Bike & Cycling Shop: 5-Year Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Starting up a bike or cycling shop could be the dream of many outdoor enthusiasts. You get to sell what you love. Doing so will require some financial planning though and this means figuring out your initial startup costs, expected sales, expenses, and having a general plan for how you stay afloat while getting off the ground.

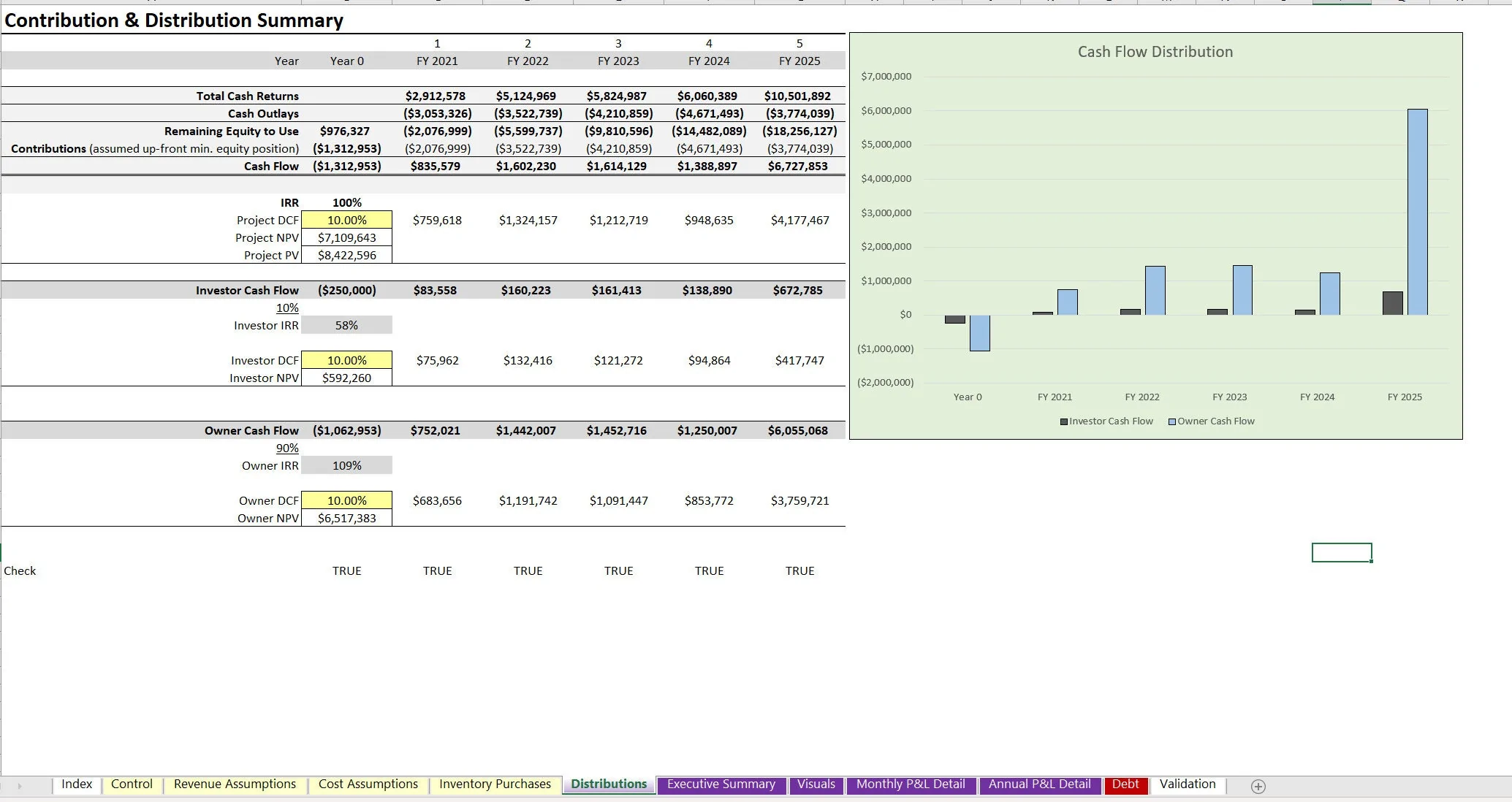

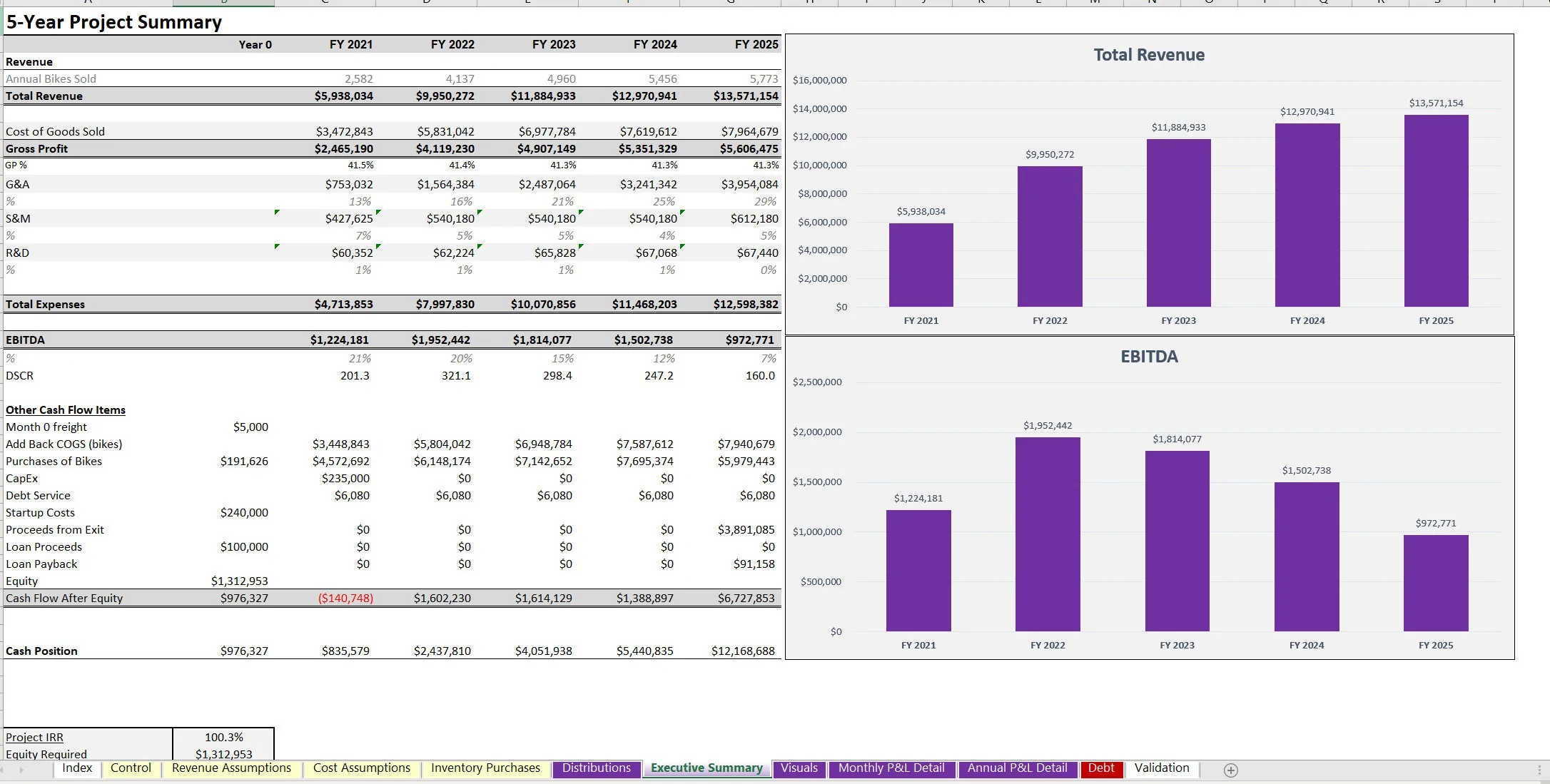

This model will all the user to input assumptions about all financial related dynamics in order to understand initial investment and minimum viable sales to break even as well as potential IRR / multiples if investors are being brought in or if there are enough cash flows to cover debt service if this is being financed via a traditional loan from a bank.

Final output reports include:

• 5-Year Monthly and Annual Pro Forma

• 5-Year Annual Executive Summary

• DCF Analysis / IRR / ROI for project / operator / investor if applicable

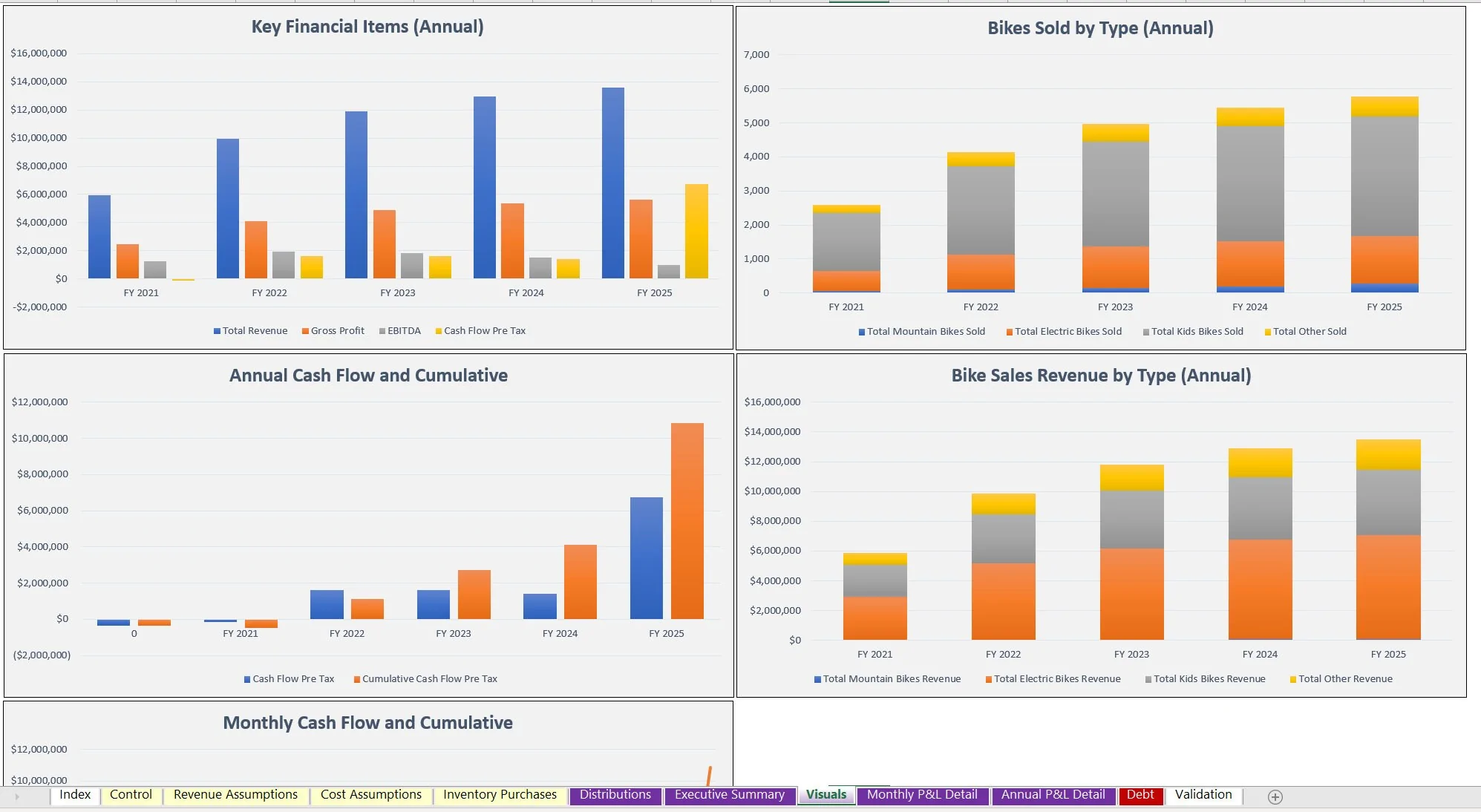

• Visualizations

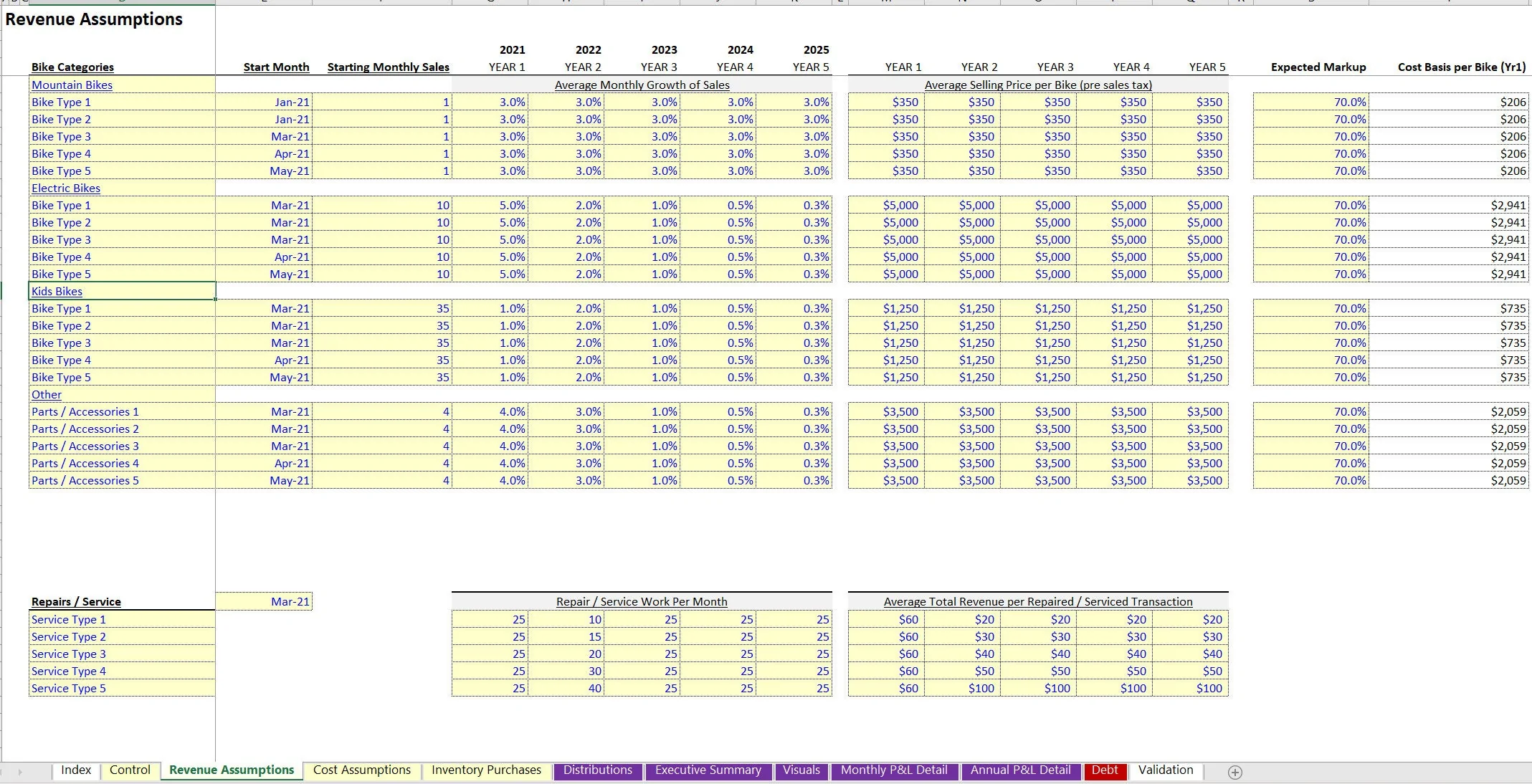

Revenue is driven off of 4 bike categories and each category has 5 slots to identify sales segments easily. Each slot lets the user define the start month, starting sales per month, and percentage monthly growth in sales across 5 years. There is a spot for parts and accessories as well as logic to define revenue from repairs / services.

The cost of goods sold (bike inventory) is based on the defined selling price and a percentage markup (which then backs into the cost per bike).

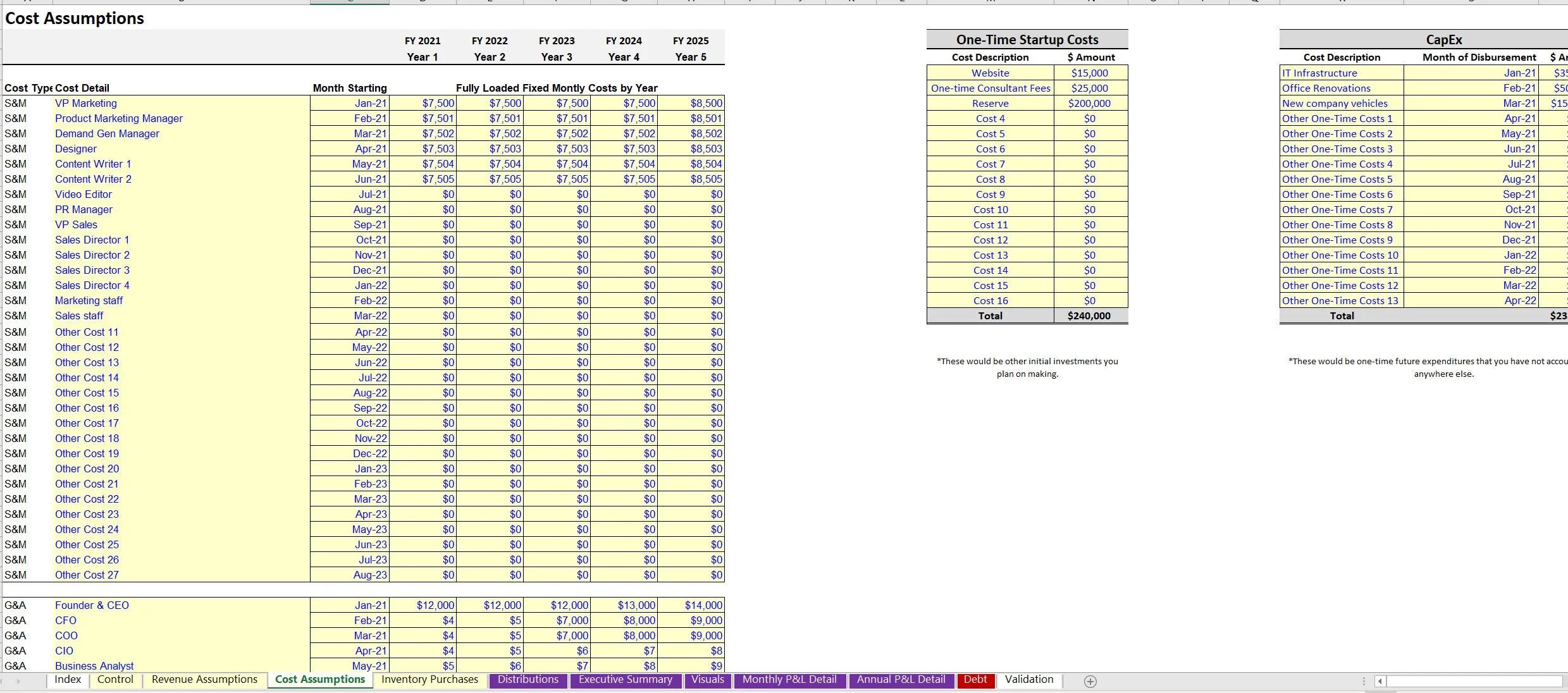

Operating expenses are defined in over 90 slots if needed, but most often only a handful of these spaces will be used. For freight / shipping costs, there is a dynamic schedule based on bike volumes. This will be an expense that populates upon each shipment, which is dynamically calculated based on how much inventory is purchased ahead of time i.e. 1/2/3 etc.. months of sales purchased in advance.

The resulting cash flow is calculated accordingly. Keep in mind this logic can very easily be used for other retail shops and not just a bike use case. Anything that can be defined to be sold in categories and has some inventory logic will be able to fit to some degree.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Bike & Cycling Shop: 5-Year Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping