Mobile App Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

MOBILE APP EXCEL DESCRIPTION

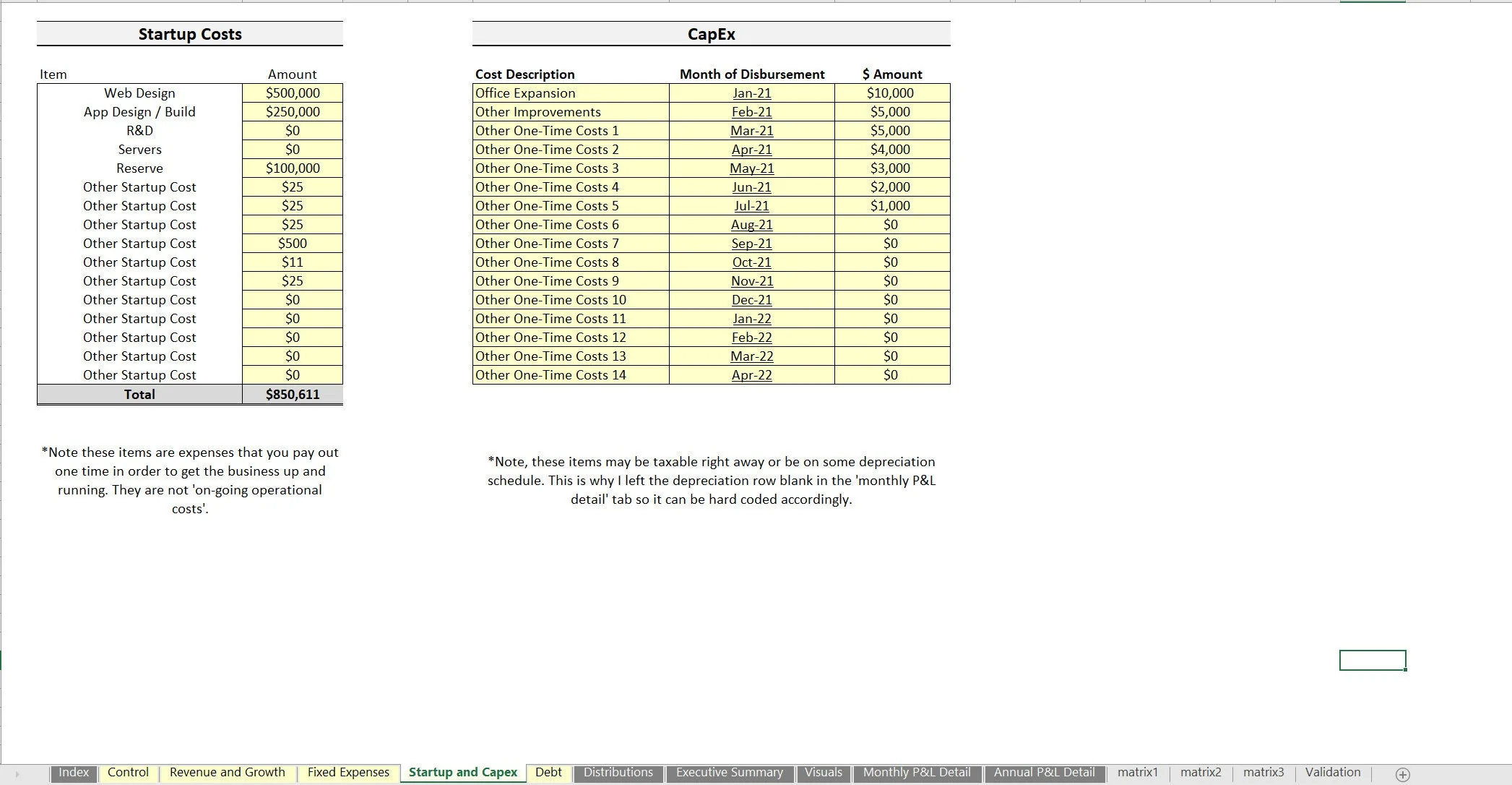

Recent updates: Integration of Income Statement, Balance Sheet, Cash Flow Statement that runs off all assumptions as well as a cap table and capex schedule.

The mobile app industry is really broad, however some general revenue logic can be applied to it in order to do a financial forecast for your specific app based on how it works.

This model can also be used for nearly any freemium business that sells in-app or in-game purchases to its' users over time. The revenue logic can be configured based on the following:

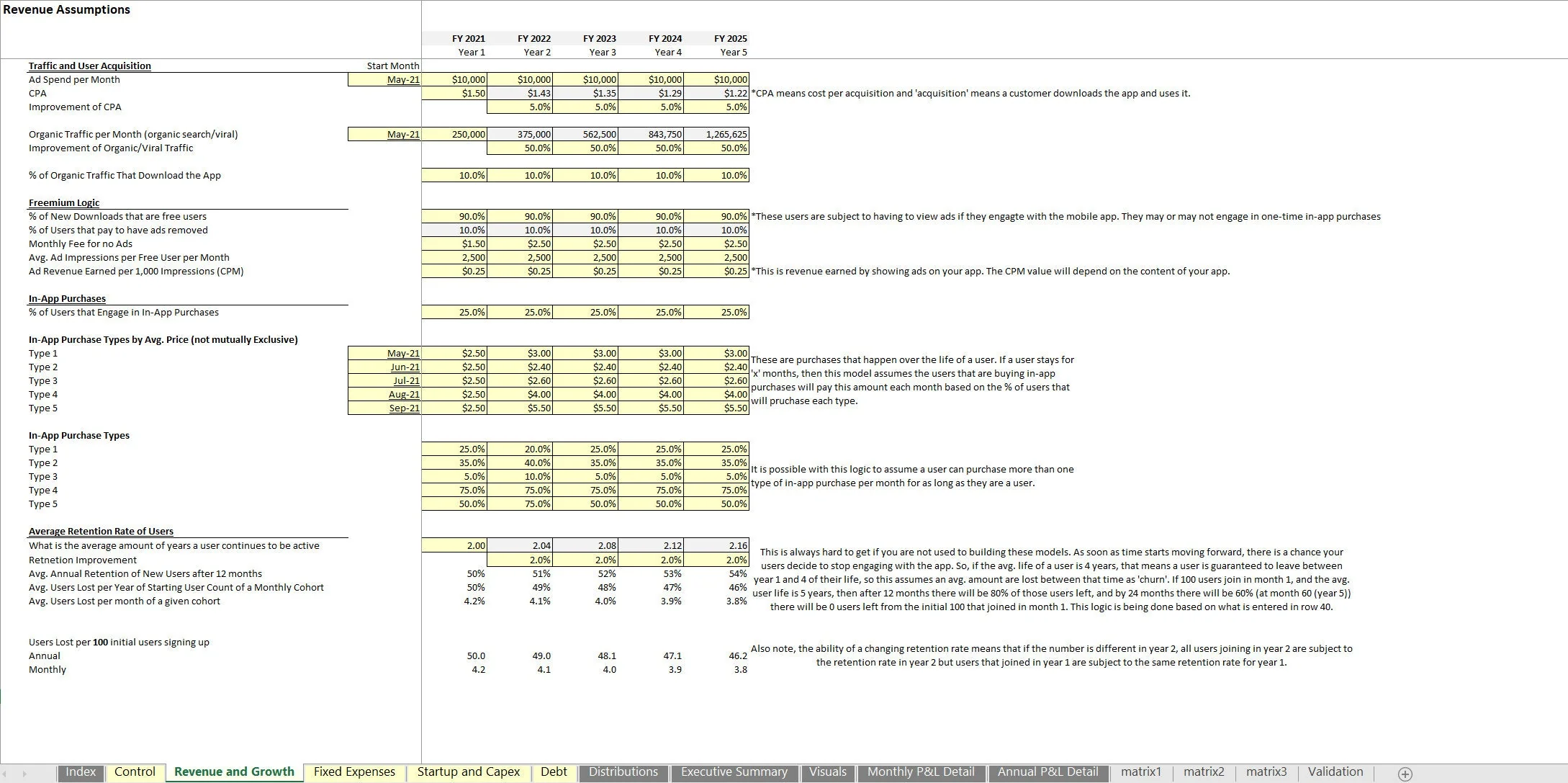

-User acquisition happens based on defined Ad spend against a CPA (adjustable over 5 years) and based on organic traffic per month / % of organic traffic that downloads the app (adjustable over 5 years).

• Freemium – Define % of new downloads that are free users vs. % of users that pay to have ads removed as well as the monthly fee for no ads / average ad impressions per free user per month / Revenue per 1,000 impressions.

• In-App purchases – Up to 5 pricing tiers that define the average spend of a user per month as long as they are an active user.

A retention rate is applied to all users. Also, define the % of users that will buy each of the 5 types of in-app purchase categories. This does not have to be mutually exclusive or maybe one of the tiers is a monthly subscription while the others are add-on revenues. The rest of the model is fairly straightforward.

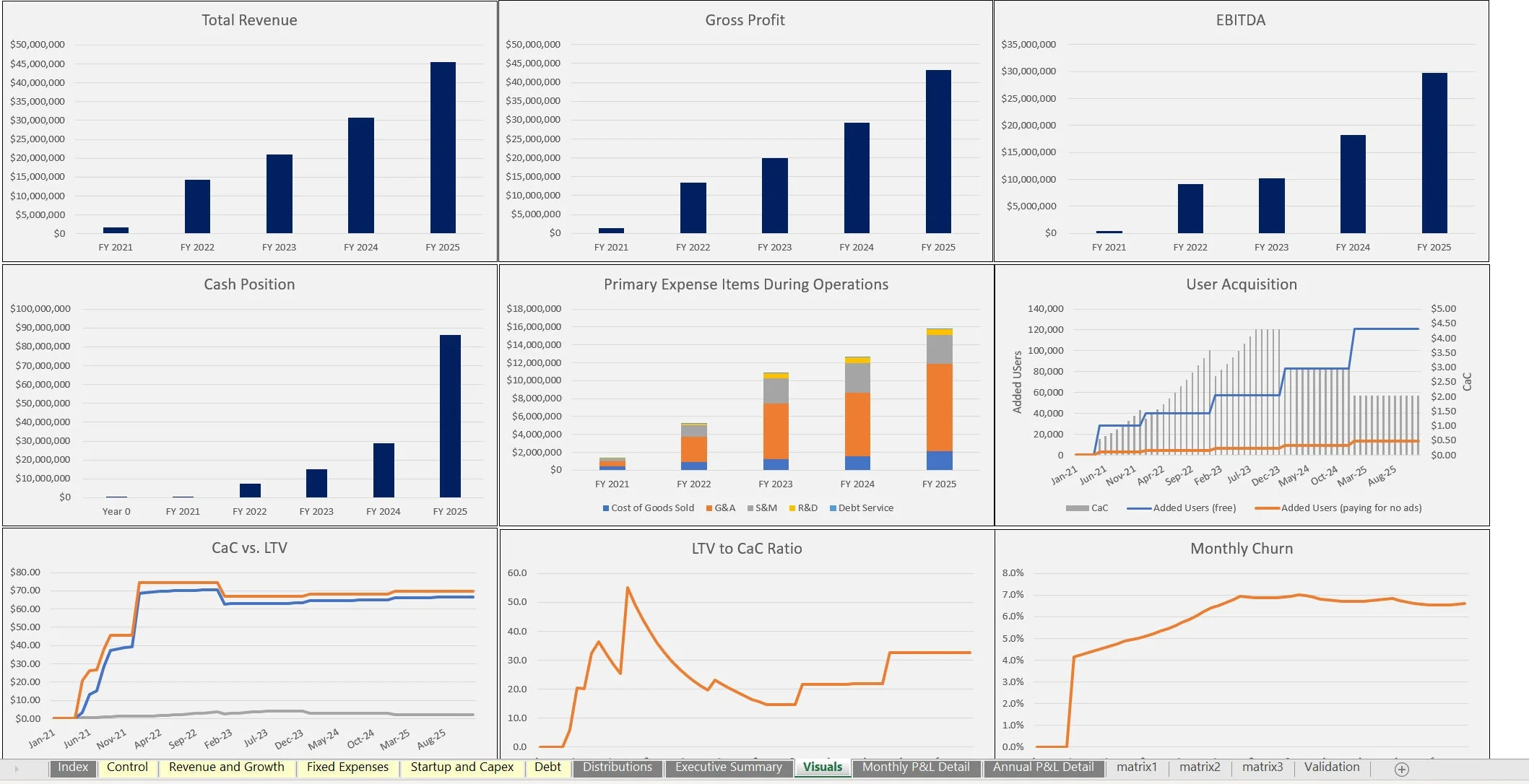

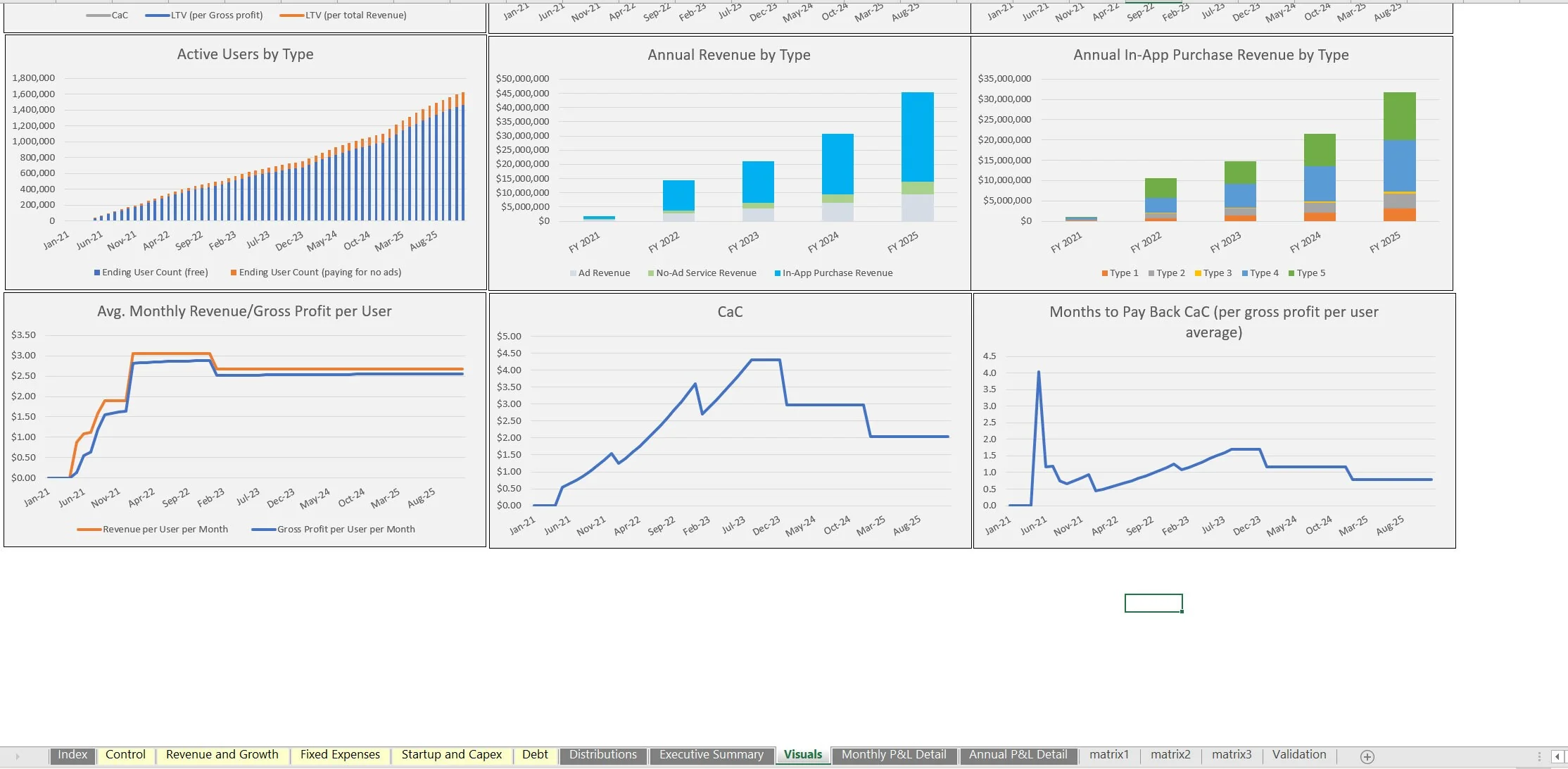

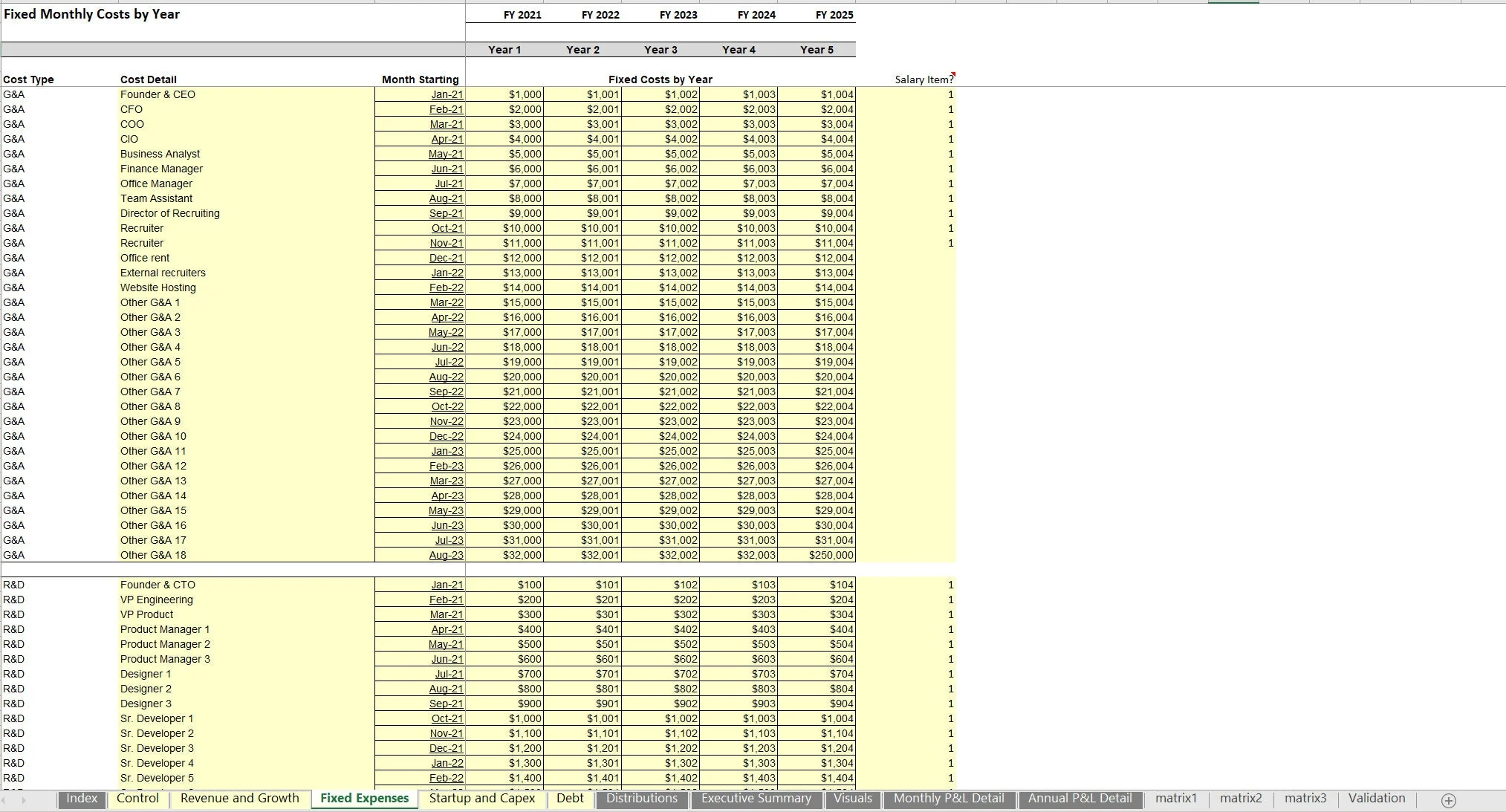

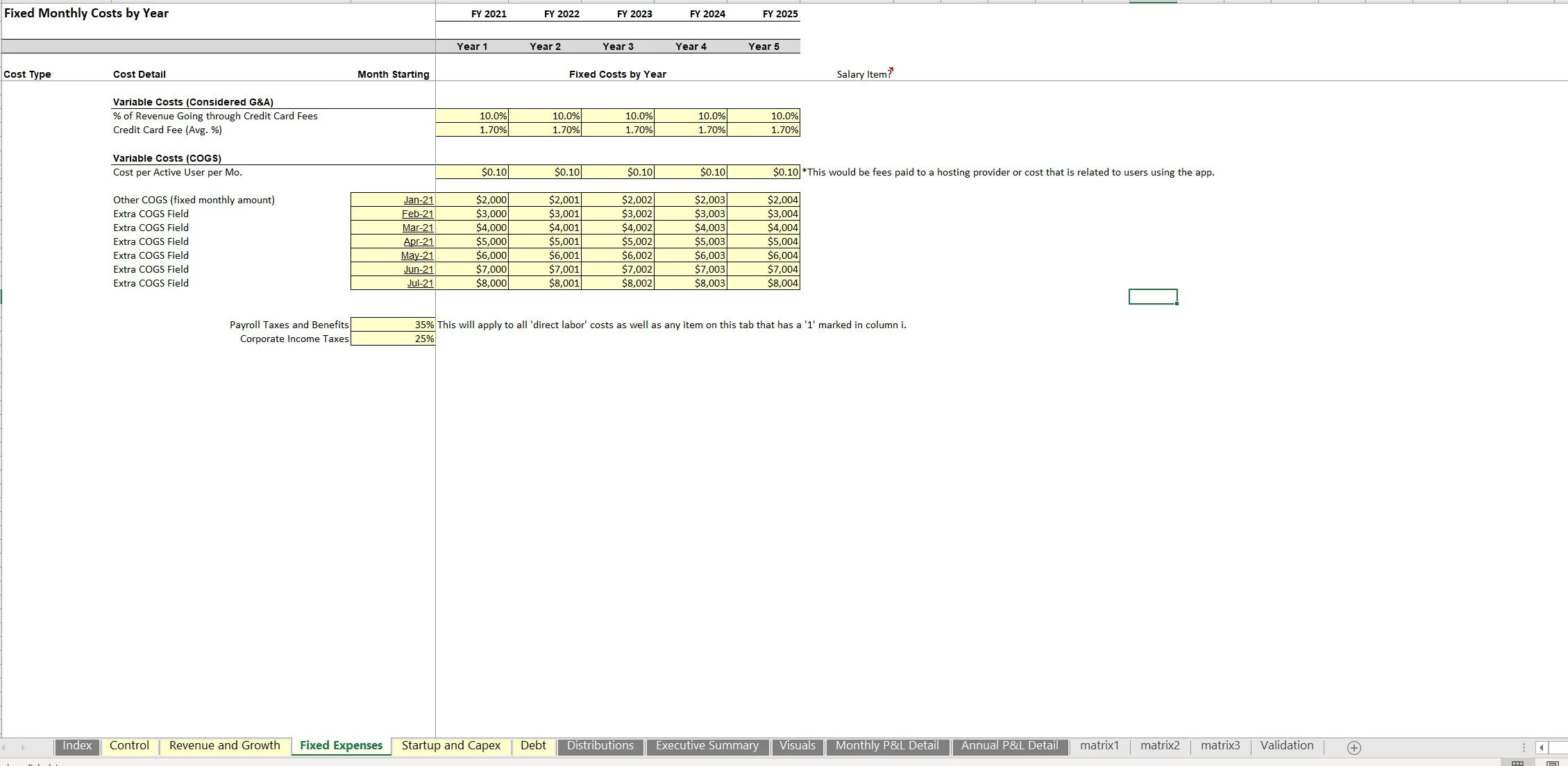

Operating expenses are defined in four main categories based on start month, monthly cost per year, and the Cost of Goods Sold is based on a percentage of revenue and/or a cost per user per month as well as a defined fixed cost if applicable.

One more advanced piece of logic was that for payroll taxes and benefits, the user can define if an opex item is a payroll item subject to taxes (like employee salaries). Final outputs include a monthly and annual pro forma detail that drives down to EBITDA, EBT,

Net Income as well as cash flow and a terminal value is configurable per trailing 12-month revenue. Up to fifteen visualizations exist to show a digestible story of the expected financial performance based on the defined assumptions.

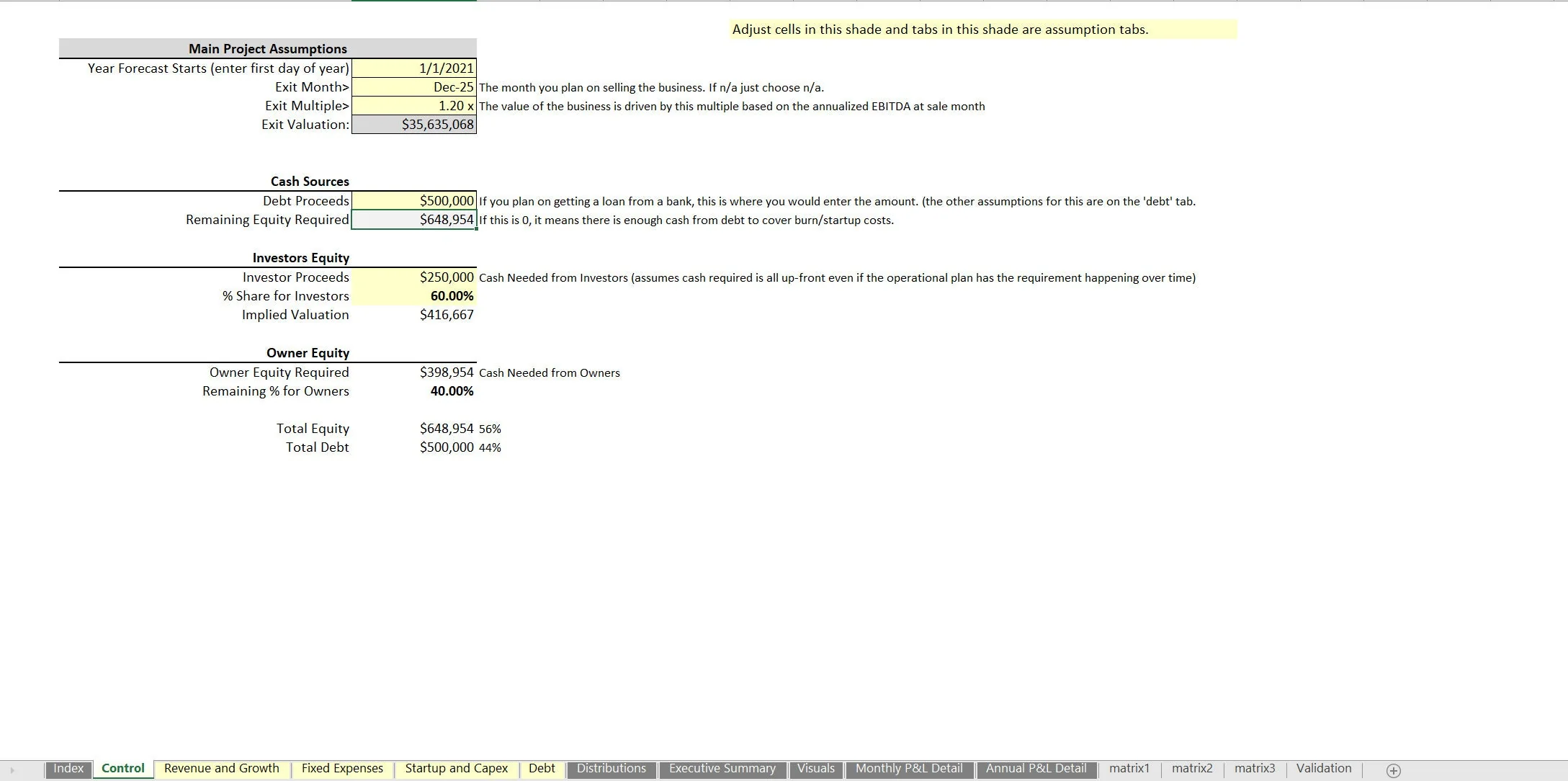

Advanced key metrics are also displayed visually and include LTV, LTV to CaC, CaC, months to pay back CaC and monthly average revenue / gross profit per user. There is an annual Executive Summary along with a DCF Analysis that splits into three views (project, owner, investor) and the resulting IRR, NPV, equity multiple, and ROI for each.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Mobile App, Integrated Financial Model Excel: Mobile App Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping