Preferred Equity with Subordinate Soft Preferred Waterfall (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INVESTMENT VEHICLES EXCEL DESCRIPTION

Model updates:

• Added an option to not compound unpaid accrued returns.

• Added a DCF Analysis with NPV to the end of this model.

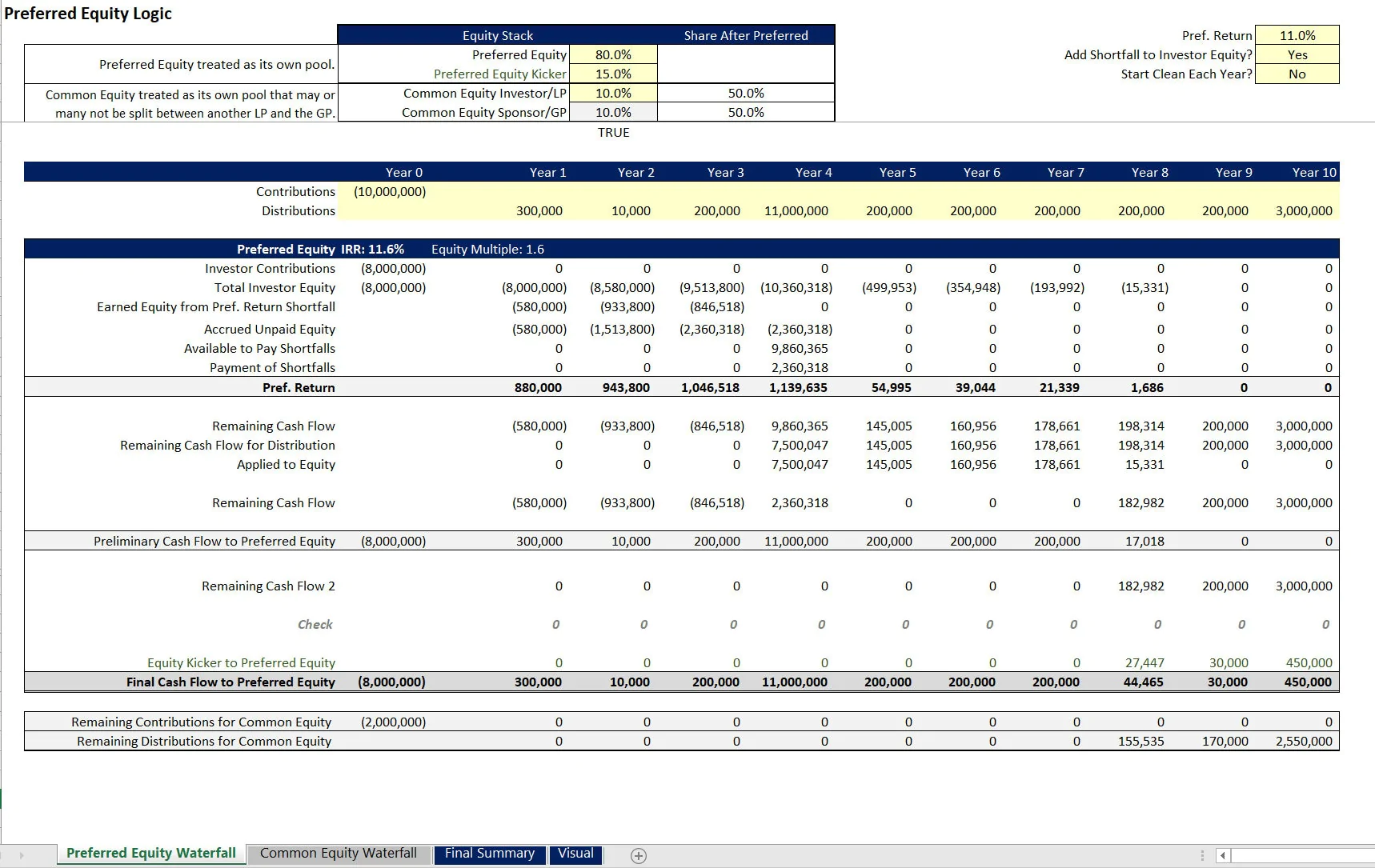

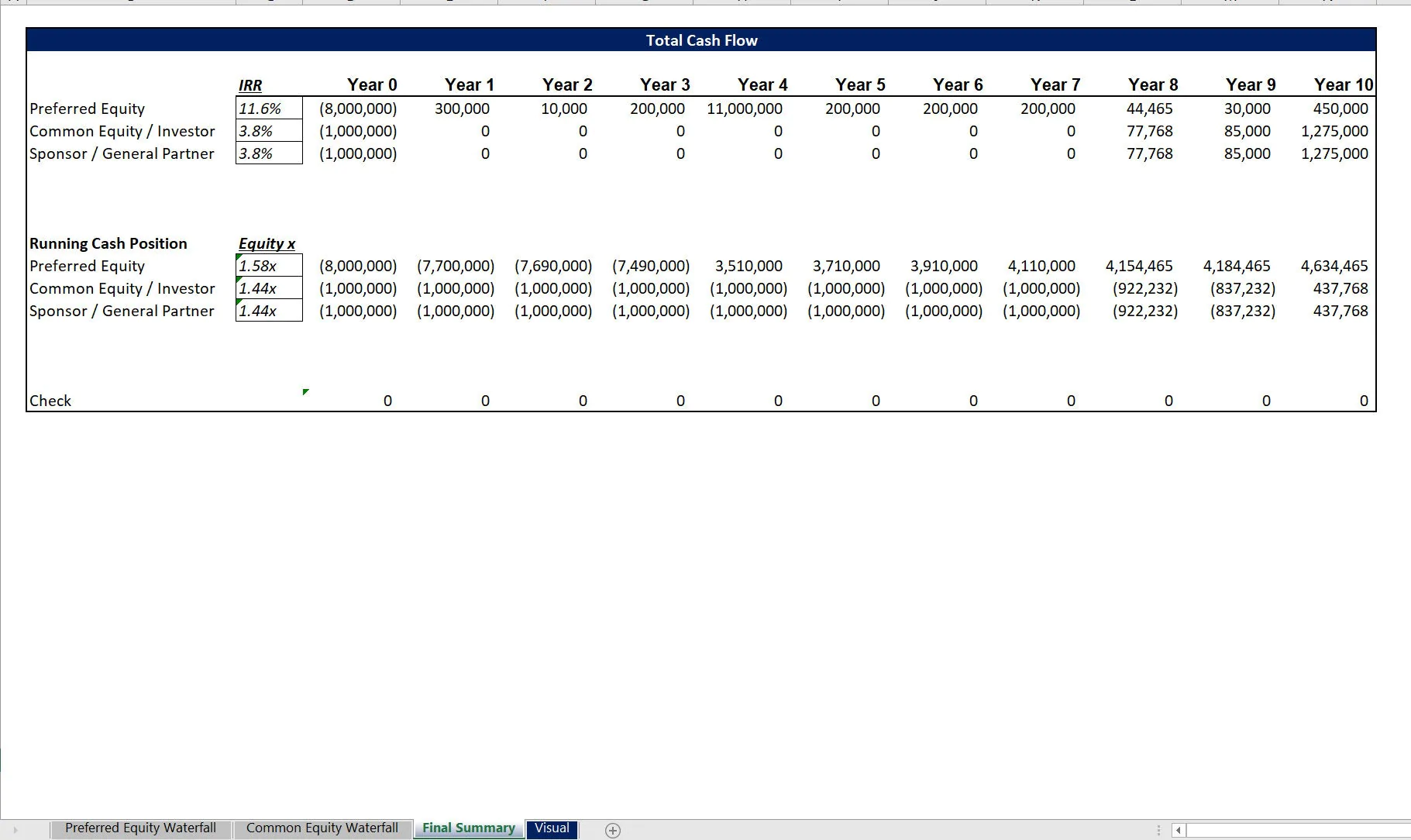

This joint venture model is designed to be used for any kind of deal (real estate or otherwise) once the user knows final project-level cash contributions and distributions (year 0 to year 10).

Those are input at the top of the template and then based on the defined inputs, cash will split to the Preferred Equity Leg and subordinate Sponsor (GP) and Investor (LP) accordingly.

This is a 2-part model and it is flexible enough so that only one of the two parts can be used if that is what is needed. The first part is a hard preferred equity leg. This is equity that comes in and requires an annual rate of return as well as 100% of the equity repaid before cash can flow anywhere else.

There is an equity kicker for the initial pref. and will apply to remaining cash available. After that is paid, the remaining cash flows to the subordinate equity pool, which can also be made up of its own joint venture with a sponsor and investor.

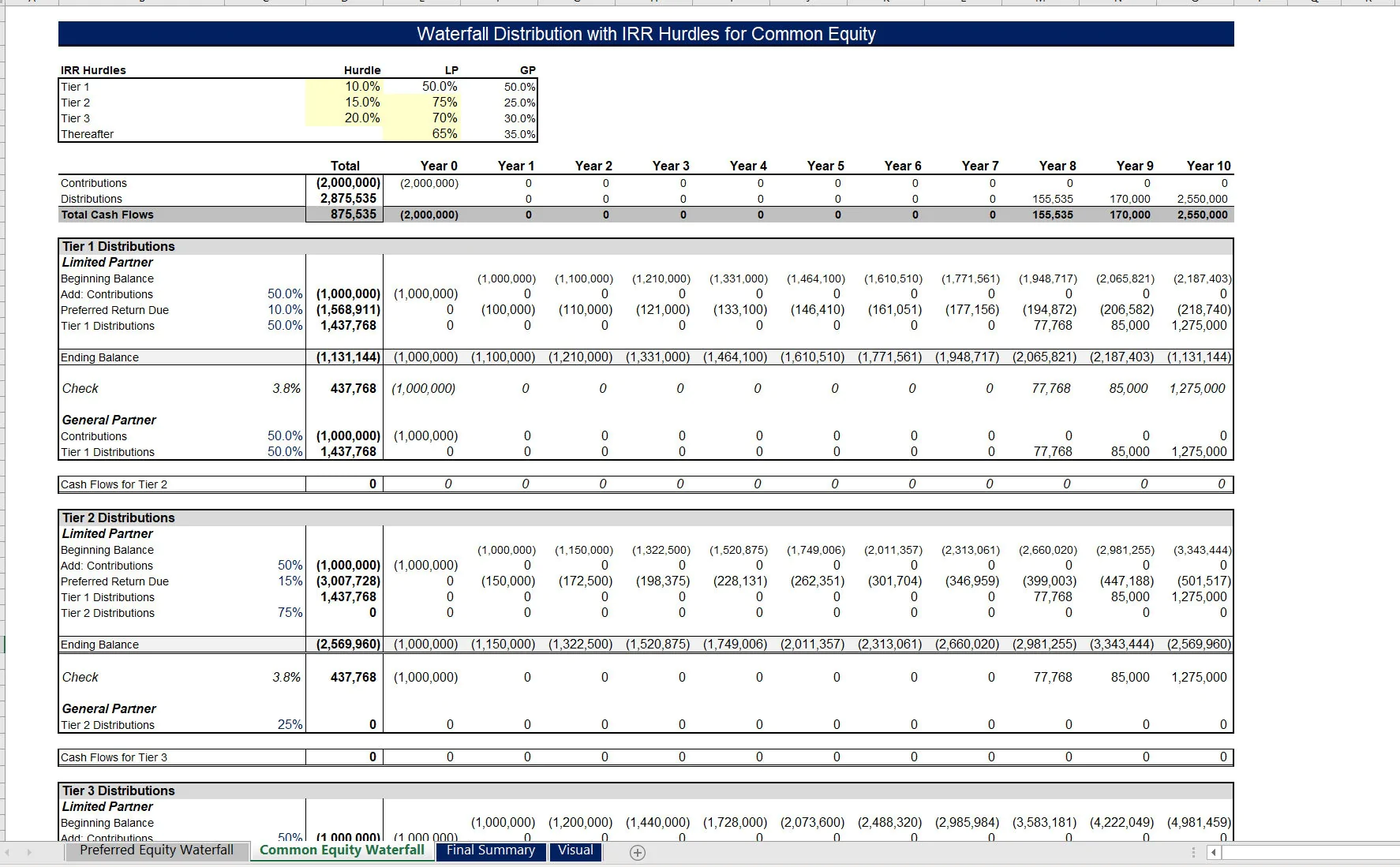

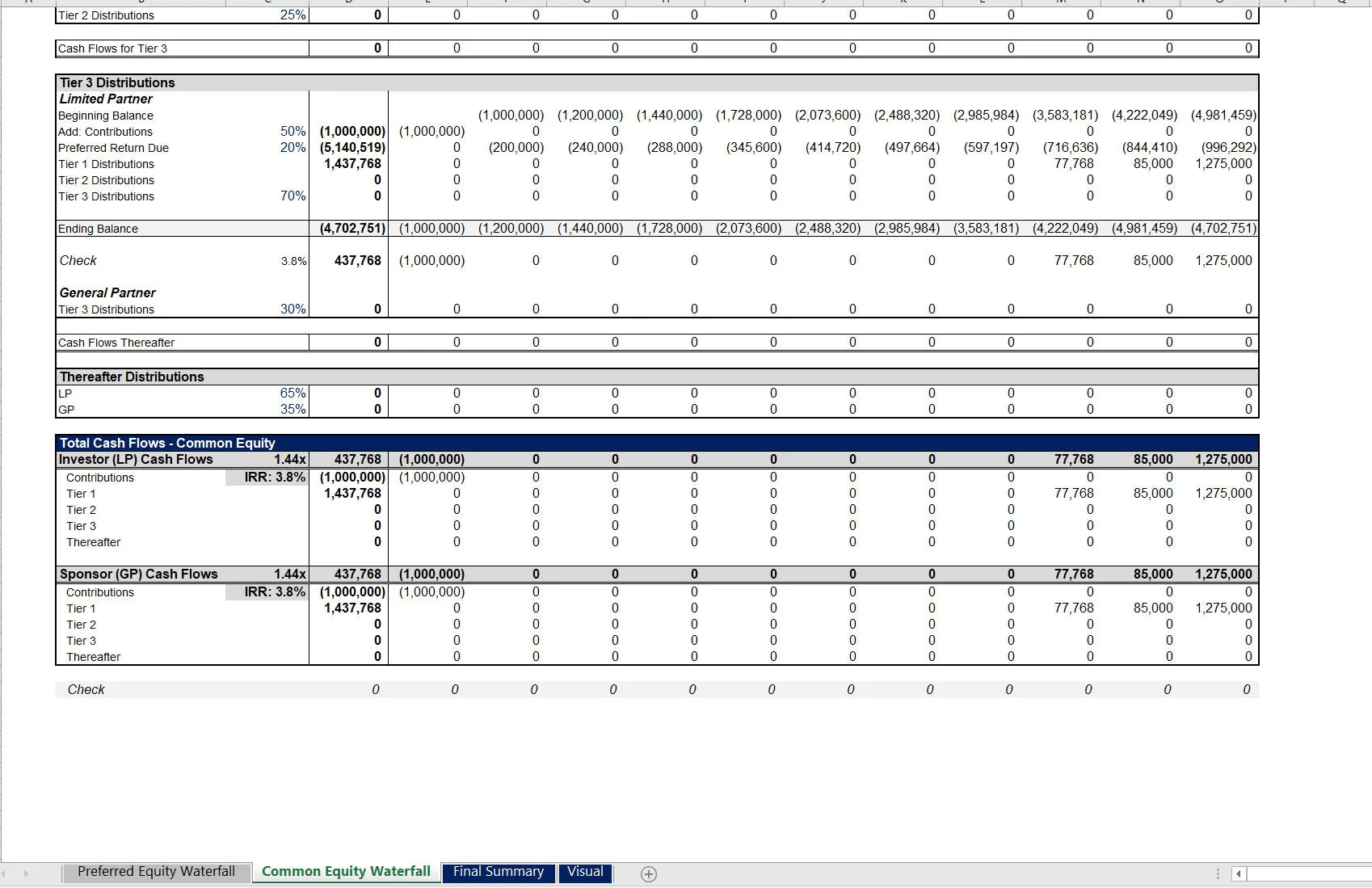

This subordinate logic is based on IRR hurdles. The first hurdle is soft preferred where cash is split pari passu until the investor meets the minimum hurdle rate (it could be 'hard' if you just set the split at 100/0 instead of pari passu).

After that, remaining cash goes through two more hurdle rates and defined cash splits therein. So, in total you have three cash flow pools.

• Initial Investor (hard pref.)

• Secondary Investor (soft pref.)

• Sponsor (participates with any remaining cash flow after both investors have attained their cash flow requirements).

In the initial hard preferred equity waterfall, the user can define if any shortfalls flow to the next year, if the return should reset each year, and the rate.

Other inputs include the total equity requirement contributed by the preferred equity pool (hard), and the remaining equity contributed to the secondary investor and sponsor. Final output summary includes the cash flow and final IRR of all three pools along with a visual bar chart.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Investment Vehicles, Return on Investment Excel: Preferred Equity with Subordinate Soft Preferred Waterfall Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping