Driving Range: Startup Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Recently, updated with two new revenue stream assumptions (food and beverage + memberships).

Also recently updated were all the visualizations.

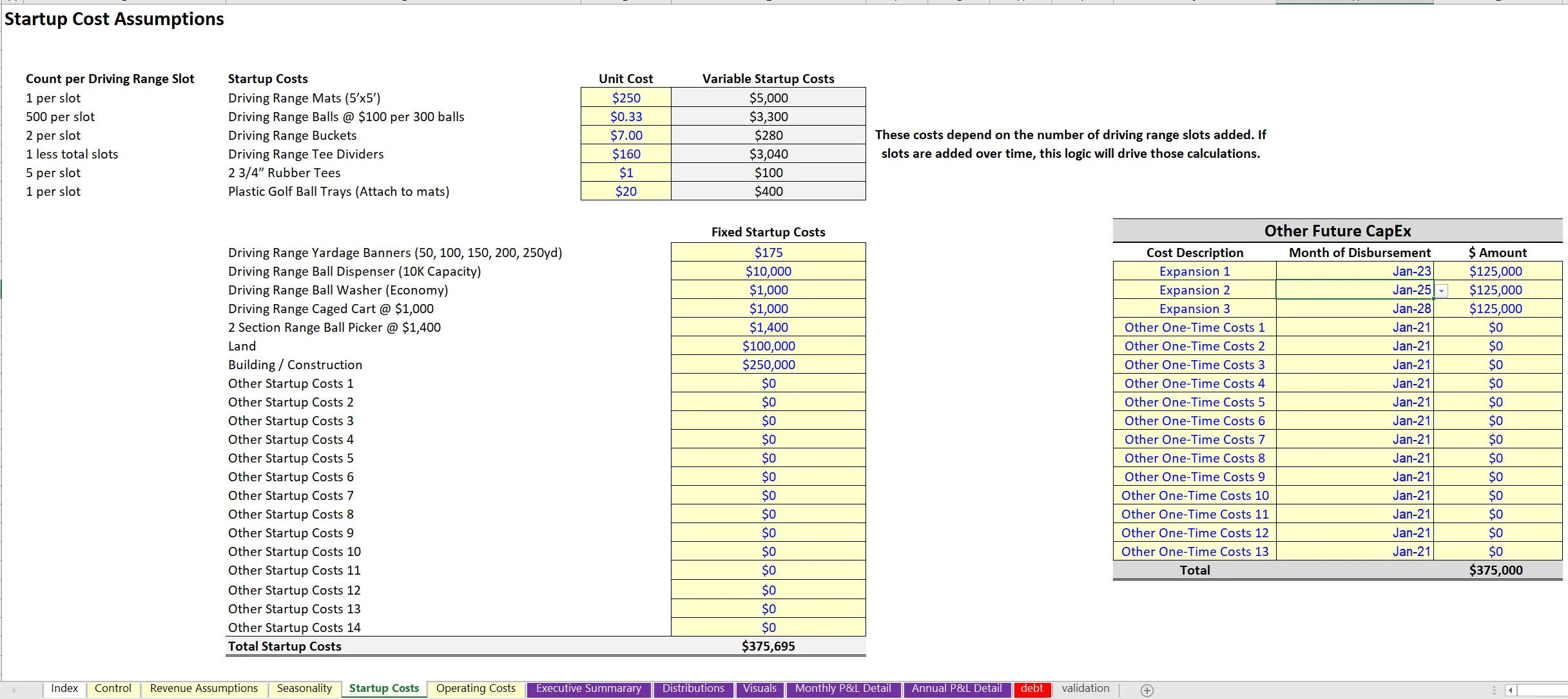

Normally I don't get too deep into the actual startup costs, but for this it was relevant because much of the startup costs require logic in order to calculate, for example, the number of driving range slots that are input will drive a lot of the resulting initial investment costs in equipment.

Mainly:

• Driving Range Mats (5'x5′)

• Driving Range Balls @ $100 per 300 balls

• Driving Range Buckets

• Driving Range Tee Dividers

• 2 3/4″ Rubber Tees

• Plastic Golf Ball Trays (Attach to mats)

There are also other standard pieces of equipment that are usually purchased for such a business and those are written in as (note they can be modified as needed):

• Driving Range Yardage Banners (50, 100, 150, 200, 250yd)

• Driving Range Ball Dispenser (10K Capacity)

• Driving Range Ball Washer (Economy)

• Driving Range Caged Cart @ $1,000

• 2 Section Range Ball Picker @ $1,400

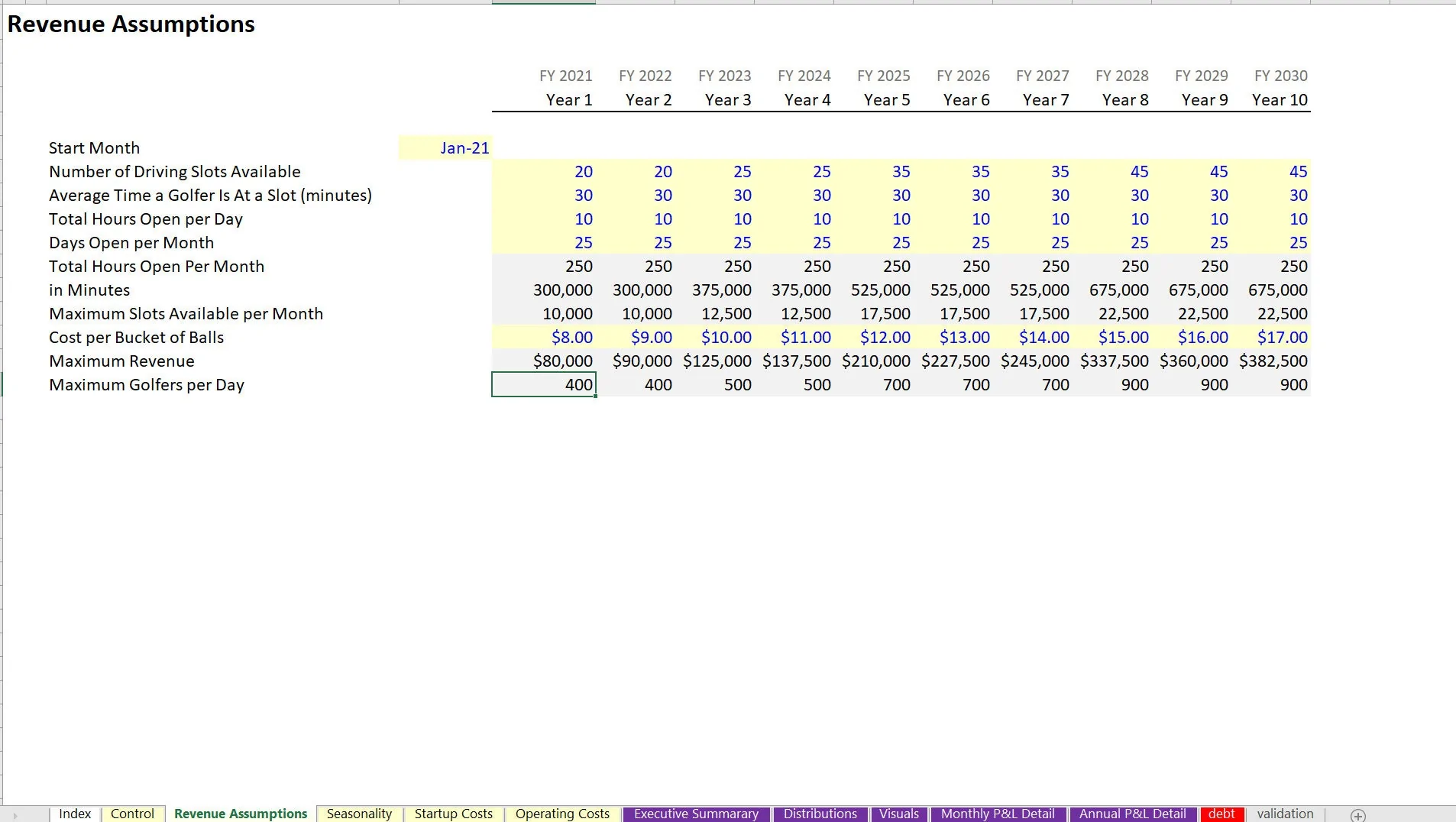

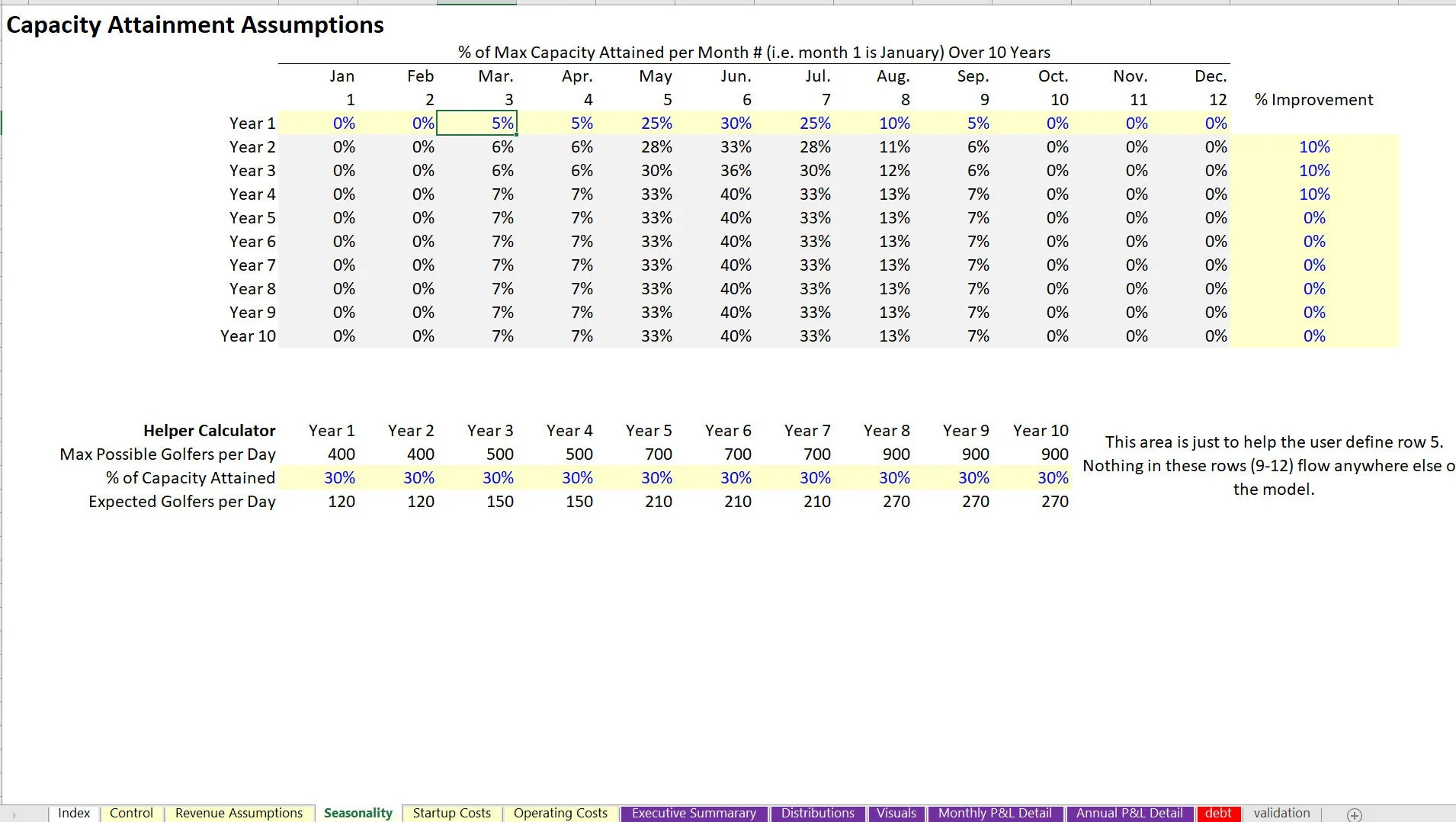

Revenue is driven off of the number of driving range slots that exist over time, the average expected time customers spend on the driving range, the cost per bucket of balls (assumes each bucket of balls will last a defined number of minutes).

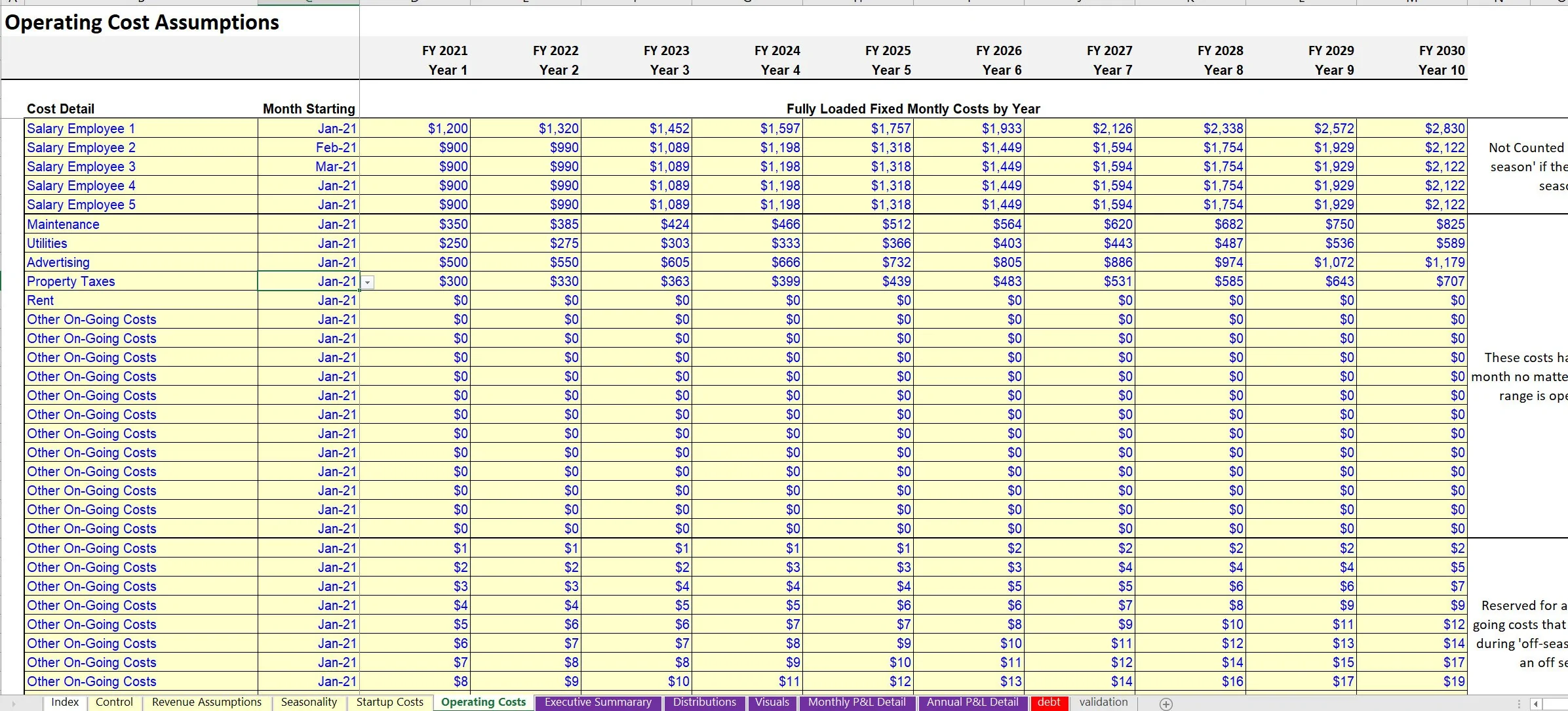

There are also fixed cost schedules to define on-going recurring overhead expenses. The user can define the description, start month, and monthly fixed cost in each year.

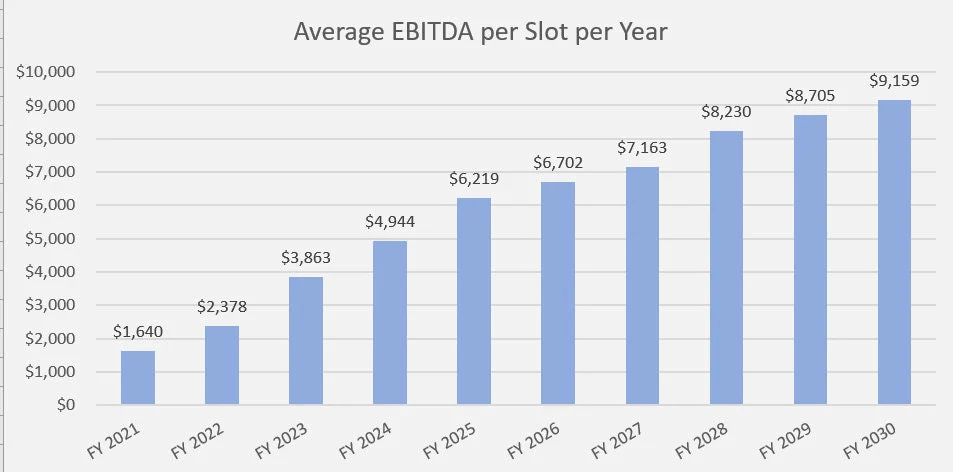

Everything comes together in a monthly and annual pro forma summary that formats the assumptions into a revenue, expense, operating income, and cash flow forecast. This is rolled up into an annual Executive Summary so the financials are easy to digest as well as a contribution/distribution cash flow summary and DCF Analysis for the project as a whole and investor / operator.

Over 9 visualizations exist to make everything easier to understand. There is an input slot if you want to account for an exit of the business with a terminal value based on trailing 12-month net operating income. This is important for proper valuation (NPV).

There is an assumption for debt as a part of the financing scheme and resulting debt service will populate accordingly. Final metrics include: IRR, NPV, ROI, Equity Multiple The logic and structures in this model could probably be applied to all sorts of businesses as well. Enjoy!

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Driving Range: Startup Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping