Golf Course Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

GOLF EXCEL DESCRIPTION

Recent upgrades: Added fully connected Income Statement, Balance Sheet, and Cash Flow Statement that adjusts with all the assumptions. Also added a cap table, capex schedule with depreciation and better global assumption layout.

Starting up a golf course can be done in a few different ways. You could have a membership-based model, a course fee model, or some hybrid. There are also things like ancillary income to account for if a restaurant or some food and beverage revenue is likely.

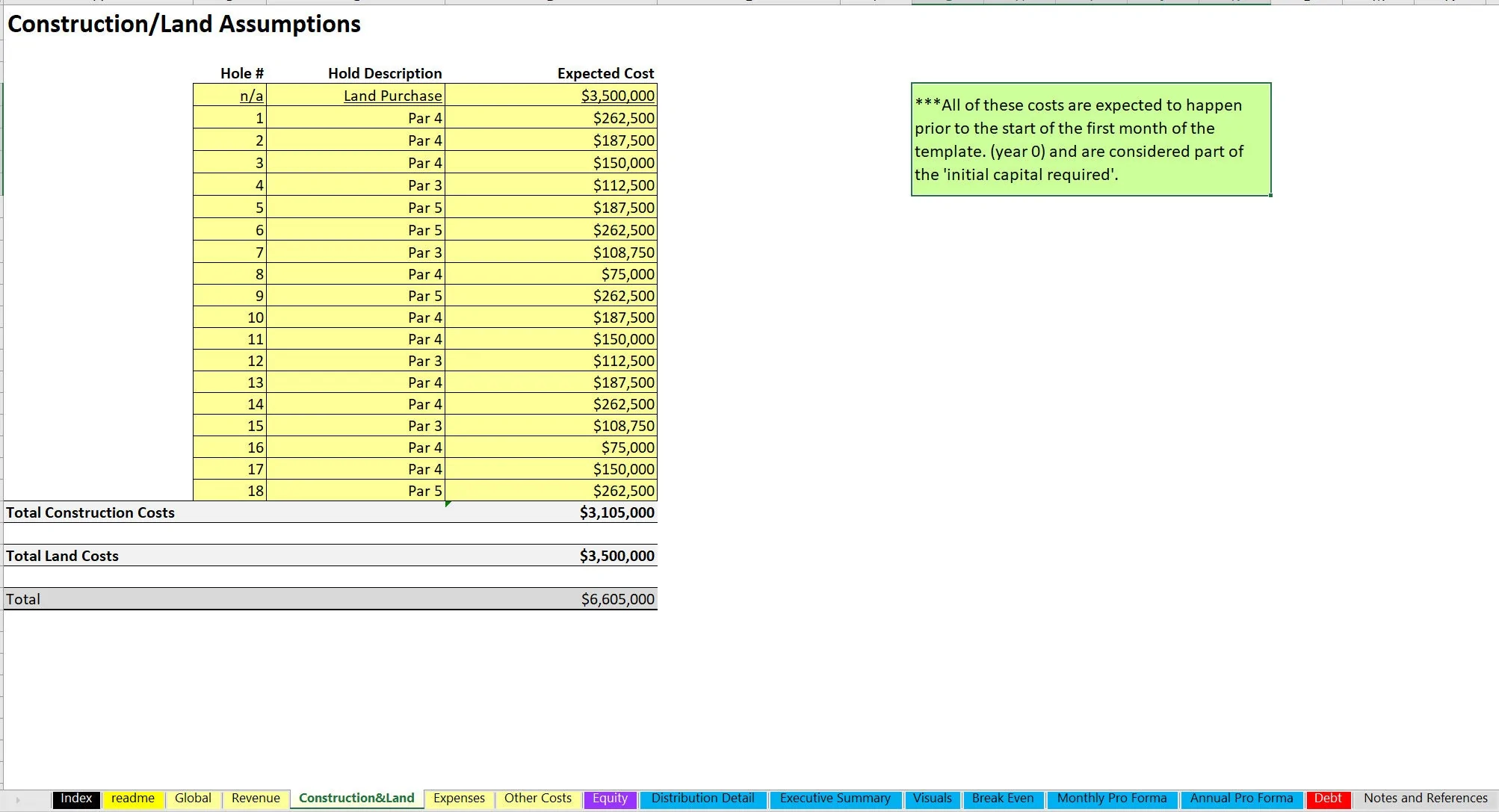

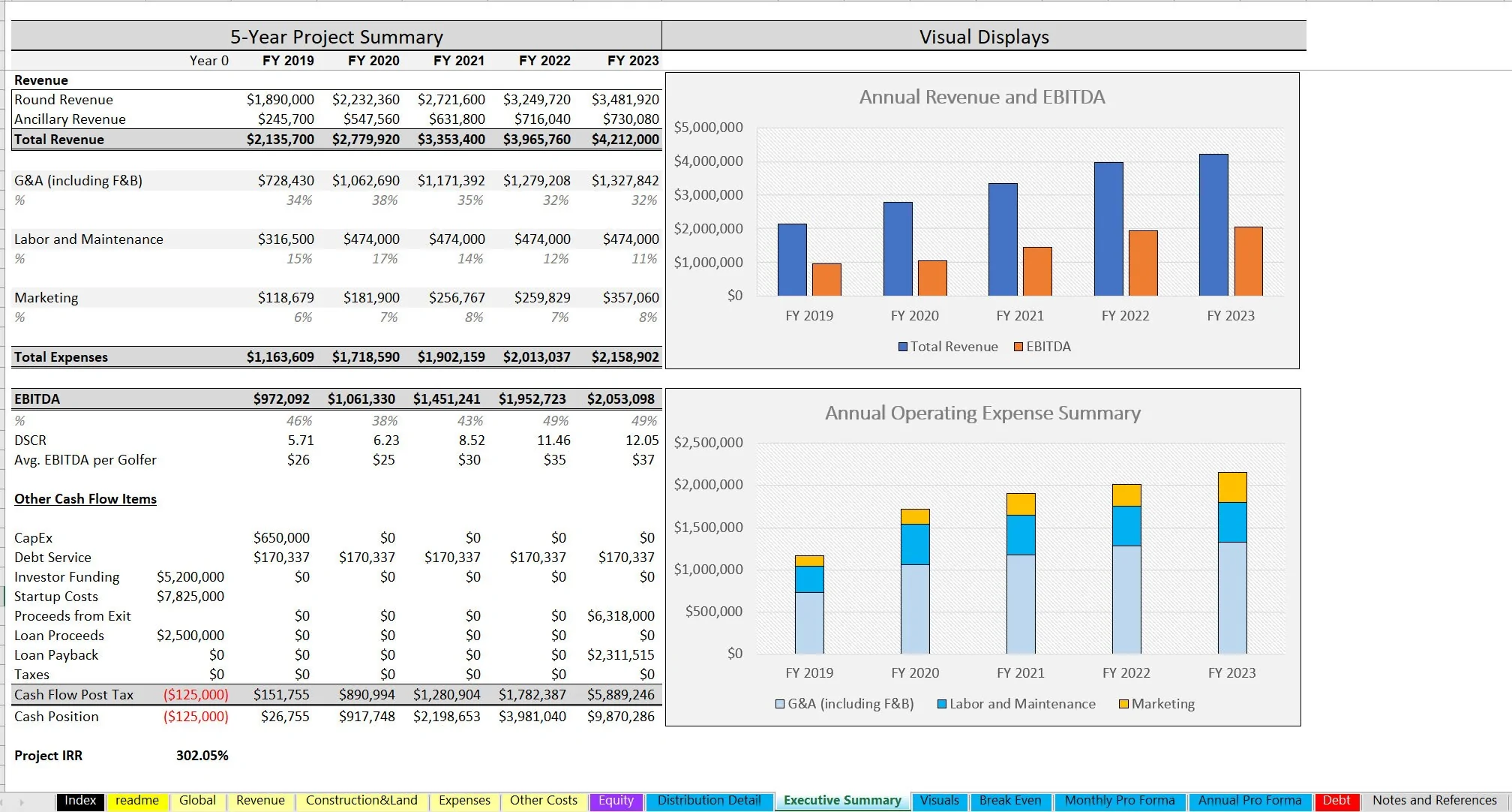

You might even have special events that have their own set of assumptions. In this financial model, you can forecast the expected startup costs (investment per hole and general building or other construction), expected revenues, expenses, and resulting cash flows of running a golf course.

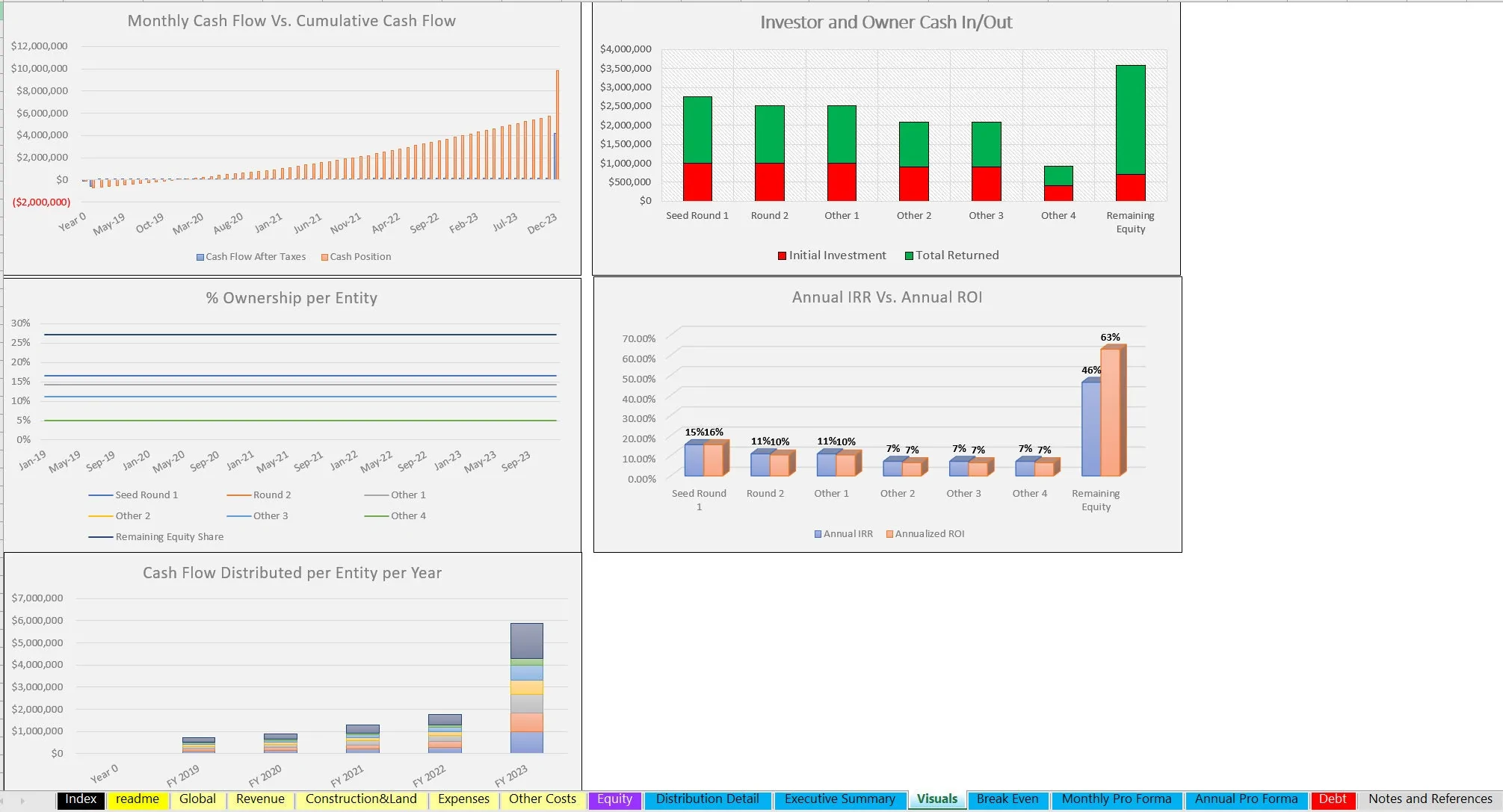

Final outputs include a DCF Analysis, return summary (IRR / ROI), and a monthly/annual pro forma detail as well as a pro forma roll-up summary (annual). Plenty of visualizations also were put in to make the case more digestible.

There is also an annual revenue break-even analysis per fixed/variable costs per year.

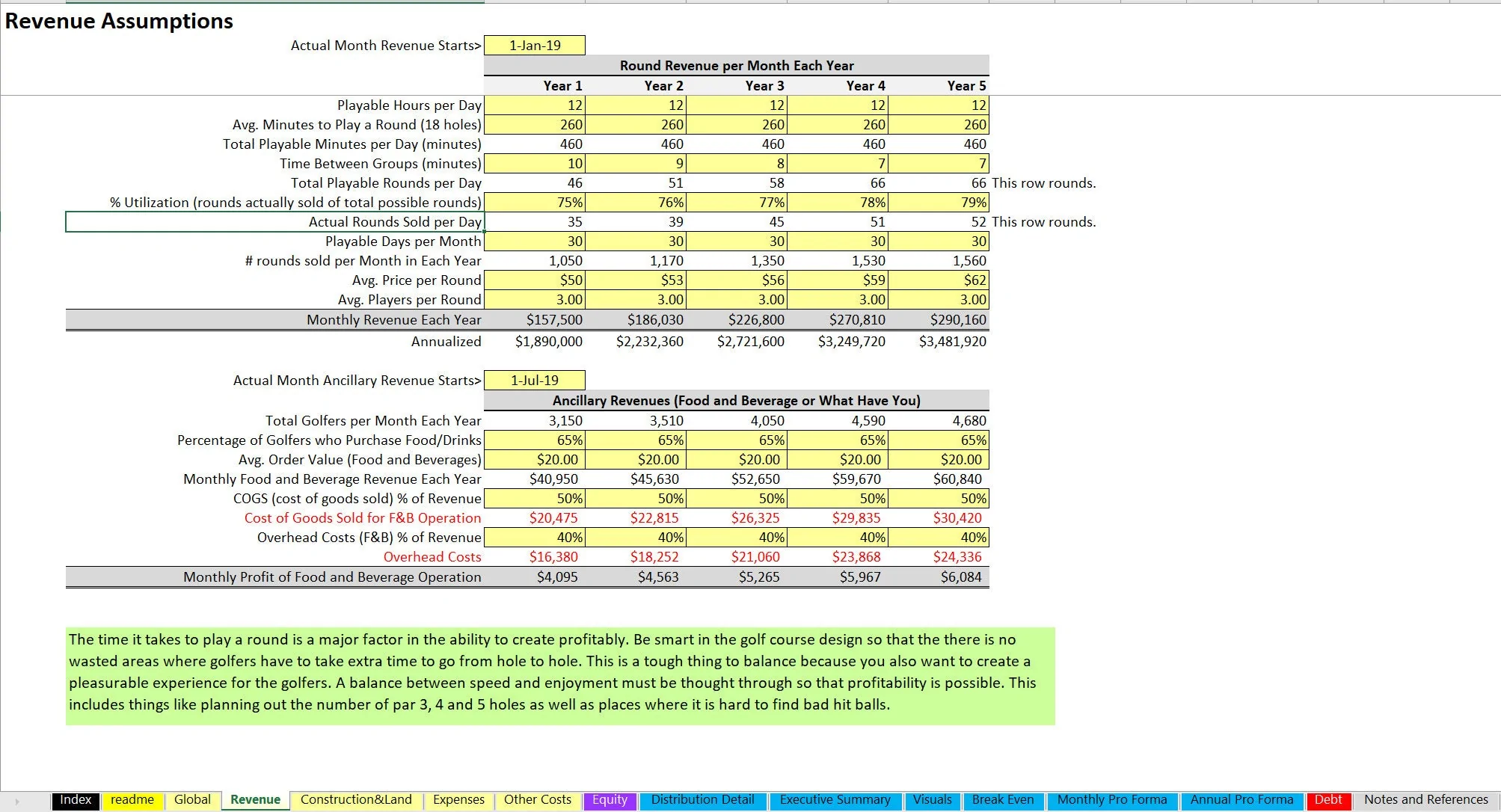

The revenue is based on a capacity attainment model that is bottom-up.

Inputs can be adjusted in each of the 5 years and include:

• Playable Hours per Day

• Avg. Minutes to Play a Round (18 holes)

• Total Playable Minutes per Day (minutes) (formula)

• Time Between Groups (minutes)

• Total Playable Rounds per Day (formula)

• % Utilization (rounds actually sold of total possible rounds)

• Actual Rounds Sold per Day (formula)

• Playable Days per Month

• # rounds sold per Month in Each Year (formula)

• Avg. Price per Round

• Avg. Players per Round

Bottom-up assumptions were also put in for ancillary income based on the number of golfers that are coming through and what percentage of them buy food/drinks / average ticket sizes and the cost of goods sold / overhead percentages of operating that segment of the operation.

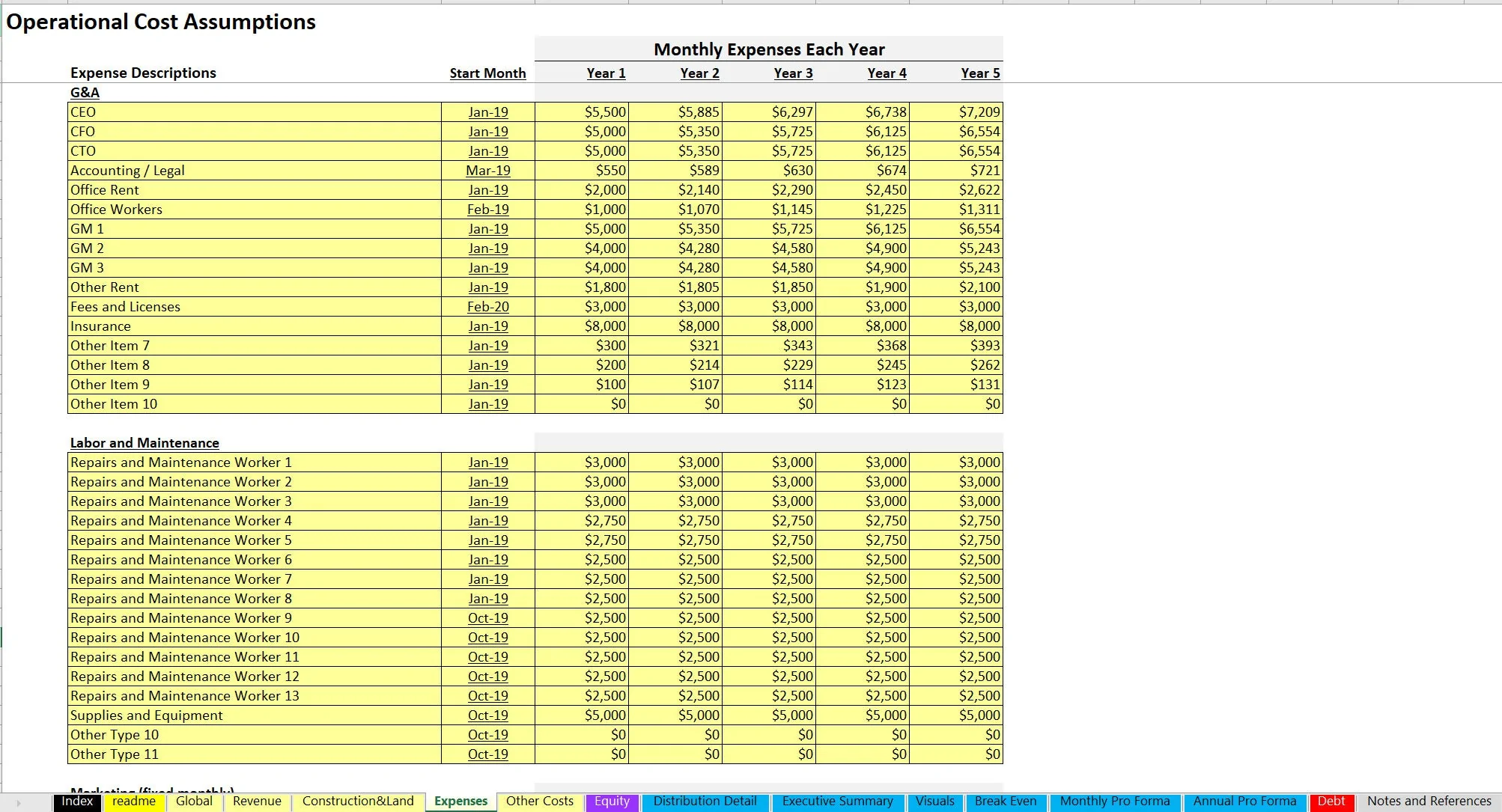

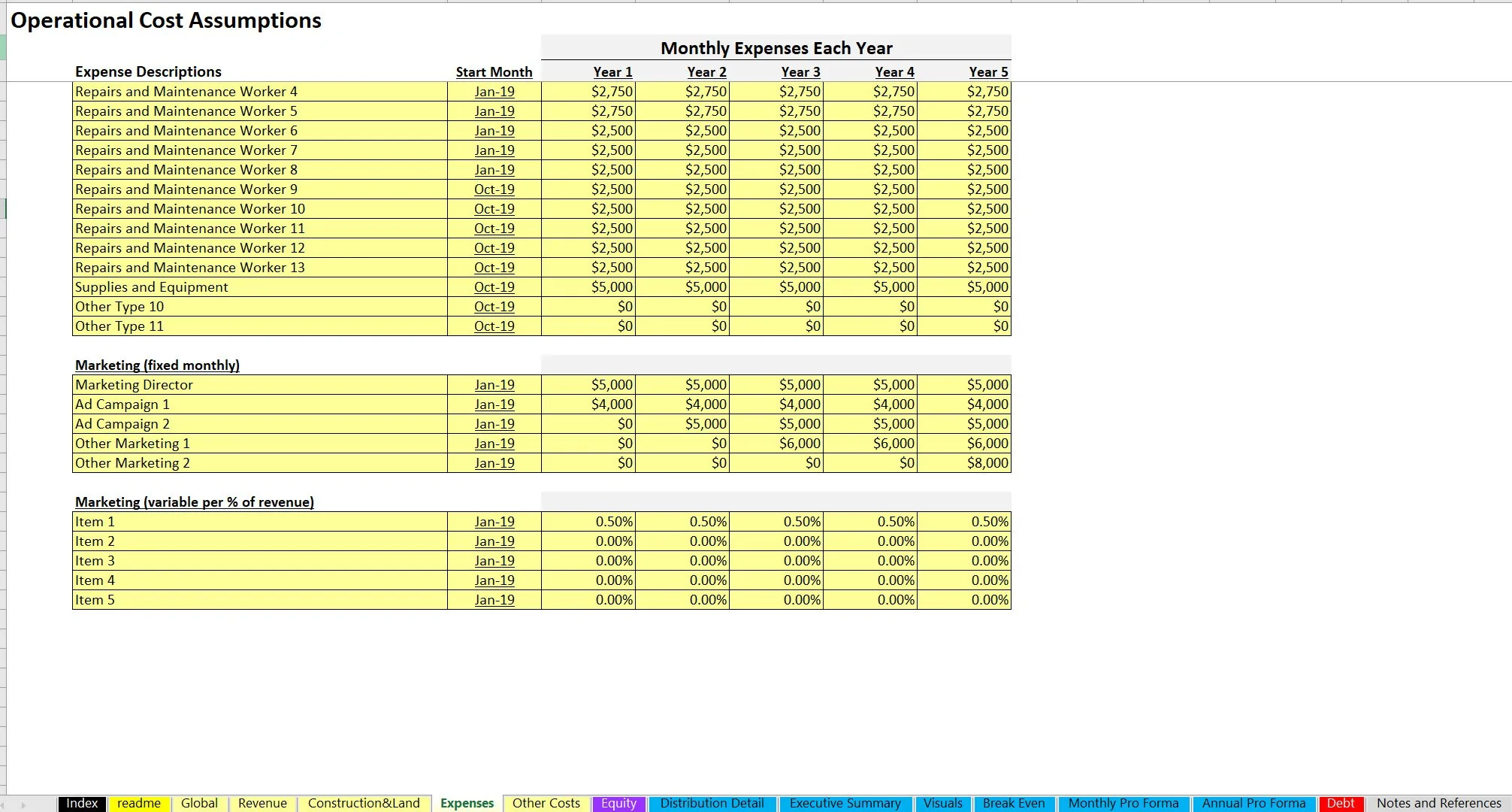

Other general and administrative fixed costs can be defined based on their description, start month, and monthly cost in each year. Labor and maintenance / marketing have their own schedules.

For a final catch-all, there are five slots to account for other expenses that can be calculated as a direct percentage of revenue.

Other startup costs and capex beyond the hole/construction can be accounted for in their own expense schedules. Everything comes together in a clean pro forma and cash flow summary.

To account for funding from investors, there is a cap table to define up to six separate rounds at various valuations and funding amounts. Any remaining cash required falls to owner equity.

A DCF Analysis will display the NPV for each investment round and owner equity. The final investment funding can come from debt, which is configured as a traditional p+i loan if so desired.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Golf, Integrated Financial Model Excel: Golf Course Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping