Auto Repair Shop Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

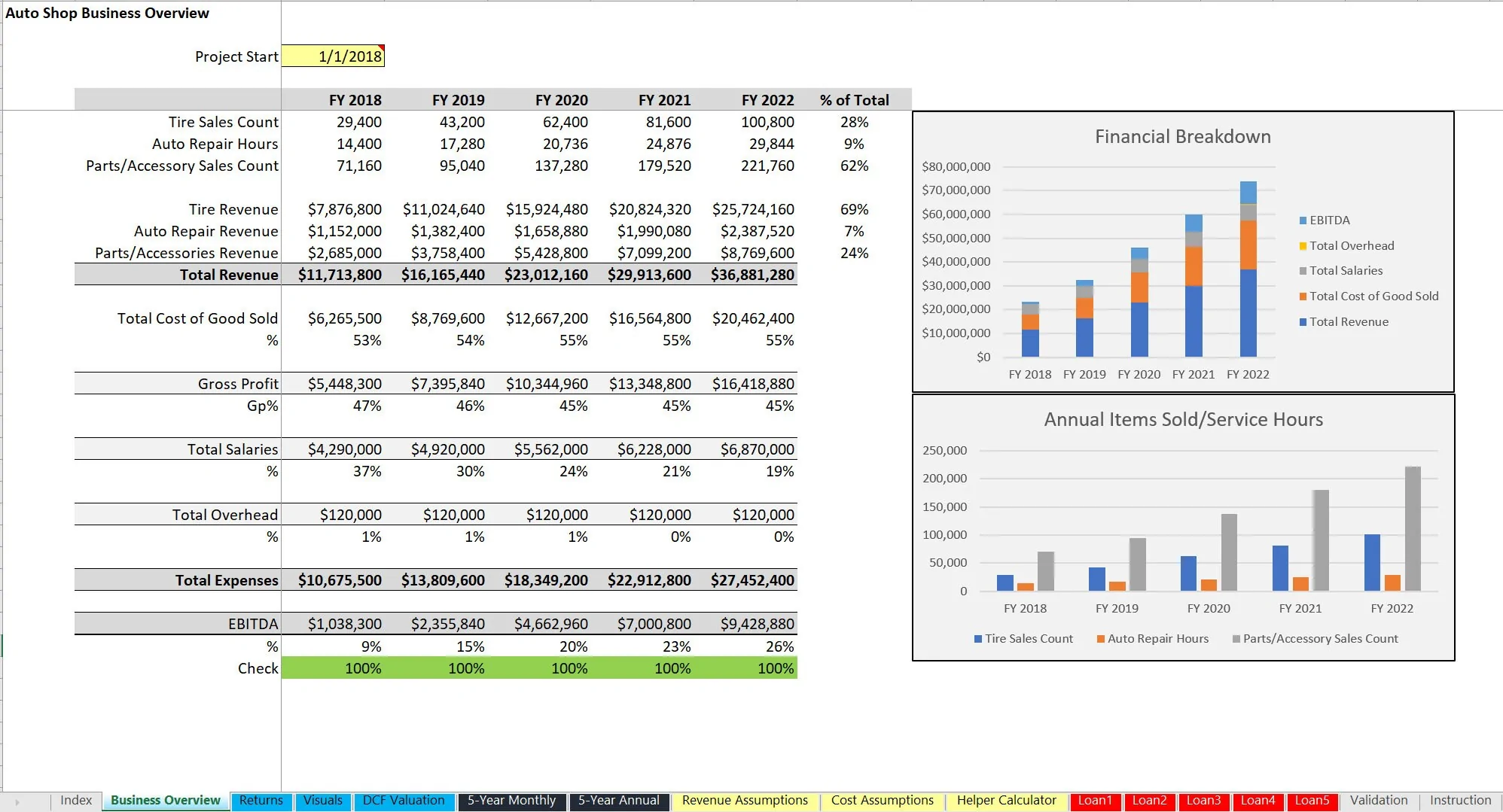

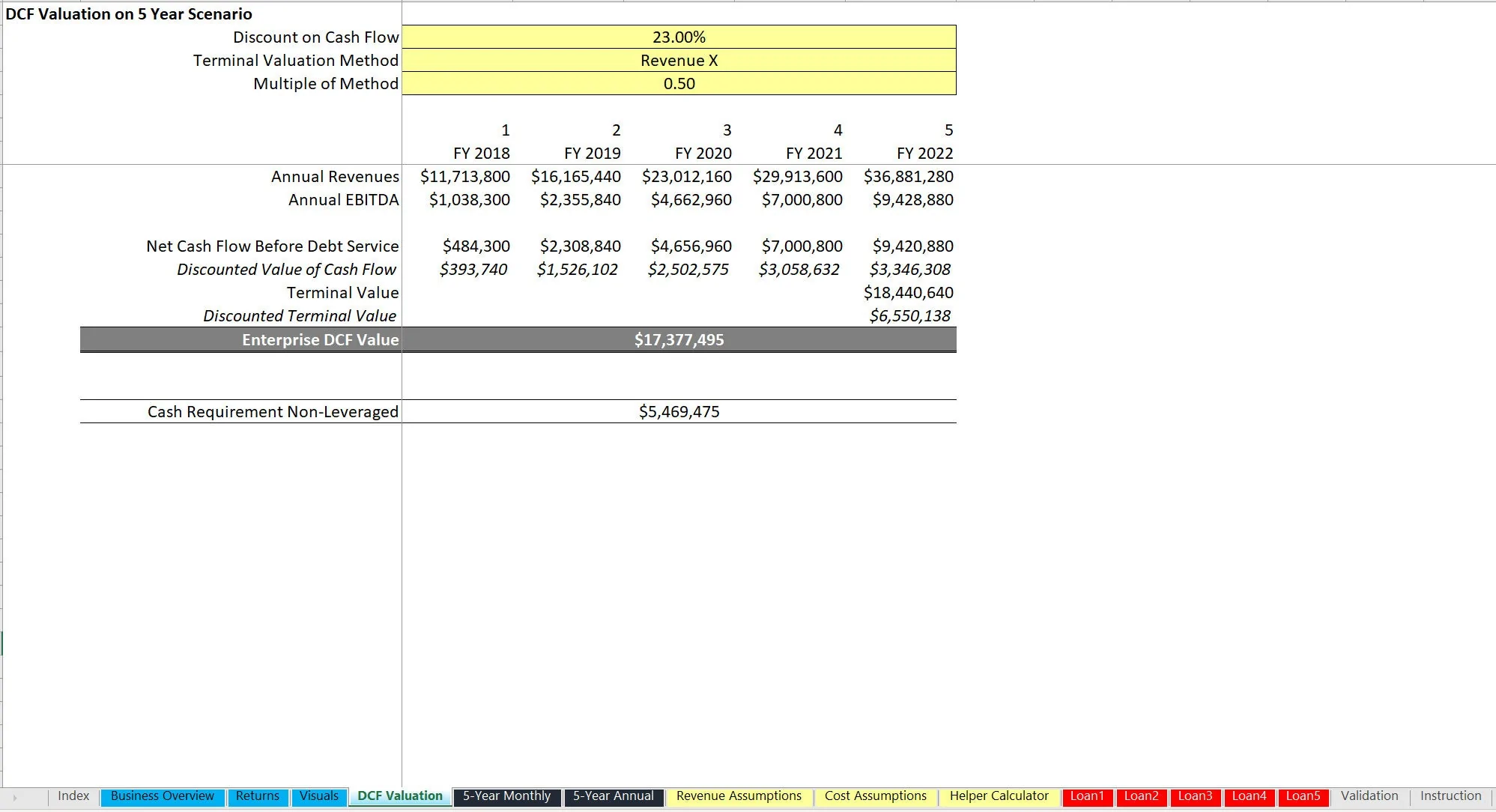

Recent update: Fully integrated Income Statement, Balance Sheet, Cash Flow Statement (3-statement model), added a cap table, capex schedule, better global assumptions, sanity checks, and an improved Executive Summary as well as DCF Analysis.

Starting up an auto repair shop requires some financial planning. You will need to know expected one-time startup costs, timing assumptions regarding when revenues start and how they scale, as well as potential debt service depending on how your initial investment requirements are funded (equity or debt or a combination).

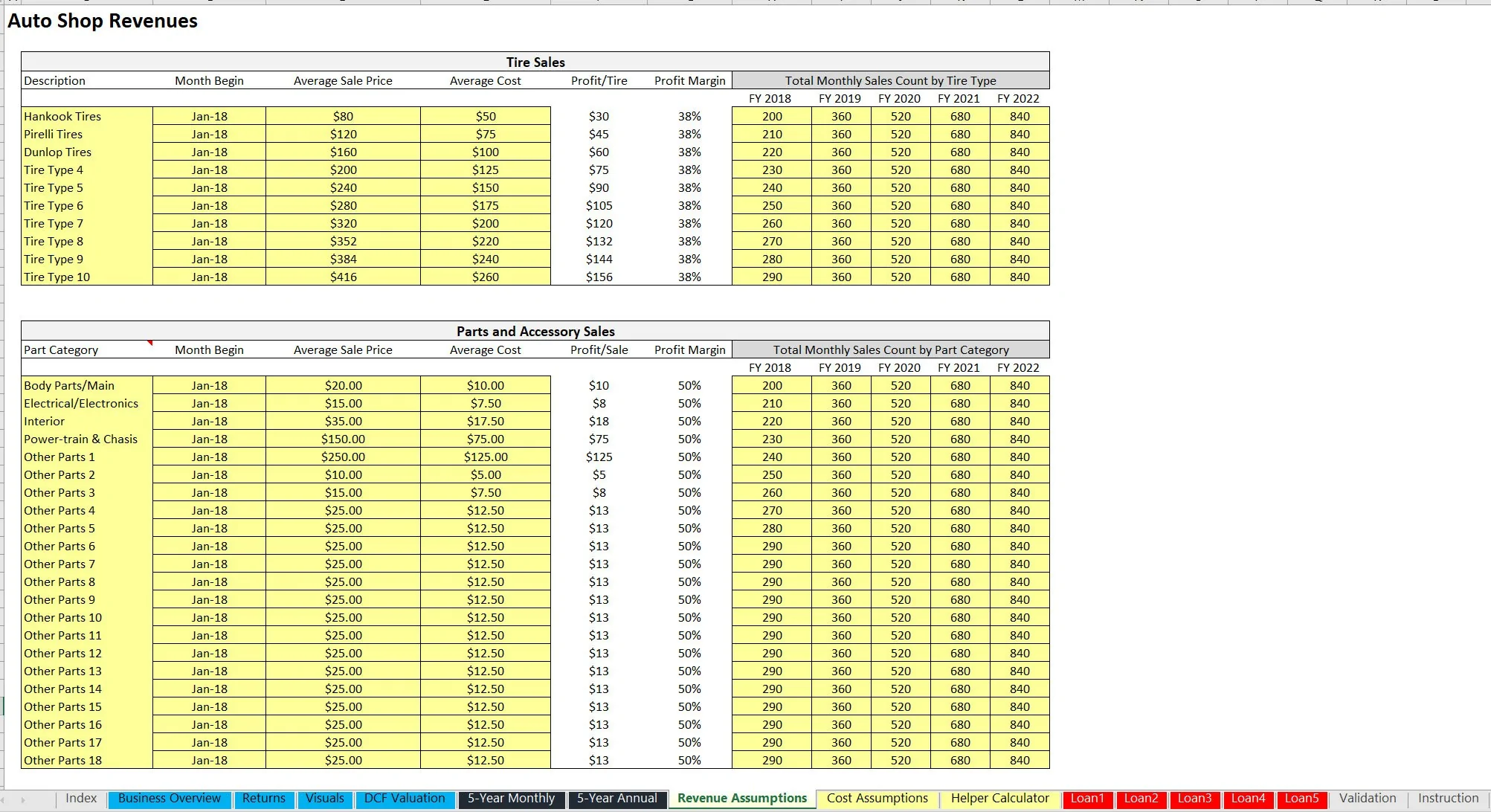

In general, all auto-repair shops will have three primary revenue streams. They are auto repairs, tire sales and part sales. The shop should be making some sort of margin on all and each needs configuration. This 5-year financial model will let the user plan for all aspects of the above.

Revenue Assumptions:

Tire Sales

• Up to 10 tire brands can be configured based on their start month the brand will begin to sell, average selling price per tire, average cost per tire, and average monthly sales per tire over each of the 5 years.

Auto Repair Work

• Up to 12 different types of work can be modeled. Each defined by its description, hourly billable rate, and expected labor hours per month for each type (adjustable per year).

You will have to make sure the amount of labor headcount / wages make sense for the labor service volume you have entered.

Parts and accessories

• Up to 22 slots and the logic here is the same as the tire sales. Define start month, average selling price per unit, average cost per unit and the expected monthly unit sales per category (adjustable per year).

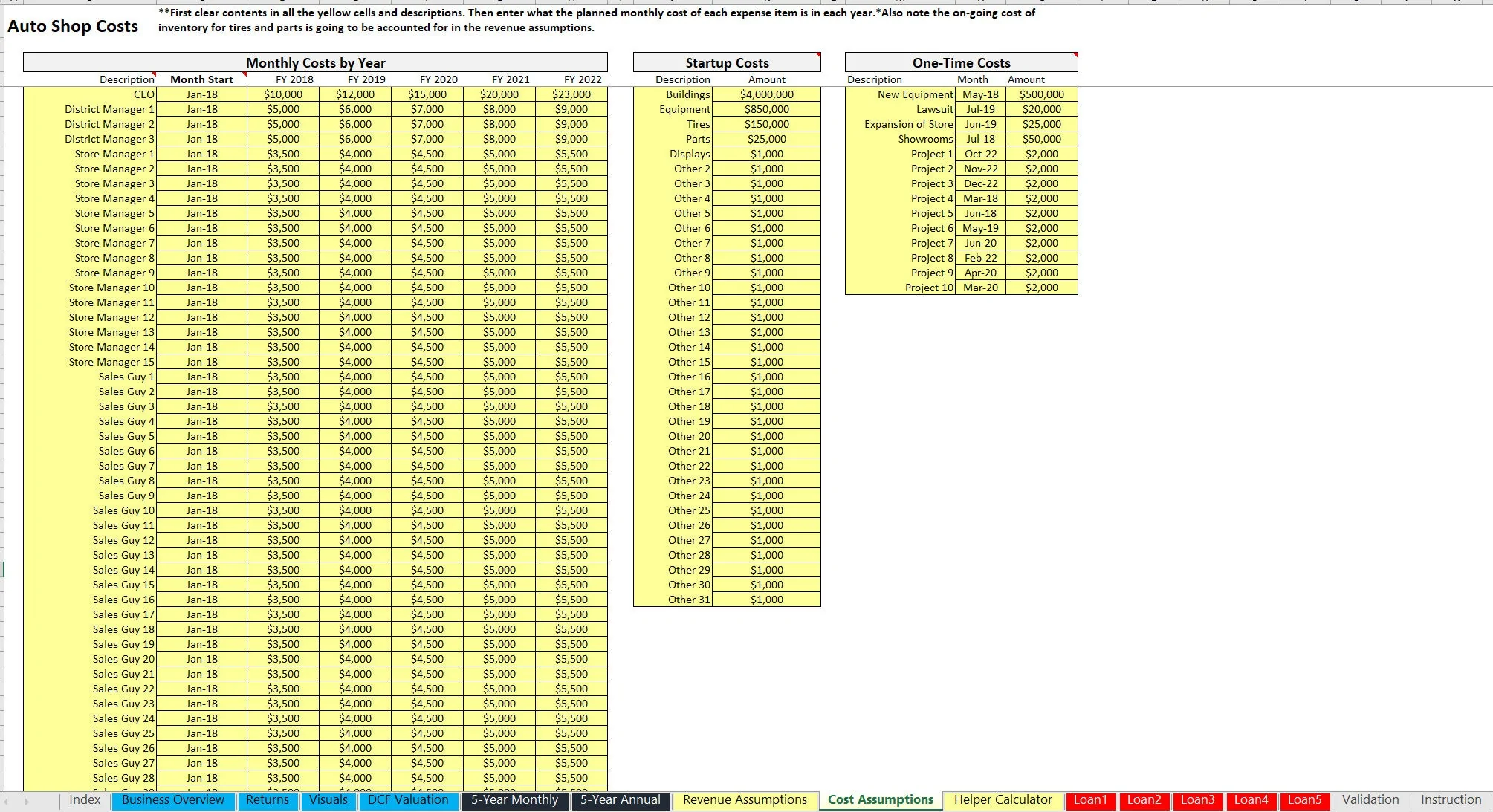

For costs, there are a few different modules.

They include:

Operating Expenses (129 slots)

• Define label, start month, and fixed monthly cost (adjustable per year).

Startup Costs (35 slots)

• Define item description and total amount.

CapEx (14 slots)

• Define item description, month of on-going expenditure, total amount.

After all these assumptions are configured, the model will product a monthly and annual pro forma that drives down to EBITDA and leveraged / unleveraged cash flow before taxes.

Up to 5 different loans can be configured based on their terms and start month of funding received for each loan as well as their repayment configuration.

There is also a DCF Analysis, return summary for leveraged / non-leveraged and shows ROI, IRR, $ values of cash required / returned, and 10+ visuals.

Finally, an annual business overview shows the high-level revenue and expense categories as well as EBITDA and a few visuals.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Auto Repair Shop Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping