Used Car Lot Financial Model (Excel XLSM)

Excel (XLSM)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Recently updated to include an option for payment terms of inventory purchased and includes accounts payable balance that updates automatically.

Running a used car lot is fairly simple as far as the mental model goes. You purchase cars at some cost and then resell them at a higher price over time. You will have to ensure good inventory record-keeping, but these types of businesses don't get super messy if you have good accounting procedures right off the bat. Having a good financial planning tool is going to help give you an idea of what the initial investment and operating profits look like given various key assumption changes.

Recent Updates: Added new logic for length of time vehicle is on lot per type, added 3-statement modeling logic (Income Statement, Cash Flow Statement, Balance Sheet), added a cap table, and built all new visualizations.

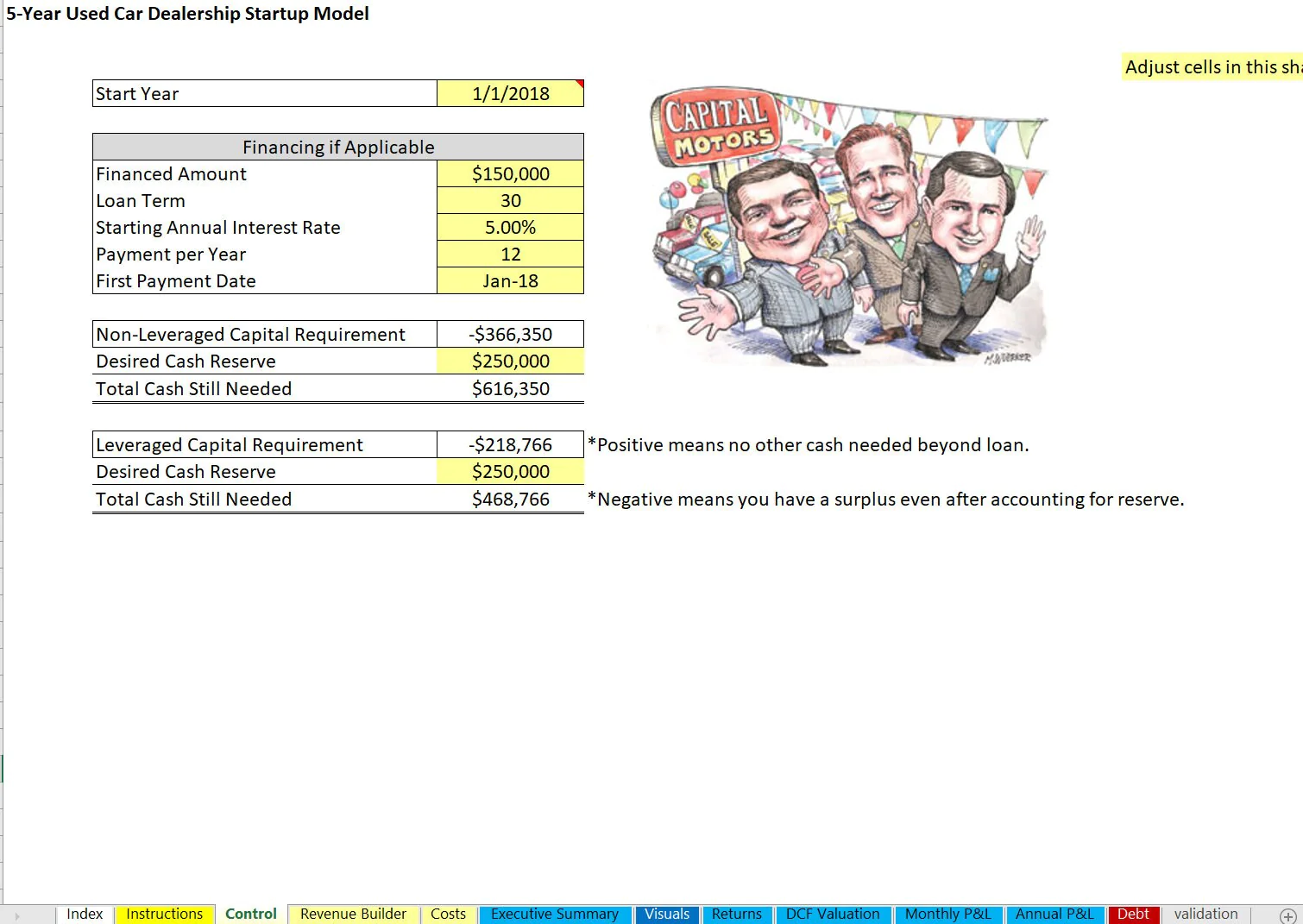

This is a high level general model for used car lots / dealerships. The logic was designed for a quick 5-year financial forecast and minimum equity requirements.

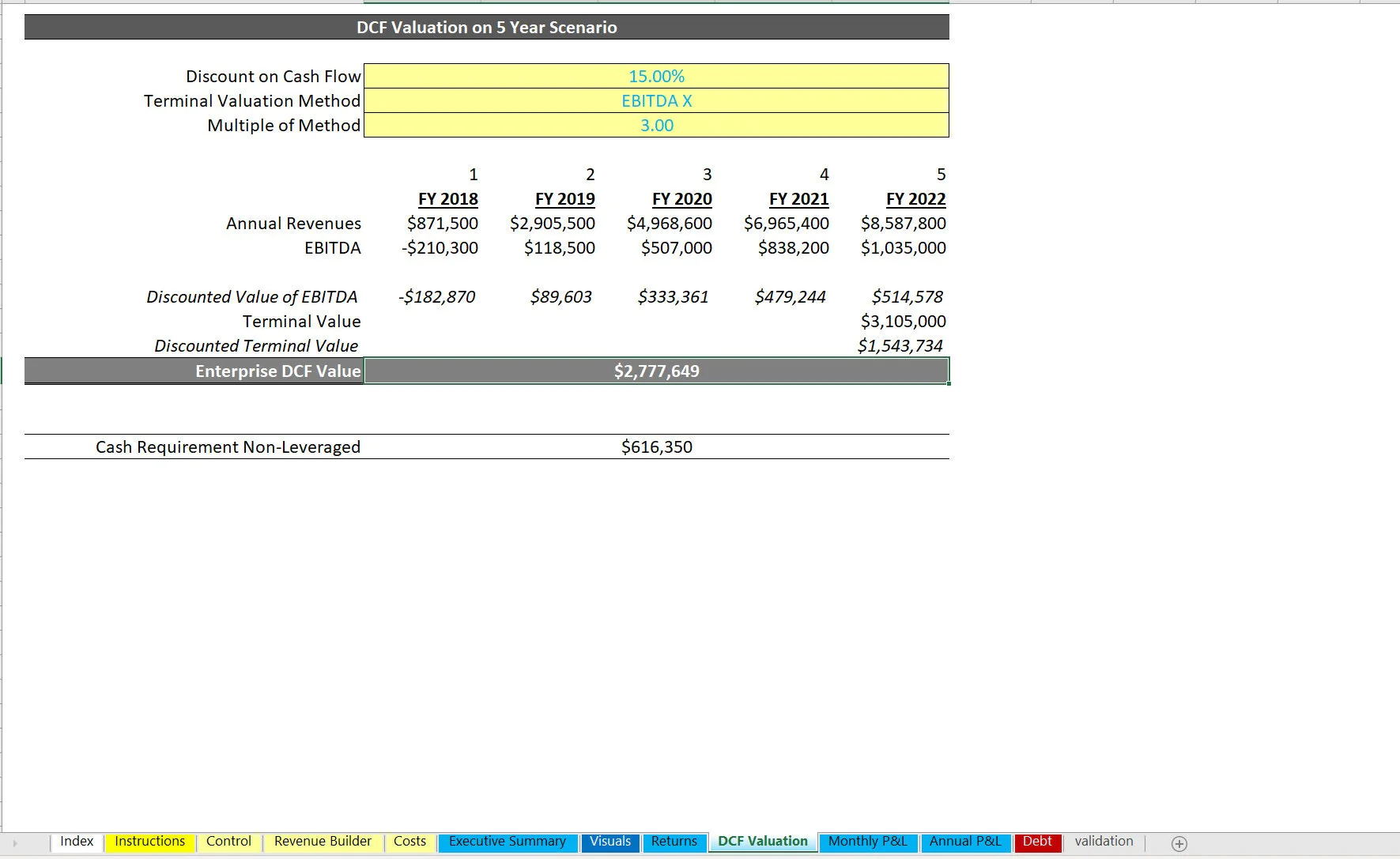

There are exit assumptions as well as startup funding sources that include traditional debt. Leverage and unleveraged IRR will be an output.

There is some logic surrounding the amount of inventory that is purchased ahead of time. The cash flow takes into account this difference in cash and non-cash items when being calculated.

After the initial inventory runs out from startup costs, the cost of goods sold are assumed to be just-in-time.

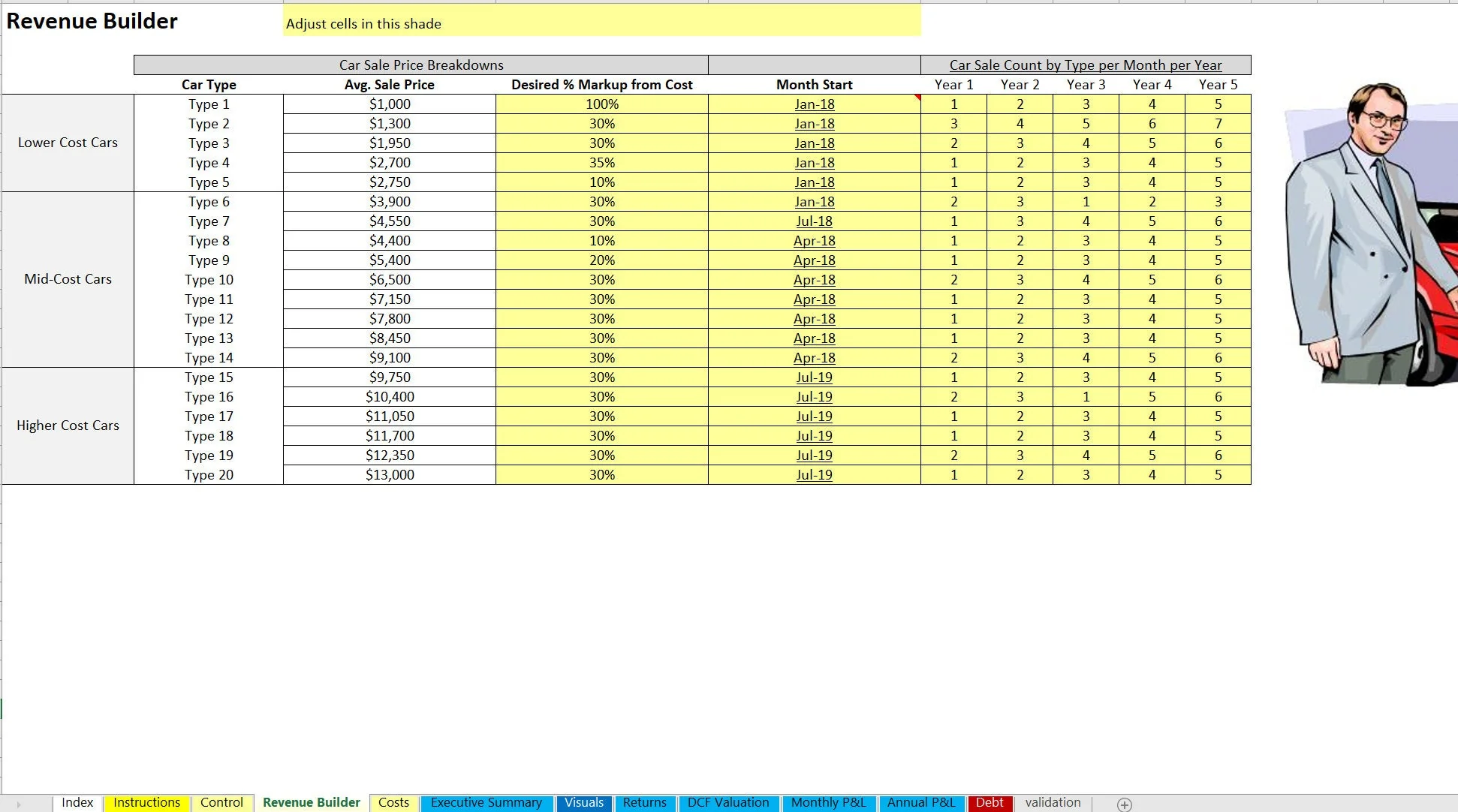

Revenue Drivers:

• Up to 20 car types split into 3 categories

• Average count of cars sold per month (over 5 years)

• Start month each car type begins to be sold

• Percentage markup from average cost per car type

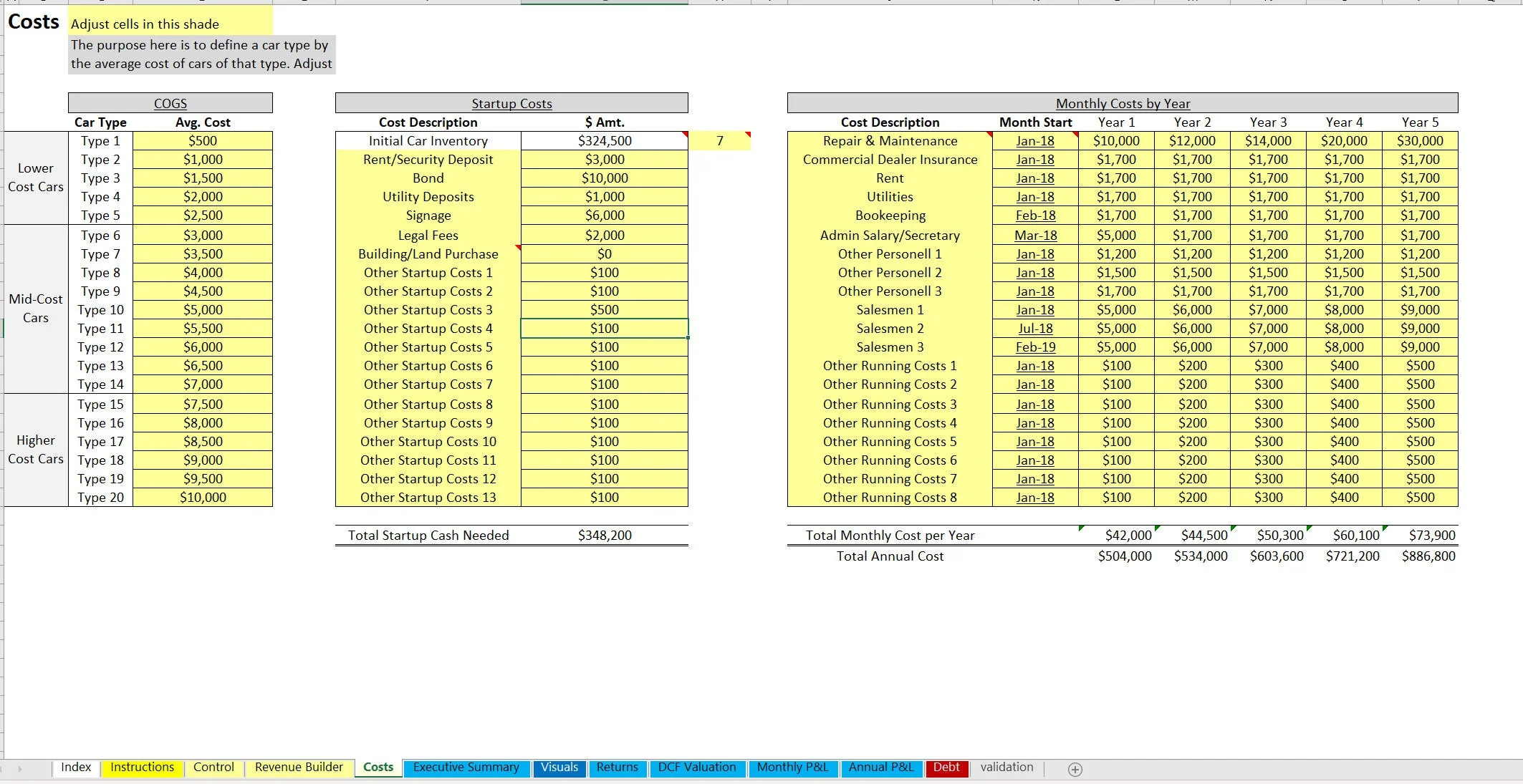

Cost Drivers:

• Average cost per car type

• Up to 20 fixed cost slots (cost item description / start month / monthly cost in each year)

Final Outputs:

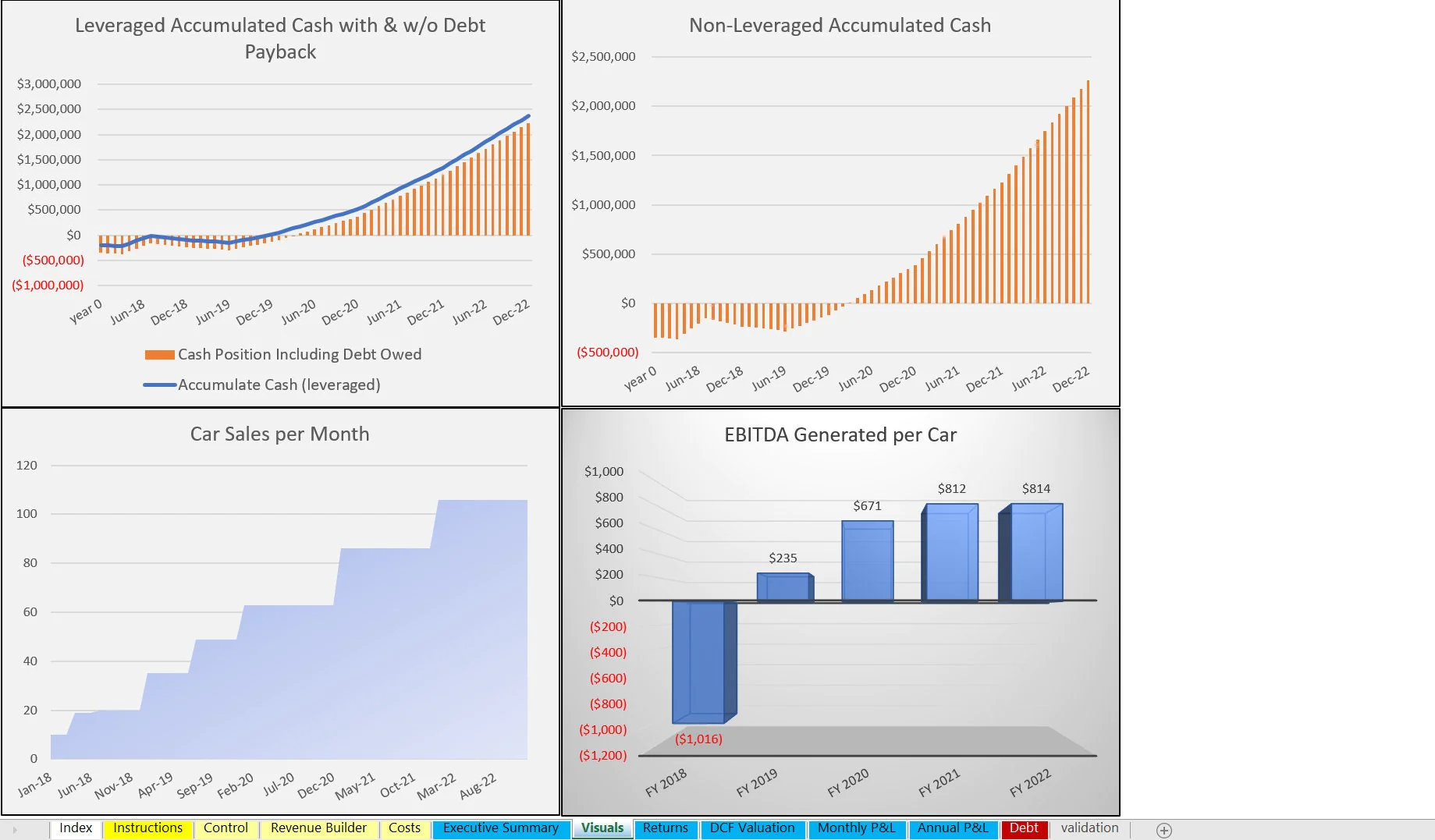

• Monthly and Annual Pro forma details (showing granular assumptions on a monthly timeline)

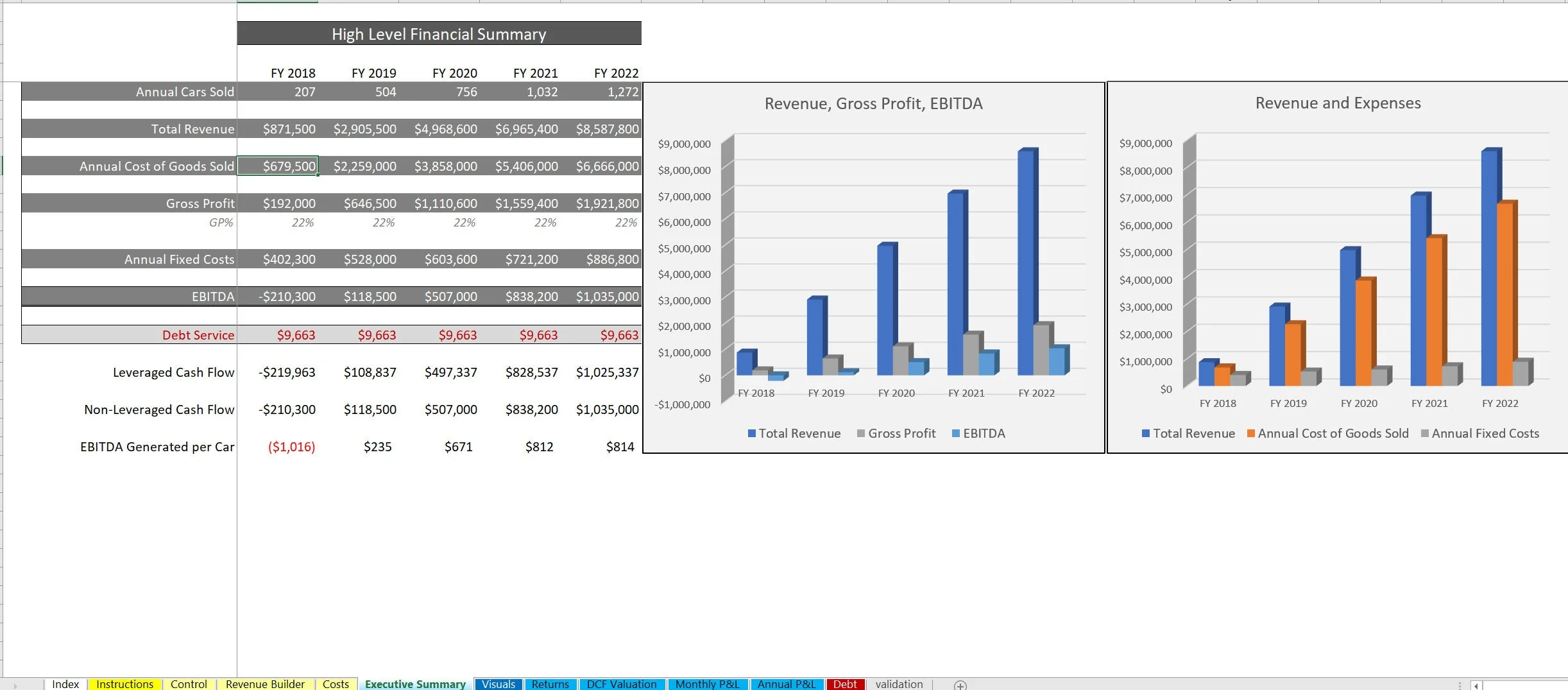

• Executive Summary (annual with visuals)

• IRR, ROI, Equity Multiple, NPV

• DCF Analysis

The model includes detailed startup costs and monthly expenses broken down by year, ensuring comprehensive financial planning. High-level financial summaries with visualizations provide clear insights into revenue, gross profit, EBITDA, and cash flow projections.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Used Car Lot Financial Model Excel (XLSM) Spreadsheet, Jason Varner | SmartHelping