Condo Development Financial Planning Template (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Financial planning framework for build and sell developers.

- Includes joint venture waterfalls.

- Test pricing, costs, and measure resulting return metrics.

REAL ESTATE EXCEL DESCRIPTION

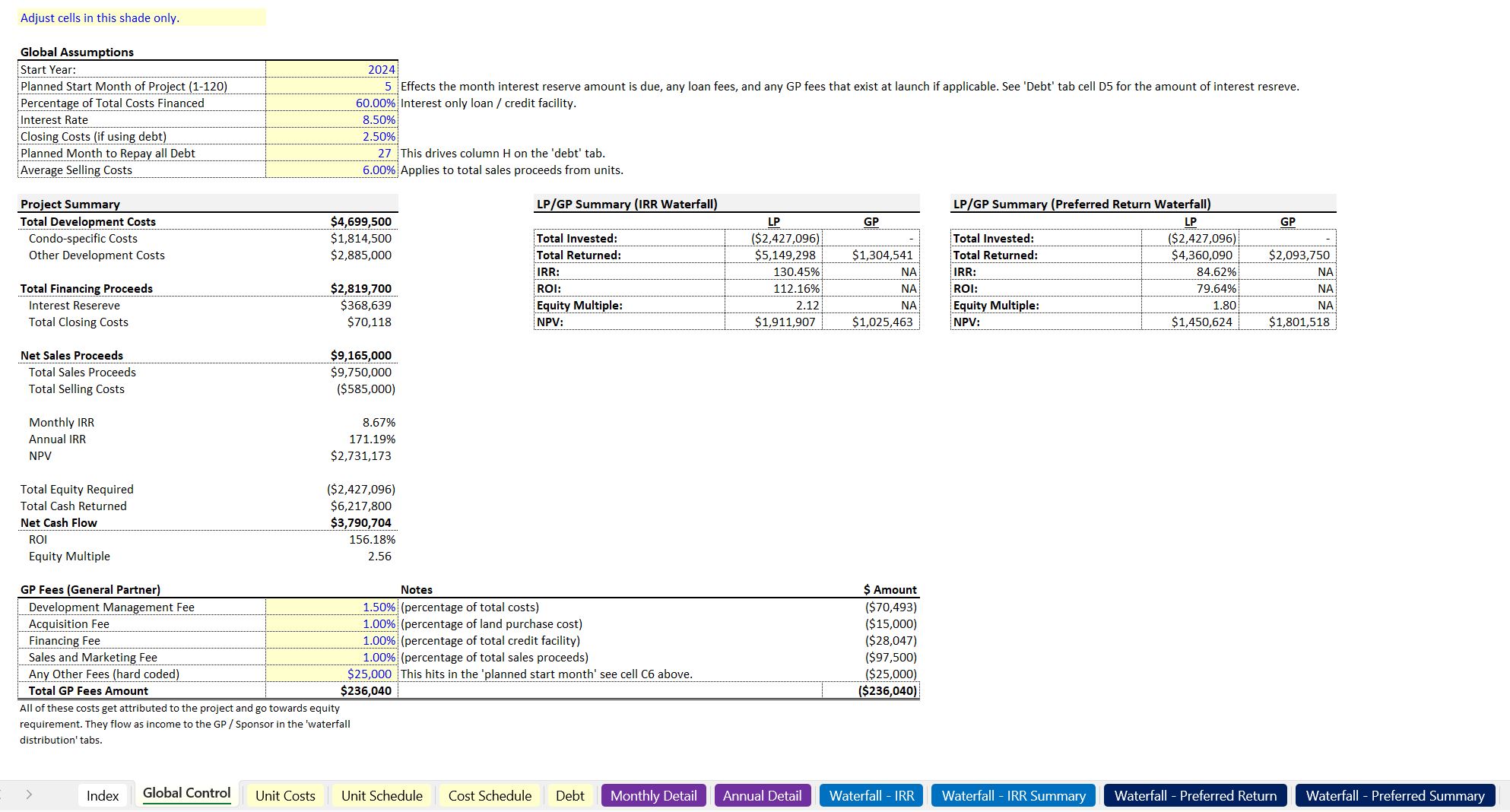

This financial model lets the user run all sorts of feasibility analysis scenarios for real estate development. The best fit scenario for this template is any build and sell business with up to 10 unit types and arbitrary counts of total units per type that are started and sold over time. The model lets the user forecast for up to 10 years of time.

You can model out a joint venture or a single investor / operator structure as I included a couple different cash flow waterfall options.

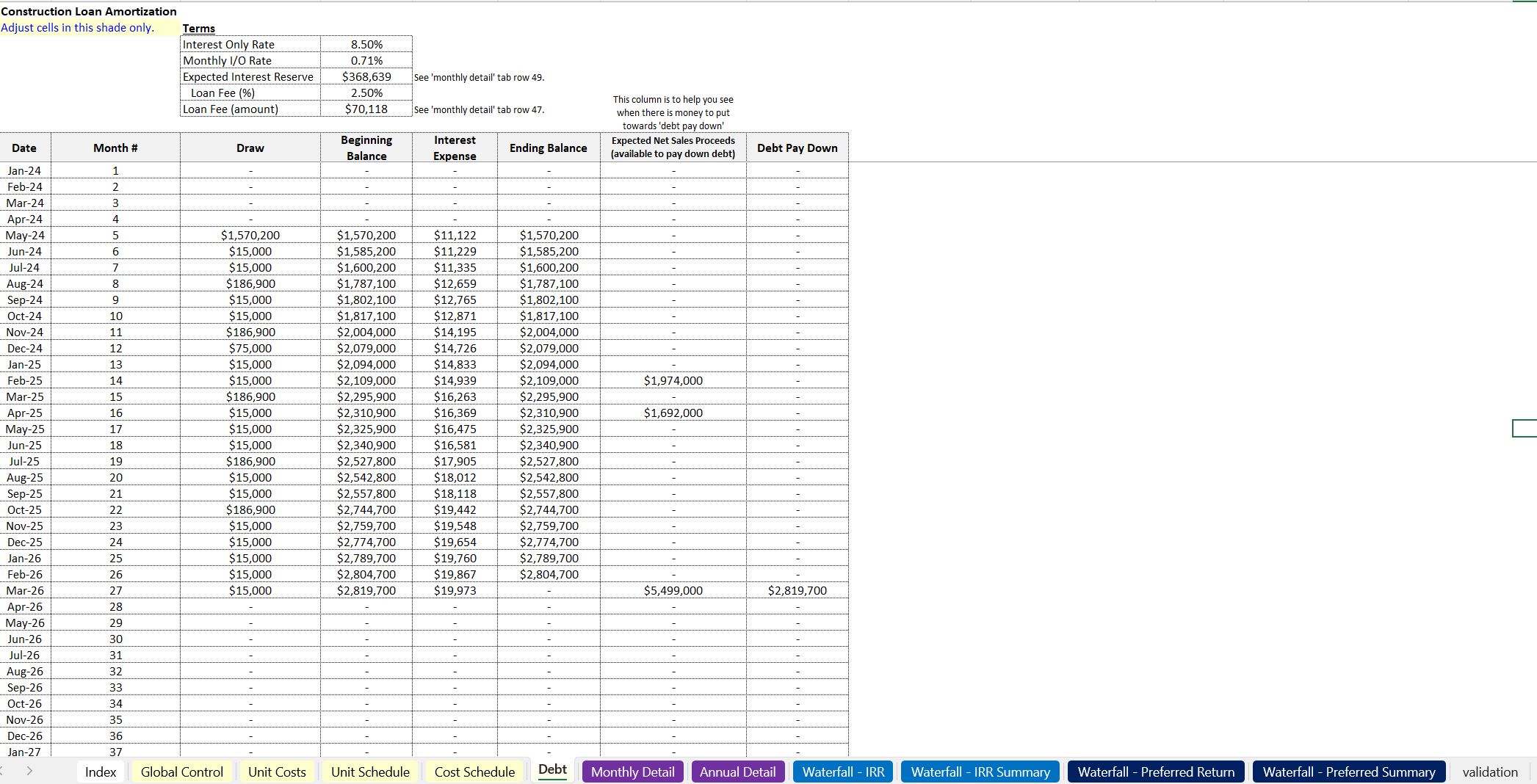

There is an input configuration for how much of the costs are financed with an interest-only construction loan and to make it most usable, I had the debt repayment schedule a simple input. This means you can see the total sales proceeds per month and input when you want to repay any debt based on that. Interest will calculate accordingly as long as there is a balance. Any cash flows that are not financed flow to equity requirements.

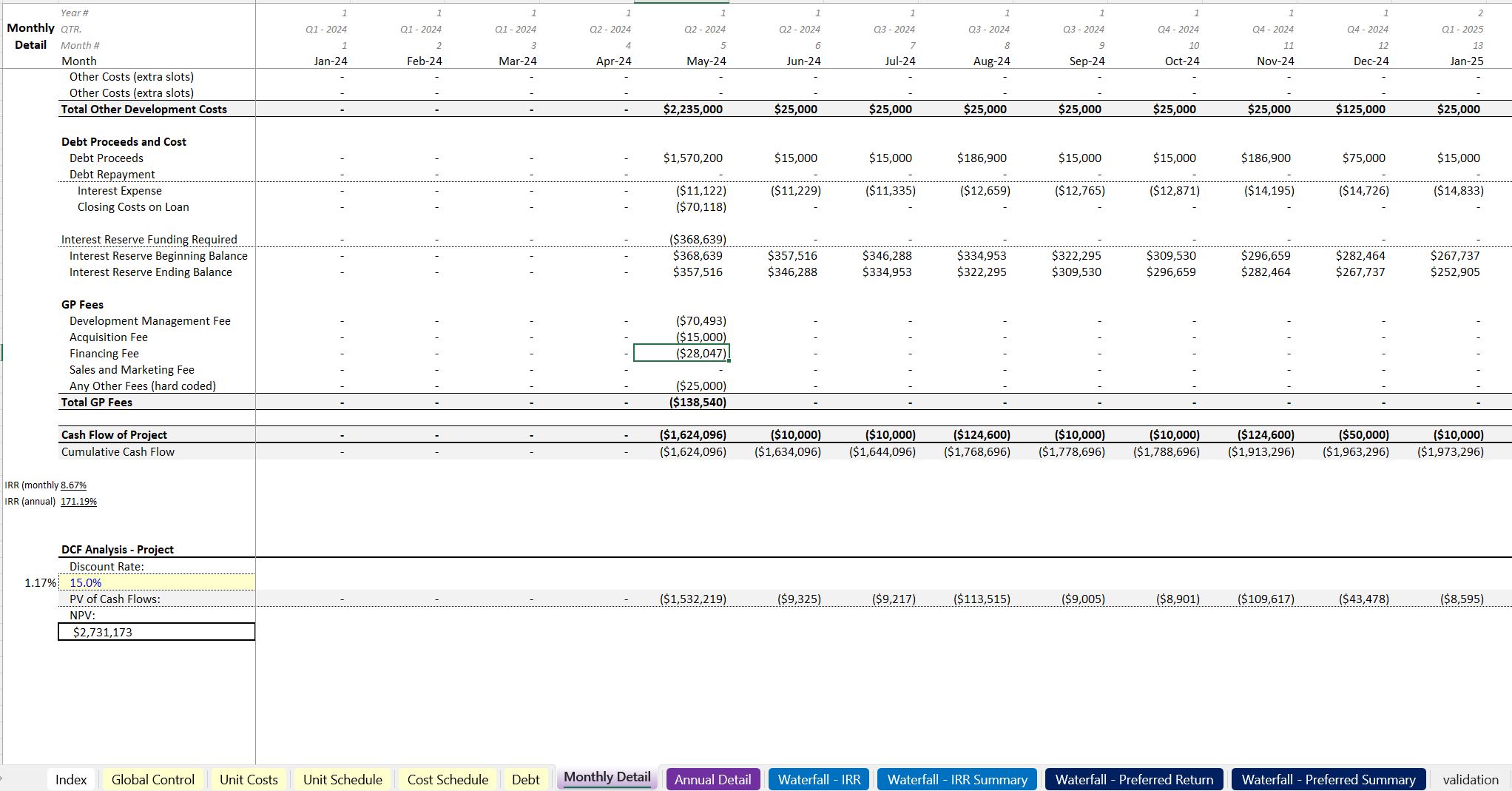

Output metrics include IRR, ROI, Equity Multiple, and NPV for the project, and the LP (investor) / GP (operator) individually. There is also a robust GP fee configuration if this is a fund.

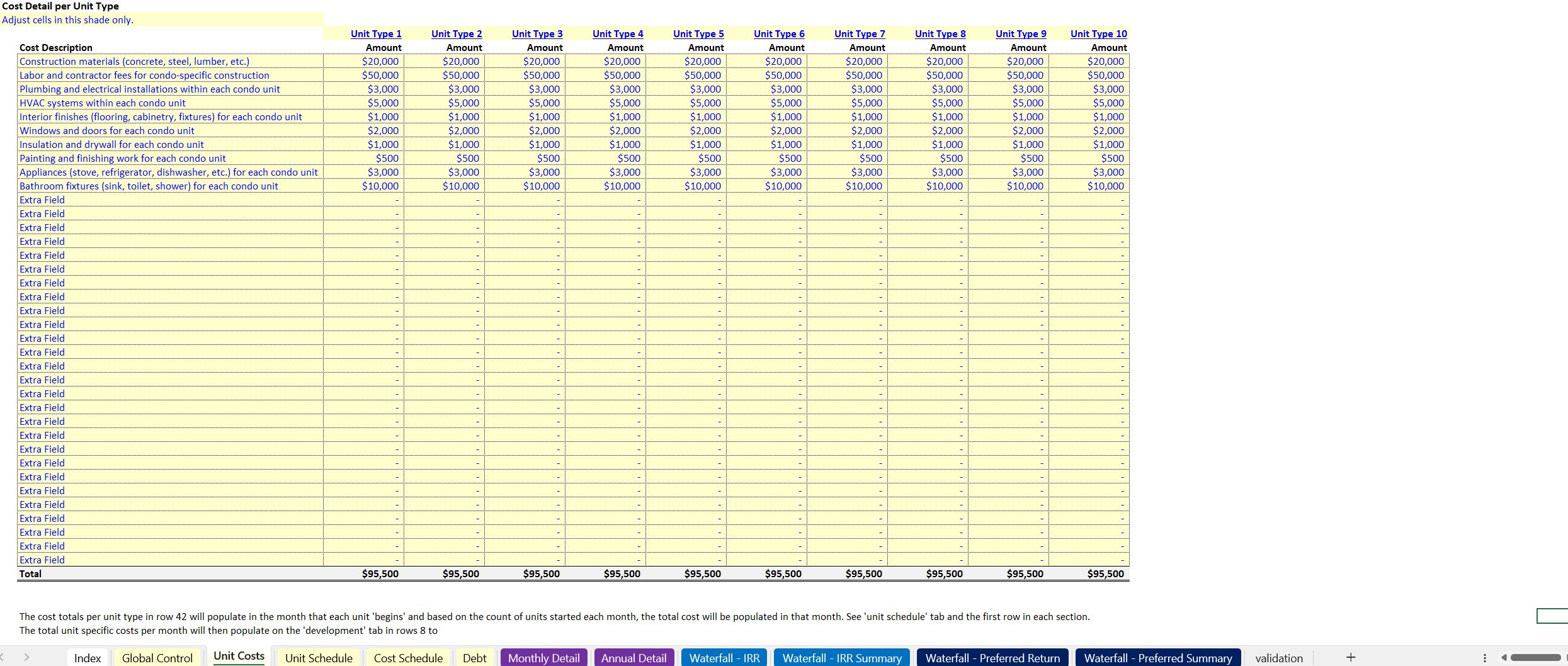

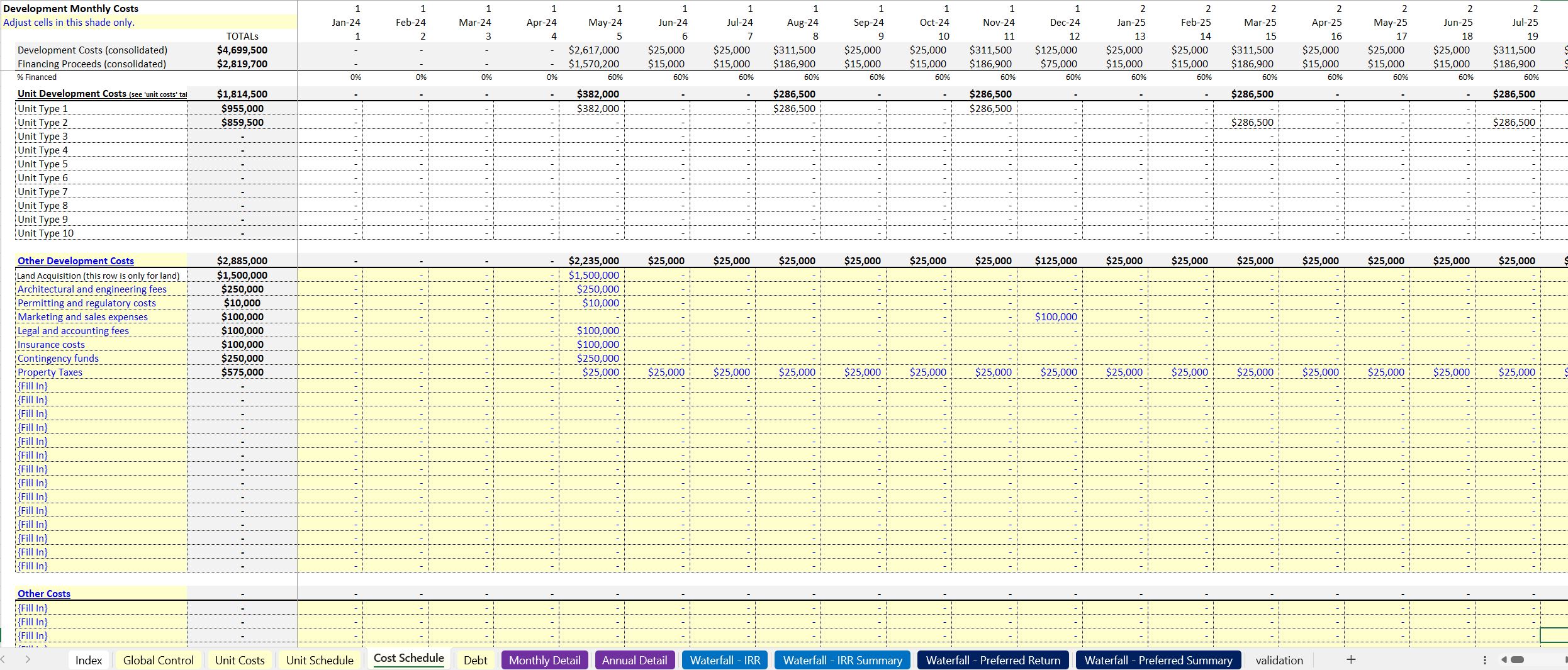

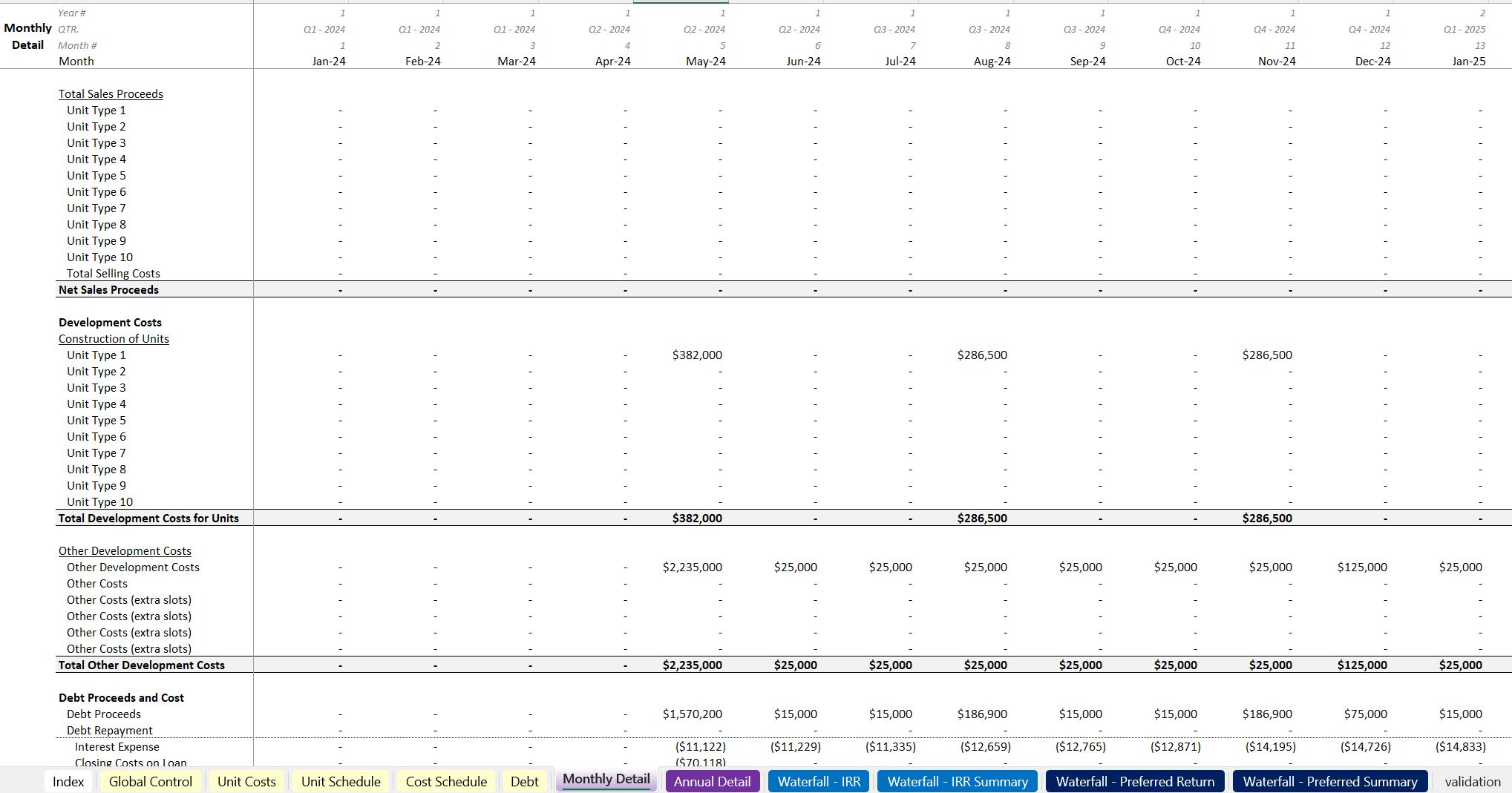

There are two ways that development costs are populated. The first is by defining the expected hard costs for each unit type. Then, as the unit counts are added per month, the total development cost will populate accordingly. The second is a simple monthly cost schedule with various sections to account for other hard costs that are not directly related to the count of units.

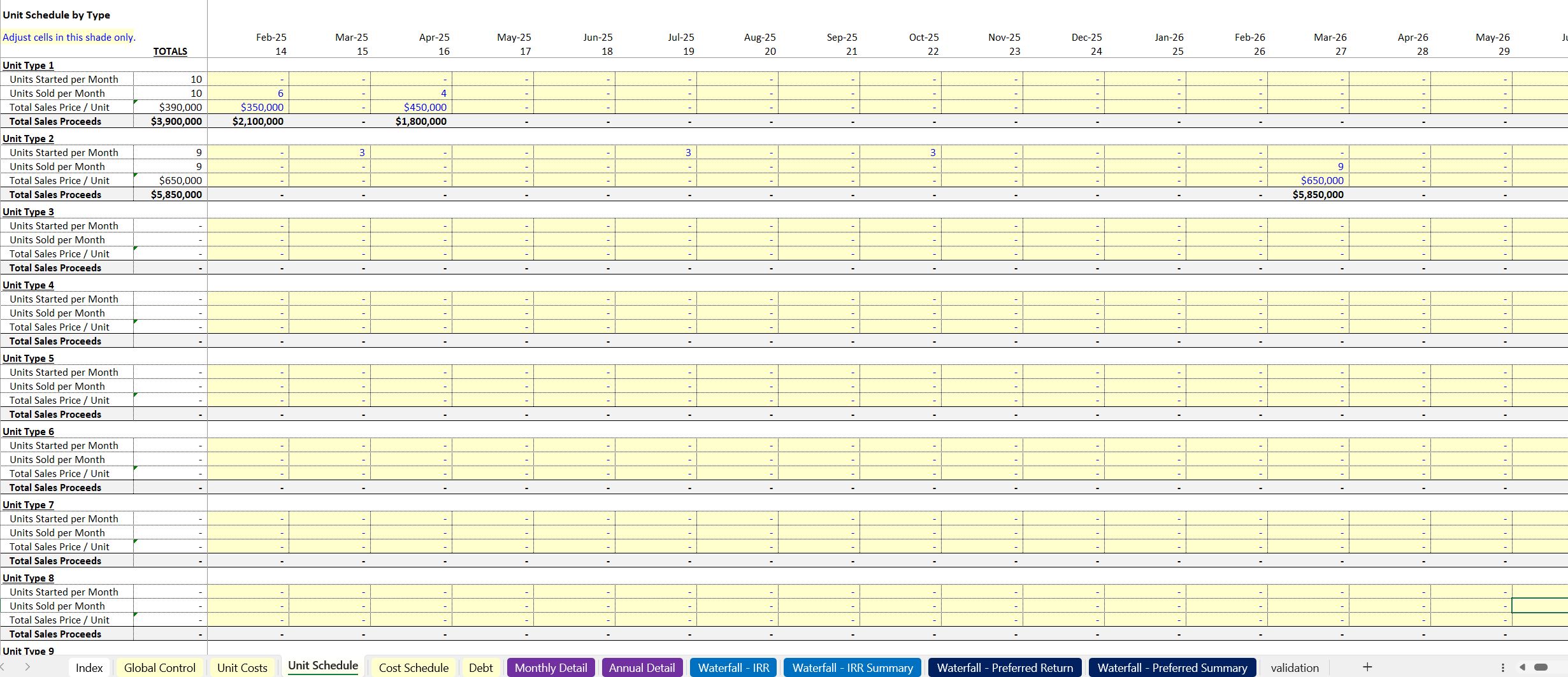

There is a simple input section for units started per month by type, units sold per month by type, and the average sales price per unit by type. This makes it easy to plan any kind of strategy or scenario no matter how long it takes to build and sell these condos. A simple sanity check will display total units started / sold in order to ensure you don't enter different total counts built vs sold.

Note, the first file is a blank version with all the assumptions zeroed out and the second is a filled-out version.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Condo Development Financial Planning Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping