Apple Orchard Operating Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Recent Updates: Fully integrated 3-statement financial model (IS, BS, CF), cap table, capex schedule, dynamic depreciation, executive summary, DCF Analysis, terminal value (based on trailing 12-month EBITDA multiple) and improved global assumptions / formatting.

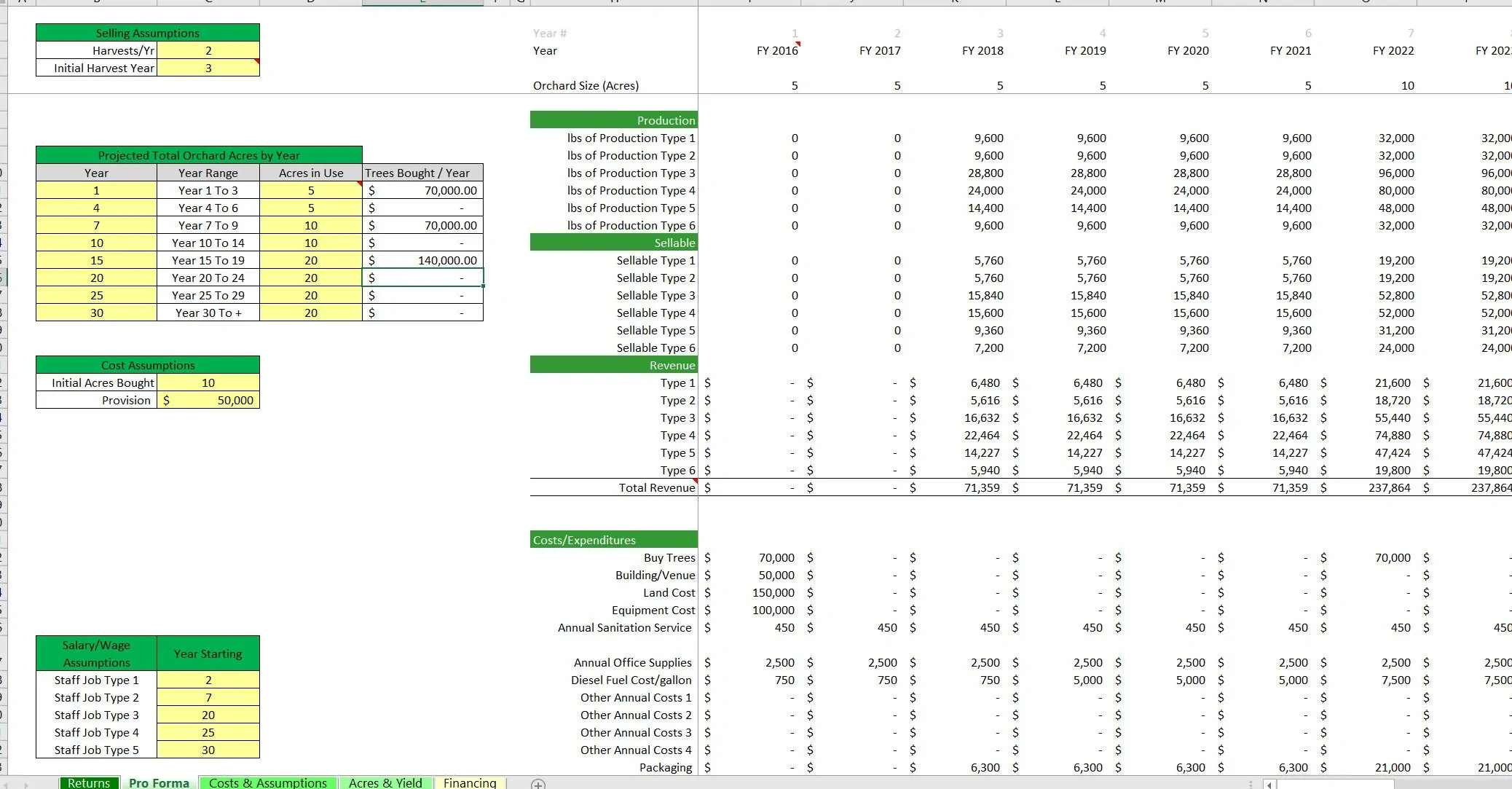

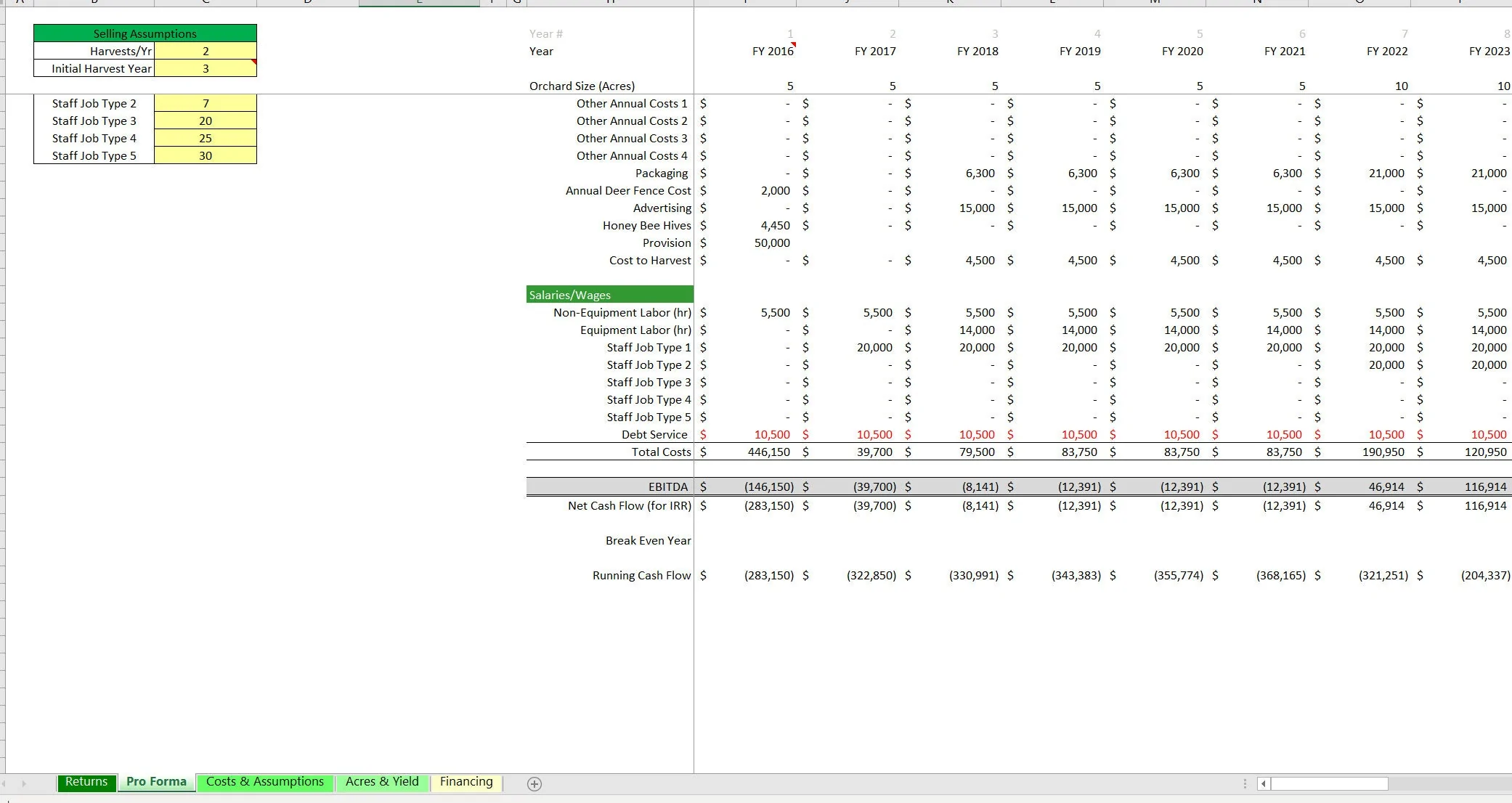

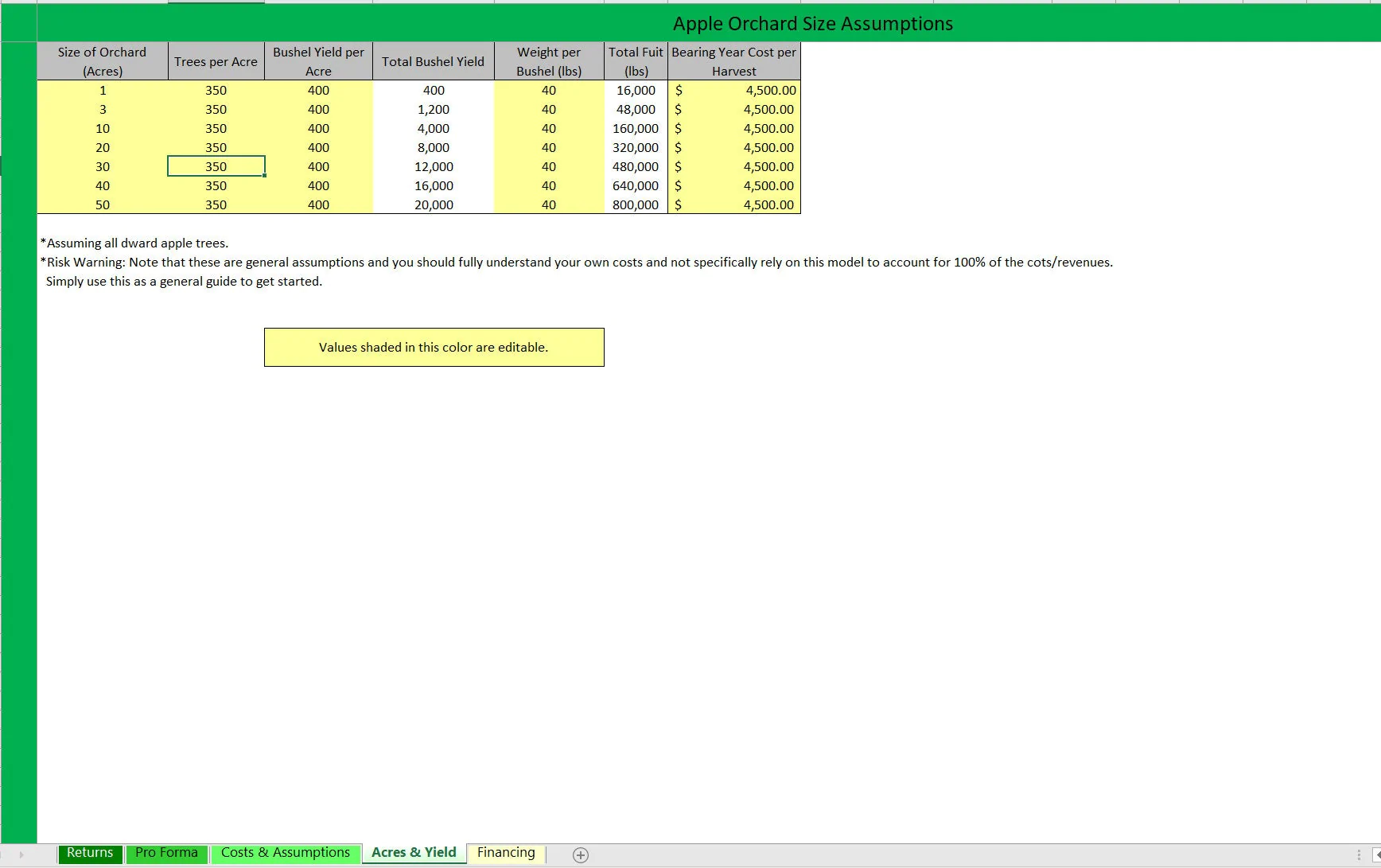

This is a startup model to help plan out initial investment costs and operating assumptions regarding an apple orchard. It goes out for 50 years.

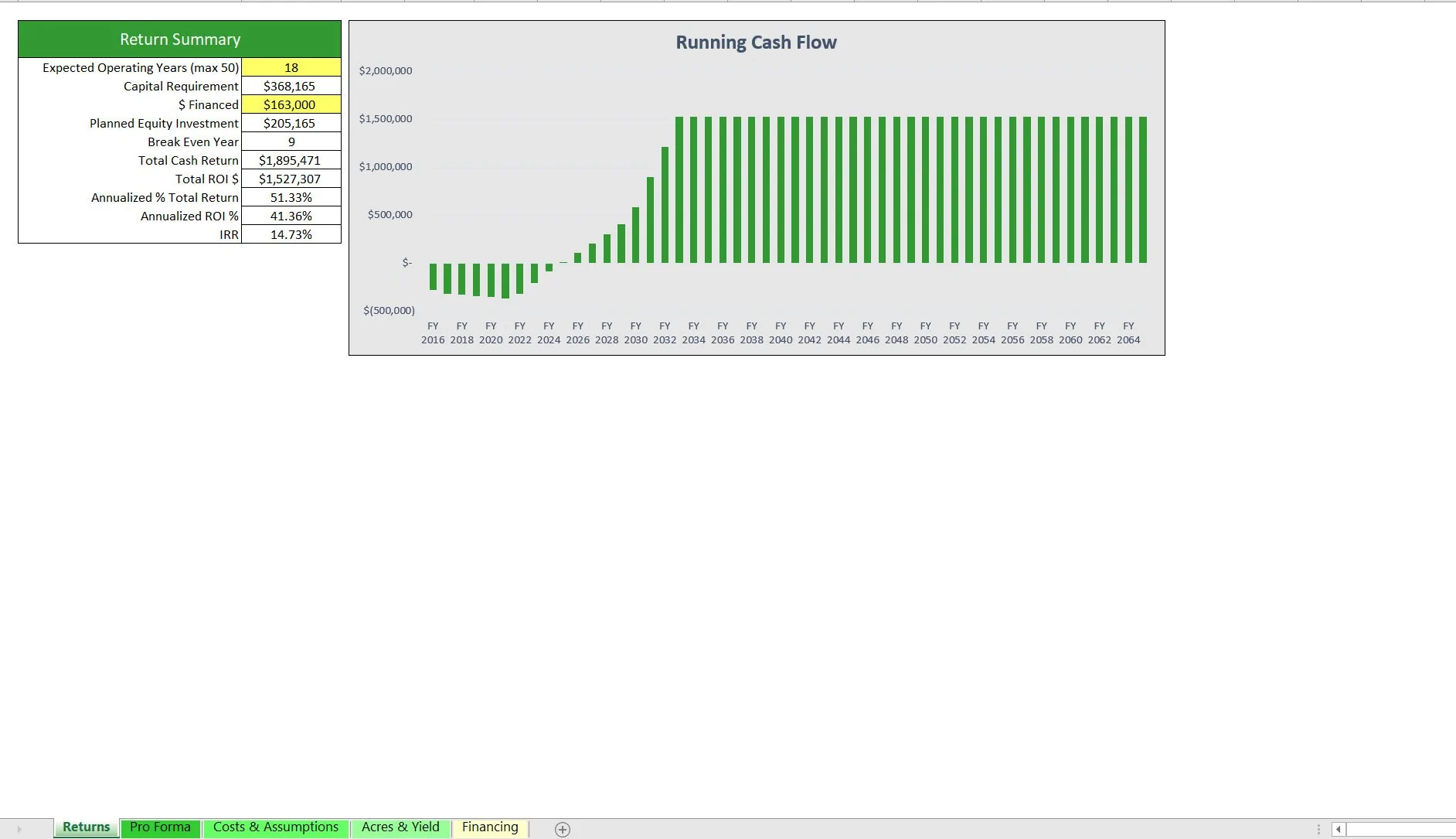

Toggle various scaling assumptions and logic specific to an orchard as well as a final IRR / cash flow summary. There is a standard debt schedule if some or all of the startup costs are being financed through a bank source.

Final outputs include an annual Pro Forma as well as a Return summary that has IRR, ROI, cash position visualization, and total equity required. The user can plan out when the first harvest year begins (normally in a brand new orchard it will take a few years before there are marketable fruits/vegetables/what have you) as well as the number of harvests per year.

Additionally, there is an acreage ramp-up option to plan out the expansion of the orchard based on up to eight different periods defined by start/end year.

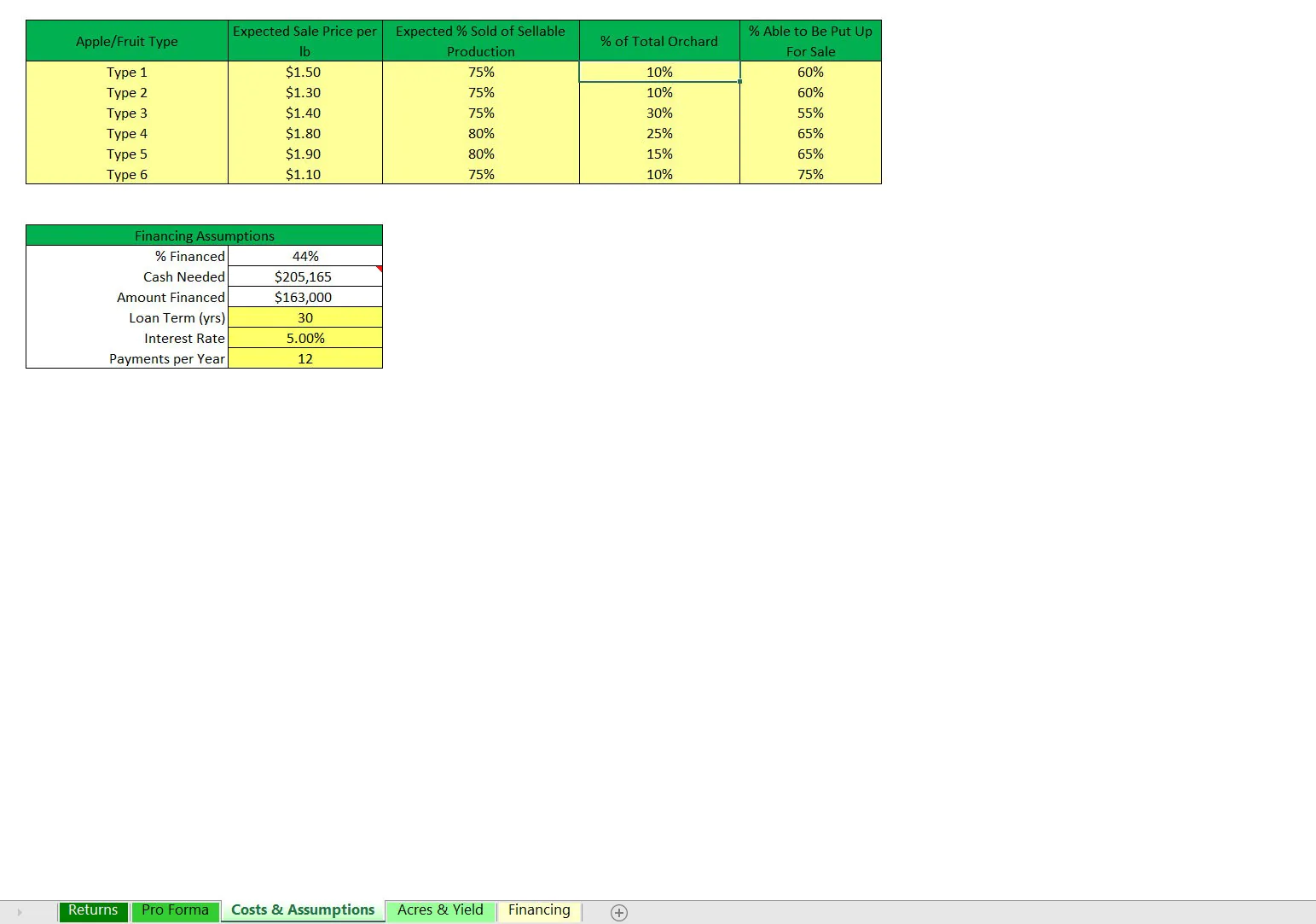

For revenue, the following can be configured for up to 6 fruit type:

• Apple/Fruit Type Description

• Expected Sale Price per lb

• Expected % Sold of Saleable Production

• % of Total Orchard

• % Able to Be Put Up For Sale

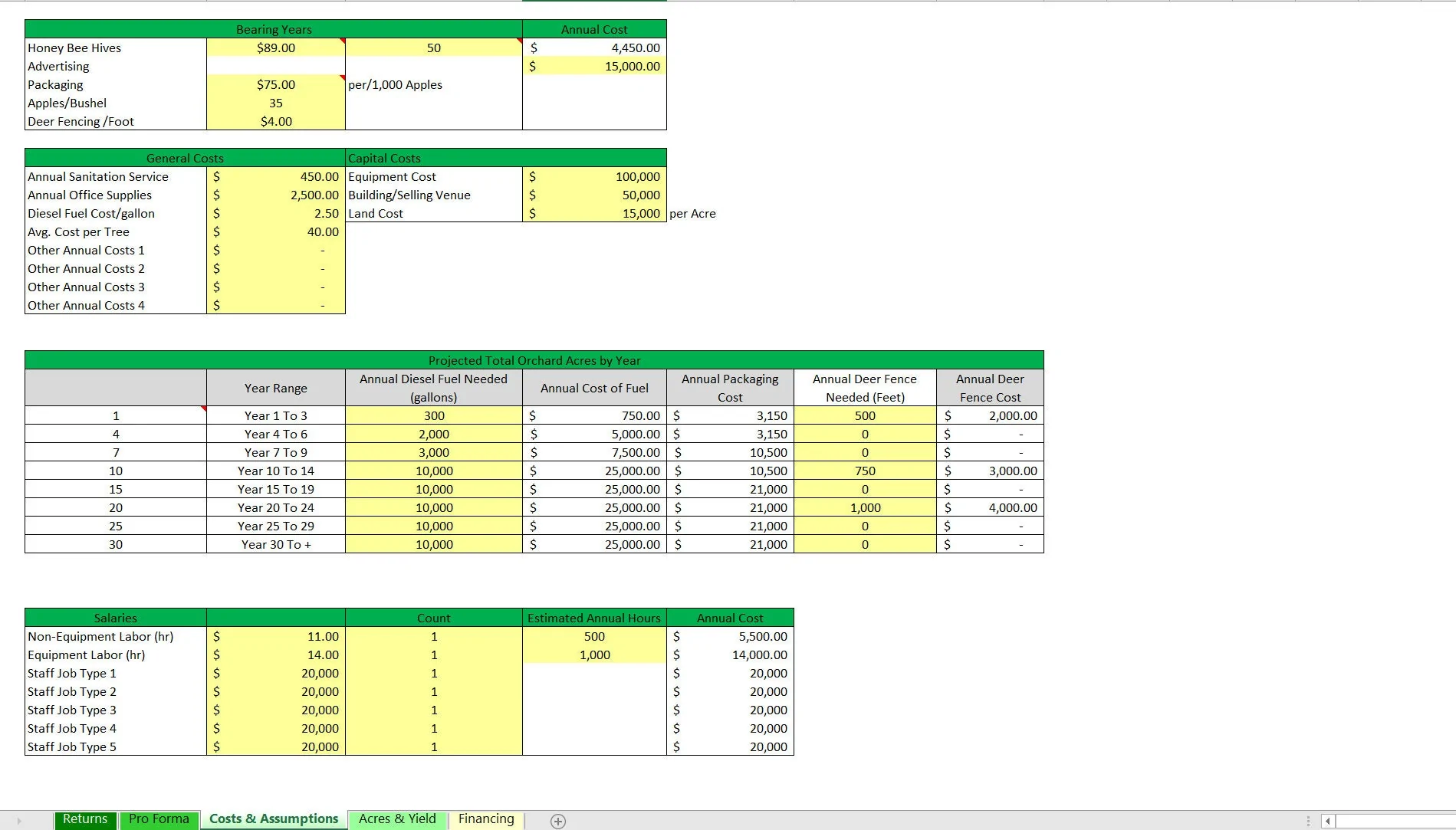

For Operating Expenses, the following can be configured: Bearing Years Only:

• Honey Bee Hives

• Advertising

• Packaging

• Apples/Bushel

• Deer Fencing /Foot

General Expenses:

• Annual Sanitation Service

• Annual Office Supplies

• Diesel Fuel Cost/gallon

• Avg. Cost per Tree

• Other Annual Costs 1

• Other Annual Costs 2

• Other Annual Costs 3

• Other Annual Costs 4

• Deer Fencing based on orchard size

Salaries/Wages:

• Non-Equipment Labor (hr)

• Equipment Labor (hr)

• Staff Job Type 1

• Staff Job Type 2

• Staff Job Type 3

• Staff Job Type 4

• Staff Job Type 5

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Apple Orchard Operating Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping