Oil and Gas Well Drilling Feasibility Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Feasibility Analysis

- Cohort Modeling

- Joint Venture

OIL & GAS EXCEL DESCRIPTION

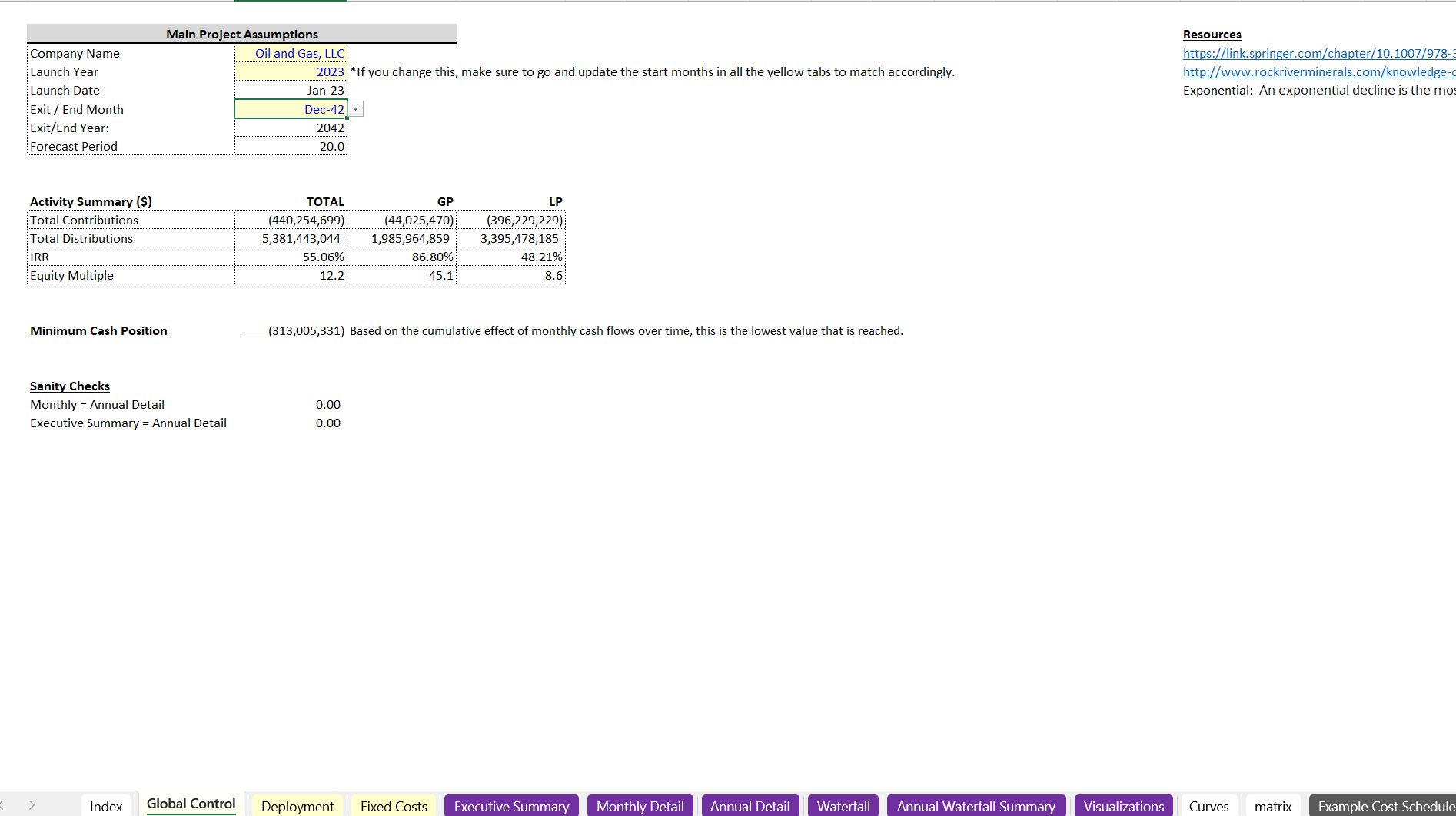

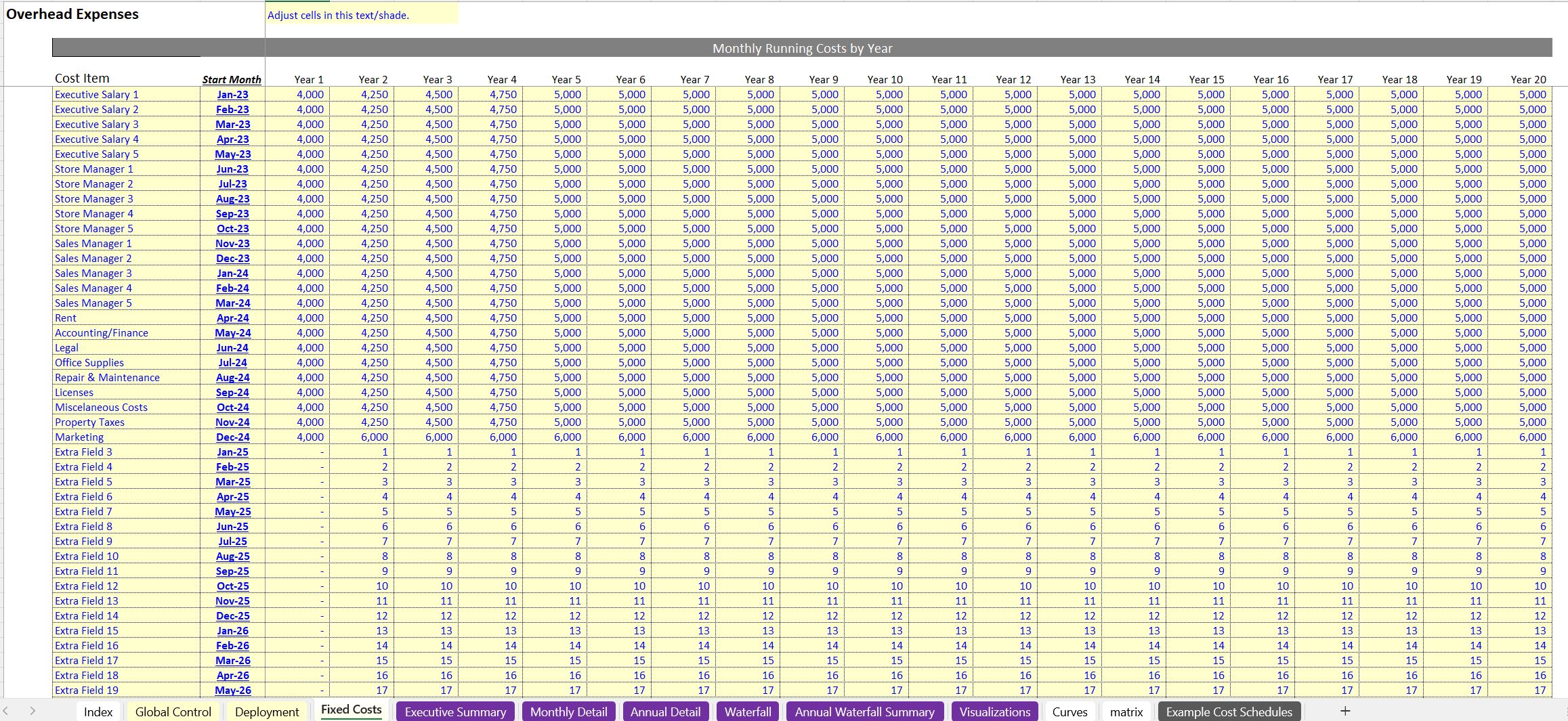

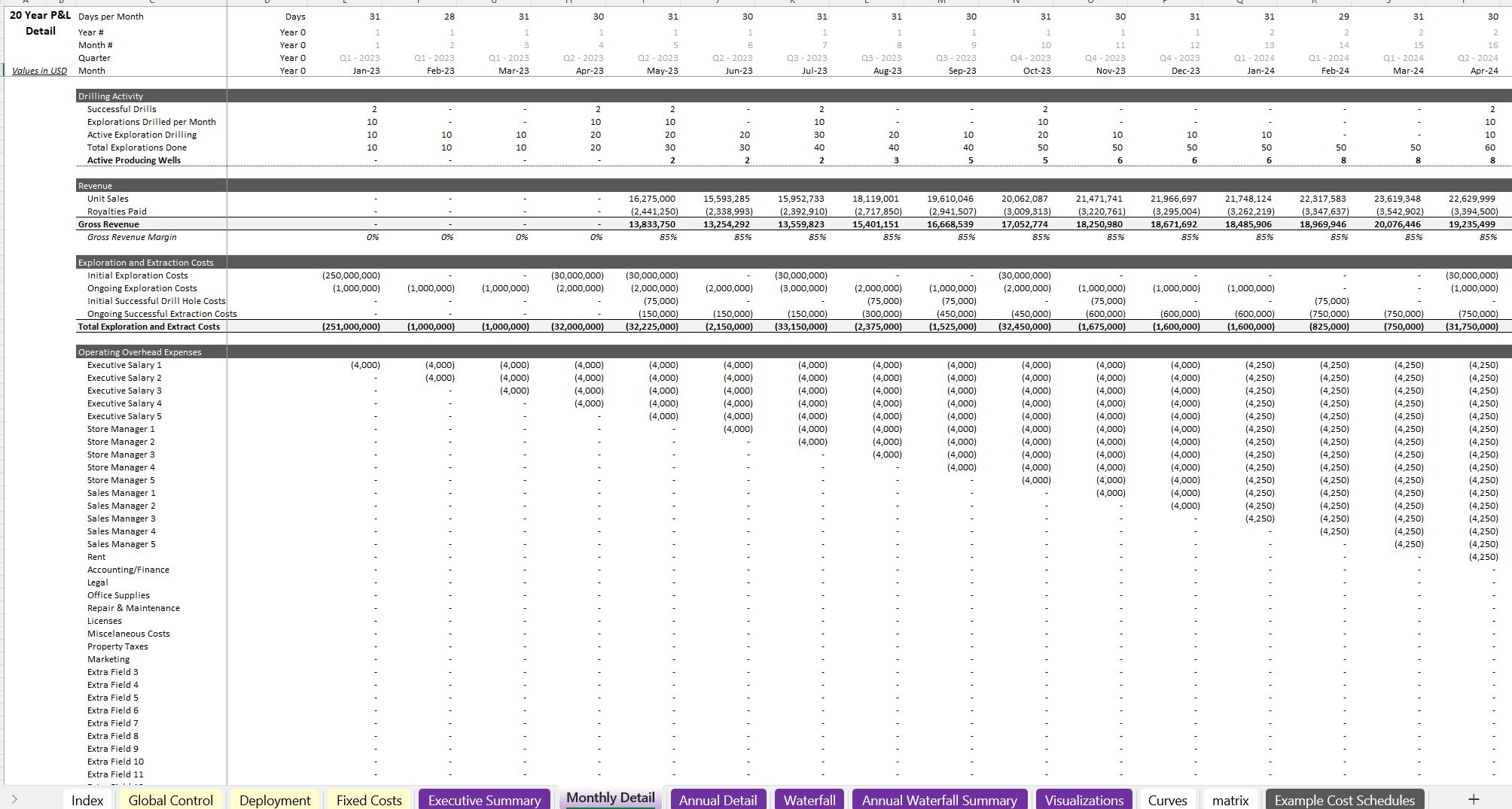

This is a 20-year financial model for the oil and gas industry. It involves some of my best cohort modeling techniques as well as contains specific logic related to the economics and dynamics of drilling oil and gas wells.

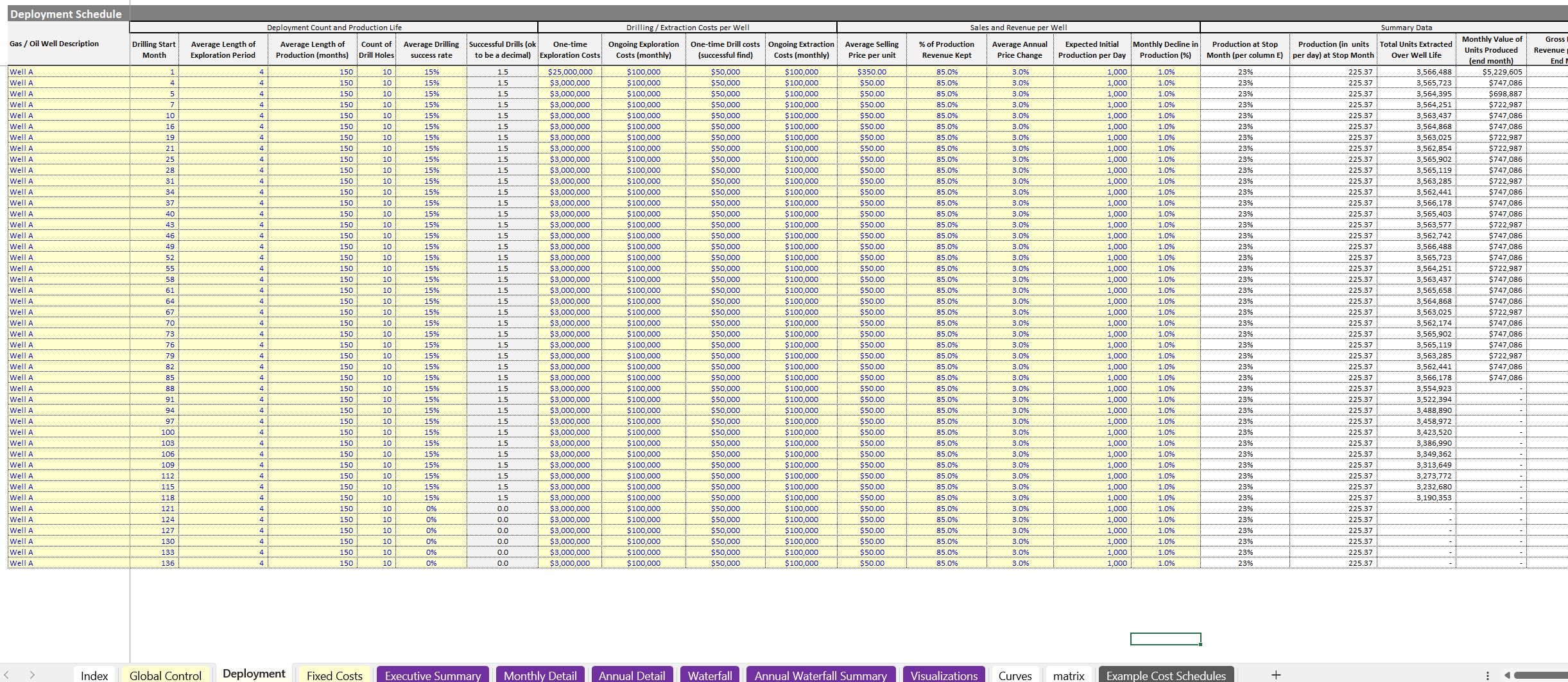

Some of the general economics involve the cost of drilling test holes with some success rate. Then measuring the cost to implement equipment on a successful test hole as well as the ongoing costs to maintain that drill for a determined length of time where extraction is happening.

While the extraction is happening, pressure changes in the well. What that means is a changing flow rate over time and so the production output changes over time relative to the initial flow rate. That requires an exponential decay curve to be implemented so a better economic analysis can be done for each well cohort that is successful.

You get all the above logic built in for up to 46 well cohorts. Each cohort can have an arbitrary count of wells that are drilled and have their own configurations for costs, flow rate, pricing of the units extracted, active period, and decline curves. You could even use some of the cohorts for gas drilling and some for oil drilling. The assumptions are the same as they are broad enough to account for the general economics of each.

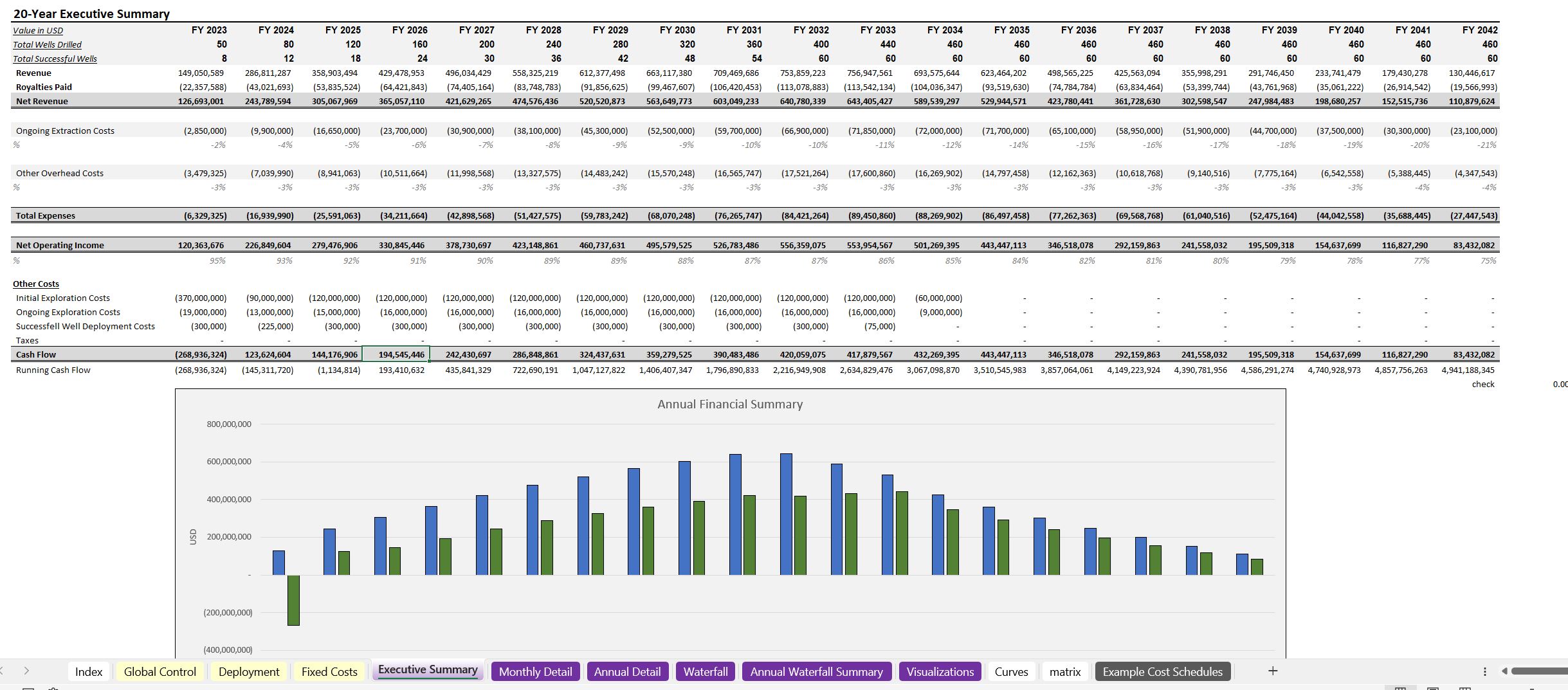

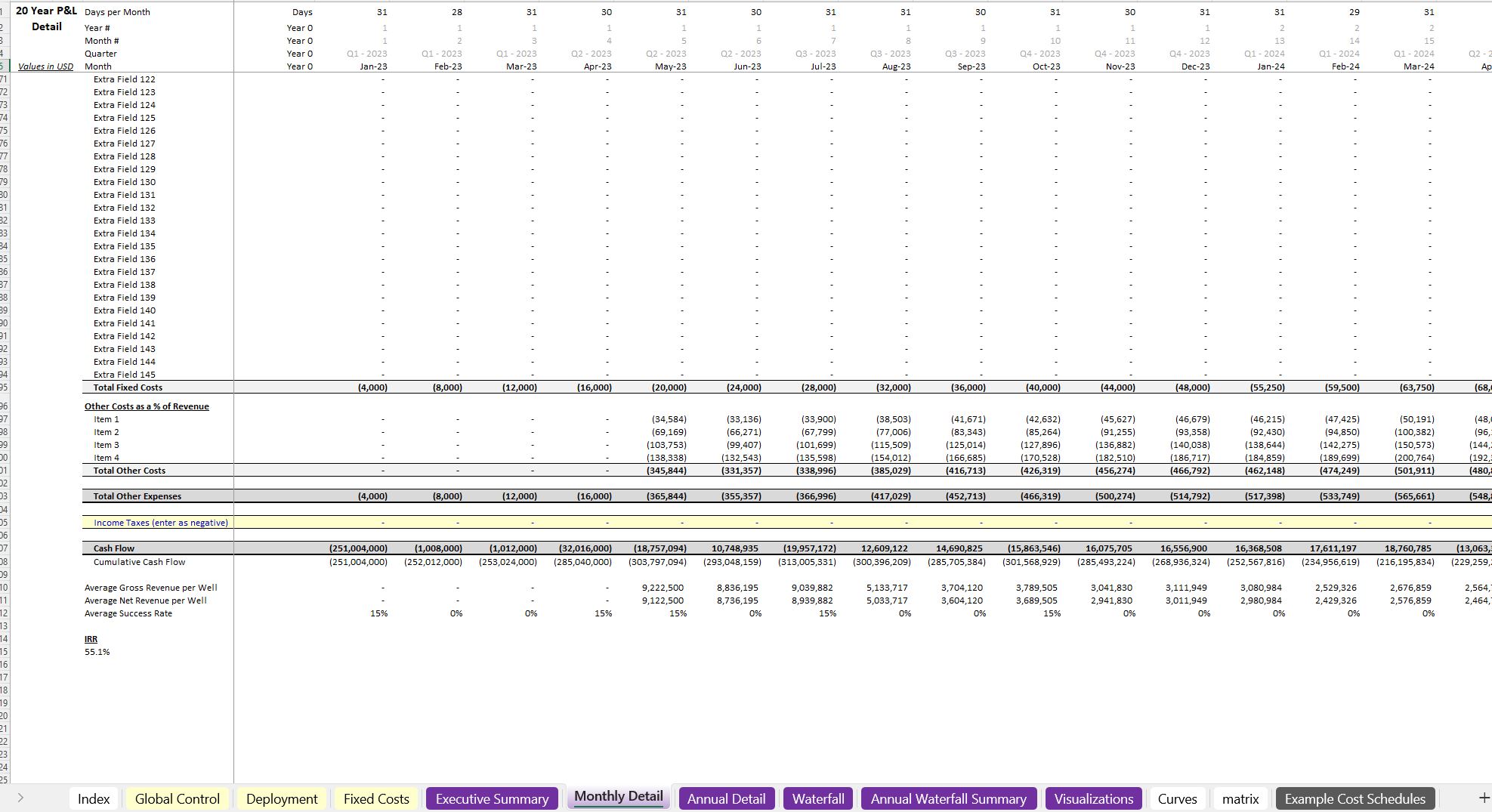

To properly analyze the results of these well deployments over time, there is a 20-year executive summary that shows the expected revenues from extraction, all relevant operating costs, and resulting cash flow per period. The final return on investment, IRR, and DCF Analysis will also automatically calculate.

My goal with this model was to build something that could be used to analyze one specific site or the effect of drilling many sites over time.

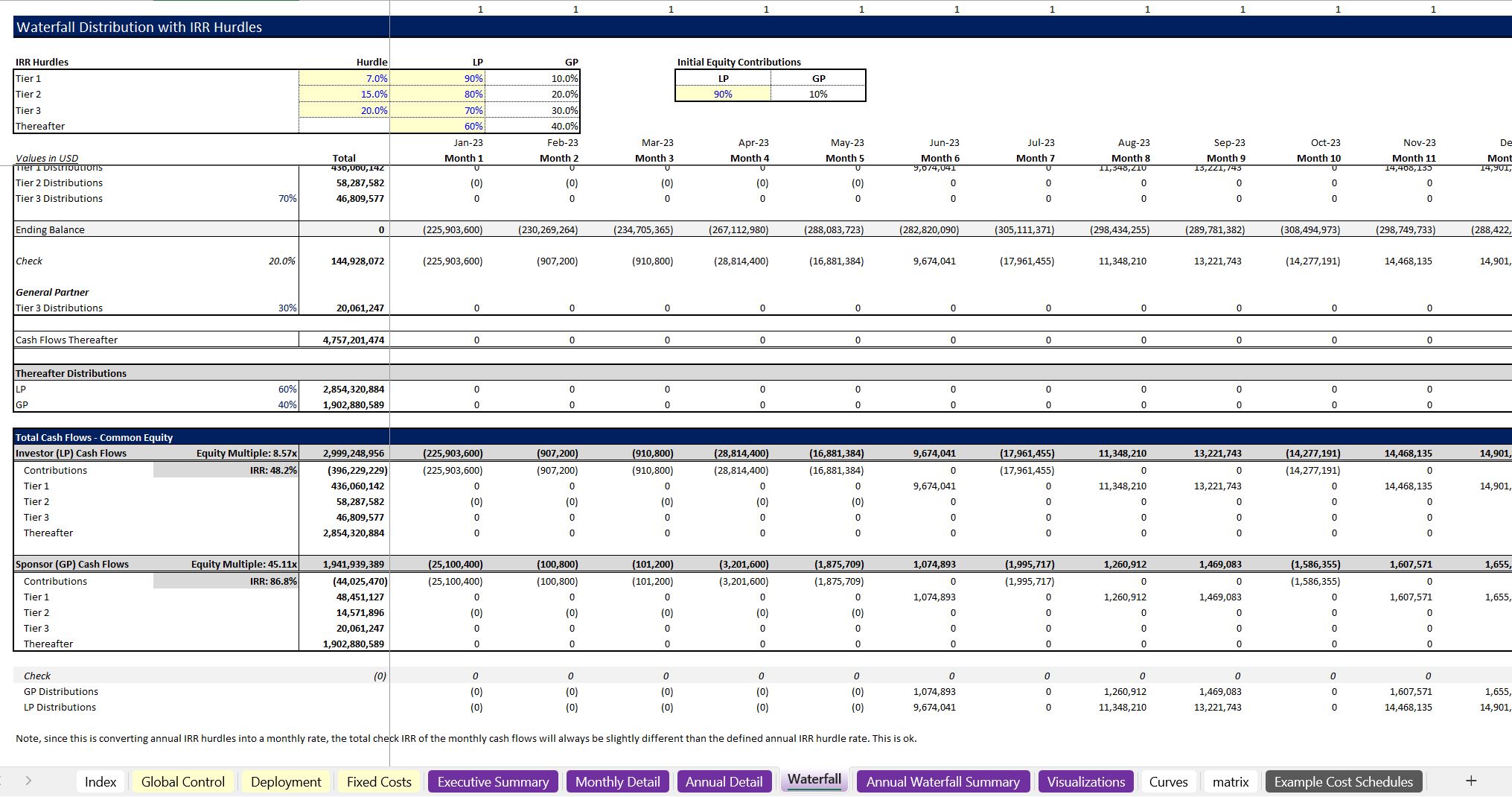

Because oil and gas can be a risky business, financing is usually sourced from partners and so joint ventures are common. That means one party comes with the cash and the other comes with experience. To account for this type of deal, I have integrated a joint venture cash flow waterfall that uses IRR hurdles to determine how cash is distributed to each party as well as their contribution rate for the initial investment.

I also included many visualizations and monthly / annual summaries, so the entire financial picture is easier to understand.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Oil & Gas, Integrated Financial Model Excel: Oil and Gas Well Drilling Feasibility Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping