Startup SaaS Financial Model: Driven by Account Executive (AE) Deals (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

SAAS EXCEL DESCRIPTION

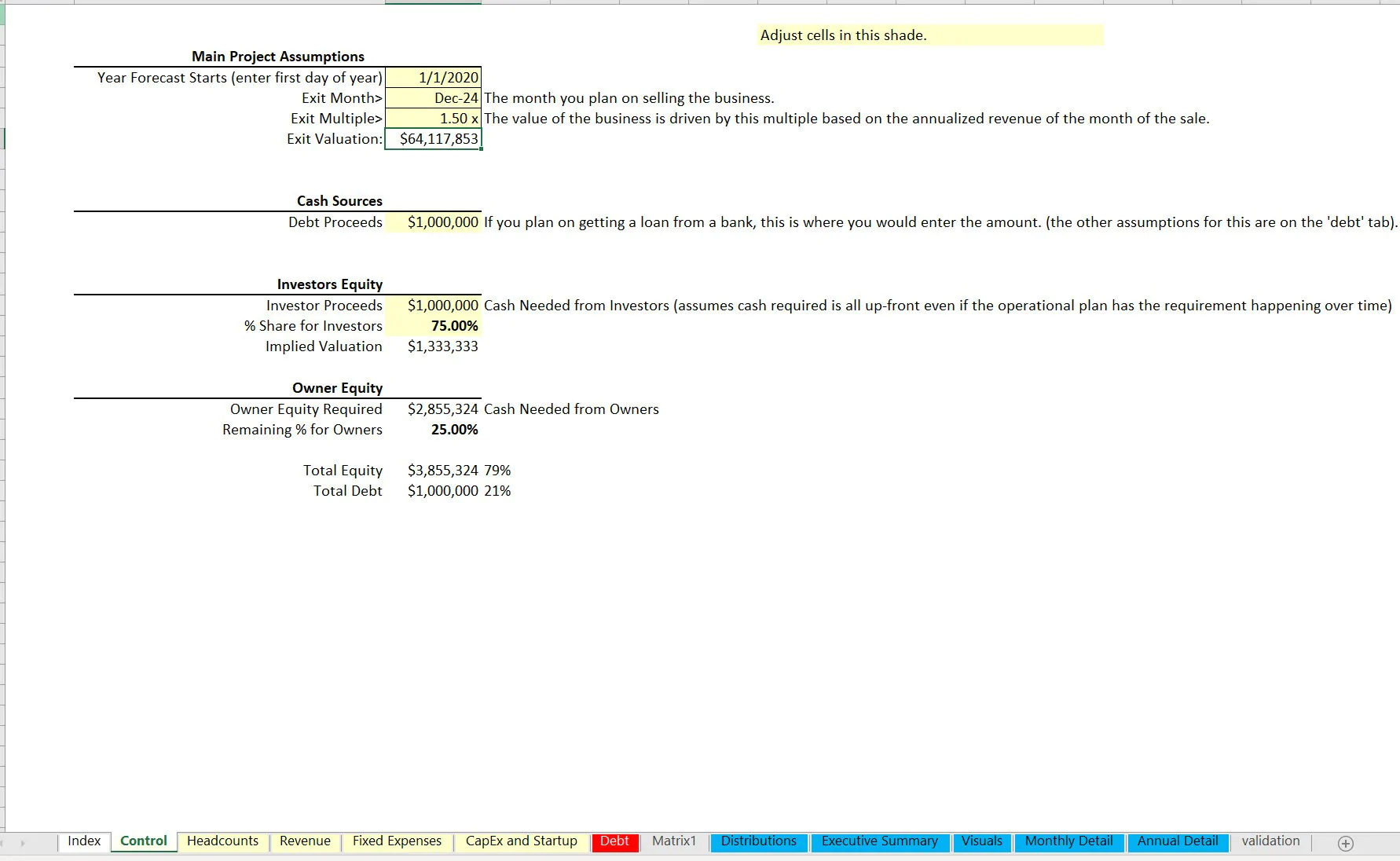

Recent Update: Integrated financial statements monthly and annual, cap table (joint venture multiple fund raising capable), and capex with dynamic depreciation.

This SaaS model is focused on driving growth from bottom-up assumptions and ratios for all relevant employee types that naturally scale based on the number of new customers / existing customers.

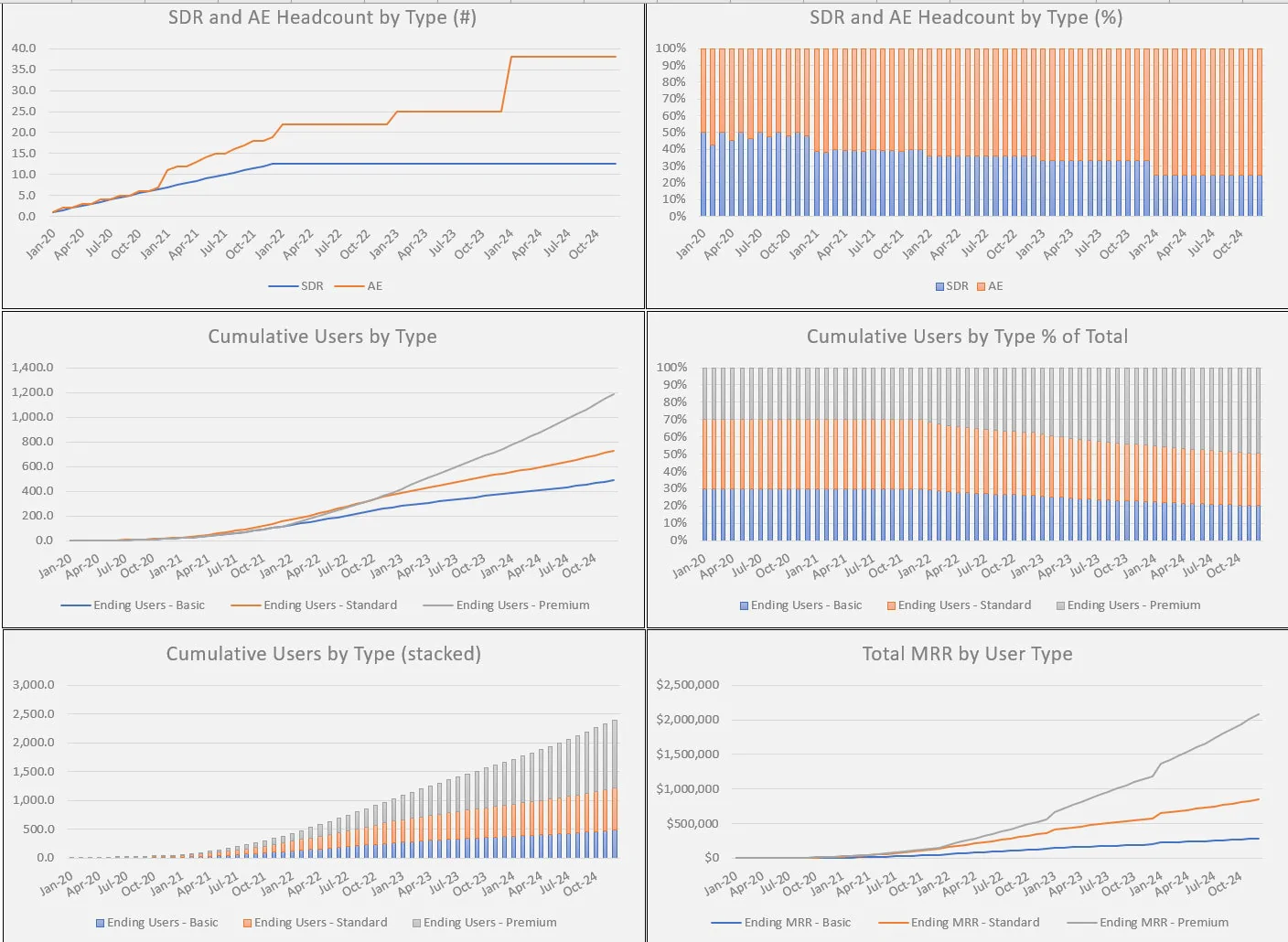

Account Executives (AE) will have a target deals per month input and a quota attainment schedule that defines how long it takes them to get to full efficiency. The count of AEs added and when they come on will drive revenue growth exclusively. Customers are split in up to three monthly priced tiers and you can define the percentage of new monthly customers signups that fall into each pool.

The primary target user for this financial model is a recurring services (with an option for setup fees) business that has a fairly high average monthly revenue per customer or a very high new customer signup level per AE since all new customers are driven by AE performance and that means a high salary burn.

The model makes it easier to see the costs that come with scale based on various pricing, growth, salary assumptions.

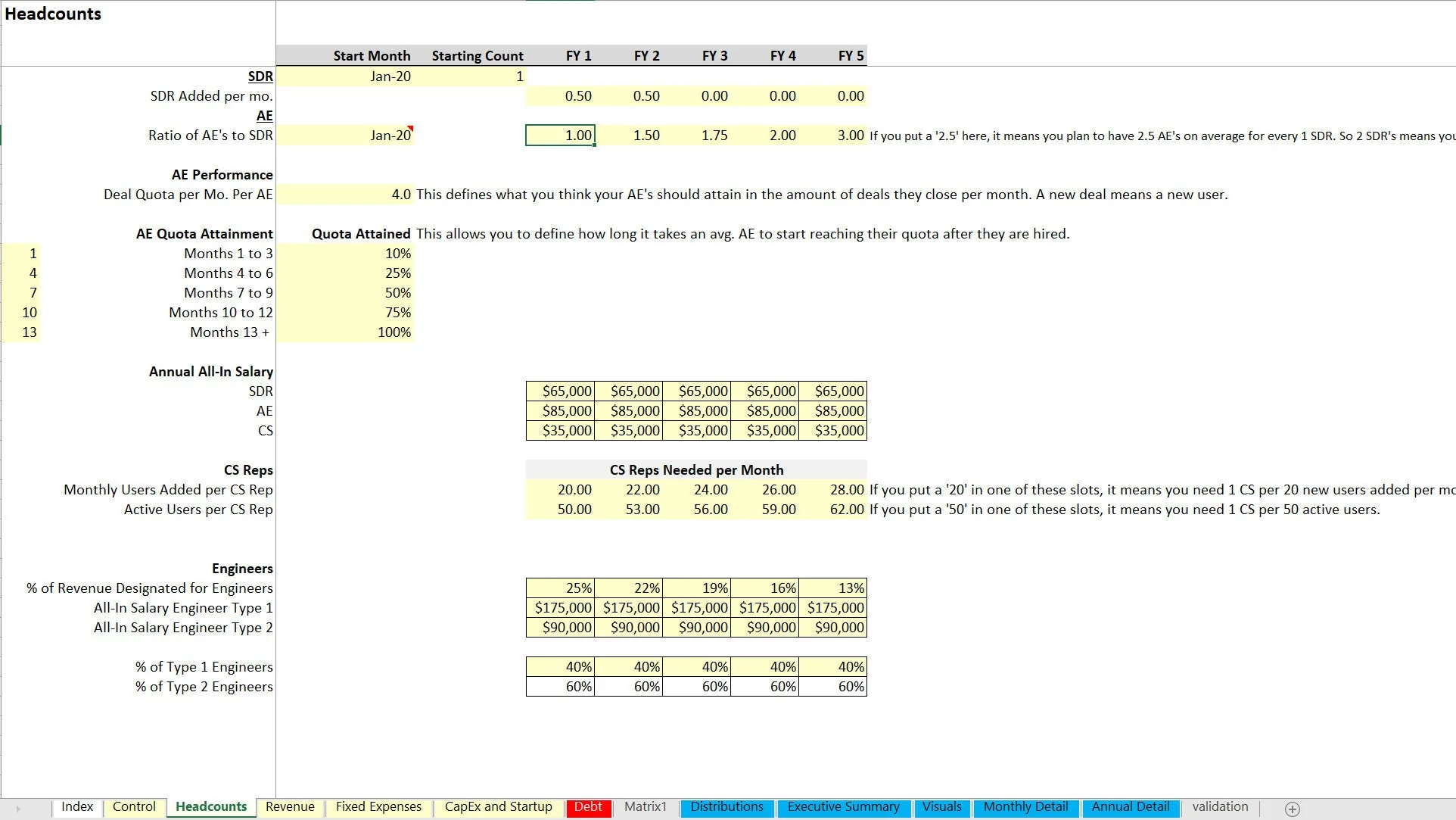

The following can be defined in order to determine expected primary employee headcounts (sales / customer support) and new customer sign ups per month:

• SDR Added per mo.

• Ratio of AE's to SDR

• Deal Quota per Mo. Per AE

AE Quota Attainment

• Months 1 to 3

• Months 4 to 6

• Months 7 to 9

• Months 10 to 12

• Months 13 +

Annual All-In Salary

• SDR

• AE

• CS

CS Reps

• Monthly Users Added per CS Rep

• Active Users per CS Rep

Engineers

• % of Revenue Designated for Engineers

• All-In Salary Engineer Type 1

• All-In Salary Engineer Type 2

• % of Type 1 Engineers

• % of Type 2 Engineers

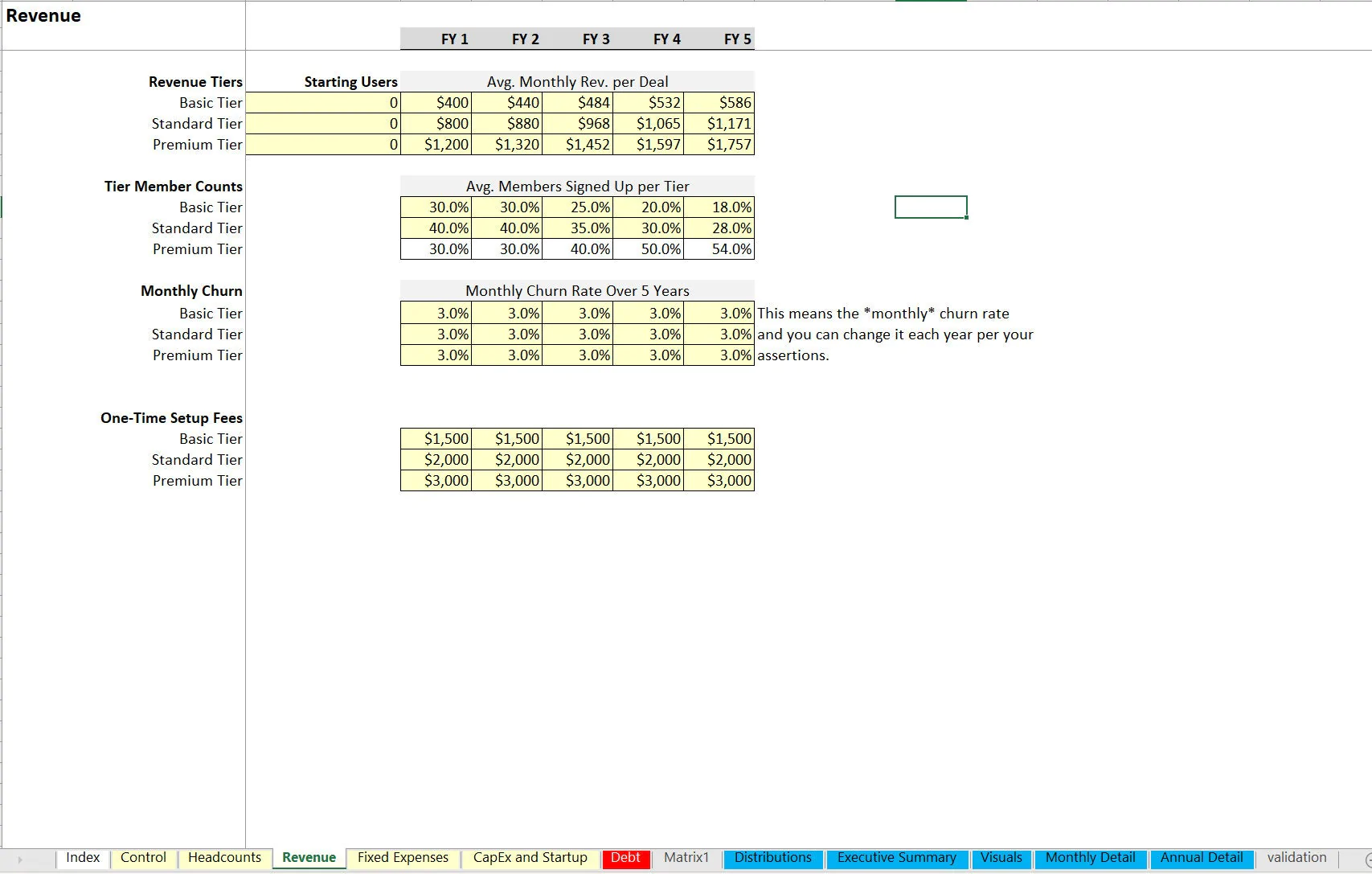

For revenue assumptions, the following inputs are available:

Revenue Tiers (average monthly revenue per deal)

• Basic Tier

• Standard Tier

• Premium Tier

Tier Member Counts (% per tier)

• Basic Tier

• Standard Tier

• Premium Tier

Monthly Churn (average monthly rate)

• Basic Tier

• Standard Tier

• Premium Tier

One-Time Setup Fees

• Basic Tier

• Standard Tier

• Premium Tier

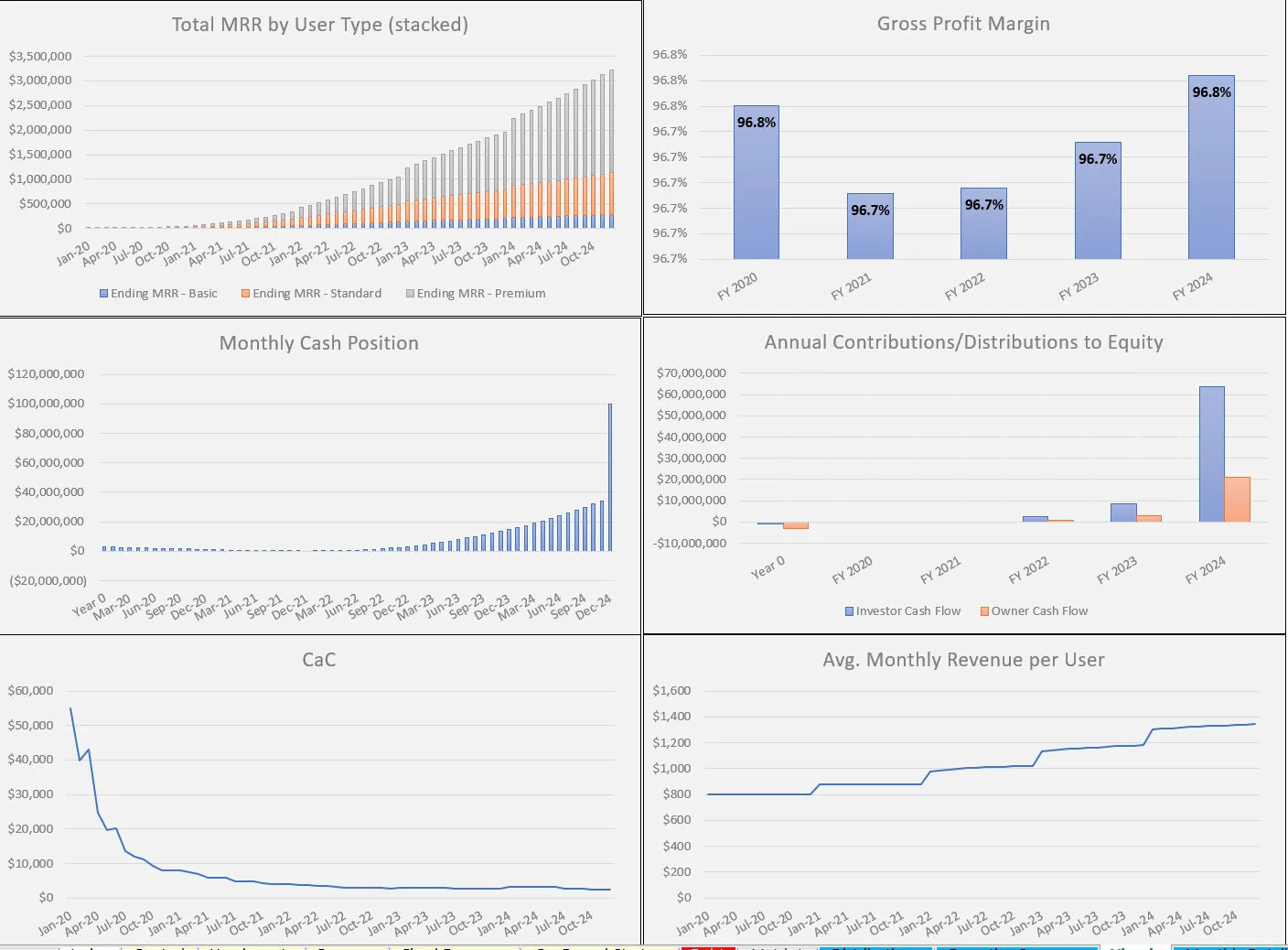

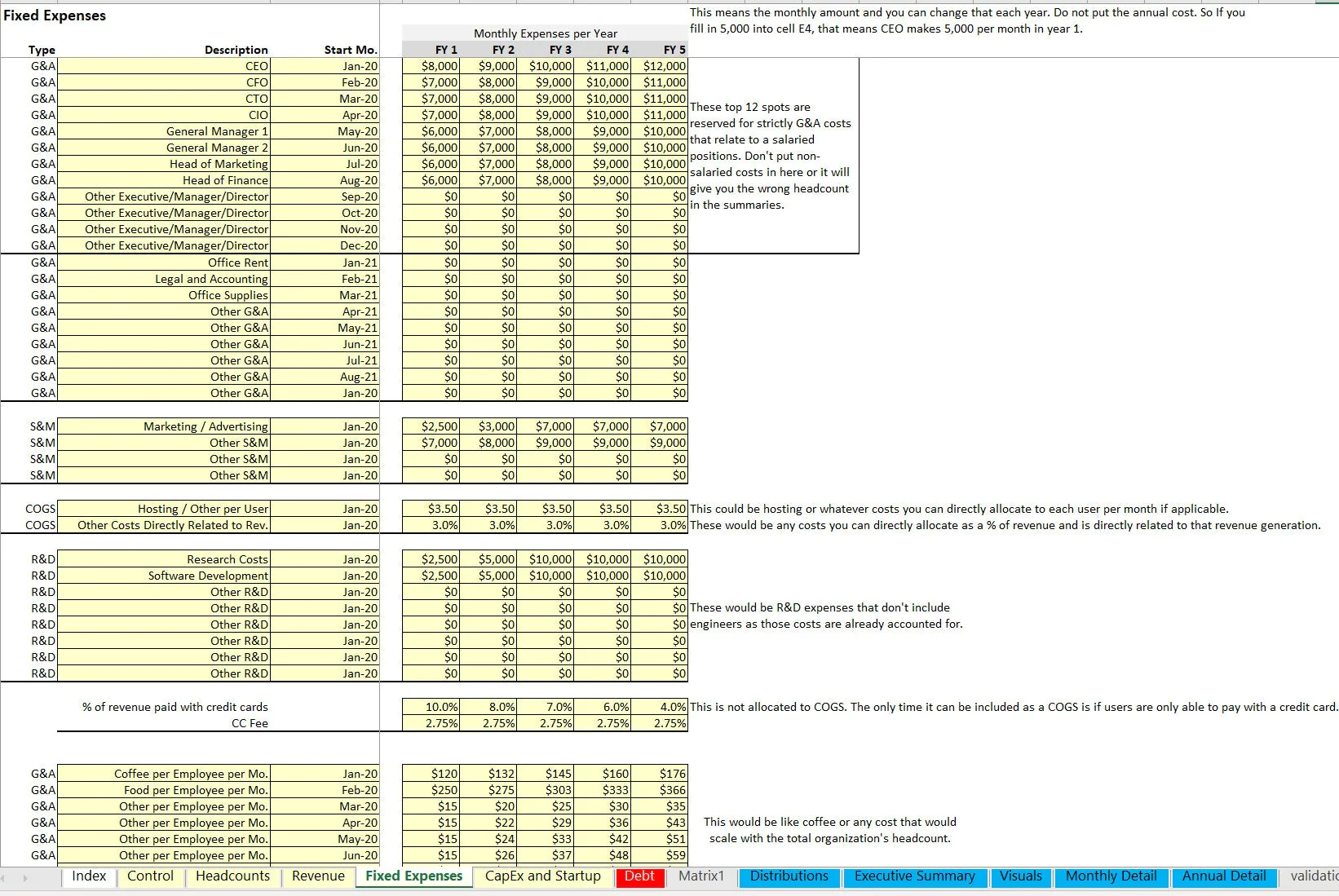

For operating expenses, there is a fixed cost schedule where the user defines the cost description, start month, and monthly cost in each year. There are also some variable costs based on a percentage of customers paying with credit cards and the fees associated, as well as costs per employee per month. For cost of goods sold, there is an input for cost per active user per month and costs as a direct percentage of revenue.

An advanced matrix style logic system allows for the scaling of AEs and accurate forecasting of the amount of total deals coming in each month based on the total count of AEs at a given time and their quota attainment performance.

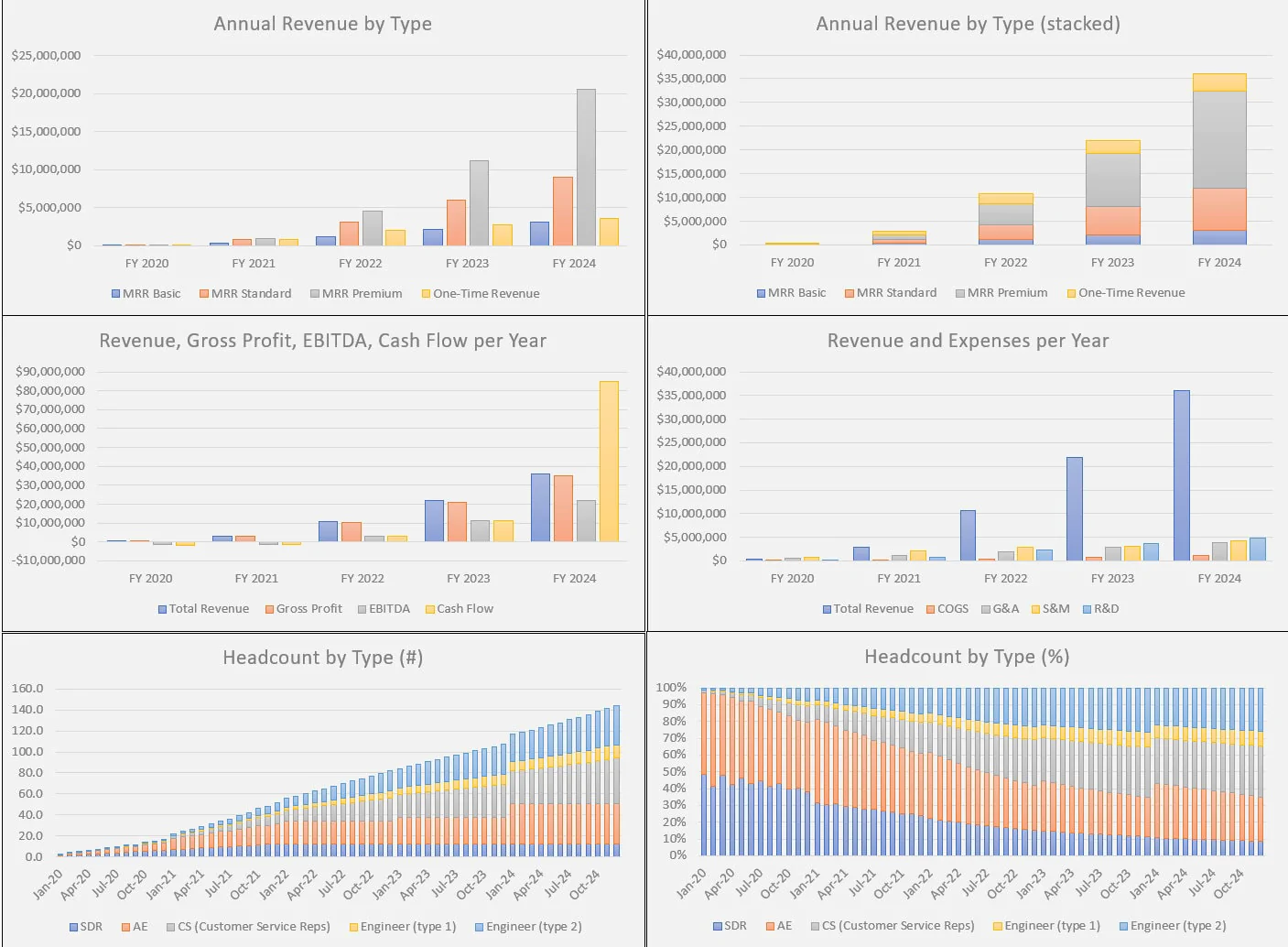

Final outputs include a monthly and annual pro forma detail that shows all results of the assumptions in a granular way and drives down to EBITDA / cash flow. There is also an annual financial summary showing key financial line items as well as a DCF Analysis for the project as a whole and the owner / investor if applicable.

An exit value is based on a multiple of annualized revenue as of the defined exit month. Over 22 visualizations are included to show a clear picture of the financial forecast as well as key performance indicators and stats that are specific to a SaaS business, including CaC, months to pay back CaC, Customer Lifetime Value, and LTV to CaC ratio.

These metrics become really important when there are such high acquisition costs (AE salaries) and based on their performance, the results could be profitable or not. The point is that you can adjust all levers to see what results in a desirable result.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in SaaS, Integrated Financial Model Excel: Startup SaaS Financial Model: Driven by Account Executive (AE) Deals Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping