Cash Flow Waterfall with 3 IRR Hurdles (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

CASH FLOW MANAGEMENT EXCEL DESCRIPTION

If you are new to IRR hurdles, don't feel bad that it is not immediately clear. Studying the logic and flow of this template will help anyone have a better understanding of how such structures work at a basic level. You most commonly see this type of deal in real estate and oil/gas joint ventures.

Recent Update: Added a DCF Analysis with NPV.

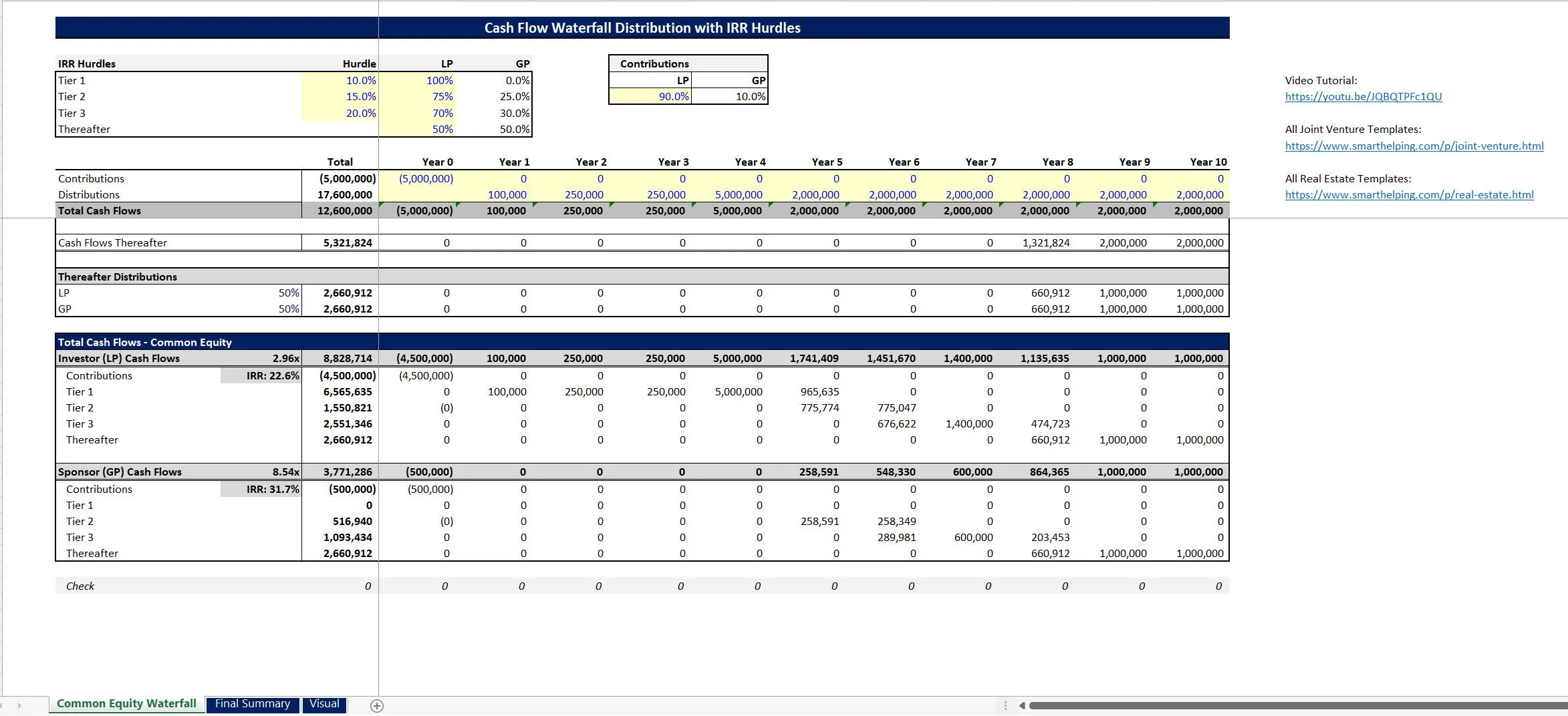

This is a great template for anyone involved in joint venture deals, wants to learn how IRR Hurdles work (the math and logic behind it) and/or anyone looking for a more sophisticated approach to approaching investors for a potential partnership structured as a GP (sponsor or general partner) and LP (investor or limited partner).

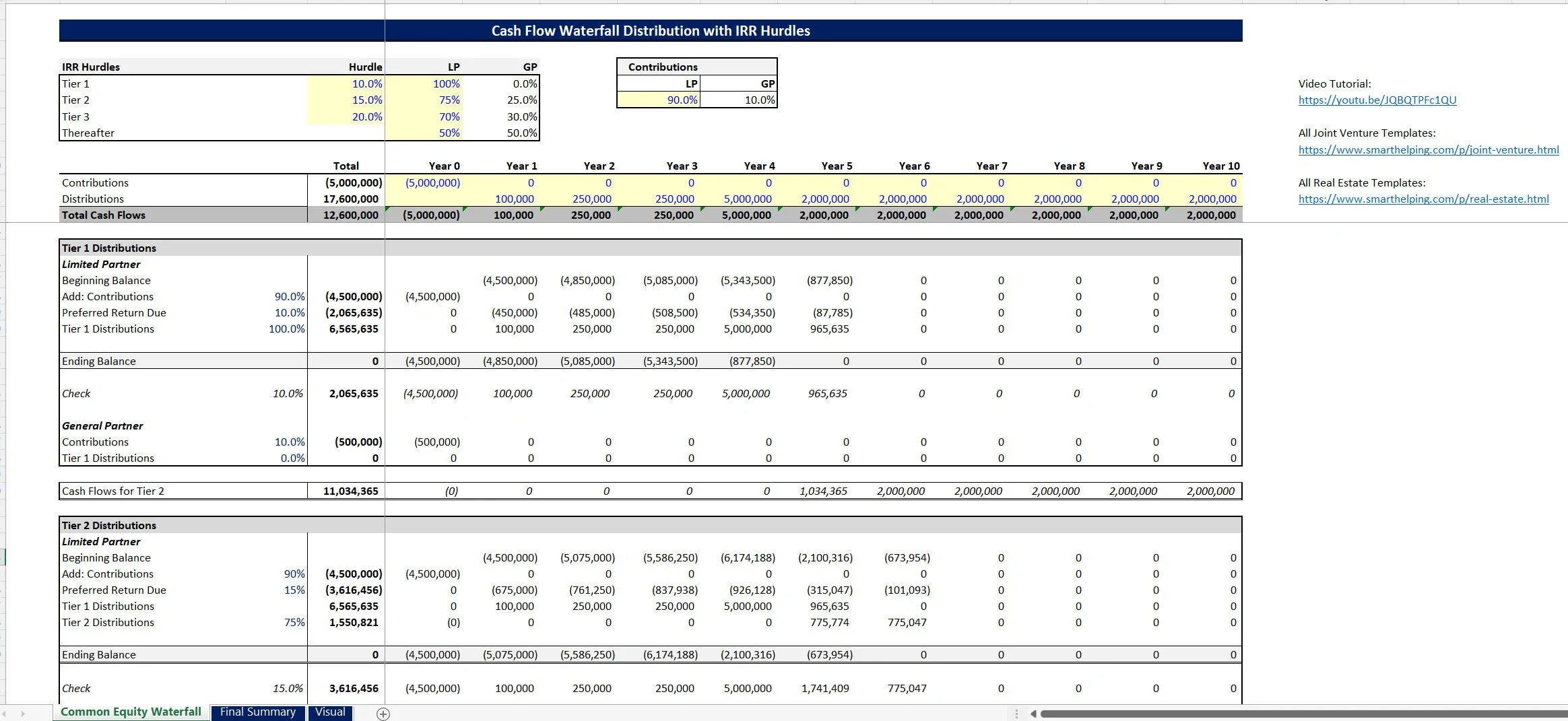

All the logic fits on a single page so it can easily be copied and pasted into an existing deal and have the top-line cash contributions and distributions referenced into the top light yellow cells. All the math will run from there.

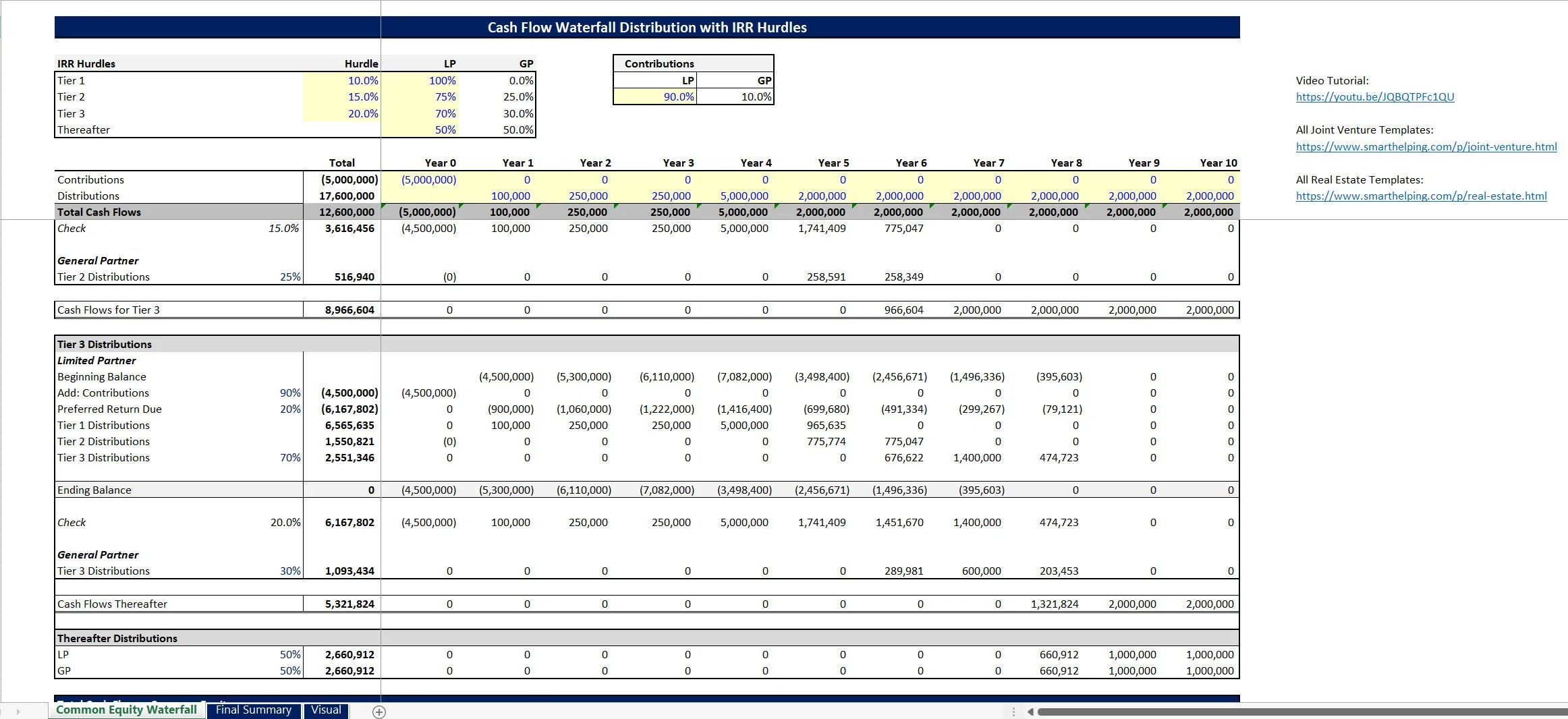

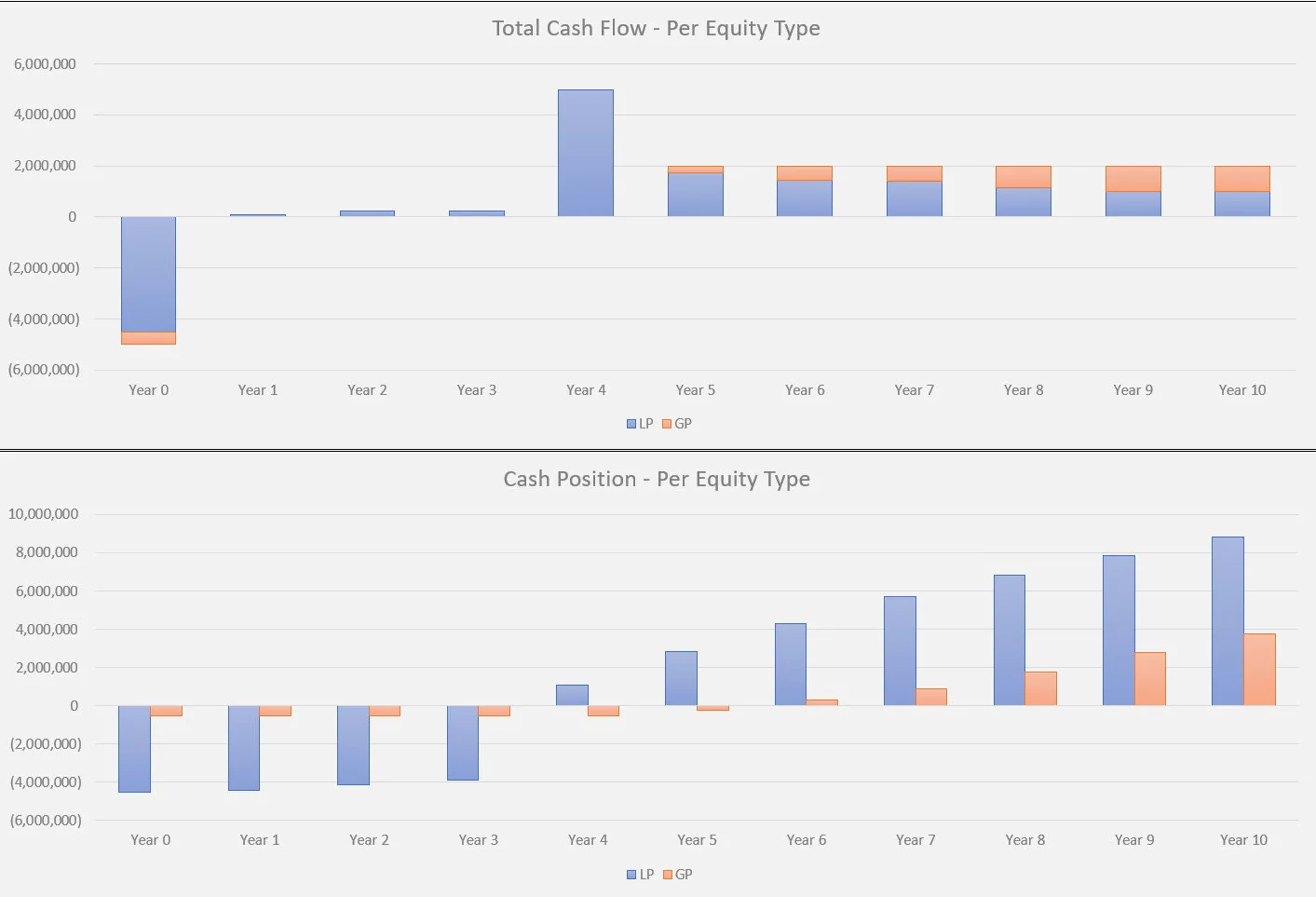

The purpose of such a strategy is to align incentives. The way this cash flow waterfall works is that based on the defined IRR Hurdles, the LP (the one that contributes most or all of the initial required investment) will give up some of the cash flow as the GP meets higher and higher returns for them.

The GP (the one that does all the work/operations and may contribute a smaller initial investment amount) is then incentivized to do so because that is how they earn a premium for the work they are doing.

This directly incentives the GP to do their job as optimally as possible because that is how they will earn the most money and the LP will receive higher total returns as the GP does a better job with operations.

You can structure this as a hard preferred return / pari passu / or something else just by adjusting the cash flow split percentages in the first hurdle. These kinds of financing structures are most common in businesses with fairly predictable cash flows, but you can use them in any deal you see fit.

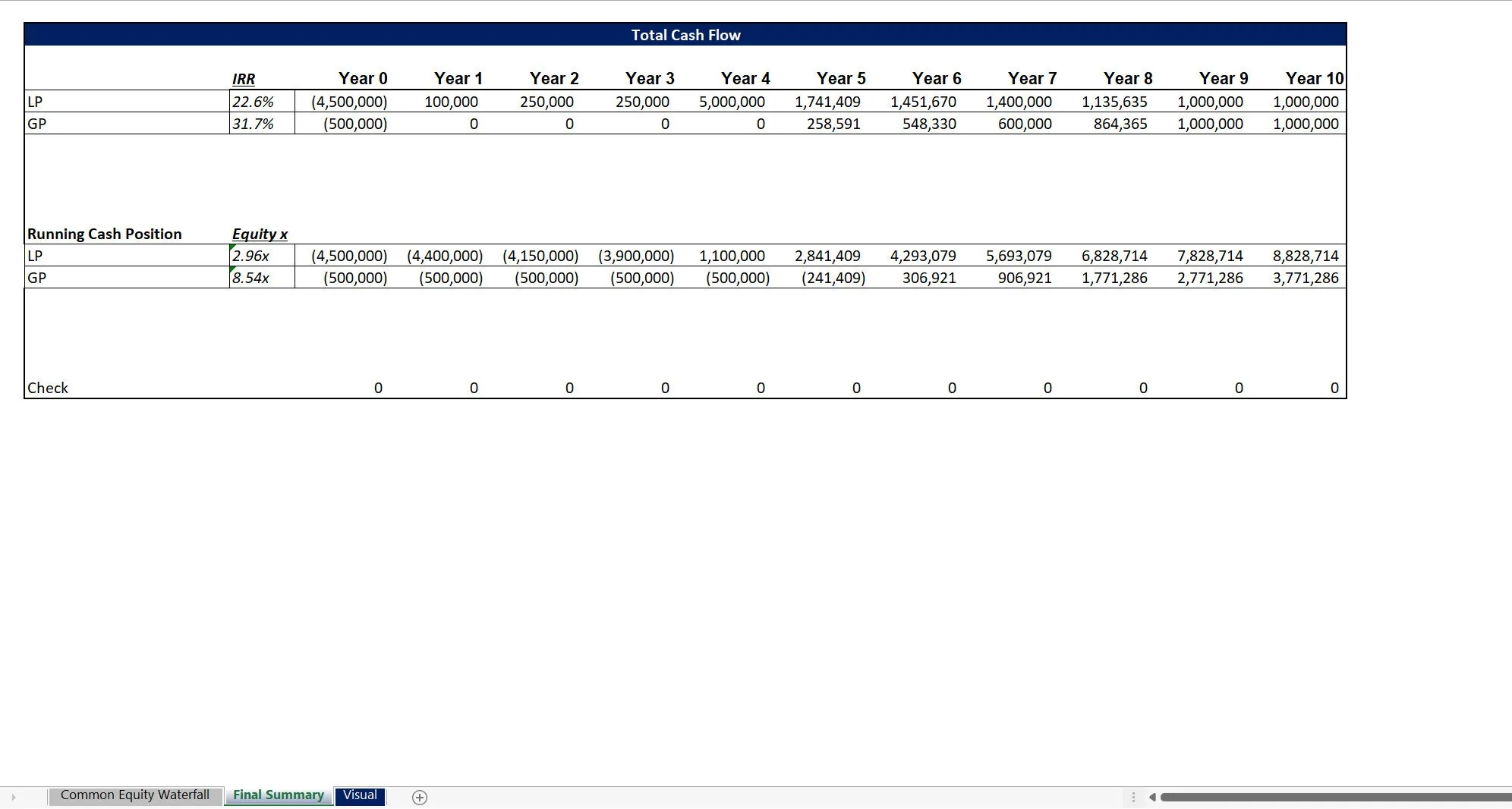

This template provides a clear visual representation of cash flows across multiple IRR hurdles, making it easier to analyze potential outcomes. The detailed breakdown of contributions and distributions ensures that all parties involved can quickly assess their financial positions and make informed decisions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

TOPIC FAQ

What is an IRR hurdle in a cash flow waterfall and how does it affect distributions?

An IRR hurdle is a return threshold at which the distribution split between LP and GP changes to reward higher performance. In waterfall structures, the LP typically concedes more cash to the GP as higher IRR hurdles are achieved, with this template illustrating the effect across 3 IRR hurdles.How do GP and LP roles typically interact in a waterfall structure?

The LP usually provides most or all initial capital and receives priority returns; the GP performs operations and earns incremental share as higher IRR hurdles are met. The model allocates contributions and distributions so the GP earns a premium tied to performance, adjustable via the first-hurdle split percentages.Which industries most commonly use IRR hurdle waterfalls for JV deals?

These waterfall structures are most commonly used in real estate and oil & gas joint ventures, where predictable cash flows make sequential return thresholds practical and where aligning sponsor/operator incentives with investor returns is important.What spreadsheet features make an IRR-hurdle template practical for deal underwriting?

Practical features include single-page logic for easy copy/paste into existing models, top-line input cells for contributions and distributions (noted as light-yellow), adjustable cash-split percentages to change promotes, and a DCF analysis with NPV to evaluate scenarios—features present in Flevy's Cash Flow Waterfall with 3 IRR Hurdles.Can someone new to IRR hurdles learn from a template, and what should they expect?

Beginners can learn the math and logic by studying a well-built template because the calculations and flow are visible; this model explicitly places all logic on one page and includes a DCF with NPV to illustrate outcomes, authored by a modeler with 10+ years’ experience.How does a waterfall model help when preparing a JV offer to potential LPs?

A waterfall model clarifies contributions and distributions, shows how investor returns change across IRR thresholds, and lets sponsors demonstrate incentive alignment—allowing LPs to assess expected returns and sponsors to show upside sharing via the contributions and distributions breakdown.Are IRR-hurdle waterfalls suitable for deals with unpredictable cash flows?

These structures are most common in businesses with fairly predictable cash flows, but can be applied in other deals if parties agree on thresholds and splits; the template notes typical use in more predictable environments while allowing flexible application.Why might a paid spreadsheet template be useful versus building a waterfall from scratch?

A paid template can accelerate deal work and learning by providing ready-built logic, single-page calculations, and example inputs. Flevy's Cash Flow Waterfall with 3 IRR Hurdles includes adjustable split percentages and a DCF with NPV to speed insertion into existing underwriting.Source: Best Practices in Cash Flow Management, NPV Calculator Excel: Cash Flow Waterfall with 3 IRR Hurdles Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping