Financial Model Feasibility for Subscription Box Businesses (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Save time and ensure greater accuracy in projections.

- Offers tools for deeper financial analysis, such as DCF Analysis and IRR.

- Proper recurring revenue cohort modeling techniques for each pricing tier.

SUBSCRIPTION EXCEL DESCRIPTION

Designed intricately for the distinct dynamics of a subscription box business, this template offers you a comprehensive financial projection tool. In essence, the business model caters to subscribers who regularly pay for curated product collections delivered monthly, resonating with specific interests or themes.

Key Features:

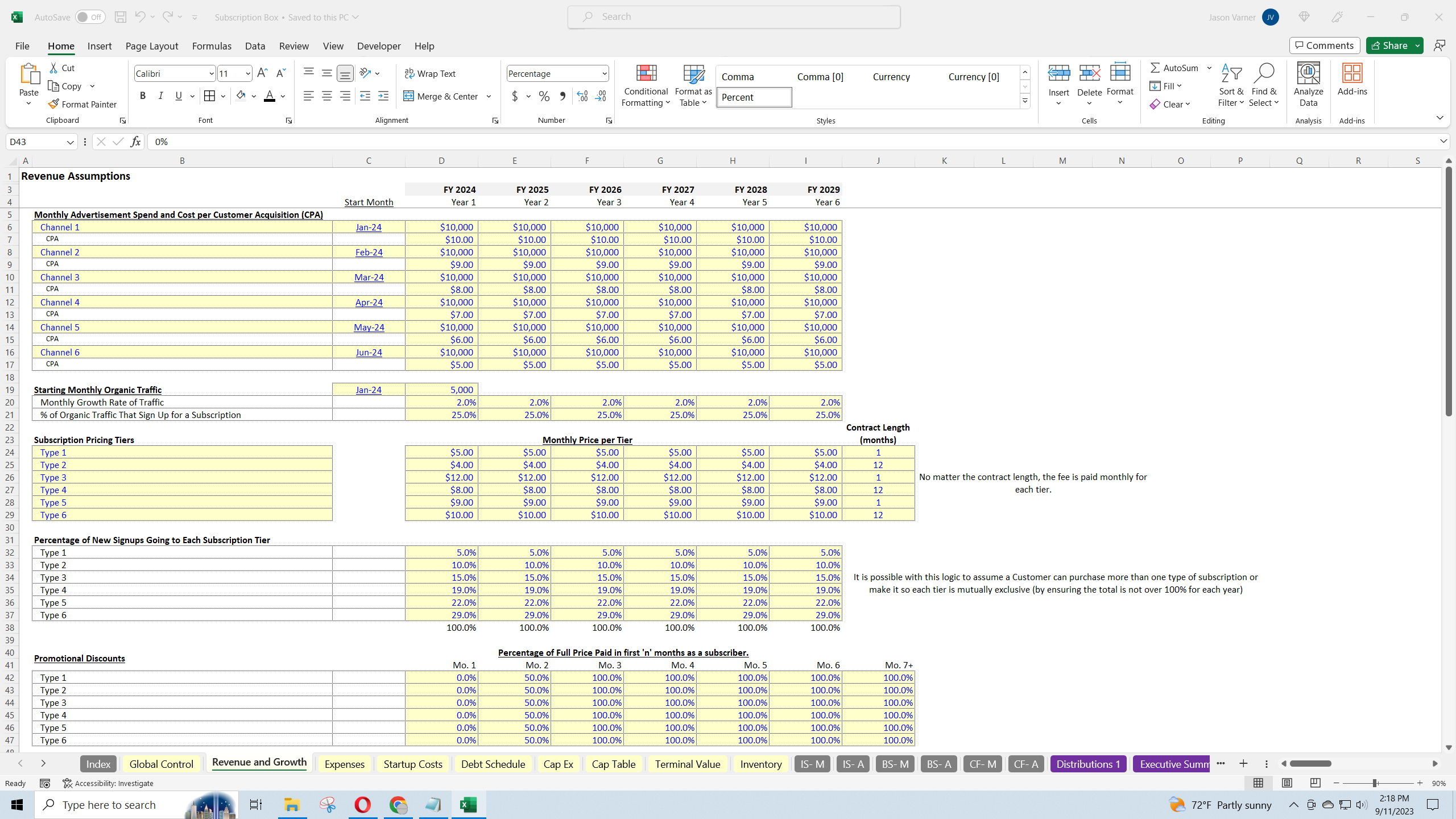

Acquisition Channels: Accommodates up to 6 advertising acquisition avenues based on diverse spend and cost per acquisition metrics.

Organic Customer Growth: Calculated using monthly traffic and conversion rates.

Flexible Subscription Pricing: Allows for up to 6 tiered subscription pricing, each with individual retention and promotional features, such as discounts and "first month free" offers.

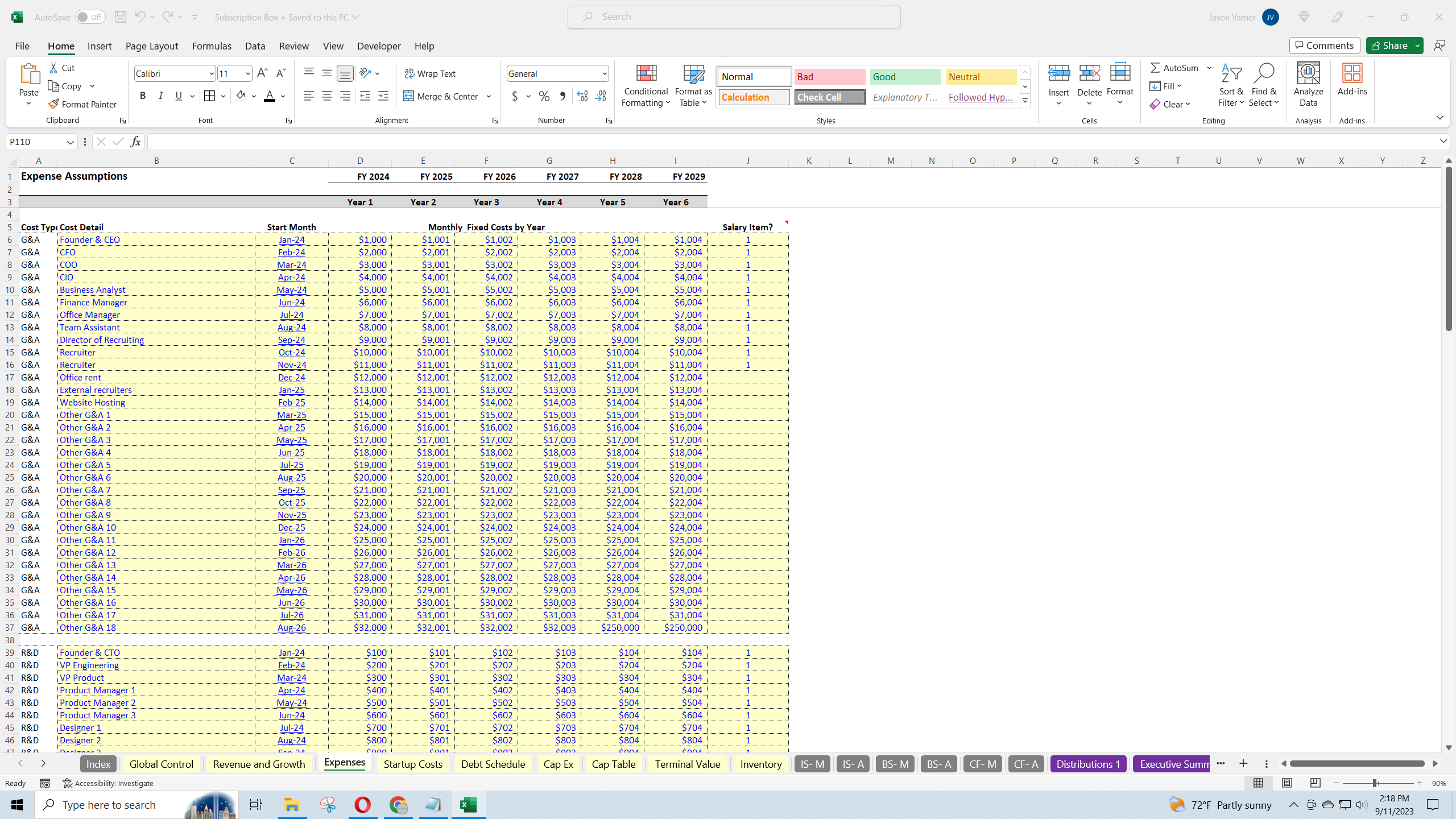

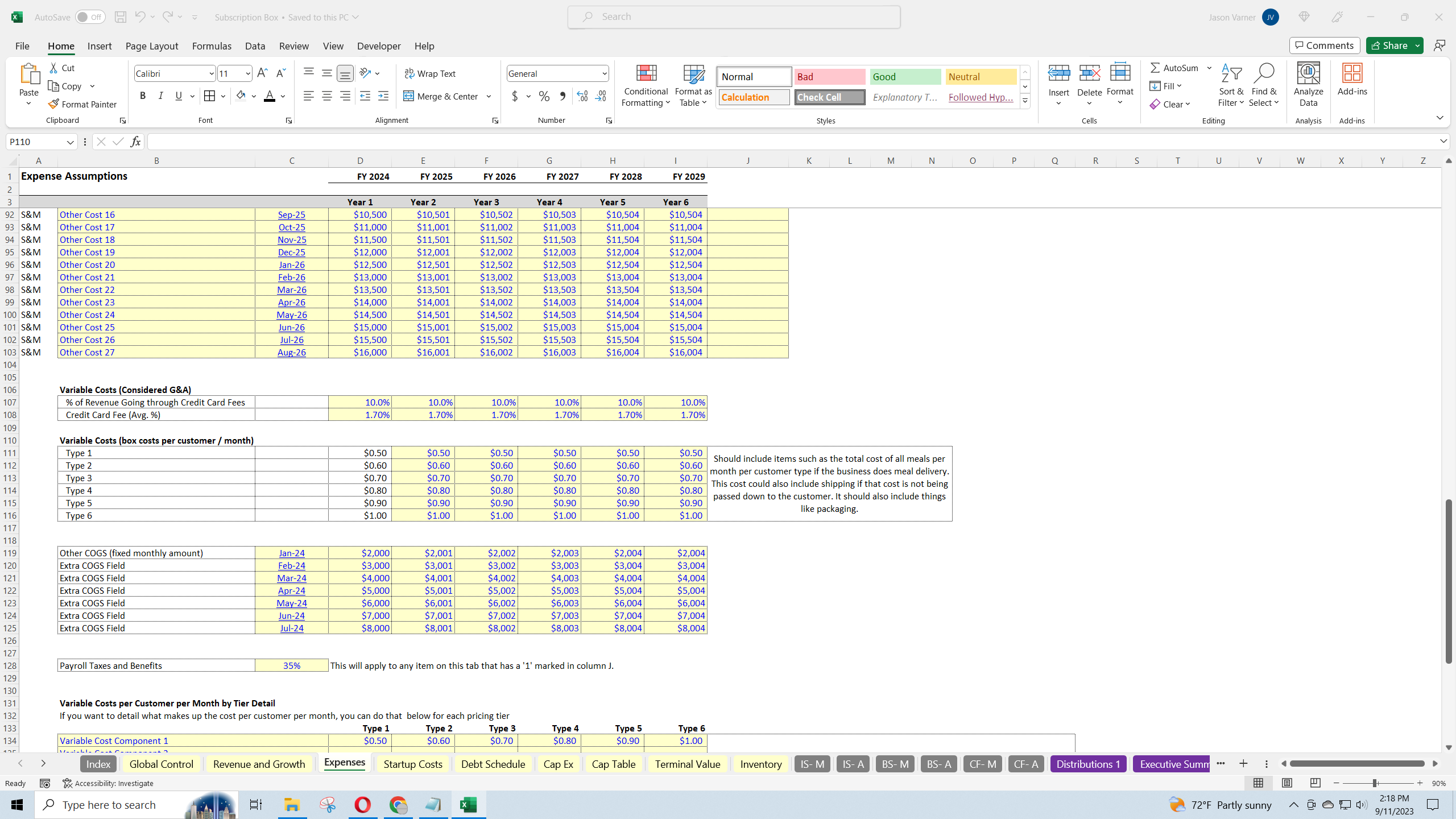

Operational Costs: Comprehensive fixed cost breakdown including overheads like rent, management, and more. Each item includes a 'start month' feature.

Inventory Tracking: Inventory purchase offsets according to purchase frequency.

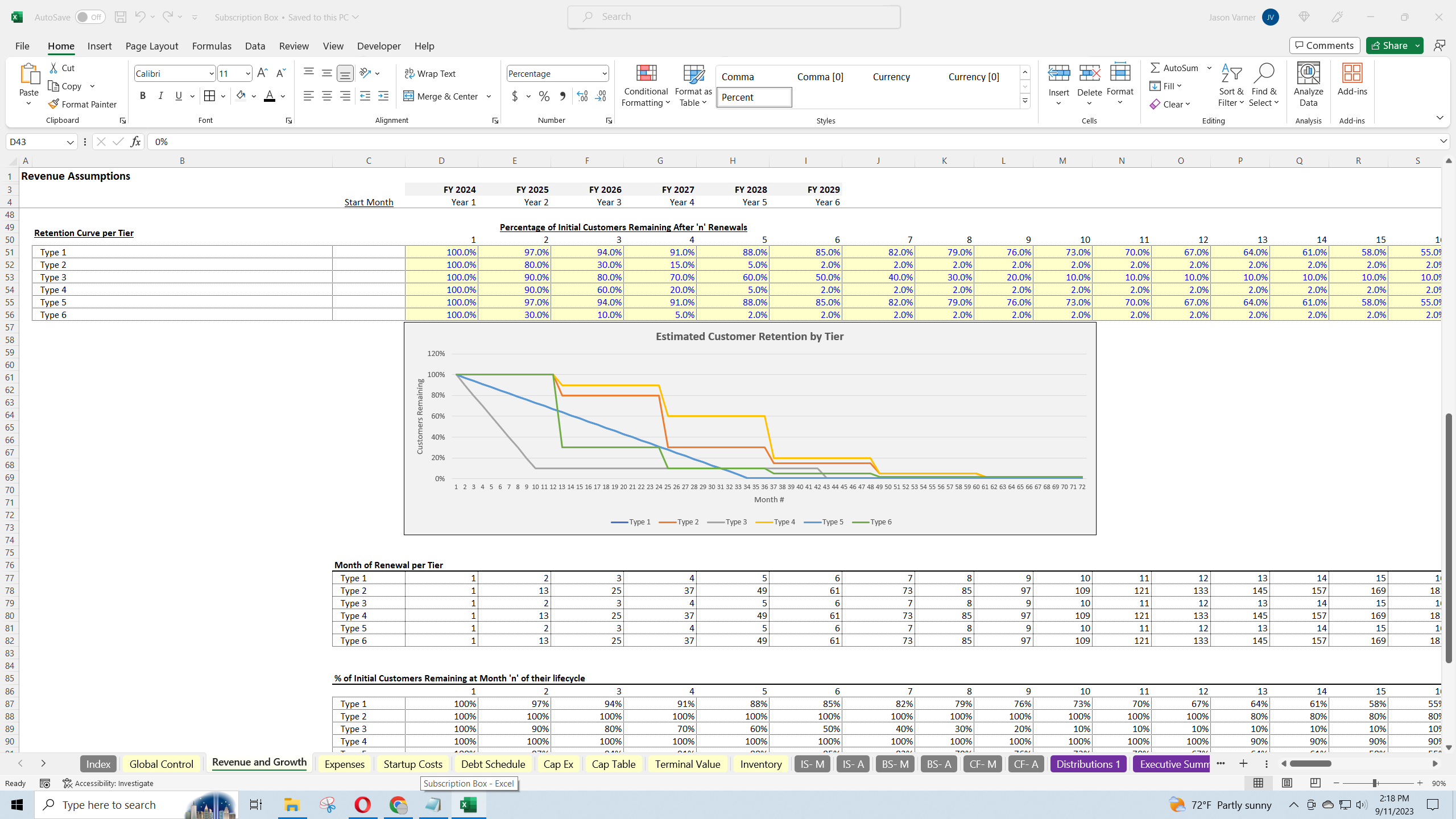

Extended Forecast: A projection model that spans up to 72 months.

Outputs:

Integrated monthly and yearly financial statements.

Detailed monthly and yearly pro forma reports emphasizing EBITDA, cash flow, and vital KPIs like CaC, LTV, monthly churn, ARR, and more.

Yearly executive summary.

DCF Analysis and IRR.

Core Purpose:

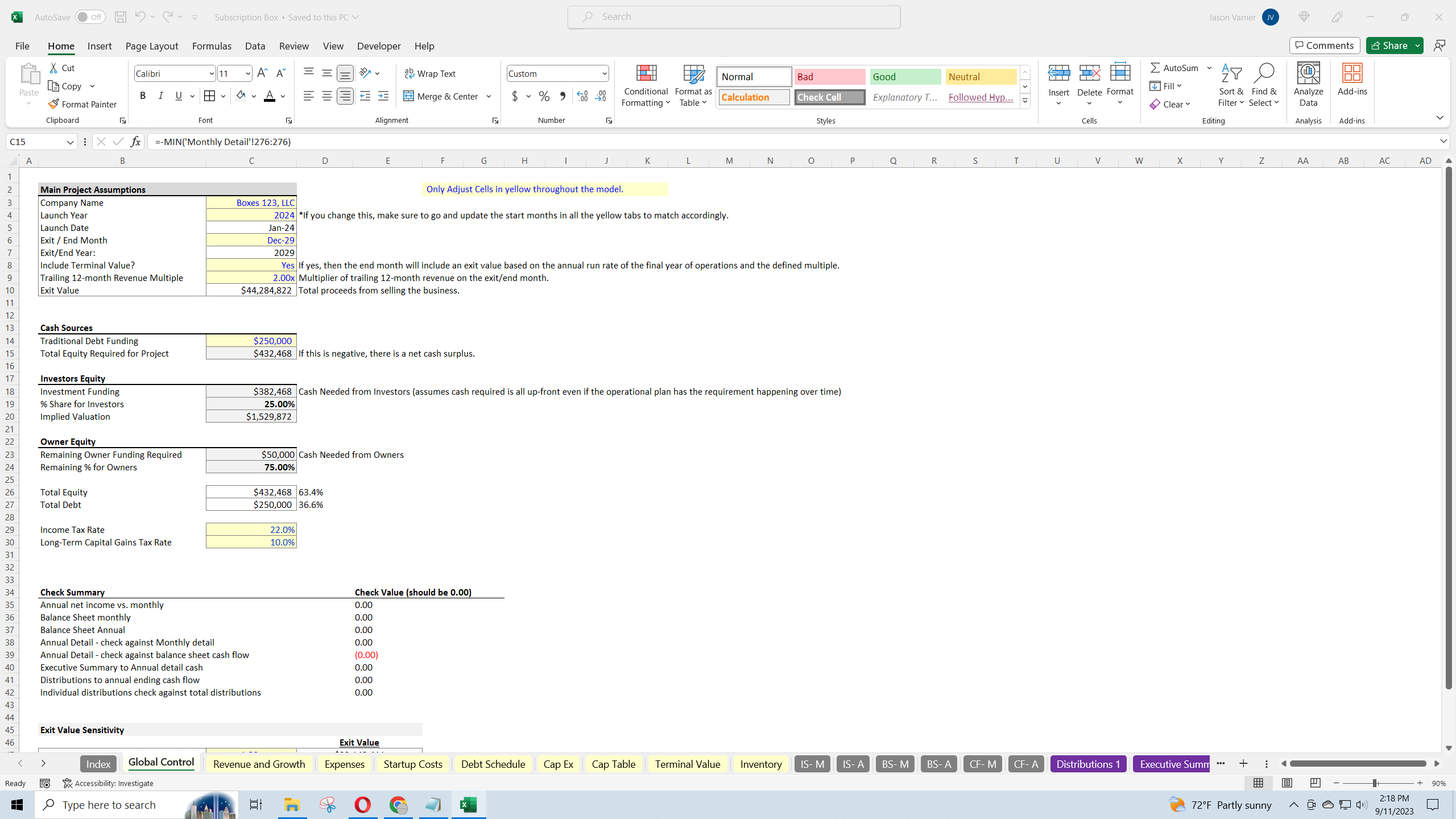

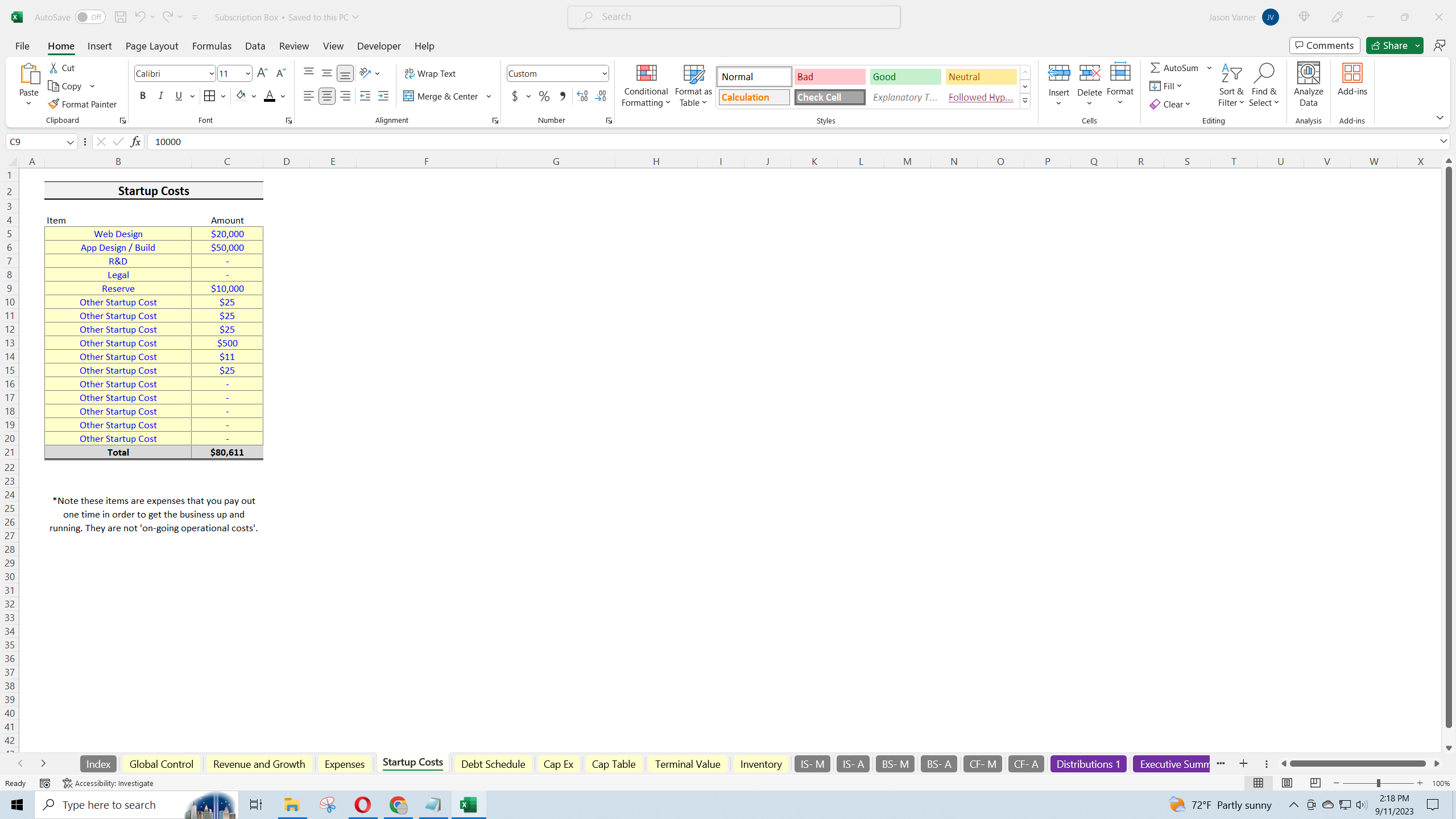

The heart of this template is to enable users to infuse their assumptions and instantly receive a tailored financial forecast. A pivotal aspect it addresses is determining the minimum equity essential for maintaining a positive cash stance, factoring in startup costs, capital expenditure, and net operational burn.

The pro forma details provide an in-depth look at periodic cash inflows and outflows, forming the foundation for varied cash flow analyses.

Additional Features:

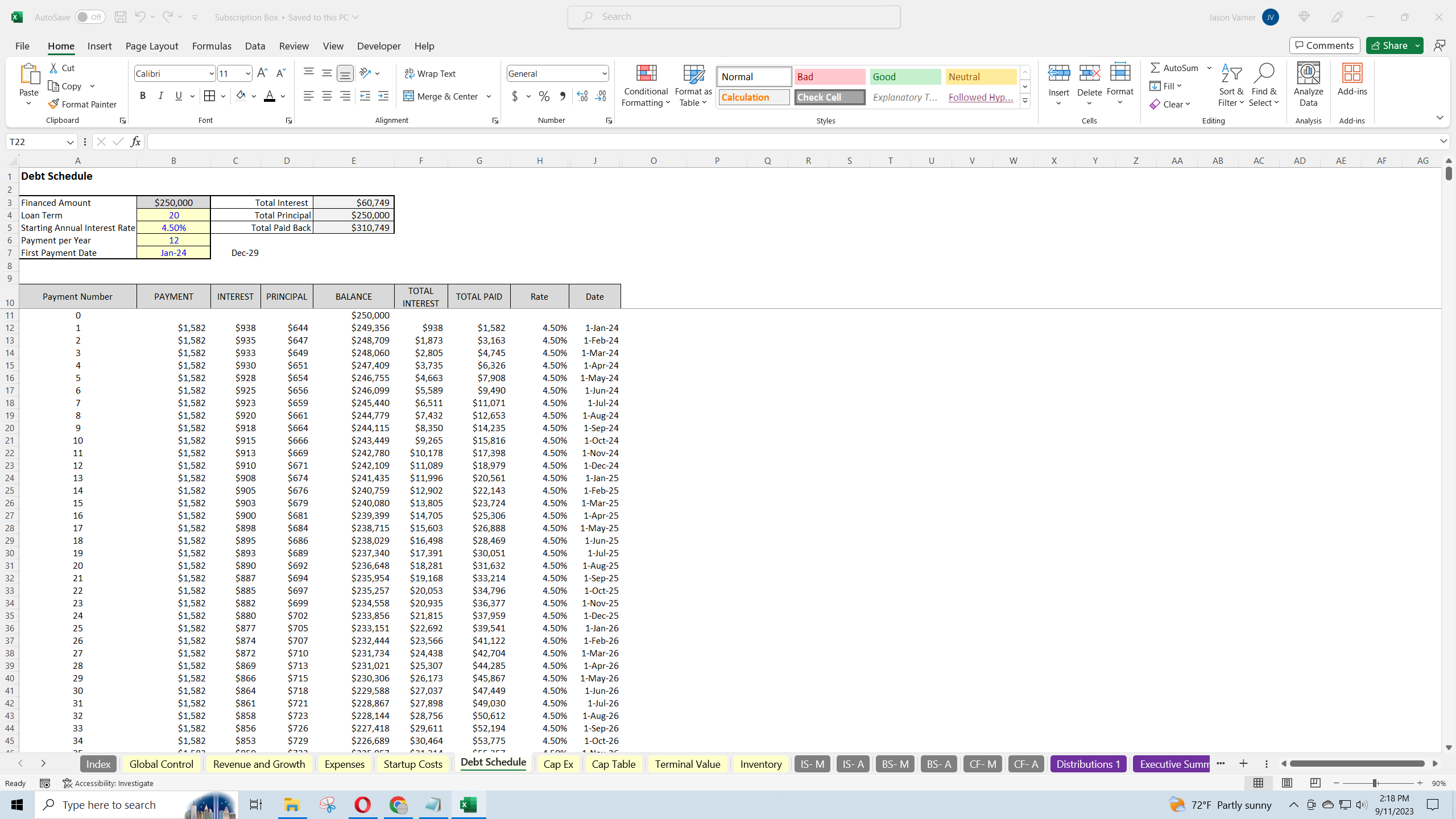

Debt incorporation options with associated configurations.

Exit value considerations based on a 12-month trailing subscription revenue.

Retention Logic:

Every subscription tier includes a contract duration and a retention percentage for each monthly new customer cohort. Users can set retention patterns, whether exponential decay or linear. Revenue calculations assume that customers honor their monthly commitments regardless of their contract length.

Utility:

This model serves as a strategic tool for conducting diverse financial feasibility tests. By tweaking parameters like pricing, customer costs, ad budgets, and conversions, users can gauge the most influential factors and project potential outcomes for different scenarios, from worst-case to best-case.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Subscription, Integrated Financial Model Excel: Financial Model Feasibility for Subscription Box Businesses Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping