Joint Venture Waterfall: GP Catch-up Option (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Joint Venture

- GP Catch-up

- Distribution Analysis

JOINT VENTURE EXCEL DESCRIPTION

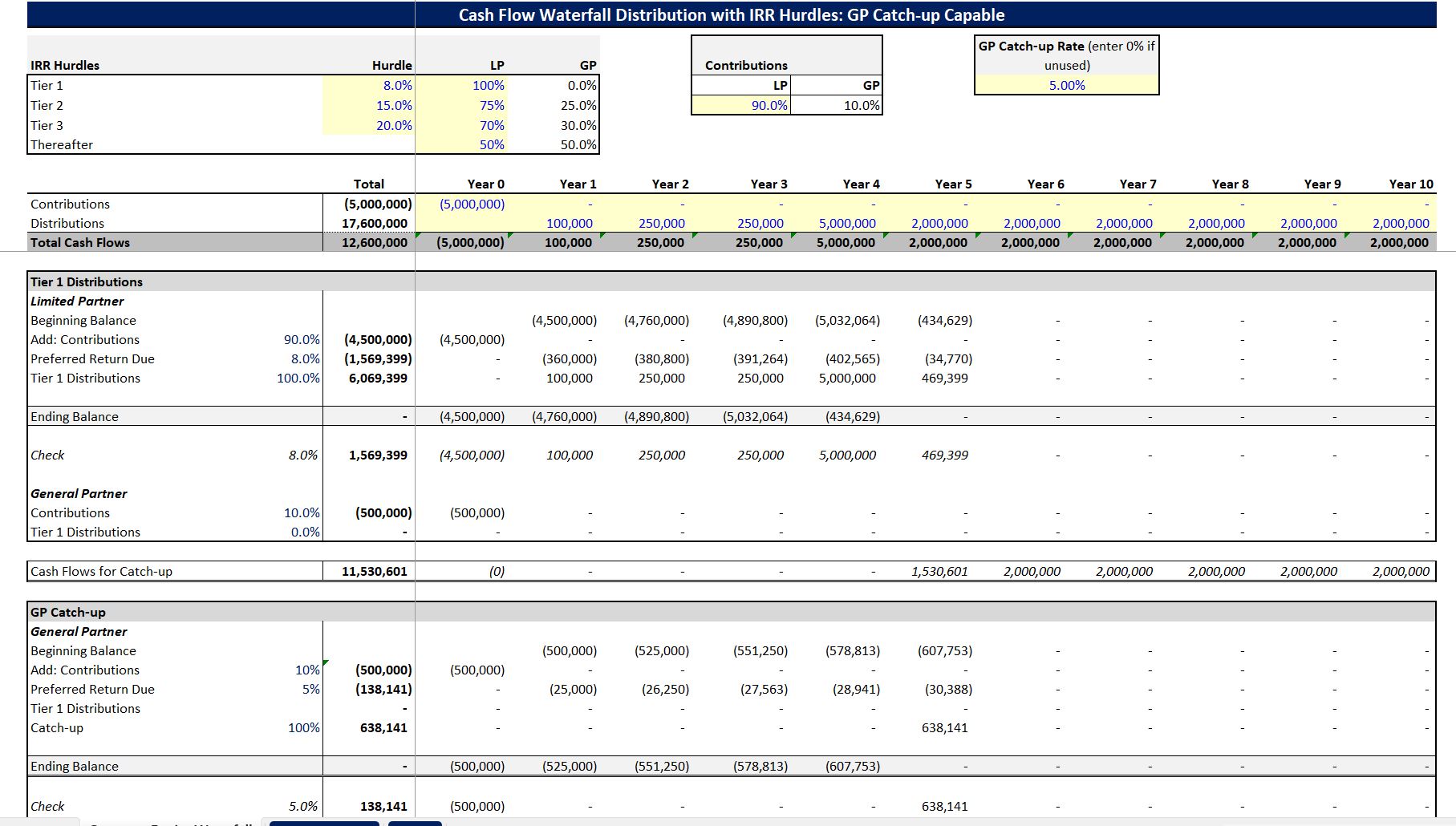

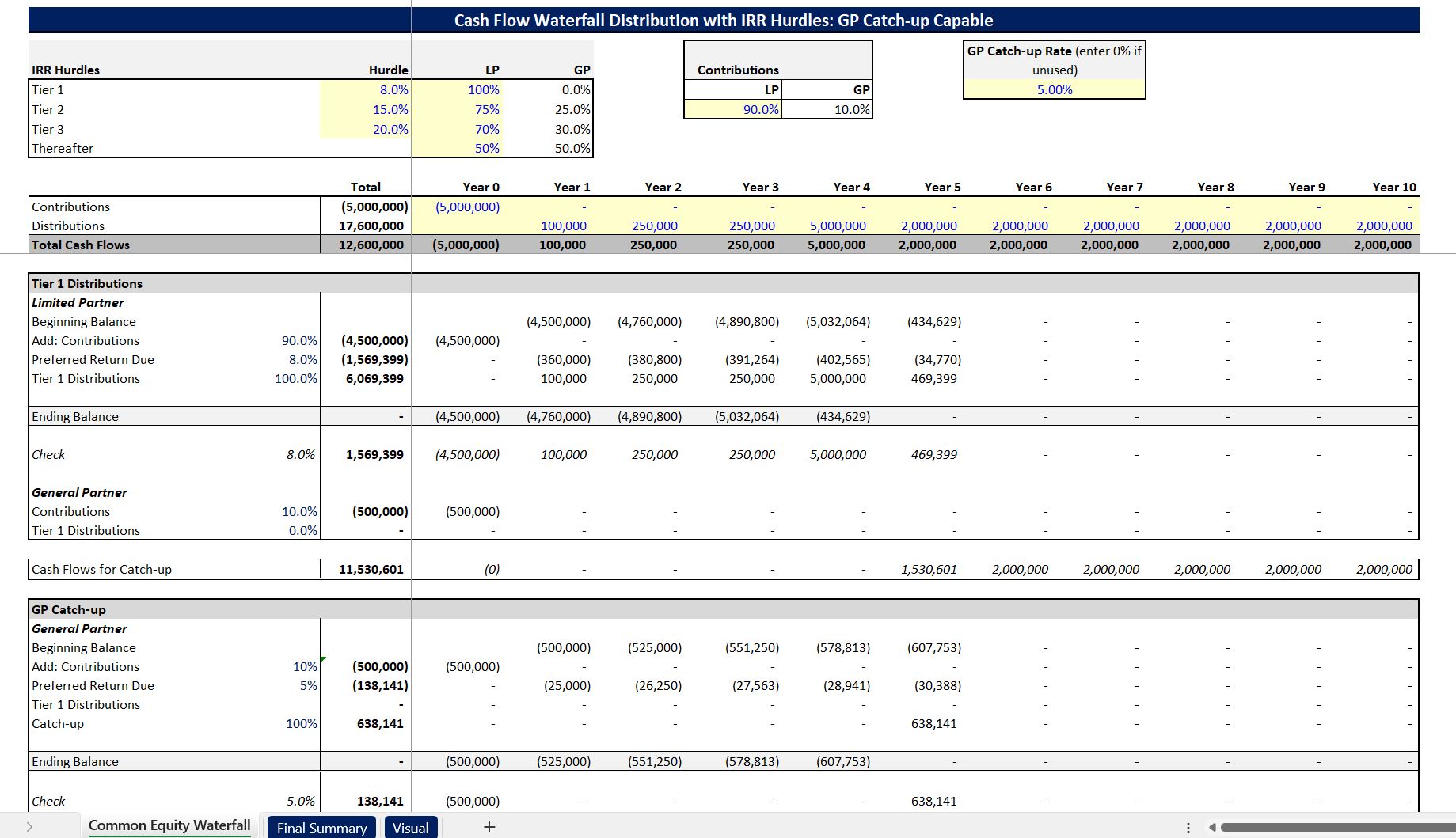

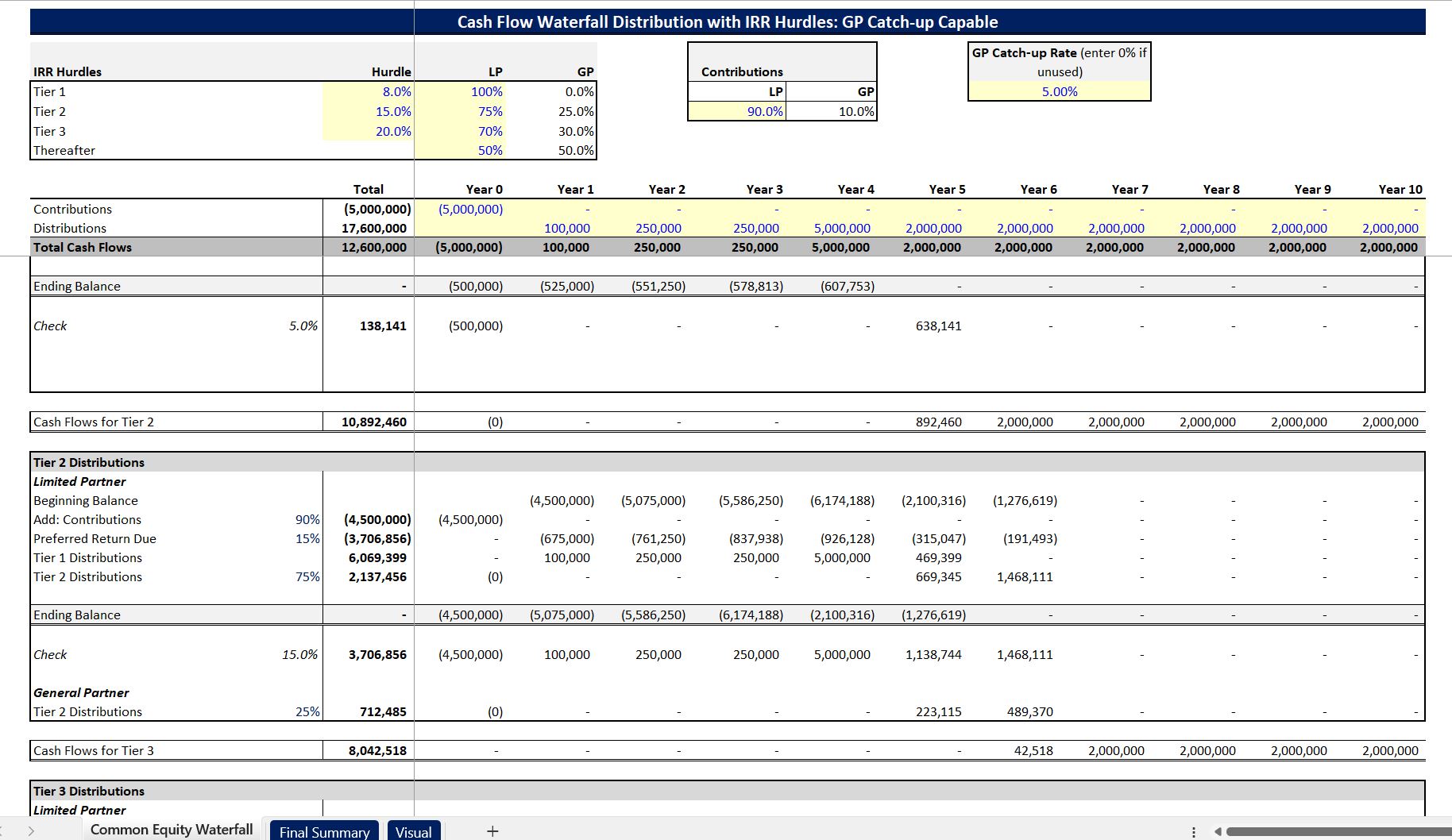

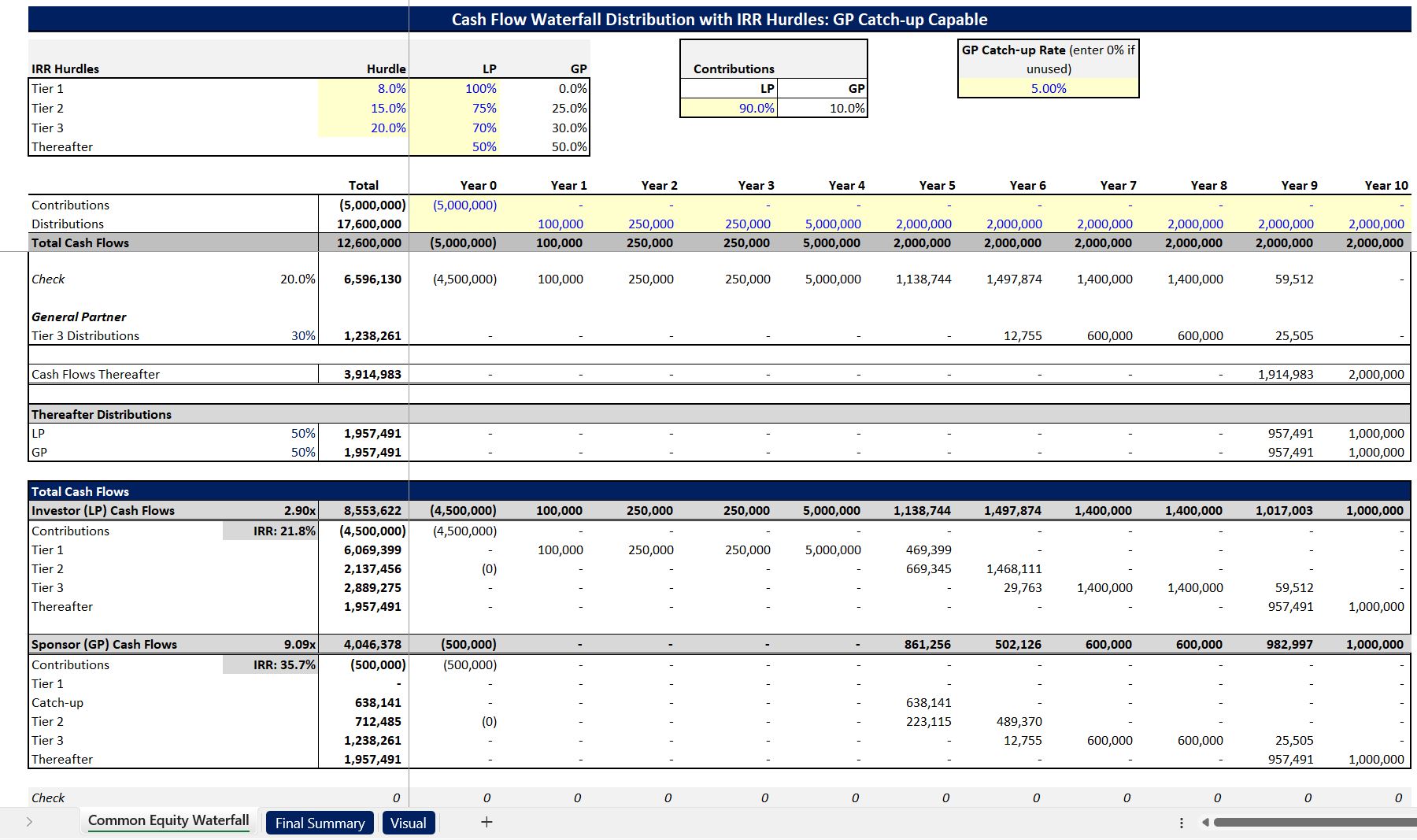

This model is based on IRR hurdles for the LP. The template is designed for any kind of syndication joint venture deal where there is an LP and a GP. The cash in and out for the project can be plugged in at the top as well as the contribution rate of the LP and GP.

The IRR Hurdles are setup for up to 3 rates where cash is split at varying amounts up to each goal rate for the LP.

I added an option for the GP to 'catch-up' so their IRR is equals to a defined rate before cash starts to get split at the next hurdle rate for the LP. If you've never modeled this, it is going to be difficult to do so and you will be able to learn a lot from the logic that is built in here.

It is setup for annual periods, but if you wanted to change it to monthly, simply drag the formulas over to as many periods as you need and change the hurdle rates to a monthly basis.

You will see this type of deal most often when the GP is contributing some amount of equity to the deal, but the LP is receiving 100% of the cash flow until their first hurdle rate is completed. The deal structure incentivizes the GP to return the LPs money and a return on top of that so then the GP can start receiving more of the cash flows. This is a win/win.

At the bottom of the model you will see a DCF Analysis for the GP and LP as well as the NPV, IRR, and Equity Multiple of each party.

The goal of this template is to be as easy to use as possible. You can plug in the cash flow per period based on any model you have and then all of this logic will automatically calculate the cash flows per tier and summarize it.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Joint Venture Excel: Joint Venture Waterfall: GP Catch-up Option Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping