Economics of the Construction Business: Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

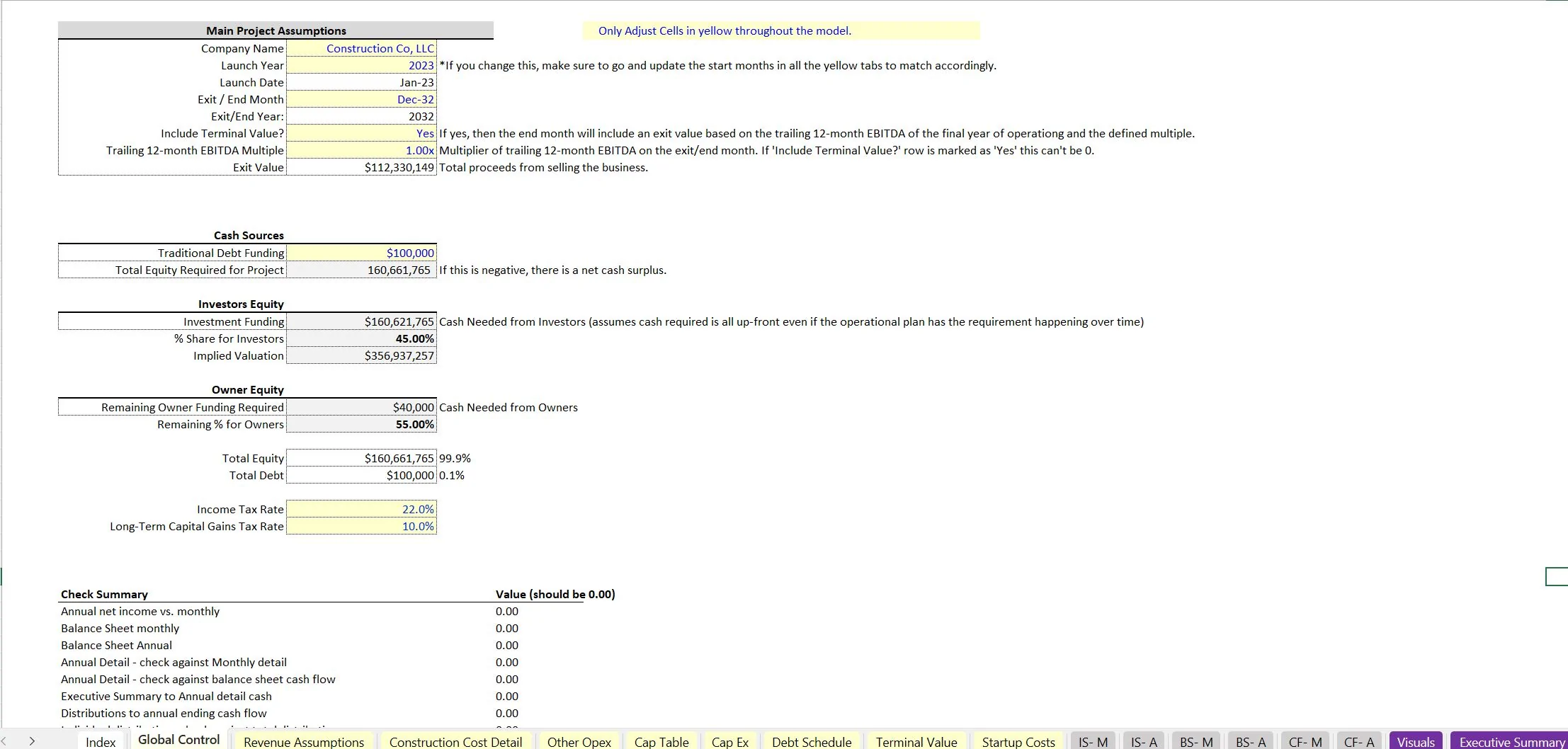

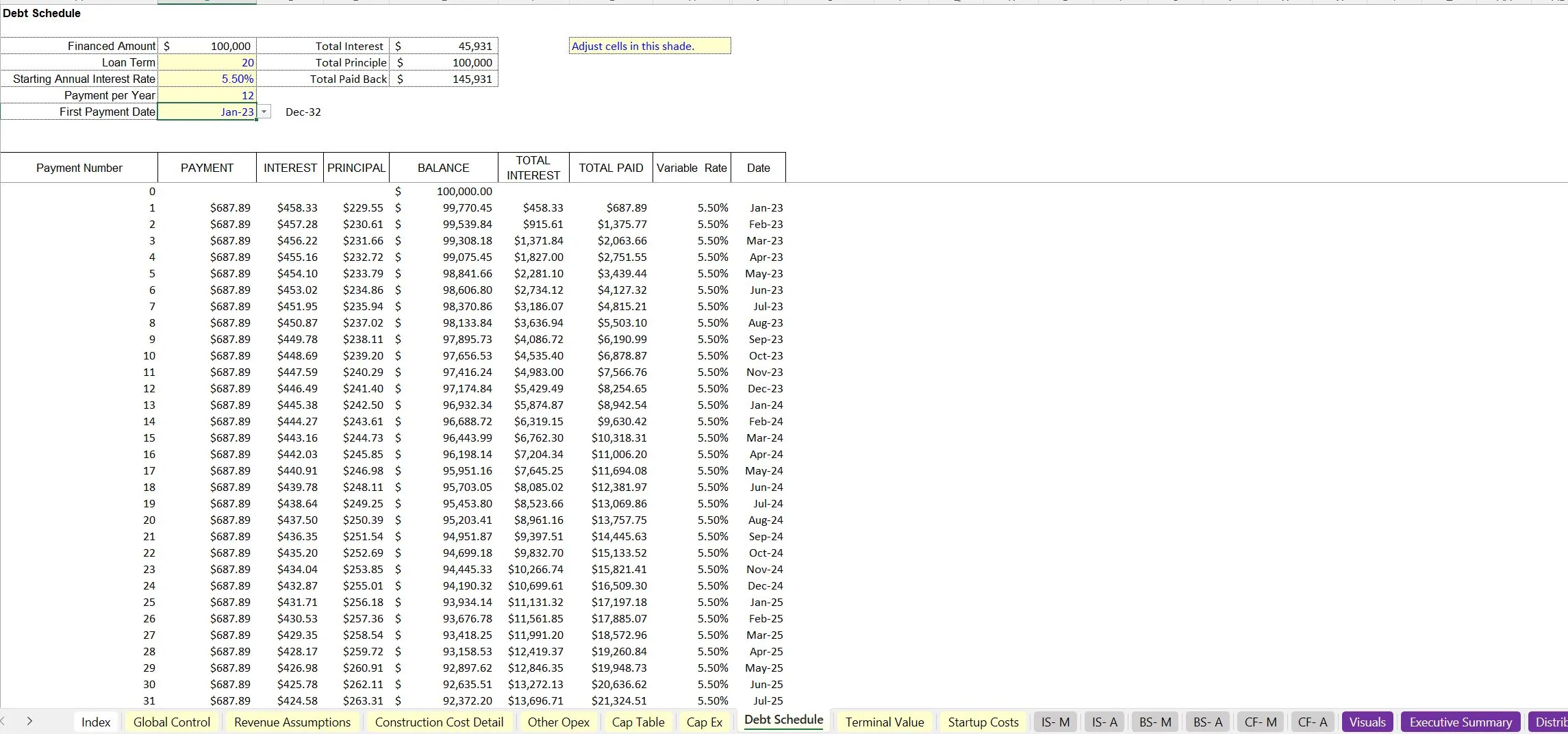

Cash flow planning is essential when operating any kind of large contract business. Expenses get paid over the course of jobs, revenue is collected at various times, you are trying to increase job volume as an owner, and there are all sorts of things happening in-between. Turn all of that chaos into order by using this financial modeling template.

Running a construction business that primarily gets work through larger contracts can be tough to plan for correctly. There are a lot of moving parts, cash flow dynamics, and costs to take into account. This financial model does a great job at helping owners create a solid financial plan and study the unit economics of a construction contracting business.

Some things this Excel model will help with include:

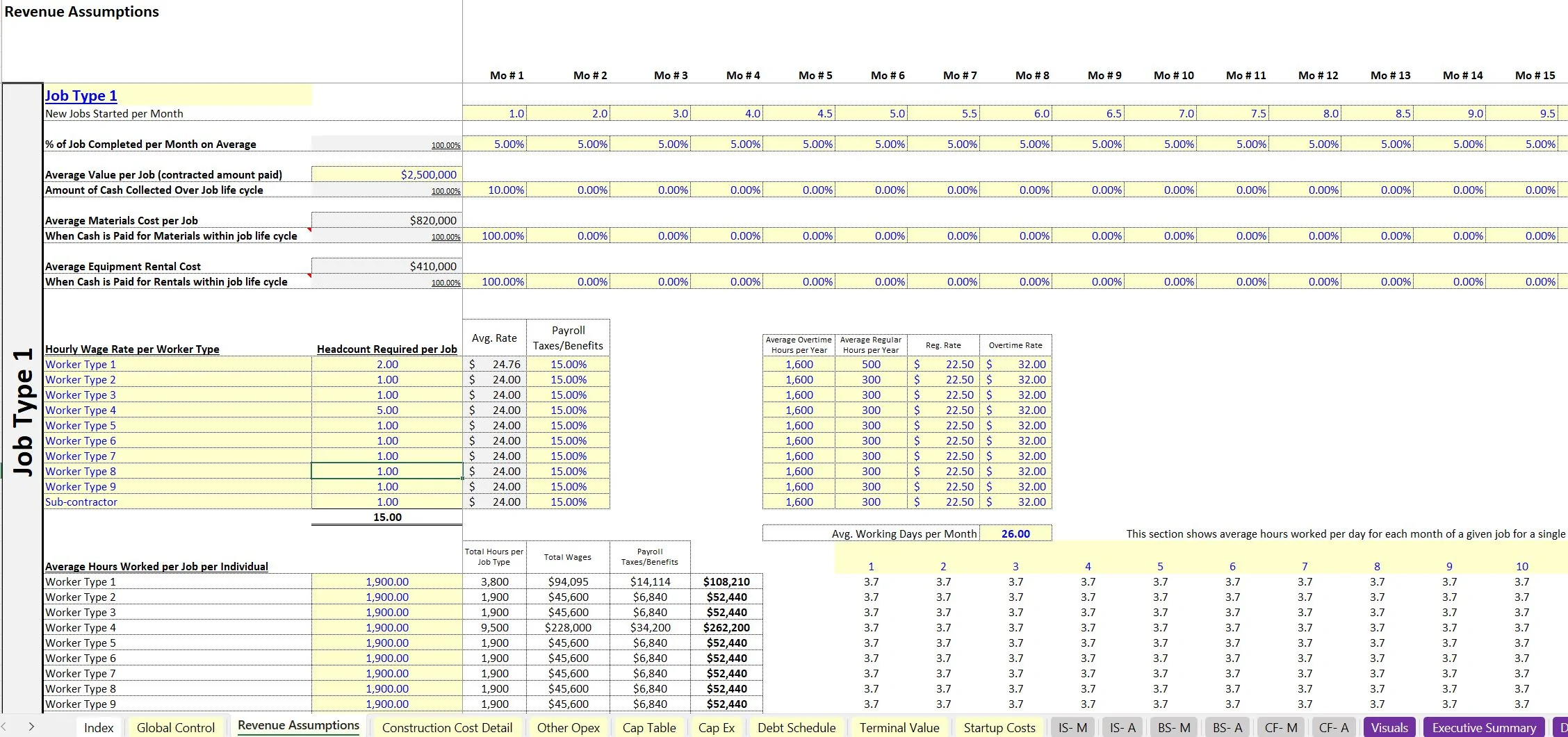

• Planning out average contract size (up to three job type modules)

• Determining when cash is collected within that contract period

• Determining how long jobs take to complete (% completion per month)

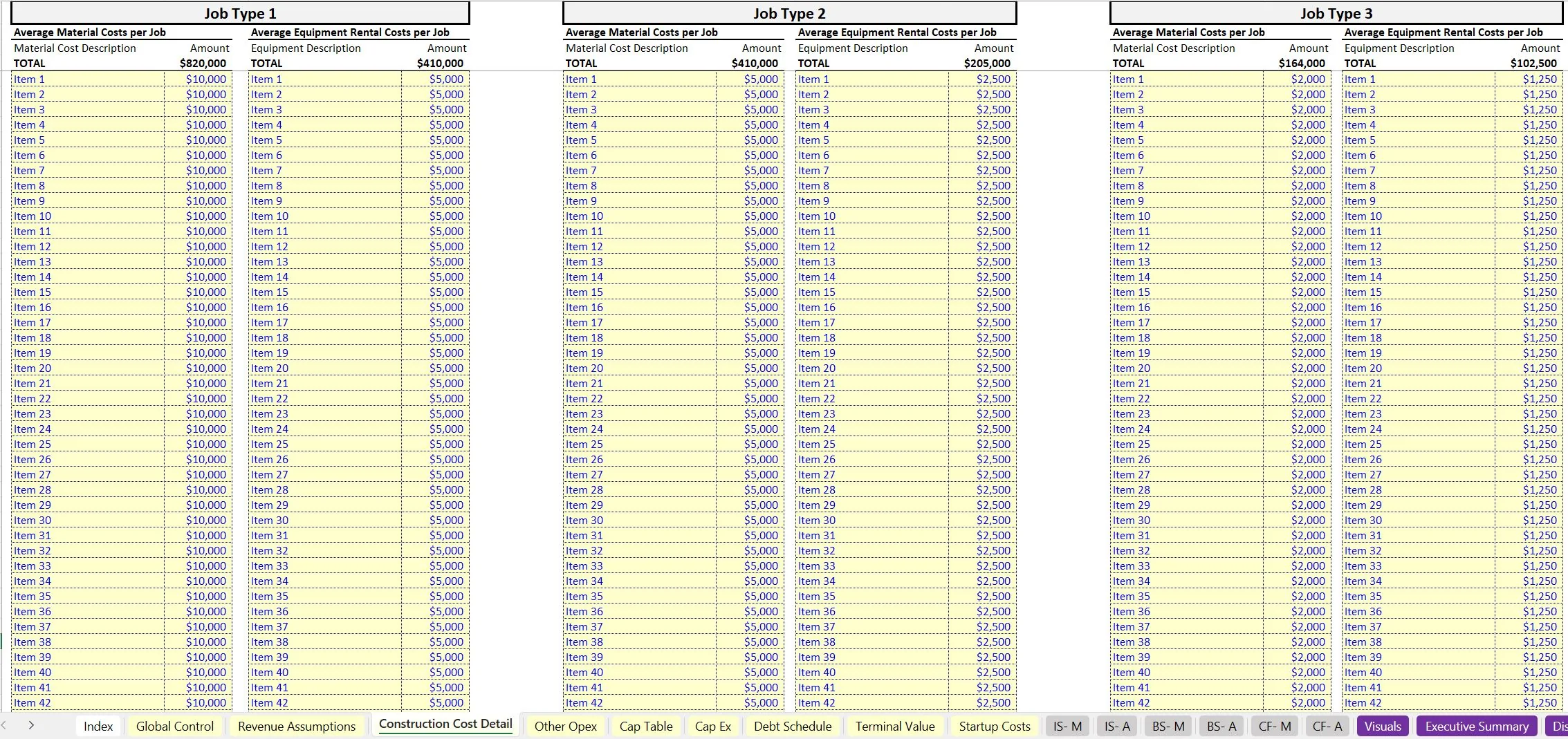

• Define equipment rental costs per job

• Define material costs per job

• Define when equipment rental and material costs are paid for over the course of a job

• Define the employee labor and/or sub-contractor labor economics (average hourly rate, benefits, total hours worked per job on average, payroll taxes, and count per up to 10 worker type slots.

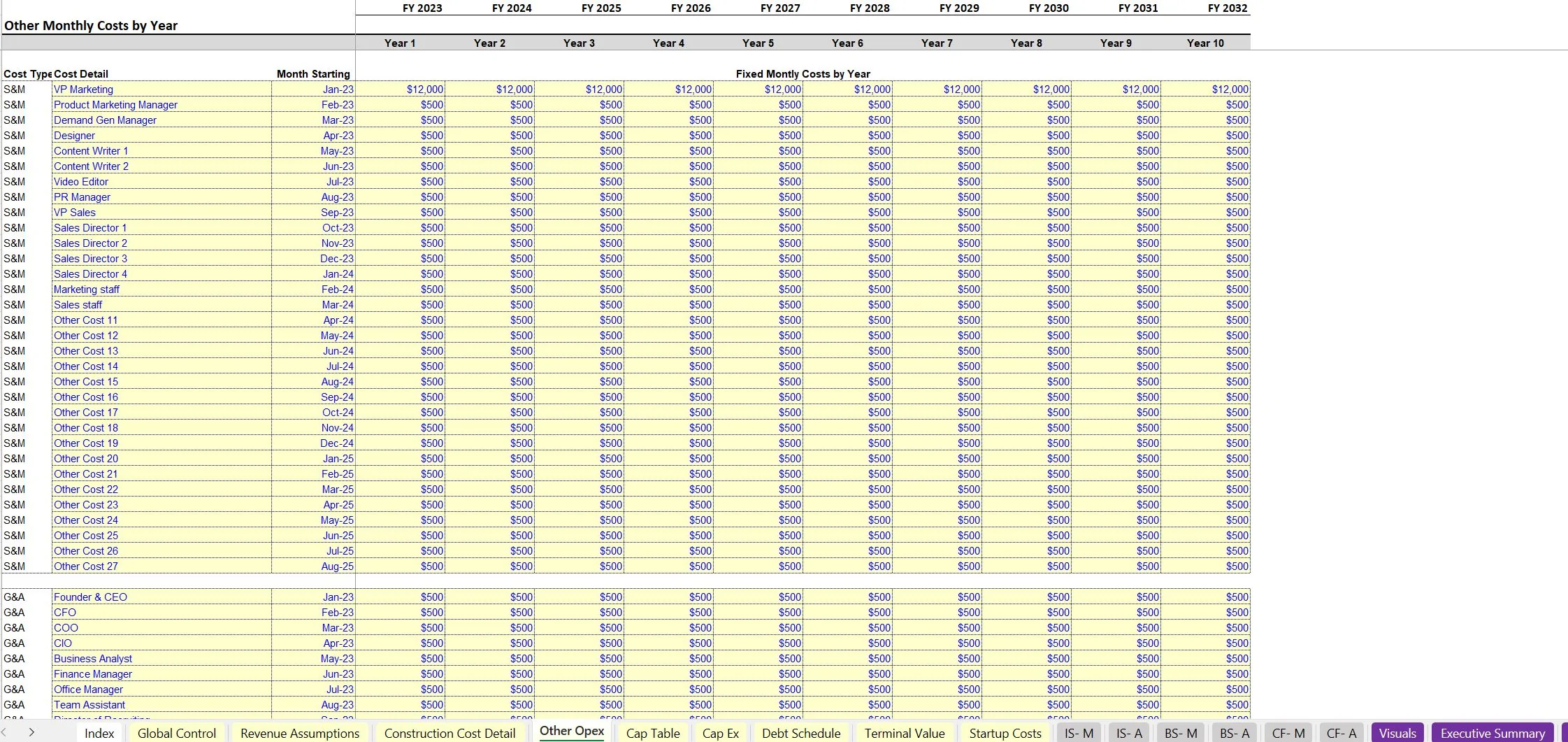

• General fixed expenses

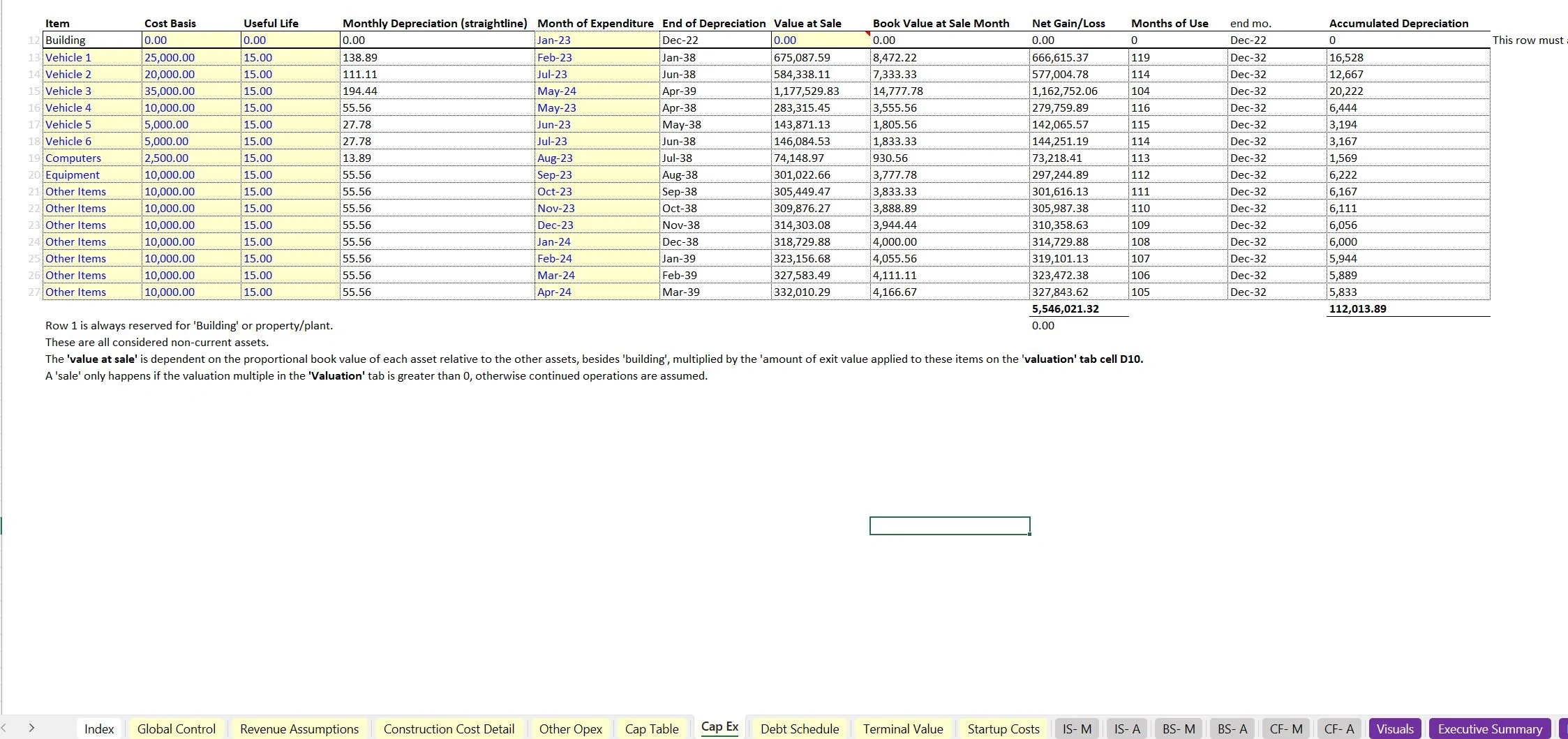

• Other capex items (if you buy equipment instead of rent)

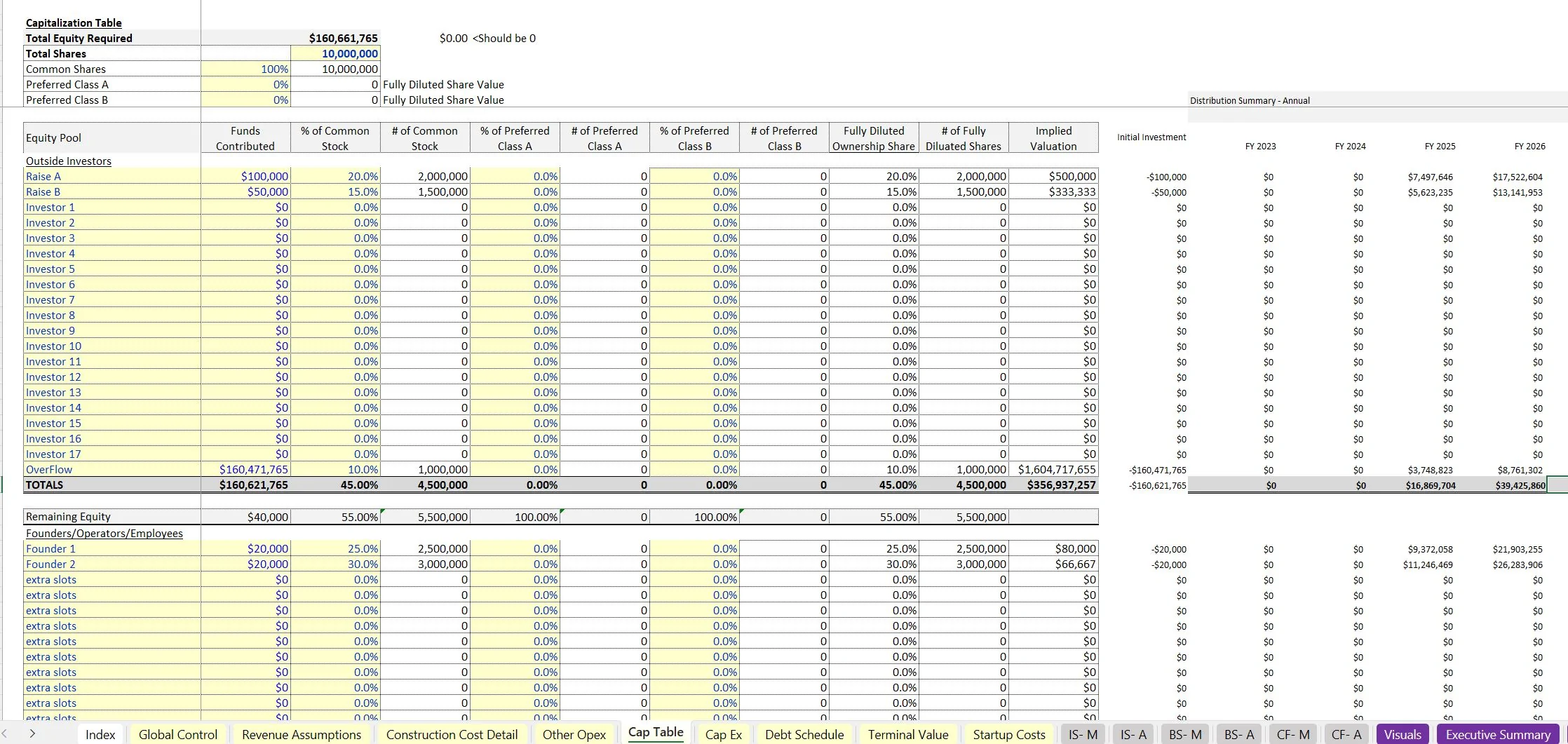

• Cap Table for various investment contributions between owners and/or outside investors

Final Outputs Include:

• Financial Statements

• Cash Flow Analysis (DCF Analysis / IRR / NPV / ROI)

• Executive Summary

• Visualizations

• Monthly/Annual Proforma Detail

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Economics of the Construction Business: Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping