Franchise Ramping Financial Model: Up to 12 Locations (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

FRANCHISING EXCEL DESCRIPTION

Latest updates:

• Dynamic interest only period for construction loan debt amortization

• Owner cash flow calculation changed to be more clear

• IRR calculated based on monthly cash flows (more accurate)

• Visualizations / Chart / Returns tab updated accordingly for better owner cash flow view

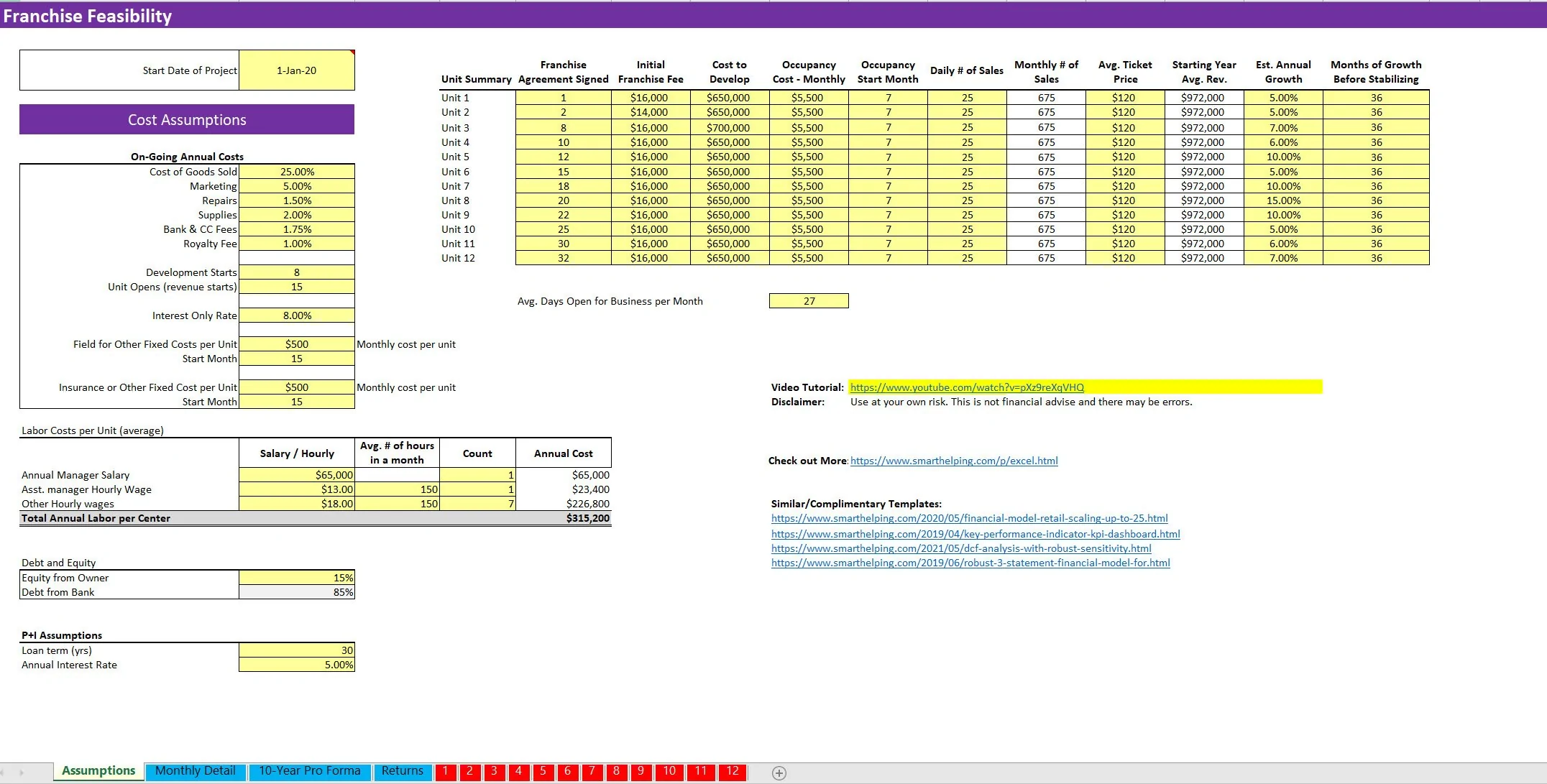

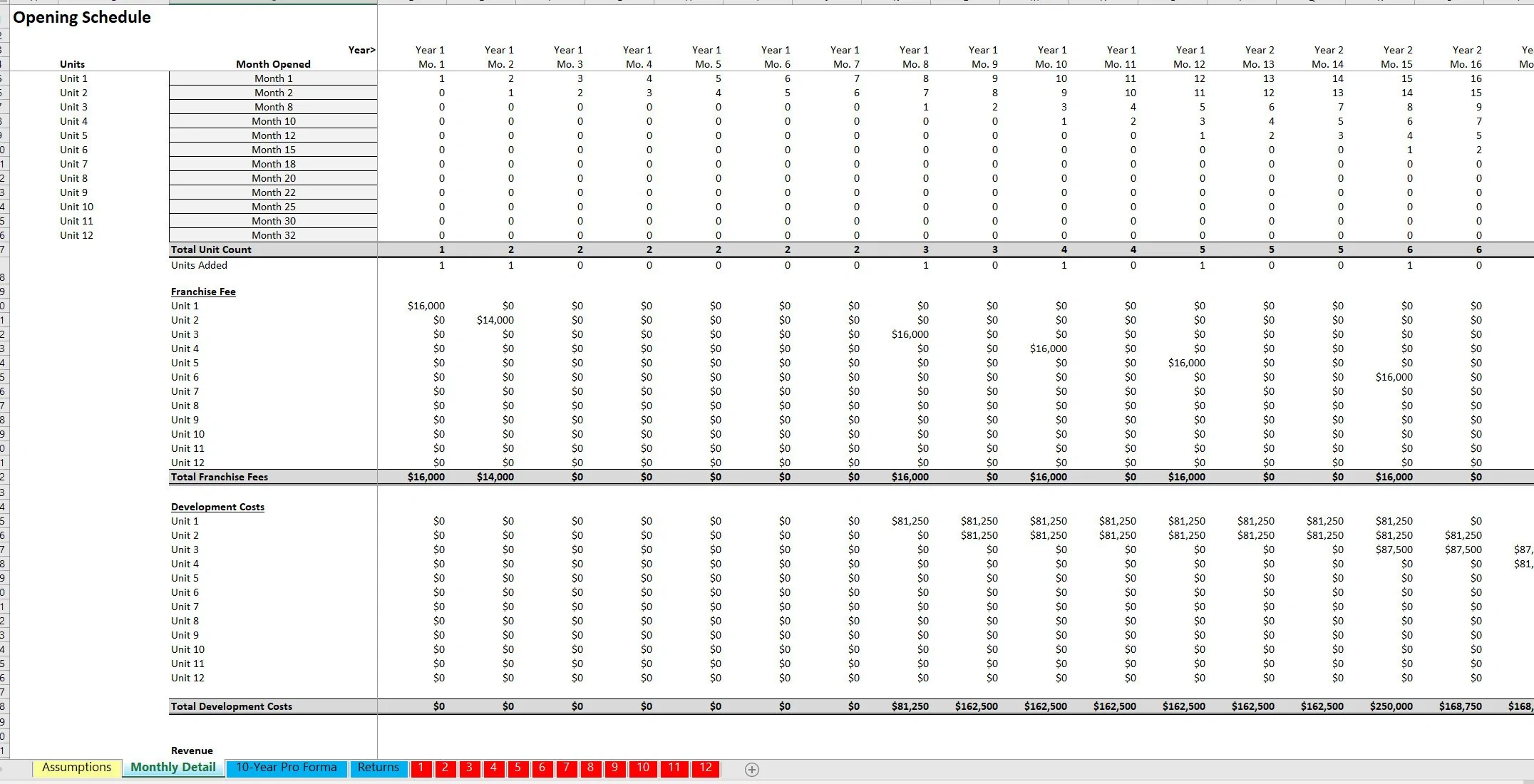

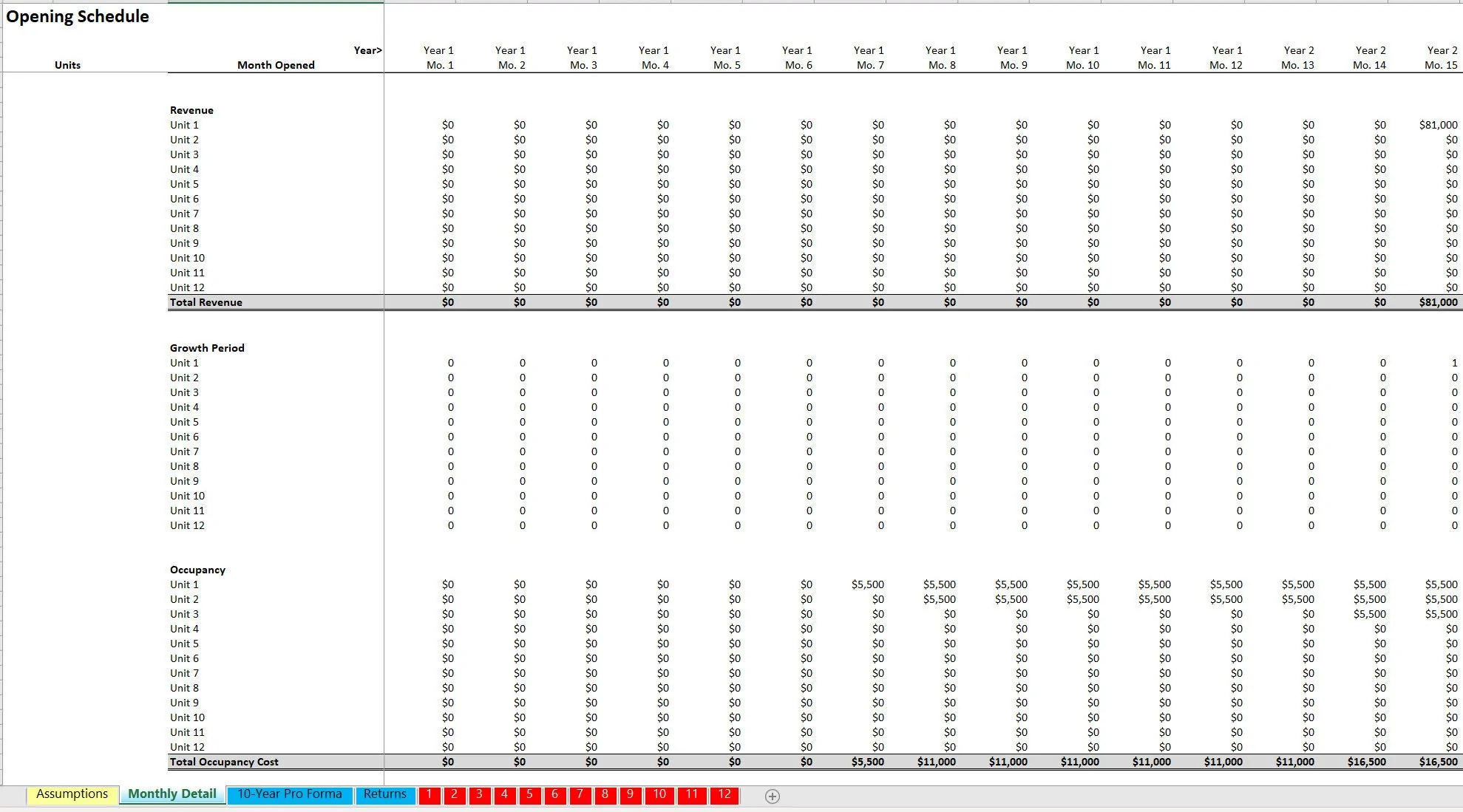

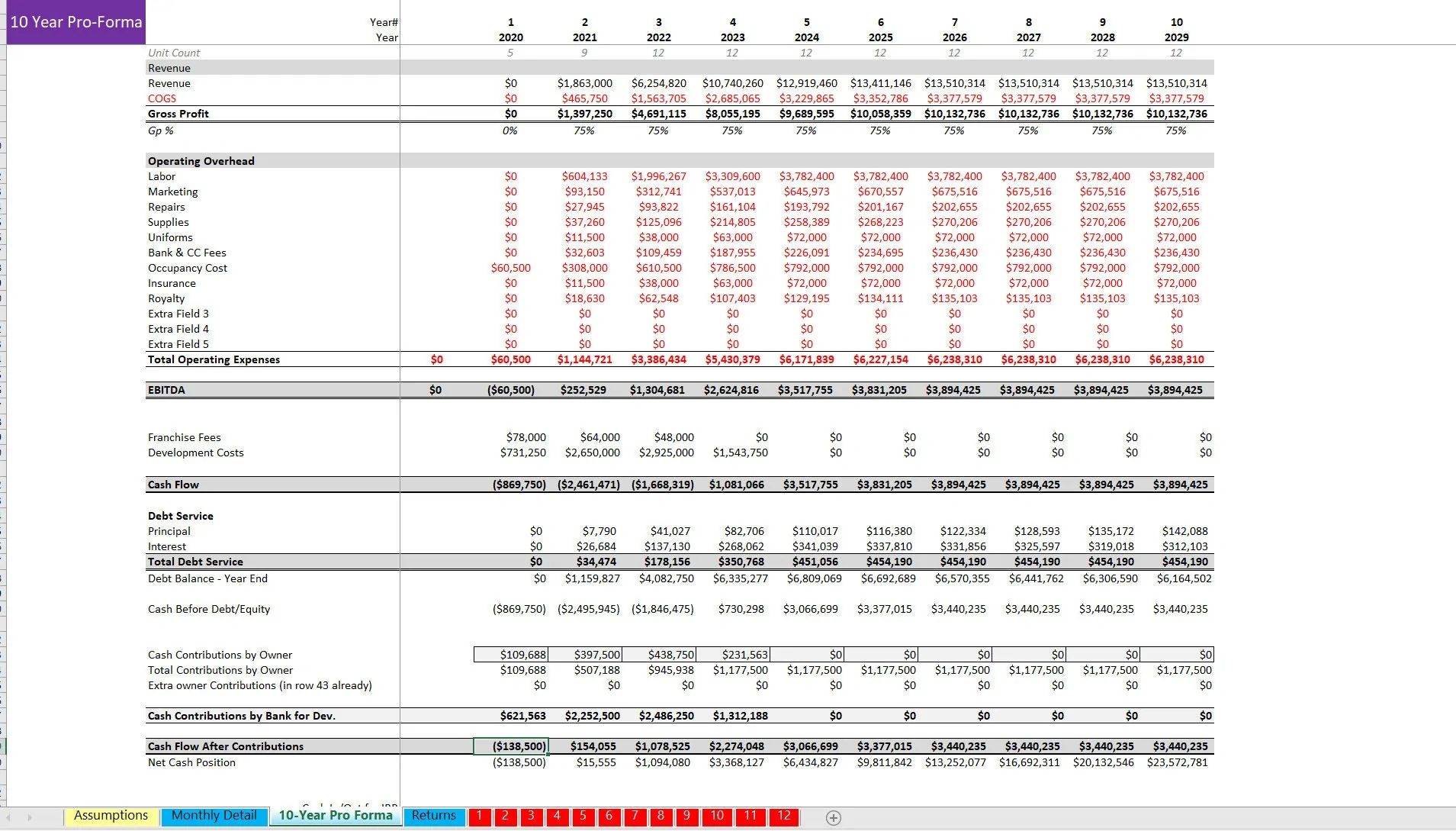

This template lets the user do some financial planning for opening up to 12 franchise locations. The model goes out for a period of 10 years and shows monthly and annual summaries of all aspects that flow down to cash flow.

Each of the 12 locations has dynamic variables for the following:

• Franchise Agreement Signed

• Initial Franchise Fee

• Cost to Develop

• Occupancy Cost – Monthly Occupancy

• Start Month #

• Daily # of Sales

• Monthly # of Sales

• Avg. Ticket Price Starting Year

• Avg. Rev.

• Est. Annual Growth

• Months of Growth Before Stabilizing

The model is great at showing the timing of cash requirements as well as the ramp up of revenues as more locations are opened.

The financing assumptions are the same for each location, meaning whatever the expected cost is to develop, a certain % of that can be allocated to long-term debt and all of that debt will have the same terms (only the amount borrowed will be different per location depending on the cost to develop per location).

For each loan, if debt is used, the development period will accrue interest and payments won't start for 12 months from the first development draw month.

All of the costs and timing are dynamic per the start month of each franchise. Salary and labor costs are defined once and apply to all locations.

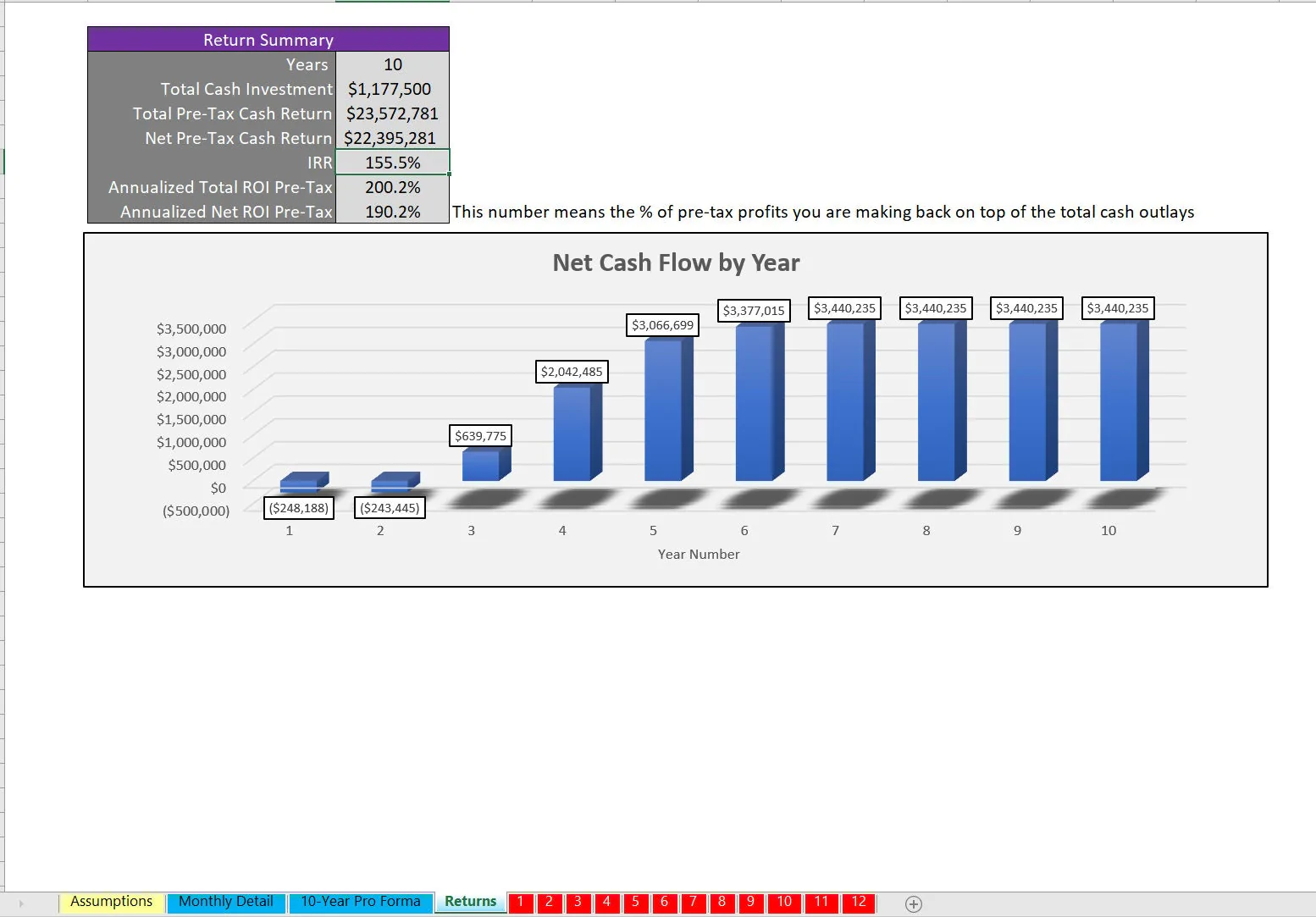

The main way to use this template is to see how much cash you can generate with earlier locations so that newer locations can be opened while only requiring initial equity that is acceptable.

Final reports include a Returns summary that has net cash flow by year visualization, total cash investment, net cash returned, IRR, and annualized ROI. Additionally, there is a 10-year pro forma that shows a high level view of each major financial line item (revenues, expenses, debt service, and cash flow.

This model provides a comprehensive framework for assessing the financial viability of scaling your franchise operations. With detailed projections and dynamic inputs, it enables you to strategically manage cash flow and optimize the timing of your investments as you expand.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Franchising, Integrated Financial Model Excel: Franchise Ramping Financial Model: Up to 12 Locations Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Financial Models for Service-based Businesses

This bundle contains 13 total documents. See all the documents to the right.

Save %!

Industry-specific Financial Models (40+)

This bundle contains 67 total documents. See all the documents to the right.