ATM Machine Financial Model: 10 Year (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Recently updated: Fully integrated financial statements (Income Statement, Balance Sheet, Cash Flow Statement) monthly and annual. Added a detailed capitalization table as well as a capex schedule for each ATM tranche that includes depreciation. Improved general global assumptions.

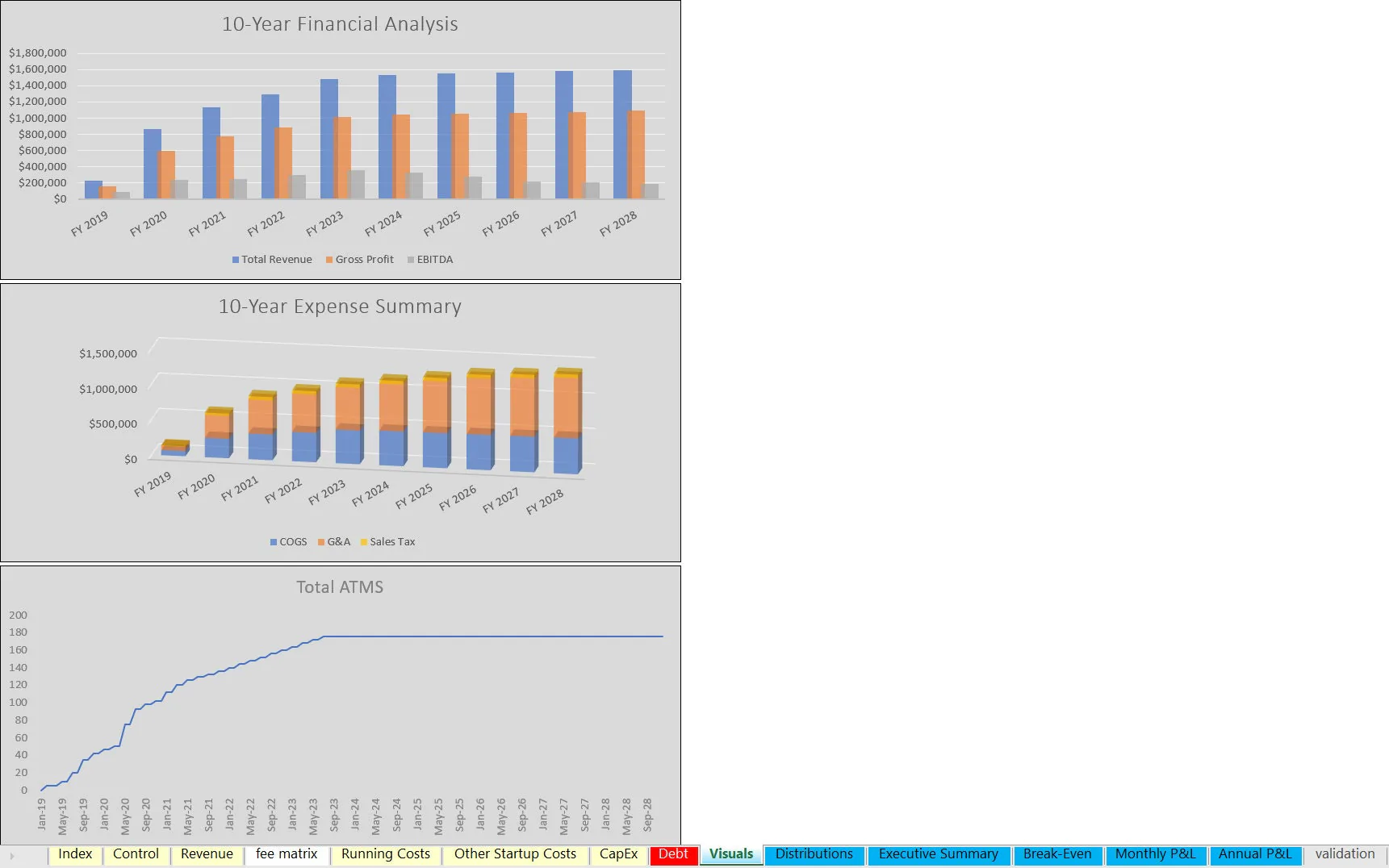

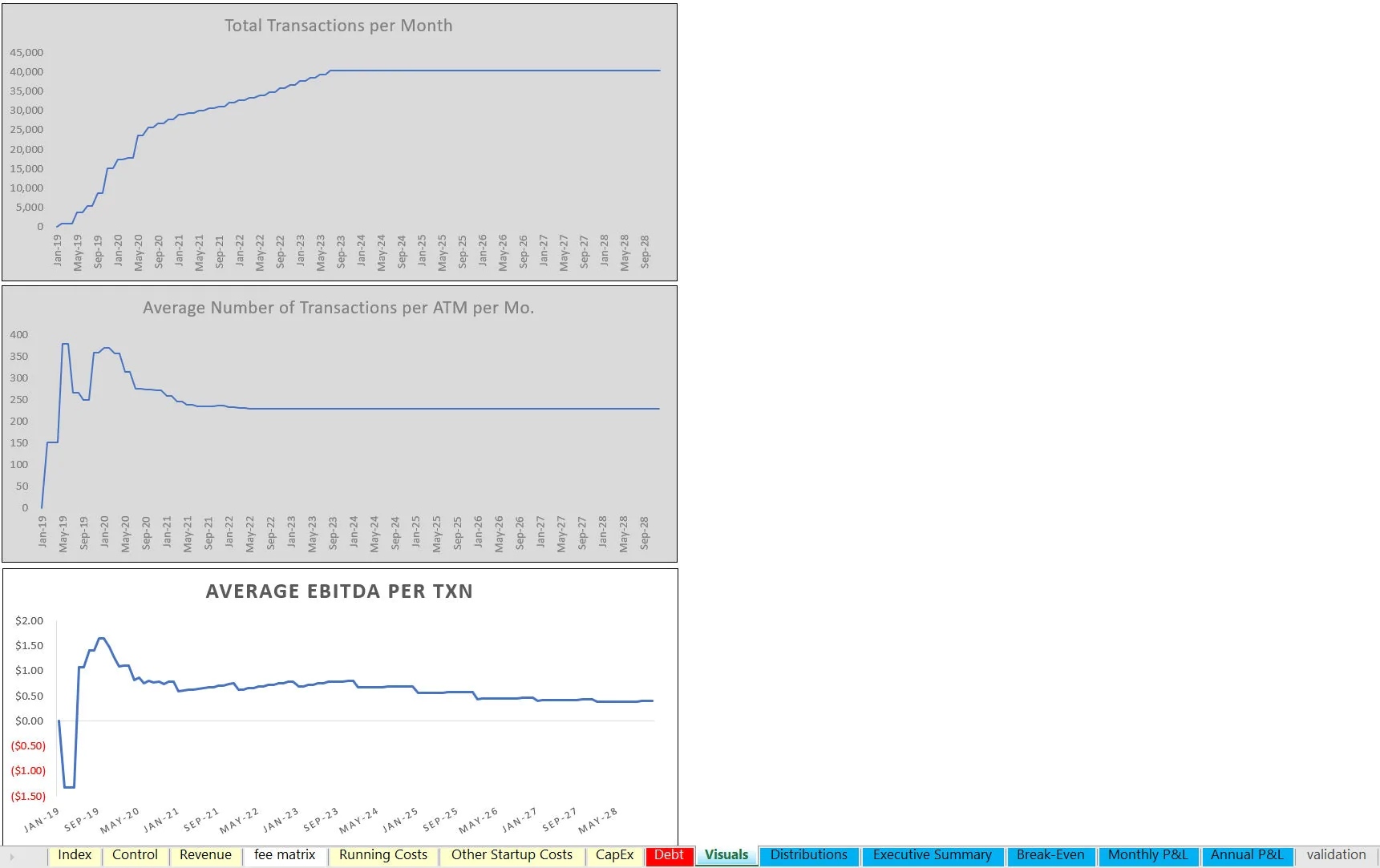

This is a comprehensive financial model for the forecasting and cash flow planning of ATM machines for up to 10 years. Such a business has specific business logic that must exist in order to properly plan out deployment, revenue, and variable costs.

Depreciation is automatically accounted for based on a defined useful life and the timing of each roll out.

Final output reports include:

• Financial statements

• Monthly and Annual Pro Forma as well as cash flow summary per period.

• Minimum equity requirement

• Annual Financial Summary of main line items for income statement and cash flow

• DCF Analysis for the project, investors (if configured), and operator

• Annual break even revenue analysis In order to arrive at a proper financial statement, all granular assumptions are accounted for in a bottom-up style.

This makes it very easy to see what things need to be true in order to attain a certain level of revenue as well as profitability.

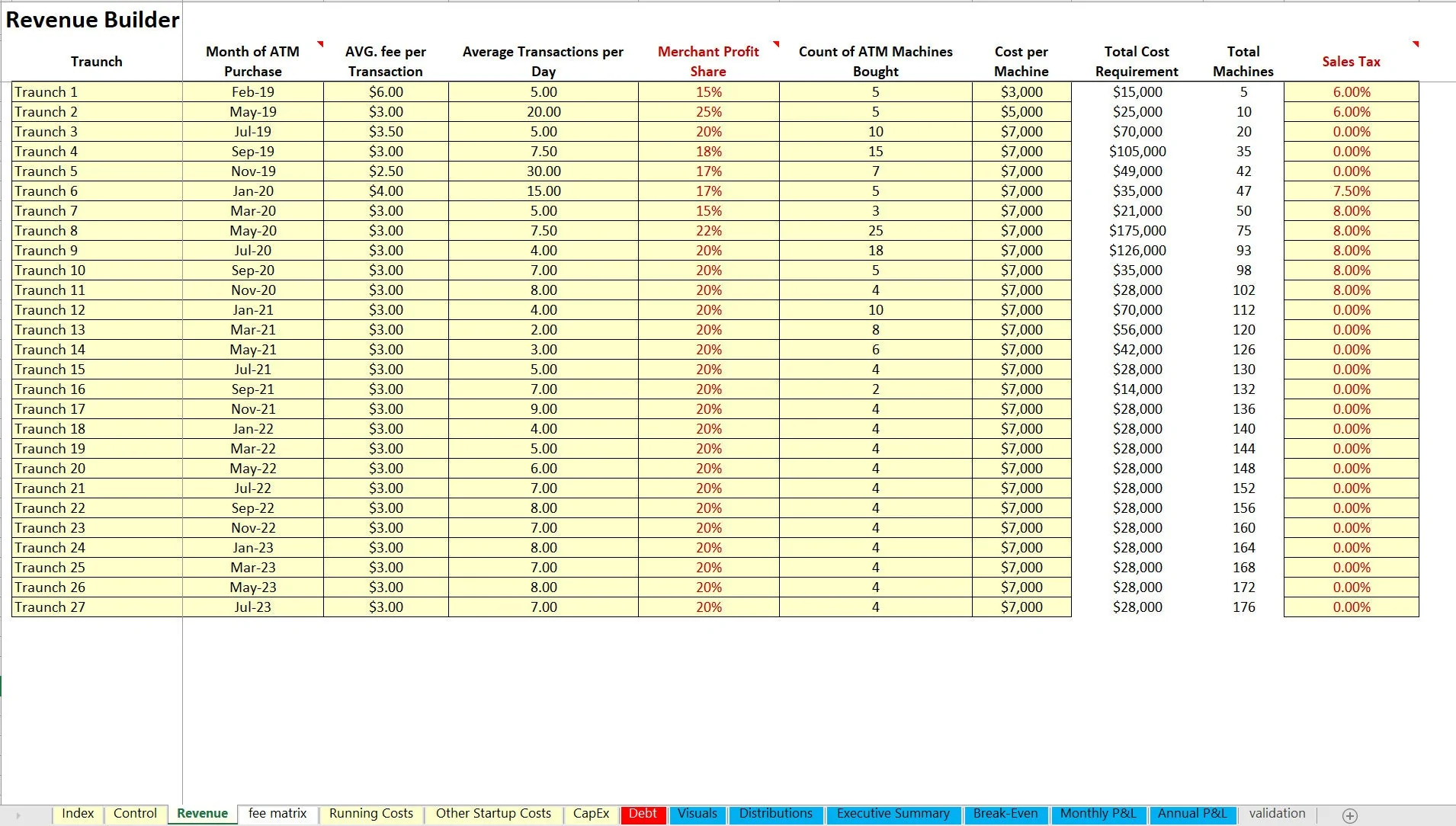

There are 27 slots for separate rollouts of ATM machines.

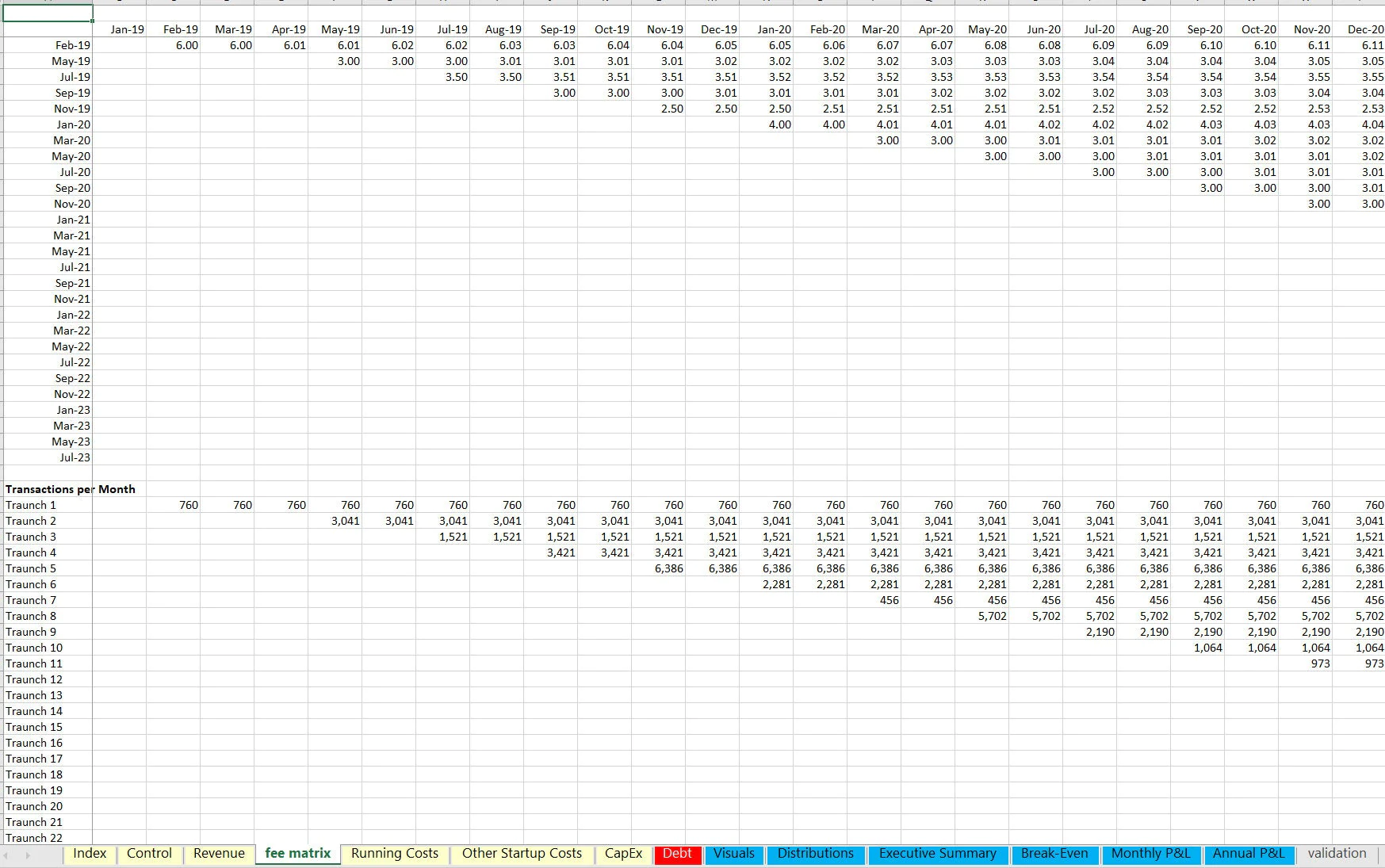

Each rollout can have any number of machines with their own configuration regarding the following:

• Month of ATM Purchase

• AVG. fee per Transaction

• Average Transactions per Day

• Merchant Profit Share

• Count of ATM Machines Bought

• Cost per Machine

• Total Cost Requirement

• Total Machines

• Sales Tax if applicable in a given state

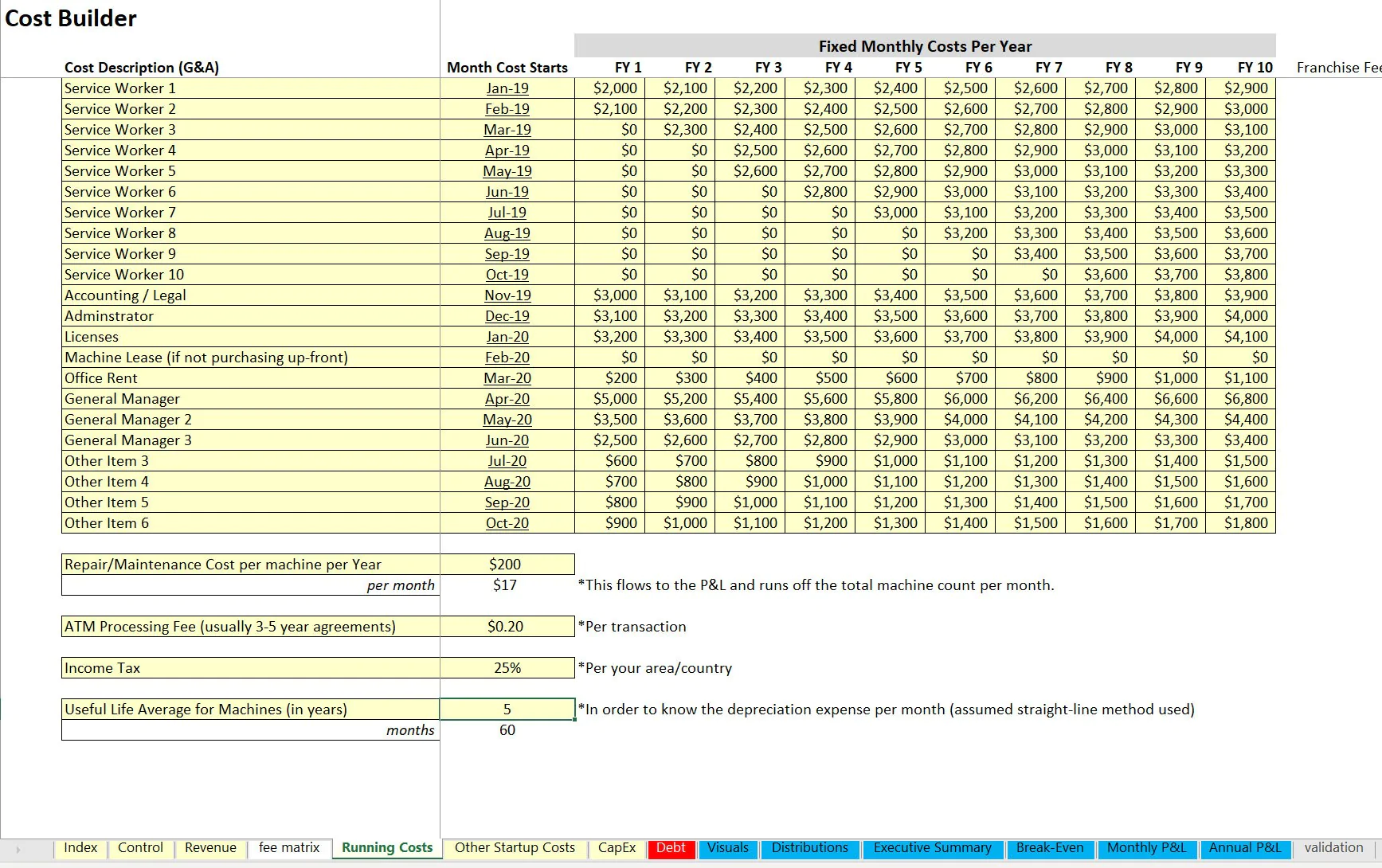

For expenses, the following variable costs exist:

• Repair/Maintenance Cost per machine per Year

• ATM Processing Fee (usually 3-5 year agreements)

And for fixed operating expenses, the user can define up to 22 slots with the expense description, start month, and monthly cost each year.

The model does account for income tax and accounts for the effect of depreciation. There are 11 visualizations, including average EBITDA per ATM machine and other KPIs as well as high level financial views with all sorts of charts.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: ATM Machine Financial Model: 10 Year Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping