Airbnb Arbitrage Financial Model: Up to 100 Properties (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

Airbnb arbitrage is not risk free by any means.

This is not a money printing scheme, however many individuals may see opportunities in housing based on interest rates, valuations, and rent rates. If the cost to rent is sufficiently cheaper than the value of listing a properties on sites like Airbnb, Vrbo, and the like, then it may be beneficial to rent out properties, pay the rent / cost to maintain, and then have people pay you for short-term stays at the properties.

This represents lower entry costs, but also lower upside compared to traditional real estate acquisition.

This financial tool was designed for users intending to lease properties then sub-let those properties to short-term, rental booking sites, e.g., Vrbo and Airbnb.

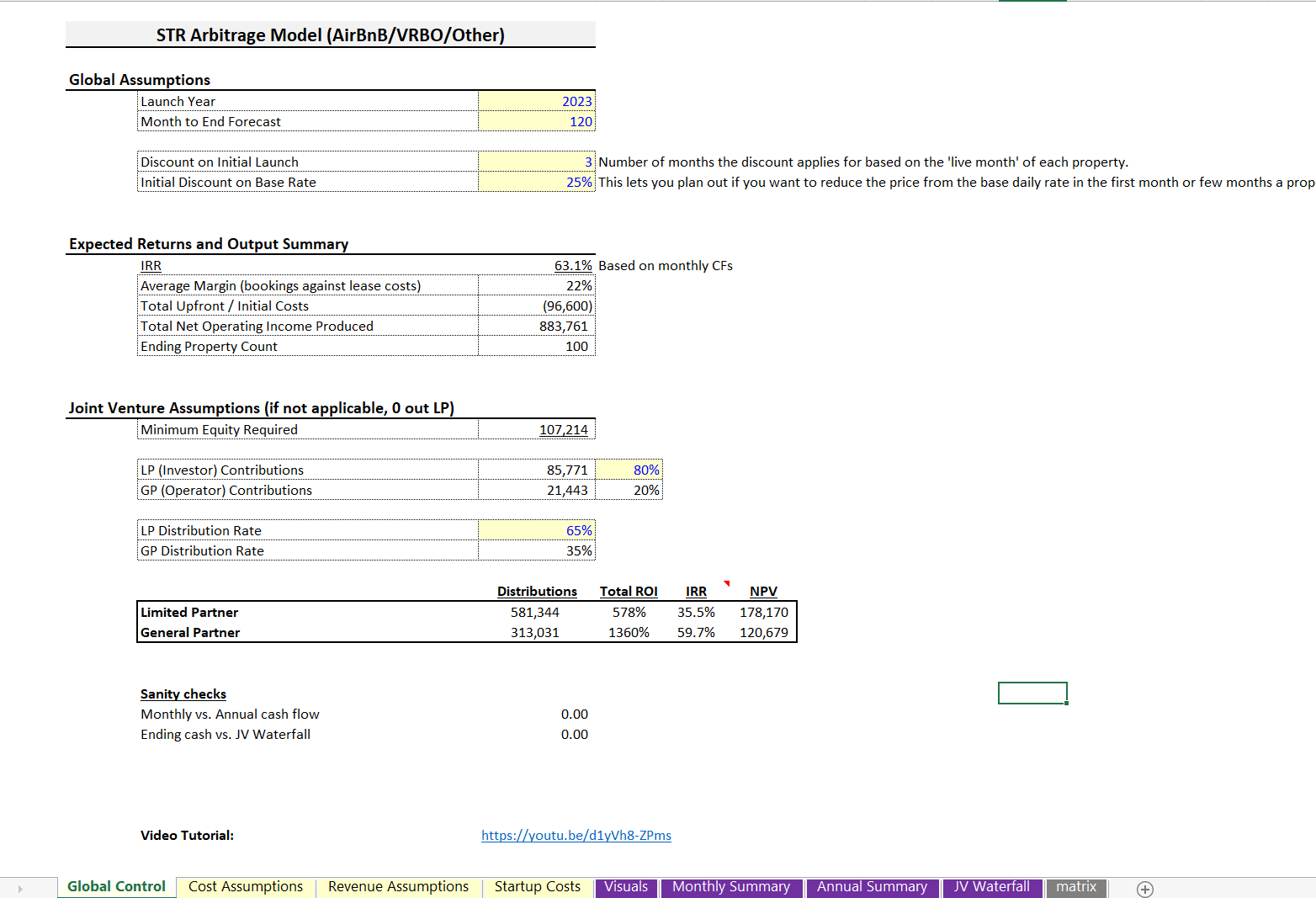

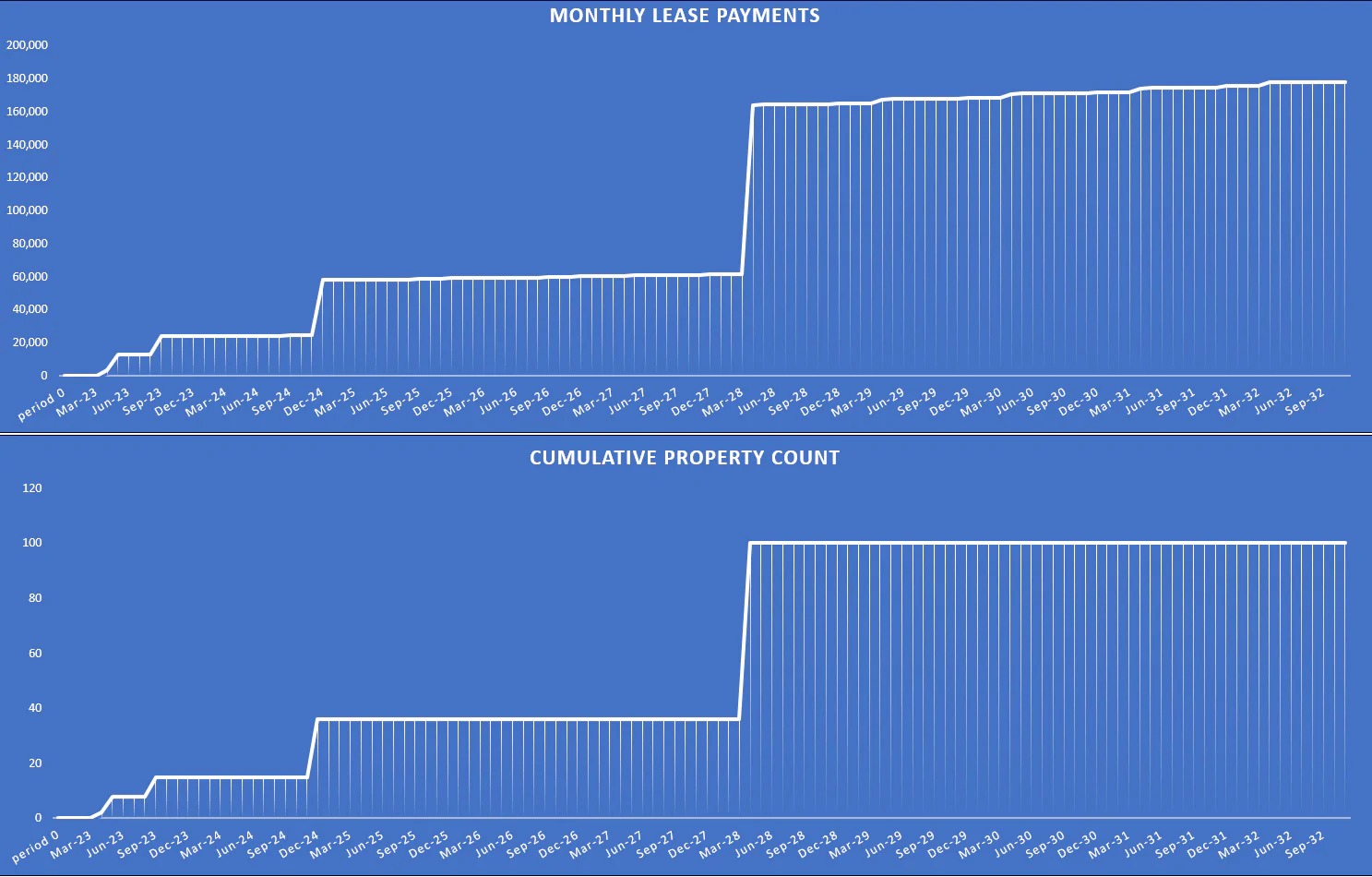

The model works for up to 10 years and 100 properties and demonstrates how higher monthly booking revenue can be generated compared to average monthly leases allowing users to test various scenarios/ feasibilities to determine what expenses/ leases will result in the most profitable situation.

Benefits & features of this financial model include:

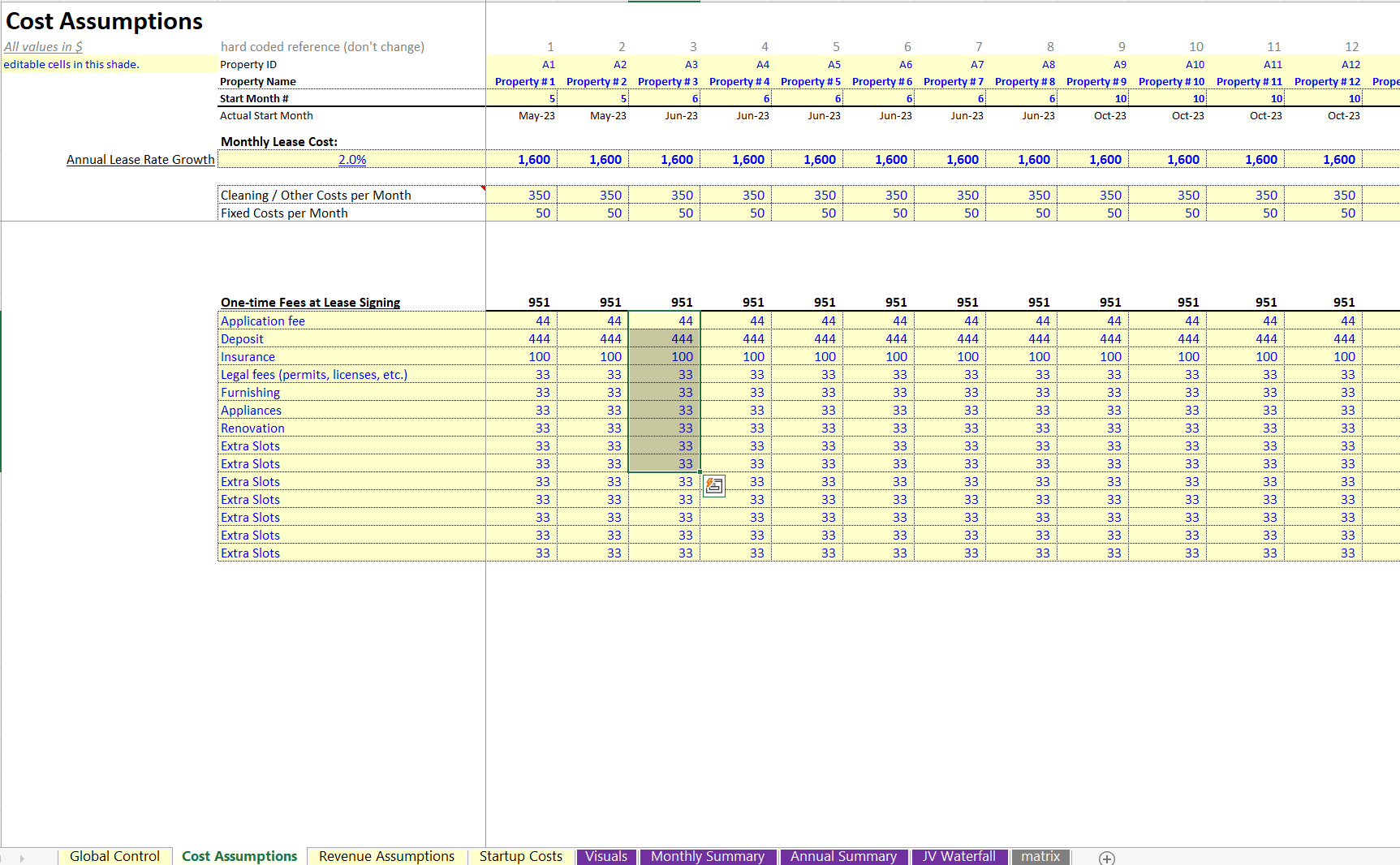

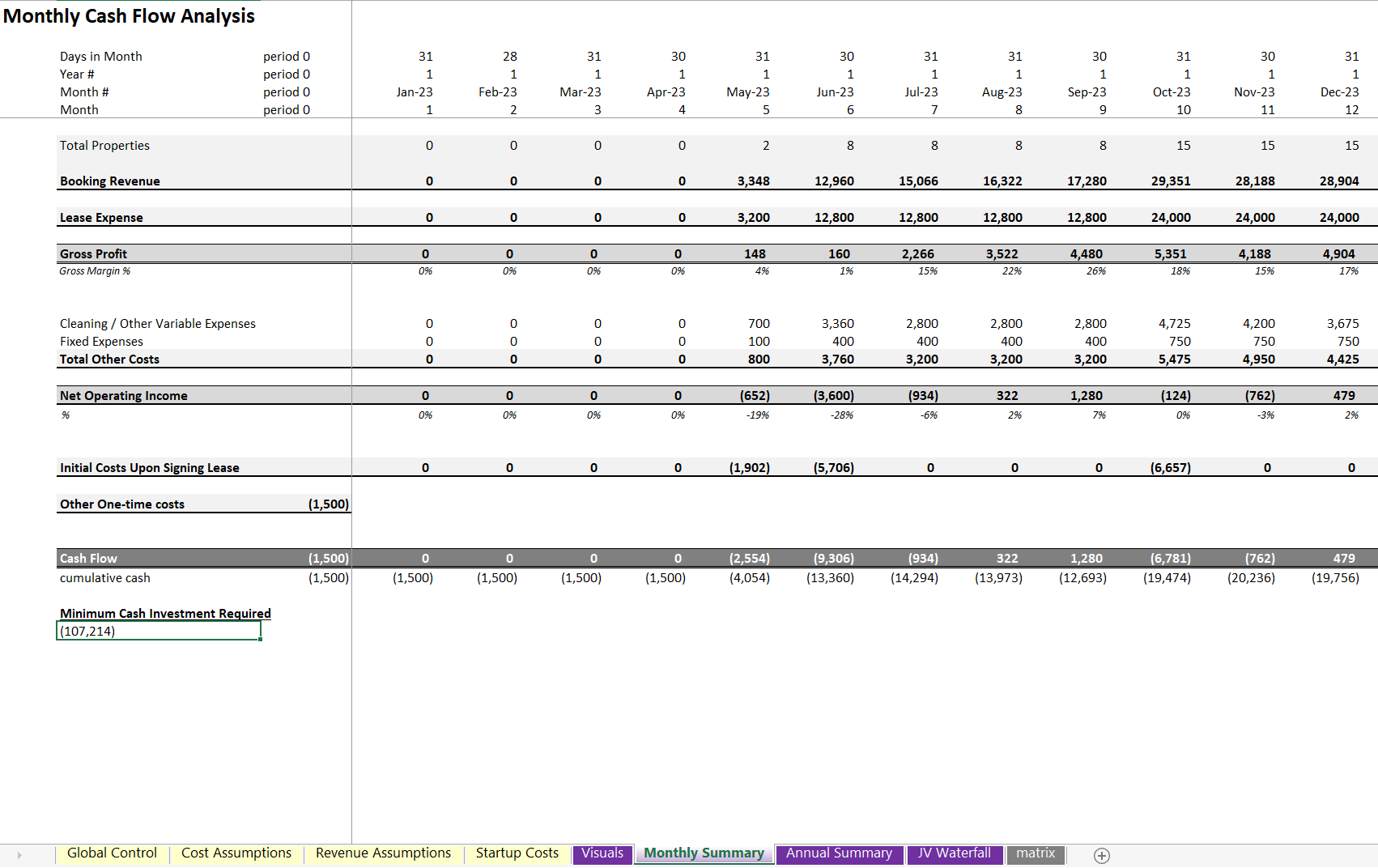

• User friendly – the model enables wide-ranging financial planning for monthly expenses, including: maintenance/ cleaning costs, furnishing costs, application fees, and other miscellaneous costs.

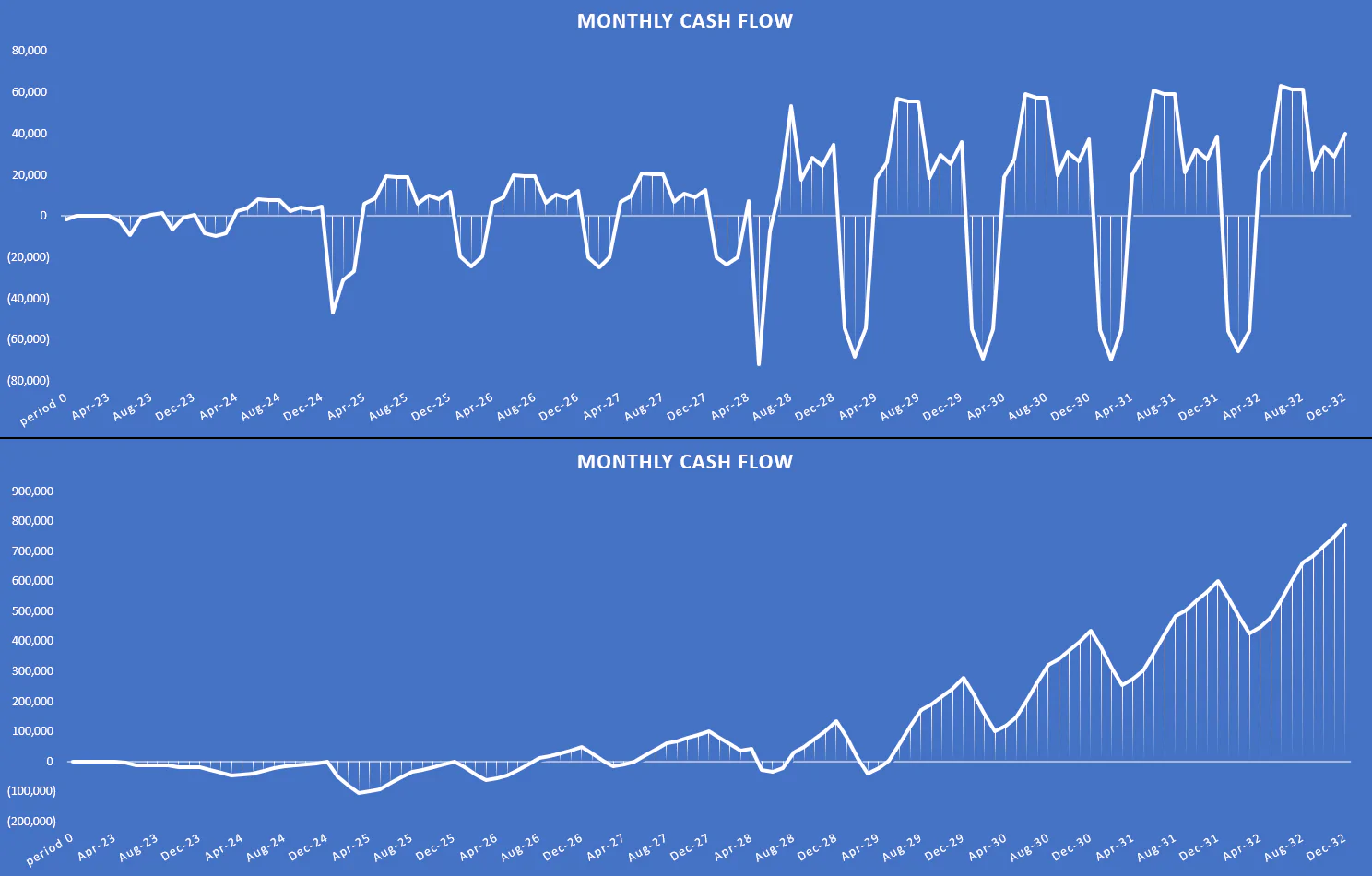

• Useful and easy to read visualizations – charts and graphs are created by flowing logic which show cumulative cash and properties, total monthly lease, and monthly cash flow.

• Expenses/revenues entered into designated boxes by users, along with general logic assumptions, produce an annual and monthly cash flow analysis, ROI, IRR, annual pro forma, minimum equity requirement, and discounted cash flow analysis.

To determine revenue and expenses, users define:

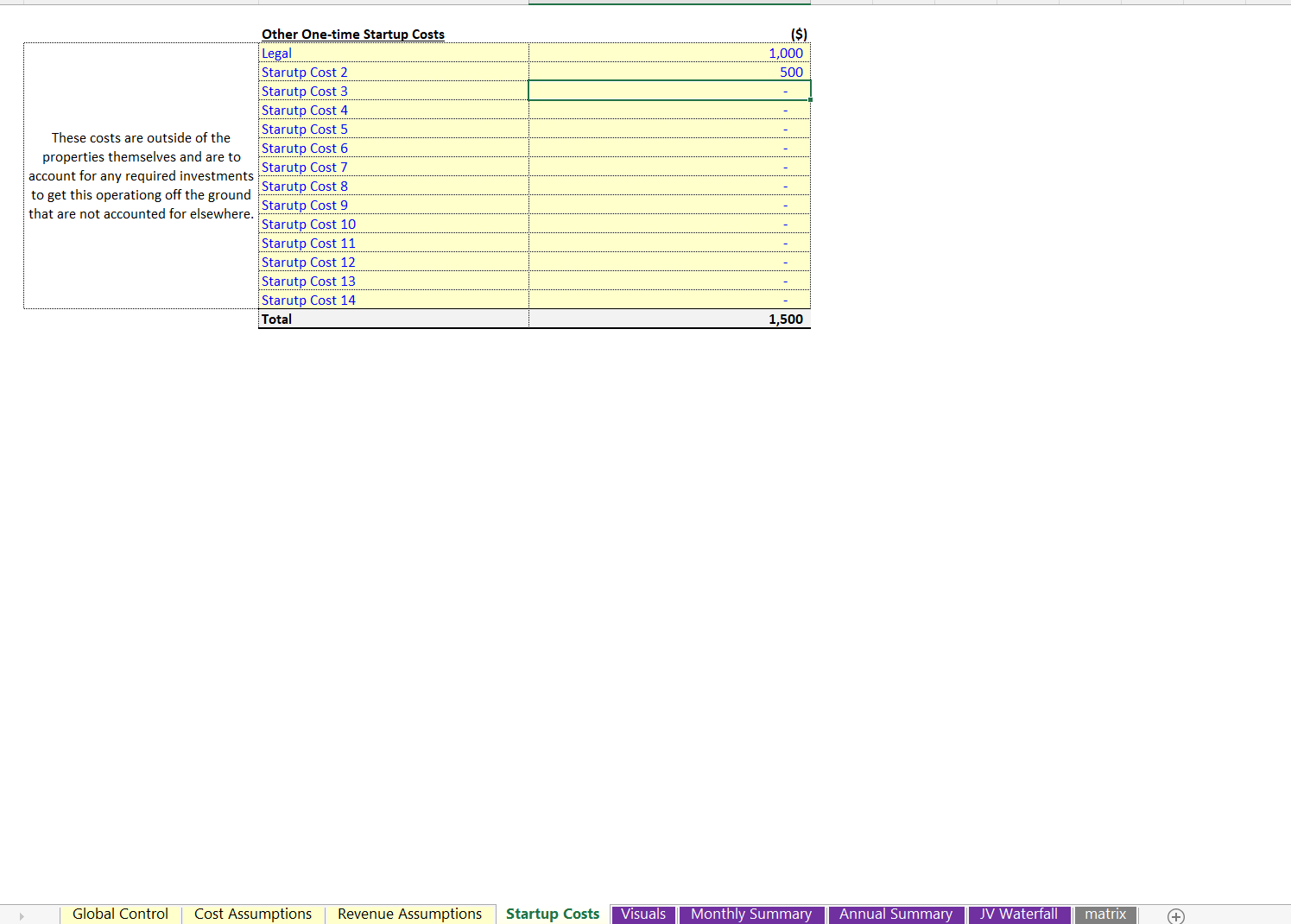

• One-time startup / lease signing costs, such as legal and consulting fees

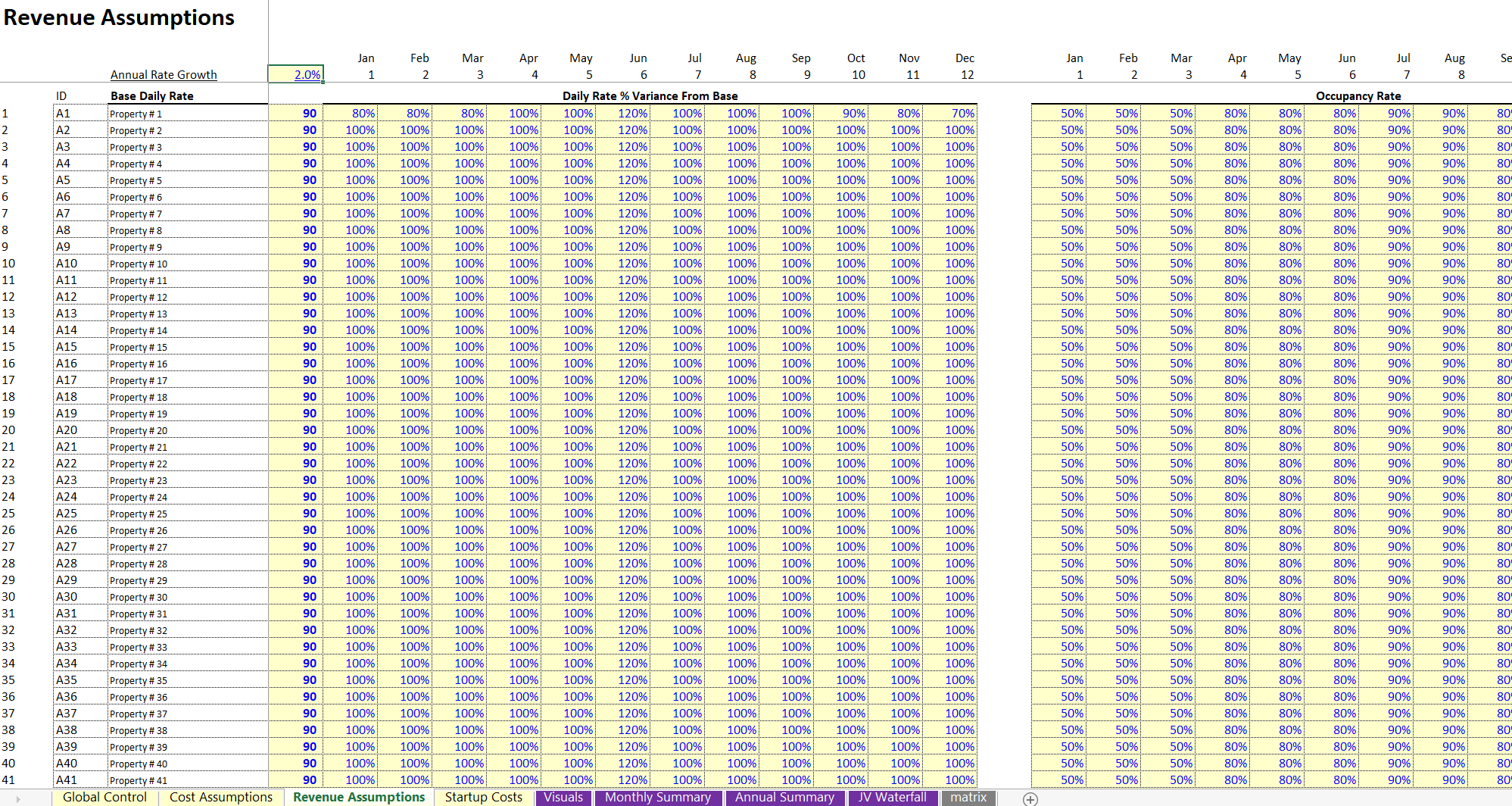

• Base daily rate, start month, and monthly lease for each property

• Annual increase in the base rate

• Variable and fixed monthly costs

• Seasonality assumptions

There is also an option for whether a discounted daily rate for first set number of months will be used to increase positive reviews on rental property.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Airbnb, Integrated Financial Model Excel: Airbnb Arbitrage Financial Model: Up to 100 Properties Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping