Preferred Return Model: 10 Year (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INVESTMENT VEHICLES EXCEL DESCRIPTION

Updates:

• Added an option (yes/no selector) to reduce LP equity basis with any distributions above the pref. return.

• Added a DCF Analysis to the end of this spreadsheet for an even more complete analysis tool.

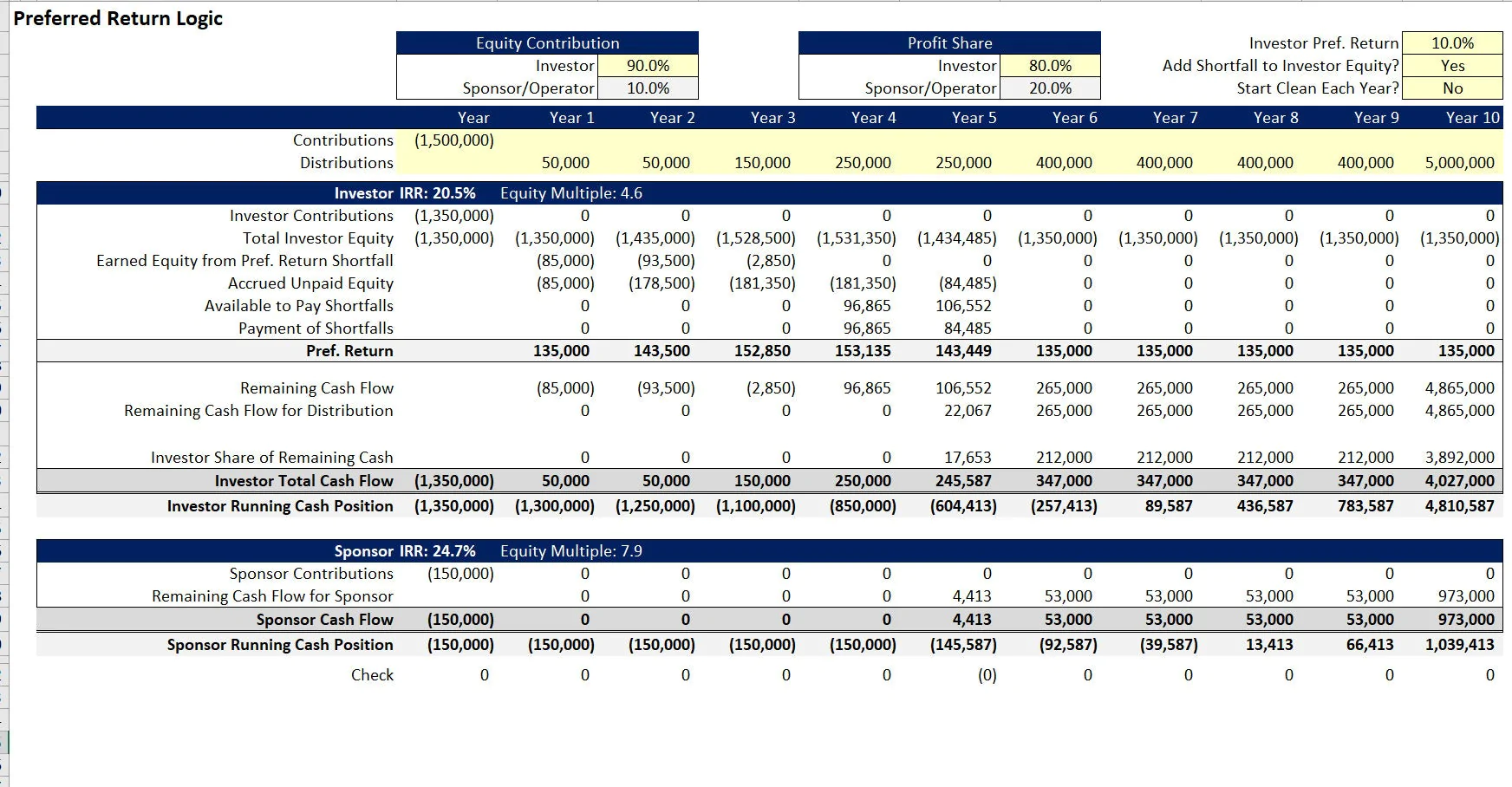

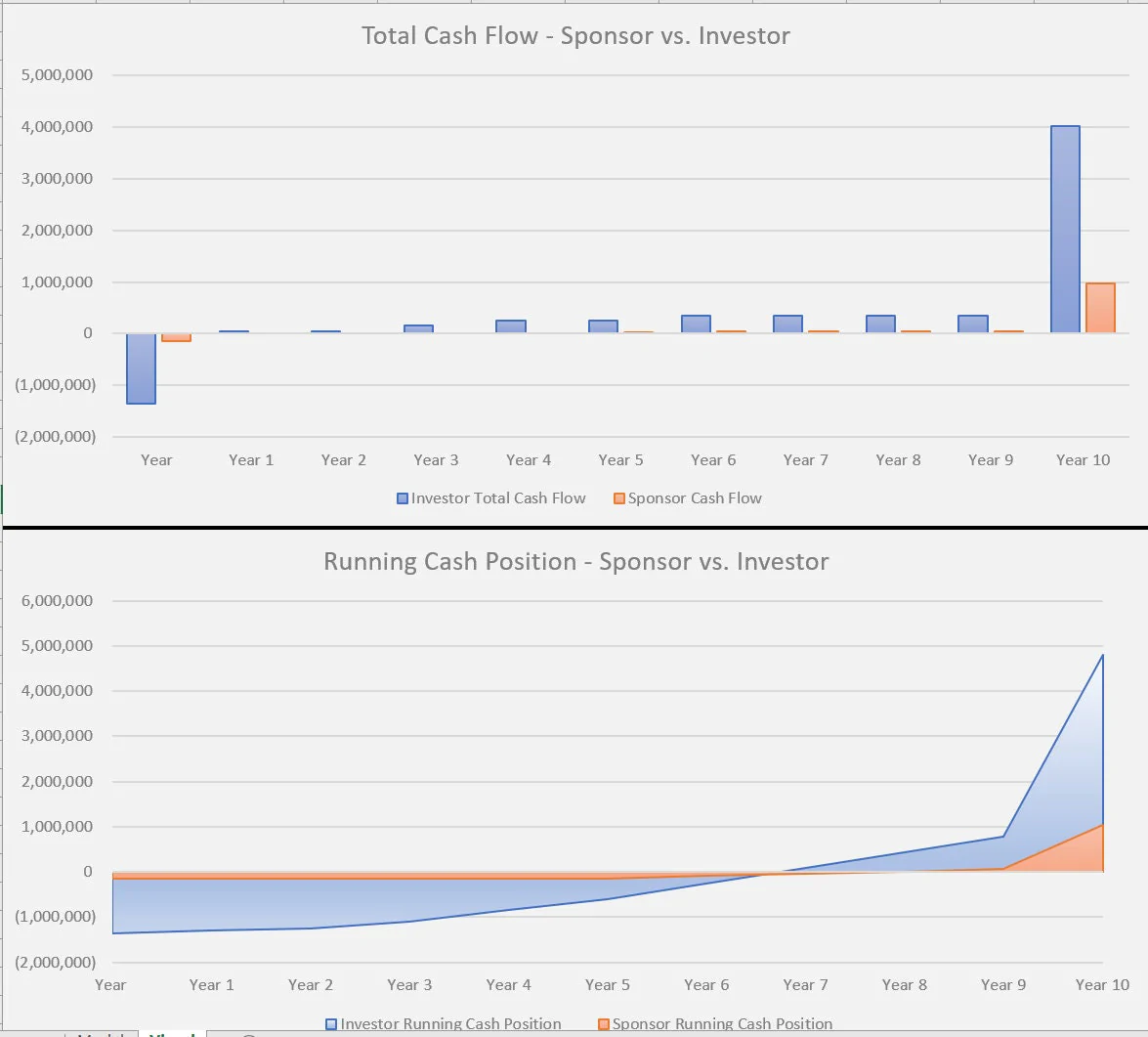

Joint venture waterfall distribution models can be used and structured in all sorts of ways and in all business types. The most common uses often end up in real estate or oil and gas deals. However, their uses easily extend to any business sector.

This model is a preferred return joint venture model. Preferred return is much different than preferred equity (preferred equity may have a preferred return attached to it).

This model is based on the investor leg having a claim on the return, but not on the contributed equity. In simple terms, this means the initial equity is not returned in the calculations.

Note, investor also means LP or limited partner and sponsor means GP or general partner.

The inputs are driven in the following manner:

• Contributions and distributions of the project as a whole are defined in period 0 through 10 where applicable

• The percentage of contributions attributed to the LP are defined (and GP therein)

• The preferred return rate is defined for the LP

• Any shortfalls can either be compounded to principal, accrued but not compounded, or wiped clean each period based on two switches.

Based on the cash that is available to distribute, there may not be enough to cover the preferred return.

If not, the unpaid return can either be:

• Accrued and paid later when there are more cash flows

• Accrued to the LP balance and increase future returns whenever there are more cash flows (and get paid down to the initial equity contribution)

• -Returns can be wiped clean each year even if there are shortfalls.

The above can be modeled with two ‘yes/no' switches. This Excel template is very easy to use and is designed to work after you know the per period cash contributions and distributions. You plug that in and adjust the pref. Rate / contribution rates. All other logic flows from there.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Investment Vehicles, Return on Investment Excel: Preferred Return Model: 10 Year Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping