Mobile Home Park Acquisition Model: Up to 40 Parks (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

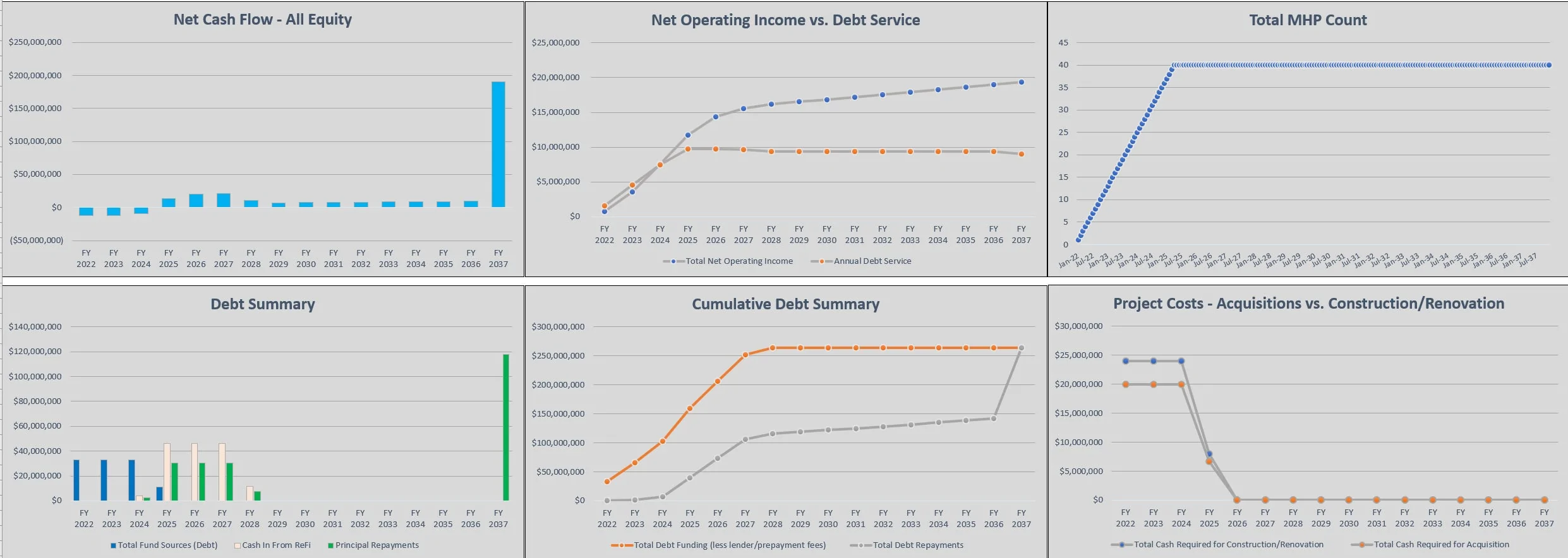

This financial forecasting template is a perfect fit for anyone investing in the mobile home park or RV park business. It doesn't matter if you are a beginner in the space or a seasoned pro looking to acquire 10 to 40 parks all at once. You can strategize and create all kinds of financial plans so you have an idea of costs, returns, and general equity requirements for up to a 16 year period.

Recent Updates:

• Added 3-statement model (IS,BS,CF) and integrated dynamic depreciation.

• Added logic for park-owned homes (PoH) to be accounted for in their own module and this does connect to all financial reports in the model.

• 5 park and 40 park version included in purchase

This is a real estate financial model designed to plan out the acquisition of up to 40 mobile home parks (MHPs) over time, operating them for up to 16 years, and then exiting for a defined exit cap. The exit can be at any month and doesn't have to be 16 years.

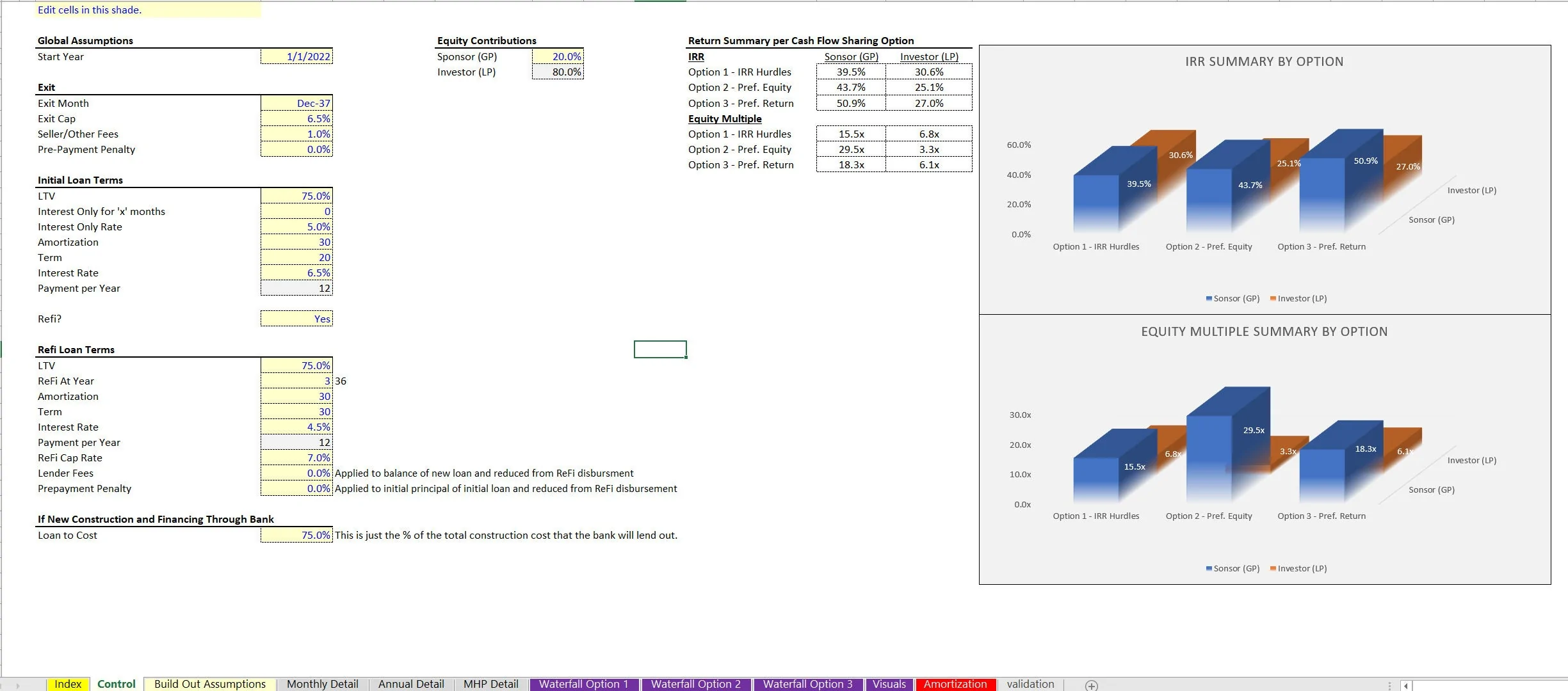

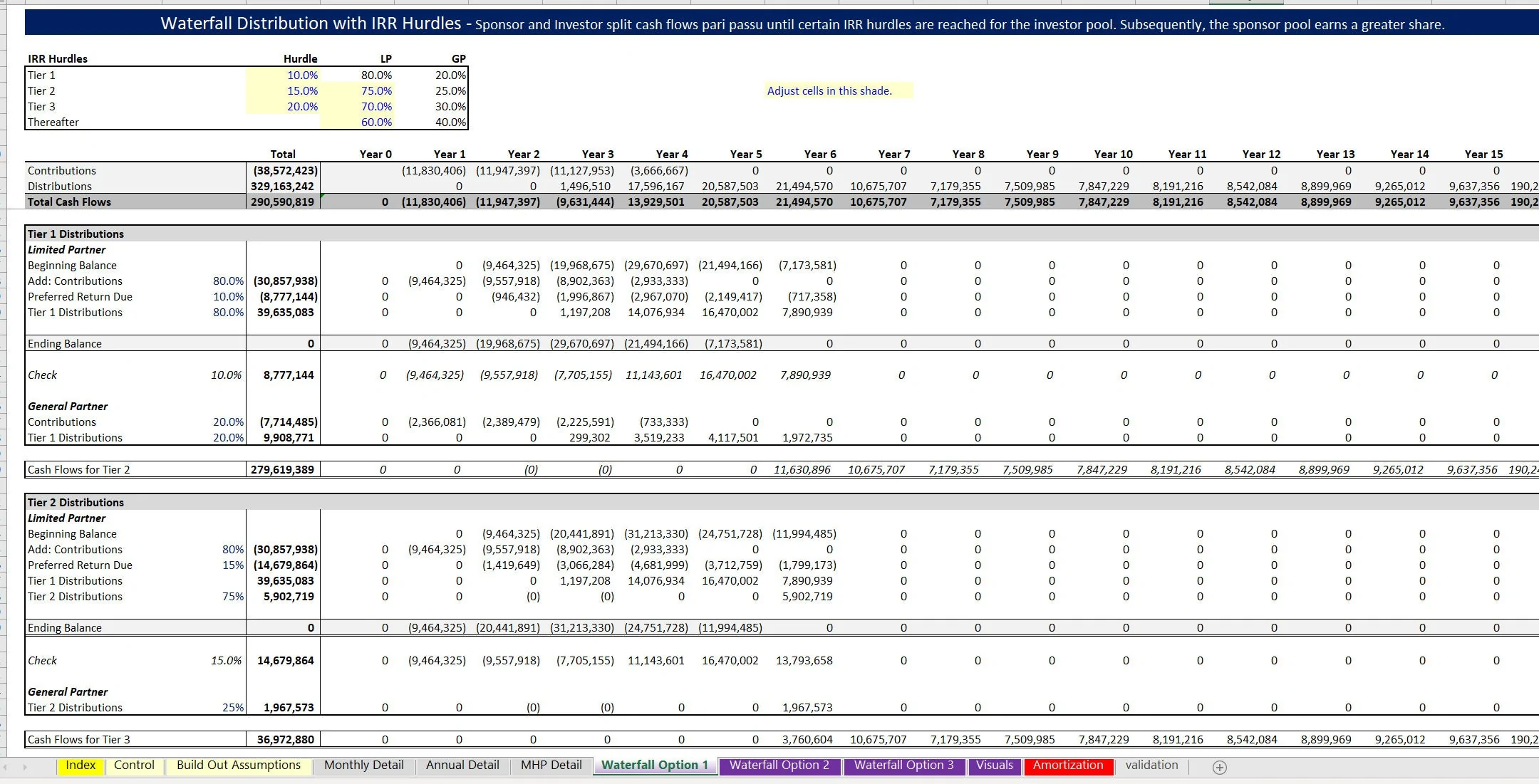

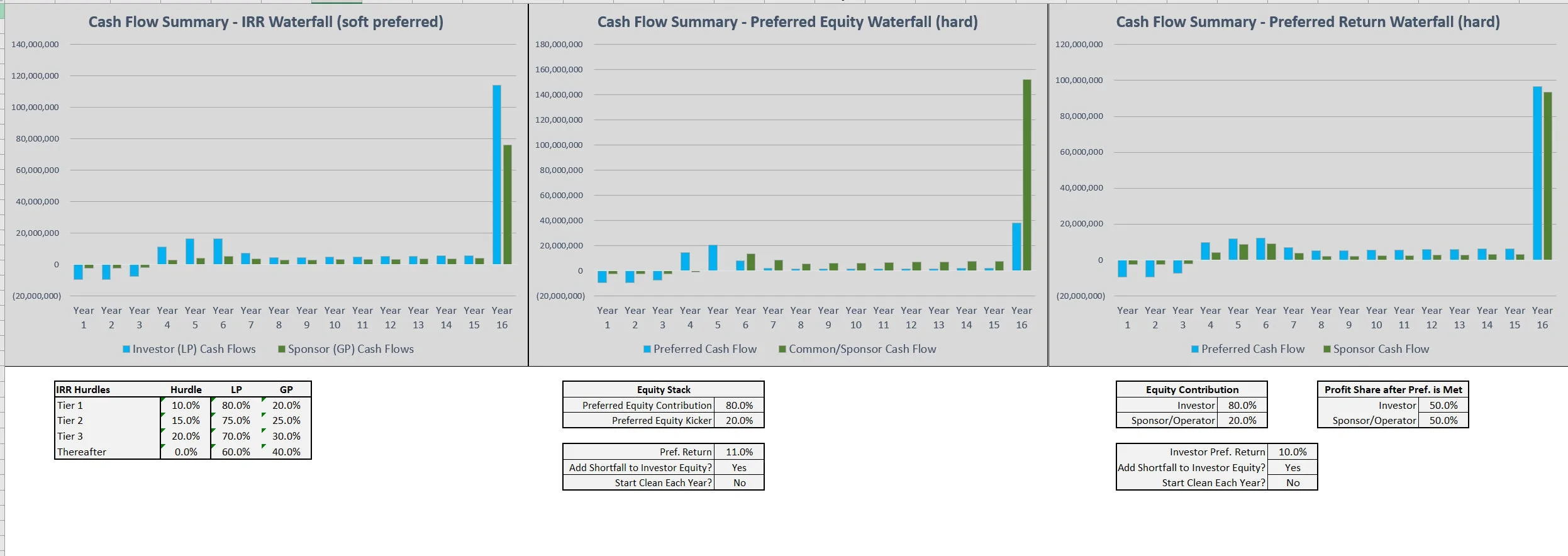

Final results flow into three separate joint venture schedules:

• Preferred Equity

• Soft Preferred Equity (IRR Hurdles)

• Preferred Return

The waterfall distributions schedules above are all independent of each other and are designed to easily compare different funding / distribution structures of the entire operation and how returns may differ between the Sponsor (GP) and Investor (LP).

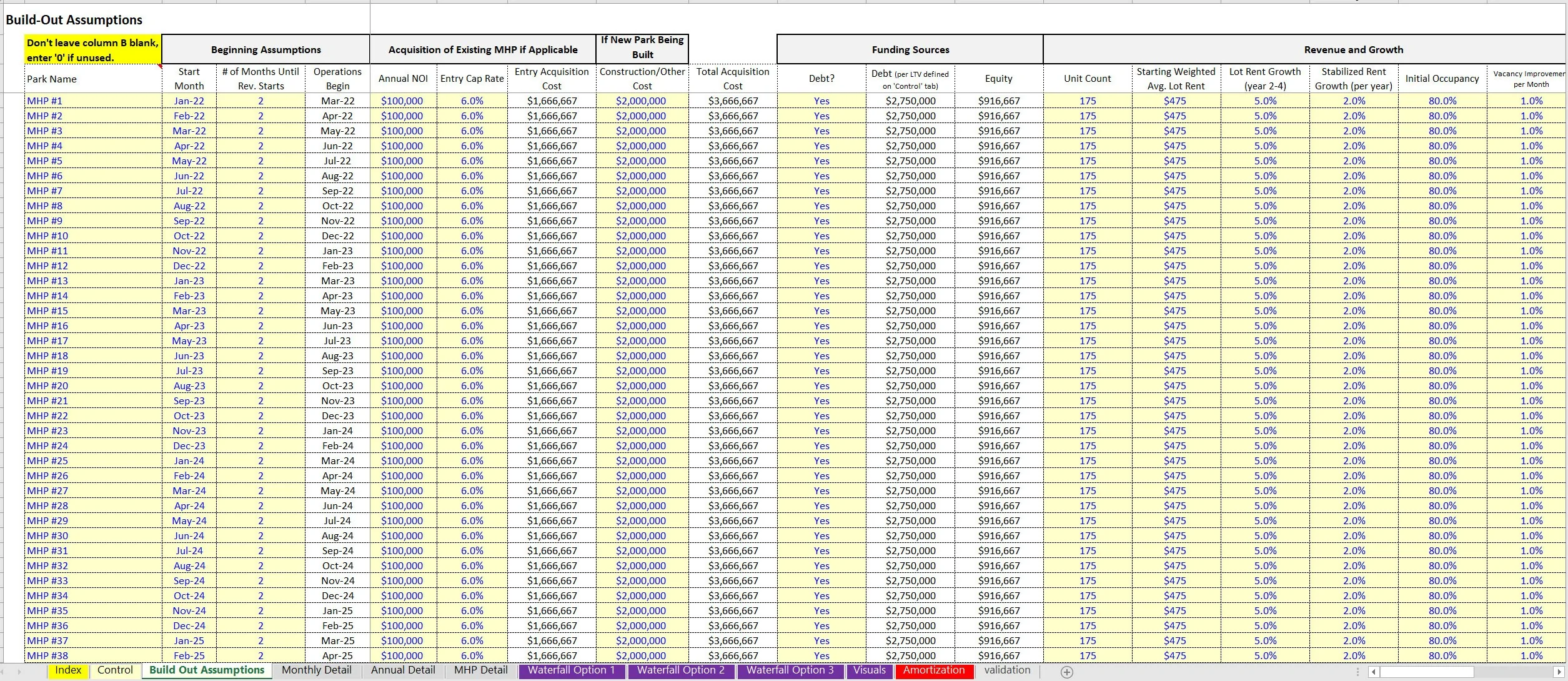

Assumptions were set up so each Mobile Home Park has its own configurations for acquisition cost, development, debt / equity funding, revenue, and expenses.

For each of the 40 parks, build-out assumptions include:

• Park Name

• Start Month

• # of Months Until Rev. Starts

• Operations Begin (formula)

• Annual NOI

• Entry Cap Rate

• Entry Acquisition Cost (formula)

• Construction/Other Cost

• Total Acquisition Cost (formula)

• Debt? (yes/no)

• Debt (per LTV defined on 'Control' tab) (formula)

• Equity (formula)

• Unit Count

• Starting Weighted Avg. Lot Rent

• Lot Rent Growth (year 2-4)

• Stabilized Rent Growth (per year)

• Initial Occupancy

• Vacancy Improvement per Month

• Stabilized Occupancy

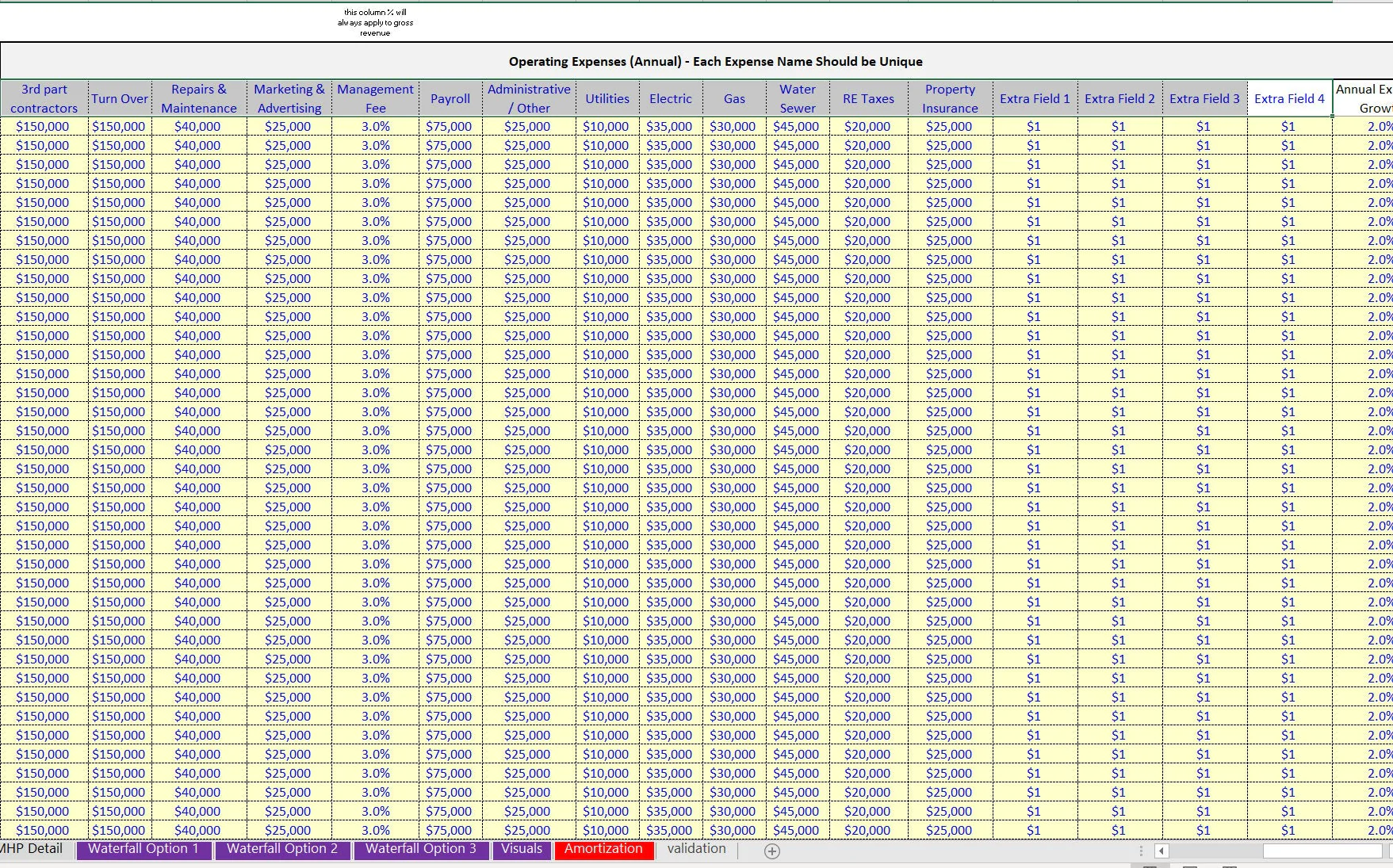

• 3rd party contractors

• Turn Over

• Repairs & Maintenance

• Marketing & Advertising

• Management Fee

• Payroll

• Administrative / Other

• Utilities

• Electric

• Gas

• Water Sewer

• RE Taxes

• Property Insurance

• Extra Field 1

• Extra Field 2

• Extra Field 3

• Extra Field 4

• Annual Expense Growth

• Other Income

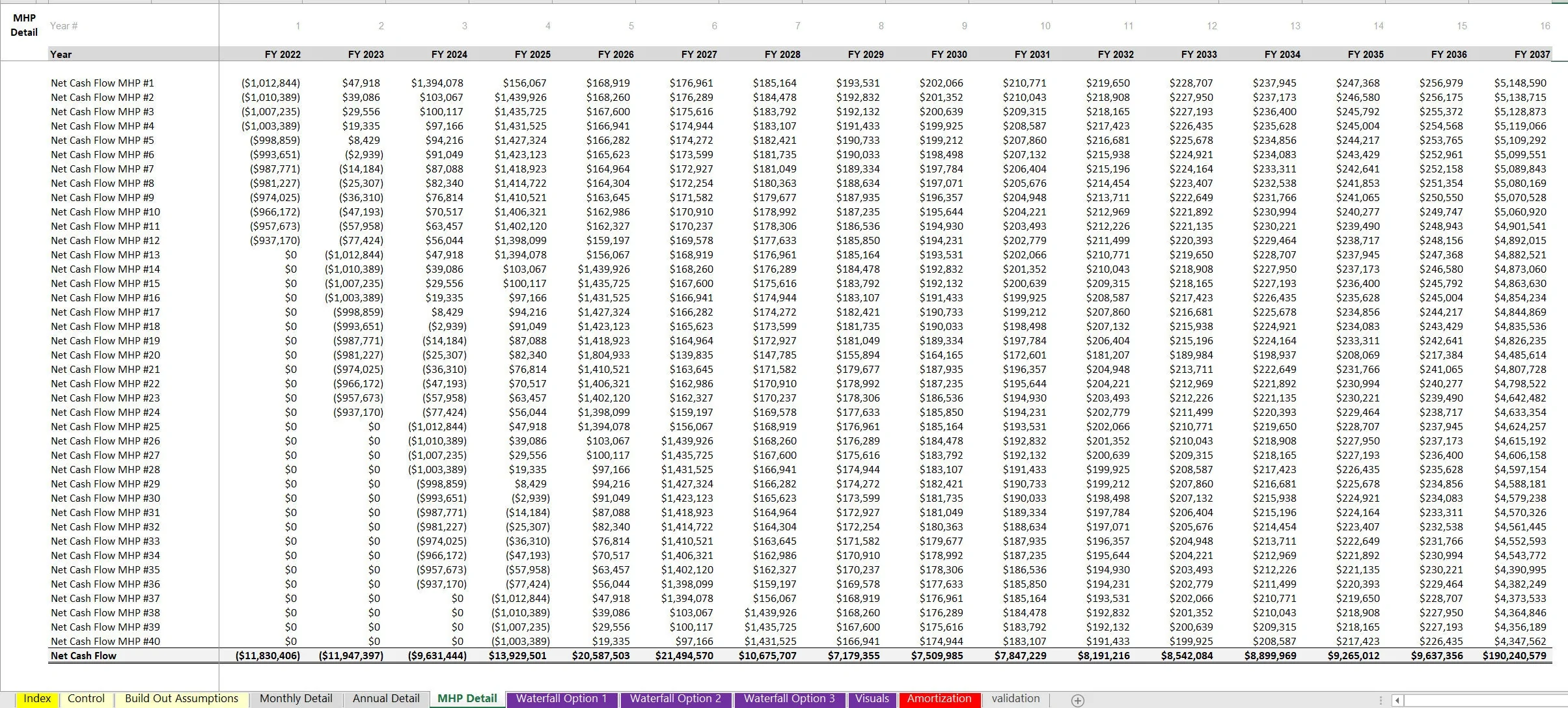

A monthly and annual pro forma detail show the total initial investment, operating activity (down to Net Operating Income) debt service, and exit value for each of the 40 mobile home parks individually.

This is all aggregated into a final total Net Operating Income and cash flow. Note, for any MHPs that were defined as being financed with debt, there is a global driver for the terms of each loan (defined once and apply to all loans).

Also, you can globally choose the debt configuration life and this includes if there is a refinance event at a certain point in time for each of the parks that had debt funding. The terms of this are defined once and apply to each park individually based on when the park started operations / required an investment.

The dynamic nature of this model is really useful if the user needs to plan out scaling multiple purchases of parks over time and wants to easily apply complex logic to each acquisition in order to see an aggregate result.

Note, a full version (up to 40 MHPs) and a lite version are included. The lite version has up to 5 MHPs and everything else is the same.

To account for construction time, the model does allow for the initial loan to have a defined interest only period as well as a defined monthly # deal regarding when rental revenue starts relative to the purchase date.

This model equips investors with the necessary tools to navigate the complexities of acquiring multiple mobile home parks, ensuring a streamlined approach to financial planning. With detailed projections and customizable assumptions, users can effectively assess potential cash flows and returns, making informed decisions that align with their investment strategies.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Mobile Home Park Acquisition Model: Up to 40 Parks Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping