Hydroponics Business: 10 Year Financial Projection Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Informed decision making.

- Profitability Insight

- Investment Attraction

AGRICULTURE INDUSTRY EXCEL DESCRIPTION

Hydroponic farming's unit economics offer a lens into the per-unit profitability of the operation, and these details can vary based on numerous factors like location, farm size, and crop choice. The revenue is primarily determined by the sales price of the crops. Costs encompass various elements like seed cost, nutrients, water, labor, energy, infrastructure depreciation, rent, pest management, packaging, and general administrative overheads.

Profitability is then determined by subtracting these costs from the revenue. Crucial factors influencing profitability include the yield (often higher in hydroponics due to faster growth cycles), crop choice, scale of operation, wastage, and the incorporation of technology, which can optimize operations but demands initial investment.

To ascertain the viability of a hydroponic venture, it's essential to analyze this data to understand per-unit profitability and to then conduct a comprehensive assessment of broader operational and capital expenses. This gives a holistic view of the farm's overall economic health.

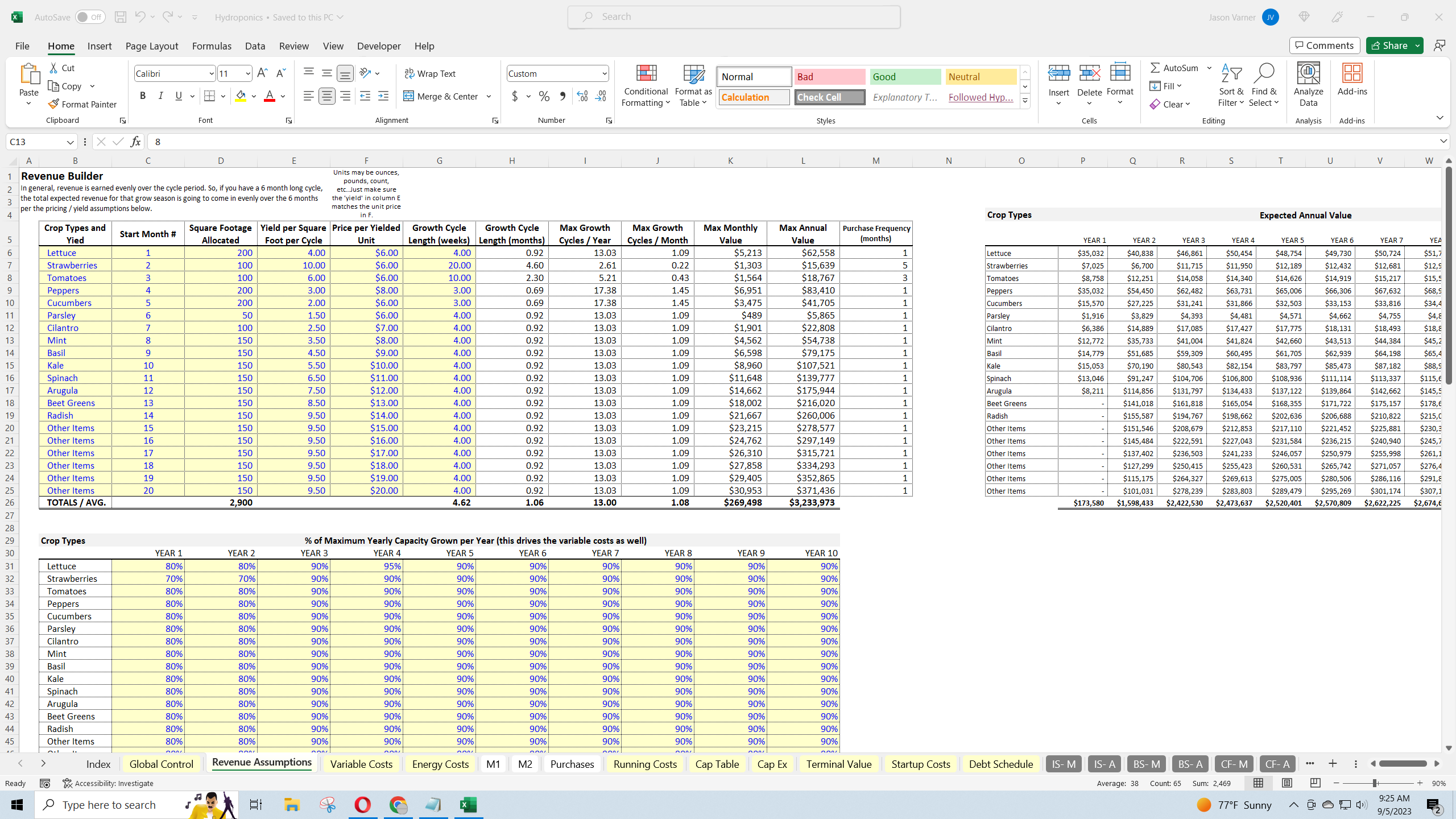

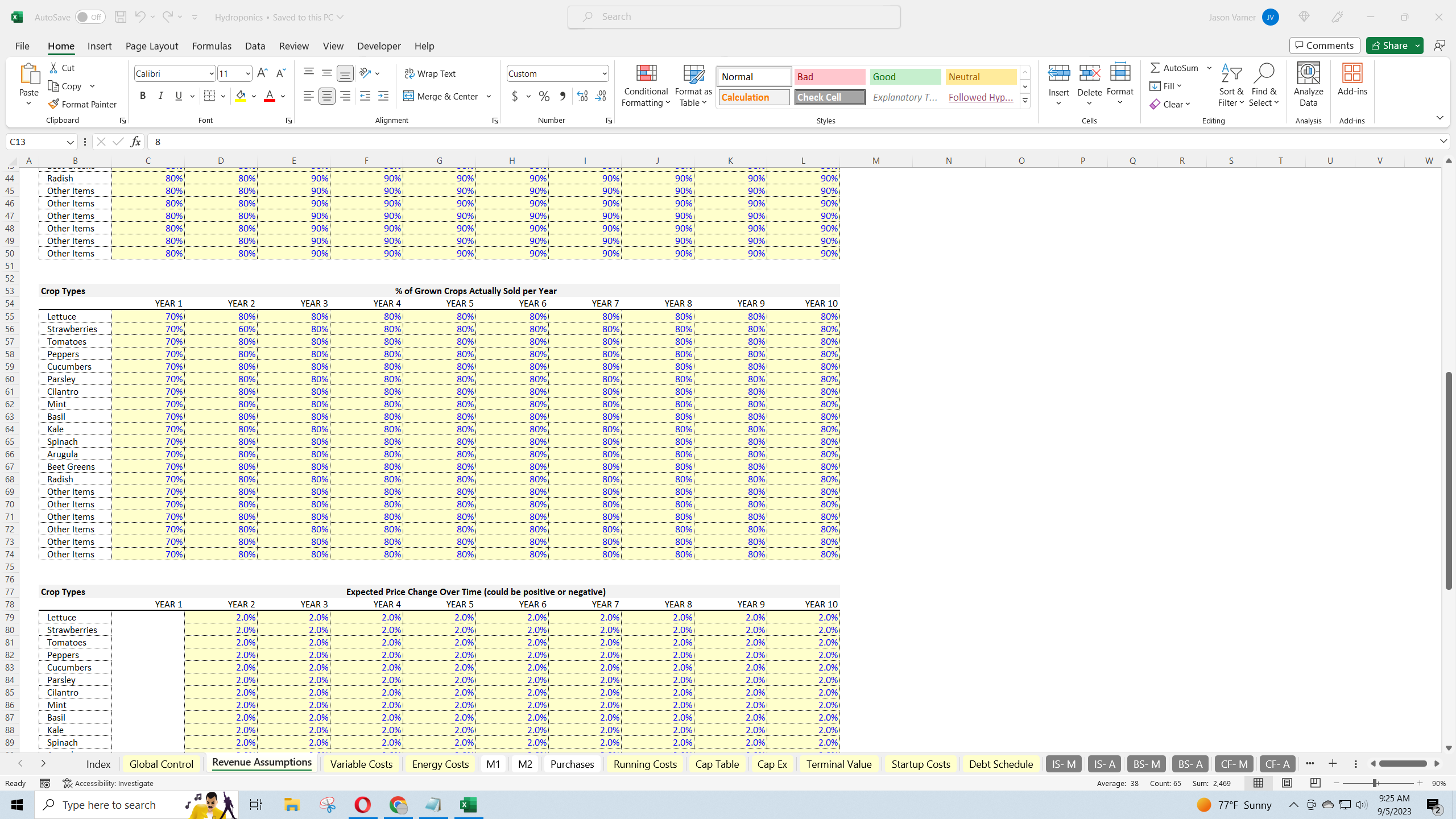

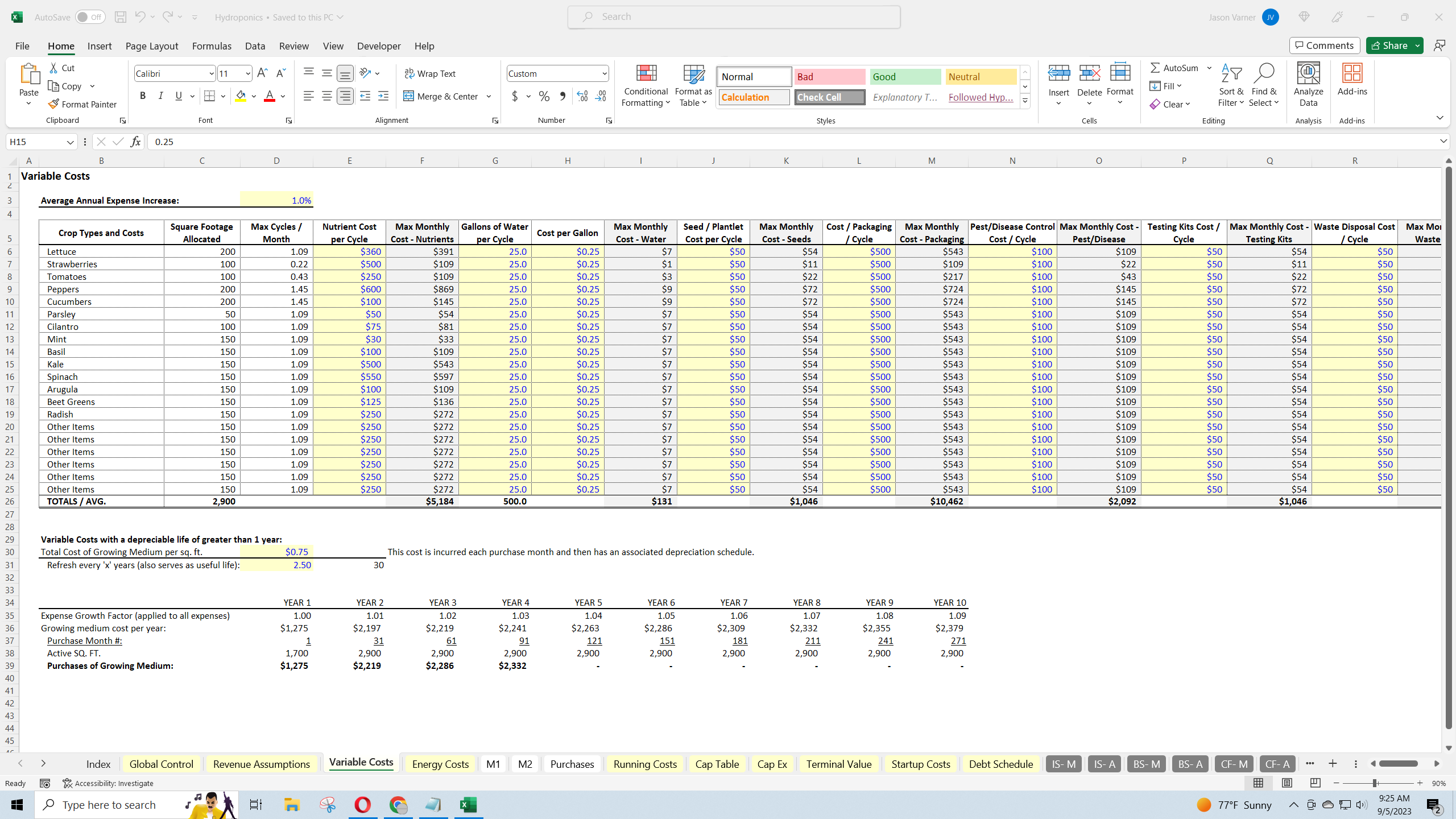

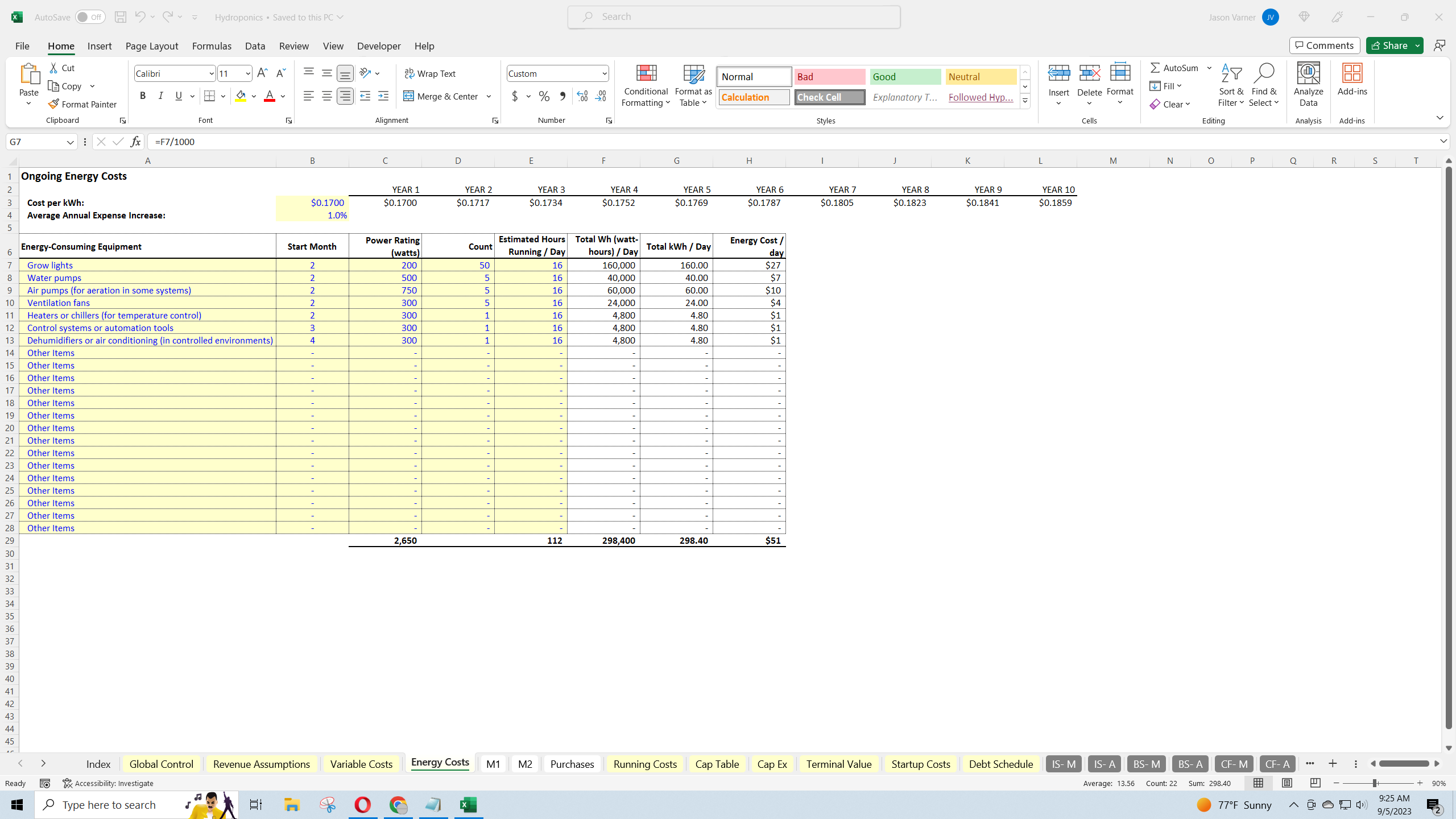

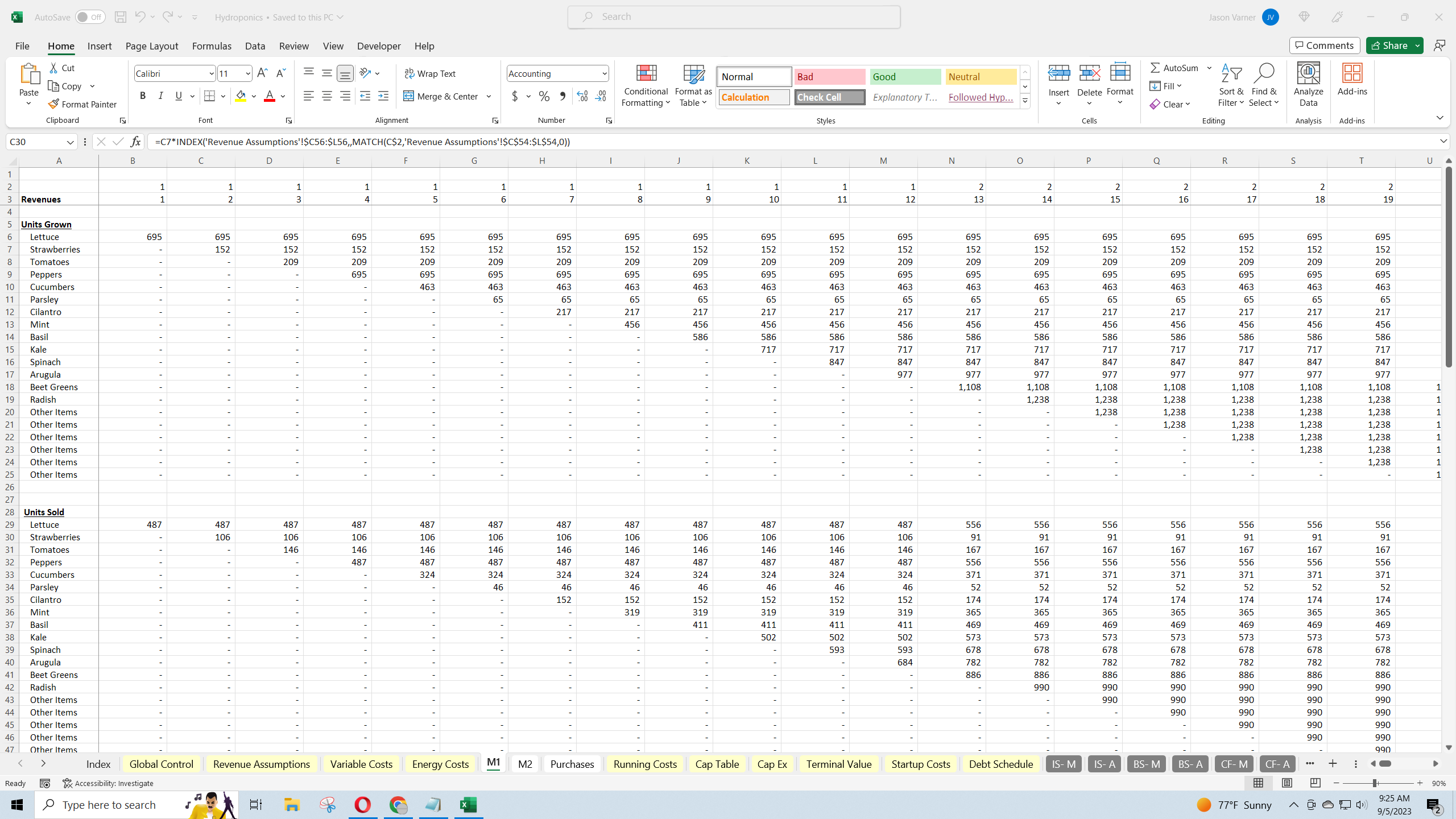

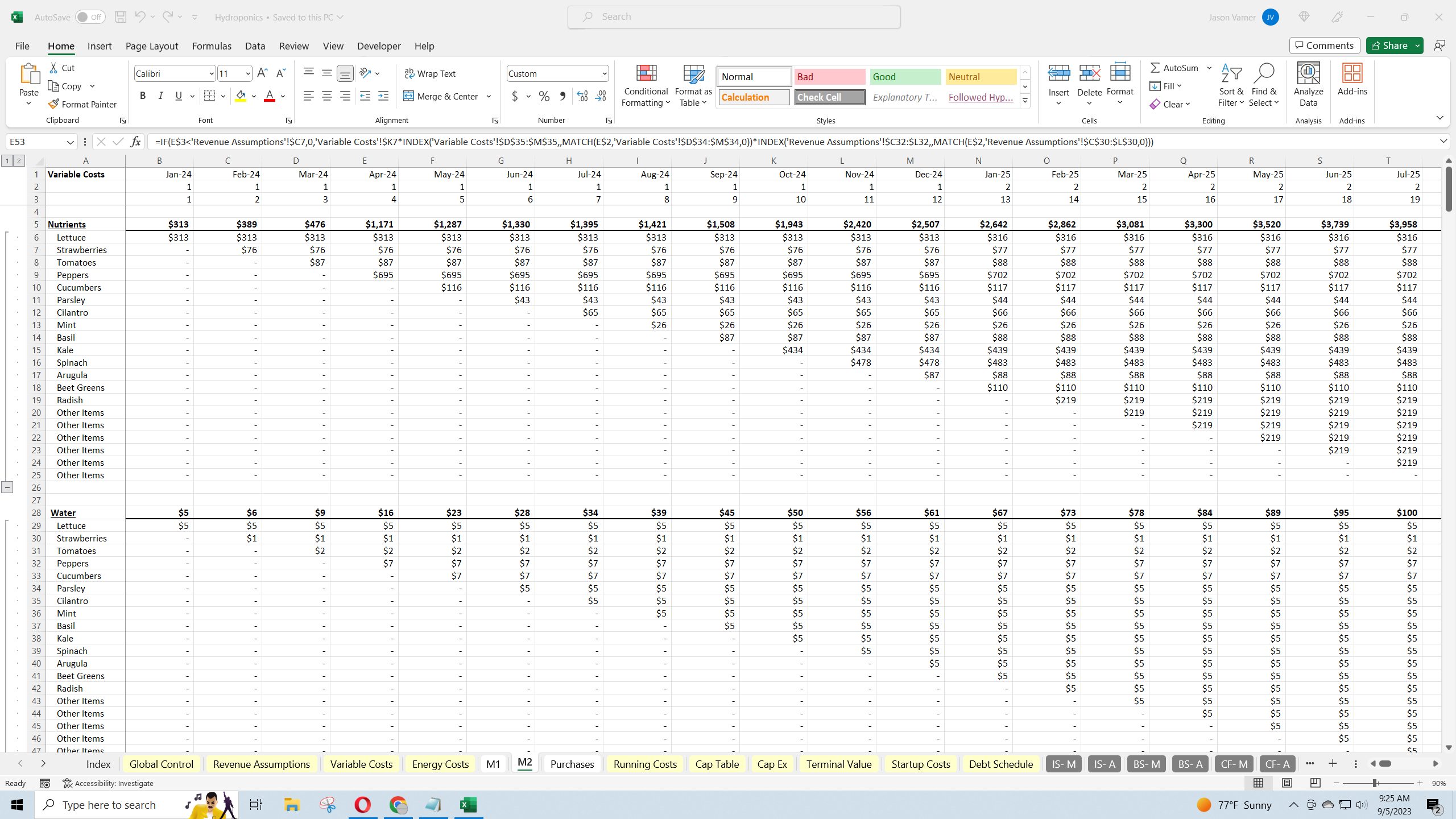

This financial model lets the user drive all data based on growth cycles, their length, and what kinds of yields can be produced within that time frame as well as the costs within that timeframe. The inputs are calculated into monthly values in order to produce a clean monthly and annual pro forma that covers all aspects of the financial simulation.

Editable variables are configurable for up to 20 crop types. Each 'type' can start at a different 'starting month'. You will also define the square footage allocated to each type, the growth cycle length of each, yield per square foot, and price of yielded production. If you are planning to start small and expand, you can use each 'type' as a new expansion that is the same crop. It could be in a different area with different unit economics and the model lets you account for that. Additionally, there are equipment purchasing schedules (depreciable items) that can be configured over time as well to match the expansion plan as well as energy usage, which is driven by an input for start month, average watts, and average cost per kWh.

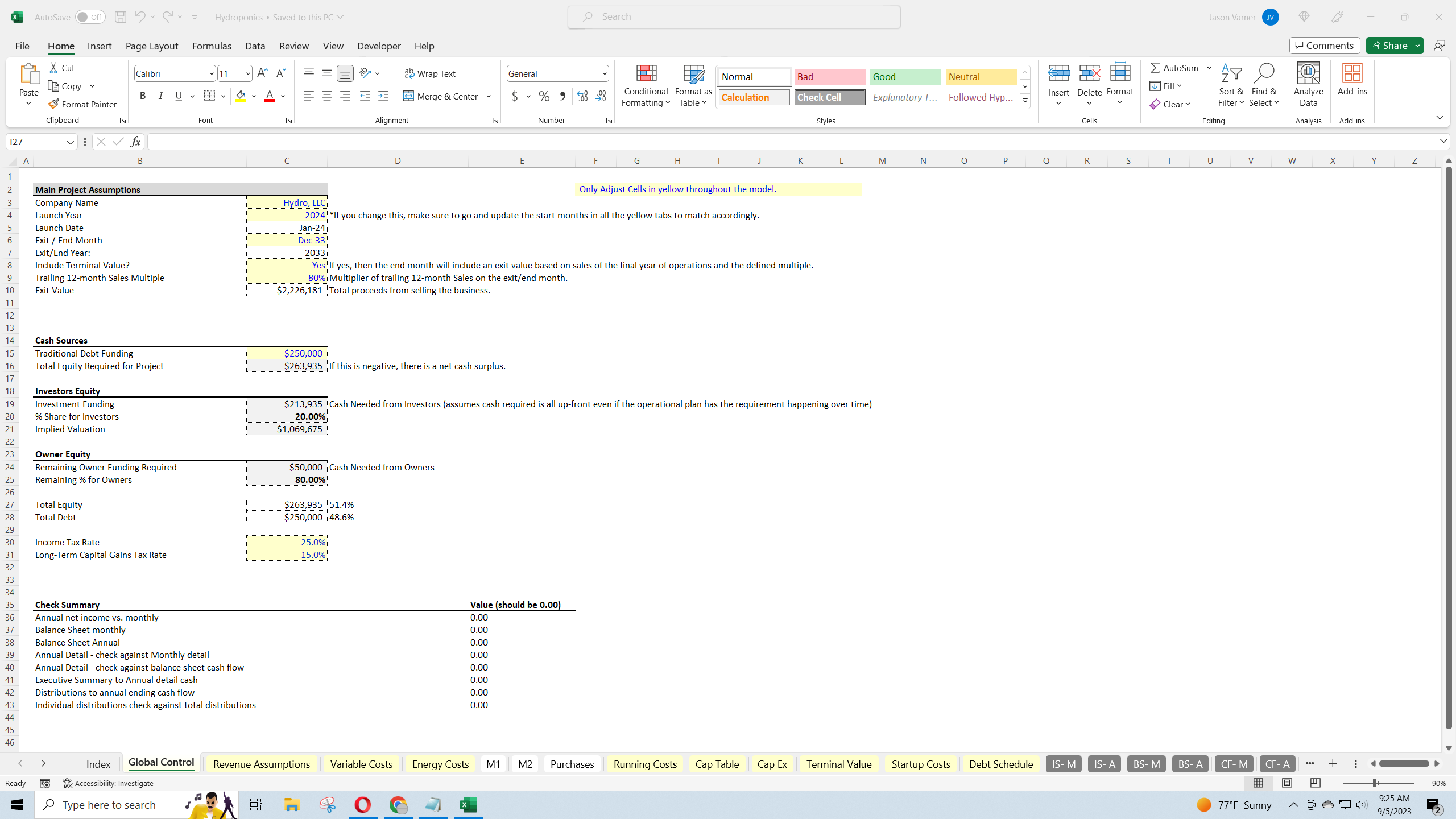

I included a DCF Analysis, IRR, ROI, Equity Multiple (MOIC), and broke that down for the project as a whole and inside / outside investors. You can also finance some of the initial capital requirements with debt.

This template provides a robust framework for assessing the financial viability of your hydroponic business over a decade. With detailed projections on revenue, costs, and cash flow, it empowers decision-makers to make informed choices and strategically plan for growth.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Agriculture Industry, Integrated Financial Model Excel: Hydroponics Business: 10 Year Financial Projection Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping