Mining Financial Model: Ore, Gems, Minerals (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

MINING INDUSTRY EXCEL DESCRIPTION

If you are looking to invest into serious mining operations as an operator, this financial planning spreadsheet will be of great use.

Another update done in January of 2026 has improved the model with additional inputs for expense escalations, displaying the tonne of ore per day per mineral / material type as well as better visualizations.

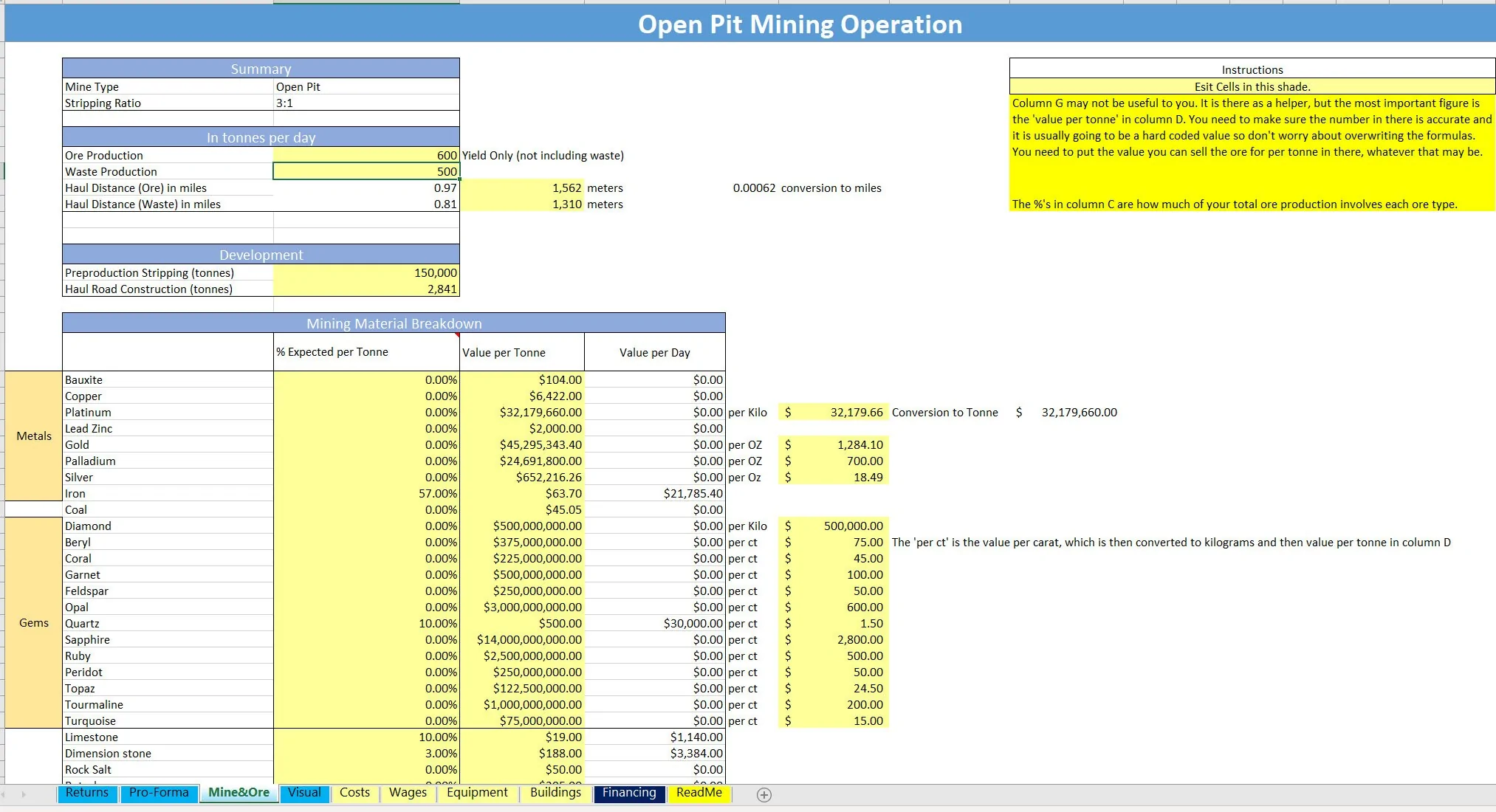

Recently updated with comprehensive financial statements that are fully integrated as well as a cap table, capex schedule, and improved global control assumptions. If you are looking at starting any sort of mining operation, Gold / other metals / gravel / rock / gems, this template will give you a good foundation for planning out startup costs, operating costs, and an in-depth yield schedule for potential revenue based on ore production.

This is an annual-only model for larger scale mining.

The following outputs will be displayed based on all revenue and expense assumptions:

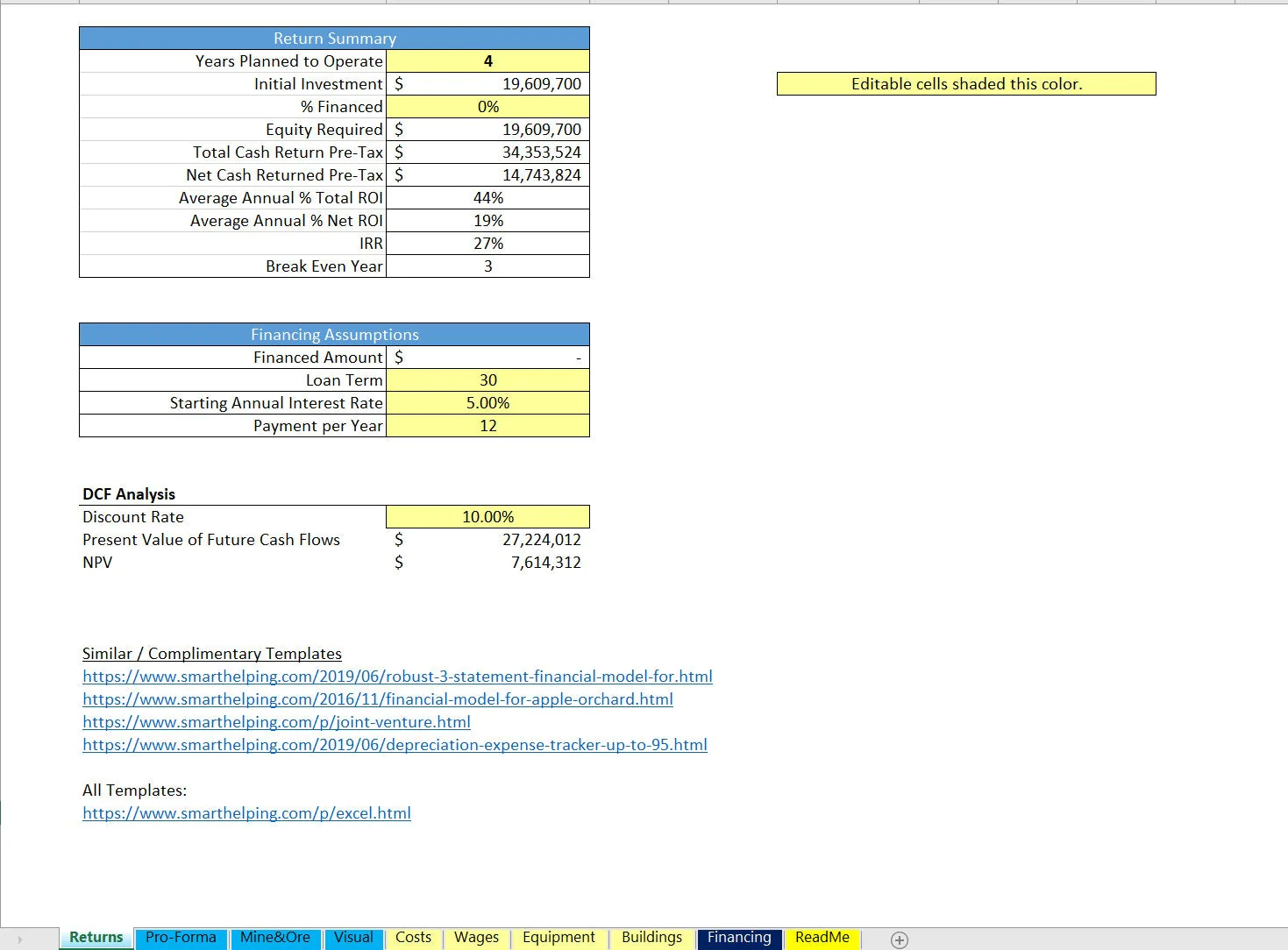

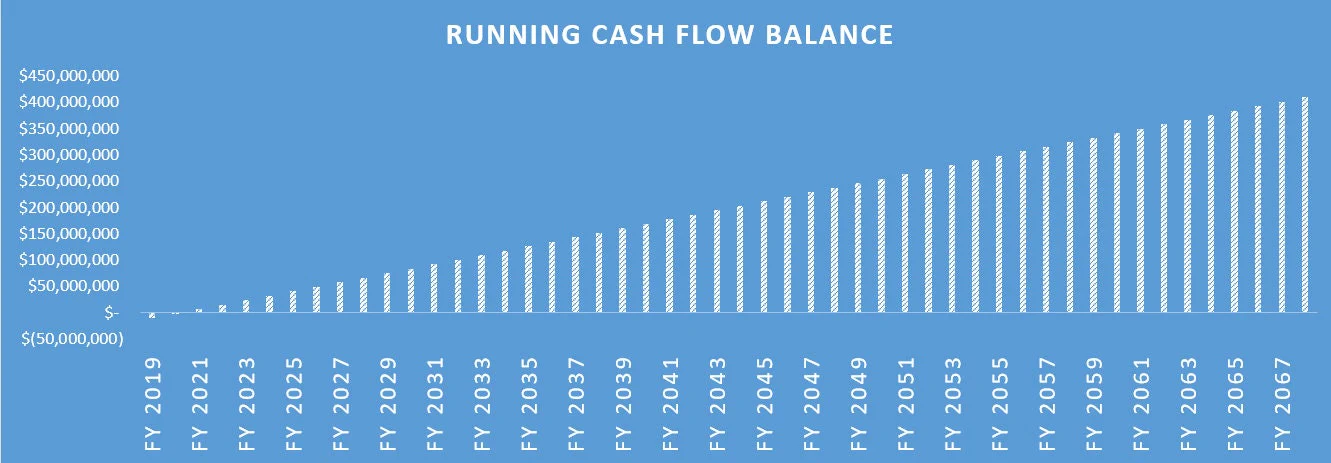

Return Summary (ROI, IRR per years operated, cash returned, cash required)

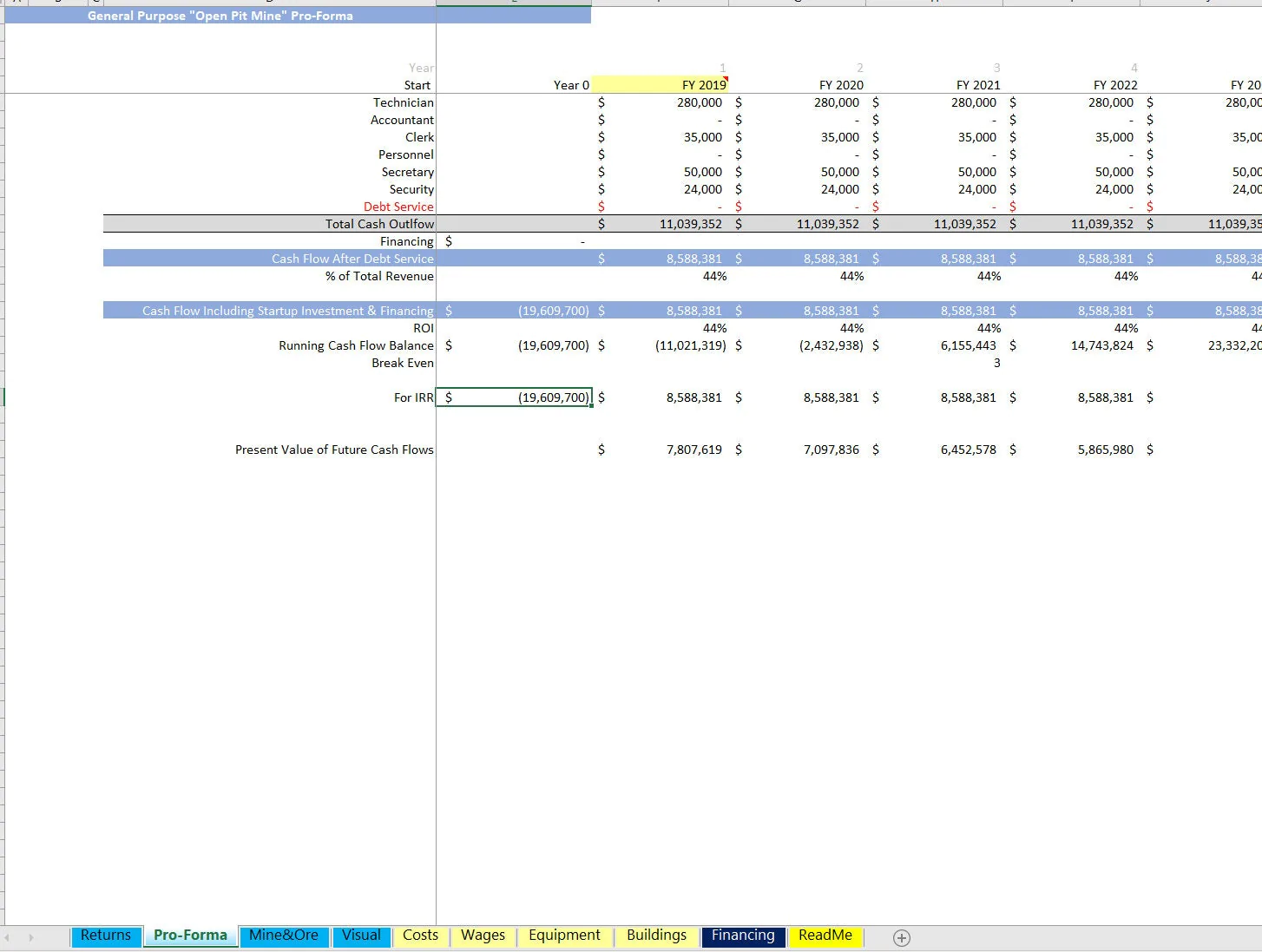

Annual Pro Forma (driving down to operating income and cash flow as well as displaying break-even year)

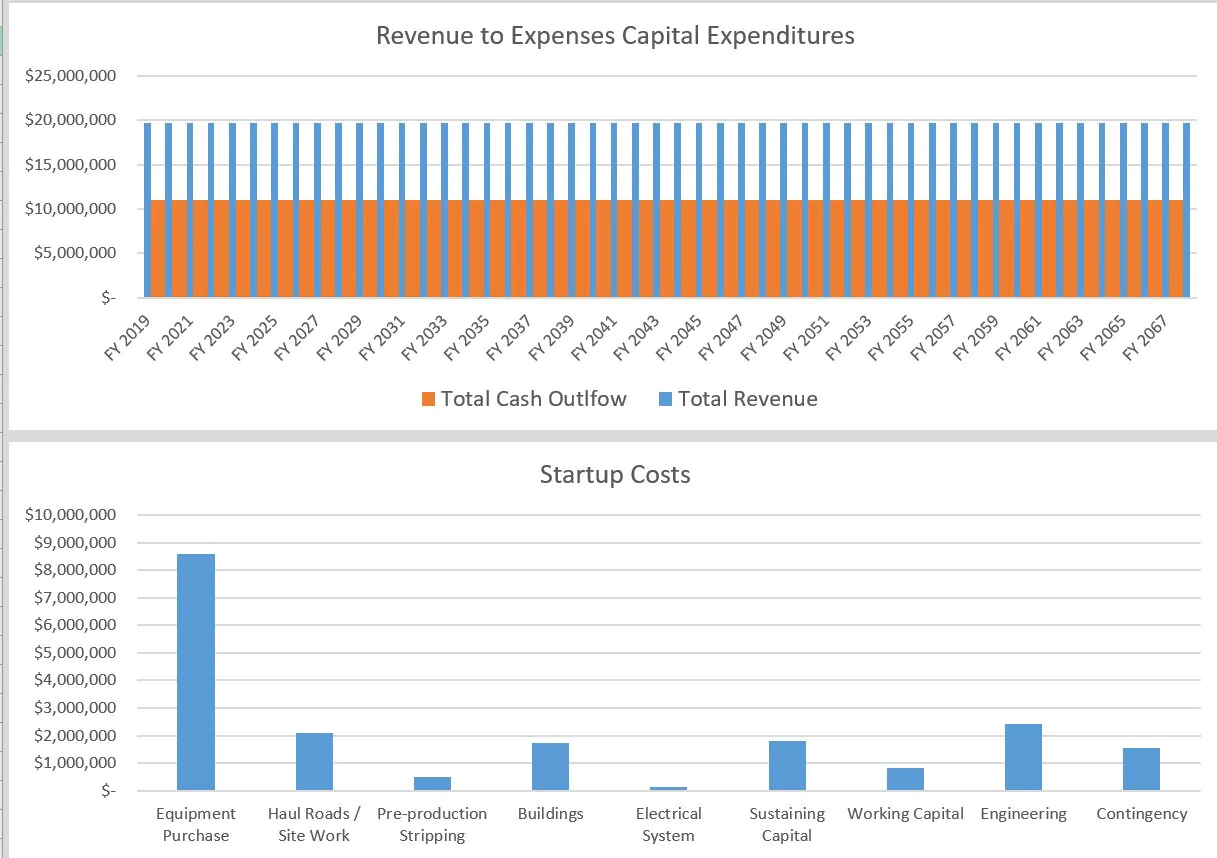

5 Visualizations to better digest the financial requirements and forecast in general

Revenue Inputs:

• Define daily ore production

• Define the expected % of each metal/gem/material that is in each tonne on average

• Define the value per tonne for each material (up to 28 materials)

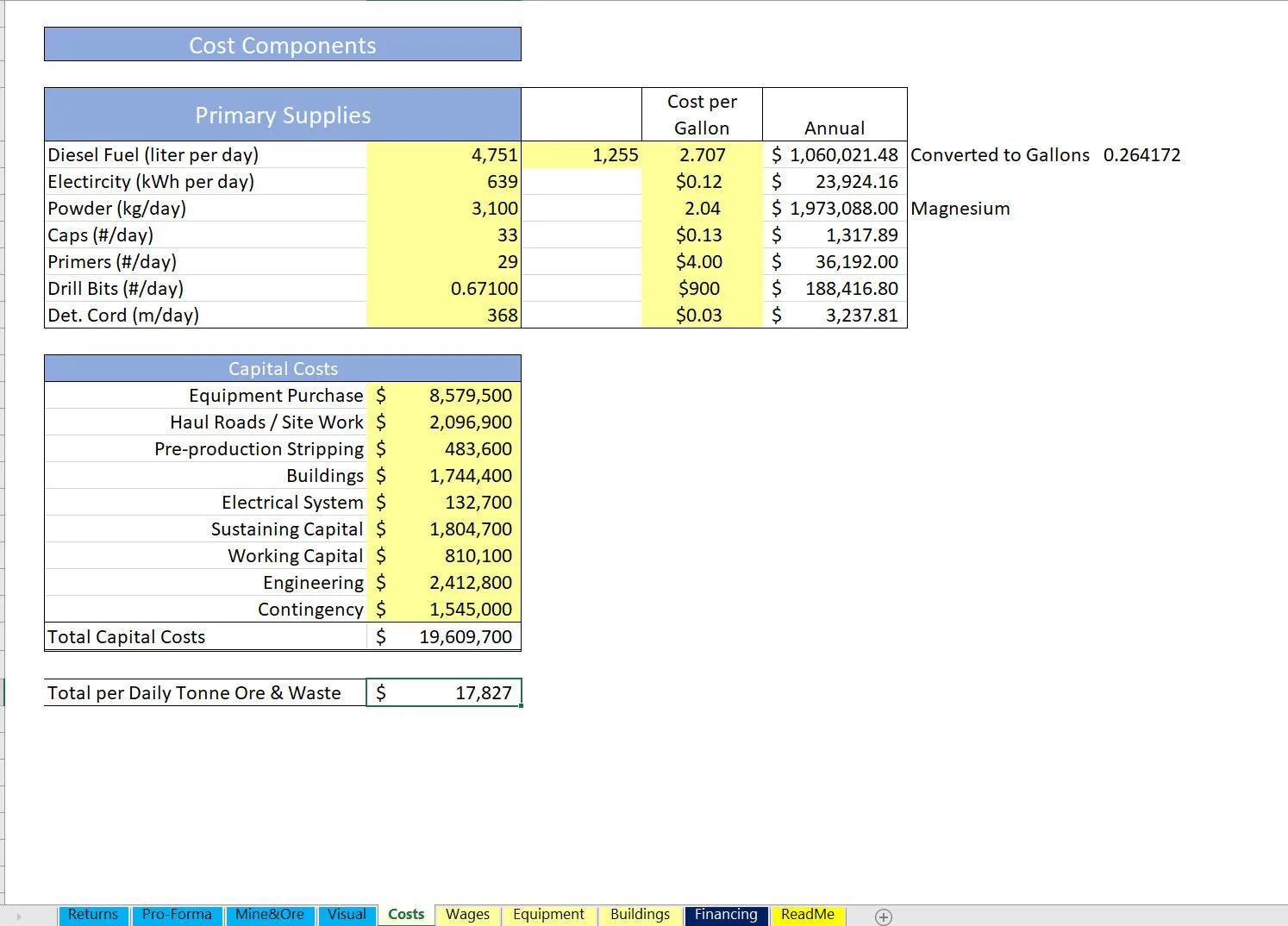

Cost Inputs (operational):

• Diesel Fuel (liter per day)

• Electricity (kWh per day)

• Powder (kg/day)

• Caps (#/day)

• Primers (#/day)

• Drill Bits (#/day)

• Det. Cord (m/day)

• Drillers

• Blasters

• Excavator Operators

• Truck Drivers

• Equipment Operators

• Utility Operators

• Mechanics

• Laborers/Maintenance

• Manager

• Superintendent

• Foreman

• Engineer

• Geologist

• Supervisor

• Technician

• Accountant

• Clerk

• Personnel

• Secretary

• Security Startup

CapEx:

• Equipment Purchase

• Haul Roads / Site Work

• Pre-production Stripping

• Buildings

• Electrical System

• Sustaining Capital

• Working Capital

• Engineering

• Contingency

The user can define various inputs for the above in order to get an accurate expected annual operating cost budget. Expected active days per year, hourly wages, count, cost per gallon / per watts / etc.. are all configurable.

The model includes detailed breakdowns of primary supplies and capital costs, ensuring precise budgeting. Editable cells are highlighted for user convenience, making it easy to customize the financial assumptions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Mining Industry, Integrated Financial Model Excel: Mining Financial Model: Ore, Gems, Minerals Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Industry-specific Financial Models (40+)

This bundle contains 67 total documents. See all the documents to the right.