Hair Salon Operating Model (with Sensitivity Drivers) (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INTEGRATED FINANCIAL MODEL EXCEL DESCRIPTION

Starting a new business can be scary, but when you actually dive into the bottom-up assumptions for revenues and expenses, the risk and potential profit as well as the initial cash investment become more transparent. Using this financial planning tool will allow for clarity about how many hair cuts / products sold happen per month, labor / overhead costs required to support those activities, and the prices you will charge to cover the costs and become operationally profitable.

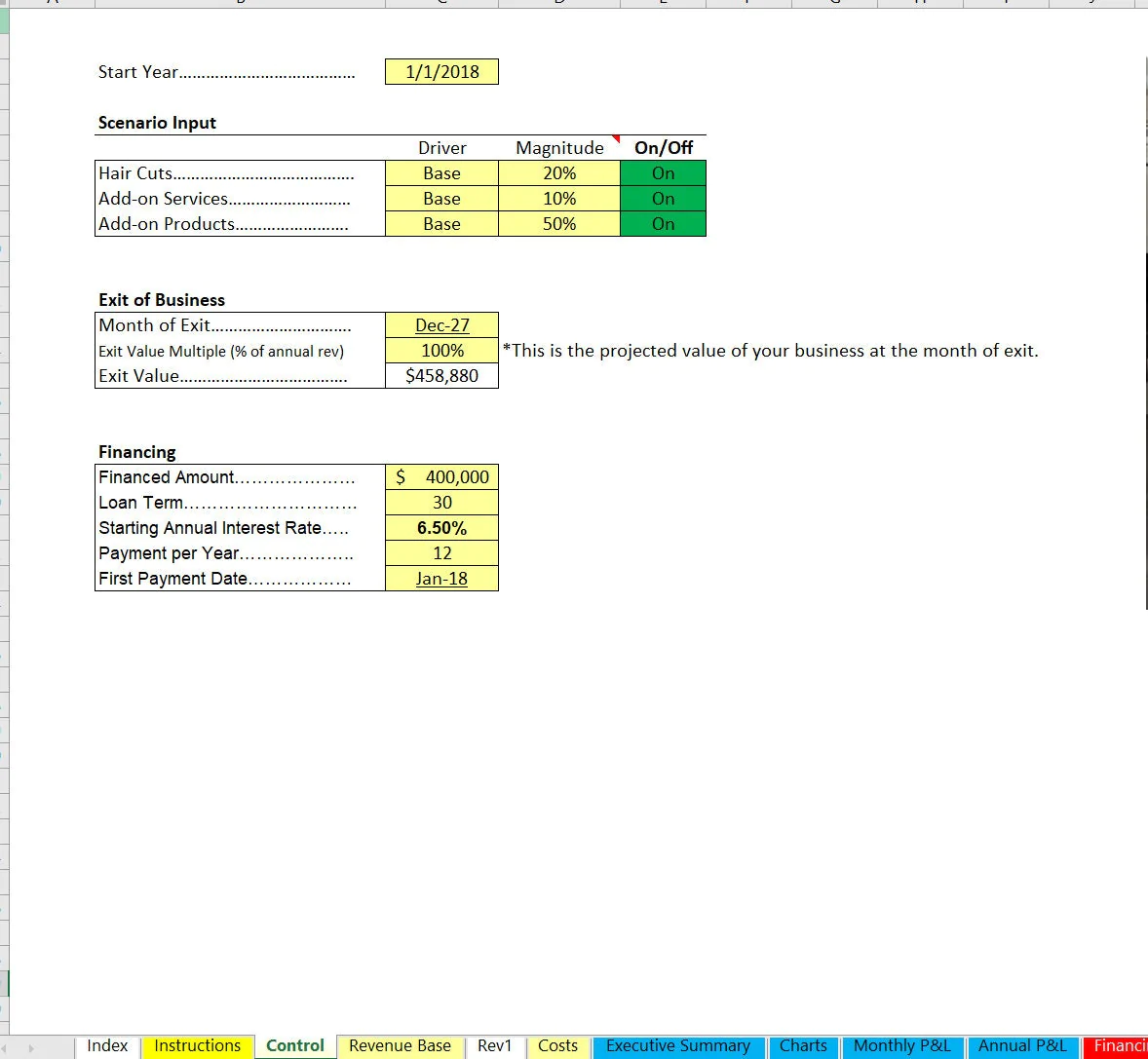

The assumptions make it easy to scale up to some level of monthly activity as you may not be as popular right off the bat. With a single hair salon, you will have capacity constraints and the way these growth assumptions work will allow for proper forecasting.

Starting up a hair salon requires one to know expected initial investment based on startup costs and operational burn and/or expansion. This 10-year bottom-up financial model will provide the user with a way to do just that.

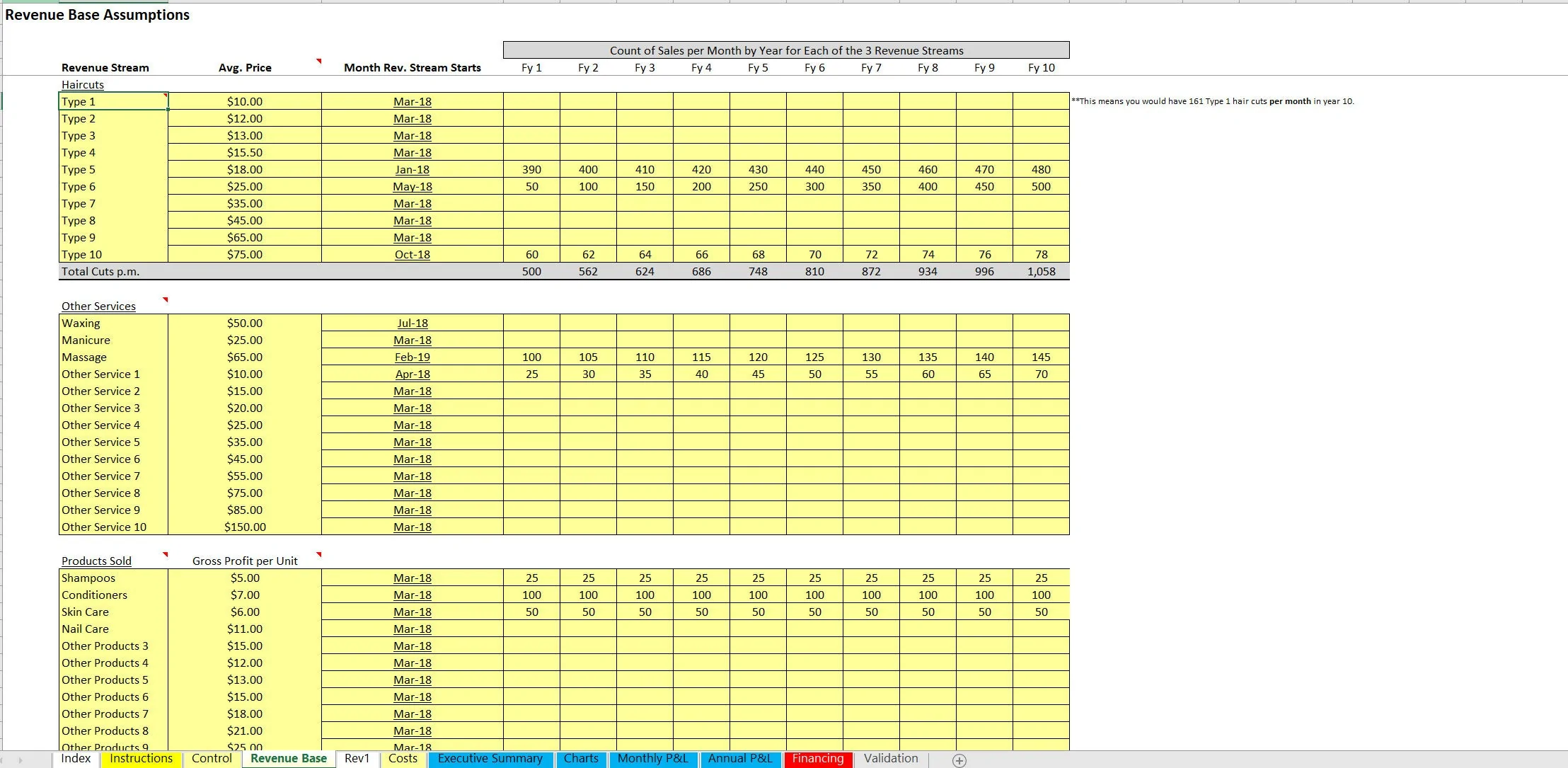

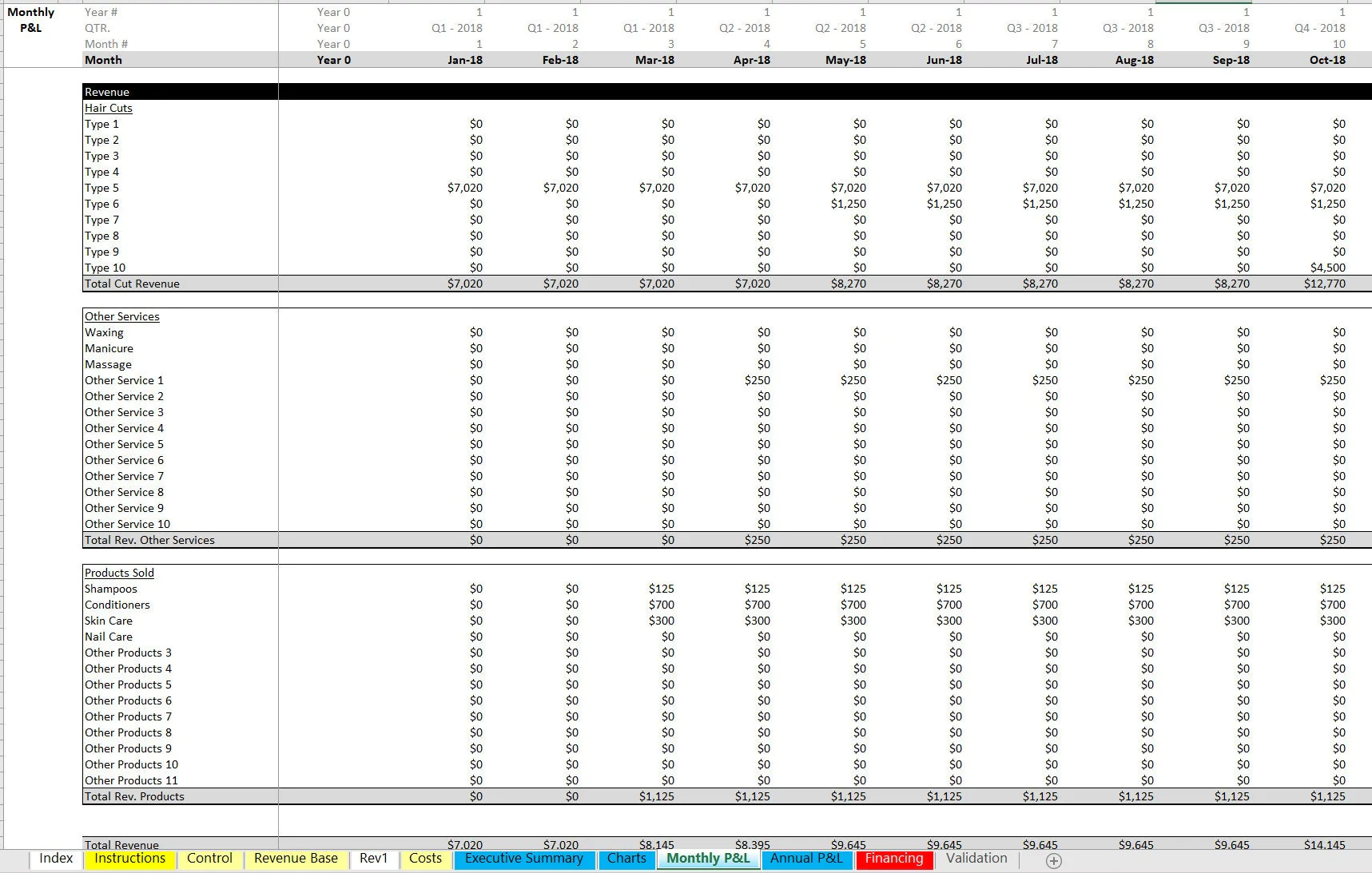

Revenue is forecasted based on up to ten haircut types / ten other services (the average price per each type and count per month over time) as well as sales of hair products and accessories and the average gross margin per product.

There are sensitivities that can be applied to base assumptions for revenue to easily see if things go +/- a given percentage from the base-level inputs. This is a good way to see how low revenues can be without losing money.

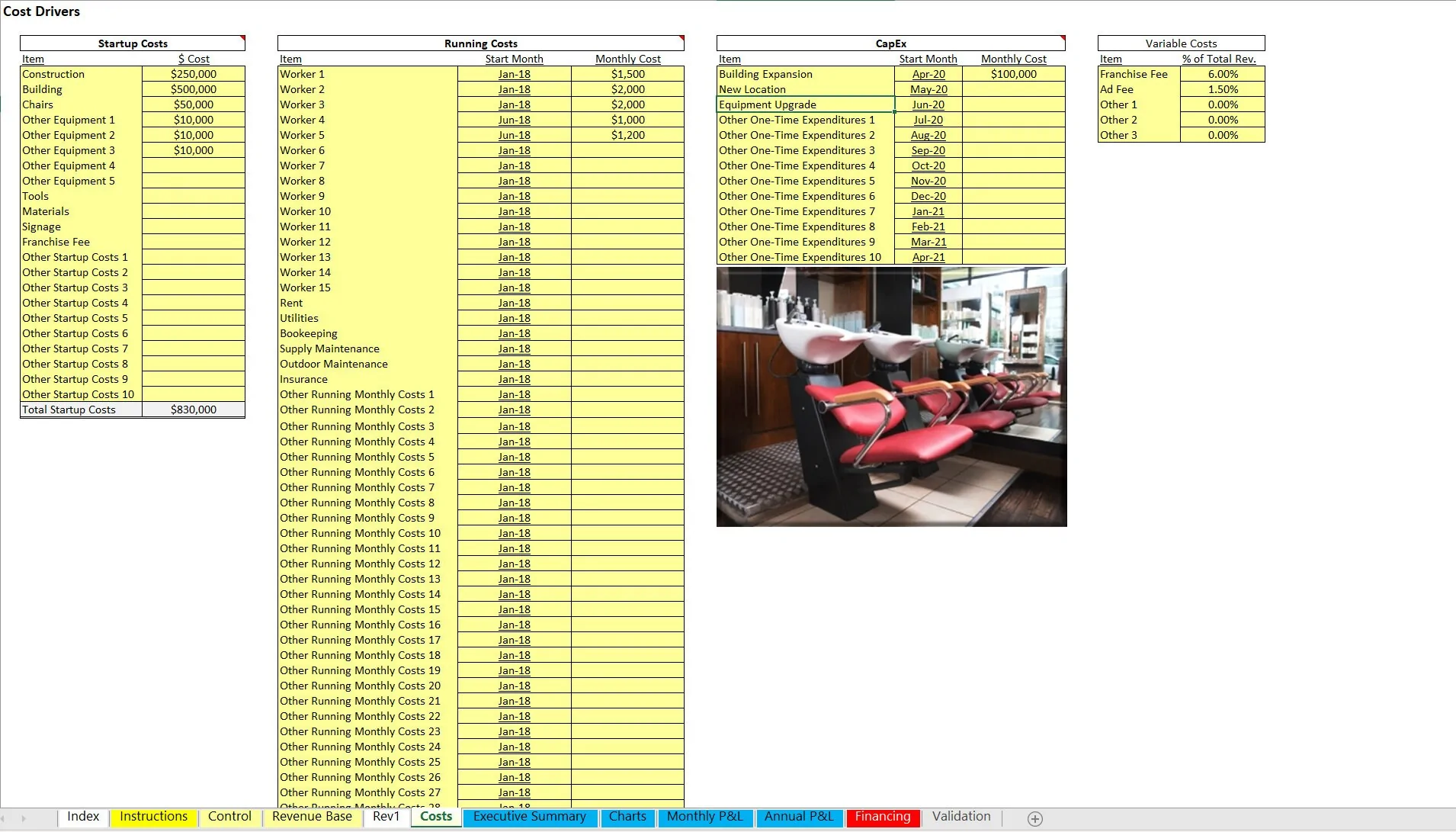

Another important aspect is the amount of staff, rent, utilities, and other fixed operating expenses that you will run into. This template lets you define the start month of each expense item, the amount per month, and the cost description.

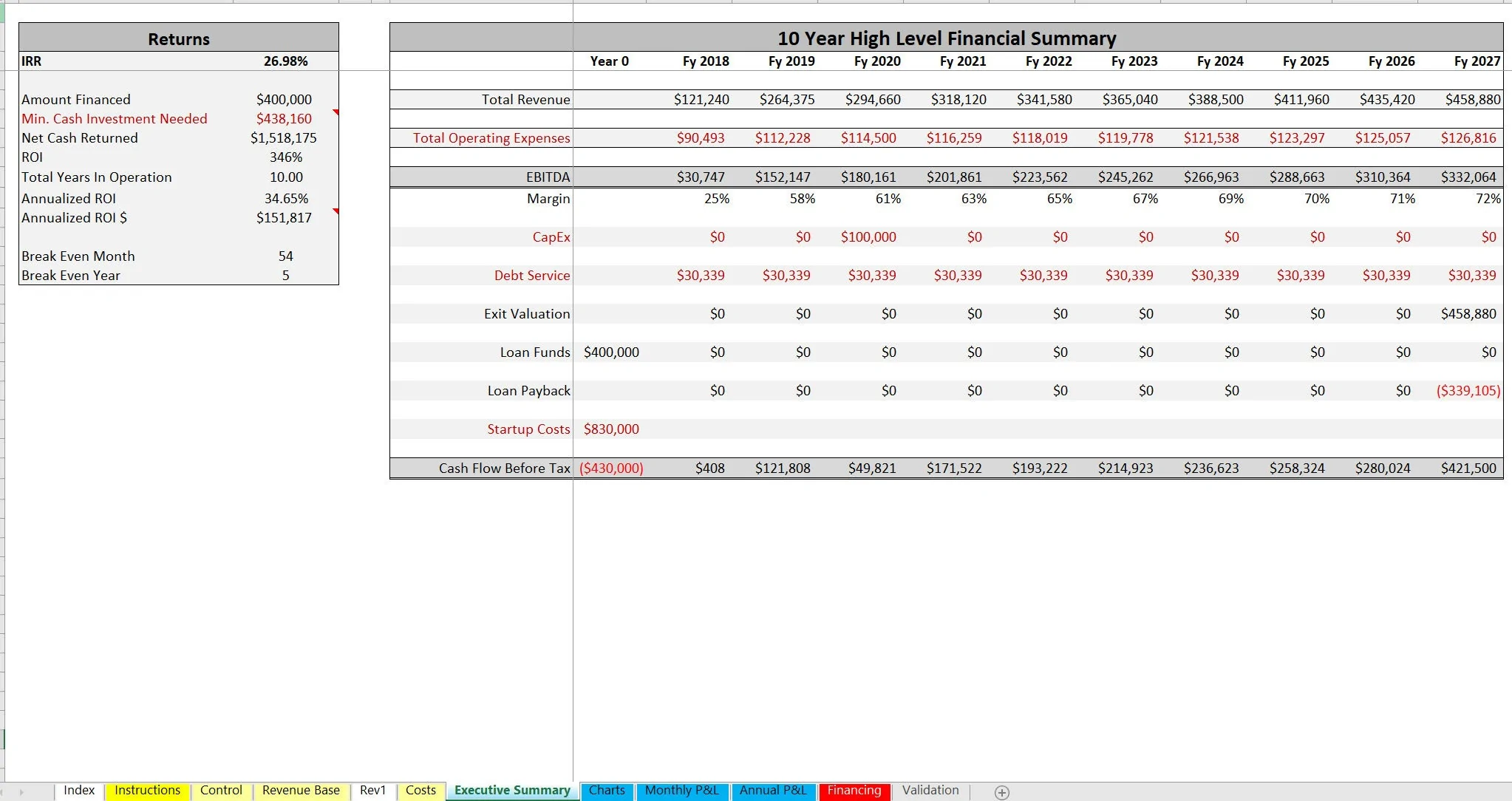

Final output summaries include:

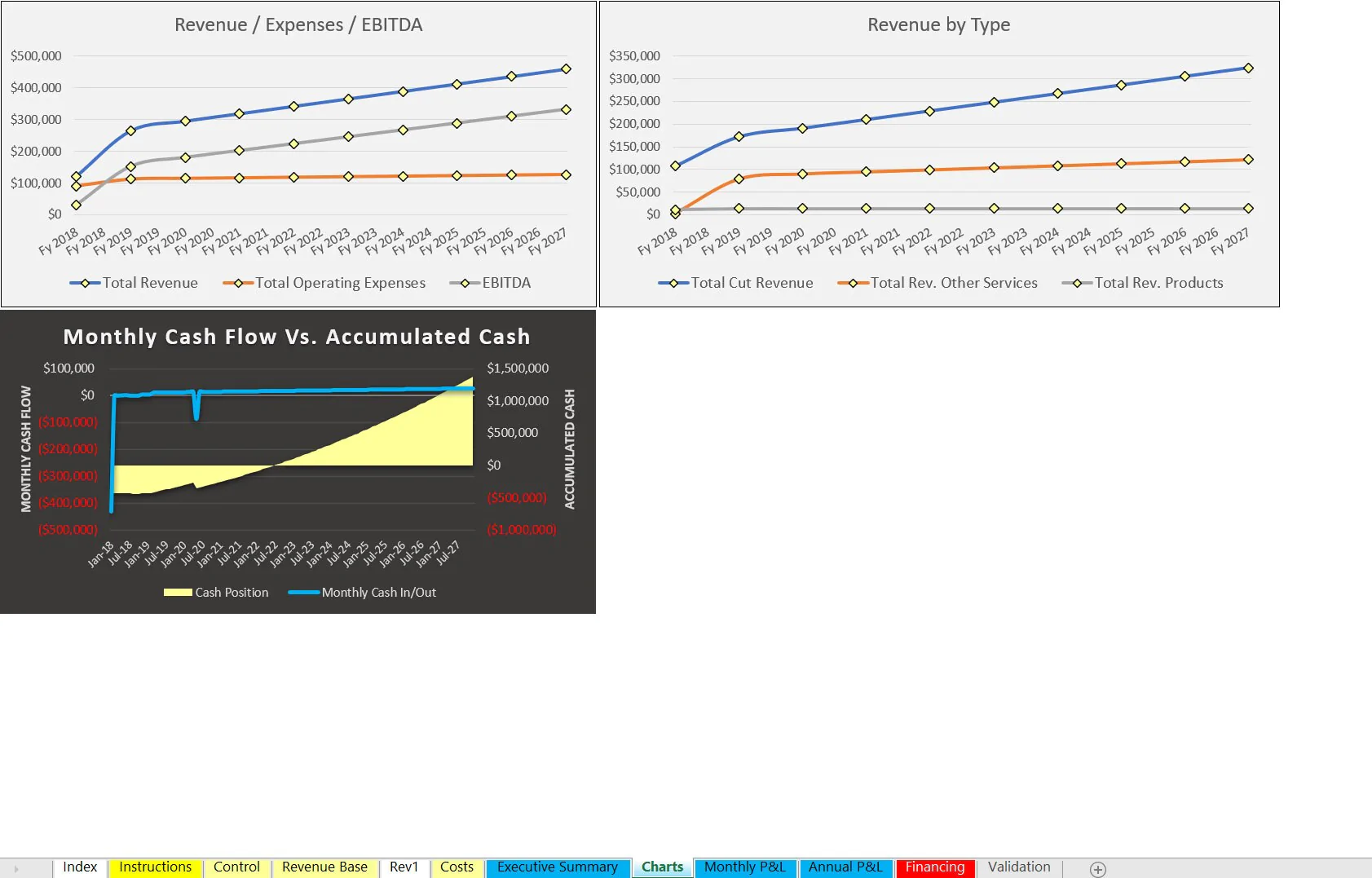

• 10-year monthly and annual Profit / Loss detail

• Cash flow summary

• DCF Analysis

• Annual Executive Summary and returns (IRR / ROI)

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Integrated Financial Model Excel: Hair Salon Operating Model (with Sensitivity Drivers) Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping