Hotel Financial Model: Development, Acquisition, Operating & Dissolution (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

WHO: Designed for individuals starting a hotel business.

WHAT: Customizable to fit individuals needs with built in logic to reflect developmental assumptions, including debt, revenue, expenses, equity, as well as generate reports/ summaries.

Users can define:

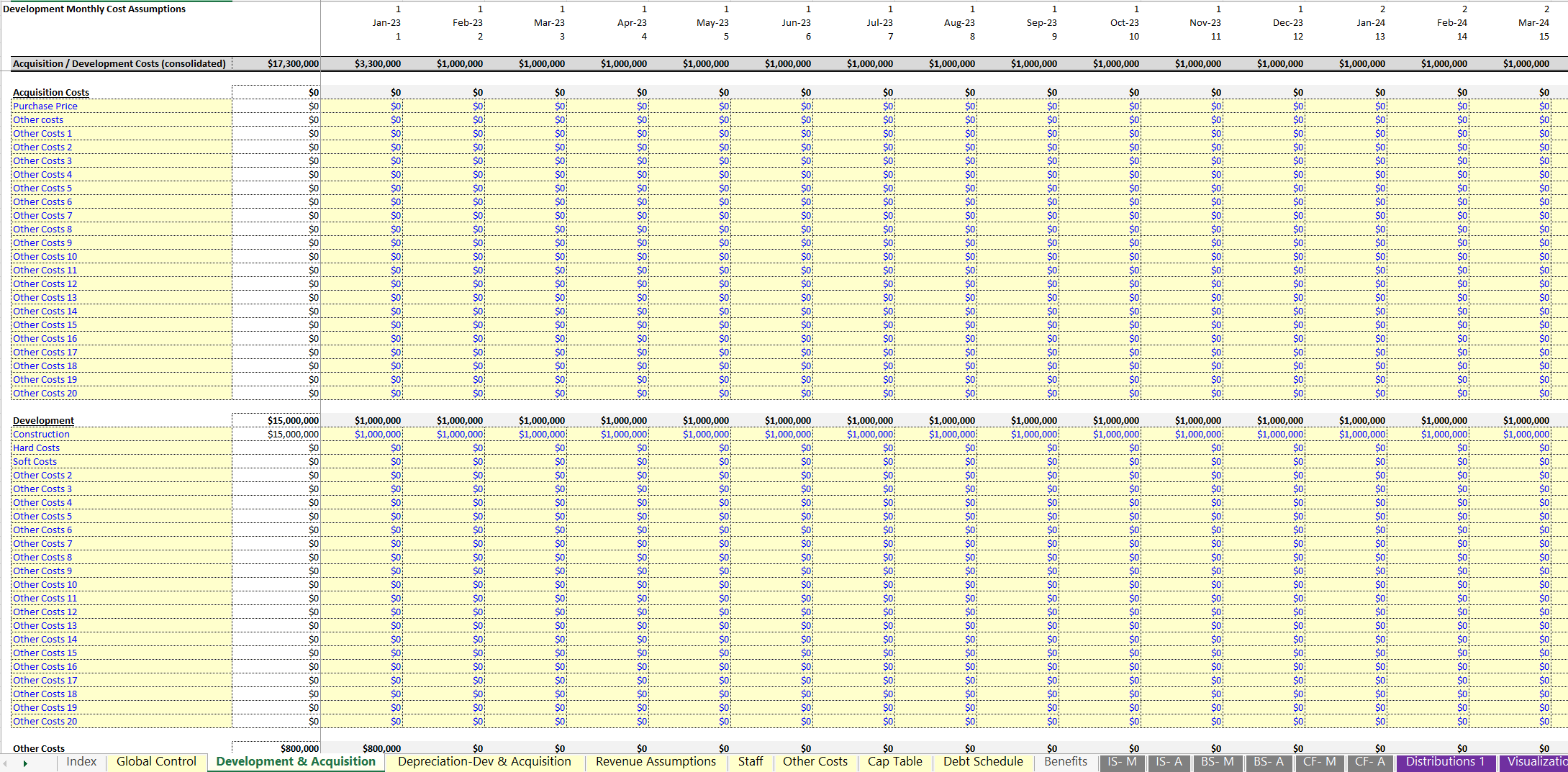

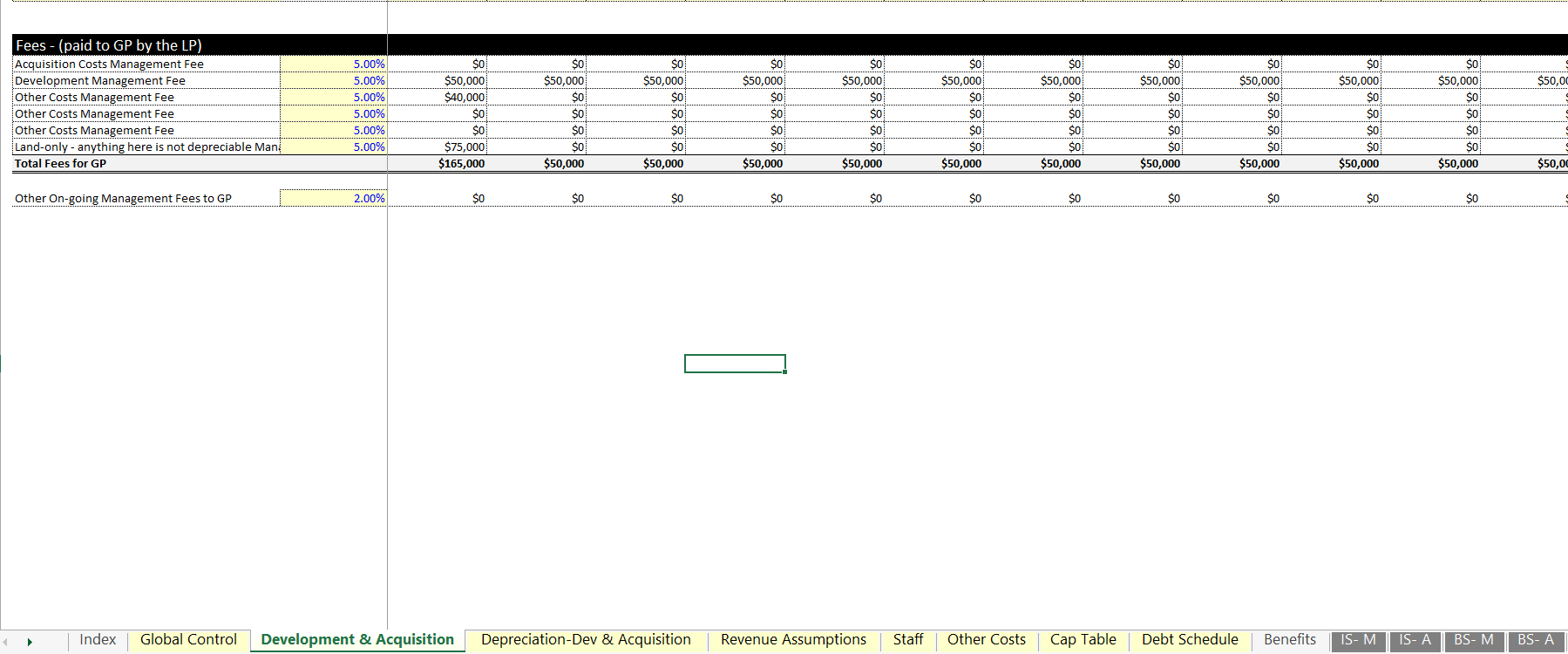

• Up to 6 sections for development/acquisition/renovation/purchase price assumptions

Each cost includes 22 slots to denote purchase price, and costs for construction, closing, development, as well as any other soft/ hard costs.

User can define the percentage of each cost, e.g., acquisition fee, renovation fee, and/ or percentage of startup cost.

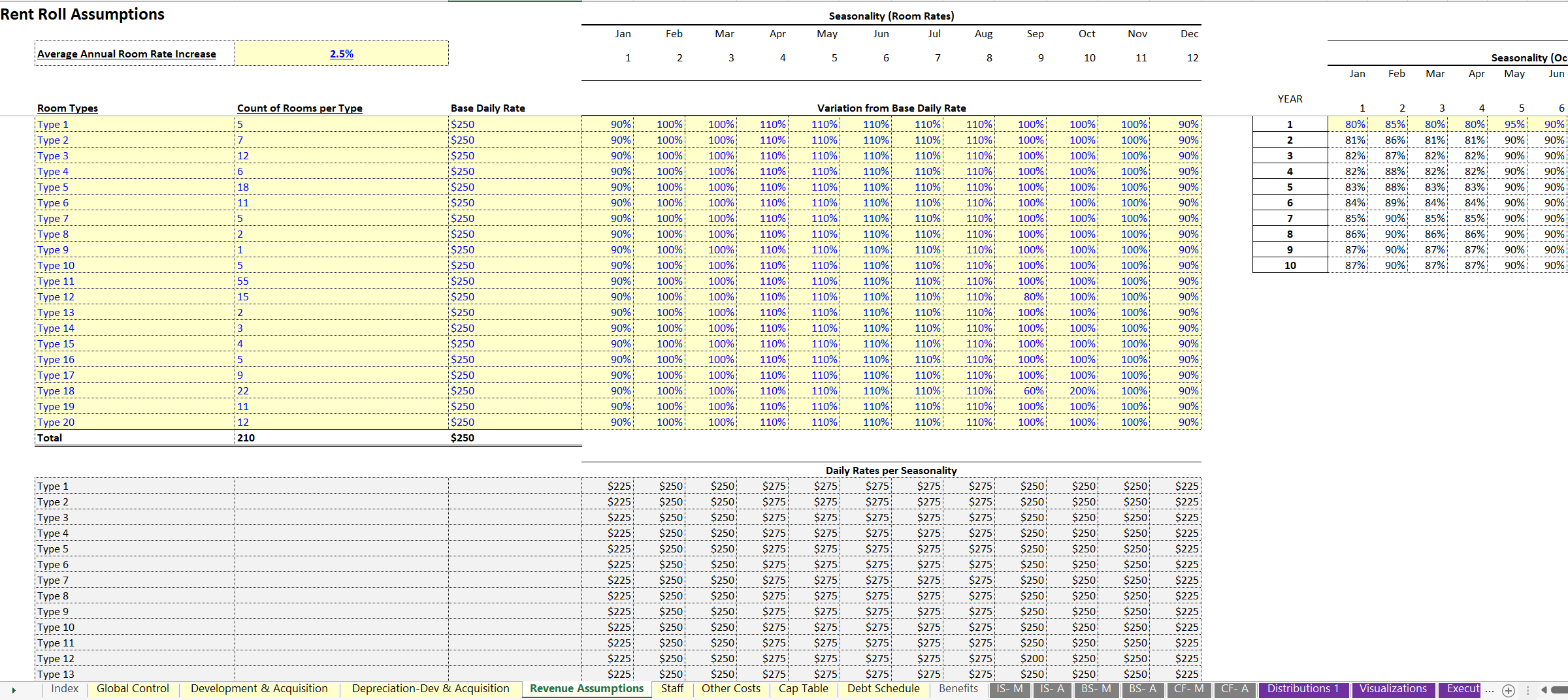

• Up to 20 room types

Including count of each room type and base room rate with configurations to consider variations in price due to supply/ demand, seasonality, etc.

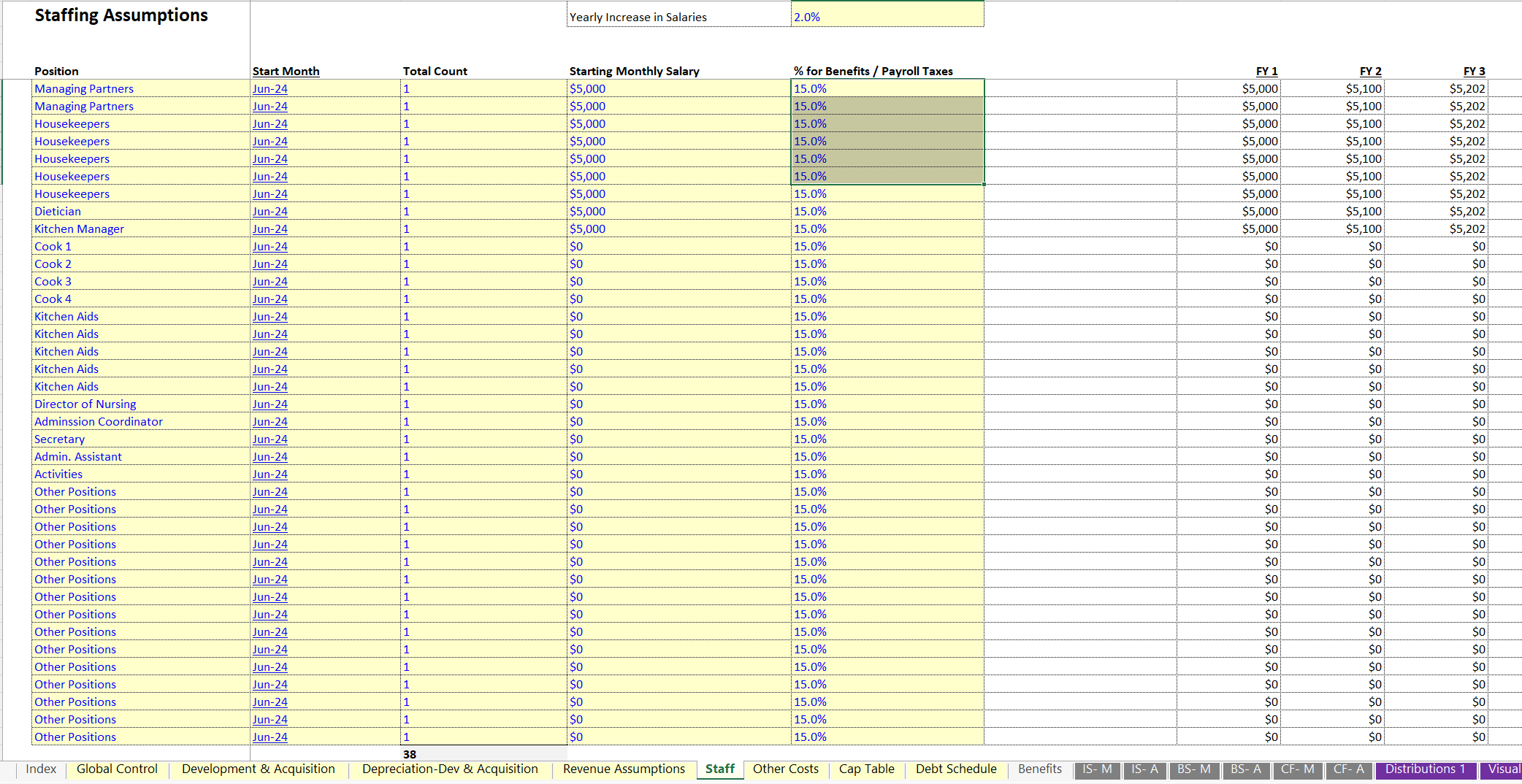

• Staff schedule, staff type, count, cost, growth rate, and payroll taxes/ benefits

• Fixed expenses (monthly total, start month, annual growth rate)

Generated reports/ summaries include:

• Monthly/ annual cash flow & operating details

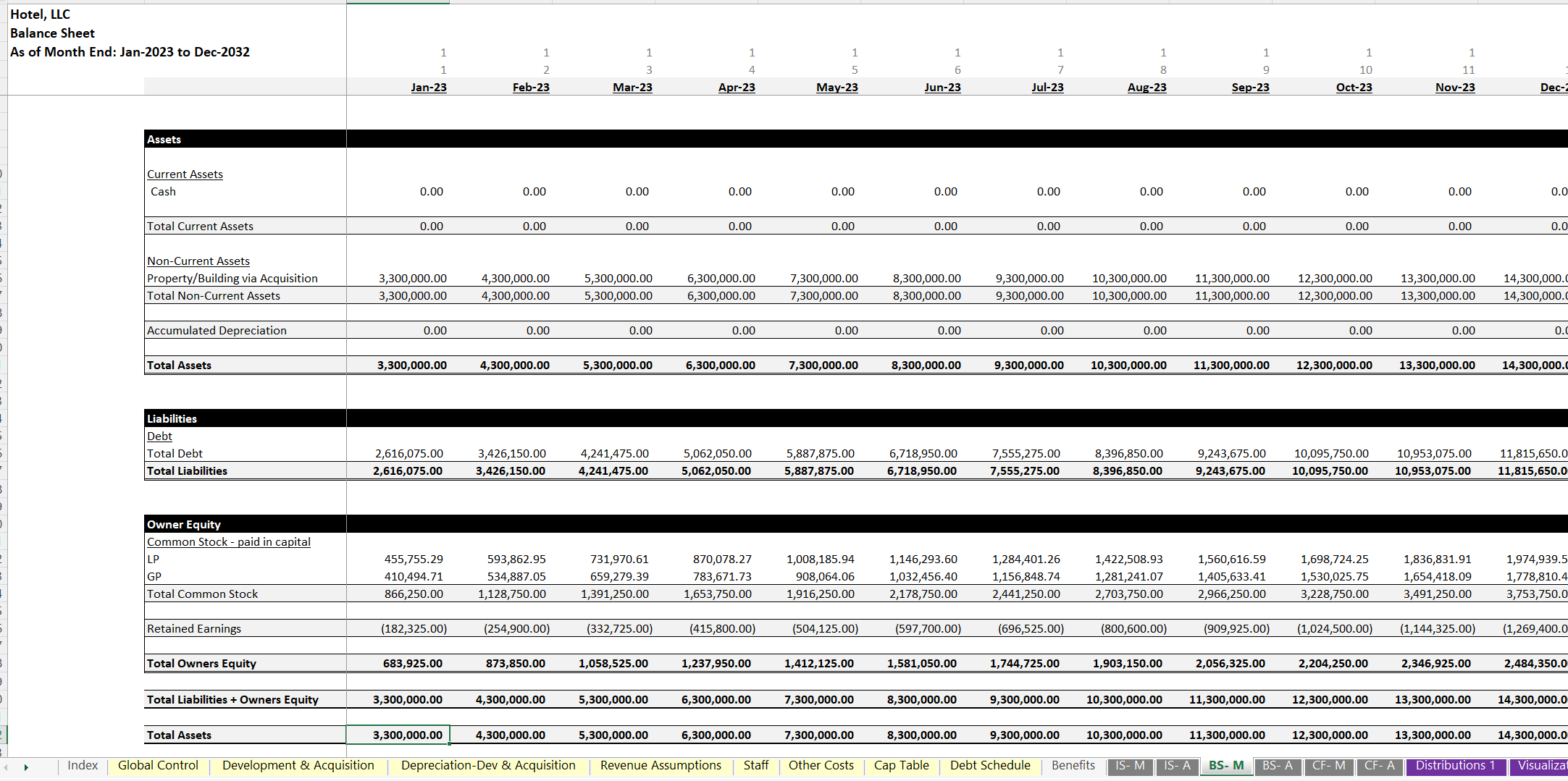

• Monthly/ annual balance sheet and income/ cash flow statement

• Annual executive summary

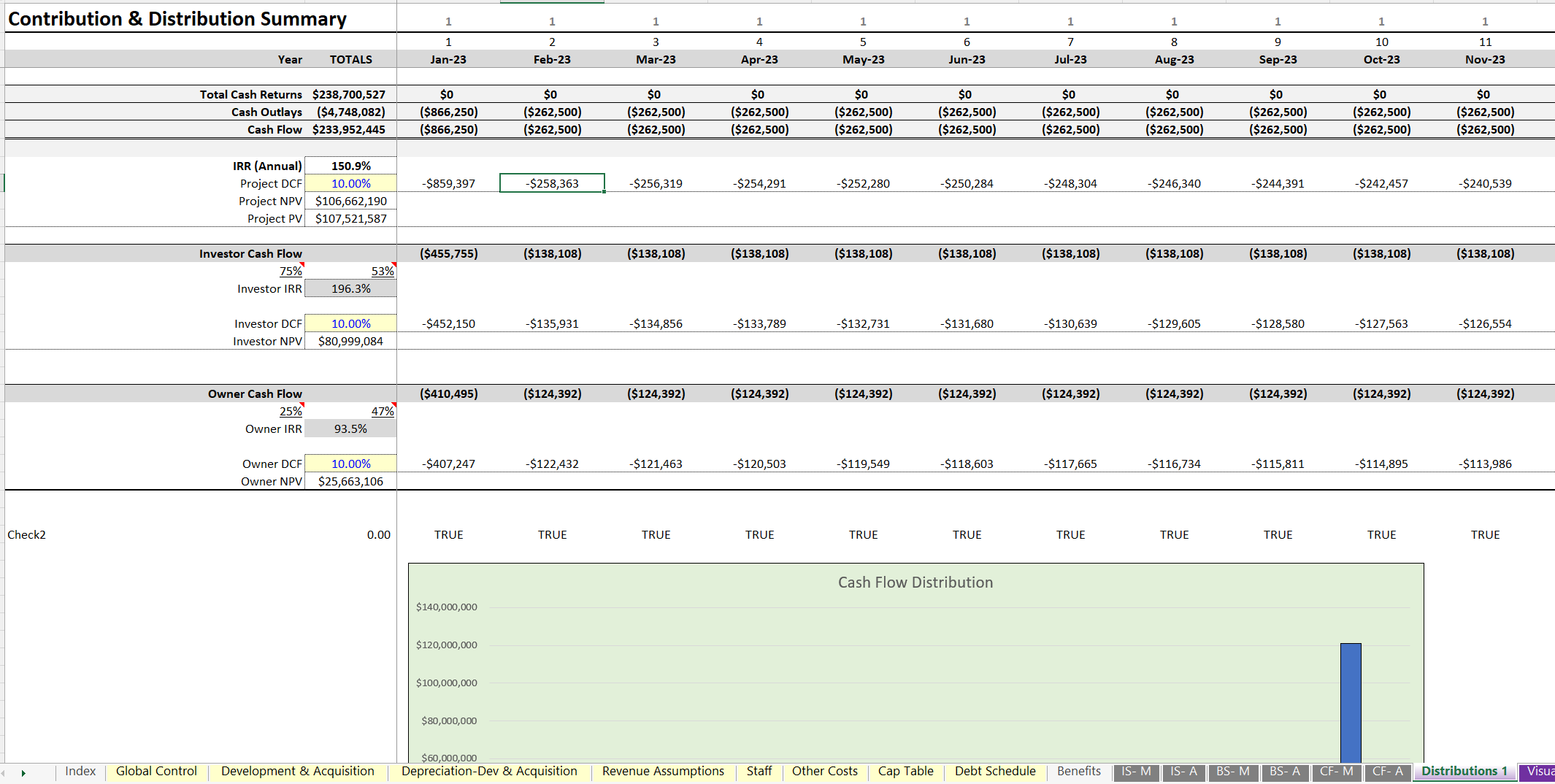

• Discounted cash flow analysis and internal rate of return for: entire project, Investors, and sponsors

• Operating visuals (charts/ graphs)

• Income report for all contributions

Equity Structure, Two options:

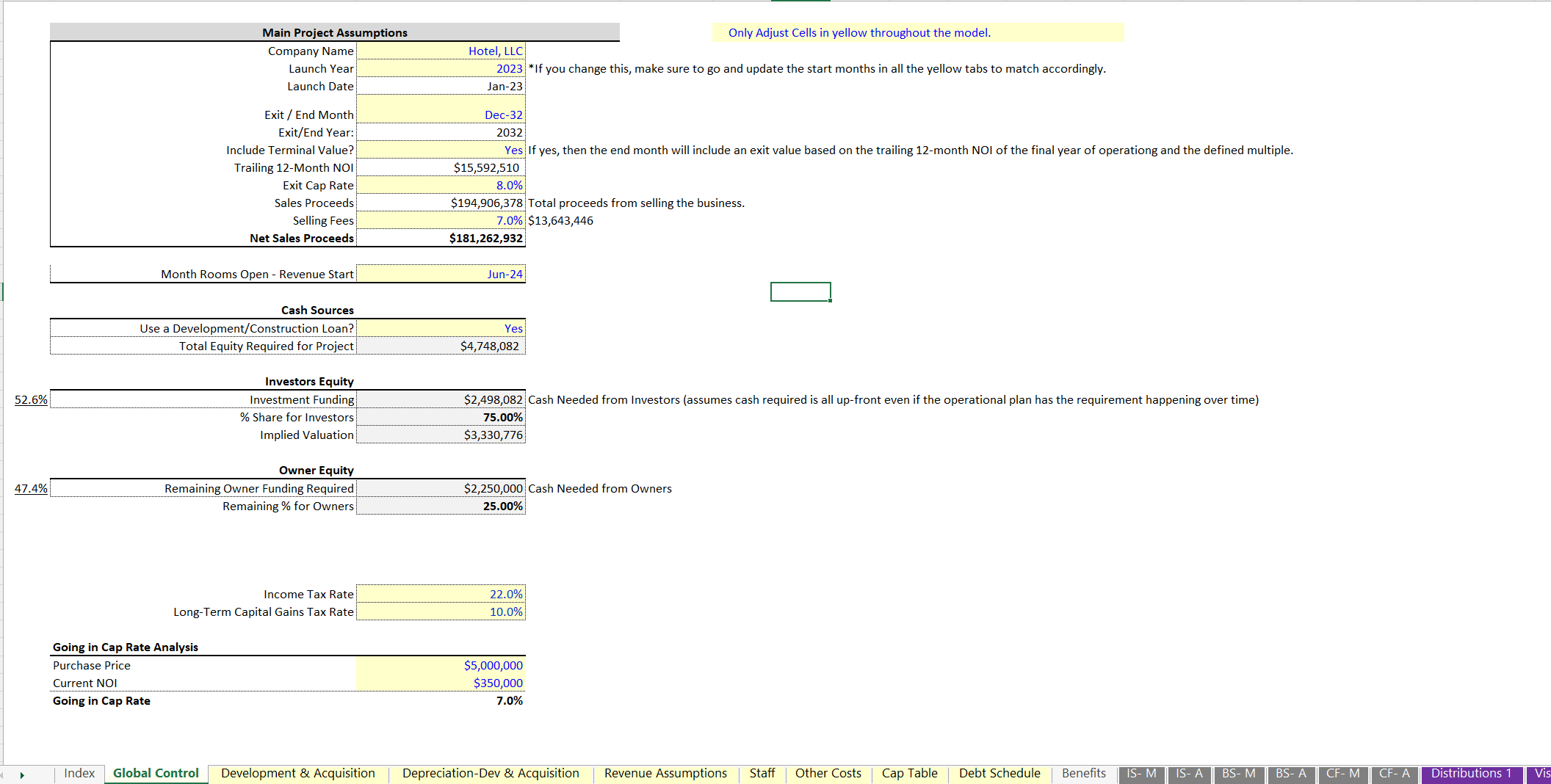

• First, simple cap table with defined inputs for total equity contributed by LP/GP and defined percentage for how much of the distributions flow back to each. Template will solve for minimum equity required based on all negative cash flows.

• Second, monthly IRR hurdle-based waterfall where defined equity contribution rates and distribution rates vary based on the return achieved by the LP. Acquisition/ management fees are paid as income to the GP. IRR/ equity multiple will be display for both sides of the real estate joint venture structure based on monthly cash flows.

Additional features:

• Depreciation drivers for each initial cost

• Going-in capitalization rate

• (Up to) 10-year forecast

• Dynamic end dates/ months

• Ability to select if hotel is sold or not at termination in financial forecast

• Includes exit values based on cap rate and trailing 12-month net operating income

• Option for a REFI to happen on a defined month

HOW: Business template designed in Microsoft Excel. This spreadsheet is dynamic but user friendly!

WHEN: Buy it now!

WHY: To underwrite hotel deals.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Hotel Industry, Integrated Financial Model Excel: Hotel Financial Model: Development, Acquisition, Operating & Dissolution Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping