Unit Driven Real Estate Acquisition Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

The goal of this spreadsheet is to provide quick underwriting for the acquisition and/or development / renovation of buildings that contain up to 10 units. It was originally commissioned from a job I had for a client that paid roughly $800 to build. I took my final result and turned this into a real estate model for general use.

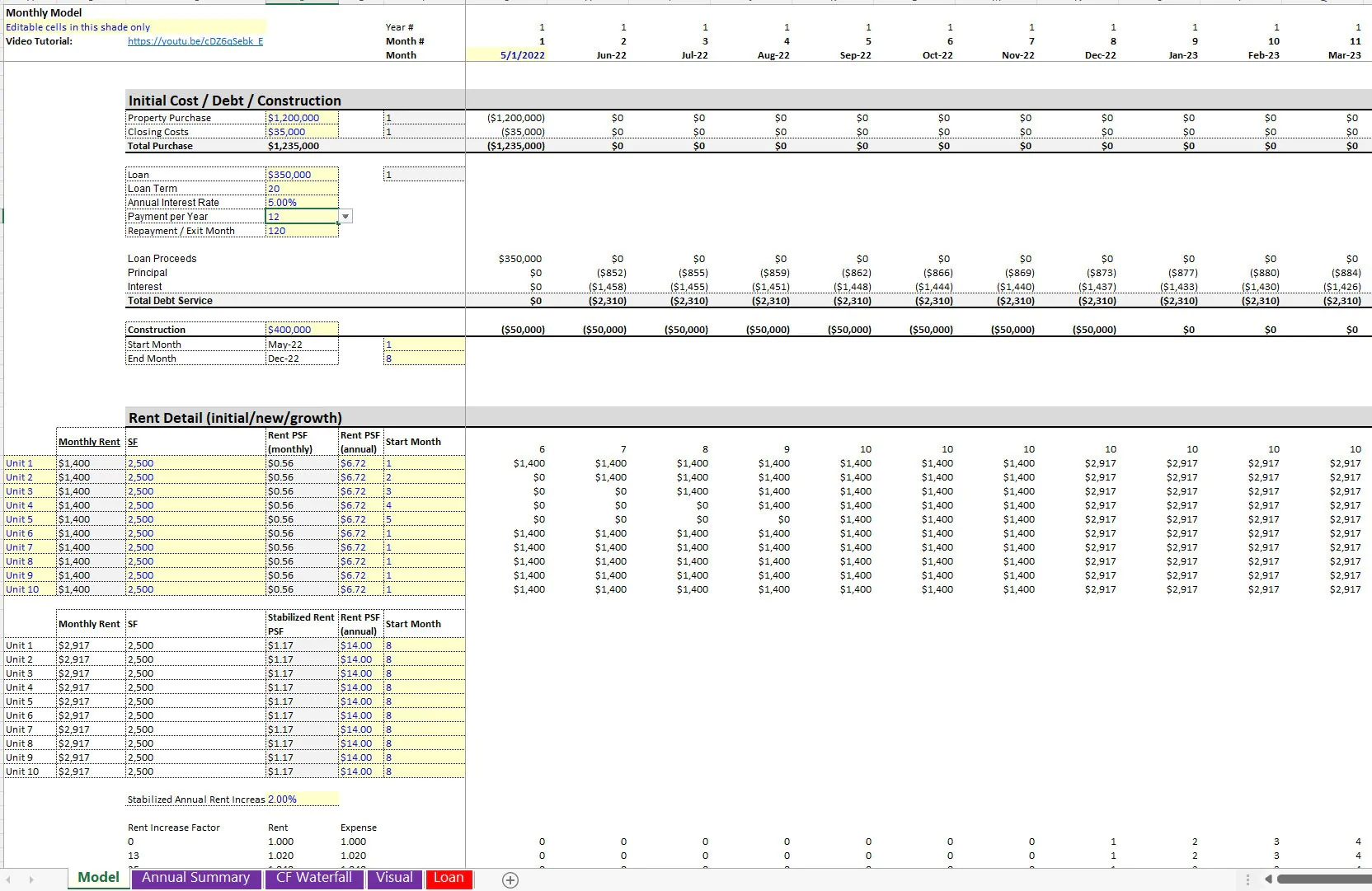

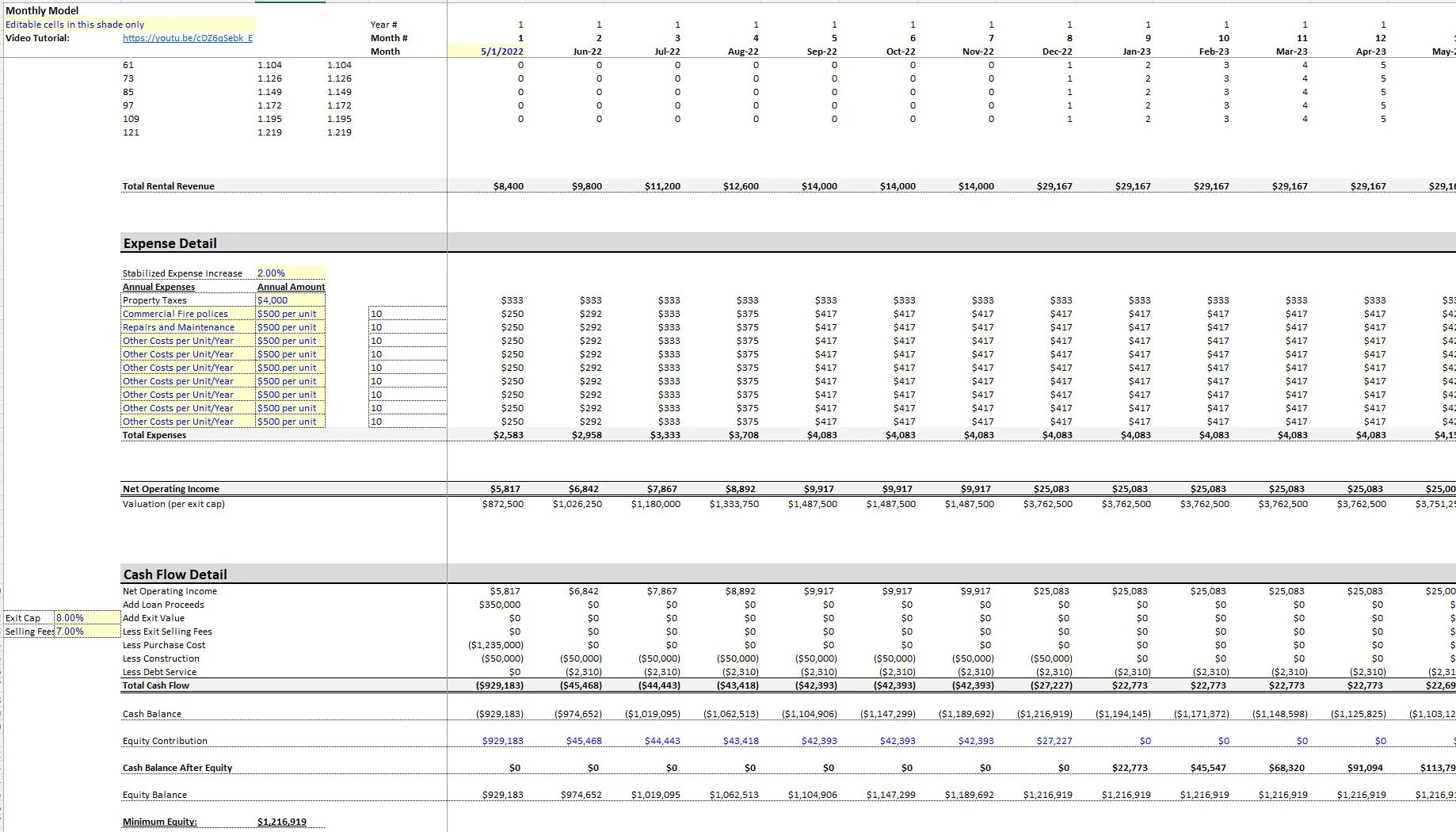

At the end of the day, this sheet will show the user if the projected cash flows and potential exit are worth the initial investment and capex. Financing logic is included with a term loan and upon 'termination date' the loan will be assumed to be fully repaid and reflected as such in the cash flow.

This is a model to plan out all the finances of a unit-driven acquisitions. The user can model up to 10 units for up to a period of 10 years with monthly and annual summaries, resulting DCF Analysis, IRR, Net Operating Income, and cash flow.

Each unit has its own rent per square foot configuration as well as an upgradable rent value and a long-term rent growth rate applies to all values dynamically. There are assumptions for financing some of the purchase price with debt and if so the term of the loan will end on the exit month and the amortization is defined separately.

You also have plenty of drivers with regards to planning out a construction period and the total construction cost. The cash flow will come out evenly over the months defined for this time frame. An exit value is defined per exit cap rate and populates according to the defined exit month (1-120).

A joint venture cash flow waterfall is included and integrated. This uses IRR hurdles to drive the cash distributions to any preferred equity legs / investors (LP) and sponsors (GP). Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Unit Driven Real Estate Acquisition Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping