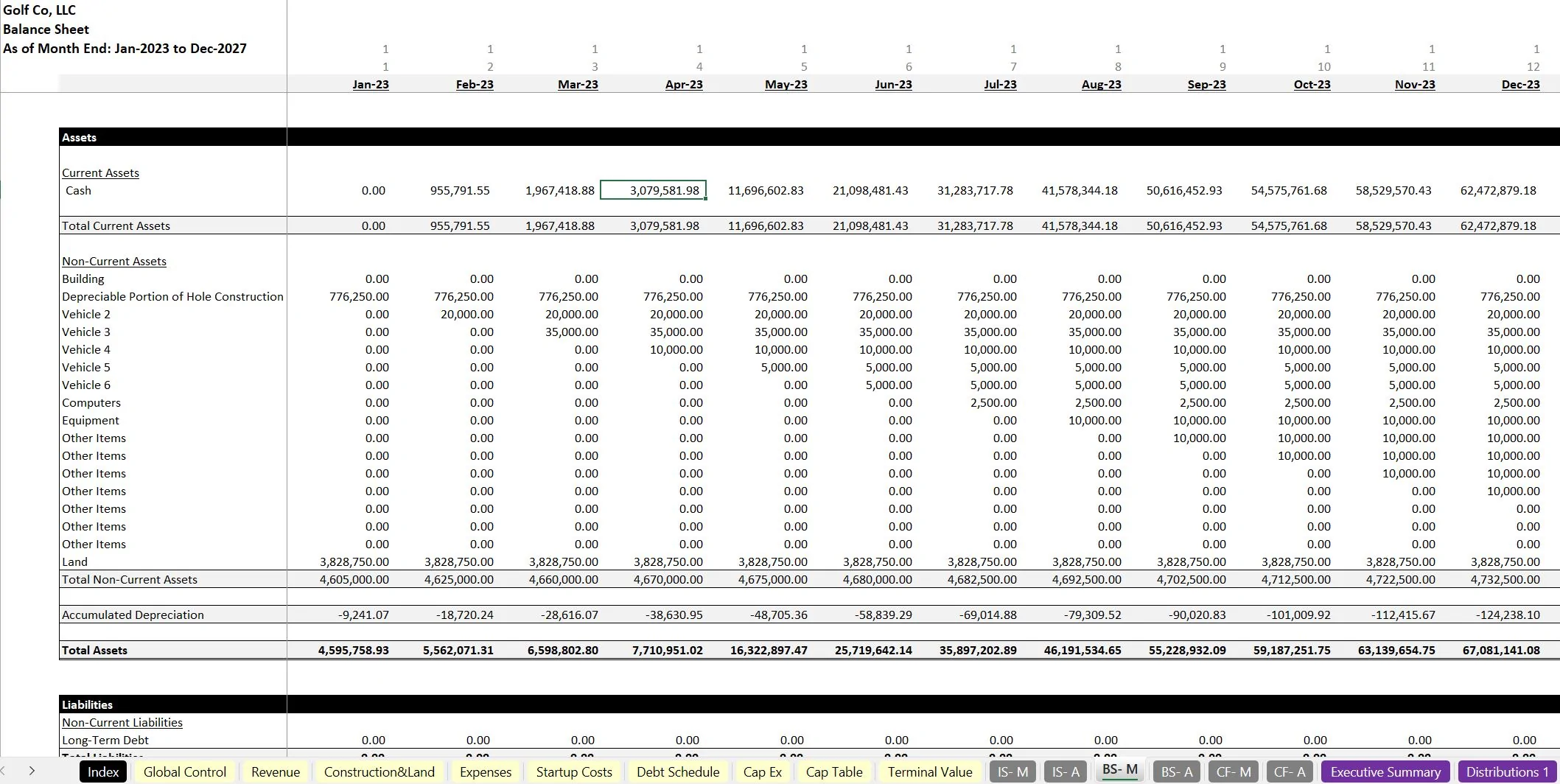

• Monthly / Annual Financial Statements

• Cap Table

• Annual Executive Summary

• Monthly / Annual Pro Forma Detail

• Visualizations

• DCF Analysis with NPV / IRR for project and any outside investors

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Golf, Integrated Financial Model Excel: Golf Course Club & Membership Only Financial Planning Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping