Loan Business Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

LOANS EXCEL DESCRIPTION

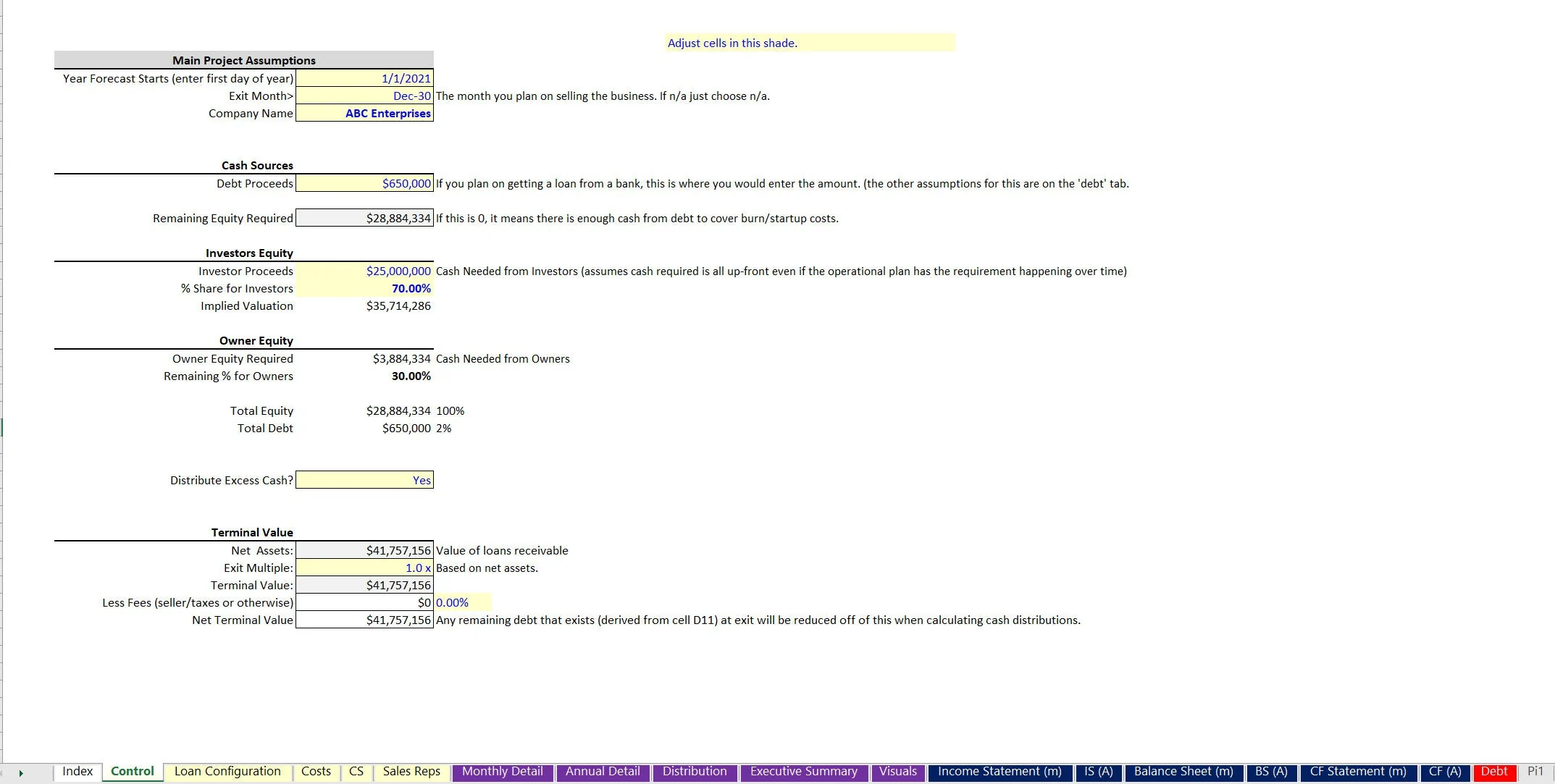

Recently upgraded to include an option to use a credit facility to fund a portion or all of the lending activity as well as an input for how much of the interest and/or fee revenue is recycled into new loans vs. used for working capital.

Additionally, the latest version of this template includes better cash flow calculations upon exit, cleaner inputs for equity investment contribution rates, and deprecated redundant logic (dividend distribution).

This is a fully comprehensive 10-year financial model specific to a lending business. It includes a monthly and annual pro forma detail as well as a formal 3-statement financial model.

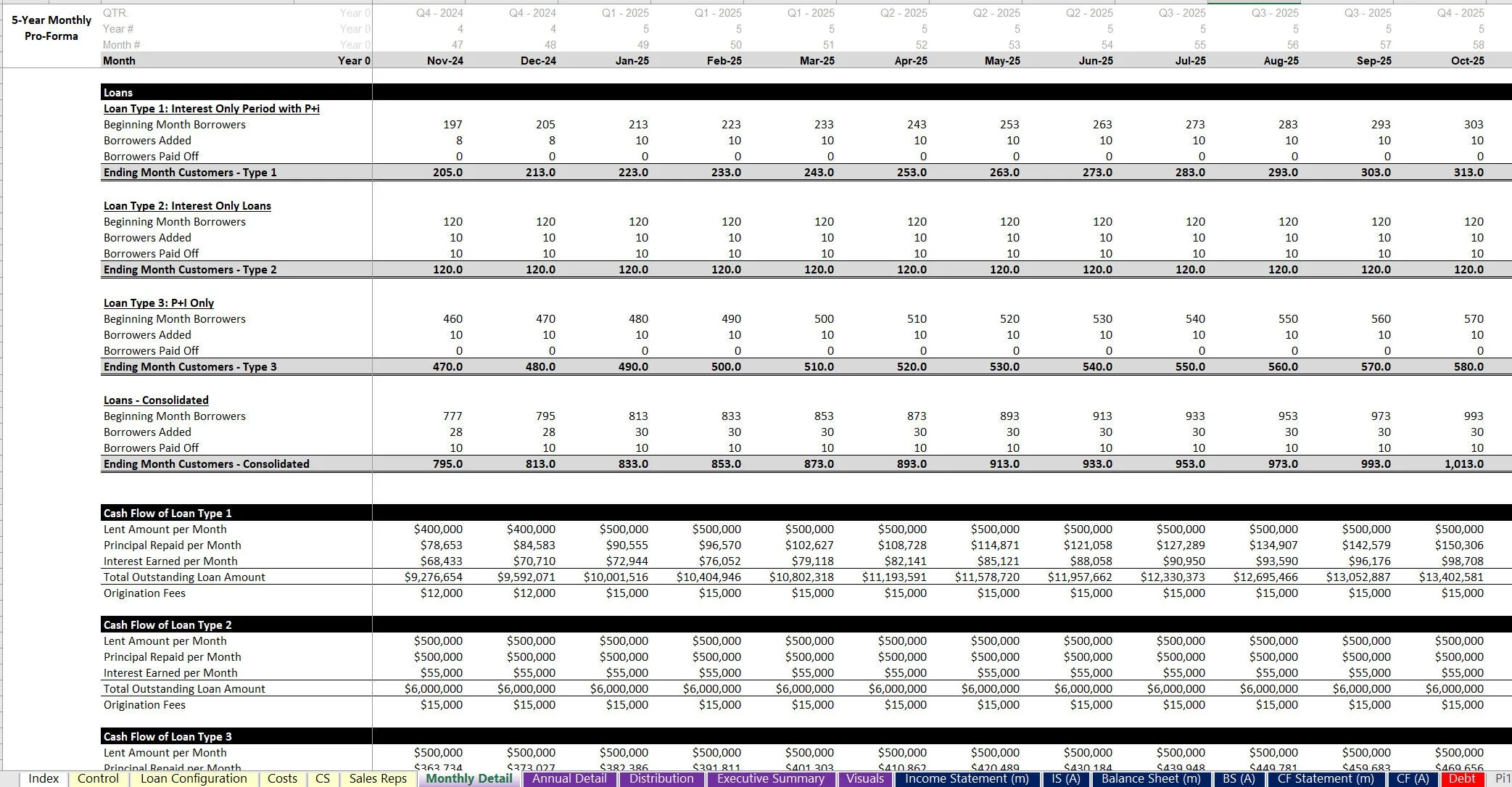

If you are in the business of making money from offering various types of loans and collecting principal and interest over time, this model is ideal for you. The advanced matrix structure and logic make it easy to see the principal and interest effects of scaling the origination of loans over time to any number (i.e. 'x' loans settled per month)

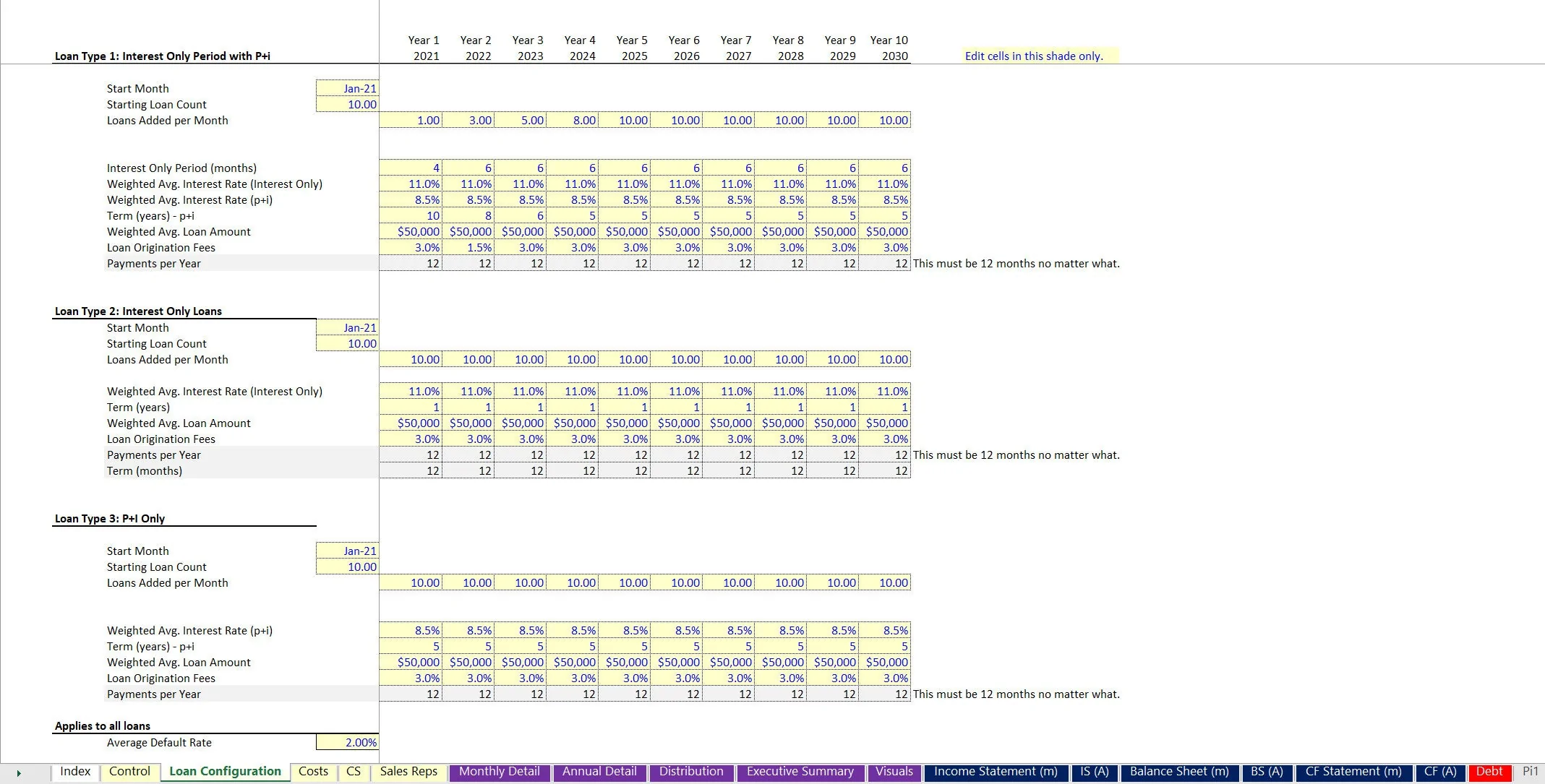

The three loan configurations that can be scaled are:

• Principal and Interest Only

• Interest Only Period followed by Principal and Interest

• Interest Only

All three loan types have their own assumptions that can vary over 10 years and include:

• Average loan amount

• Average loans settled per month

• Average interest only rate

• Average p+i interest rate

• Loan term (can be less than 12 months by using a fraction)

• Origination fees

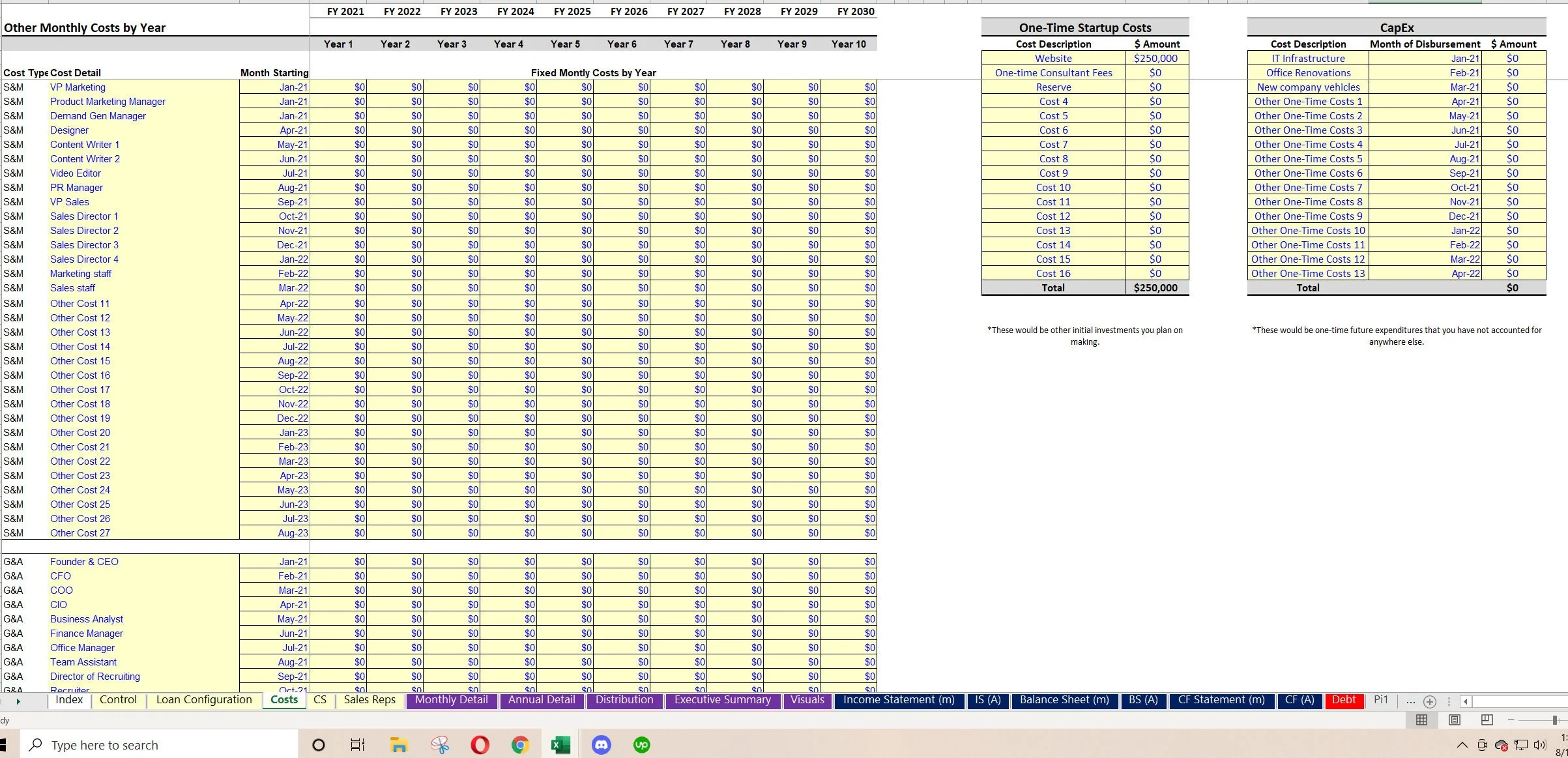

A standard default rate is defined and applied to all loans. There is an operating expense schedule if that is necessary for the operation, but if you are using this just for participating in a p2p lender as an individual you can zero out any expenses that are not relevant.

Scaling amortization schedules is a really complex thing to do, especially when you have all the various timing assumptions that need to happen on the same continuous 10-year model.

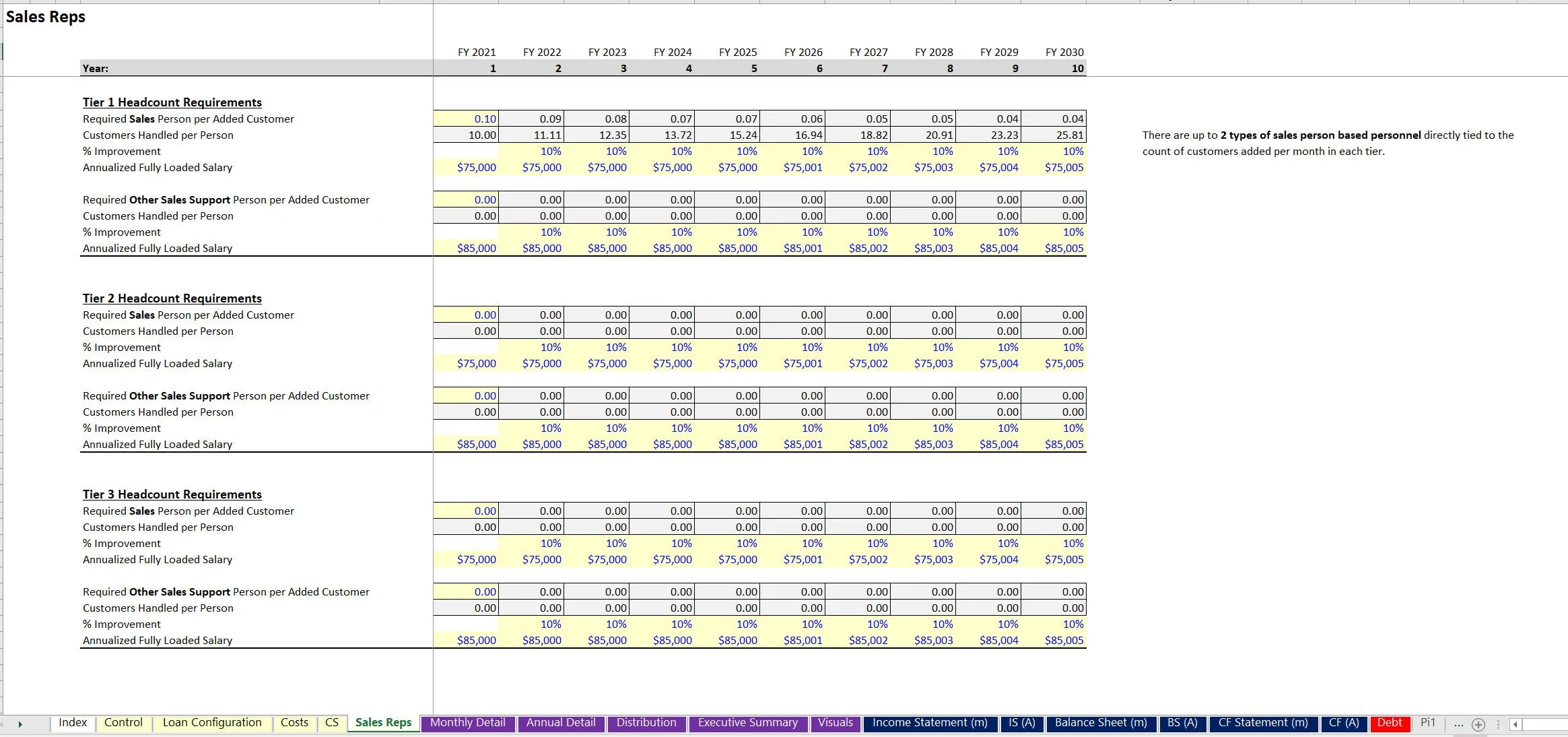

The logic in this template was able to accomplish just that. If this is a regular business that needs to scale customer service and sales reps along with regular OpEx, that is built-in and ratios define the headcount totals of CS / SR over time.

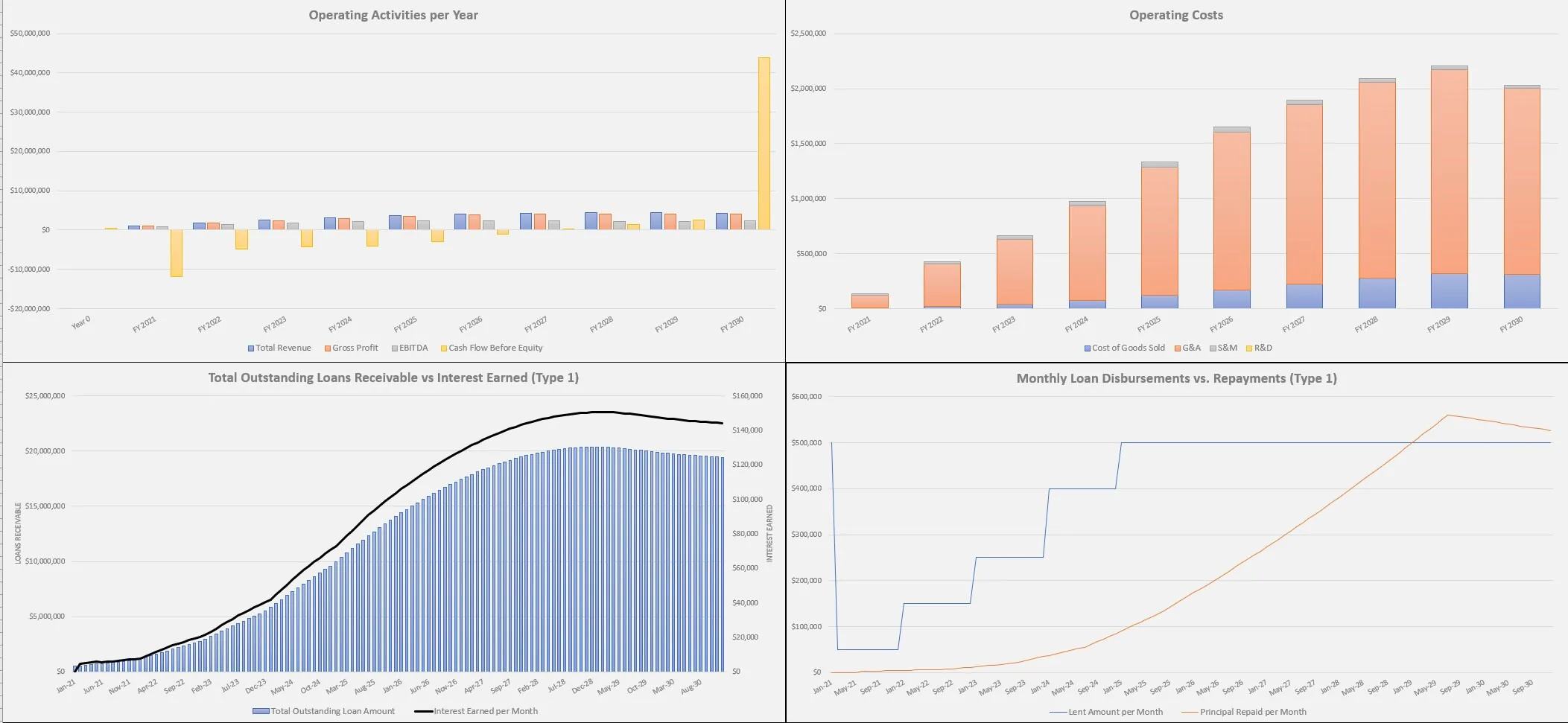

The final output is a monthly and annual pro forma detail that drives down to earnings after tax and cash flow (accounting for equity requirements to make the loans and cash flow back in from principal repayments).

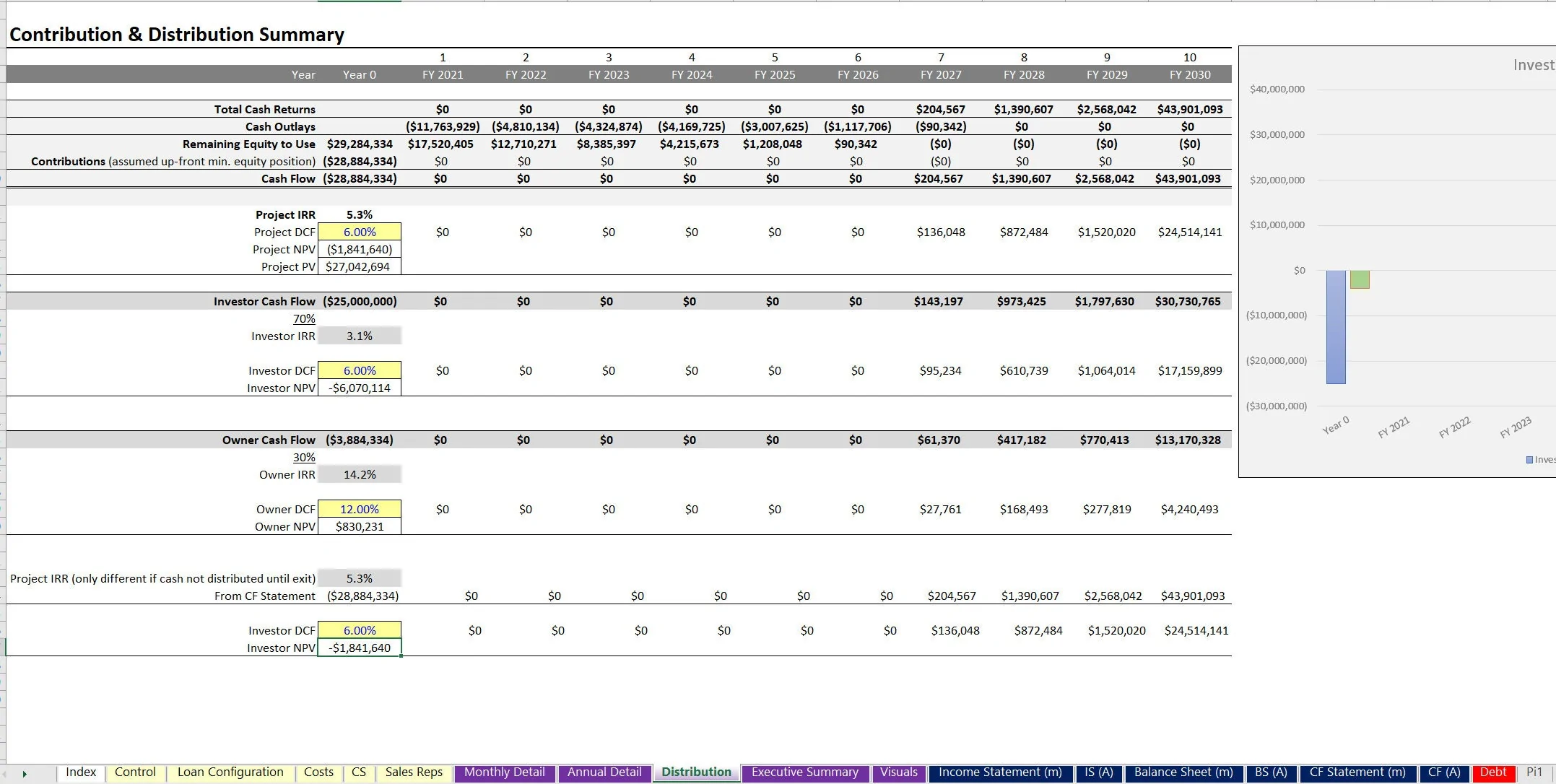

Additionally, the results were integrated into a 3-statement financial model that tracks monthly and annual views as well. The potential for an 'exit' also exists and is based on the exit month loans receivable against a defined multiple.

The model provides detailed visualizations of operating activities, costs, and loan disbursements versus repayments, enhancing clarity in financial planning. Customizable assumptions for different loan types allow for precise scenario analysis over a decade.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Loans, Integrated Financial Model Excel: Loan Business Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Industry-specific Financial Models (40+)

This bundle contains 67 total documents. See all the documents to the right.