Acquire and Operate 100 Rental Properties: Feasibility Study (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Real Estate Model

- Financial Planning

- Elevate Your Investing Strategies

REAL ESTATE EXCEL DESCRIPTION

Elevate Your Real Estate Investments with Dynamic Planning

Ever considered the strategic scaling of your rental portfolio over a span of two decades? Introducing this innovative model, tailor-made for forward-thinking real estate investors. With it, you can:

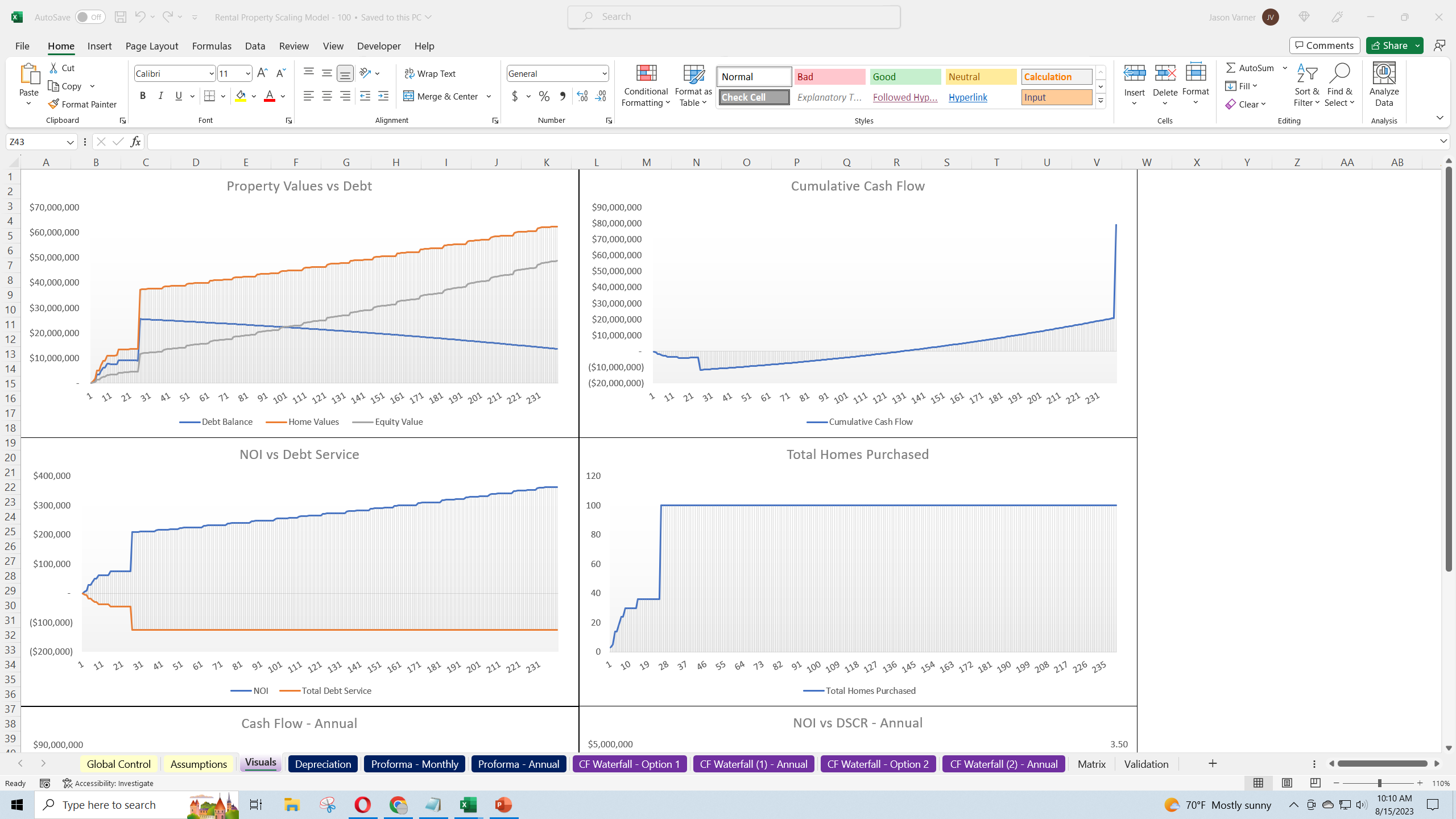

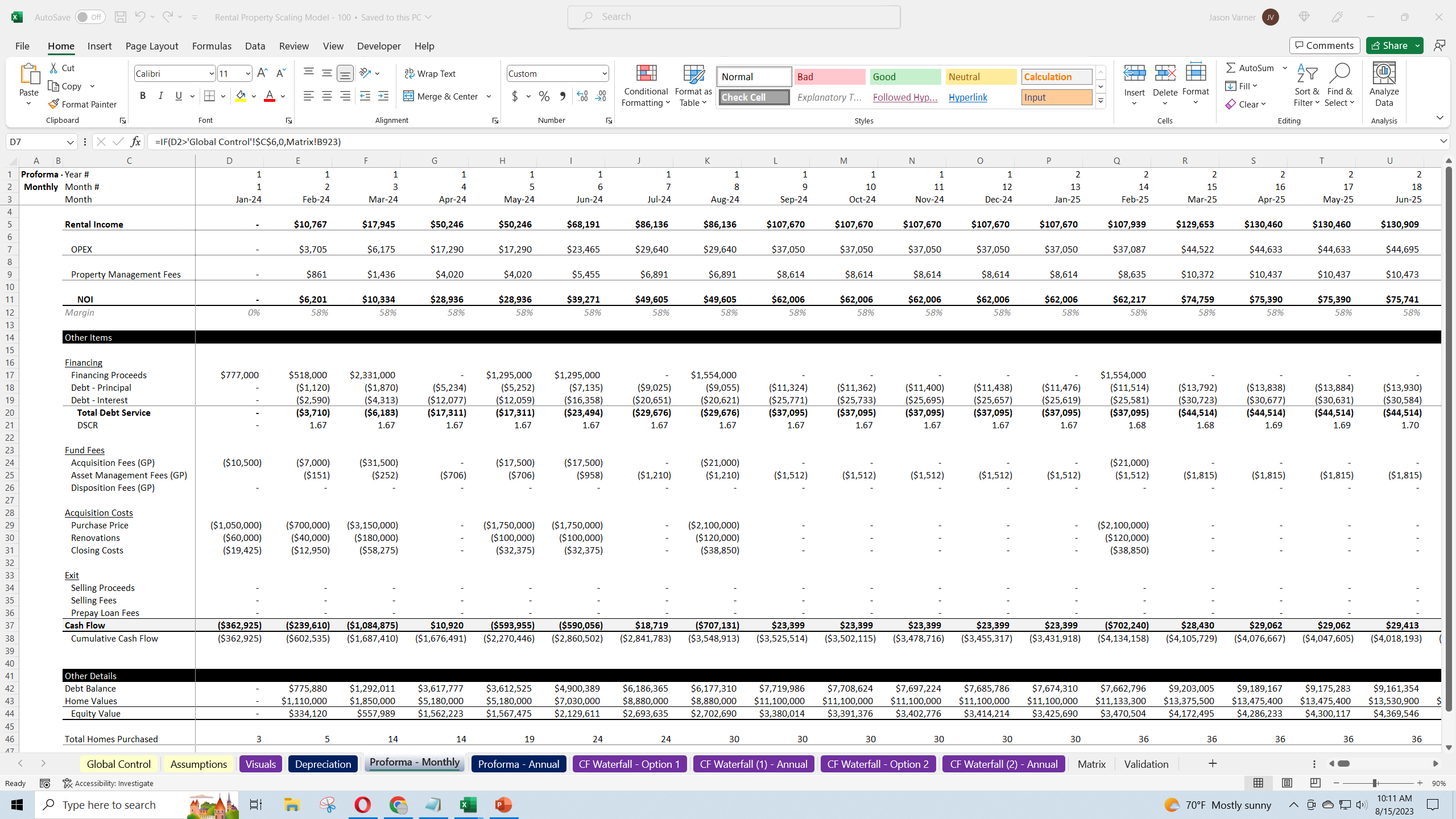

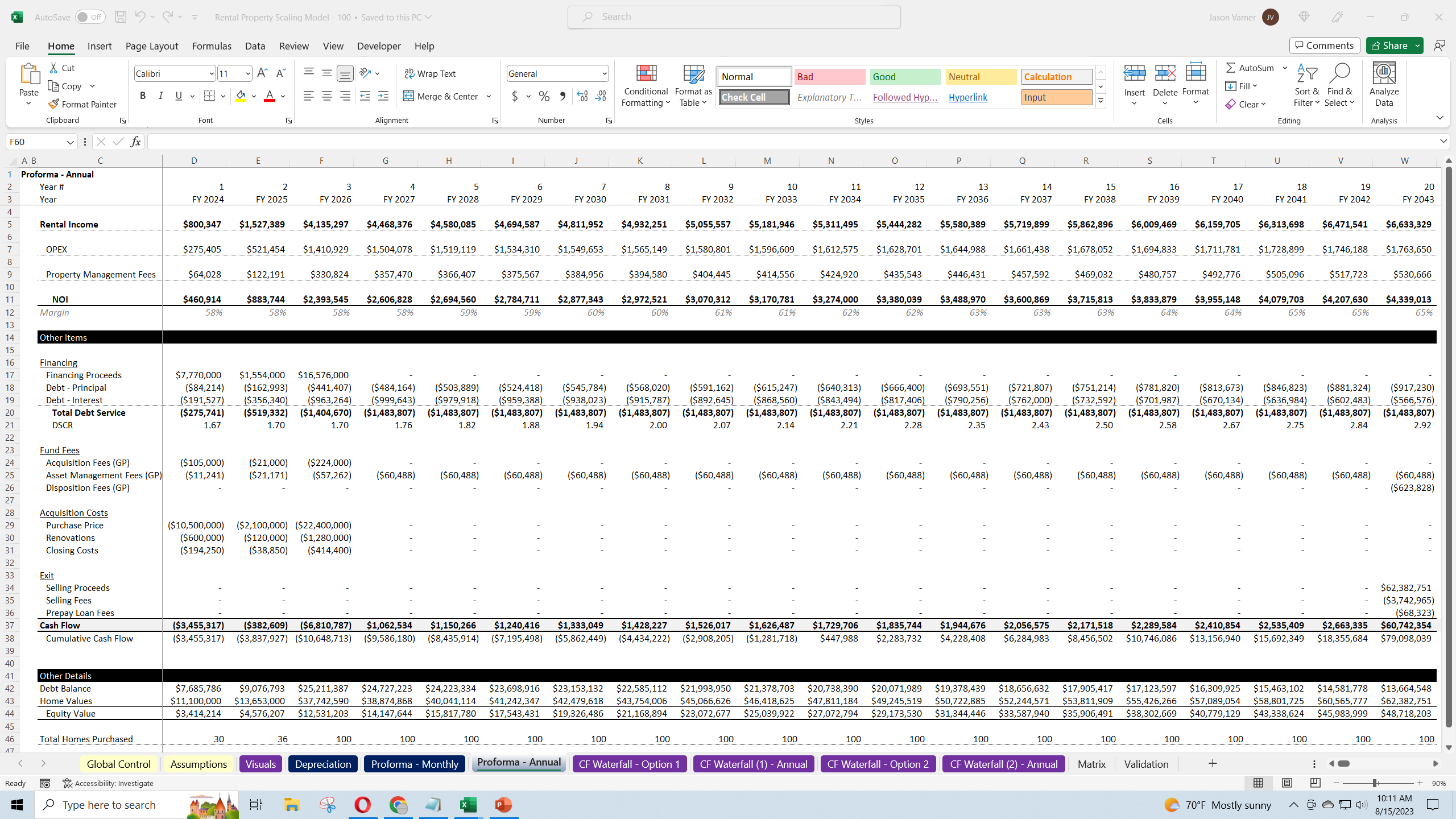

• Craft a meticulous 20-year financial blueprint.

• Forecast the financial obligations tied to acquiring and leasing properties through conventional agreements (excluding short-term rentals).

Key Features:

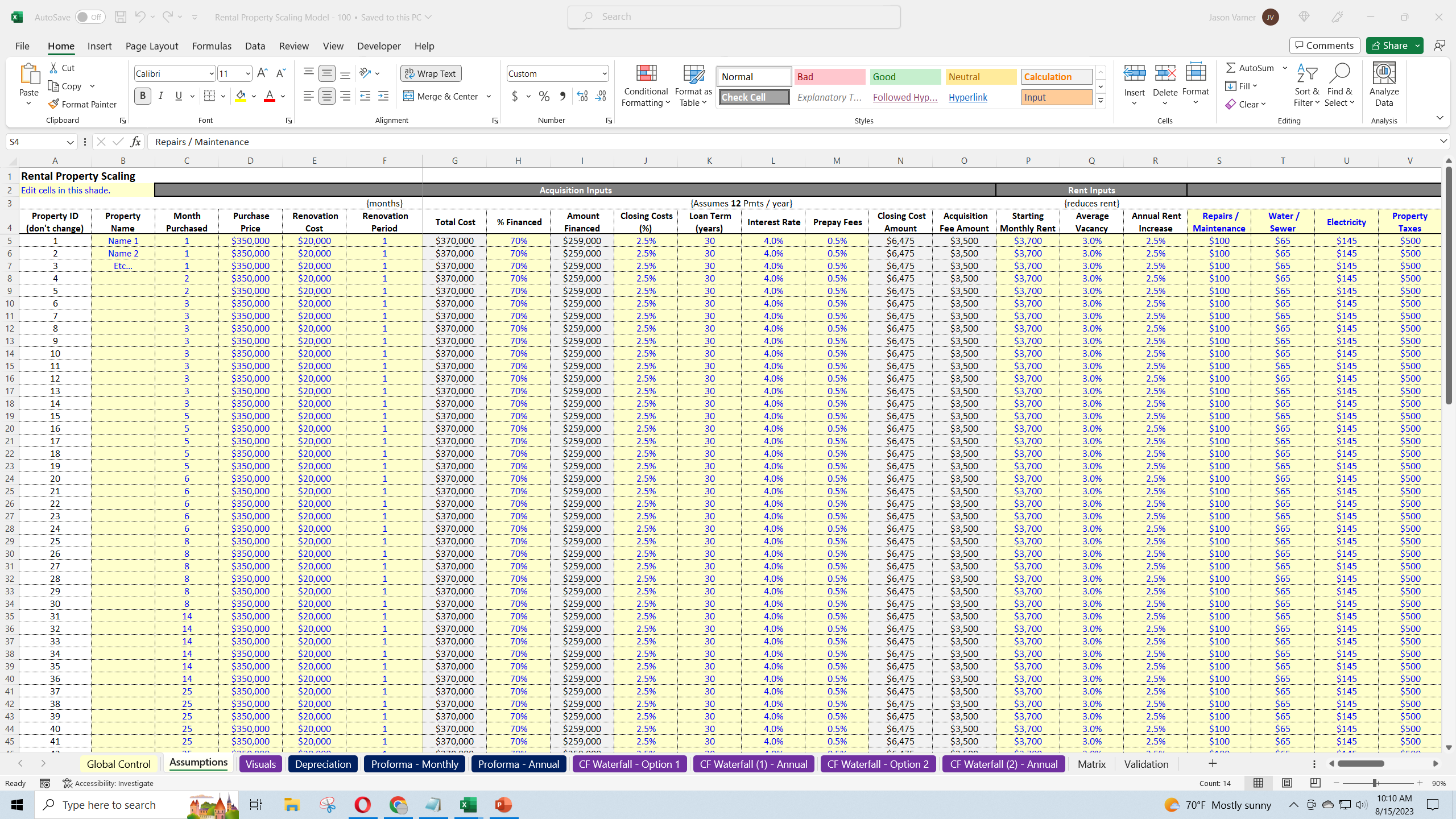

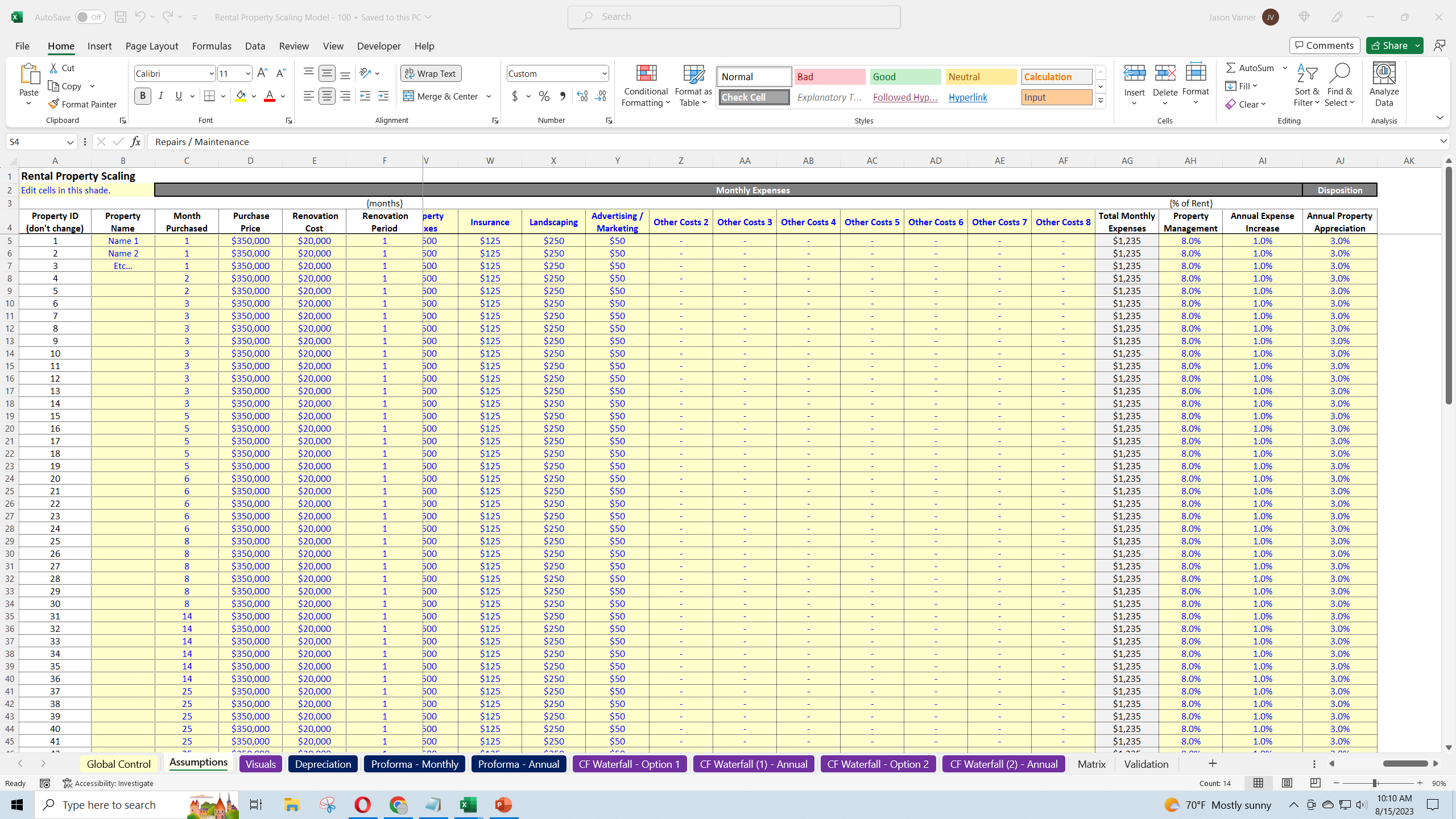

• Adaptable Assumptions: Customize details for each property – from purchase timing to financing specifics. This allows you to gauge the essential equity based on your investment pace.

• In-depth Property Configuration: Feed in variables like purchase price, renovation details, financing structure, rental figures, expenses, and property growth metrics.

• Strategic Insights: Whether you lean towards a conservative approach, reinvesting profits, or aggressive scaling, our model maps out the financial landscape for you.

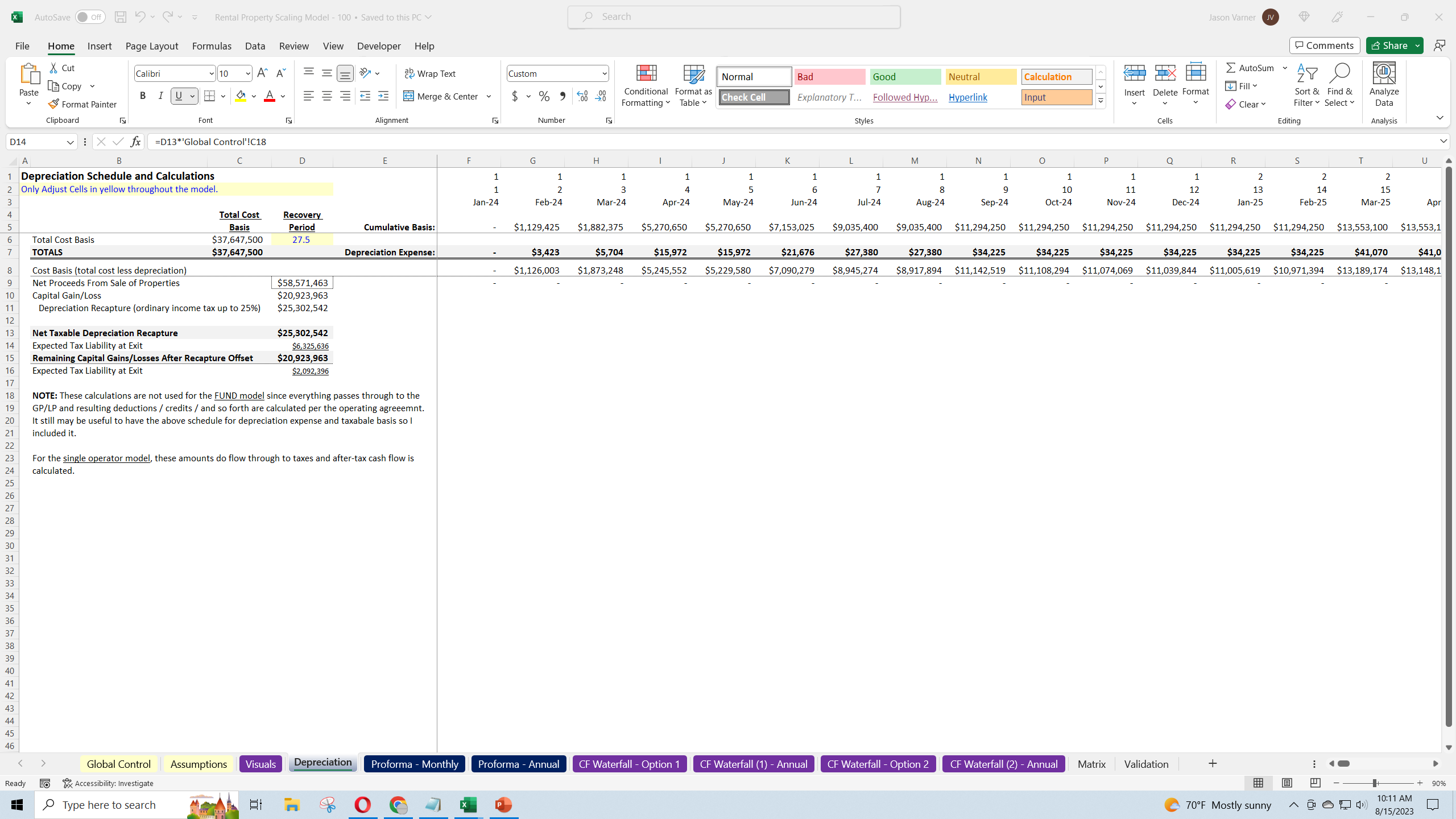

• Detailed Financial Breakdowns: Opt between single operator or fund versions. The former offers a deep dive into taxes, depreciation, and post-tax cash flow, while the latter sheds light on pre-tax flows, fund distributions, management fees, and intricate investment returns setups.

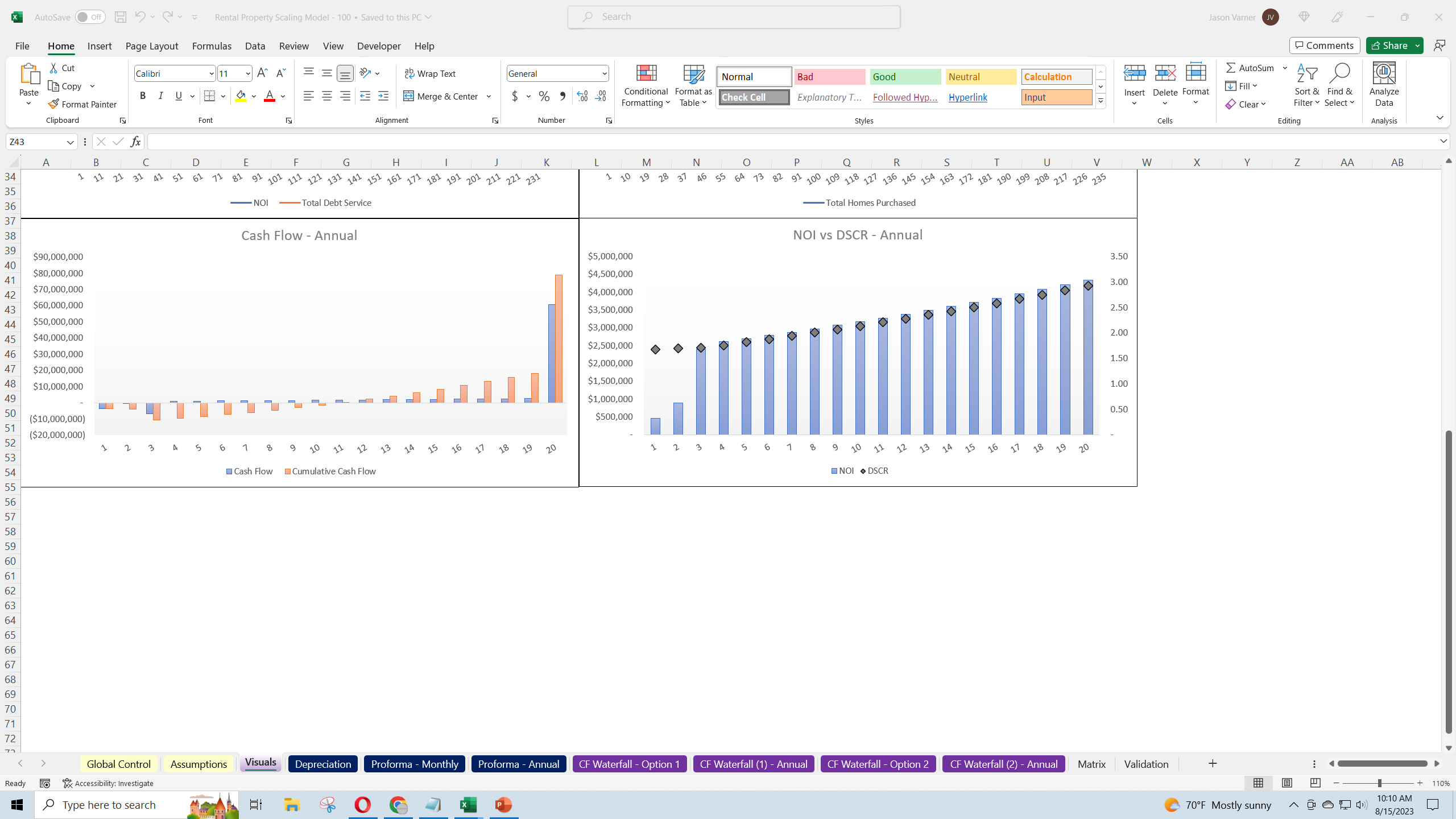

• Visual Analytics: Enhance your understanding with a plethora of visual aids incorporated within each template.

Whether you're a solo investor or part of a larger fund, our model is designed to refine your strategy, optimize returns, and propel you seamlessly towards your goal of 100 properties. Choose the tool that best fits your ambitions.

Investing in rental properties has historically been seen as one of the more stable and profitable means of building long-term wealth. Here are several long-term bull cases for such investments:

Appreciation of Property Value: Over long periods, real estate typically appreciates in value. While there might be short-term market fluctuations, in the long run, the value of the property usually grows, leading to an increase in net worth for the property owner.

Passive Income Stream: Rental properties provide a consistent and passive stream of income. With the right property in the right location, rental income can exceed the expenses associated with the property, leading to a positive cash flow.

Leverage: Real estate is one of the few investment vehicles where you can use leverage (in the form of mortgages) to magnify returns. This allows investors to control a large asset with a relatively small amount of cash and benefit from its appreciation and rental income.

Tax Benefits: Real estate investment often comes with various tax incentives, including deductions for mortgage interest, property taxes, and depreciation. In some jurisdictions, there are also capital gains tax advantages when selling the property.

Diversification: Real estate can act as a hedge against inflation and provide diversification in an investment portfolio. Its performance isn't directly tied to stocks or bonds, which can help reduce volatility.

Physical Asset: Unlike stocks or bonds, real estate is a tangible asset. This tangibility offers a psychological comfort of ownership and ensures that there's always inherent value in the land and structure.

Inflation Hedge: As inflation causes the general price of goods and services to rise, rent can also be increased over time. This means rental income can keep pace with or even outpace inflation, preserving the purchasing power of your income.

Demand Driven by Population Growth: As populations grow and urbanize, there's an increasing demand for housing. This population growth can ensure a sustained demand for rental properties.

Control Over Investment: Unlike many other investments, real estate allows for a significant degree of control. Owners can make decisions about property management, rental prices, property improvements, and when to buy or sell.

Equity Building: As you pay down your mortgage (if you have one), you build equity in the property. This equity can be tapped into for other investments or expenses, or it can continue to grow as the property appreciates.

Forced Appreciation: Through renovations and property improvements, investors can force appreciation, increasing the value of the property beyond standard market appreciation. This can lead to increased rental income and higher resale value.

It's essential, however, for investors to remember that while there are many benefits to investing in rental properties, there are also risks involved. Proper due diligence, understanding local market conditions, and effective property management are crucial to realizing the potential advantages.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate Excel: Acquire and Operate 100 Rental Properties: Feasibility Study Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping