Financial Model for Assisted Living Facility & Nursing (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

If you are looking to analyze a potential investment / operation in the hospitality industry, this Excel spreadsheet covers a lot of ground. It is a template designed for the user to drop in their own assumptions in regards to all financial aspects of the project.

An assisted living facility arguably falls into the hospitality category as far as industry classification goes. In my opinion, it is a combination of real estate/hospitality/healthcare. It sits in a grey area.

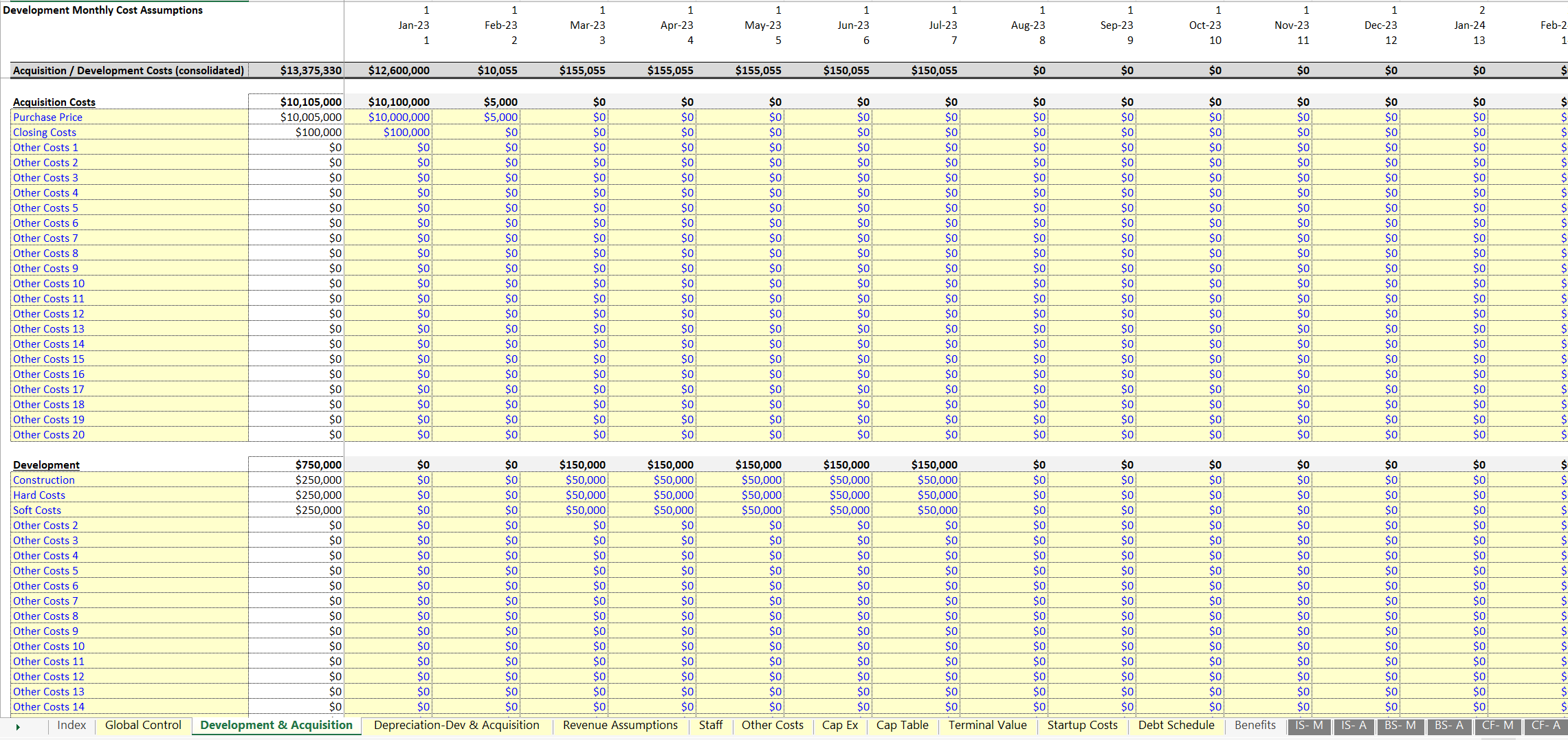

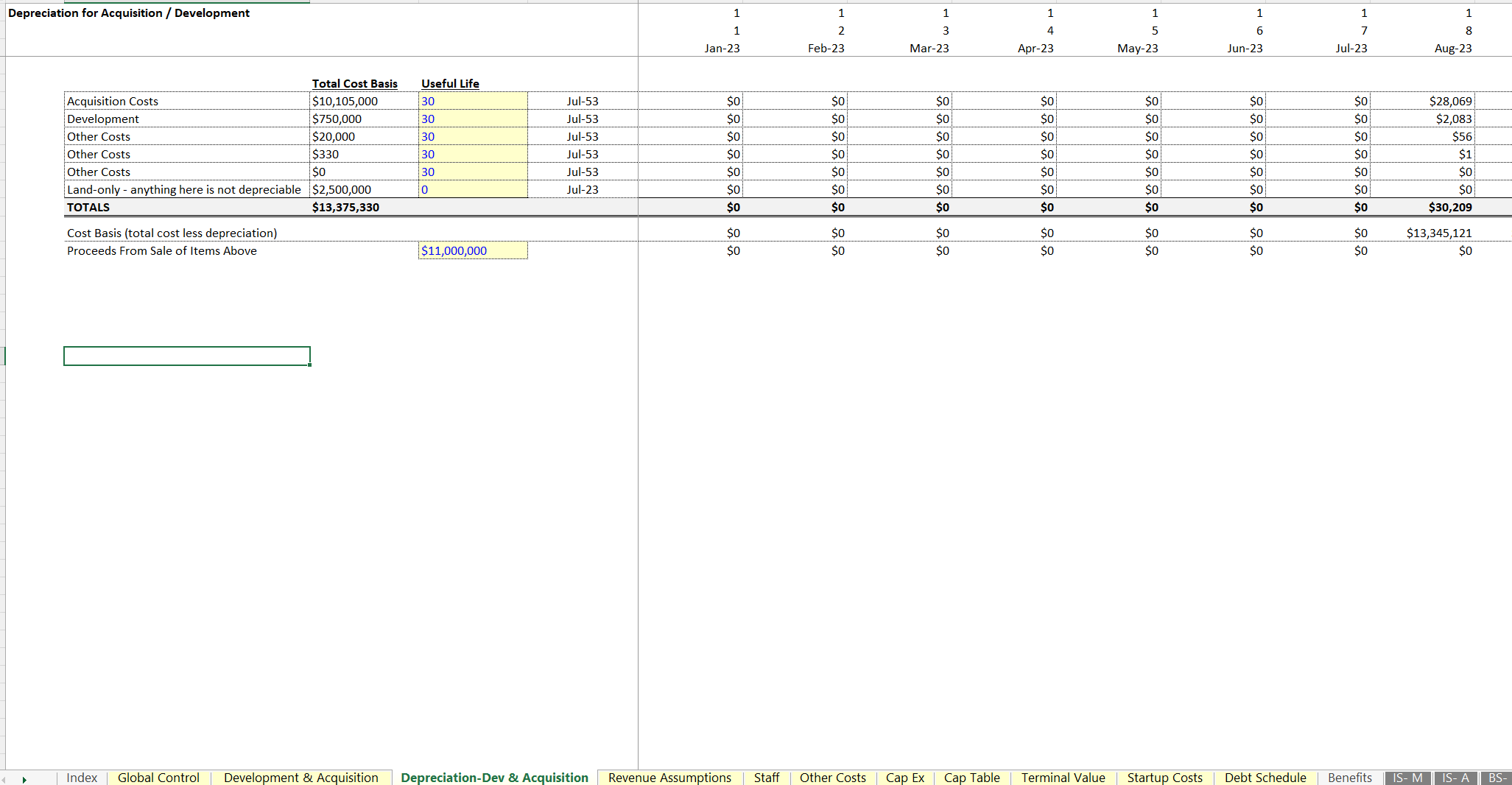

The assumptions in this financial model are similar to a nursing home and hotel in most ways. The structure of this template allows for development / acquisition costs, option for a construction loan with interest only, and very granular revenue and expense assumptions specific to the industry.

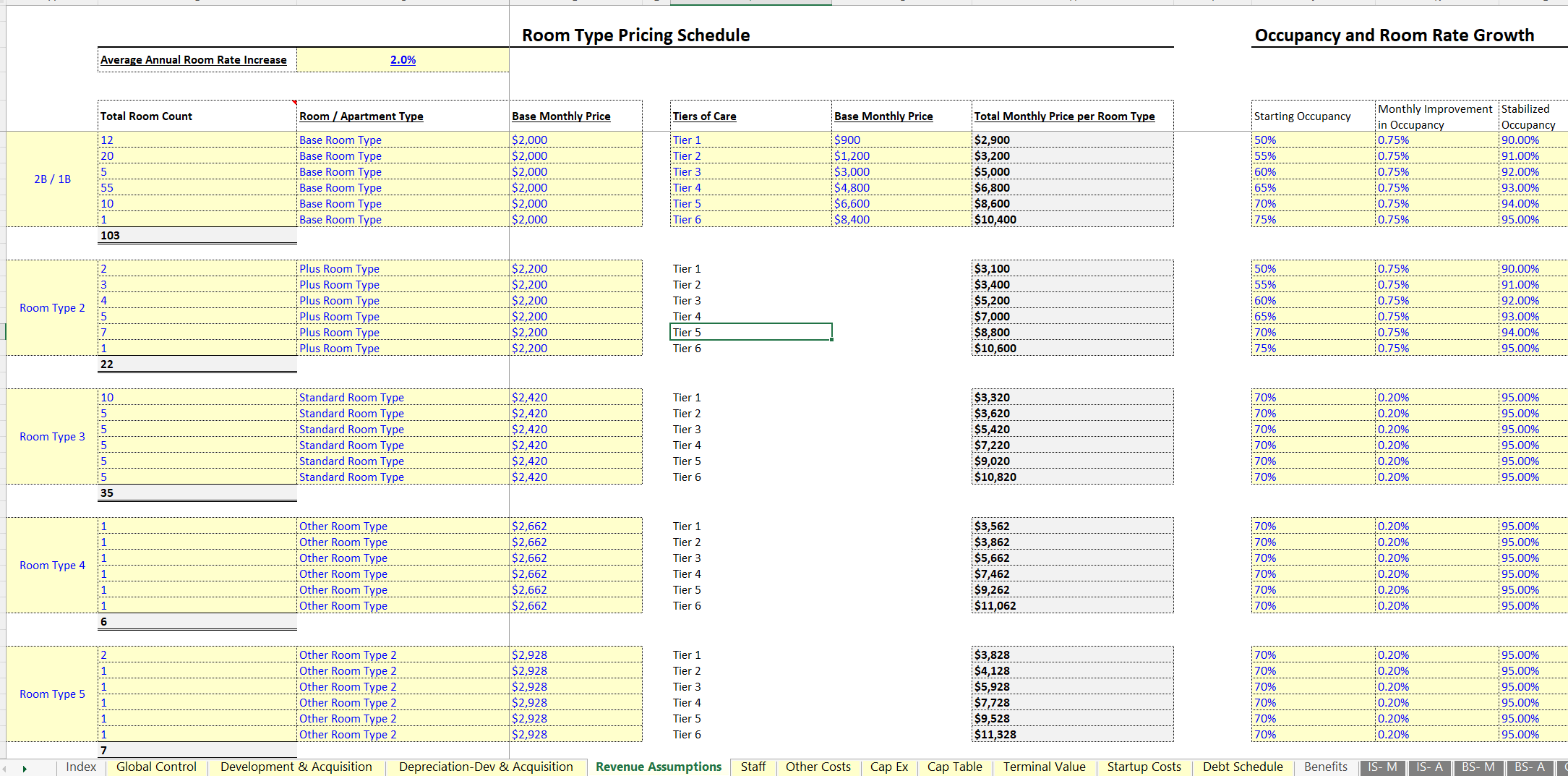

The user can define a range of room types, the count of each, and up to 6 different tiers of care. The 'tiers of care' aspect is what separates this simulation from a regular real estate model. It means that there are upcharges for each room depending on what kind of extra care is needed. This is added onto the base rent per month of each room type.

Configurations were put in for each room type for occupancy rate, improvement, stabilized occupancy and annual rent growth. There is also an ancillary income input.

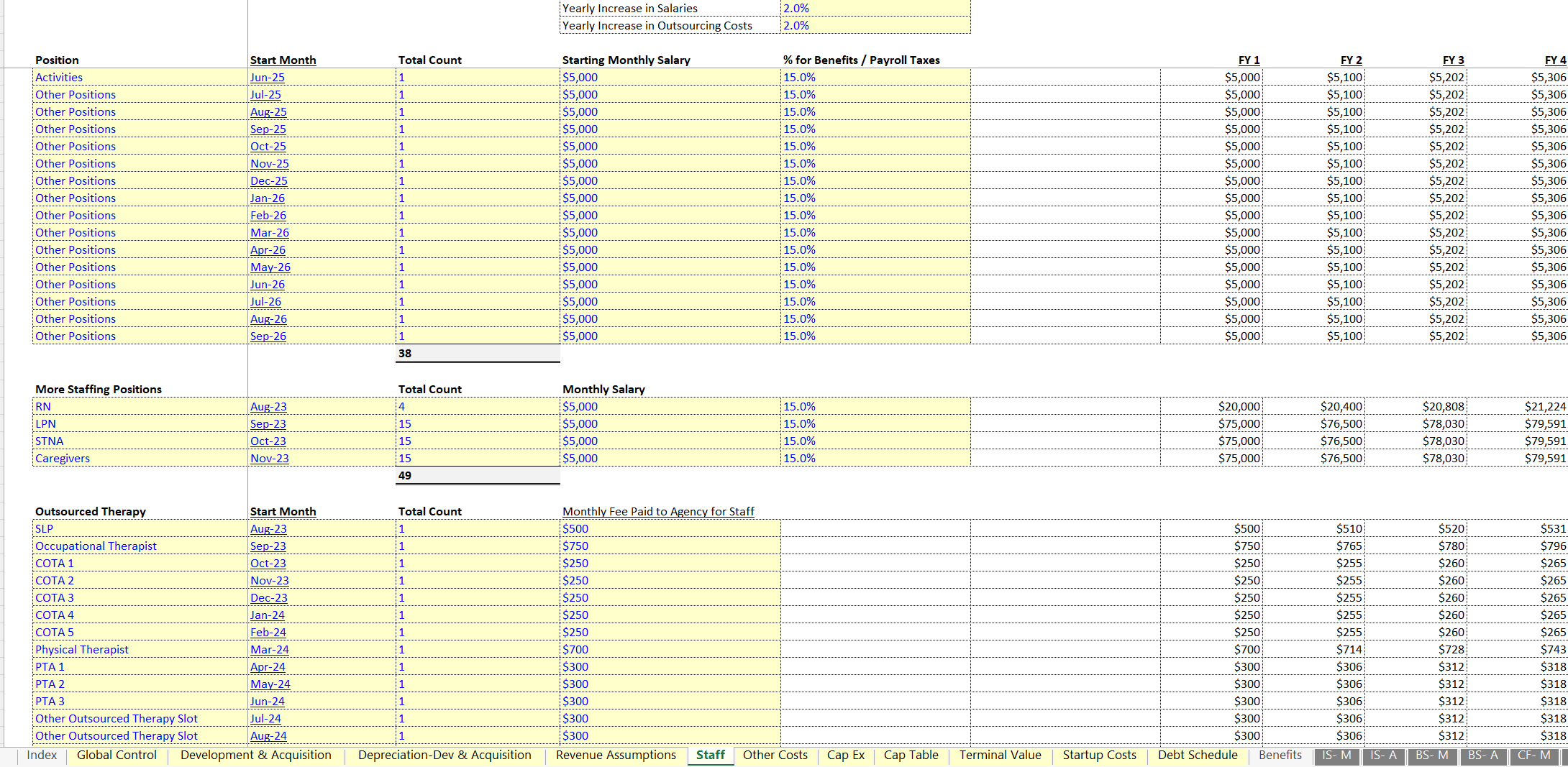

The expenses center around staffing. There are separate schedules for in-house staff vs. outsourced therapy staff and outsourced professionals.

The main use of this model will be to test out various room rates / occupancy rates against the cost to service such activity (staff, overheads, debt service) in order to see feasibility given certain assumptions. You can run poor, base, and excellent sensitivities on the various inputs to see what resulting cash flow requirements will be.

A cap table exists for the option of investors to come in and there is a separate cash flow waterfall that runs off IRR hurdles for the investor group in case that structure is needed. It is most common in real estate deals so I added it in.

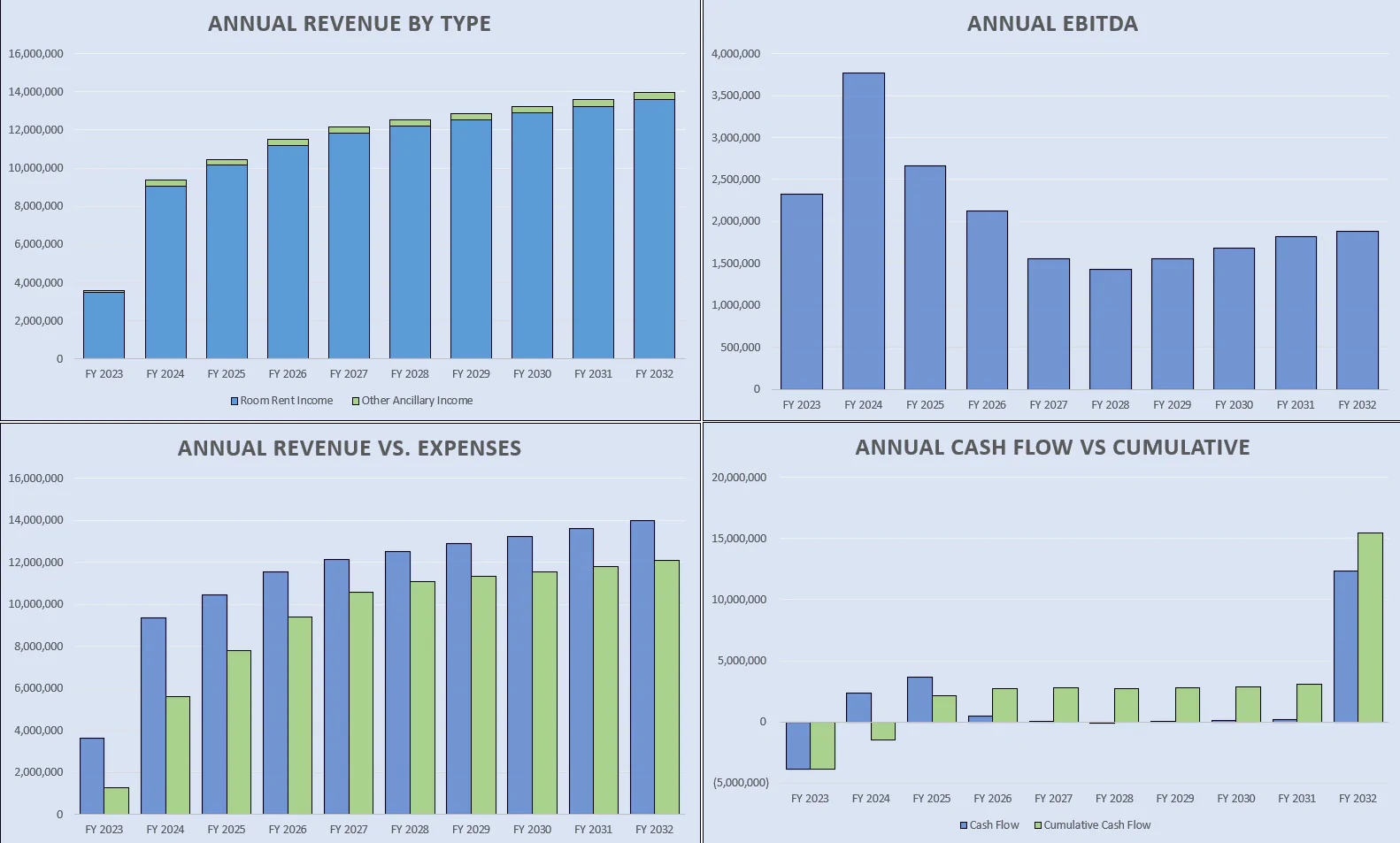

Generate tons of visualizations for key financial metrics as well.

Final Output Reports:

• Monthly / Annual Pro Forma (financial statements)

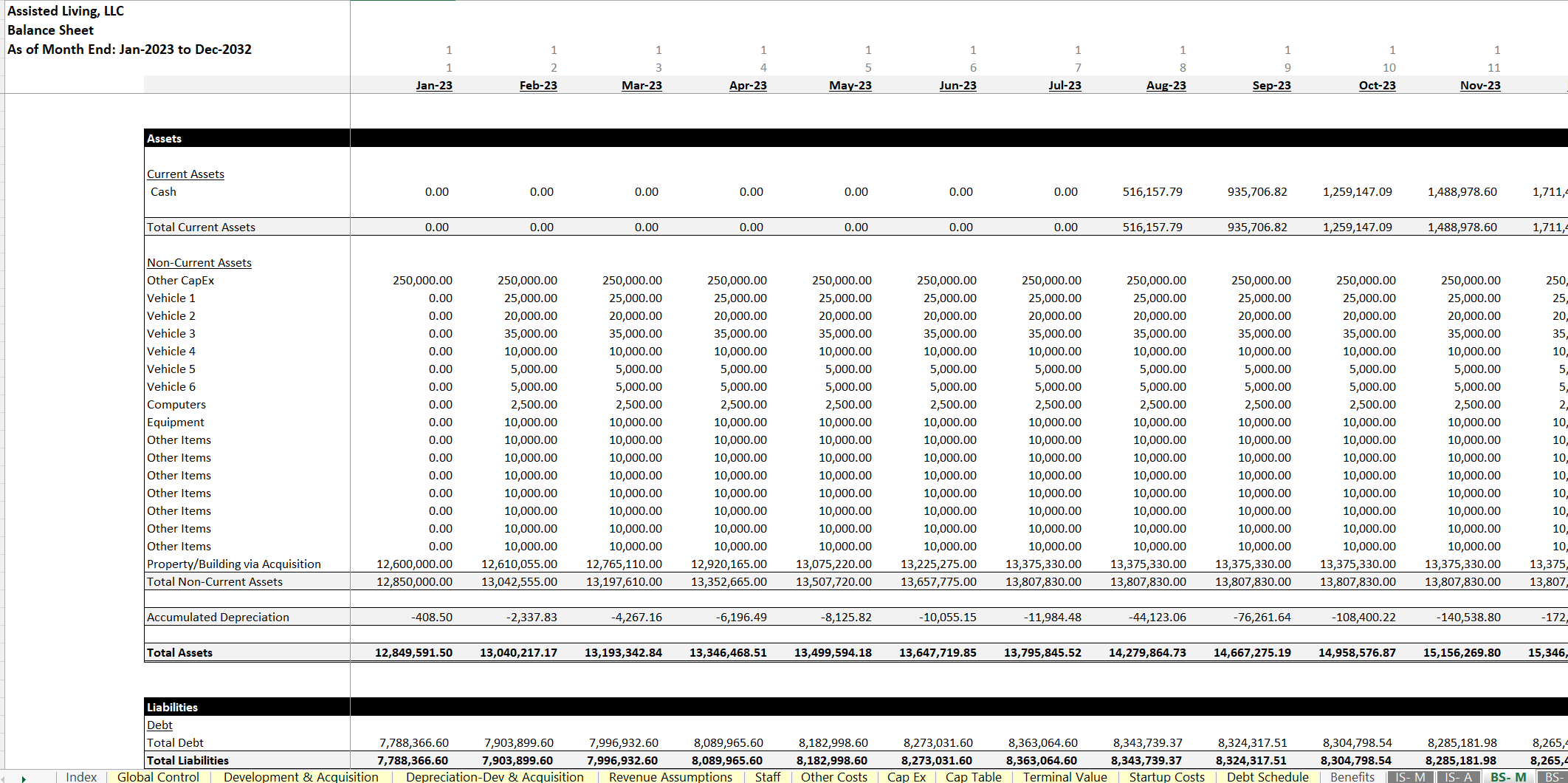

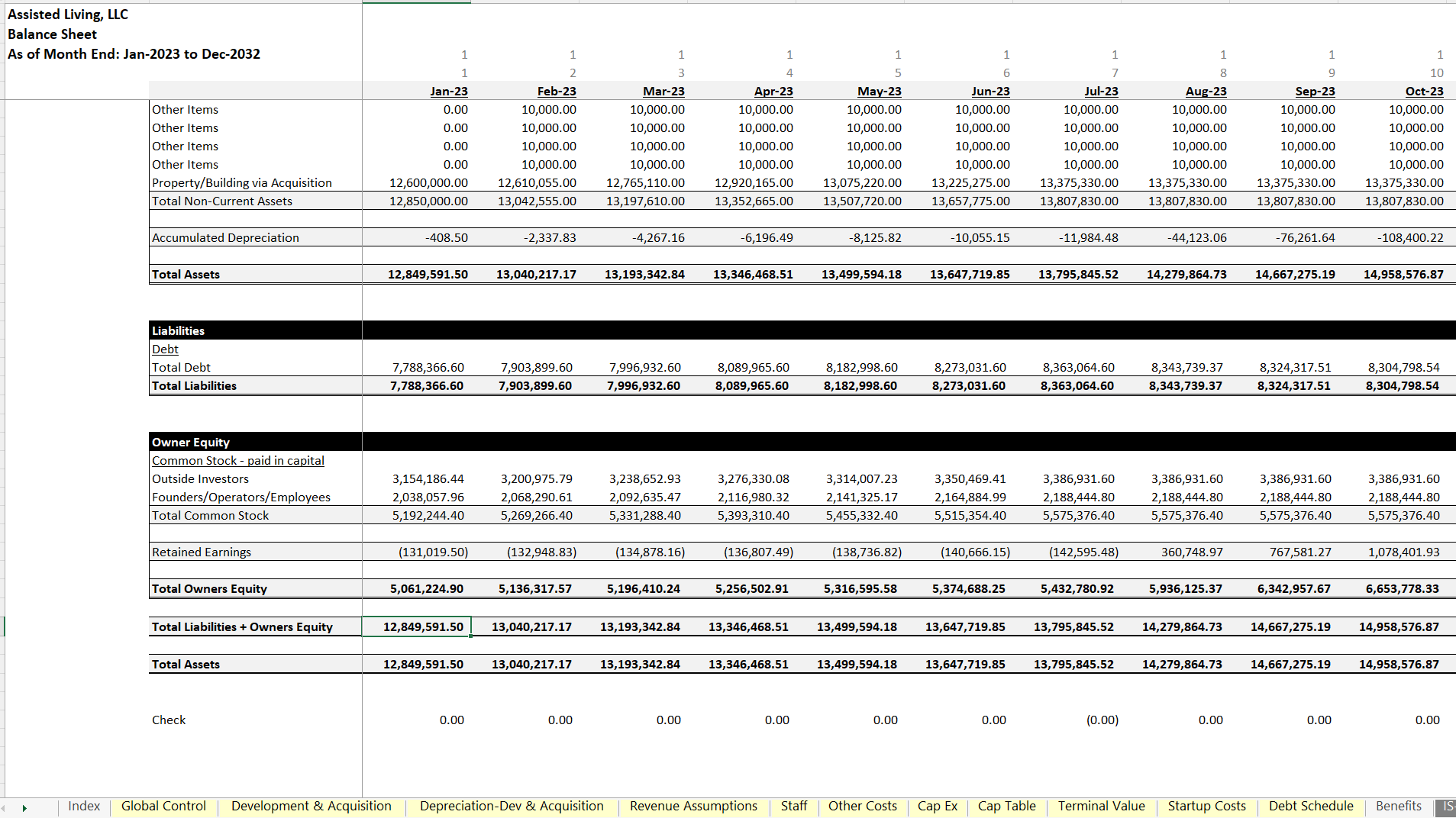

• Income Statement, Balance Sheet, Cash Flow Statement

• Annual Executive Summary

• DCF Analysis / IRR, ROI, Equity Multiple, NPV for project as a whole and investor / owner pools

• Monthly and Annual Detail that shows how all the assumptions come together on the same timeline

This template includes detailed monthly and annual pro forma statements, providing a comprehensive view of financial performance over a 10-year horizon. The model also features extensive visualizations, such as EBITDA vs. debt service ratios and annual revenue breakdowns by room type, to aid in strategic decision-making.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Financial Model for Assisted Living Facility & Nursing Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping