Subscription Marketplace 5-year Startup Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Cohort Modeling

- Recurring Revenue

- Modeling a Marketplace

MARKETPLACE EXCEL DESCRIPTION

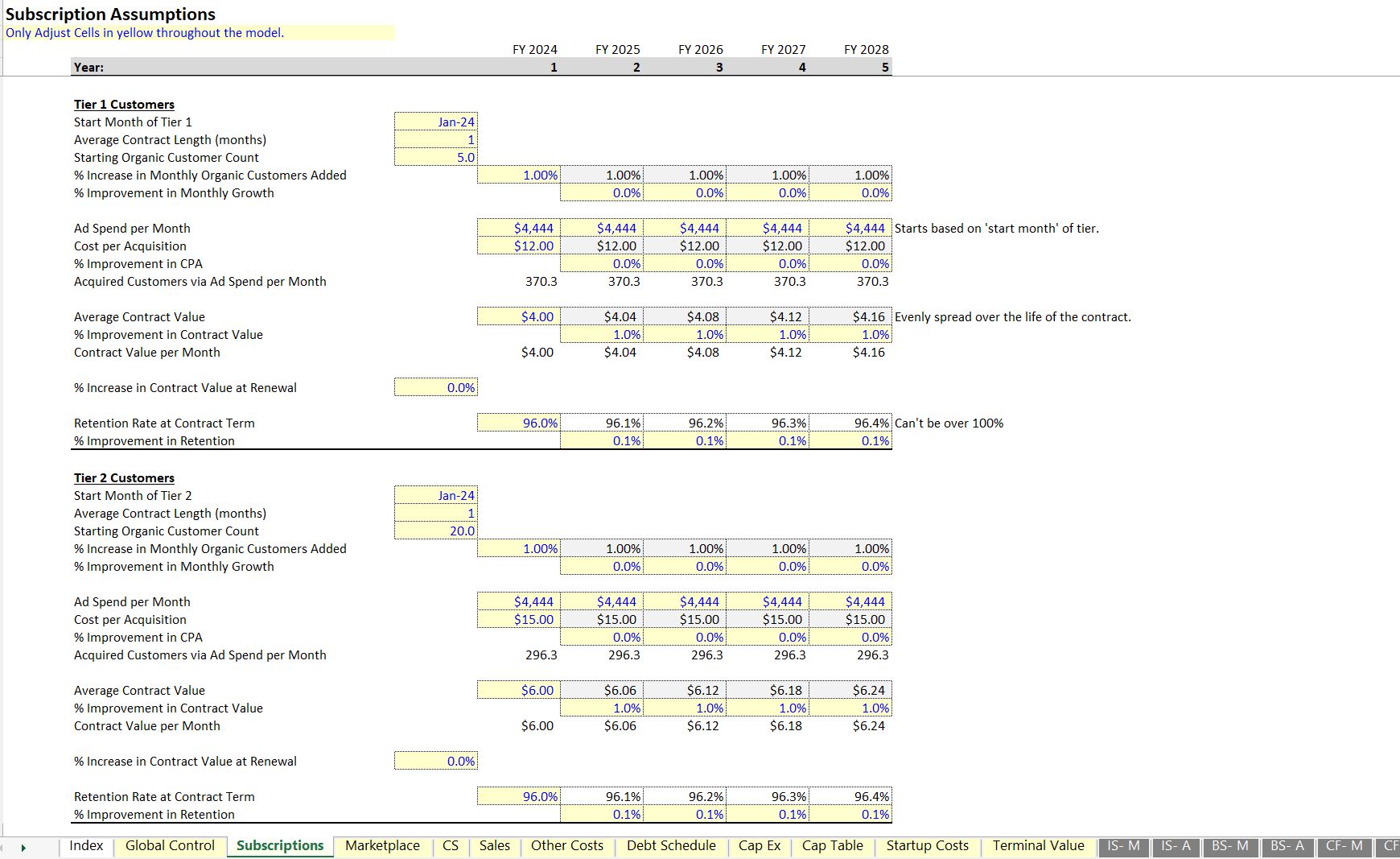

This 5-year financial model is geared toward any general marketplace that wants to consider offering a subscription option to its users. The subscription option has up to three pricing tiers, each with its own configuration for price, contract length, retention rate at renewal, percentage change in price at renewal, start month, ad spend / CAC assumptions, and organic growth.

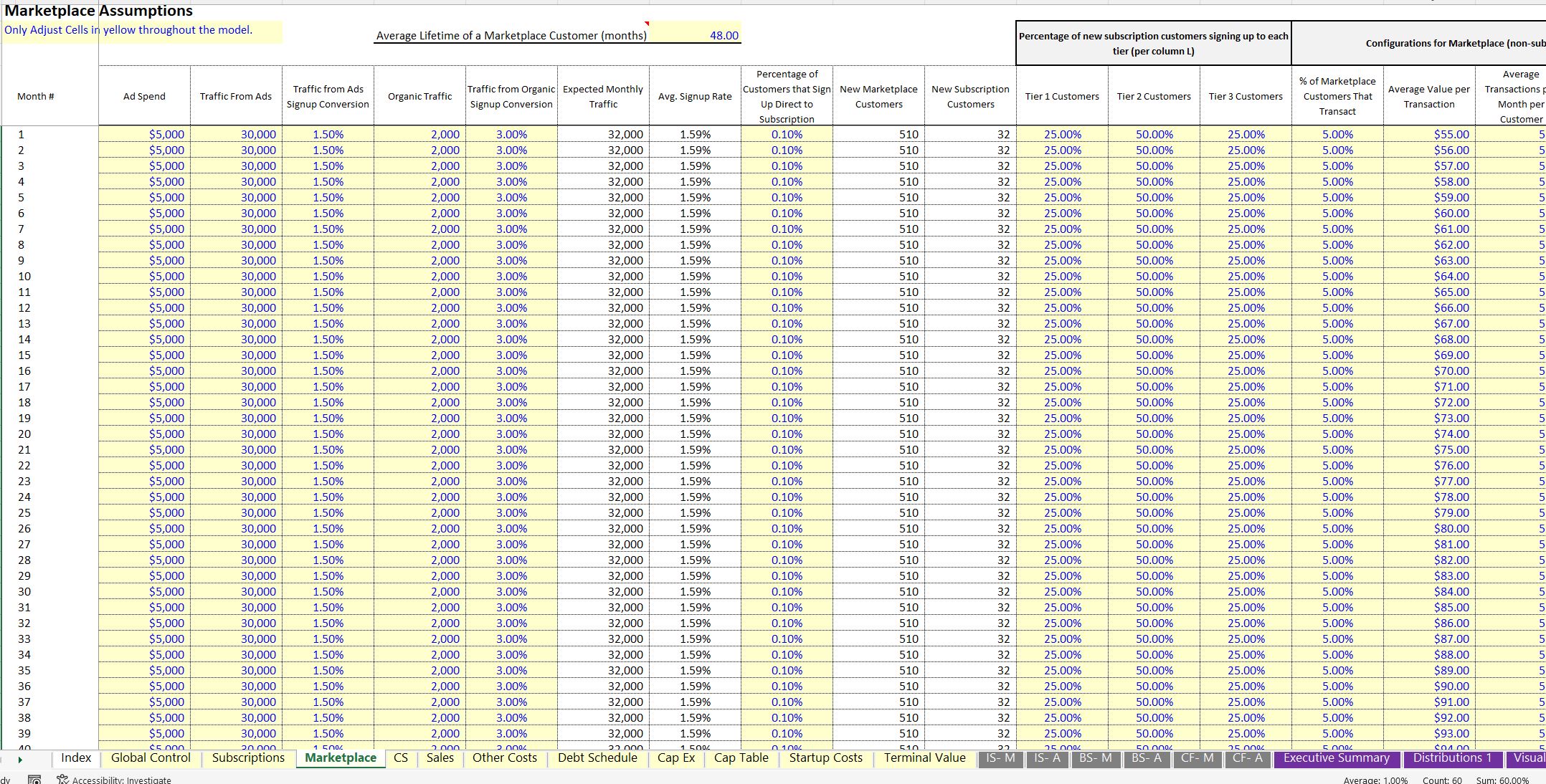

The subscription tab lets the user define marketplace users that come directly on through that channel as well as a separate assumption tab for users that come to the marketplace and possibly convert to subscribers. You can use each tab, or just one of them and so the model becomes great for forecasting the activity of a subscriber only model, a marketplace only model, or a hybrid of both.

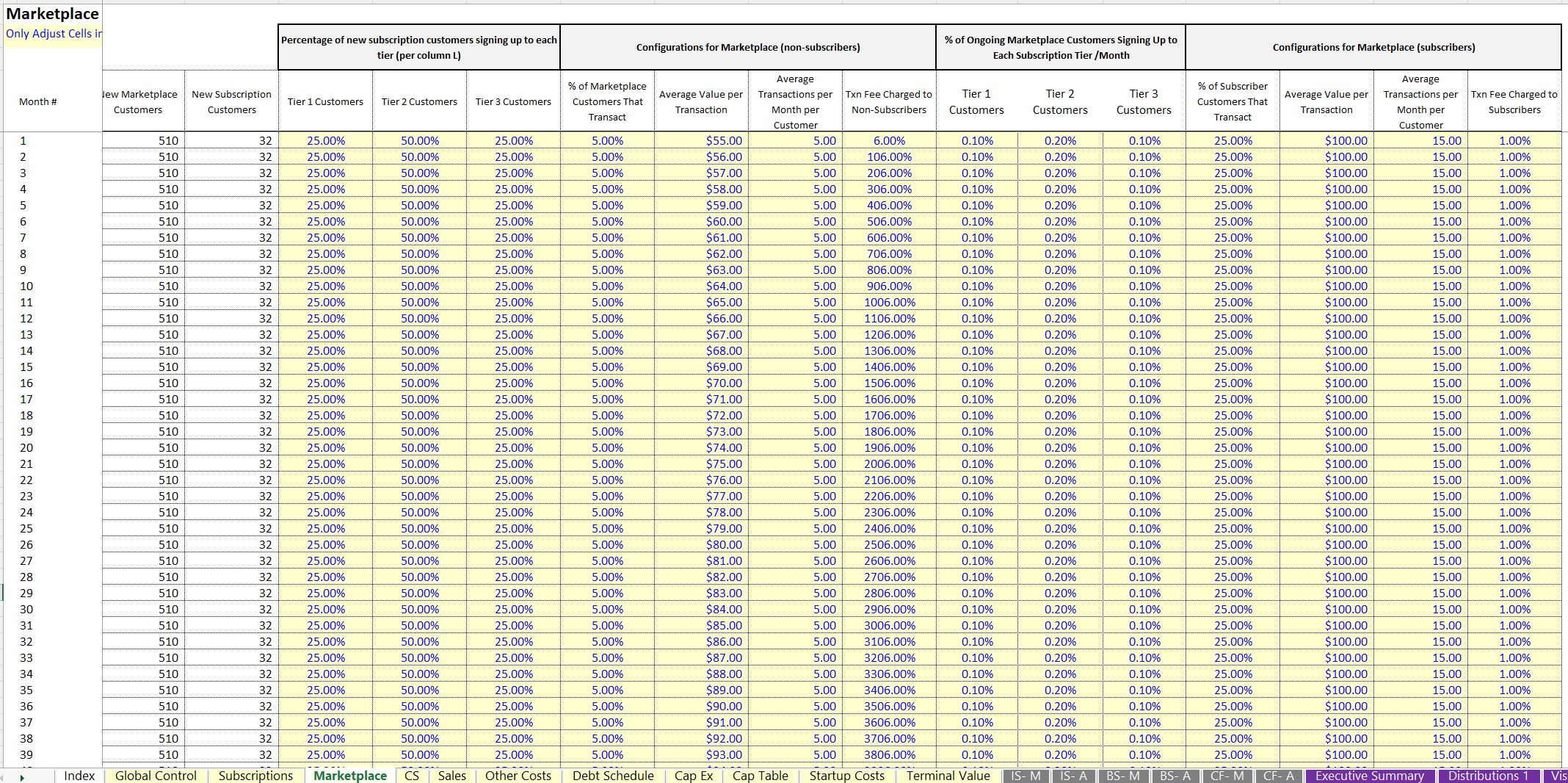

The 'marketplace' tab also has assumptions for the activity of free users as well as the activity of subscribing users such as average percentage that transact each month, average transaction volume per user per month, average number of transactions per month, and transaction fee rate.

I also added traffic and conversion logic on a monthly granularity basis for the 'marketplace' assumption tab. It makes forecasting very straightforward and allows for seasonality in traffic and adjustments over time across 60 months.

For the average customer life of a user, the best cohort modeling techniques are used for the most accurate forecast of remaining customers at any point in time based on the assumptions. This gives more accurate churn rate expectations as well as recurring revenue expectations.

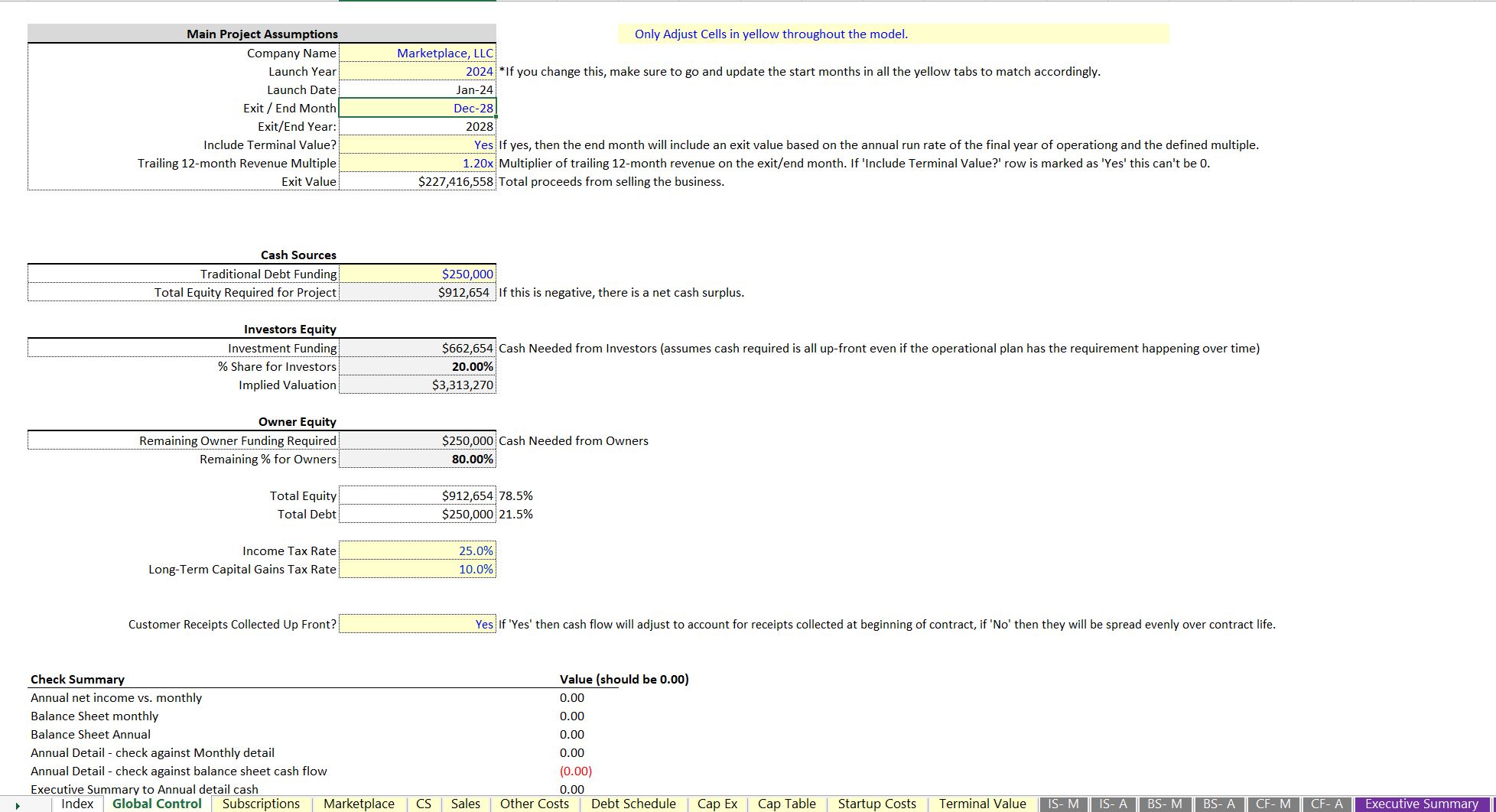

The model has all sorts of reporting output features such as monthly and annual 3-statement model (Income Statement, Balance Sheet, Cash Flow Statement) as well as a DCF Analysis, options for inside and outside investors as well as their contribution rate and distribution rate and the resulting IRR and NPV of each group and the project.

You have tons of visualizations as well so the story of what you expect to happen can be understood more easily. This includes advanced KPI metrics like CaC, LTV, CaC payback period (months), LTV to CaC ratio, and more.

The model has error checking across all final reports and cash flow totals to ensure nothing is broken and if so it will let you know with variances on the 'Global Control' tab.

You can easily apply an exit value based on trailing 12-month revenue and a defined multiple as well as the end month of the forecast (up to 60 full months).

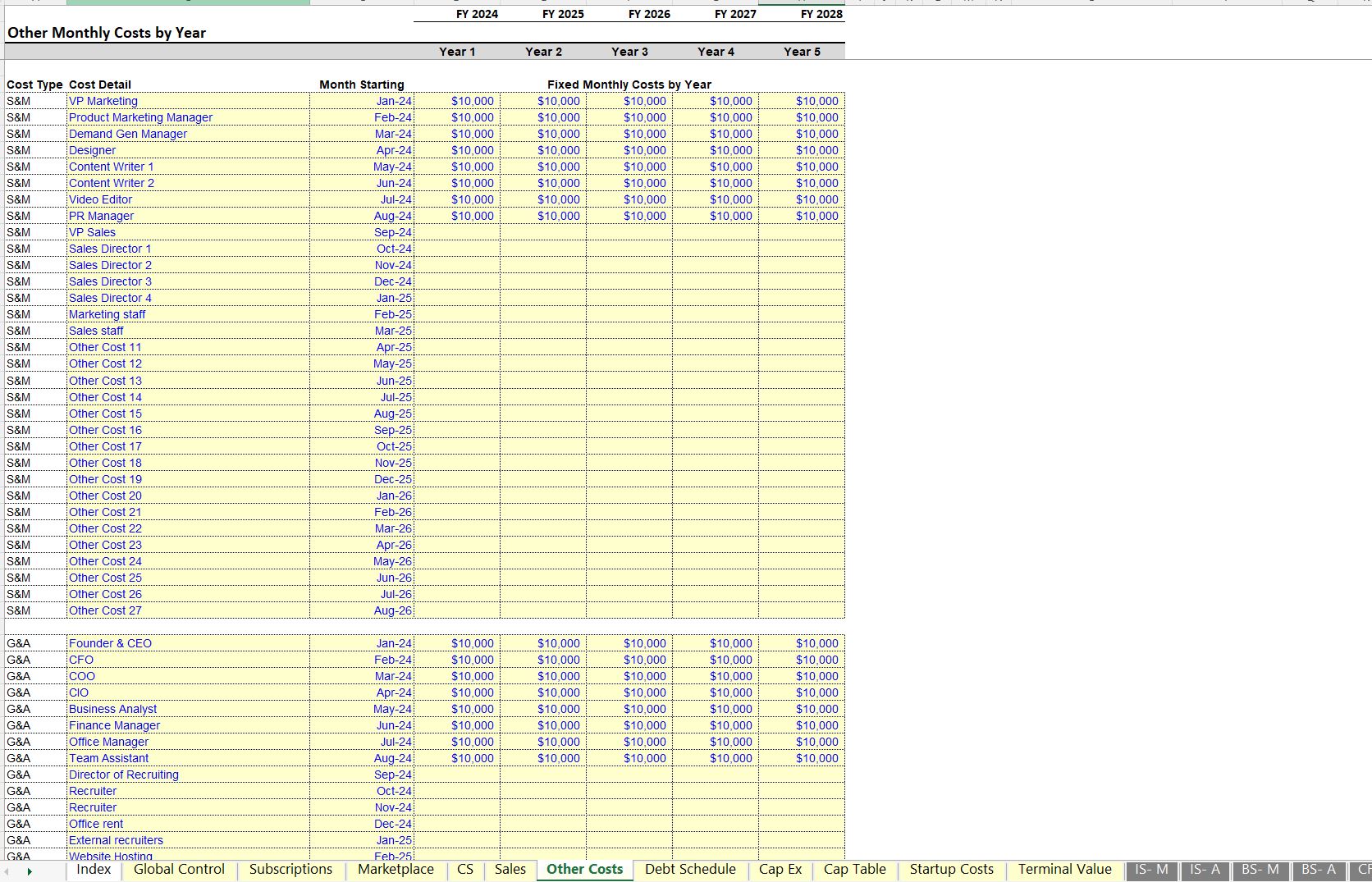

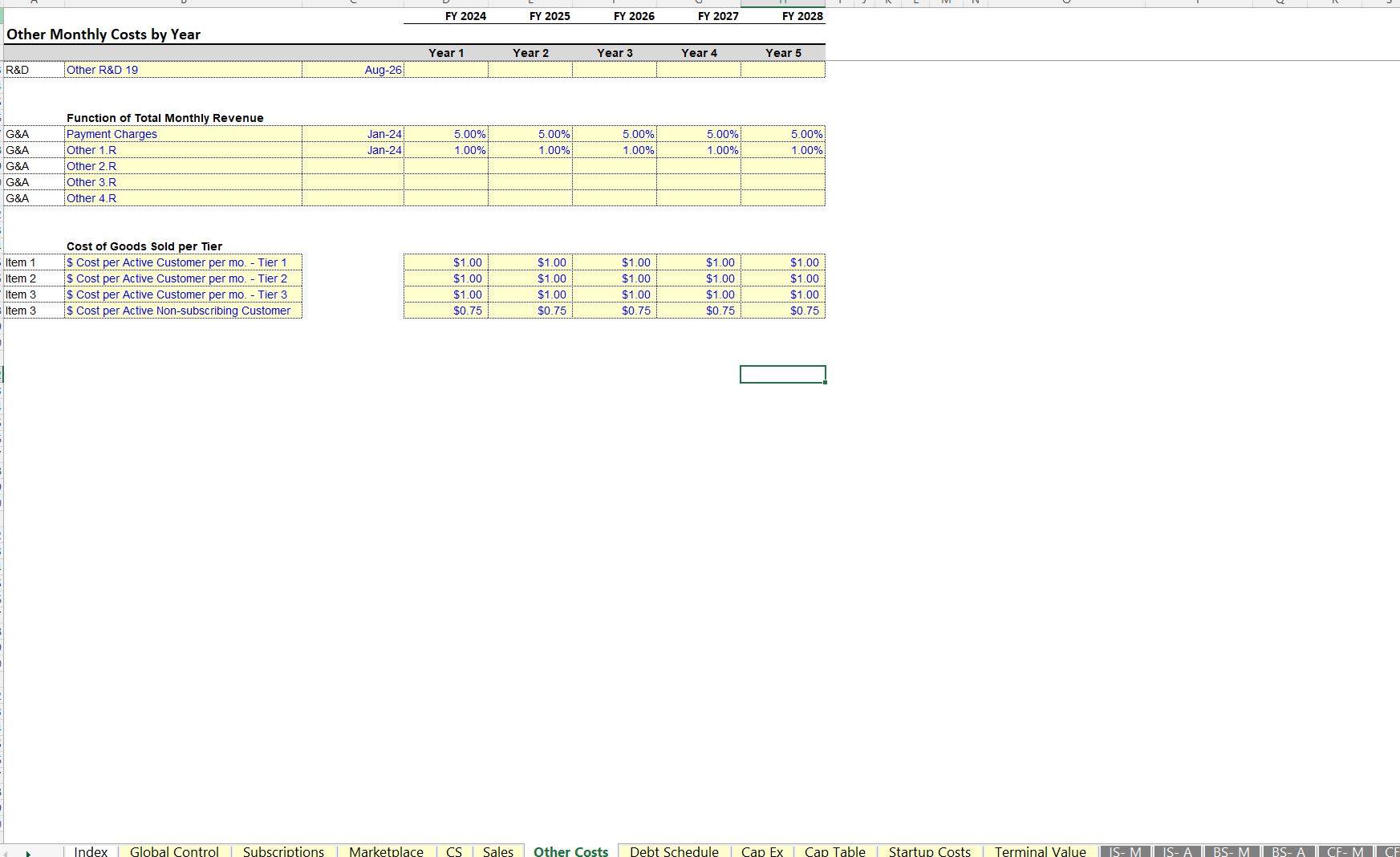

Fixed expenses and the cost of goods sold can be defined on a cost schedule that is dynamic per year and by cost type.

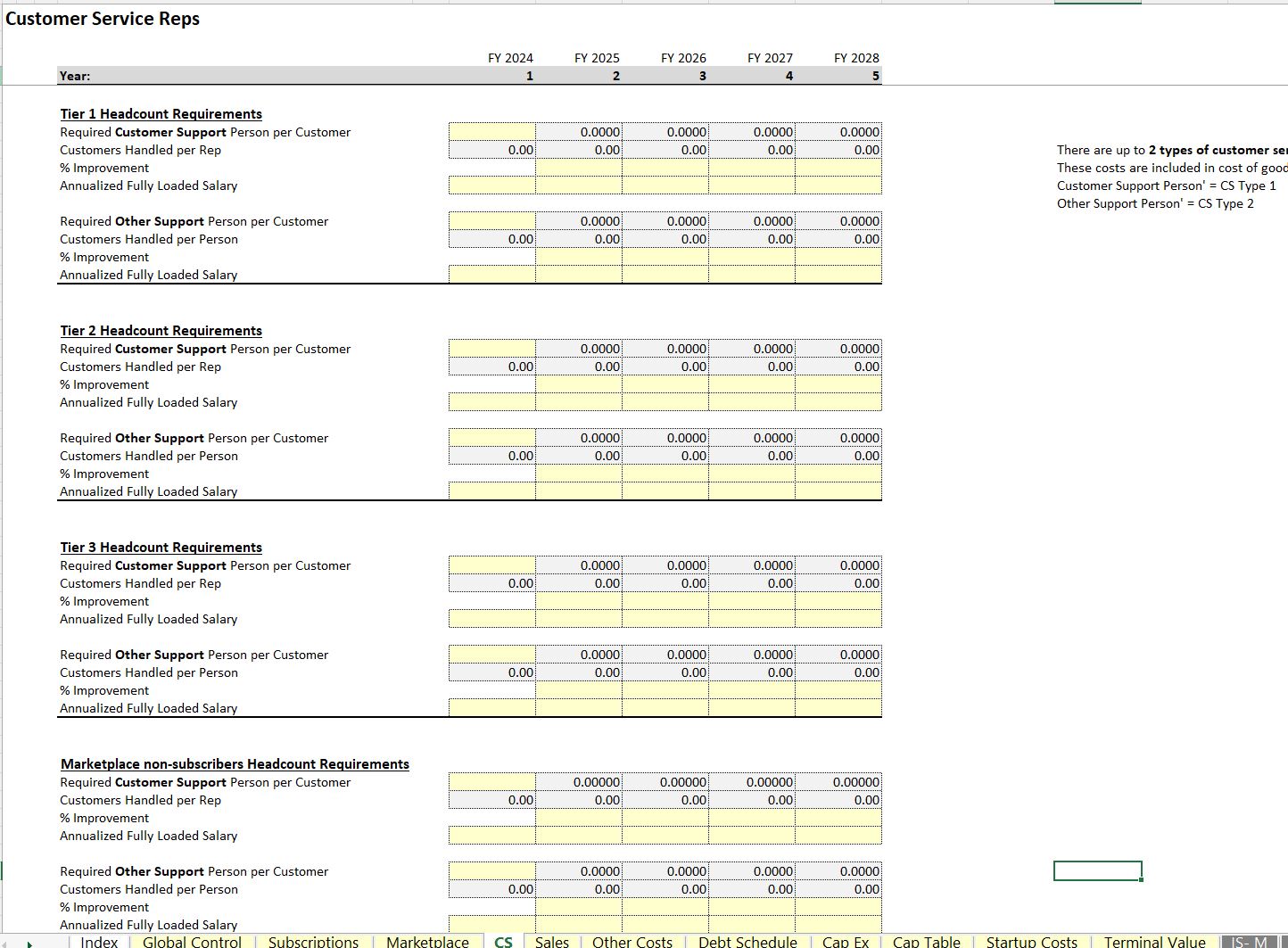

For scaling headcounts, there is logic to define salespeople and customer service reps as a function of new users added per month and total existing users.

The model input cells will be blank and highlighted in yellow across all tabs. There is an instructional video inside that shows you how to fill out all the assumptions from scratch, so it is easy to understand.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Marketplace, Subscription, Integrated Financial Model Excel: Subscription Marketplace 5-year Startup Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping