Single Tenant Industrial Real Estate Deal Scenario Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Analyze various single tenant industrial real estate opportunities and create dynamic pro forma financial statement forecasts.

REAL ESTATE EXCEL DESCRIPTION

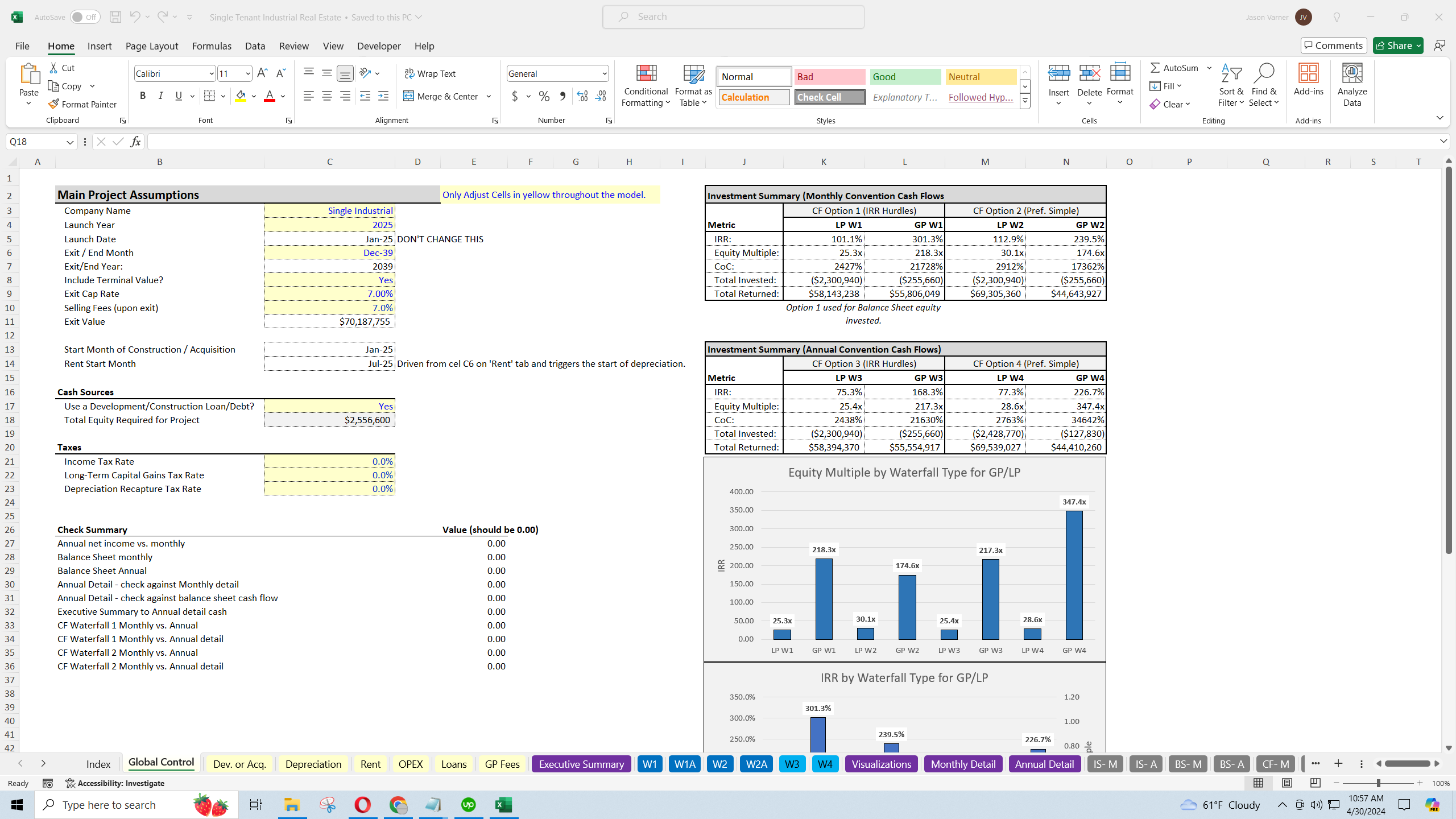

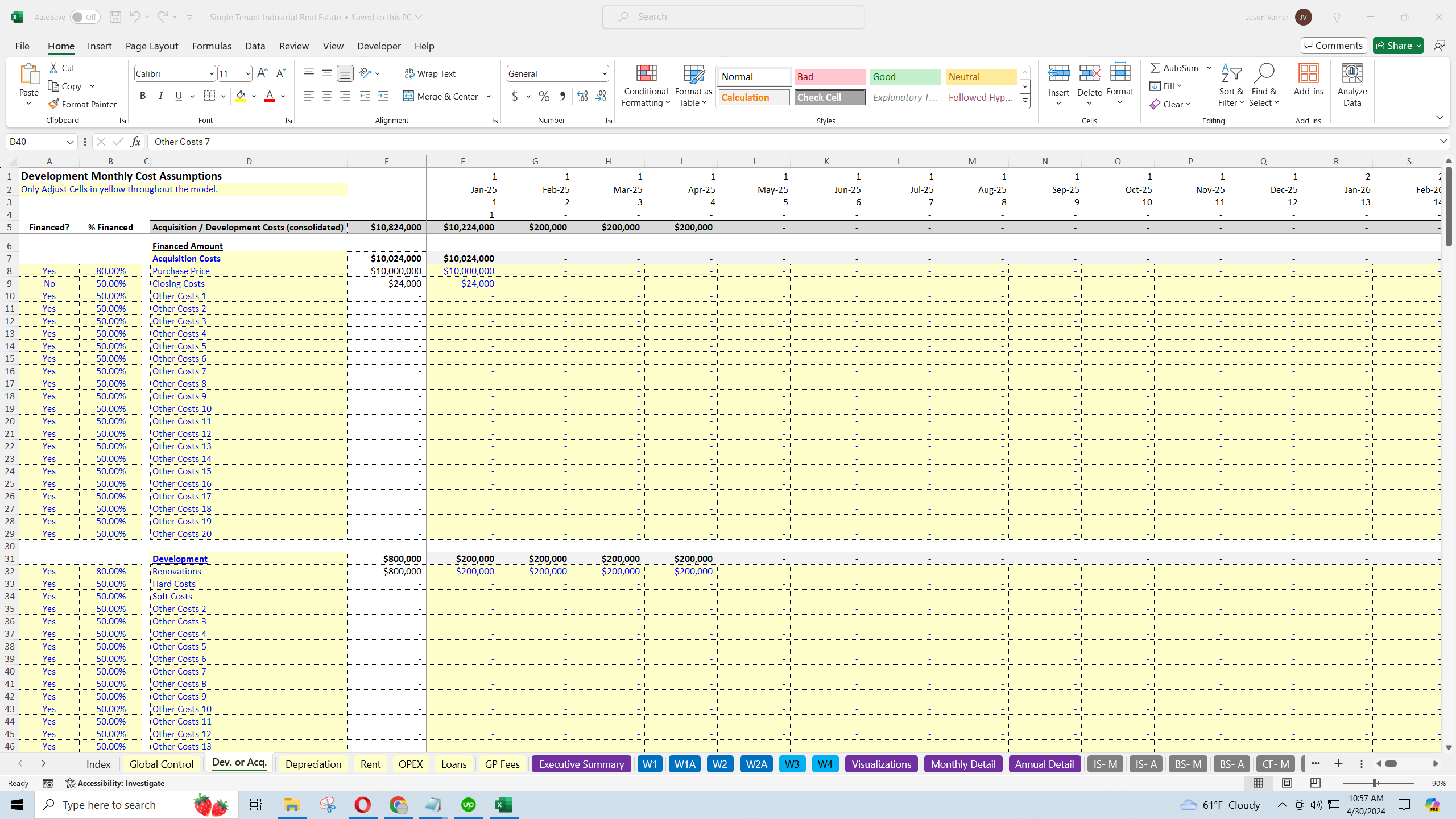

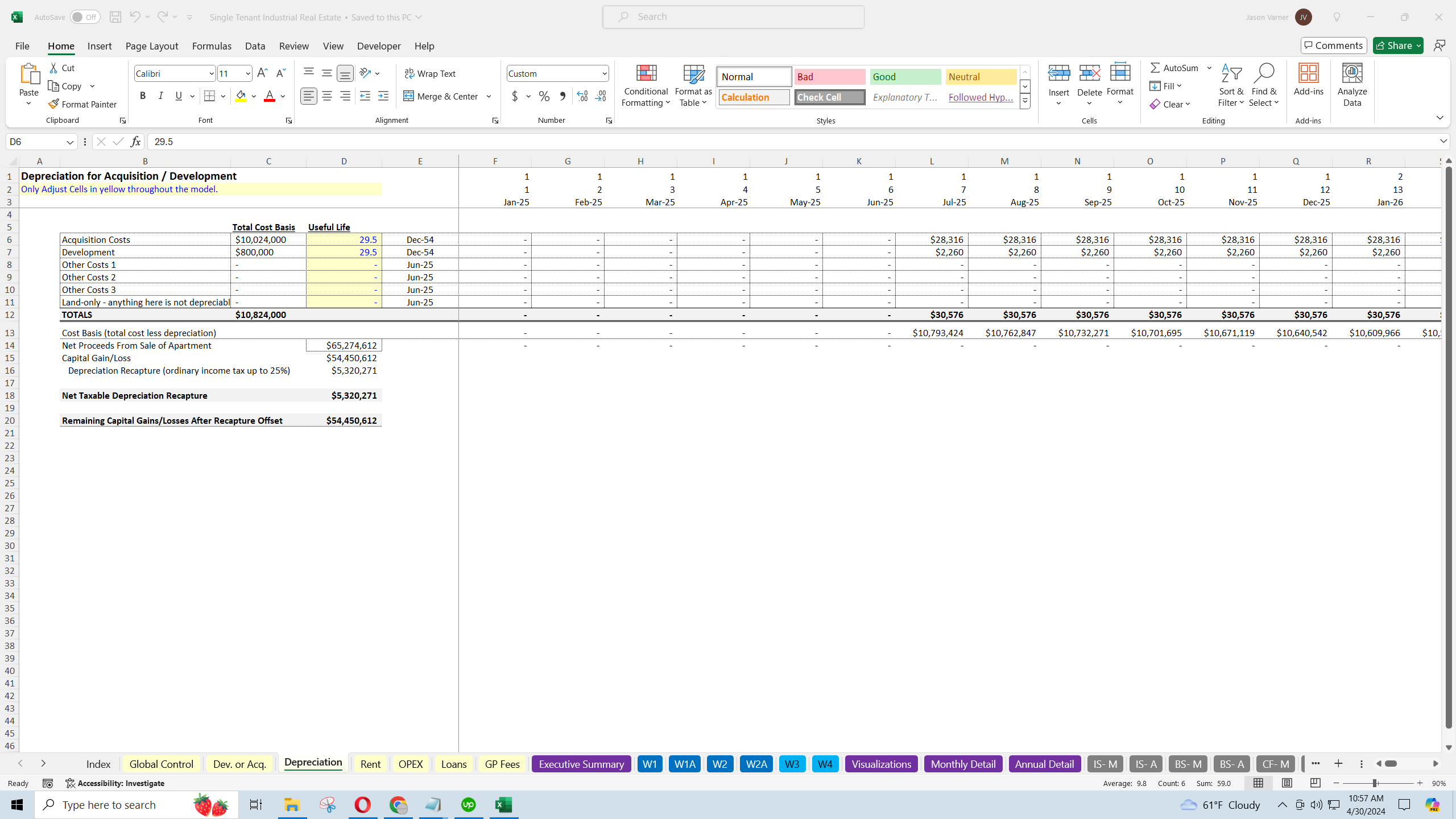

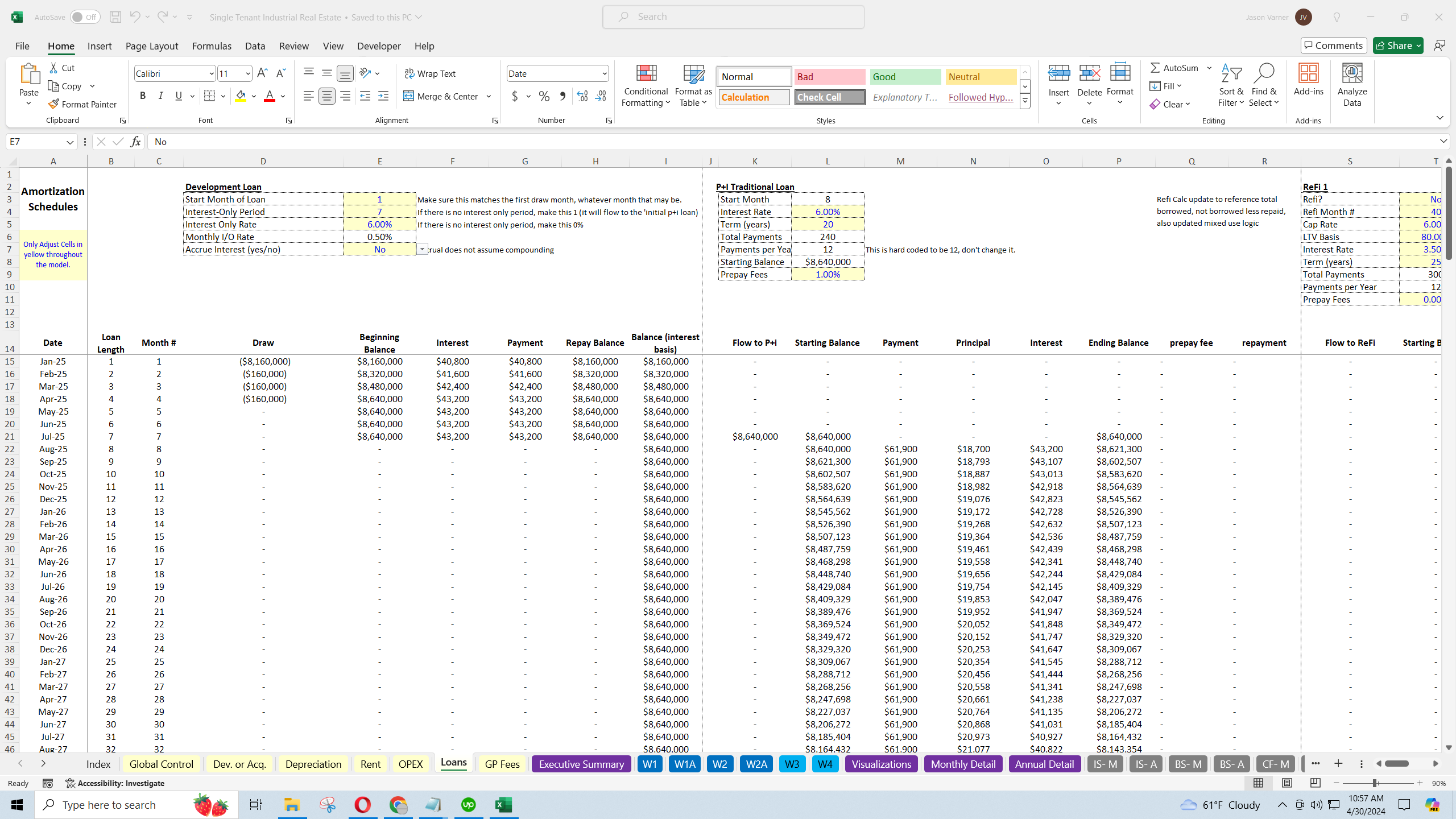

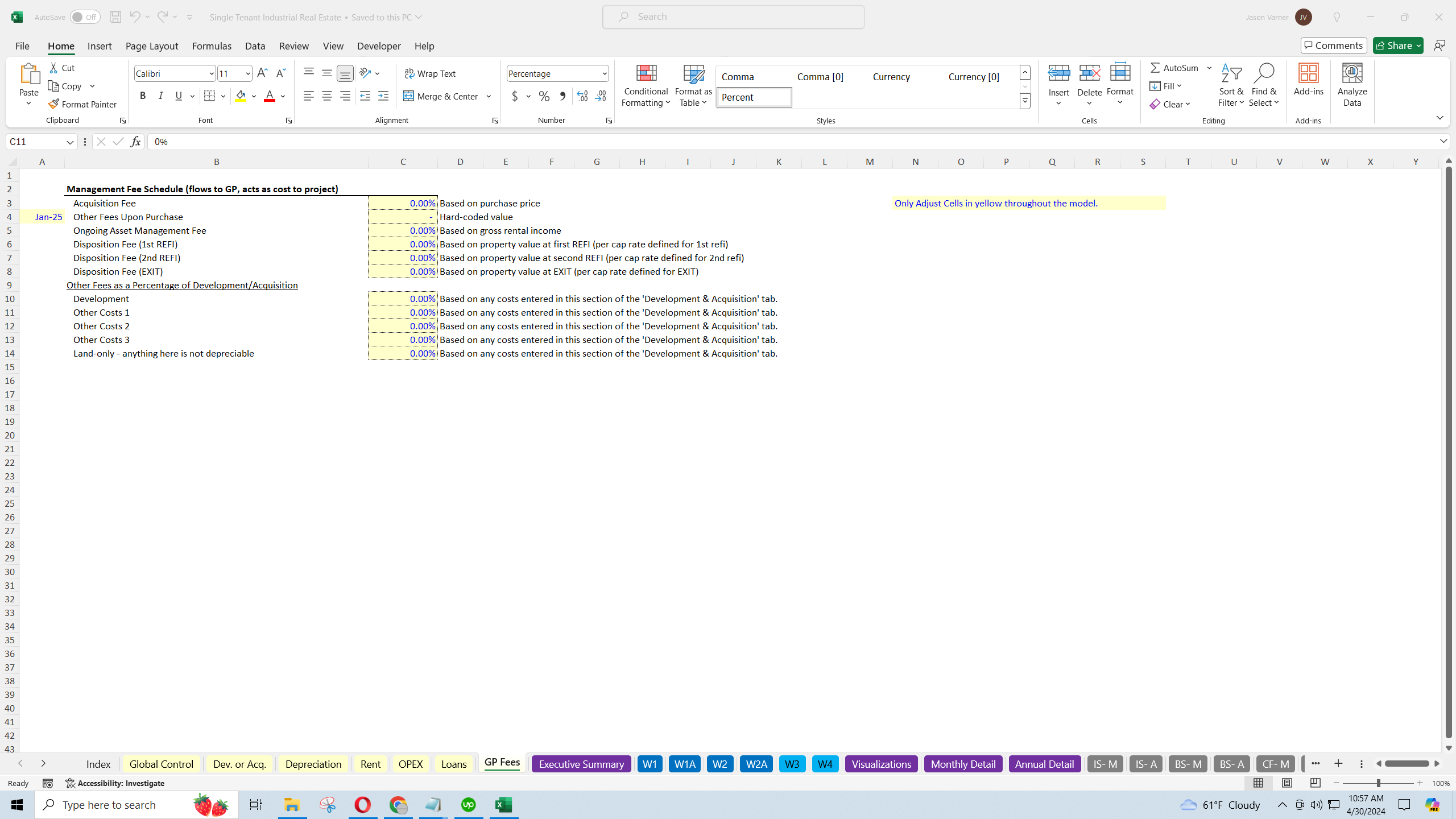

The model's outputs look at 4 potential joint venture scenarios with preferred returns or IRR Hurdles depending on what type of waterfall you want to see modeled. There are many different GP fee configurations and robust assumptions for development / acquisition costs, revenue, expenses, taxes, depreciation, and exit valuations.

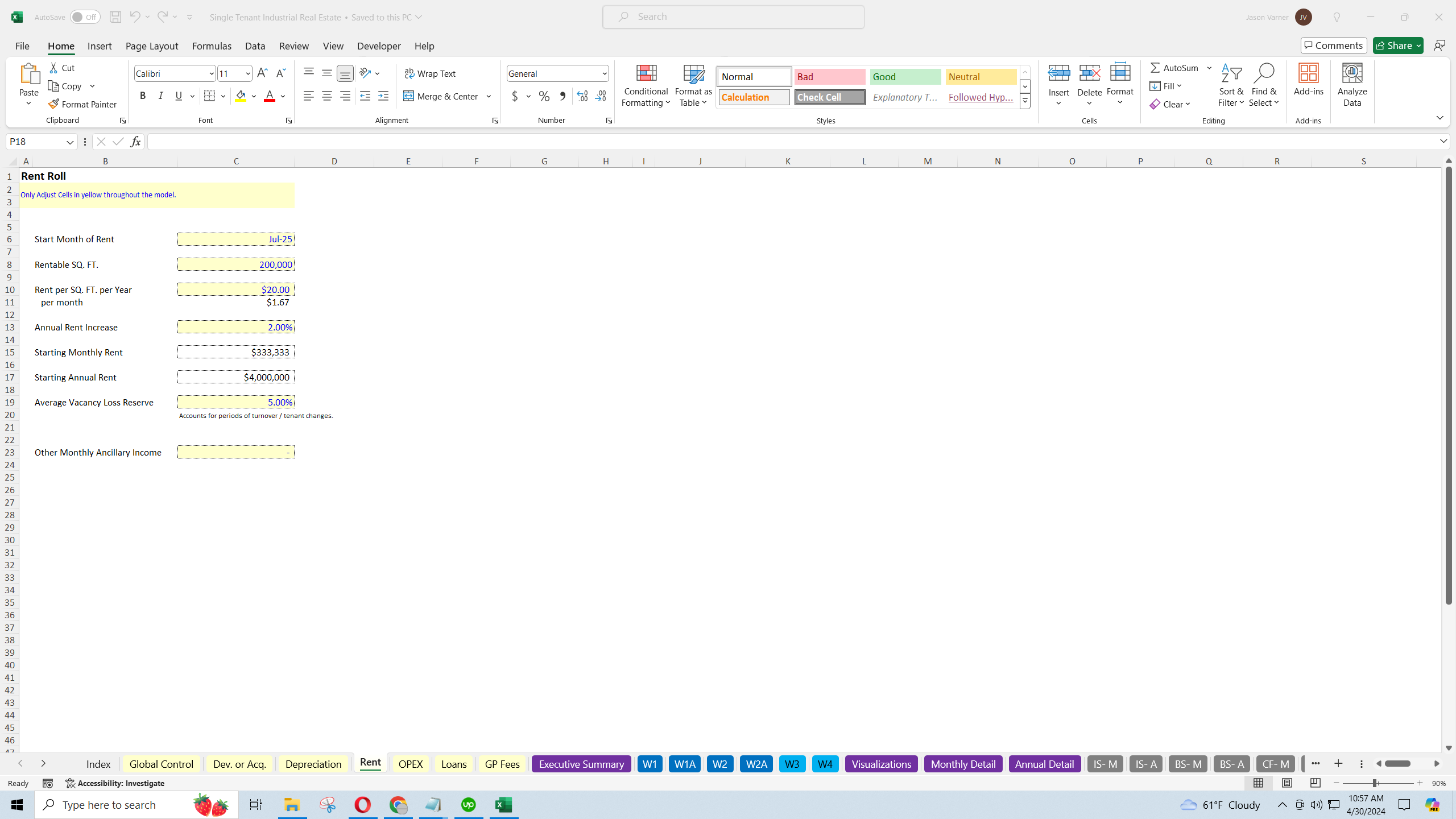

The underlying operating model is straightforward as you are just defining rentable SQ. FT., starting rent amount per SQ. FT., and escalation. There is also an input to account for tenant turnover / vacancy, which you can define as an average rate that reduces the maximum potential rent per period. This is kind of like a lease loss reserve. Finally, there is an input for other ancillary income as some cases may need to account for revenue from parking fees and so forth.

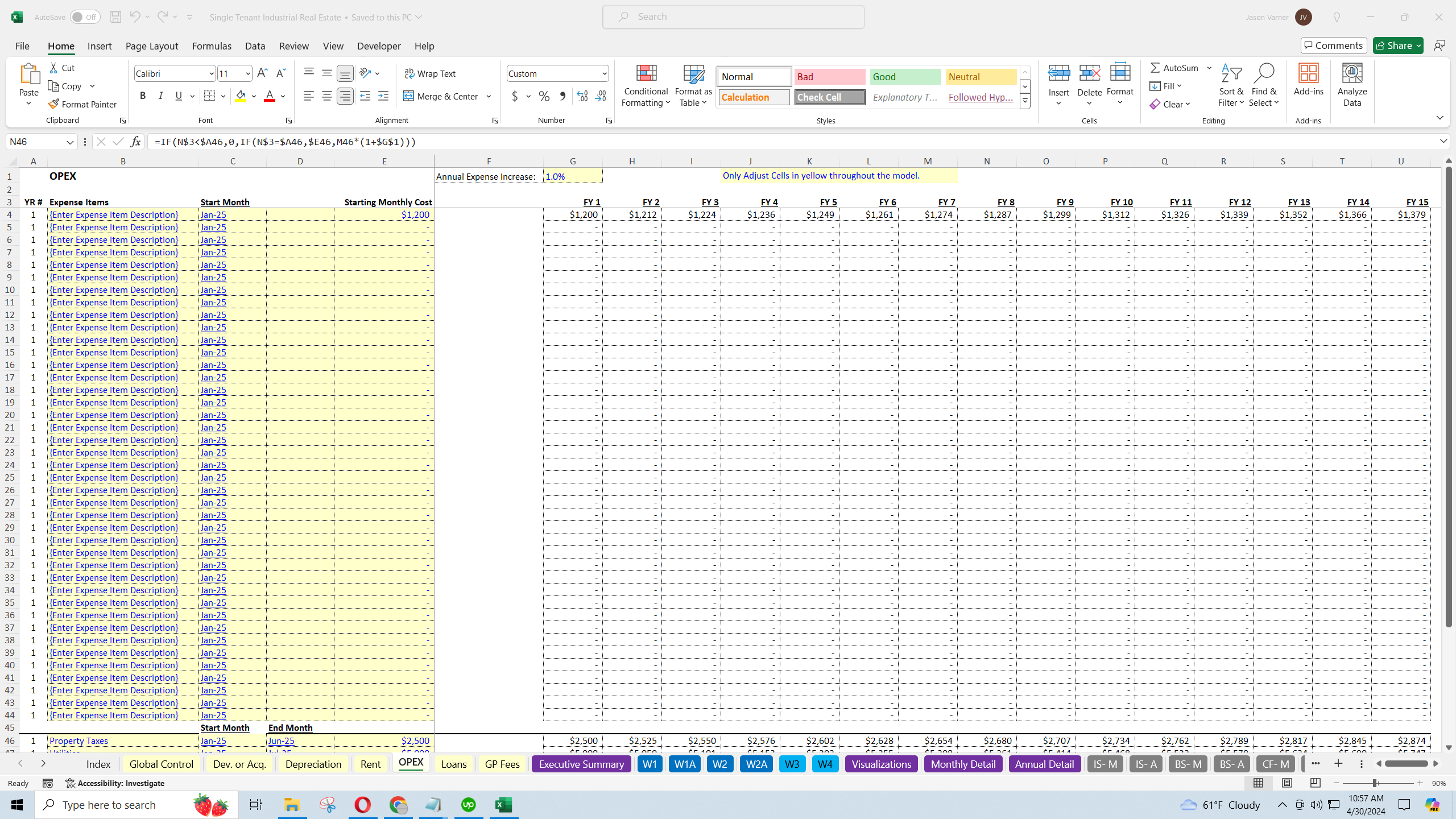

This model works for NNN deals, partial NNN, or any operating agreement that is based on how much of the expenses the tenant pays for. If the tenant is paying for the expense, simply 0 it out in the model.

One added feature I put into this template was the ability to enter fixed monthly costs that have a defined start month and end month. This is mainly to account for monthly costs the landlord must pay until a tenant has signed the lease.

Single tenant industrial real estate offers several key benefits for investors, making it an attractive option for those looking to diversify their portfolios and secure stable returns. Here are the primary advantages:

1. Stable Cash Flows

One of the most significant benefits of single tenant properties is the stability of cash flows. These properties often come with long-term leases, typically ranging from 5 to 10 years or more, which provides a predictable and steady income stream. This predictability makes it easier for investors to plan and manage their finances.

2. Lower Management Overhead

Since the property is occupied by a single tenant, the complexities and costs associated with property management are generally lower. There is no need to coordinate between multiple tenants, handle numerous lease agreements, or manage differing tenant needs and interactions. This simplicity can reduce operational costs and administrative burdens.

3. Triple Net Leases (NNN)

Single tenant industrial properties are often leased on a triple net basis, where the tenant is responsible for all costs associated with the property, including real estate taxes, building insurance, and maintenance. This arrangement further reduces financial and managerial overhead for the investor, as the tenant covers most of the ongoing expenses.

4. Enhanced Property Care and Customization

Tenants in single tenant industrial properties typically invest in the property to suit their specific business needs, which may include substantial infrastructure or customizations. These improvements can increase the property's value over time. Furthermore, tenants who invest their own capital into property enhancements are likely to maintain the property well, ensuring its upkeep and condition.

5. Reduced Tenant Turnover

Businesses that occupy single tenant industrial properties usually do so with a long-term perspective, especially if they've made significant customizations to the site. This setup tends to reduce tenant turnover, sparing the investor the costs and uncertainties associated with finding new tenants.

6. Attractiveness to Solid Tenants

Single tenant properties often attract large, established companies seeking stability and the ability to tailor a space to specific operational requirements. These tenants are usually financially stable, reducing the risk of lease default and ensuring consistent rental income.

7. Simplified Exit Strategy

Properties with a reliable, long-term tenant in place can be more attractive to potential buyers, providing the investor with a potentially smoother and more profitable exit strategy. The presence of a solid tenant can enhance the marketability of the property should the investor decide to sell.

Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Single Tenant Industrial Real Estate Deal Scenario Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping