Plumbing Business Scaling Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Starting a business is daunting. To get a better feel for the unit economics of anything, it is helpful to begin with a financial modeling spreadsheet. This one was specifically built to simulate the startup, operations, and potential exit of a plumbing business.

There are some interesting aspects to study with this endeavor. In general, the mental model is that you scale by adding new plumbers, pay them wages, pay for parts/materials, trucks, and sales and marketing while collecting revenue from customers in the form of fixed price jobs.

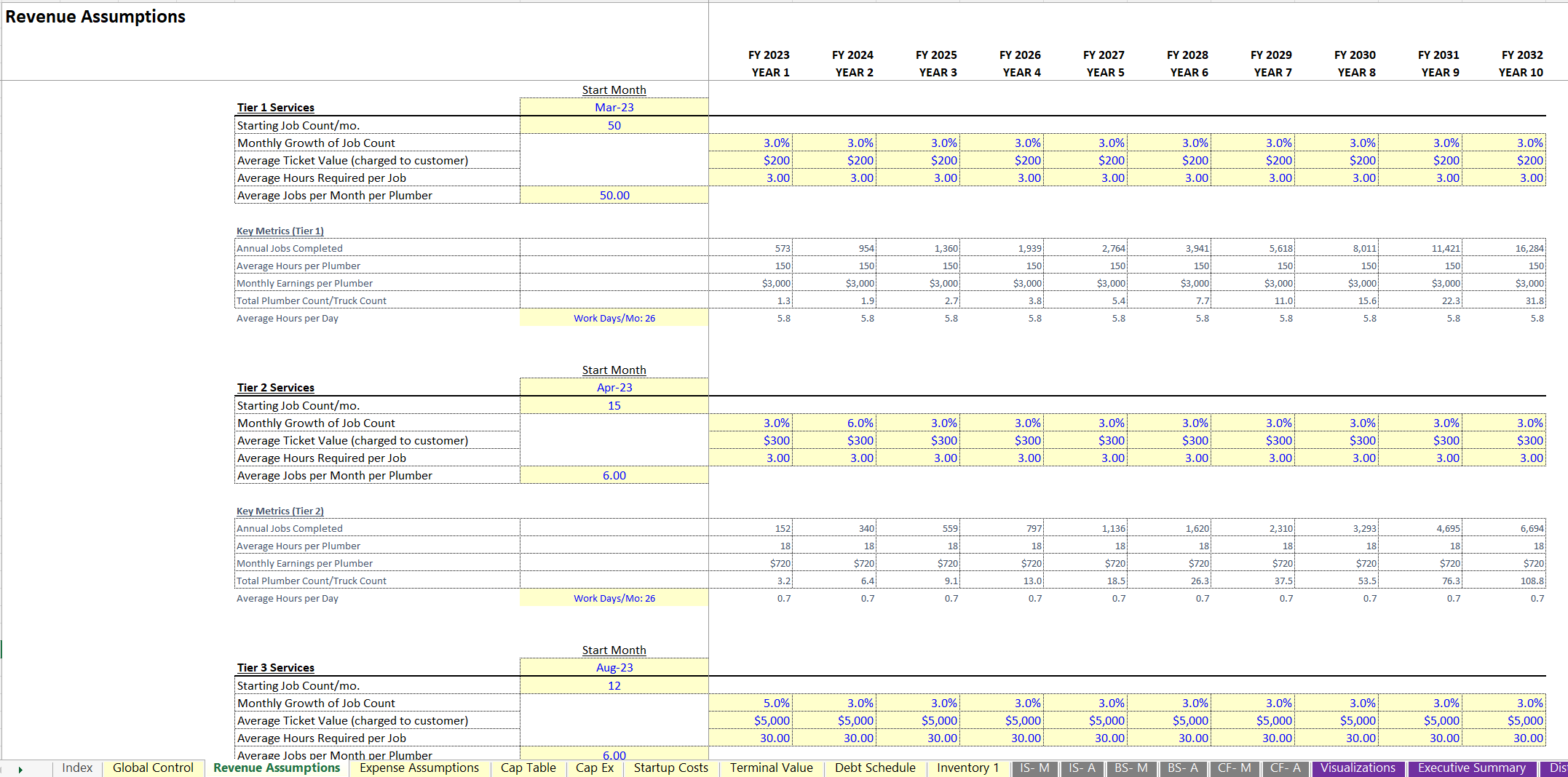

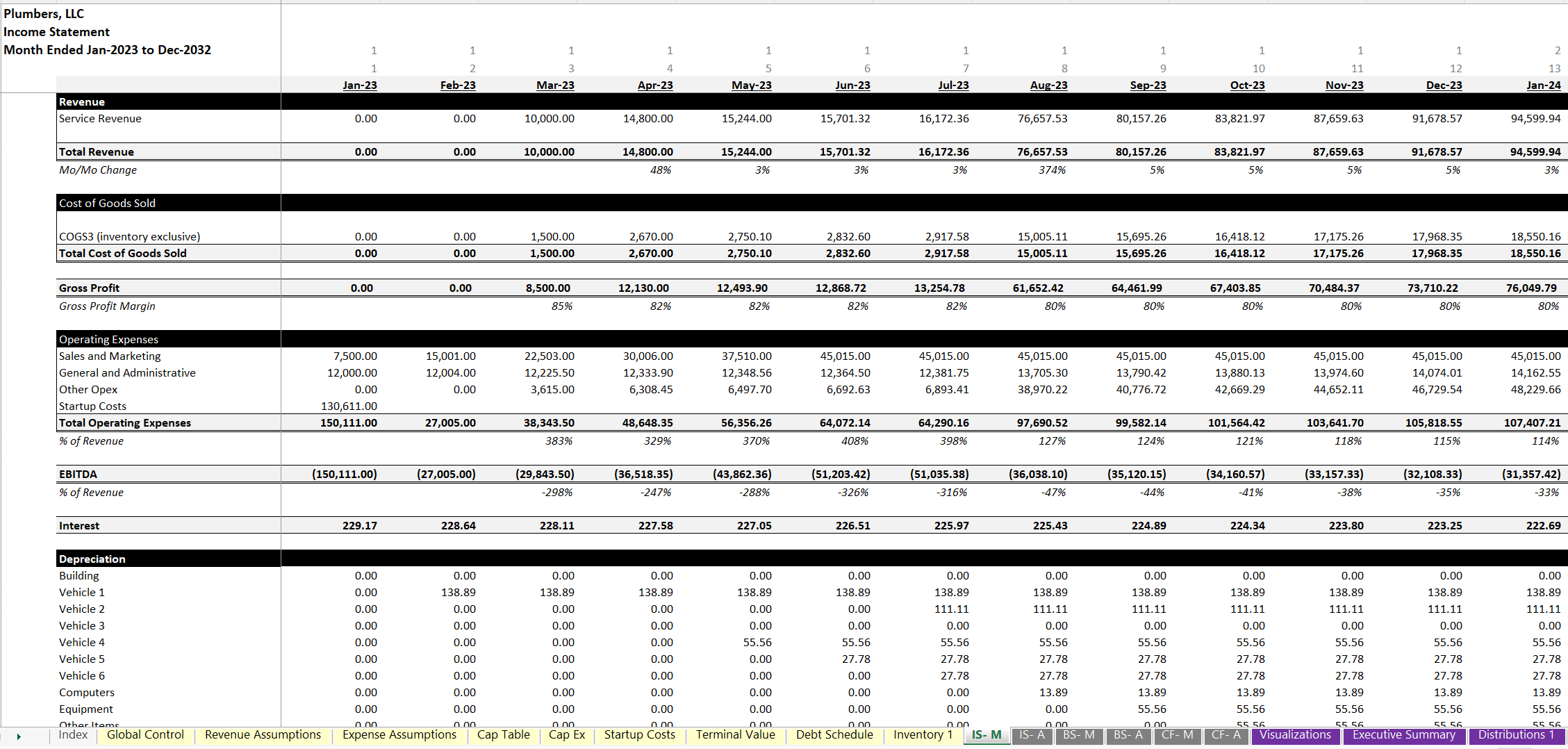

As you can see in the screenshots, revenue assumptions involve planning out up to three service type offerings. These are references to the kinds of services a plumbing business will do. Each has its own drivers for how profitable it may be and how many jobs will be completed of each type, what types of plumbers are required, what can be charged, and what the parts/overhead costs are.

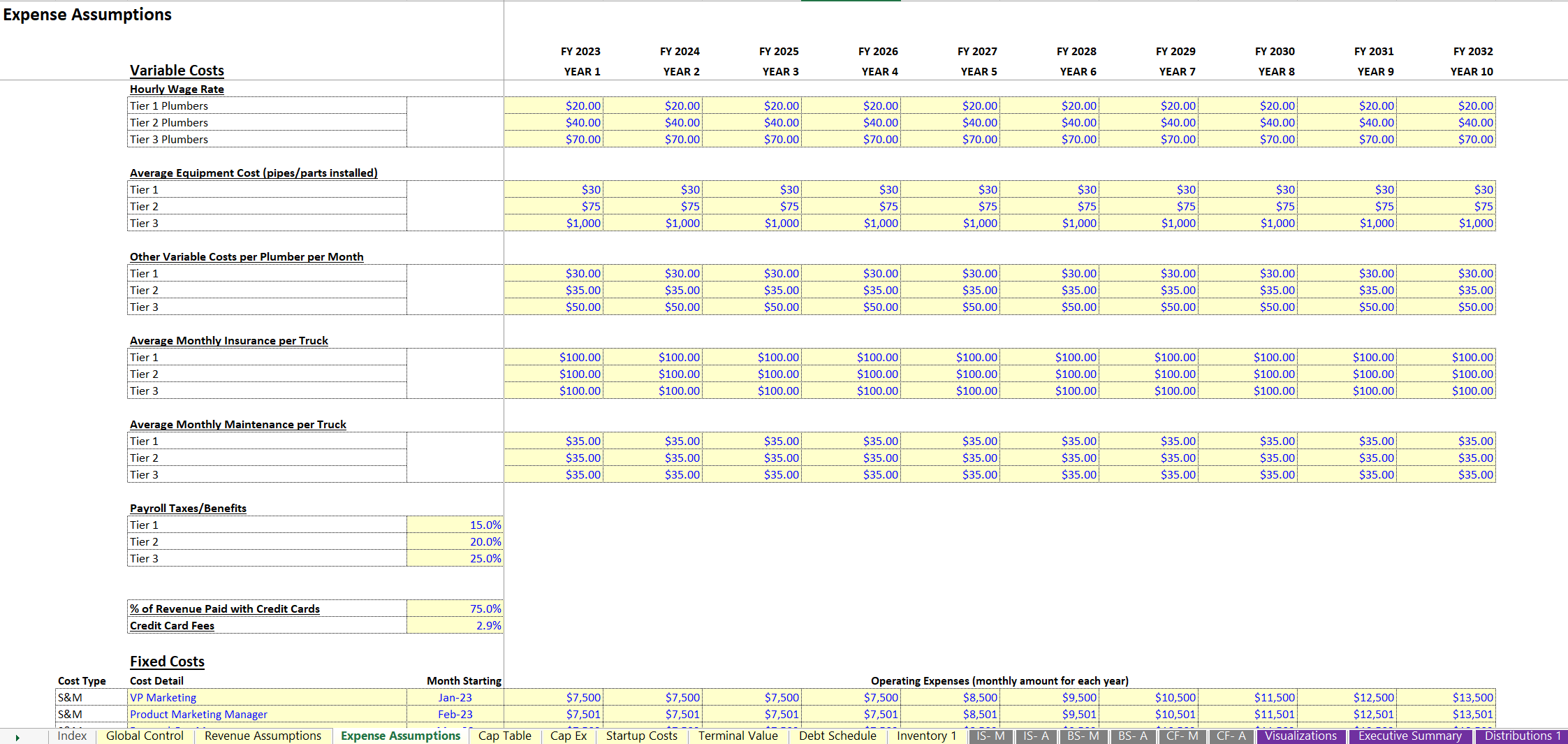

There are other variable costs to be aware of. Costs per truck (maintenance/repairs), insurance, and general miscellaneous costs per truck/plumber can all be configured and will scale with your job count assumptions.

The count of plumbers/trucks will scale based on the amount of jobs a plumber can do per month (an input), and the average hours a given job takes. There are smart output sanity checks directly on the revenue assumptions so the user can make sure their configurations make sense.

Output Reports:

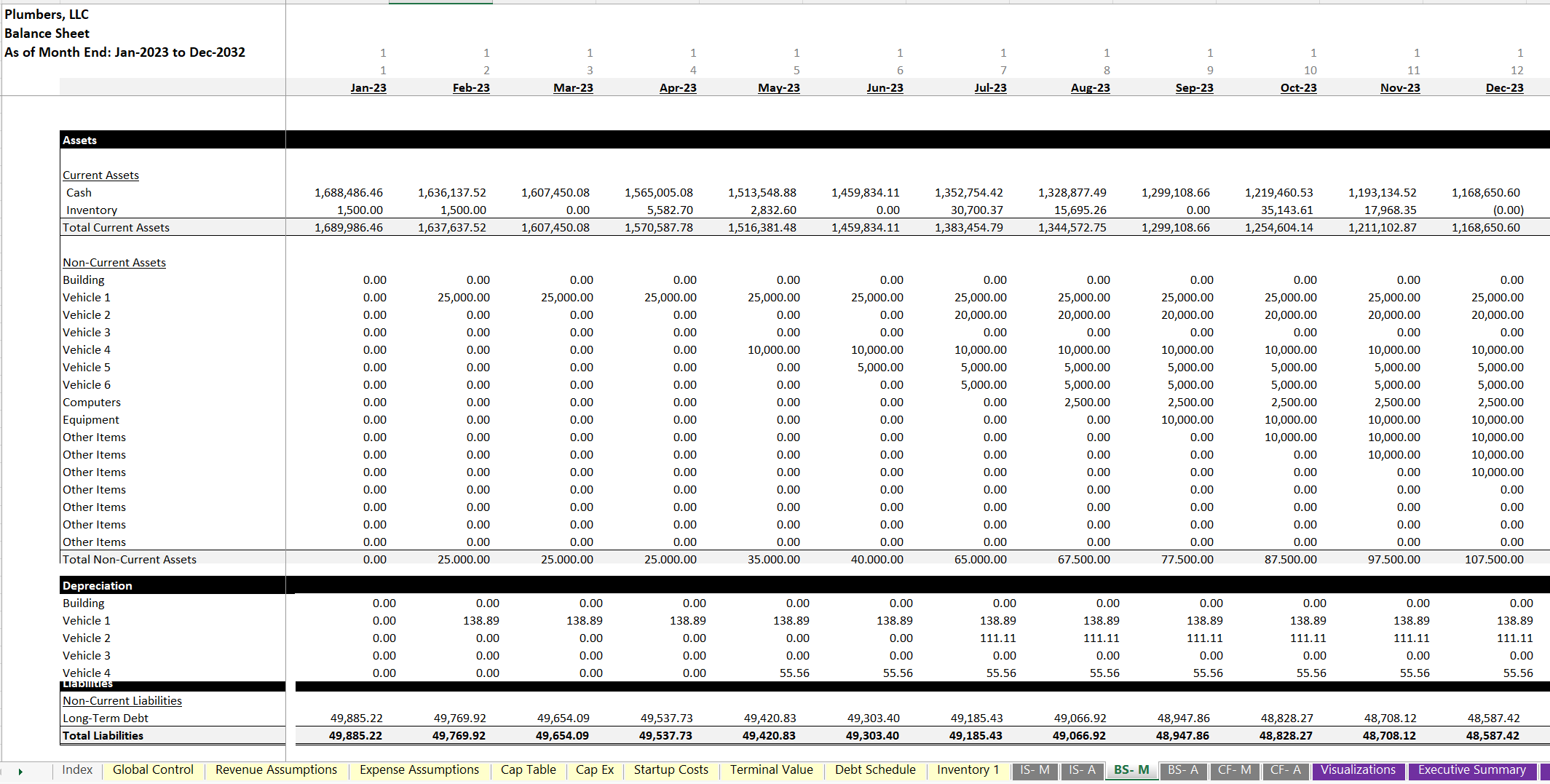

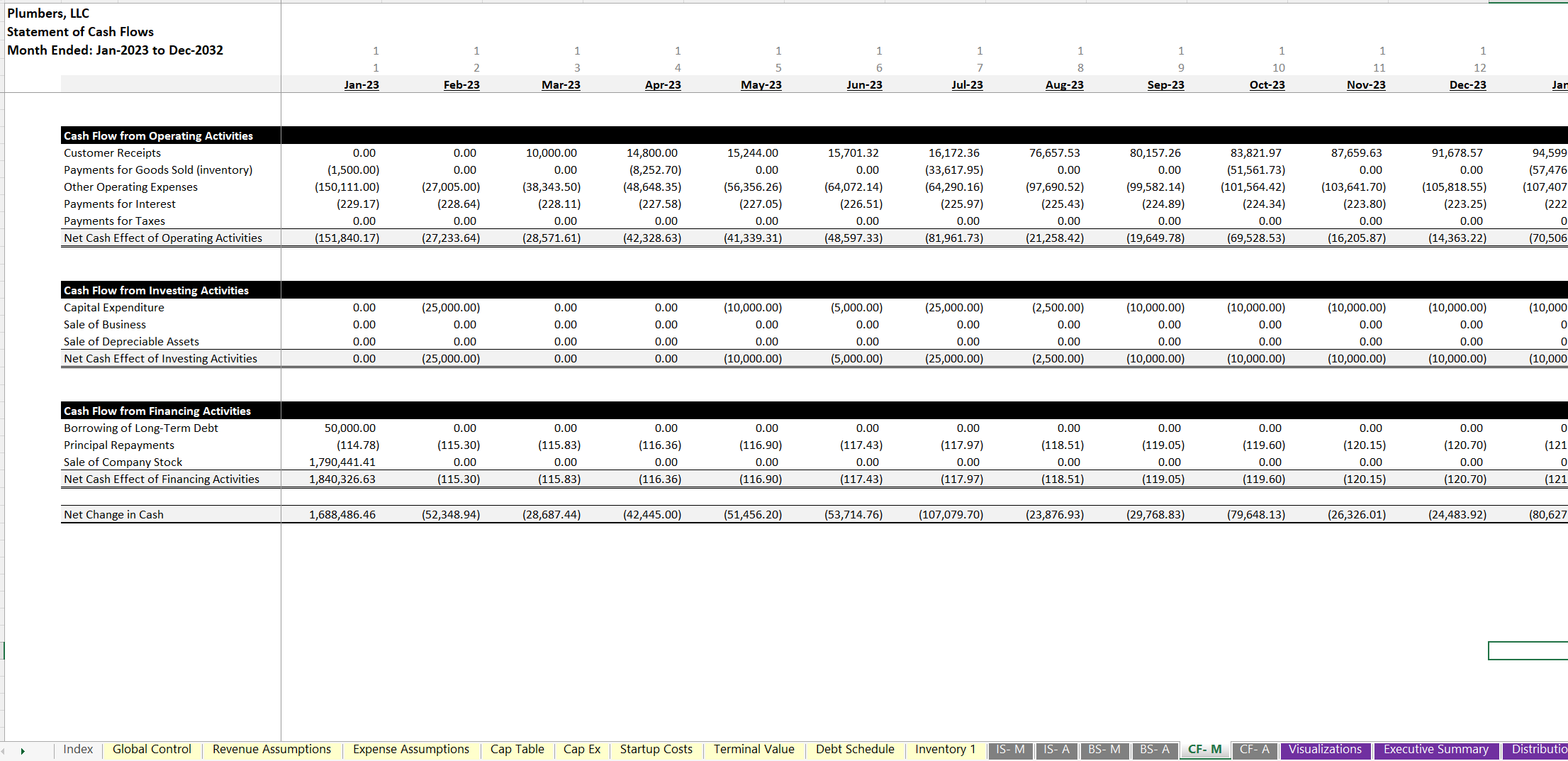

• Monthly and Annual financial statements (Income Statement, Balance Sheet, Cash Flow Statement)

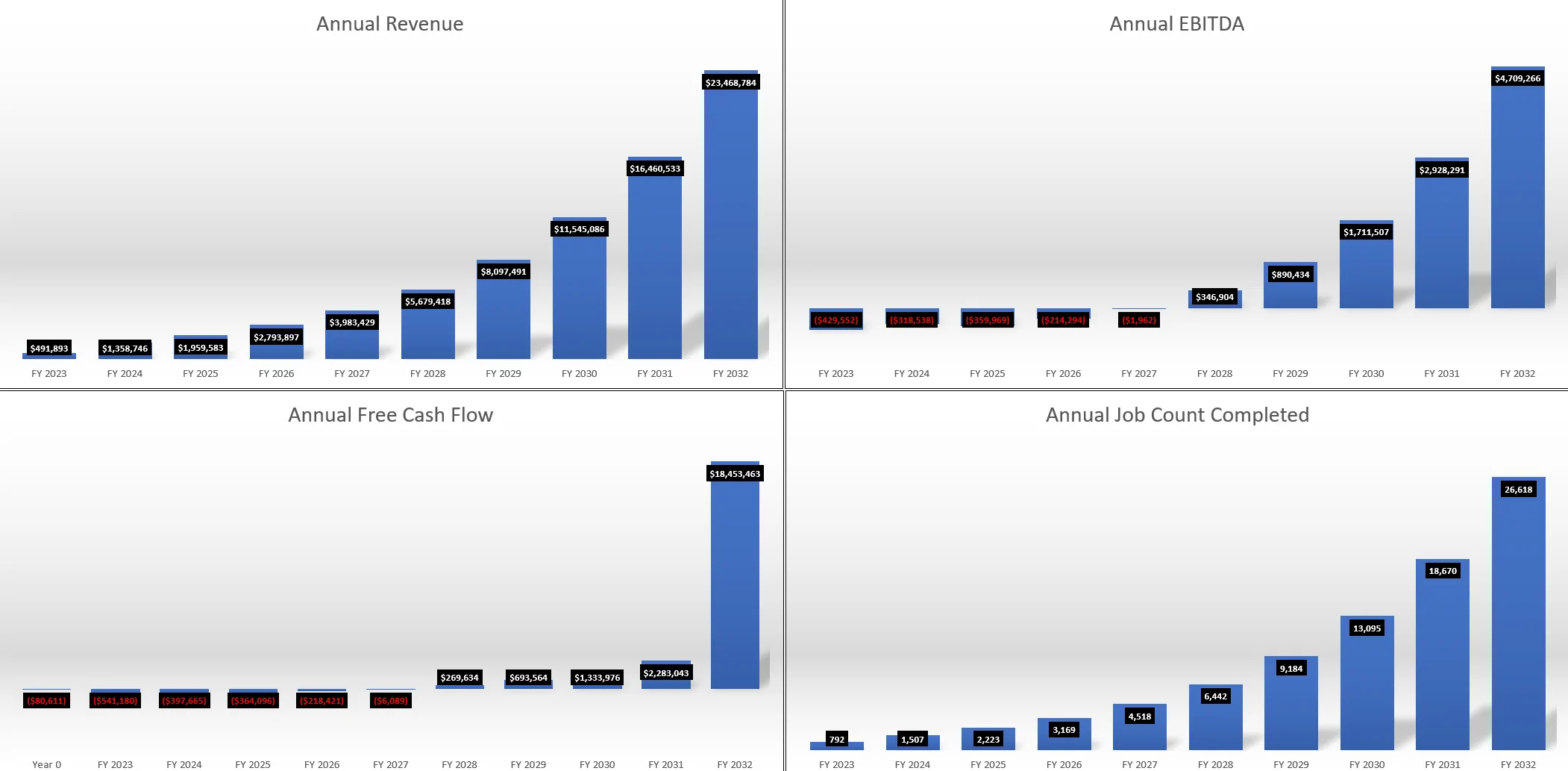

• Annual Executive Summary

• DCF Analysis, IRR, ROI, Equity multiple

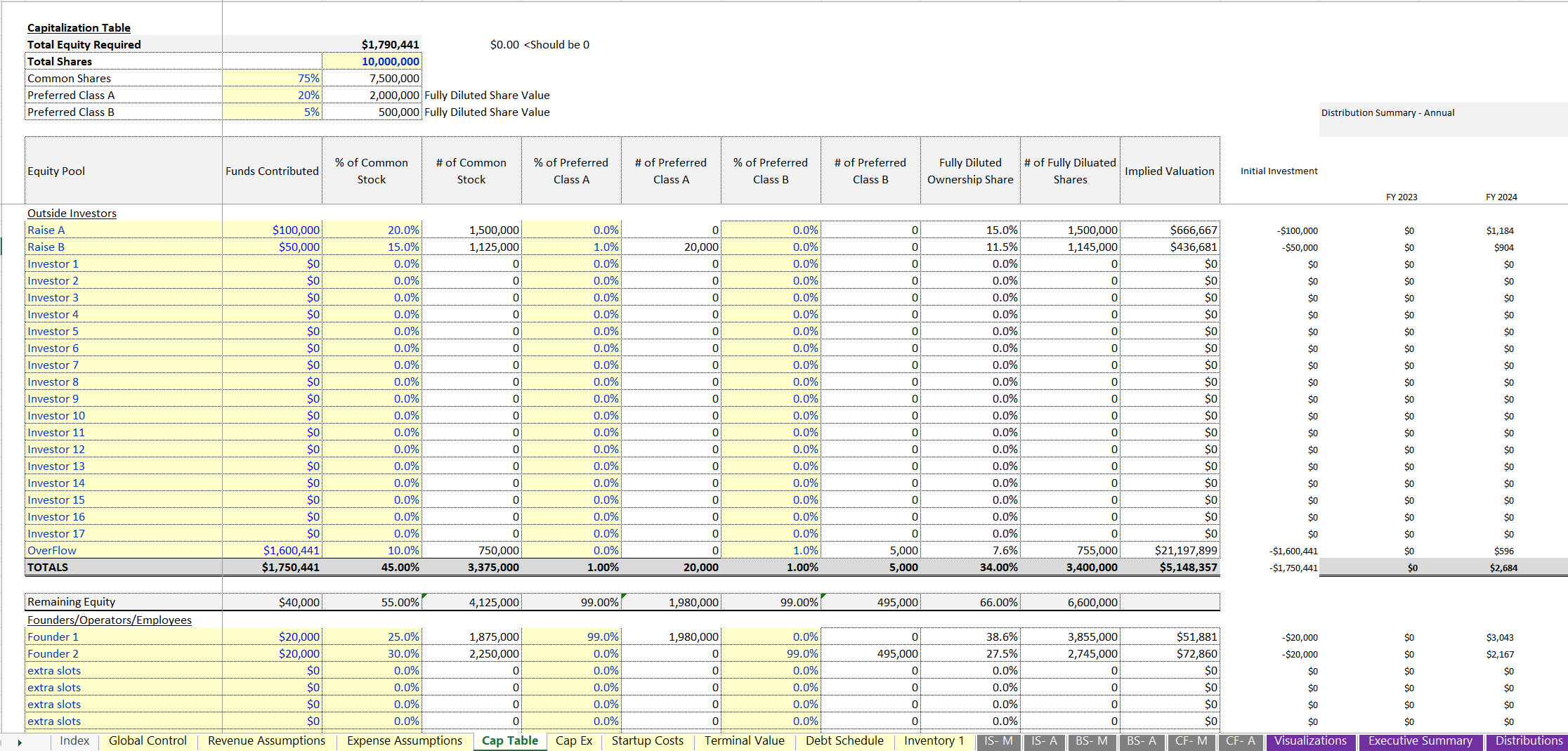

• Cap Table (inputs/outputs)

Other Features:

• Visualizations for key metrics and financial forecast

• Option for debt / joint venture

• Terminal value optional and driven from EBITDA multiple

• CapEx schedule (to account for truck/van purchases)

After running through the simulation with your own assumptions, the model will tell you the minimum equity required to keep afloat as well as how long it takes to recover the initial equity investment.

The template is built in MS Excel, but it could also be uploaded and used in Google Sheets.

This may also work for an electrician business forecast.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Plumbing Business Scaling Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping