Talent Agency & Creatives Agency 5-Year Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Recent Updates: Full 3-statement model integration and cap table / improved formatting conventions.

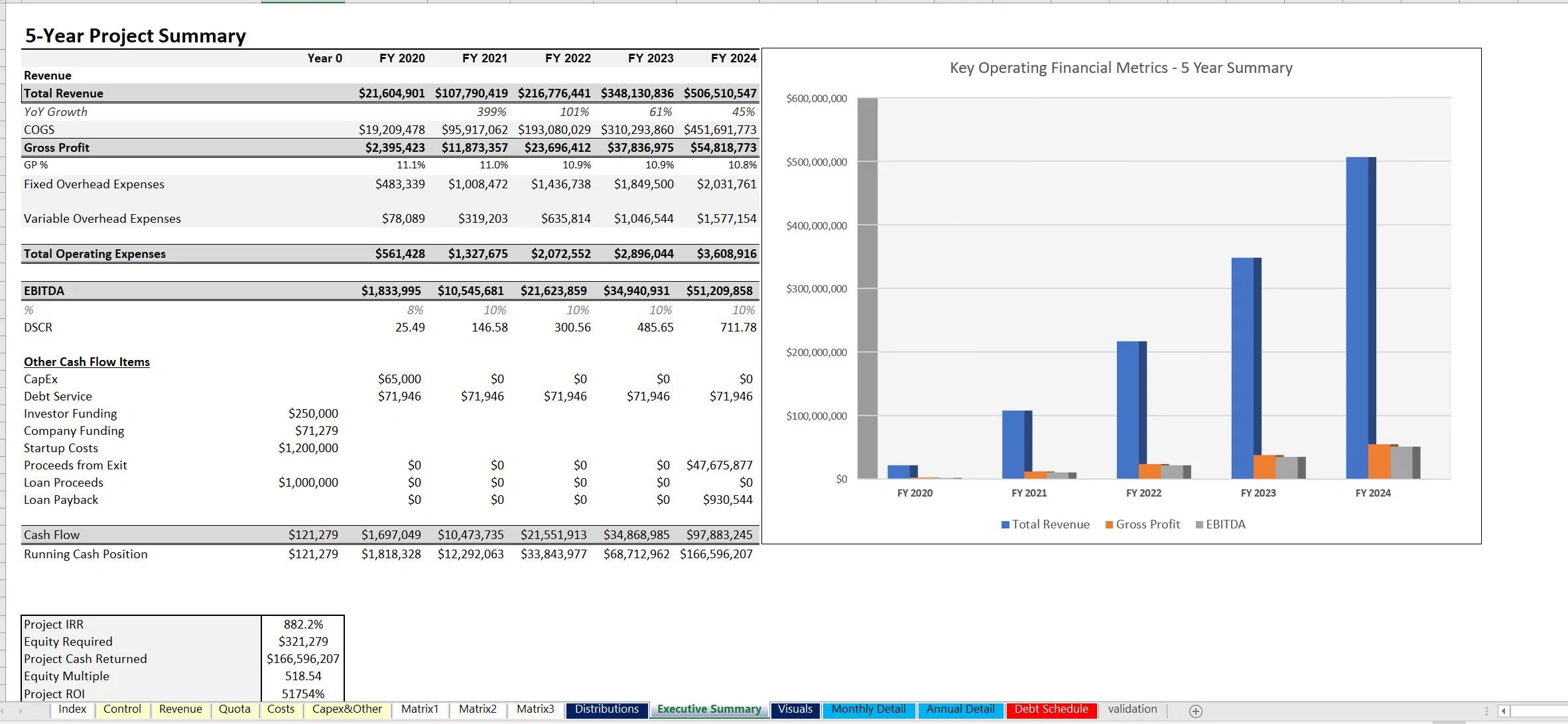

This bottom-up financial model is built specifically for a business model that adds professionals / creatives / talent over time and takes a cut of their billables. It could be a wide range of use cases (CPA firm, Law firm, or a professional services agency.

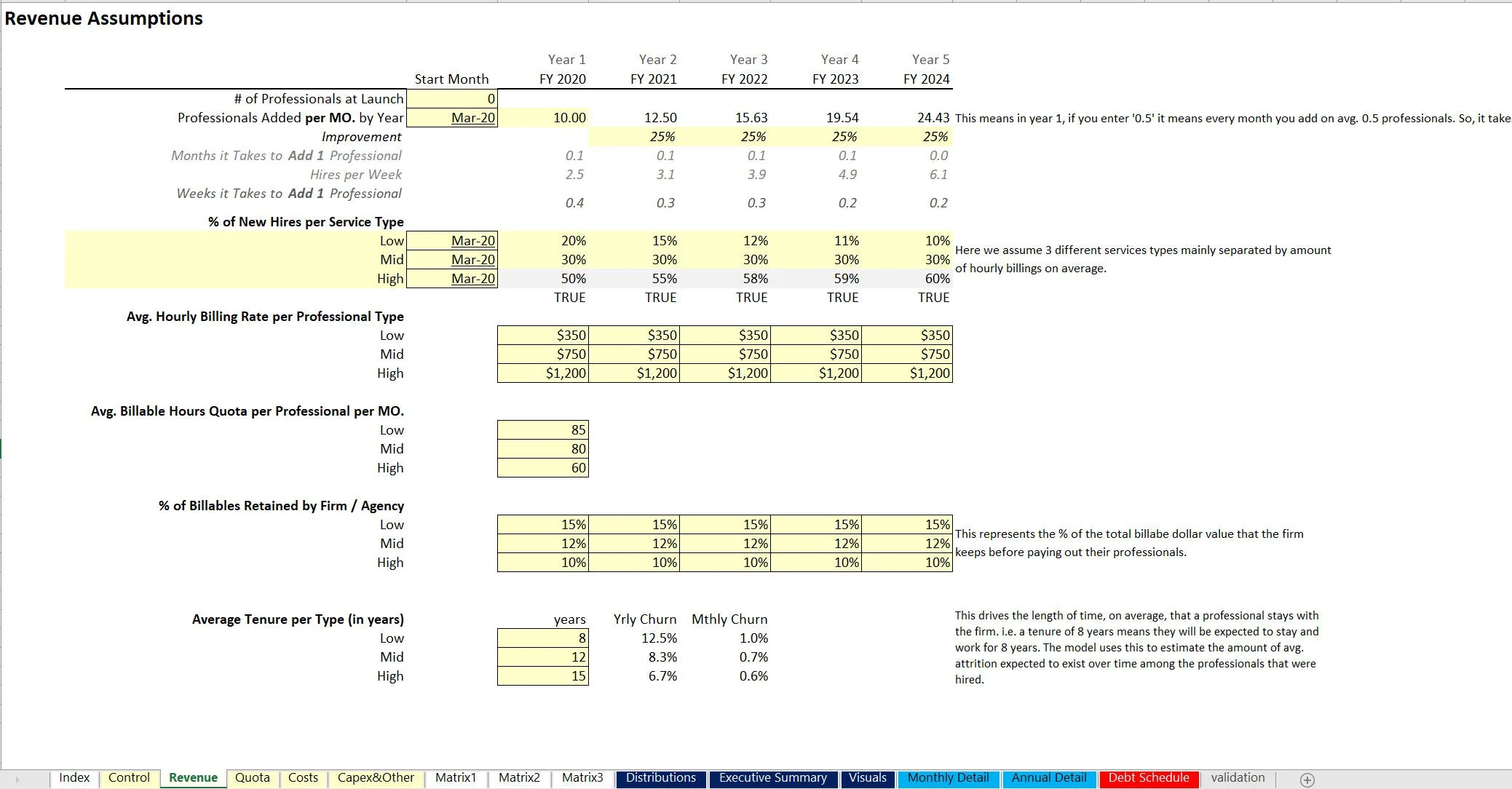

The forecast period is up to 5 years. In order to drive revenue, the following configurations are available:

• # of Professionals at Launch

• Professionals Added per month by year

• Improvement of professionals added per month

• Average hires / signings that happen per week display per a formula per year

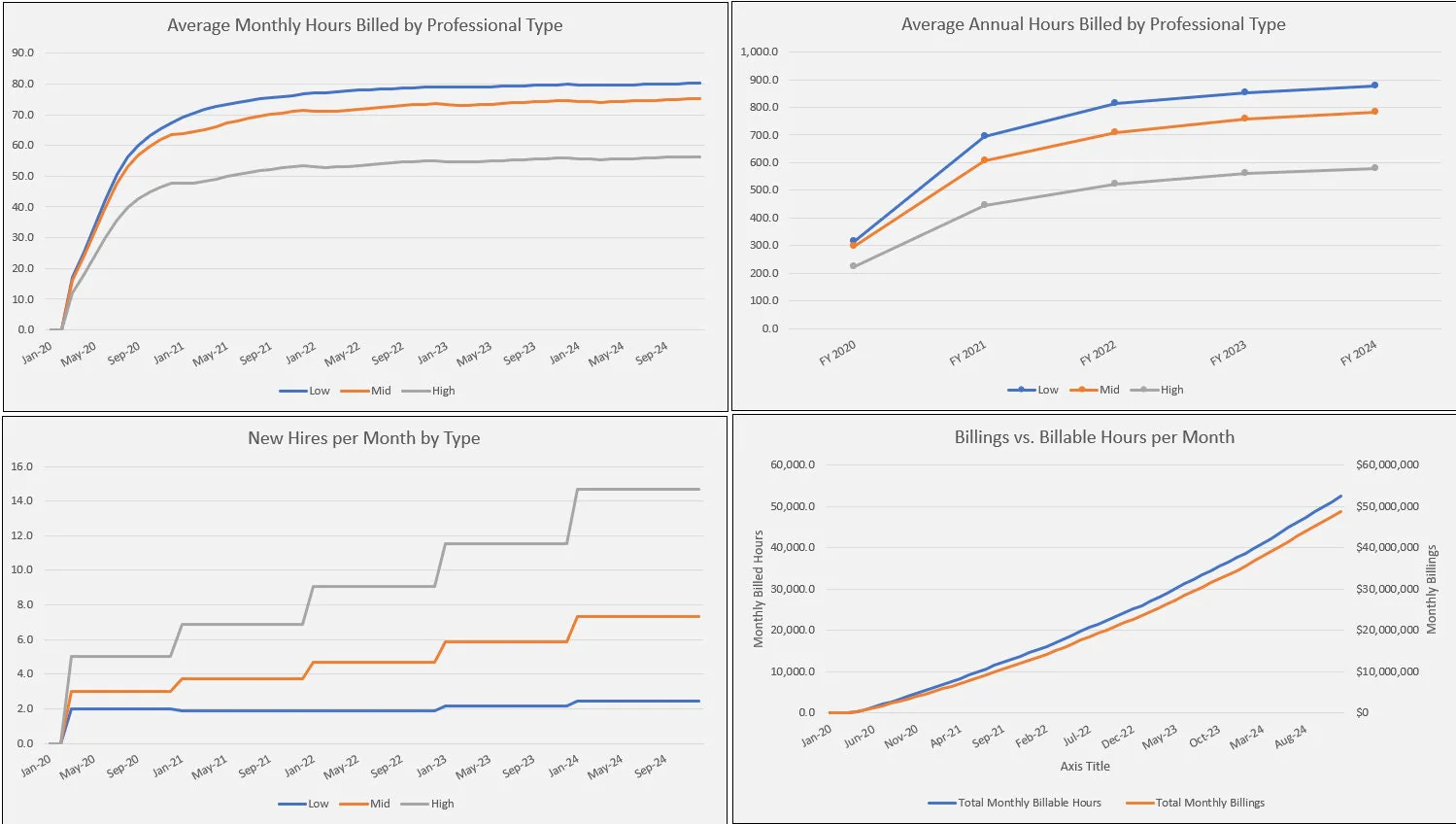

Professionals are split into three categories that are differentiated by a few different key assumptions that are configurable per year and include:

• Billing rate / daily rate

• # of Hours per month quota

• Percentage of billables retained by firm

• Average tenure

• The month each professional services category starts

A separate tab was designed to account for the percentage of quota attained over time and this assumes that over time new hires / contracts get closer to reaching their full quota. This is a monthly schedule for maximum granularity and configurability. Operating expenses are defined by description, start month, monthly cost over 5 years.

One interest variable cost schedule added to this is the monthly cost per professional per month and there are up to 10 slots in this area. It was designed for things like coffee, travel / on-going training covered by the firm for the professional.

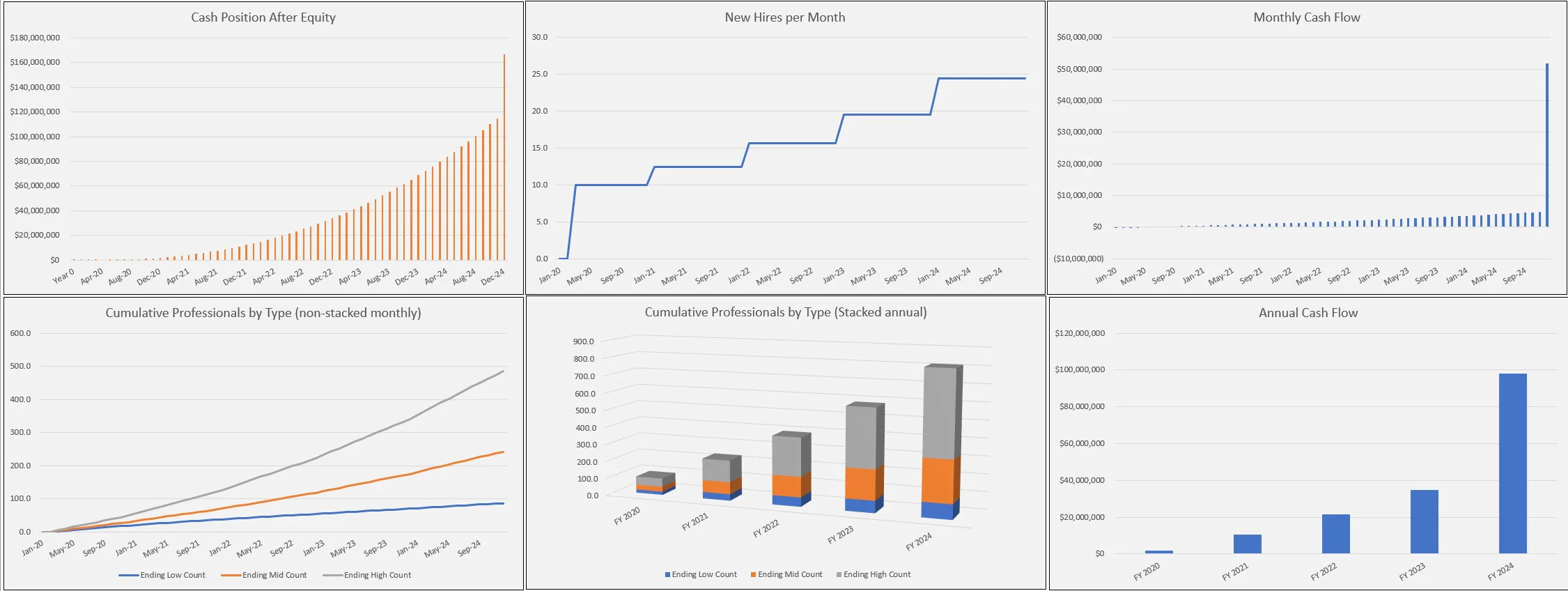

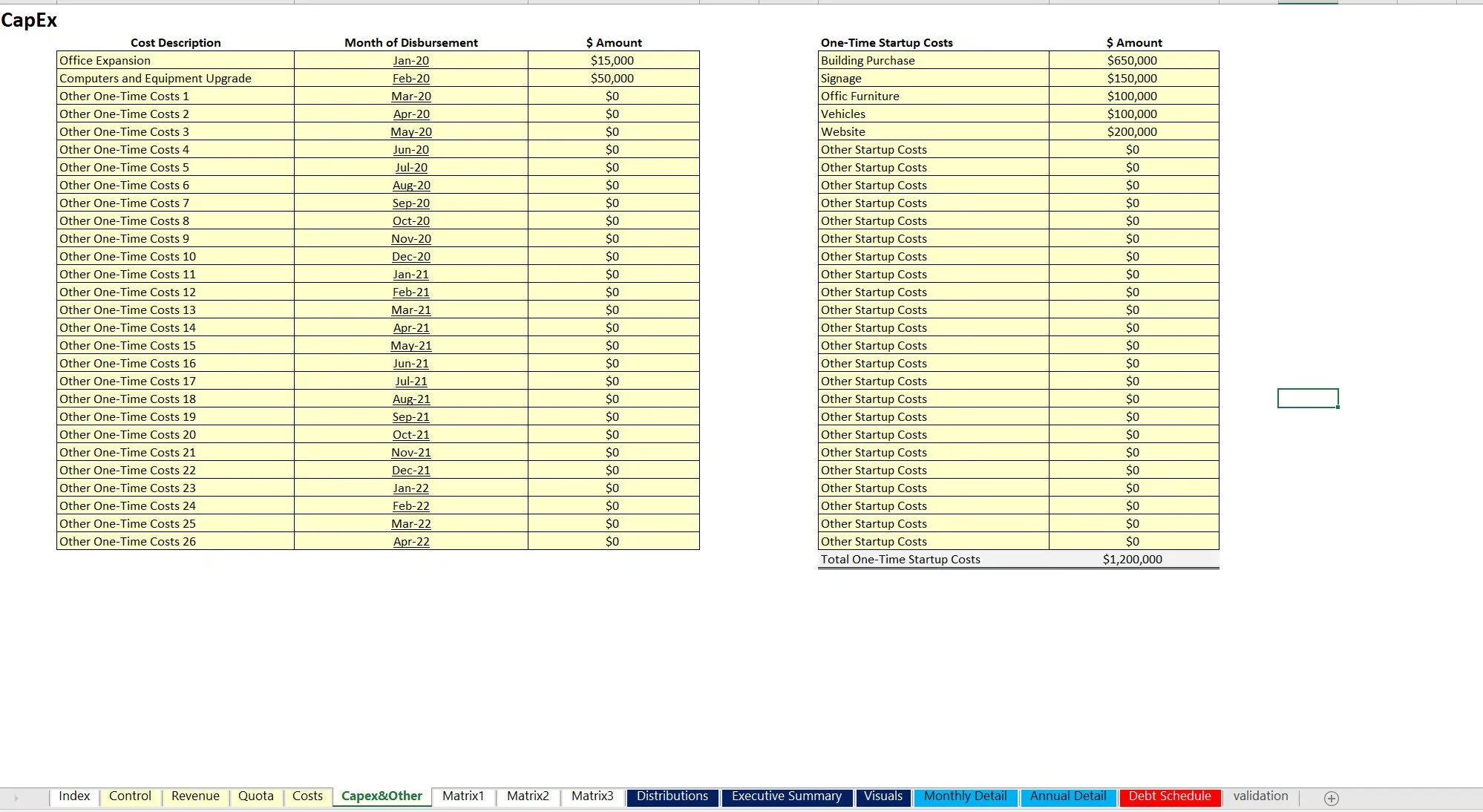

Other one-time startup costs and future CapEx are able to be defined in their own cost schedules. After all the assumptions are filled out, a monthly and annual 5-year pro forma will automatically populate.

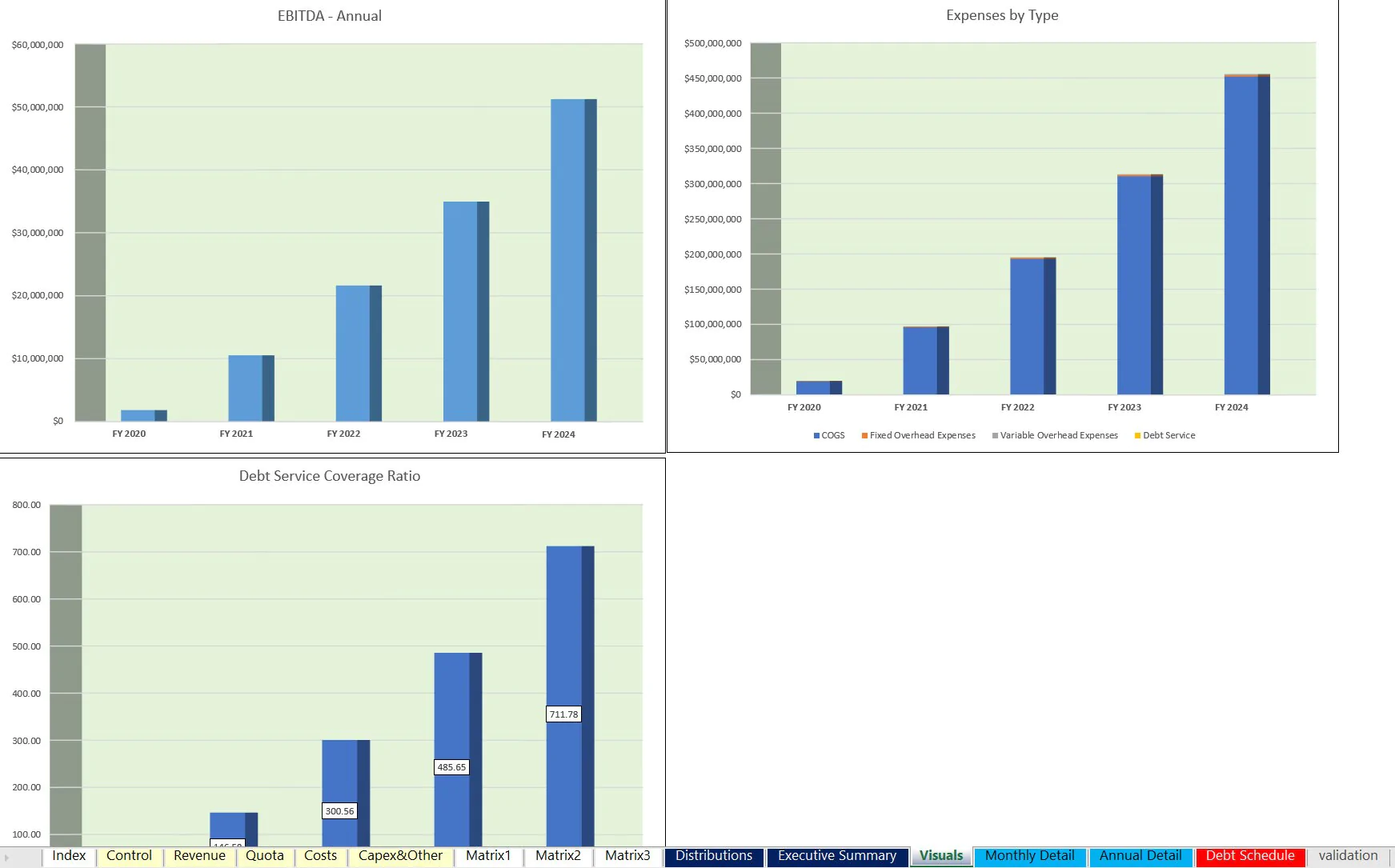

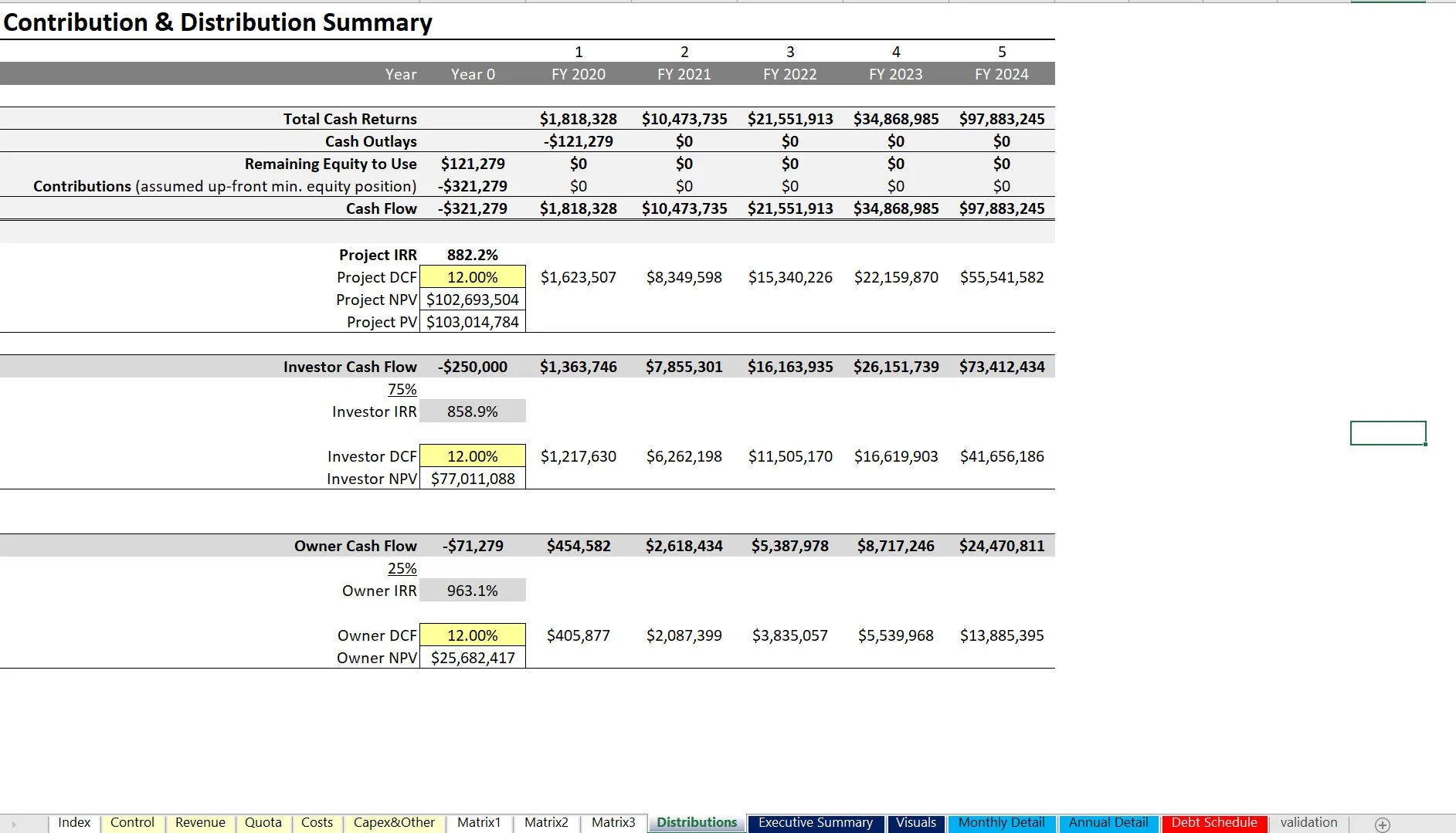

This drives down to EBITDA and cash flow per period as well as cumulative cash flow. Final summary outputs also include an annual Executive Summary with visuals and high level financial line items. A DCF Analysis is done for the project as a whole and for investors (if entered) and owner equity. Each also will display an IRR, ROI, and equity multiple.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Talent Agency & Creatives Agency 5-Year Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping