Starting a Cruise Ship Business: Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Revenue Modeling

- Pricing

- Cash Flow Analysis

SHIPPING INDUSTRY EXCEL DESCRIPTION

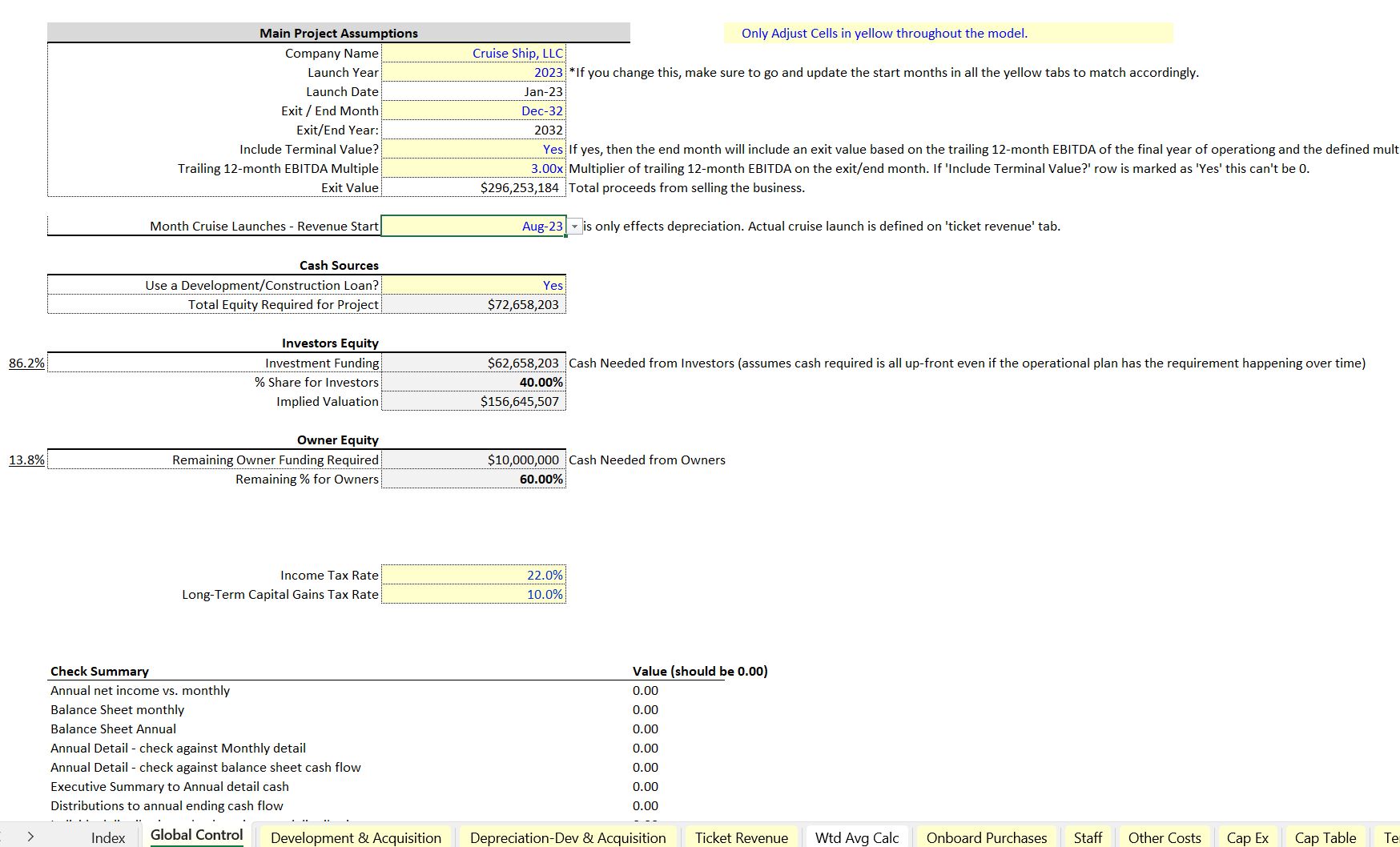

This model was designed for the financial planning of a cruise ship or general boat touring business. It goes out for a period of up to 10 years and includes monthly and annual pro forma summaries, IRR, DCF Analysis, option for inside/outside investors, and bottom-up assumptions specific to this industry. There is also an option for a joint venture waterfall with IRR hurdles for the LP as these businesses can end up taking billions to get off the ground and require advanced financing strategies.

At a high level, anyone can use this to plan out the initial costs and expected cash flows returned over time.

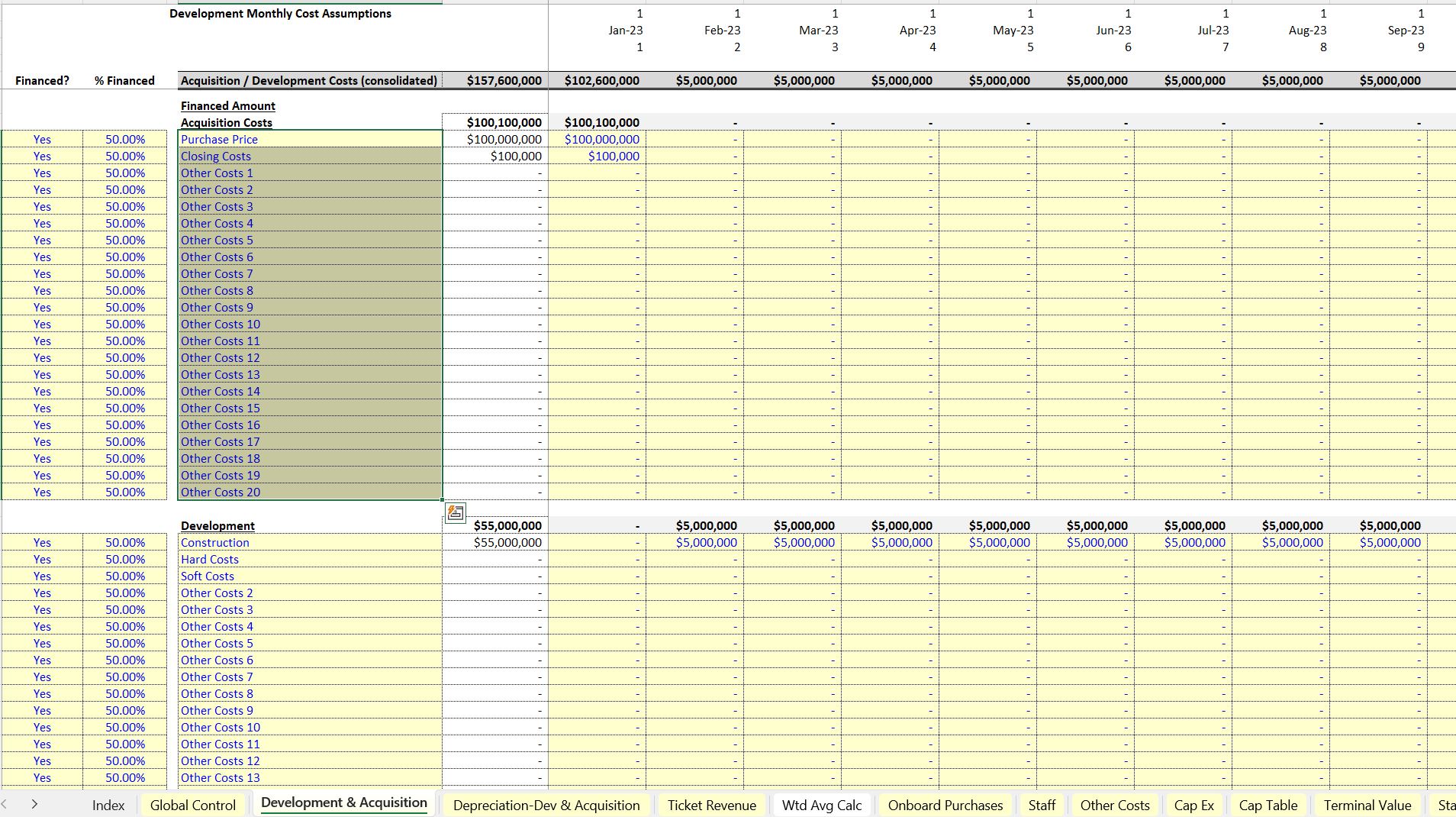

The first primary assumption section lets the user enter any acquisition or ongoing development costs in six separate schedules, each with 22 slots. Each slot has a definition for financing options and the percentage of that cost financed. It is essentially a very detailed and robust startup cost / construction cost assumption. You can enter all the costs in a single month at the beginning or account for the costs happening over time. Each of these sections also has a definition for depreciable life and depreciation expenses will popular accordingly.

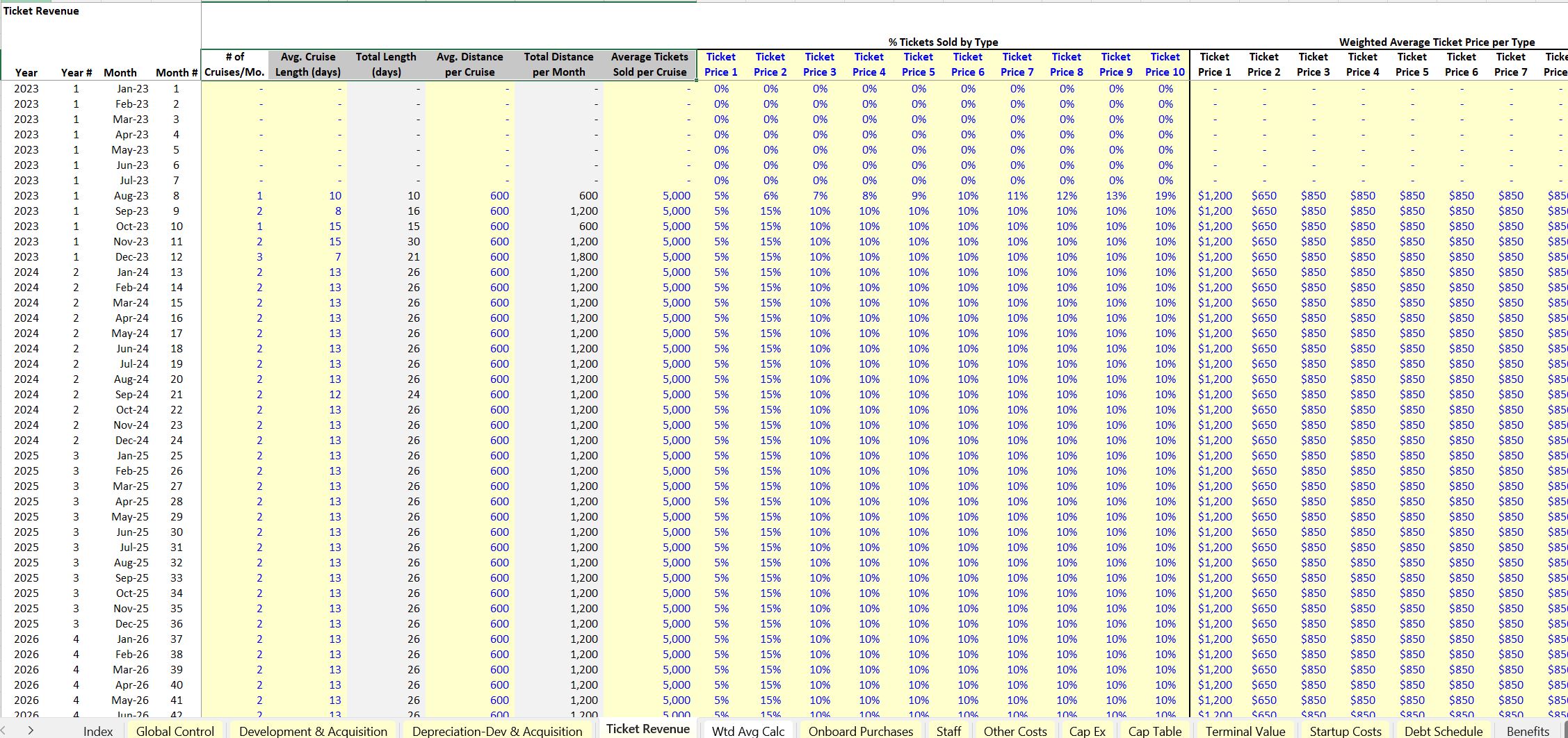

The next section is for ticket revenue, on this there is an input by month for the following:

• # of Cruises/Mo.

• Avg. Cruise Length (days)

• Avg. Distance per Cruise (drive fuel costs)

• Average Tickets Sold per Cruise (drive revenue)

There are up to 10 ticket pricing options with inputs for the percentage of purchased tickets expected for each option over time as well as the average ticket price per option.

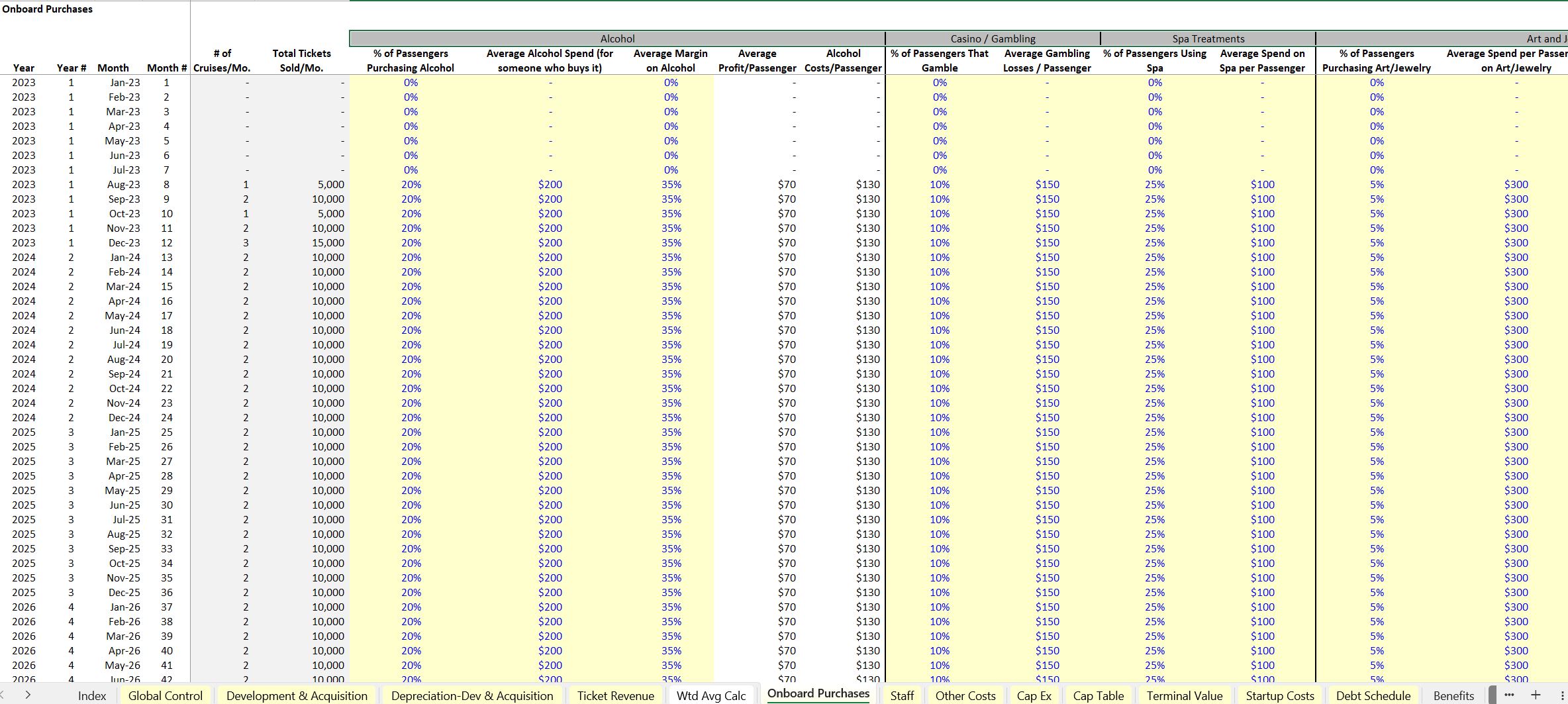

A cruise or boat touring business also has ancillary income sources such as:

• Alcohol

• Casino / Gambling

• Spa Treatments

• Art and Jewelry Auctions

• Shore Excursions

Each of the above ancillary income options has inputs for the percentage of passengers that partake in each, average spend per cruise on each, and the average cost of goods sold.

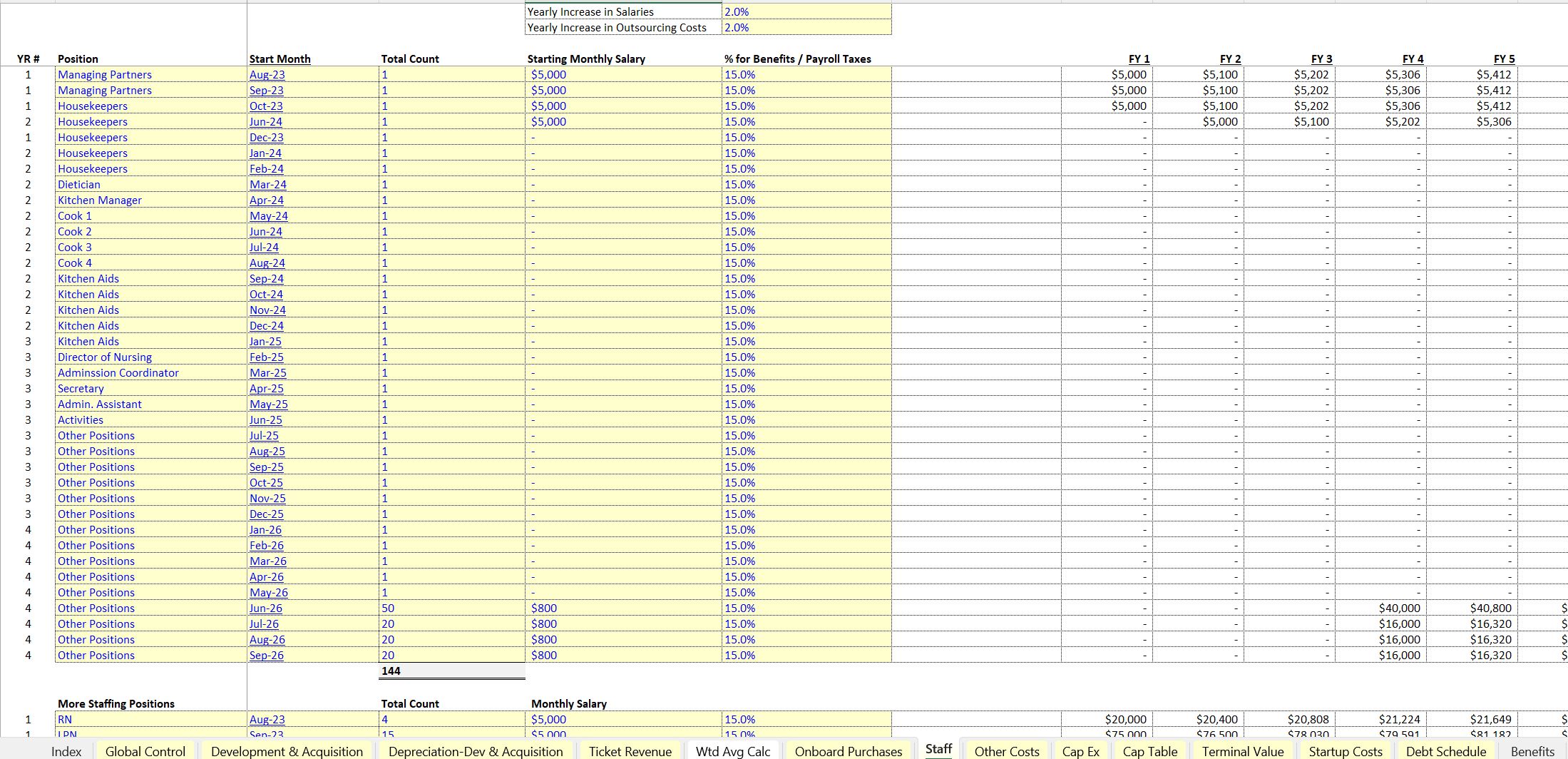

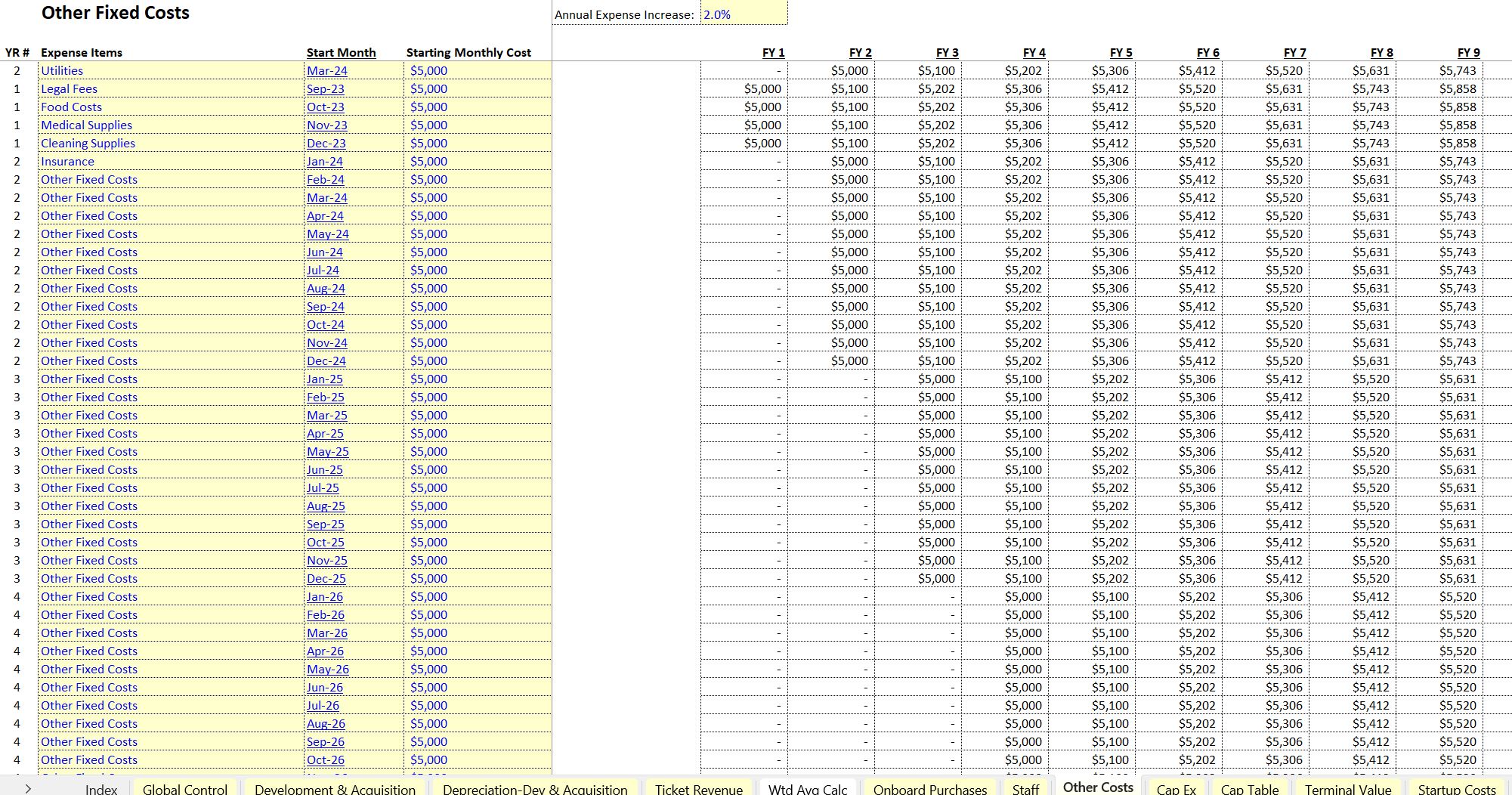

For ongoing operations, there is a detailed staffing schedule that can account for billion dollar level cruise ships or smaller ships. Simply define various staff types, salaries, start month, and adjusting in expenses over time. A separate section exists for corporate overheads and ongoing costs such as insurance, legal, accounting, and other general overheads.

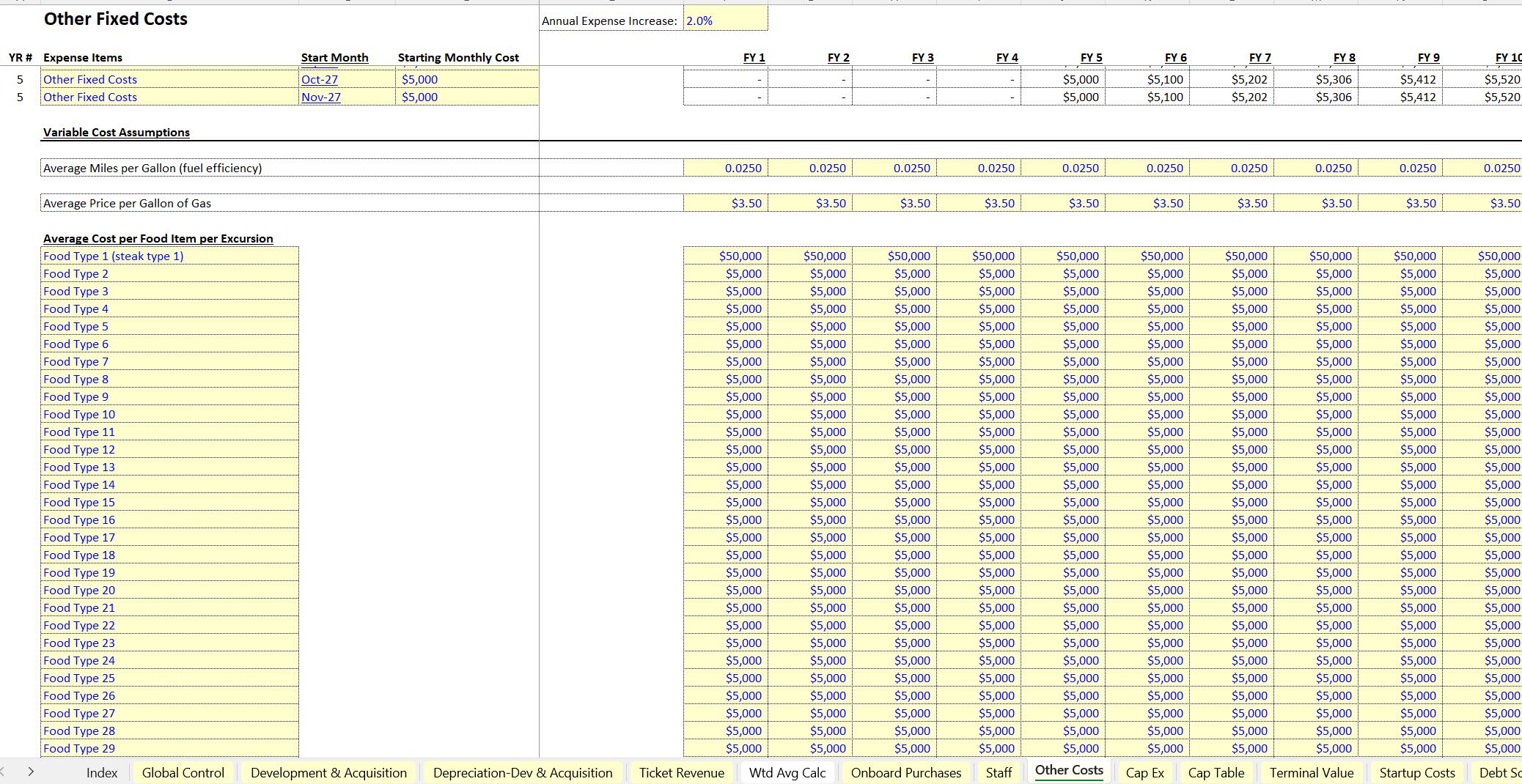

Food costs are a major cost item as well. To account for this, there is a detailed schedule to list all the various food types, there costs per each excursion.

Final outputs include monthly and annual Income Statement, Balance Sheet, and Cash Flow Statement as well as a detailed monthly and annual pro forma and lots of visualizations.

Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Shipping Industry, Integrated Financial Model Excel: Starting a Cruise Ship Business: Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping