Value-add Real Estate Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

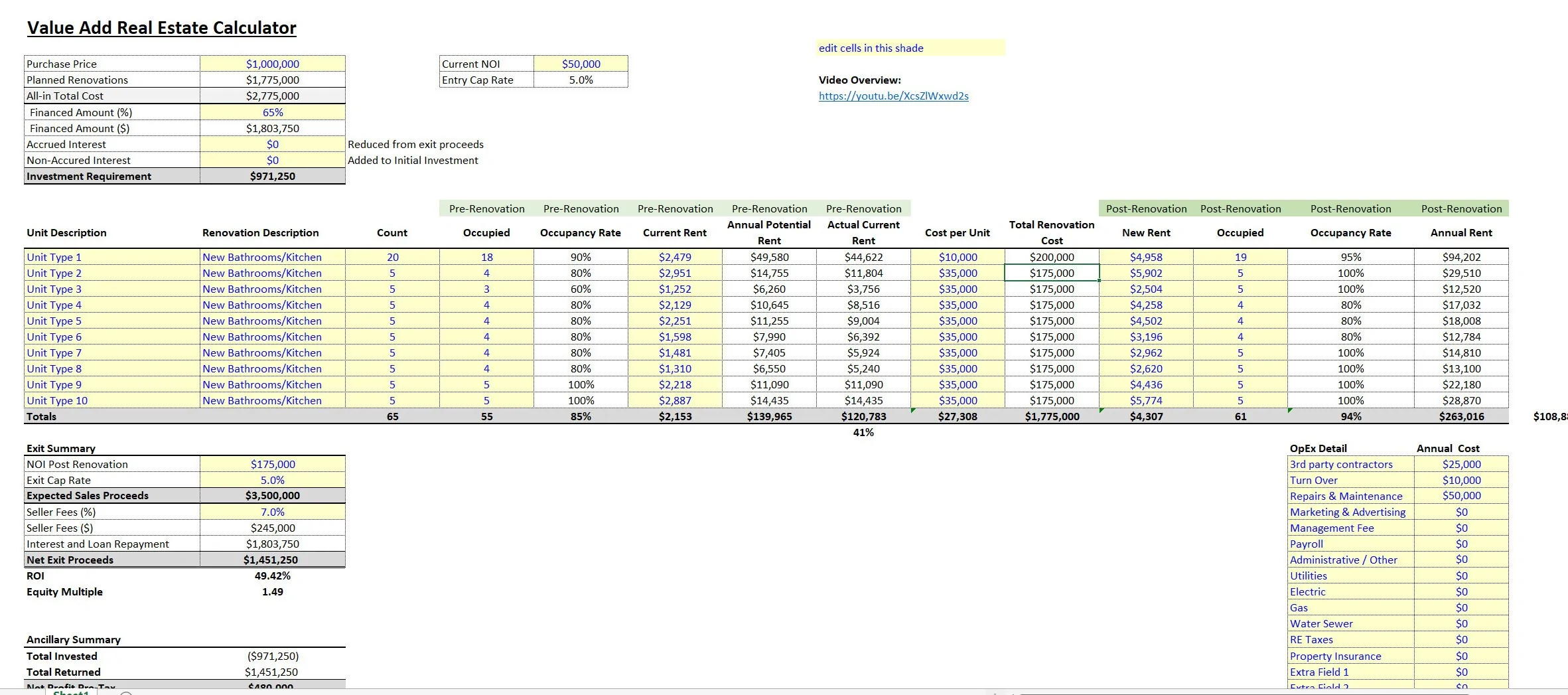

Here you have a standalone deal analyzing template with a focus on value-add flipping. This was setup to help determine the expected return on investment when buying a property, potentially financing some of the purchase, renovating it, and then re-selling.

Being able to quickly and accurately utilize a real estate flipping tool focused on value-add activities can boost efficiencies and decision making. The entire template fits on a single tab and there are three main sections to work on. It is great for large multi-million dollar projects or small single family house flipping.

They are: Initial Investment / Financing, Rent roll (pre and post-renovation), and renovation cost per unit Exit.

The primary inputs involve defining up to 10 unit types, the count of units per each type in the acquisition, and the current rent roll. Then, the user moves over to the expected CAPEX spend on each unit per unit type as well as the new monthly rent that will be charged post-renovation.

The final expected occupied units is the final input and then gross rental income will populate, be measured against new operating expenses, and produce a post-renovation NOI. This will be important for calculating the new value of the asset based on a defined cap rate.

The flexibility of the model combined with the roll-up nature of the unit type assumptions makes this real estate flipping calculator useful to a broad range of use cases.

It may be that you are rehabbing an existing apartment building yourself and trying to figure out how you can improve the occupancy and overall value or it could be a single-family home purchase where there is just a single unit type. It may be that you are a multi-family unit real estate acquisition operator and want a quick way to evaluate potential deals and produce a relevant financial analysis.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate Excel: Value-add Real Estate Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping