Cleaning Service Financial Feasibility Study Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- A financial analysis framework to strategize for operating a commercial and/or residential cleaning services company.

- Model recurring service contracts and/or fixed price jobs.

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

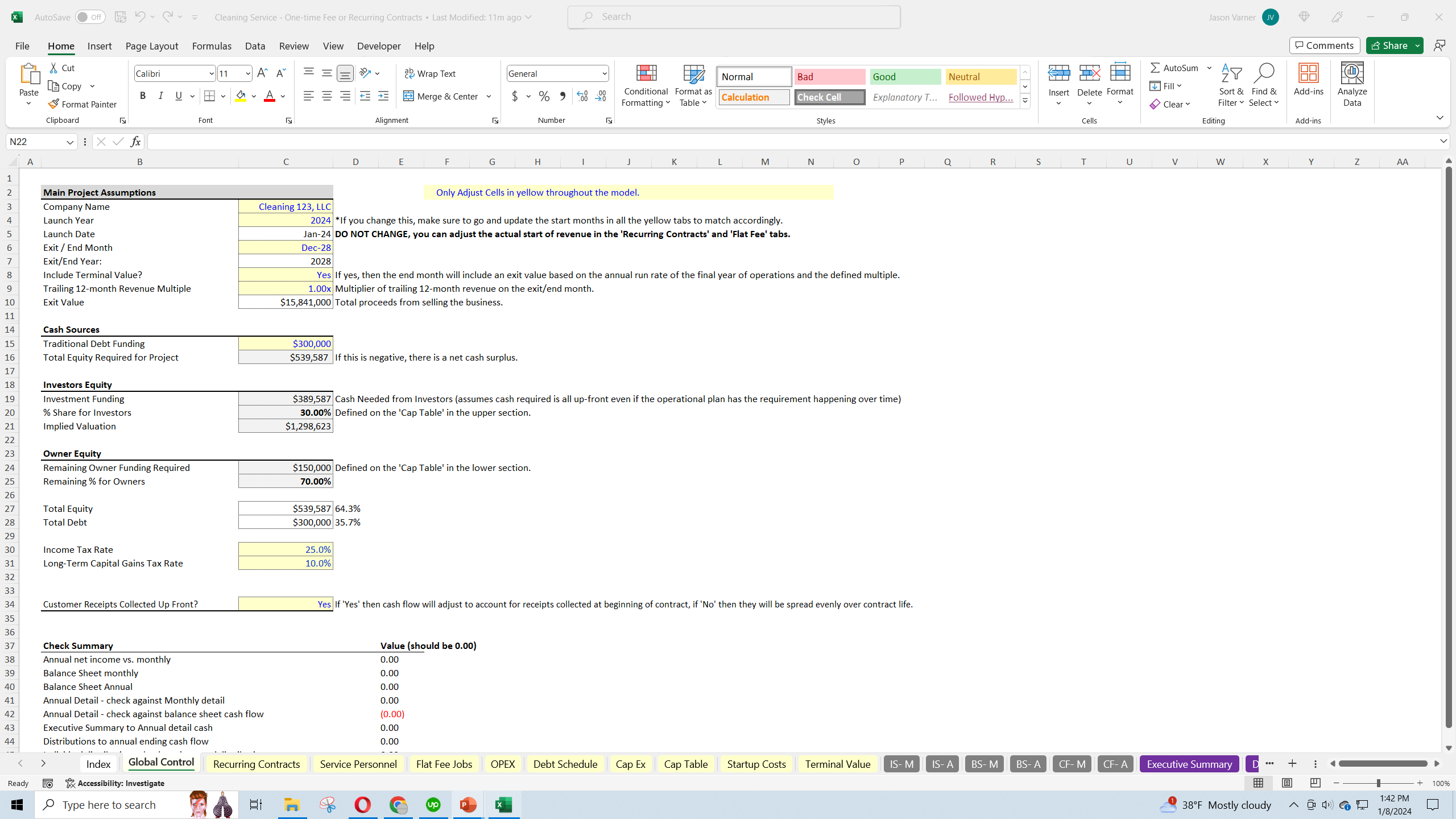

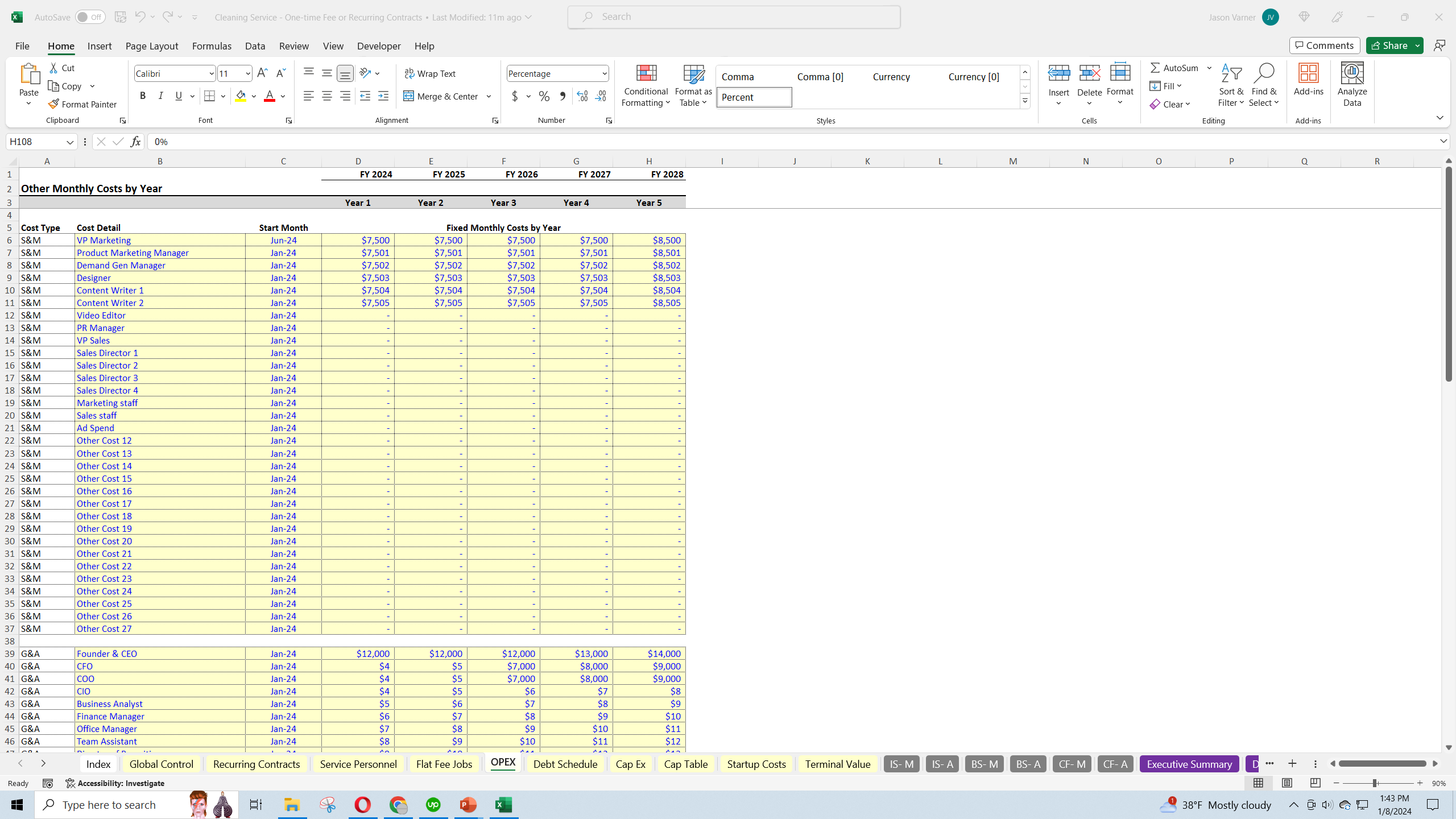

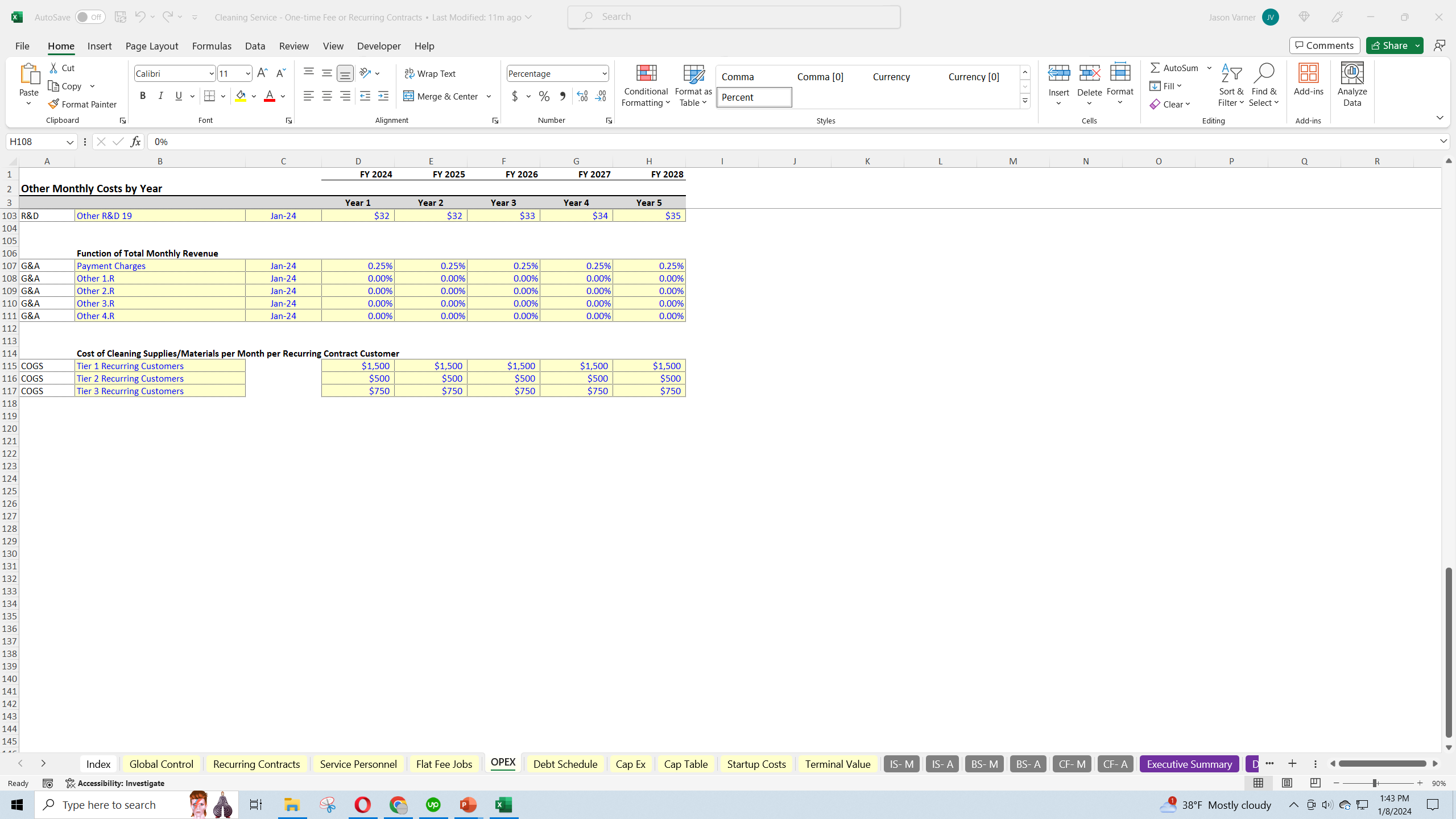

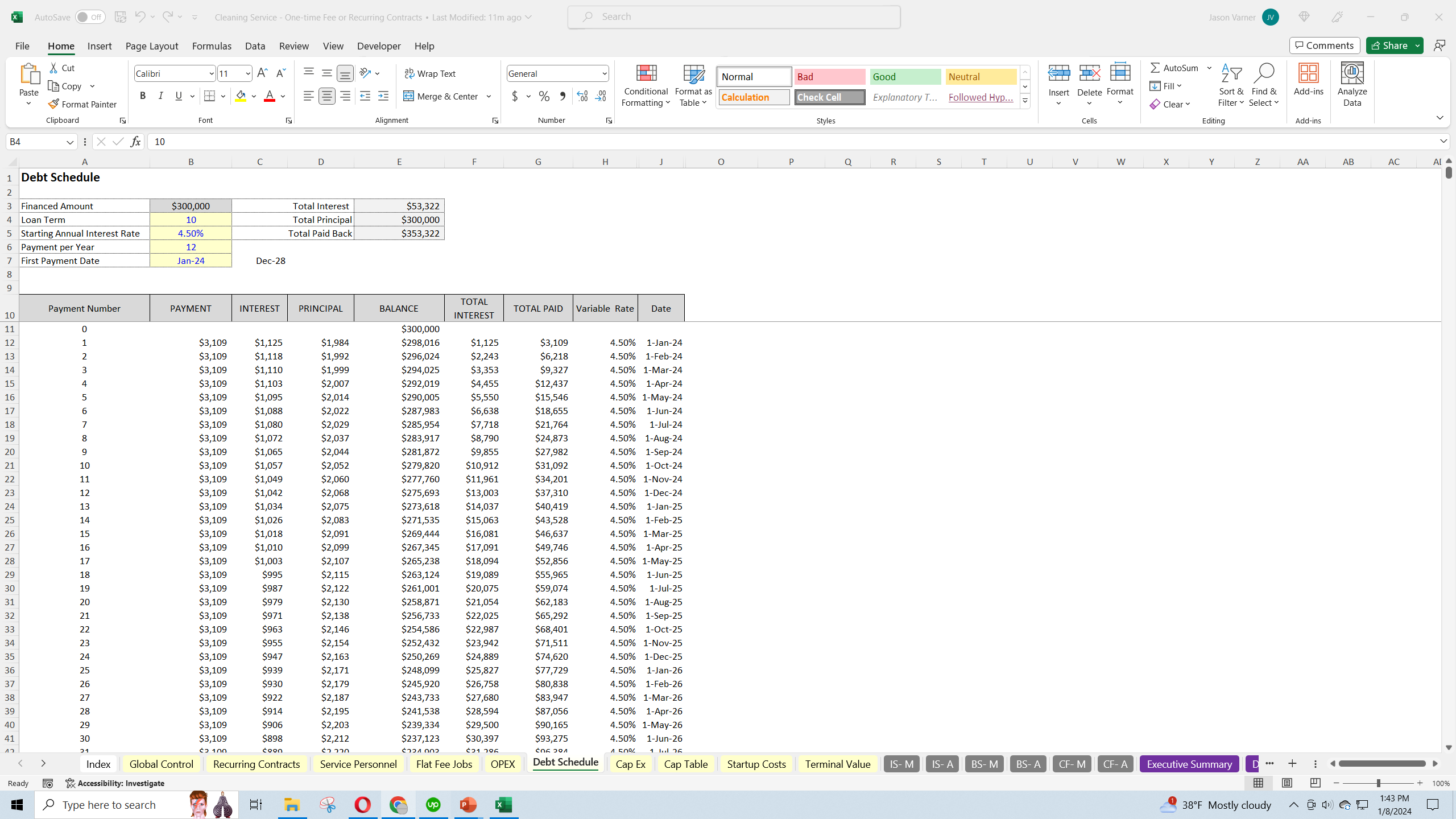

This comprehensive framework is meticulously crafted to facilitate financial feasibility analysis for general cleaning service enterprises. Designed for long-term utility, it requires only a one-time purchase and offers extensive editability to adapt to evolving business needs. The model encompasses all financial dimensions, including operating assumptions (revenues and expenses), capital expenditure requirements, initial startup costs, and both variable and fixed expenses. It even projects potential exit values using a 12-month trailing revenue multiple.

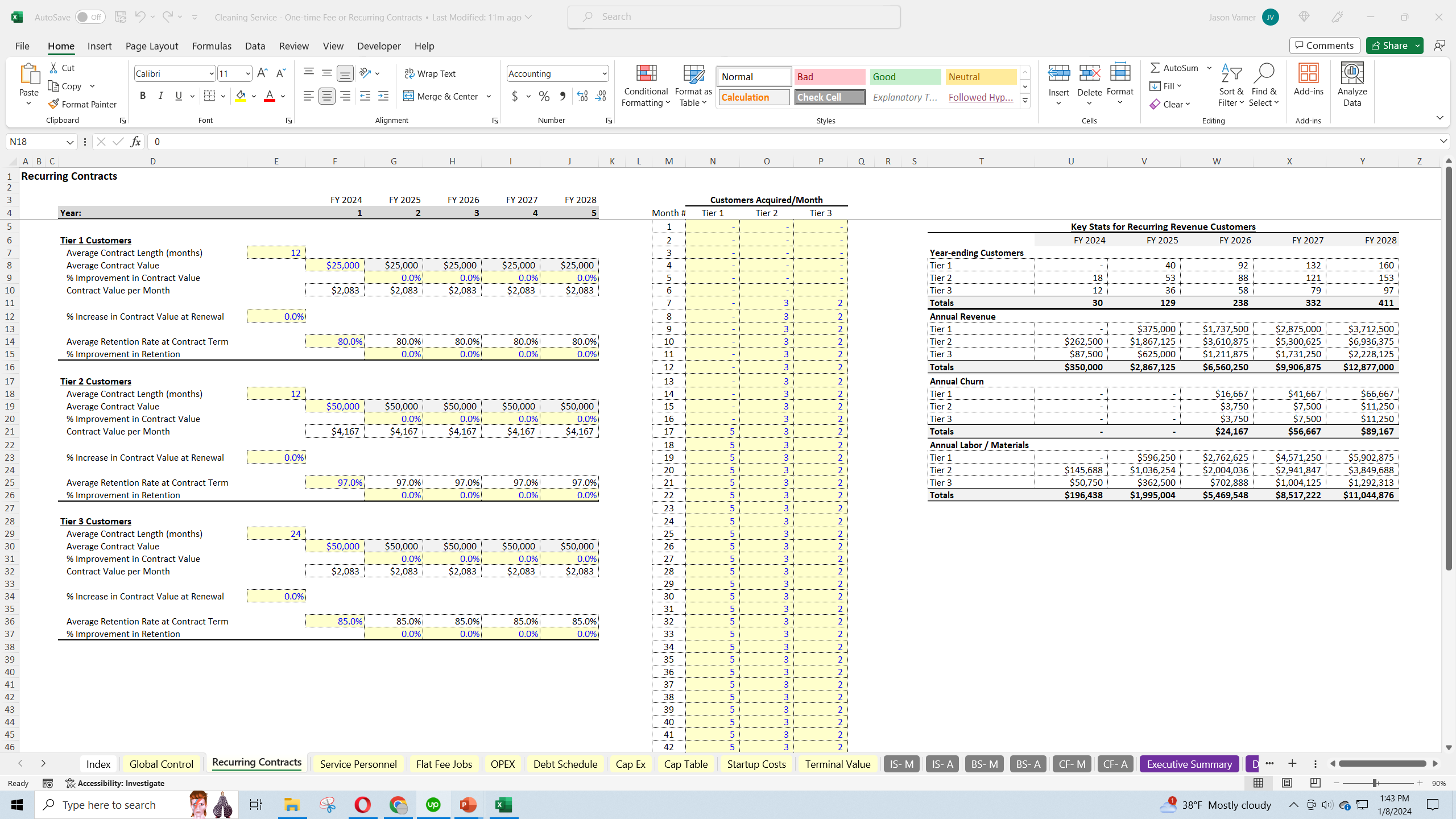

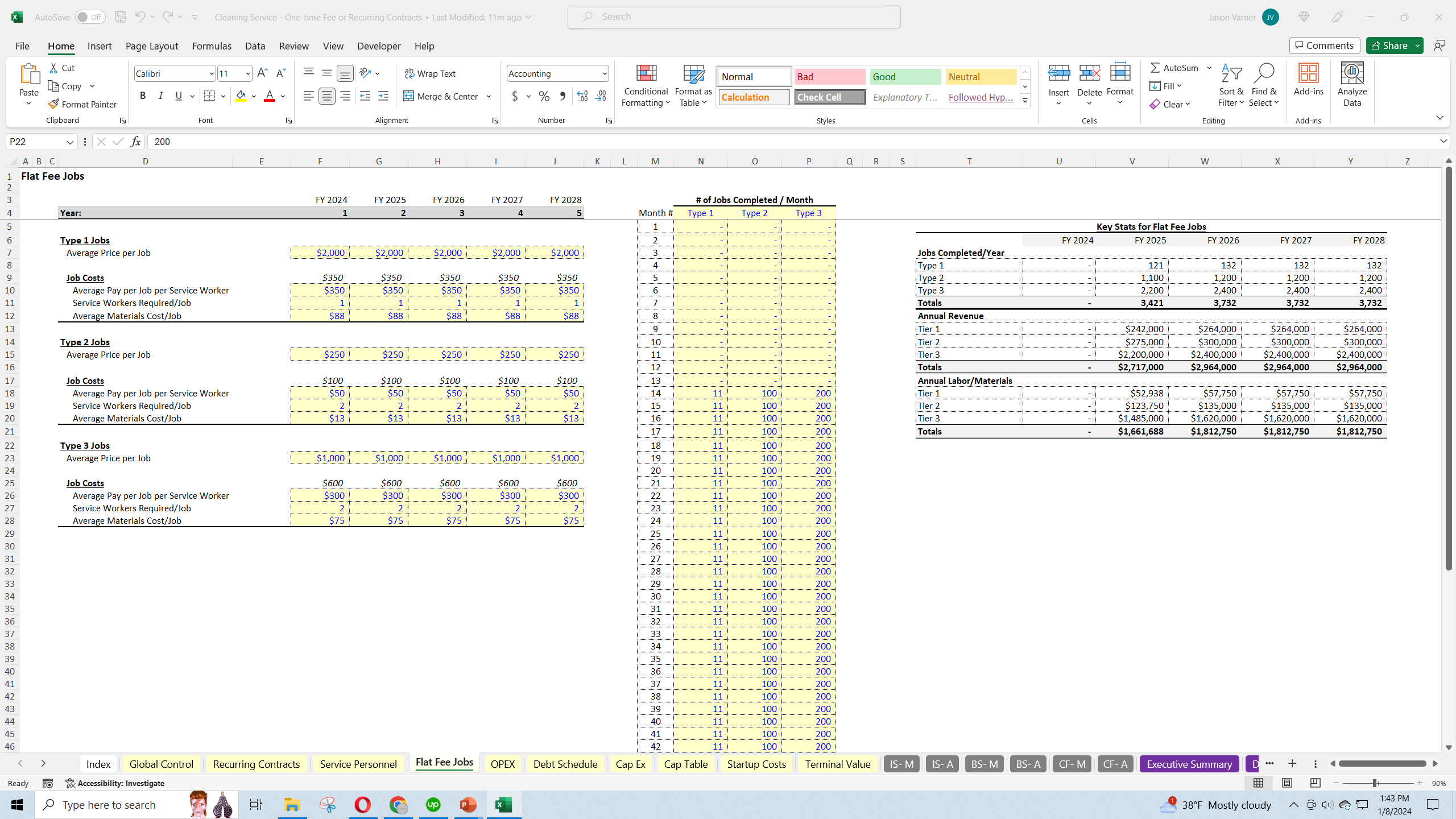

The model supports two revenue streams: recurring service contracts and fixed-price jobs. Recurring services, such as lawn care or commercial building cleaning, are characterized by contract duration, value, and retention rates. Fixed-price jobs, like gutter cleaning or power washing, are based on one-time fees and frequency.

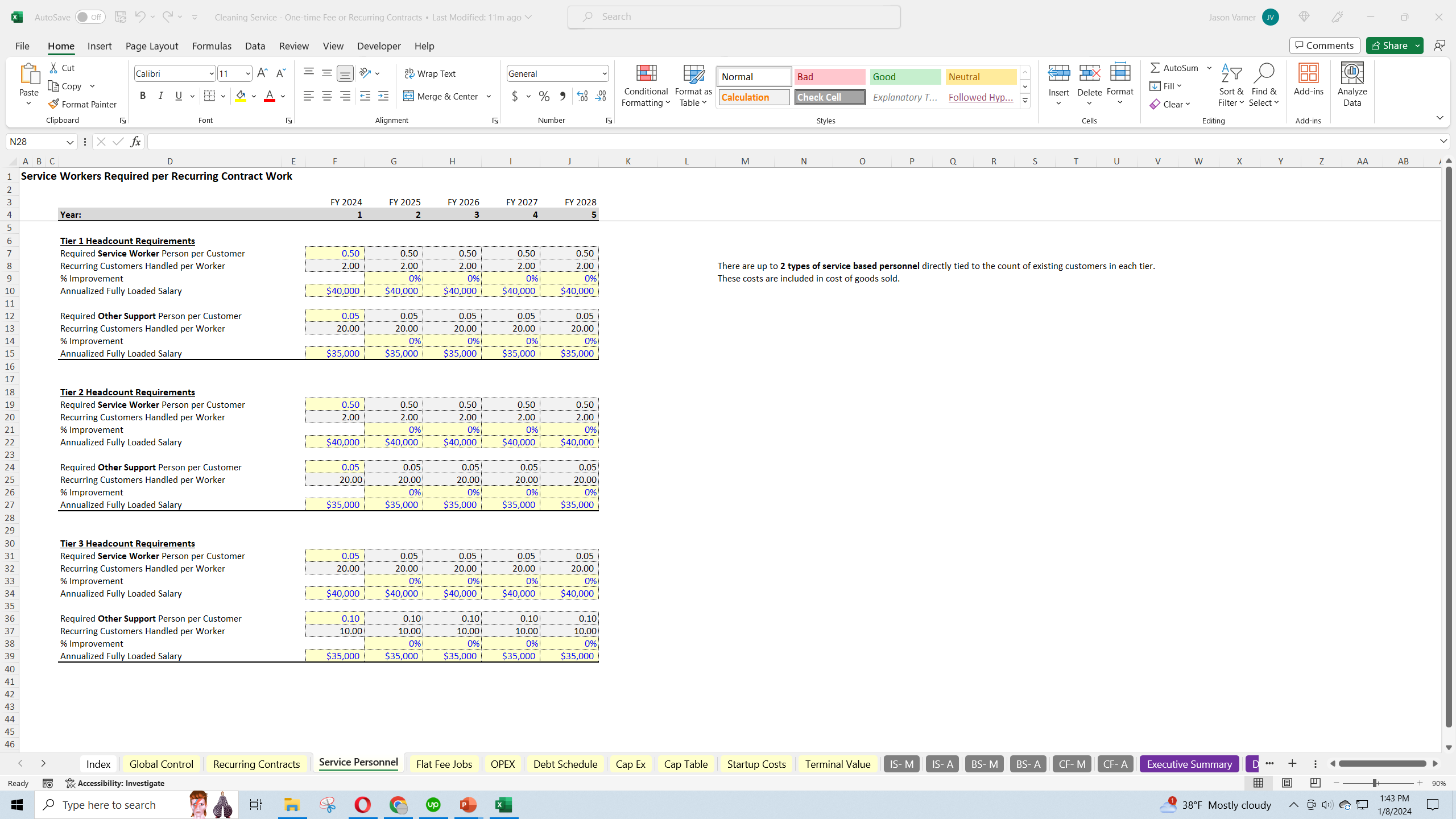

For recurring contracts, users can define new customer acquisition per month for up to three distinct customer segments, each with its own contract terms, pricing, variable costs, and personnel requirements. In the fixed-price job segment, the model allows for three job types, with customizable inputs for job frequency, pricing, labor requirements, and material costs per job type.

This configuration approach simplifies planning, enabling users to effectively strategize service launch and scale-up within the first year.

Additionally, the framework includes assumptions for corporate overheads, capital expenditures, and potential joint ventures, inclusive of investor contributions and equity shares. A robust financial analysis suite is integrated, featuring a Discounted Cash Flow (DCF) Analysis, Internal Rate of Return (IRR) calculations, Equity Multiple, and Total Return on Investment (ROI) from both the owner/operator and investor perspectives, supplemented by an array of visualizations for enhanced storytelling.

Upon inputting their assumptions, users receive auto-formatted monthly and annual financial statements (Income Statement, Balance Sheet, and Cash Flow Statement), along with a detailed pro forma analysis showcasing EBITDA and cash flow origins.

The model also calculates the minimum equity required to maintain a positive cash balance, considering all initial costs and net burn rate.

An instructional video is included for ease of use and better understanding.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Cleaning Service Financial Feasibility Study Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping