Dry Cleaning Business Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

This template has been fully upgraded to include a 3-statement financial model, cap table, capex with depreciation, and completely re-built revenue assumptions that include add-on services revenue logic and variable expense logic.

Starting a dry cleaning business can be costly and having a financial model that lets you have some reference to where you want to be can be greatly helpful and reduce some of the unknowns and fears.

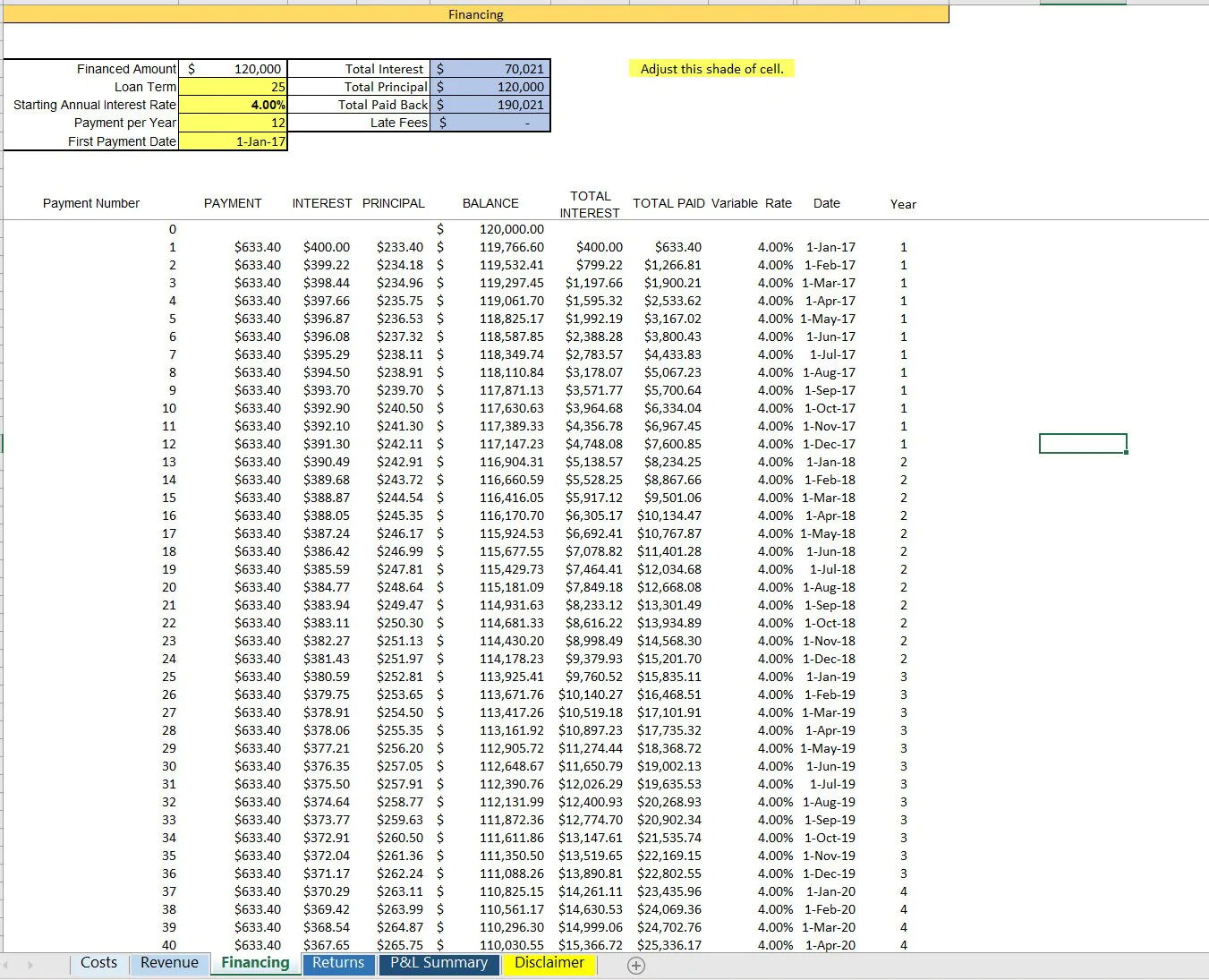

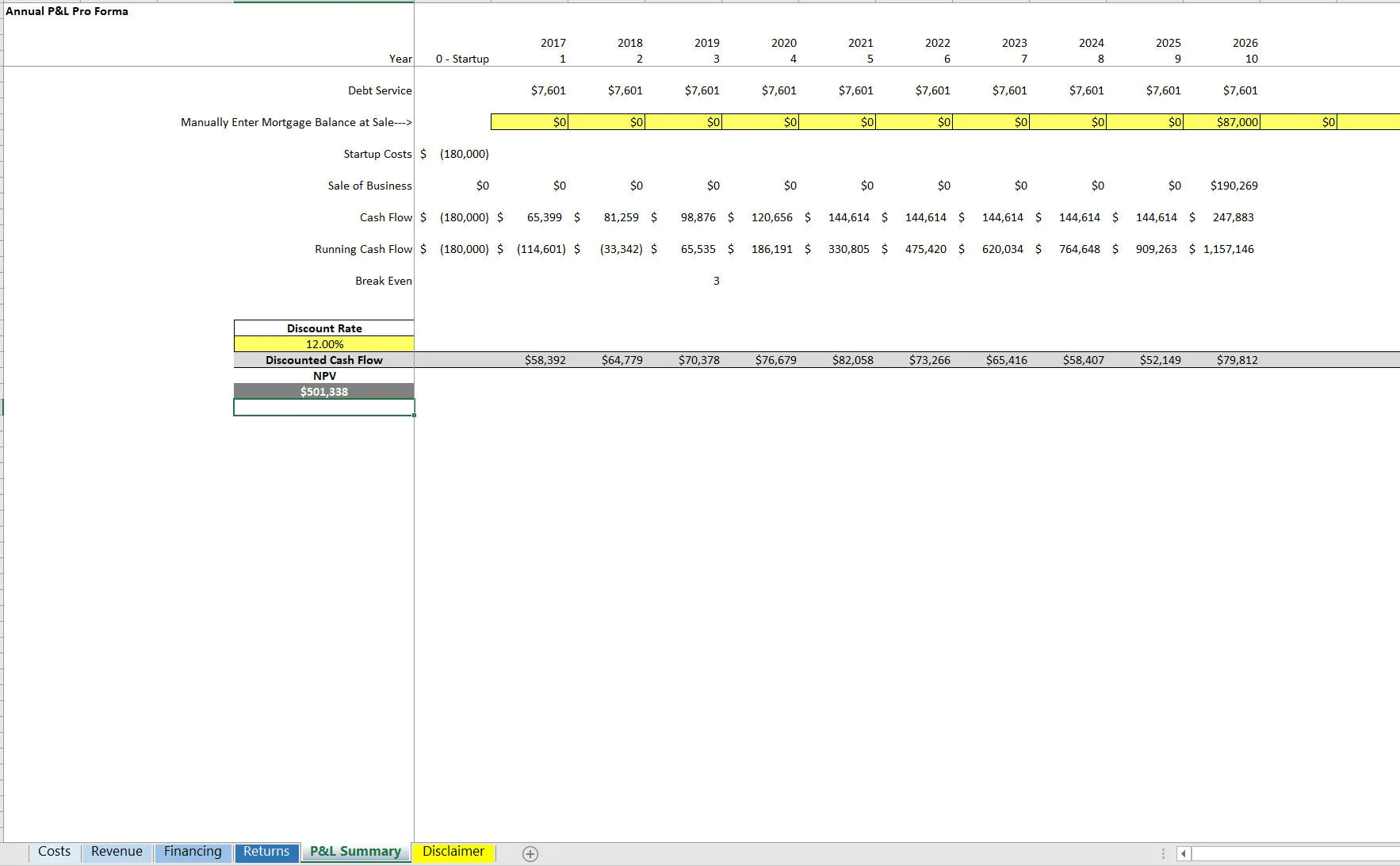

The idea of a financial model has many folds. It lets you know what kind of startup costs you are going to need to come up with after any debt / investor financing as well as what kind of revenues are required in order to reach a certain break even point and start earning profits.

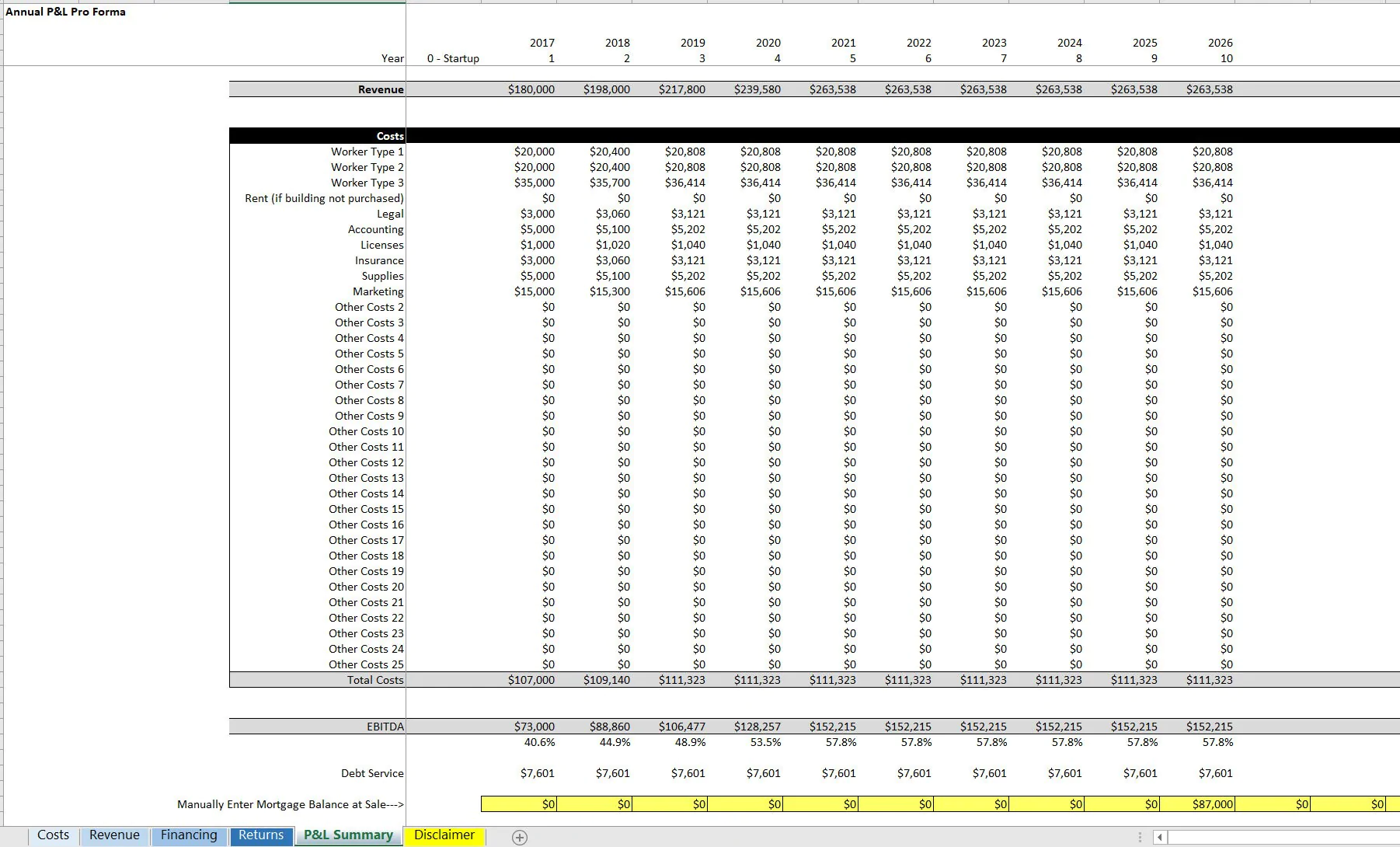

This financial model is designed to forecast the annual profit and loss and cash flow of a dry cleaning business. The main inputs are fairly high level and make for a quick analysis, but detailed enough to be useful.

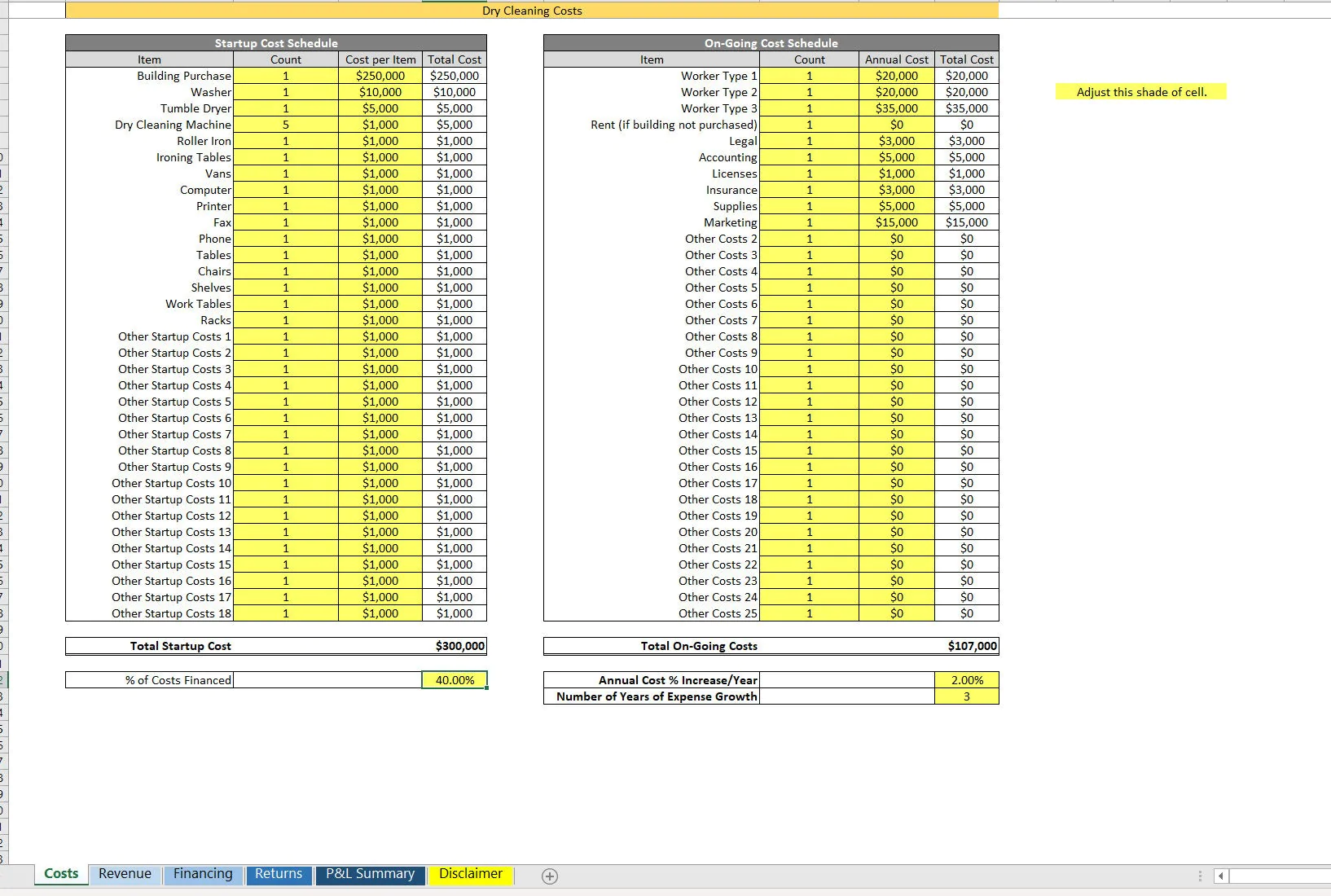

The user inputs:

• Startup cost items

• On-going cost items (count / annual cost per item / total annual cost)

• Percentage growth of fixed costs per year

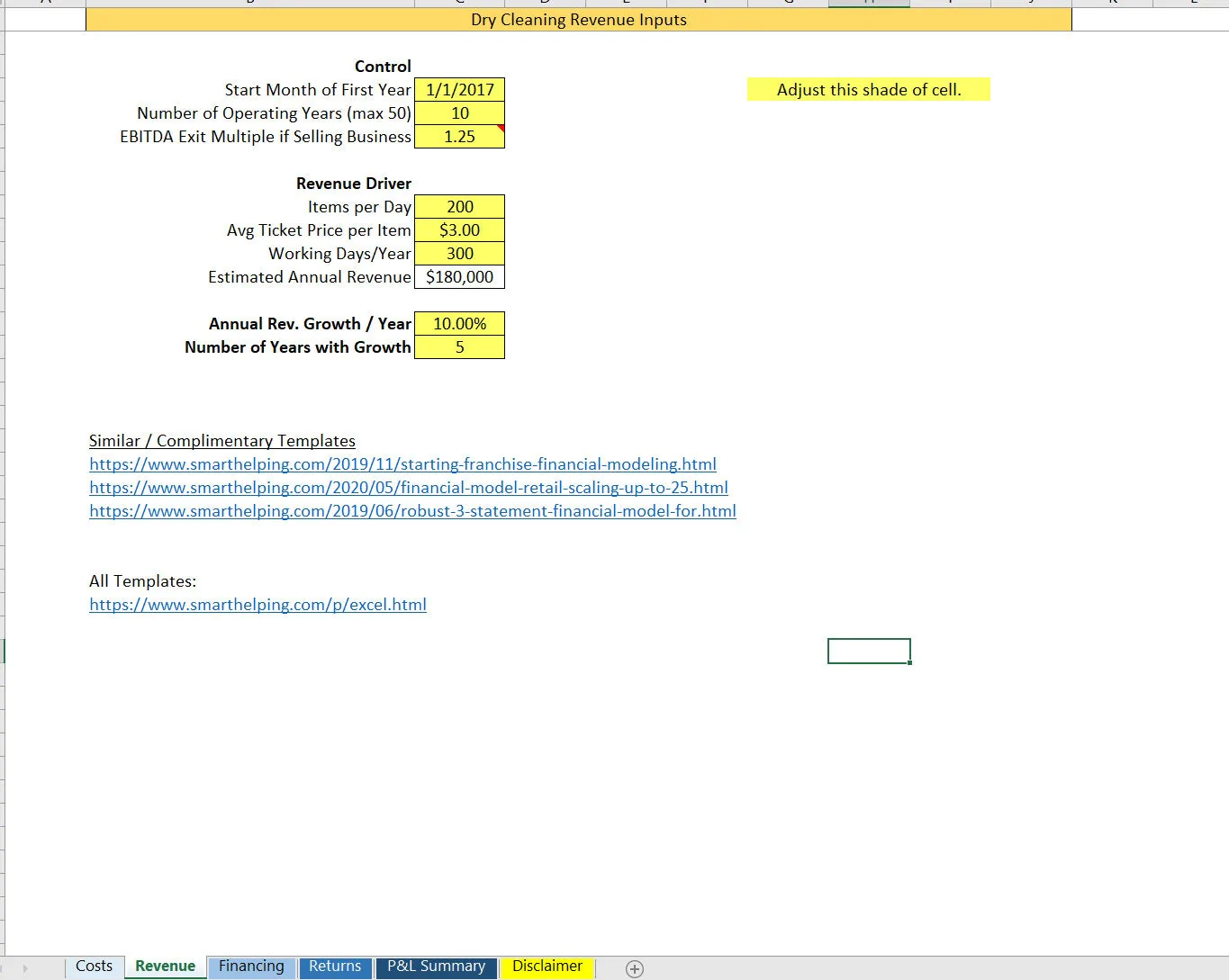

• Start year of operations

• Number of operating years

• Exit multiple (per annualized EBITDA at exit year)

And for revenue assumptions:

• Items per Day

• Average Ticket Price per Item

• Working Days/Year

• Estimated Annual Revenue

• Annual Revenue Growth / Year

• Number of Years with Growth

Based on all entered assumptions, the result is organized into an annual profit / loss statement and cash flow.

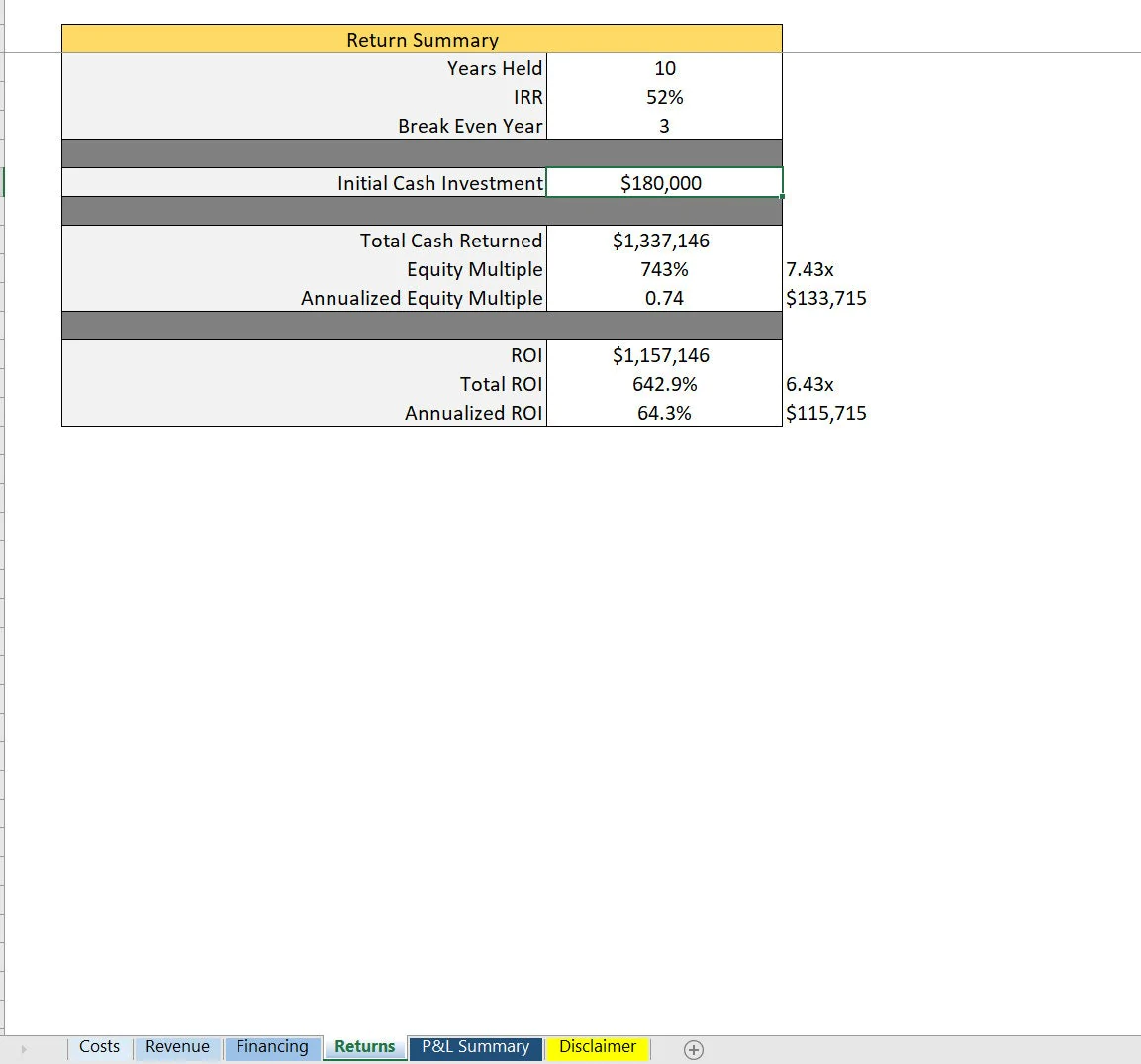

The return summary will display the total project IRR, equity multiple, and annualized equity multiple as well as total Return on Investment (ROI) and annualized ROI. This is a simple tool, but well organized and easy for anyone to understand / use.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Dry Cleaning Business Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping