Equipment Rental Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

ASSET MANAGEMENT EXCEL DESCRIPTION

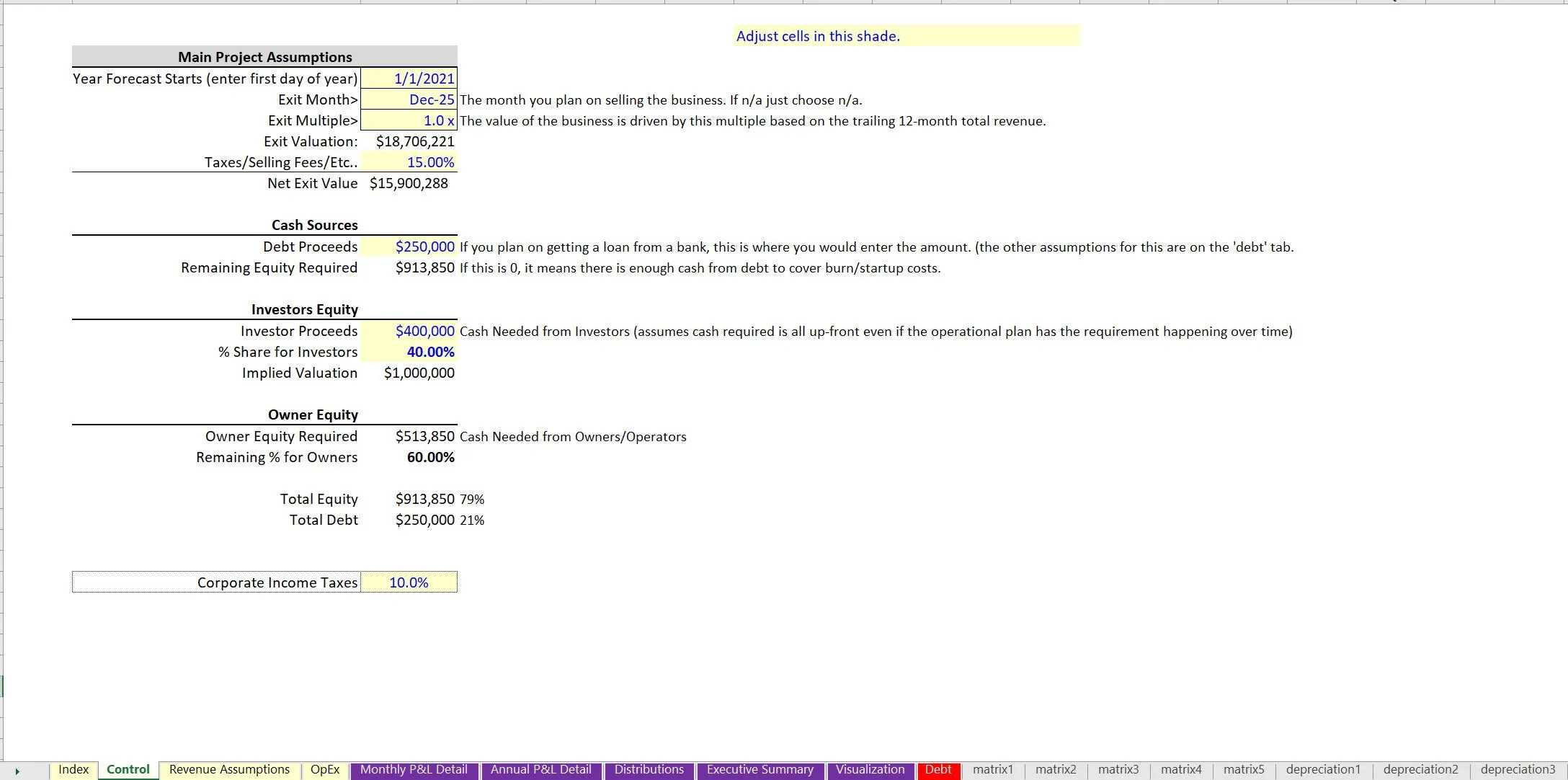

Recent Update: Integrated with formal financial statements (Income Statement, Cash Flow Statement, and Balance Sheet) monthly and annual periods as well as been updated with a capitalization table (cap table), dynamic exit month if applicable, distributions, startup cost schedule, and better general formatting conventions.

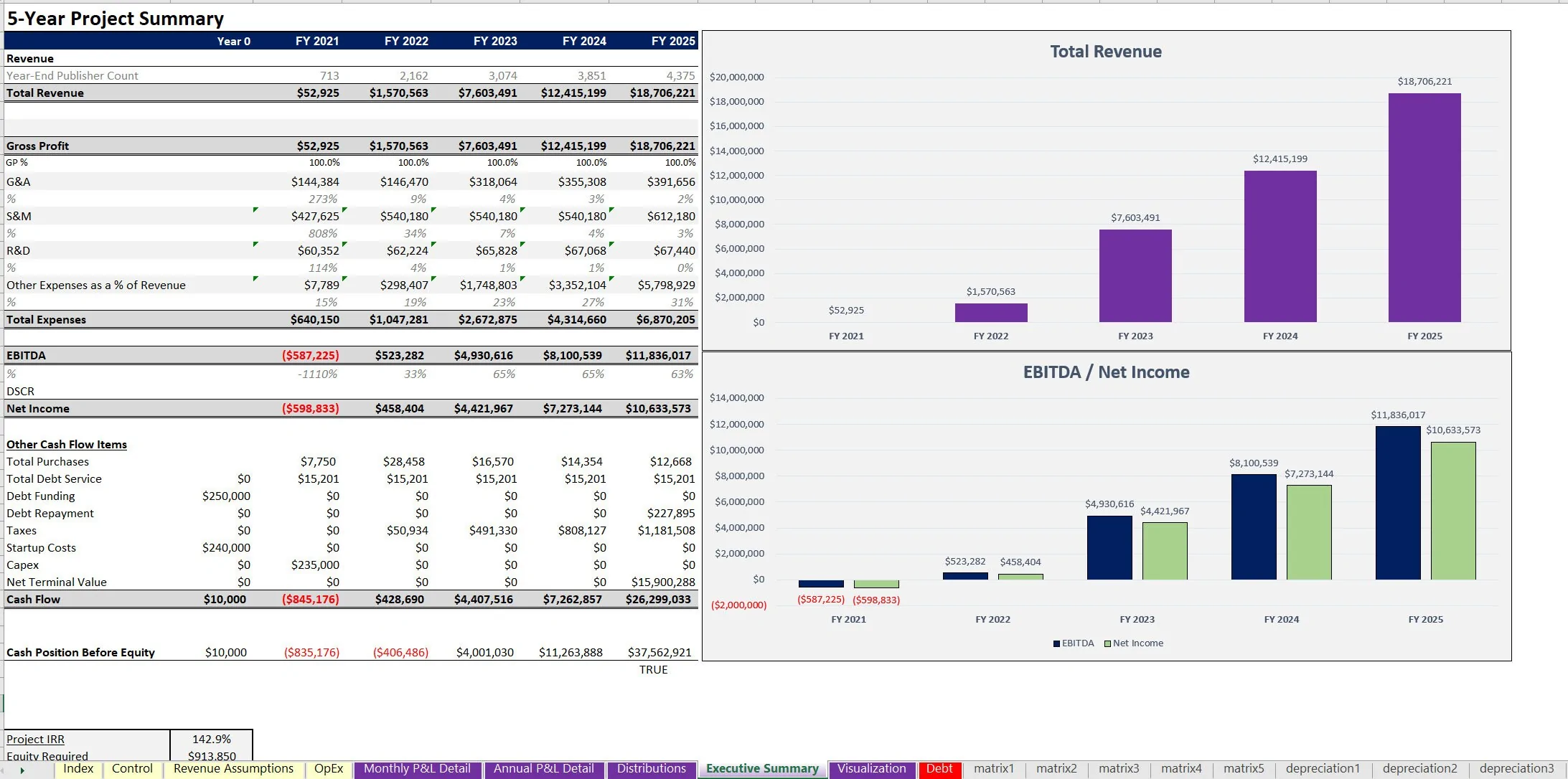

If you are looking to get into the cash flow business of equipment rental, this template will help you plan out expected cash requirements, revenues, expenses, and returns over a 5-year period.

The logic was structured so this template can be used for the rental of any tangible good, not just equipment. Car rental, tool rental, furniture rental, electronic device rental, and more would all fit the assumptions.

It was built with the following configurations:

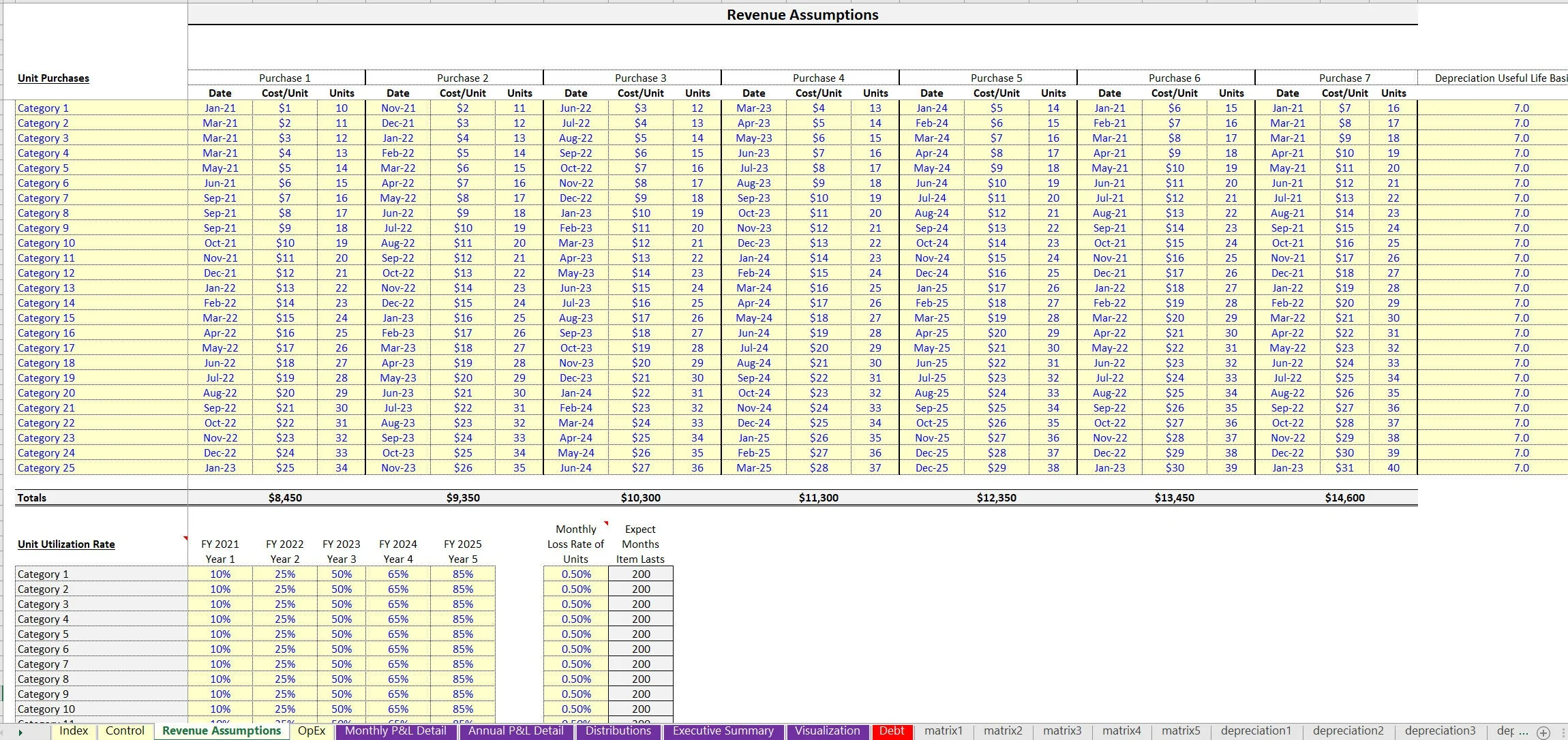

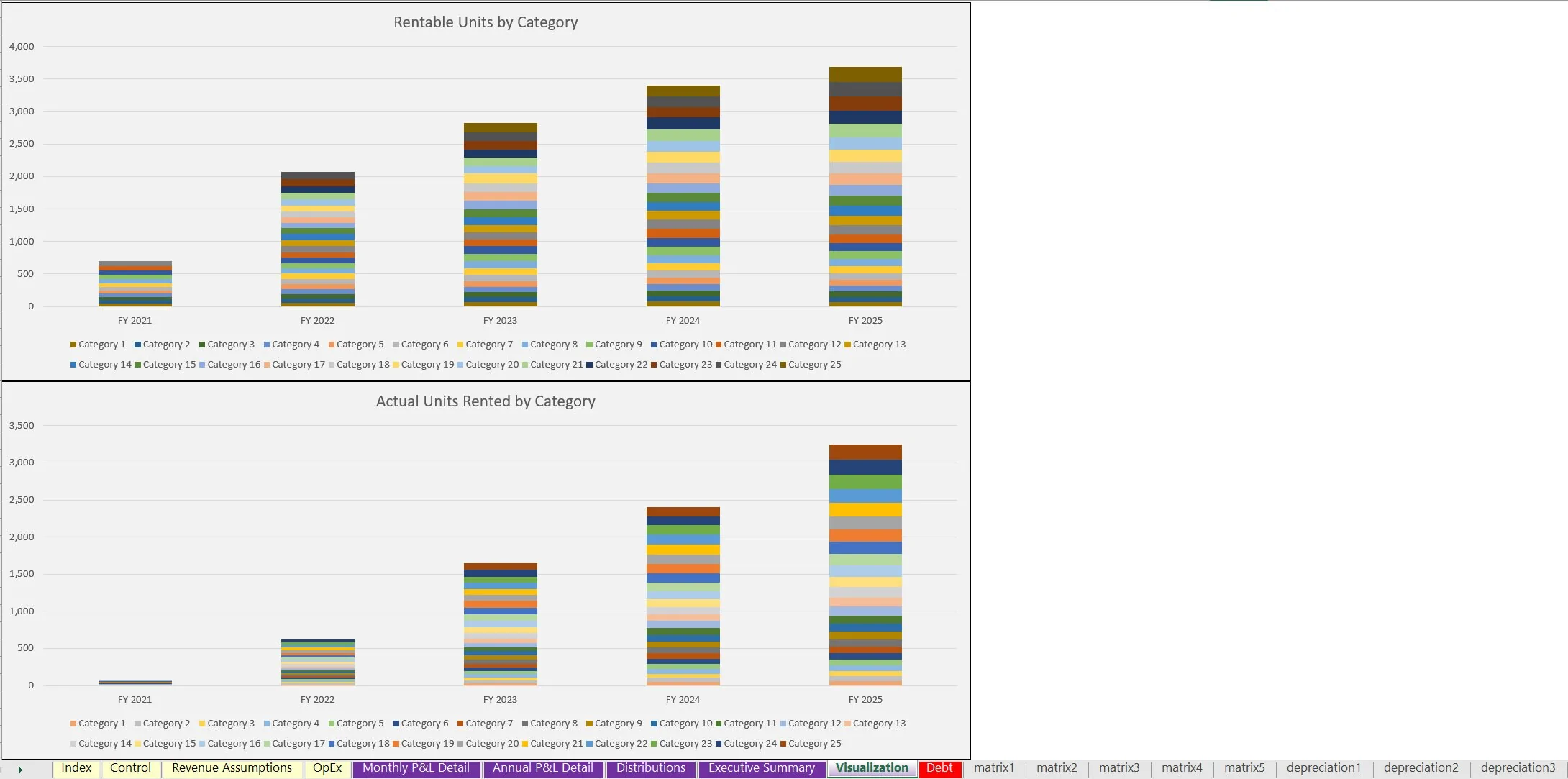

• Up to 25 categories of units

• Up to 7 separate purchase tranches for each category

For each category, define:

• Date of Purchase

• Cost per Unit

• Unit Count

The revenue logic begins at the start date of each purchase tranche. For each of the 25 categories, the user can define the utilization rate over time, the loss rate over time (account for units becoming obsolete), and the rental fees per unit per day and average uptime per month (in days).

The depreciation is automatically calculated after a given batch of units is purchased based on a defined useful life. This is integrated into the pro forma as well. A unique feature of this model is that the user can define the frequency that units get rented out for i.e. every 2 months, monthly, or every 'x' months. Based on that, there is a defined cost to deliver and pickup.

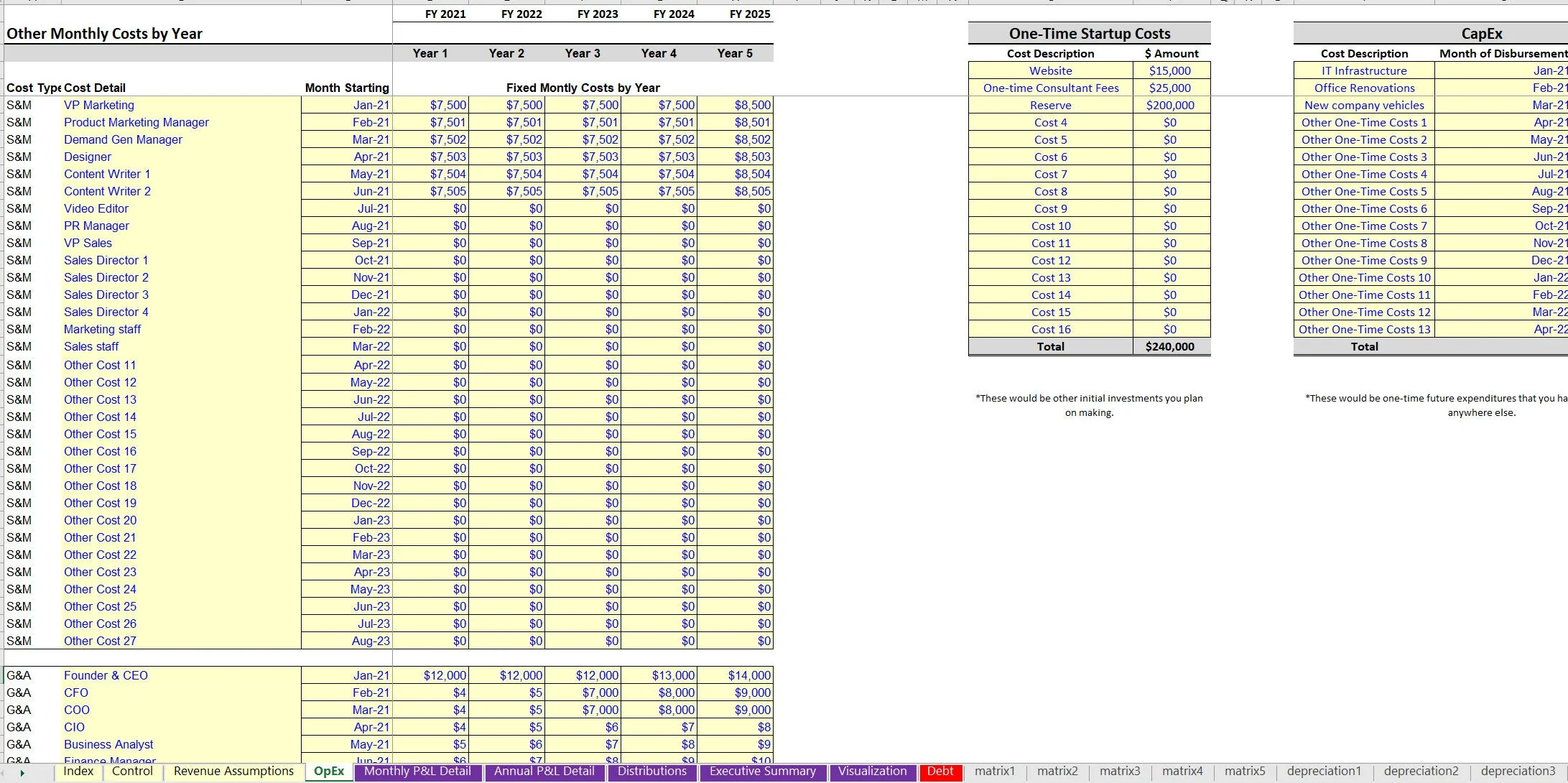

This goes down to a granular basis on a per category and per purchase tranche unit group in order for more accurate calculations. General operating expenses are defined with over 60 slots as well as up to five category slots that are defined by a percentage of revenue.

There are also areas to enter one-time startup costs outside of equipment purchases and future capex outside of purchases of units to be rented.

Final output summaries include:

• Monthly and Annual pro forma detail

• Annual Executive Summary

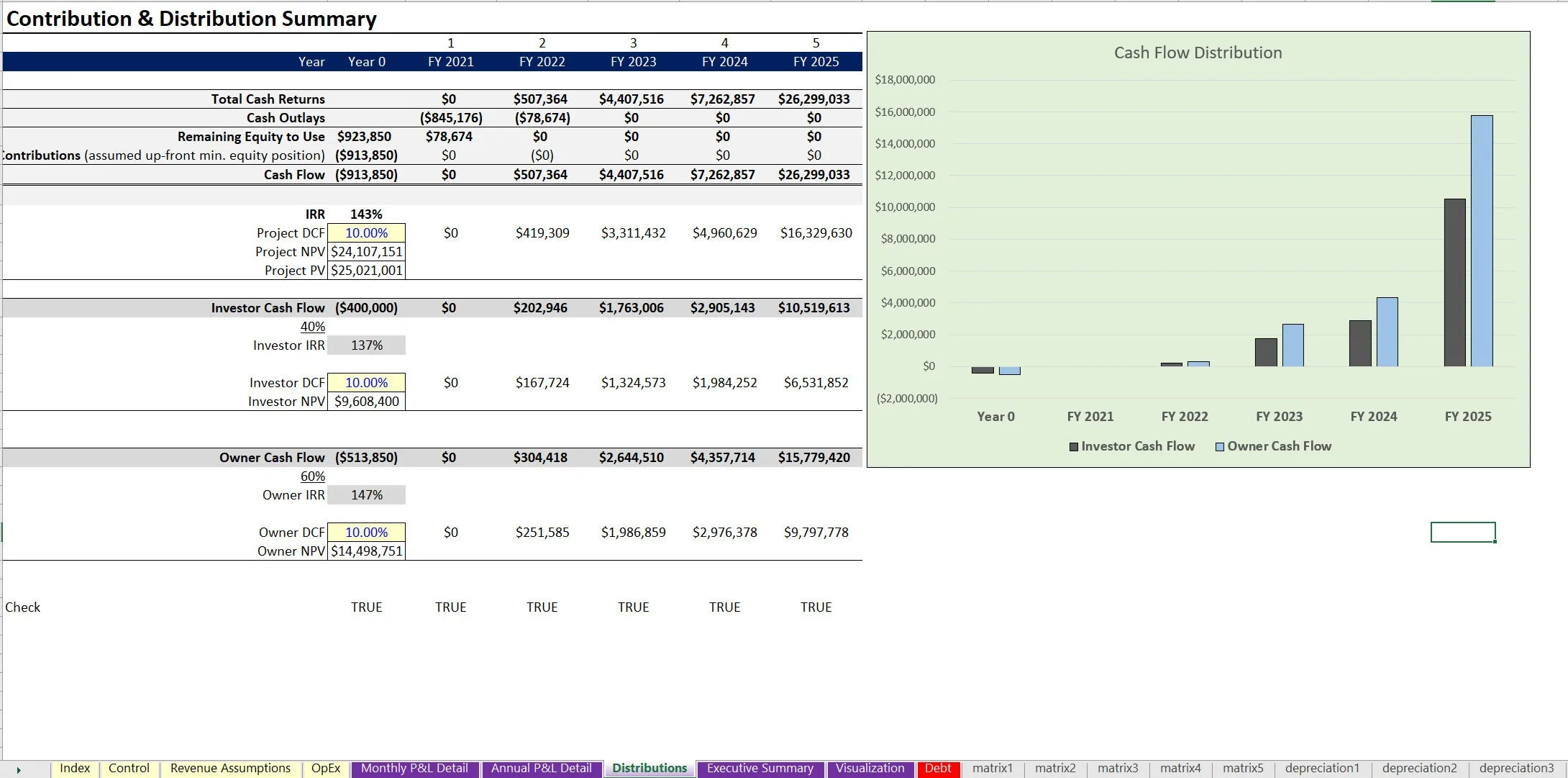

• DCF Analysis (project / owner / investor) and IRR / ROI

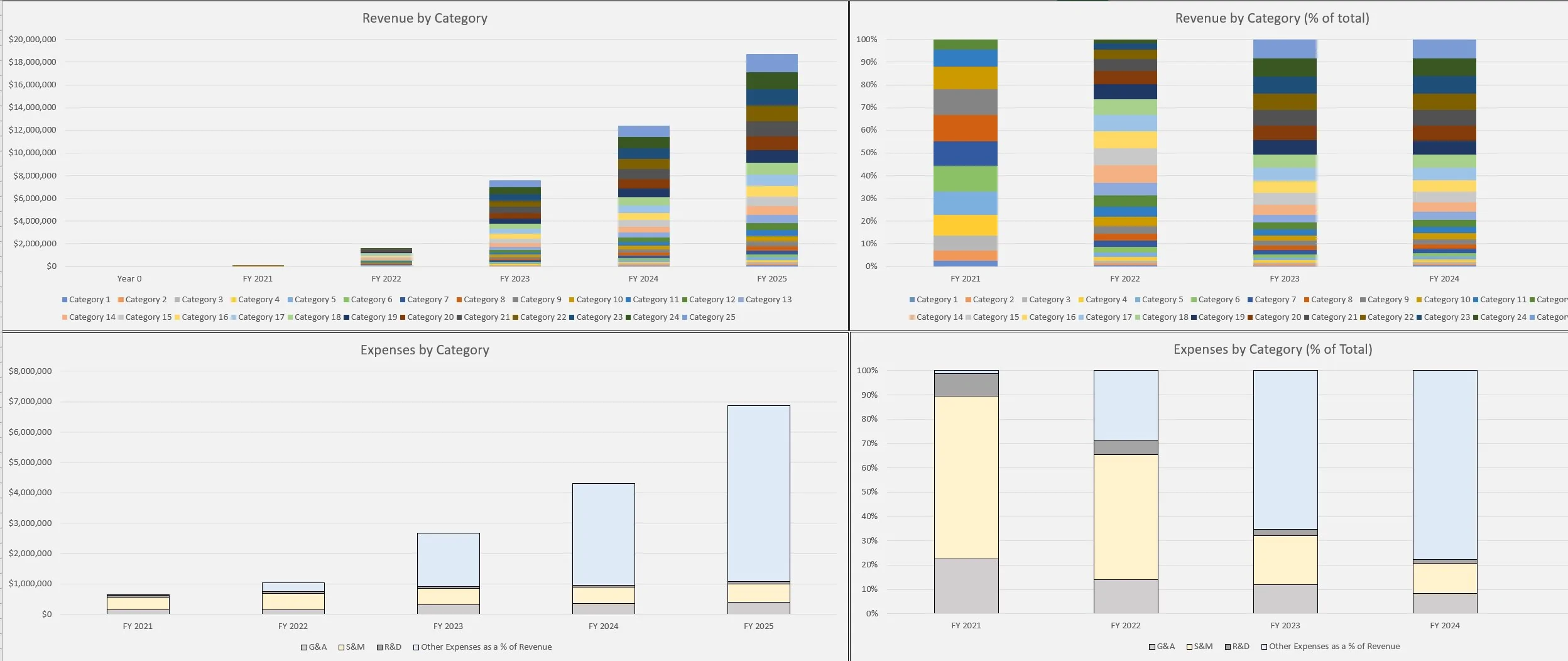

• Lots of visualizations

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Asset Management, Integrated Financial Model Excel: Equipment Rental Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping