P2P Lending Platform (LaaS) 10 Year Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

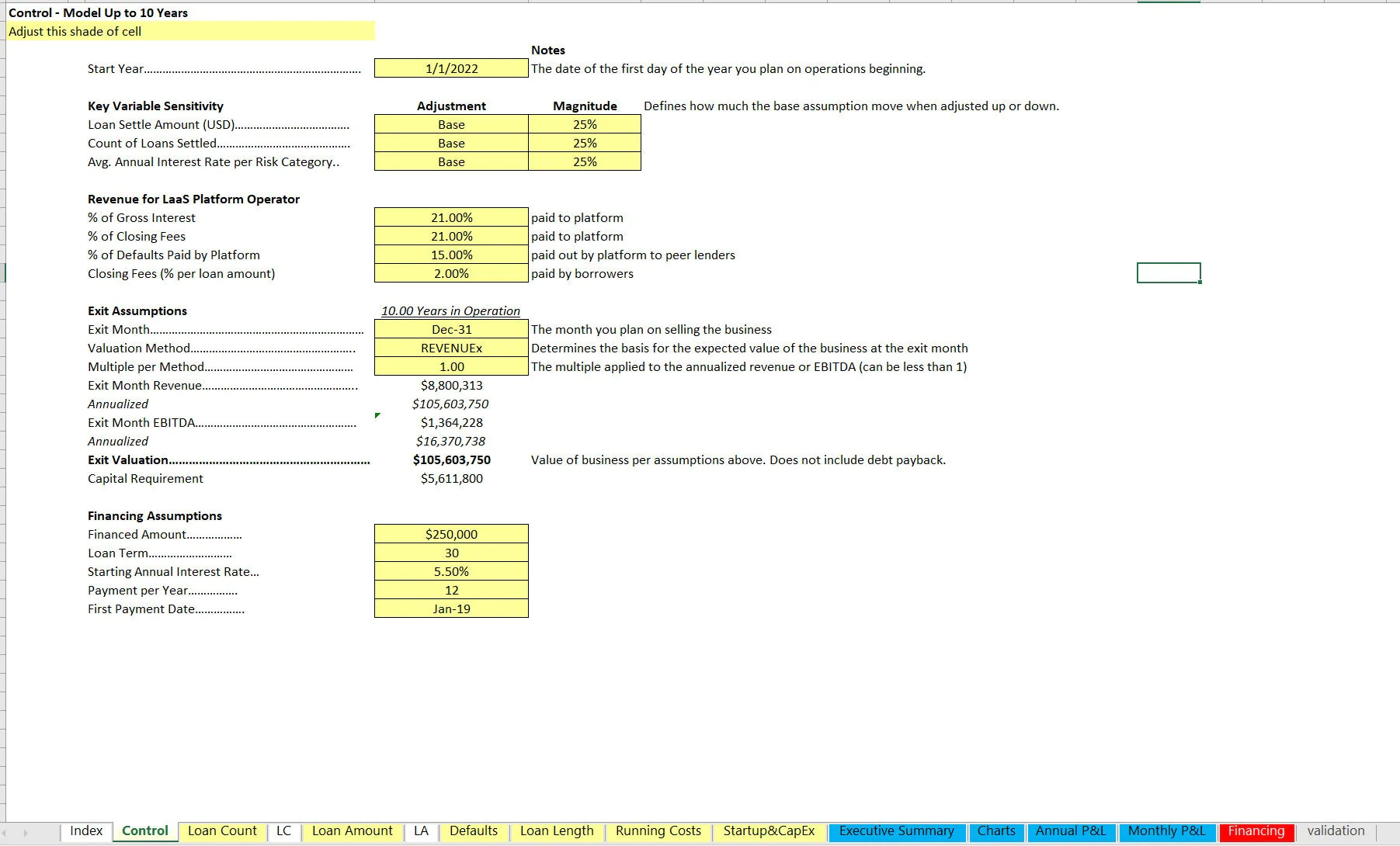

Recently updated with a full 3-statement model, cap table, and capex schedule as well as better global assumption formatting and control.

Lending-as-a-Service or P2P lending is another type of recurring revenue business whereby a platform facilitates lenders and borrowers to come together in exchange for a fee. The various terms and structures vary by platform, but in general the lenders will pay some portion of the interest earnings to the platform and the platform may take the entire origination fee or some percentage share of the platform fee.

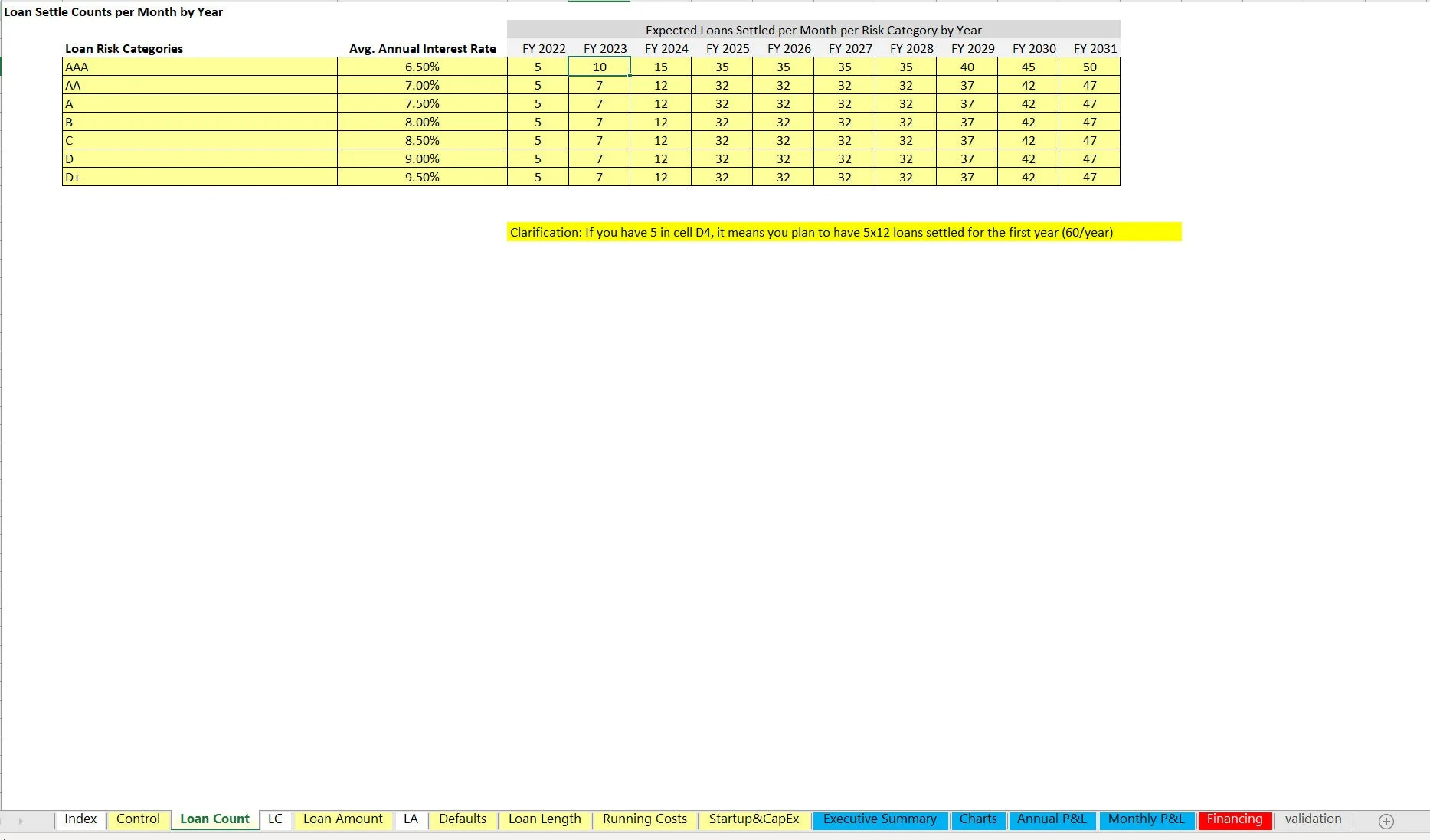

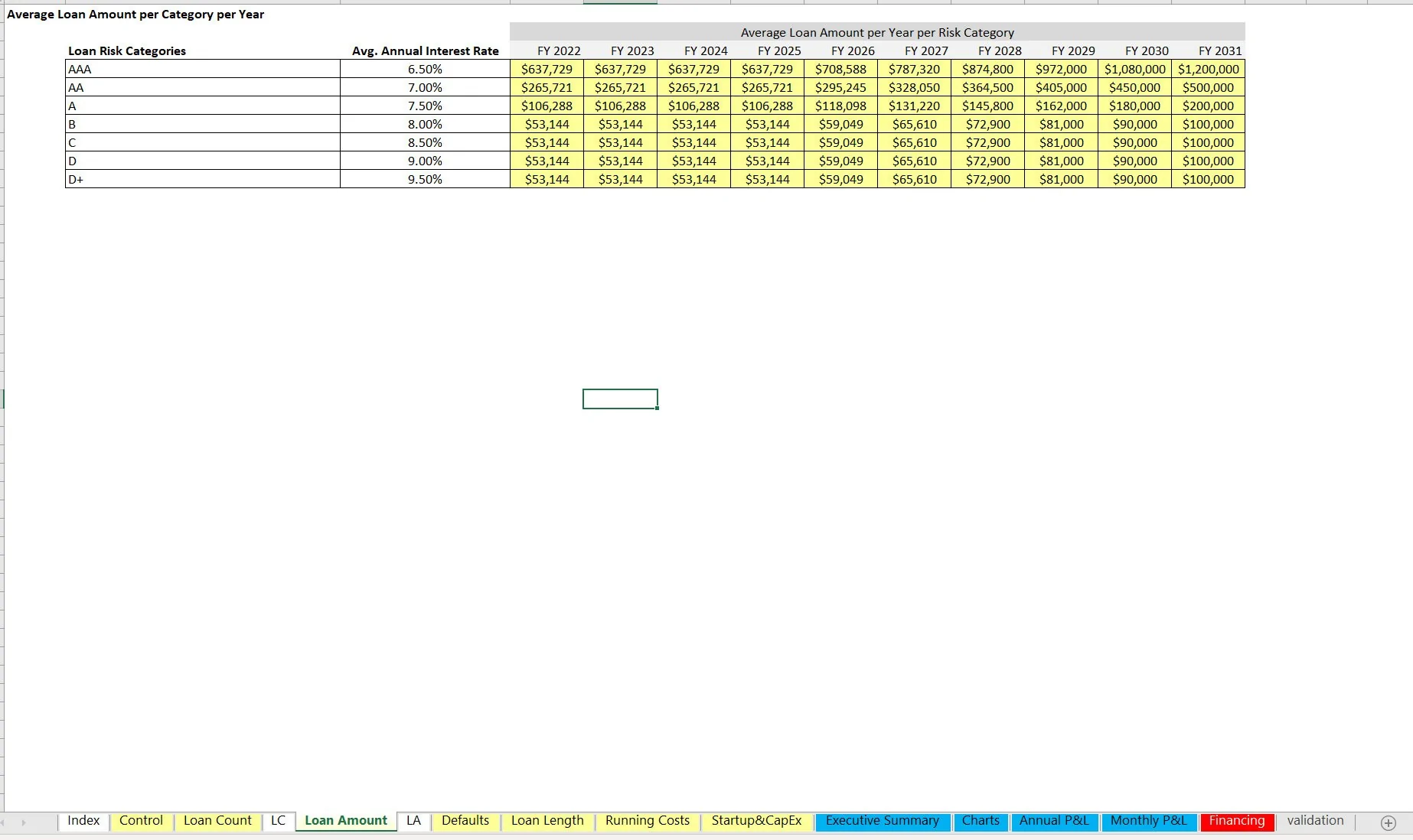

This model allows for the configuration and scaling of up to 7 interest only loan types. They vary based on:

• Average loan size

• Average interest rate

• Average default rate

• Loan length (in months)

Percentage of loans settled per loan type that are in up to 4 loan lengths (i.e. loan type 1 has 25% of total settled loans fall into the 12 month term bucket and 50% into the 6 month loan term bucket etc…)

The amount of interest the platform takes, how much of the default value the platform will cover (if any), and how much of the origination fee the platform takes can all be configured. Also, the average origination fee is defined in the same area.

This model has three sensitivity drivers that let the user make the base assumptions adjust up or down in magnitude by a defined % (low, base, high) and the assumptions that can be changed like this are:

• Average loan size

• Count of loans settled

• Average interest rate

General operating expenses are defined by description, start month, and monthly amount over ten years (up to 27 slots). There are also one-time startup and future capex schedules if required.

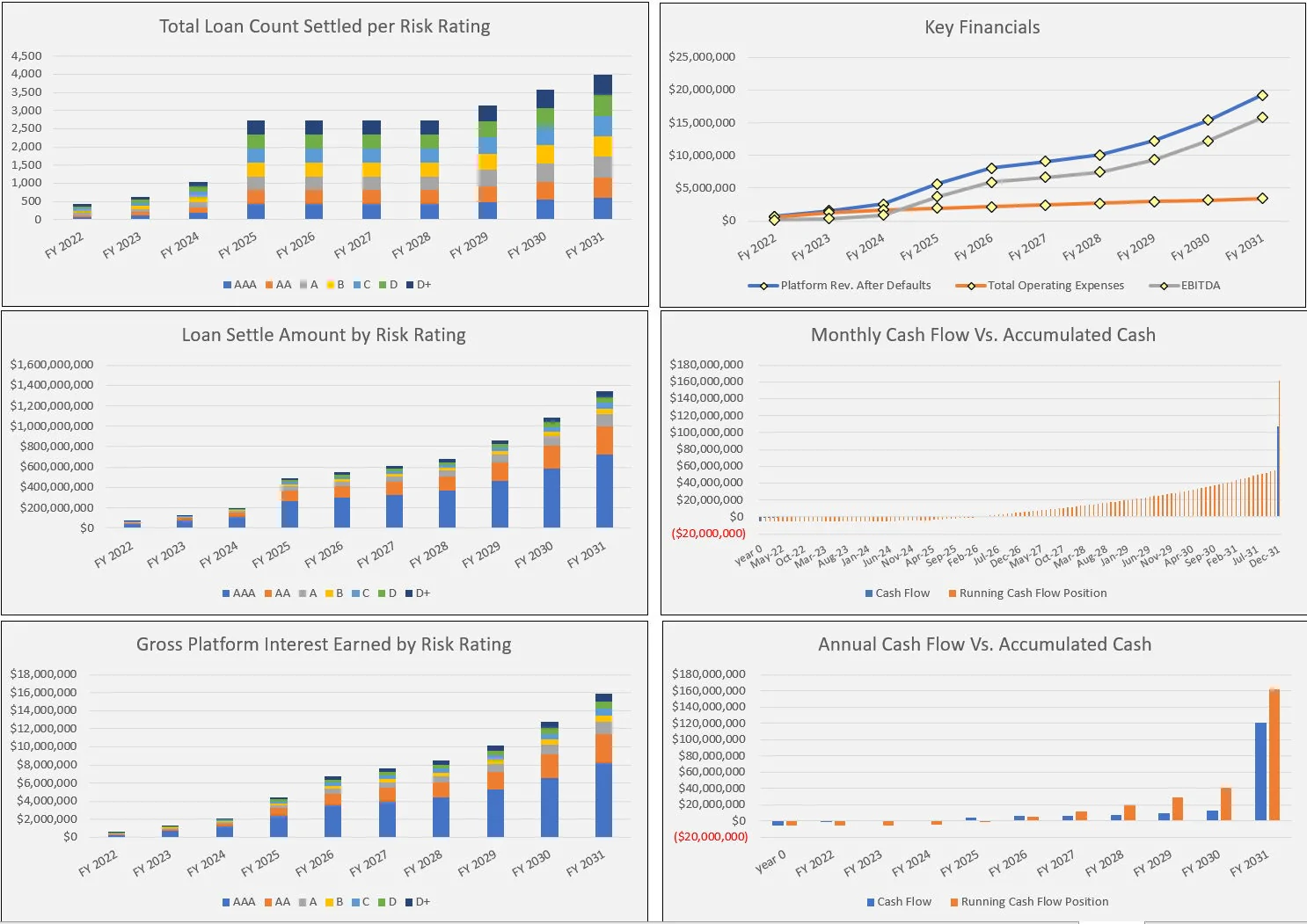

Final summaries include a monthly and annual pro forma detail that drives down to EBITDA for the platform and final cash flow. A wide range of visualizations are included in order to make the financial forecast and key metrics more digestible.

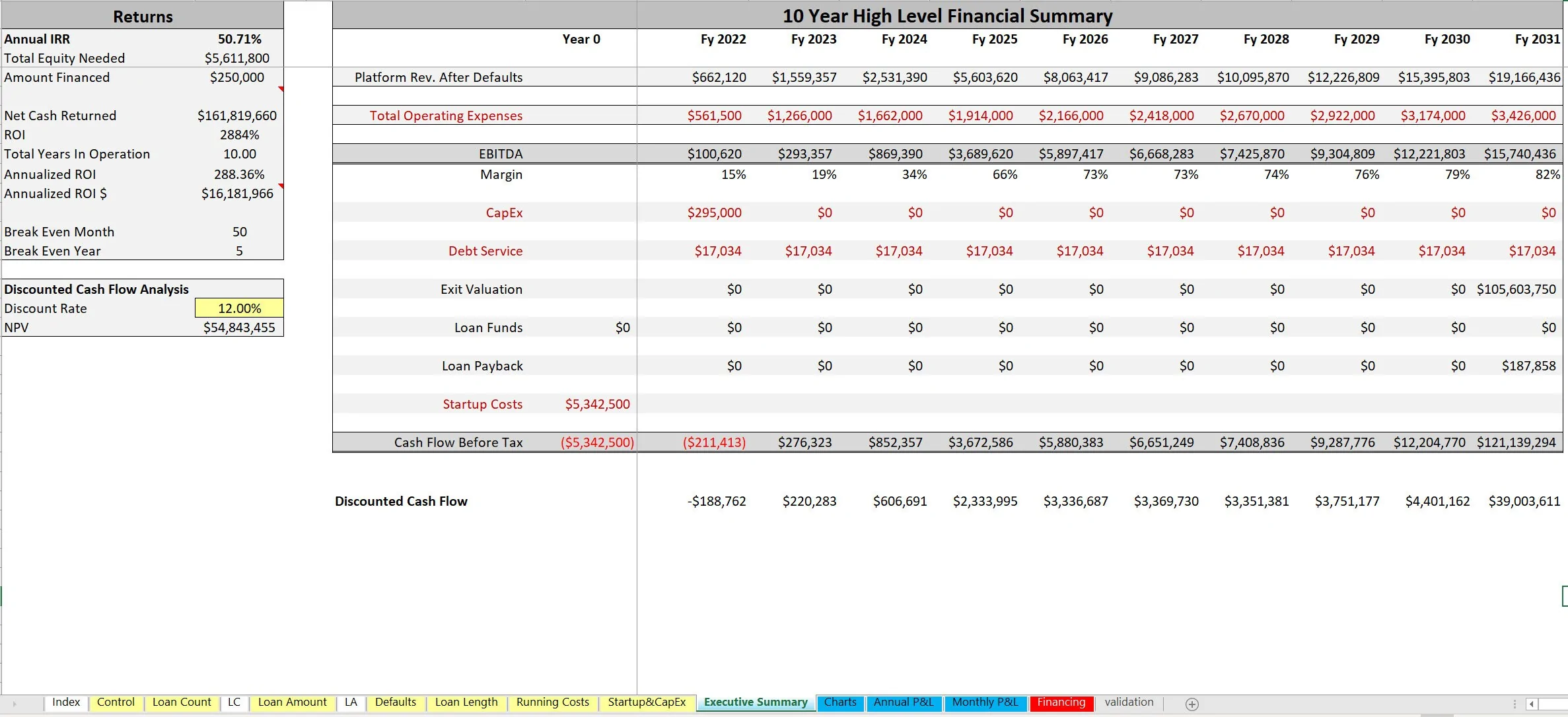

Based on all the assumptions, a high level Executive Summary was built and it shows key financial line items per year, the overall project IRR, total equity required, ROI, and a DCF Analysis. There is an assumption configuration for terminal value and it is based on the annualized EBITDA in the exit month if chosen.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: P2P Lending Platform (LaaS) 10 Year Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping