Product & Service Subscription: Startup Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

SUBSCRIPTION EXCEL DESCRIPTION

Recent Updates: Added monthly and annual financial statement outputs (3-statement integrated), cap table, dynamic inventory purchasing schedule, and improved global control assumptions.

This sort of financial model has so many different variations. Having a template that lets the user tinker with prices / margins / general running expenses is a great way to dive into the idea of running a hybrid business model.

I am talking about Product + Subscription Add-on and that means the production of some device (product) that is available for purchase and is accompanied by some sort of recurring revenue service.

Think of a workout machine that you buy and then also pay a monthly fee for. There are all kinds of use cases here though. It could be a service that is required in order to use the product or the service could just be an add-on that is not necessary to use the product.

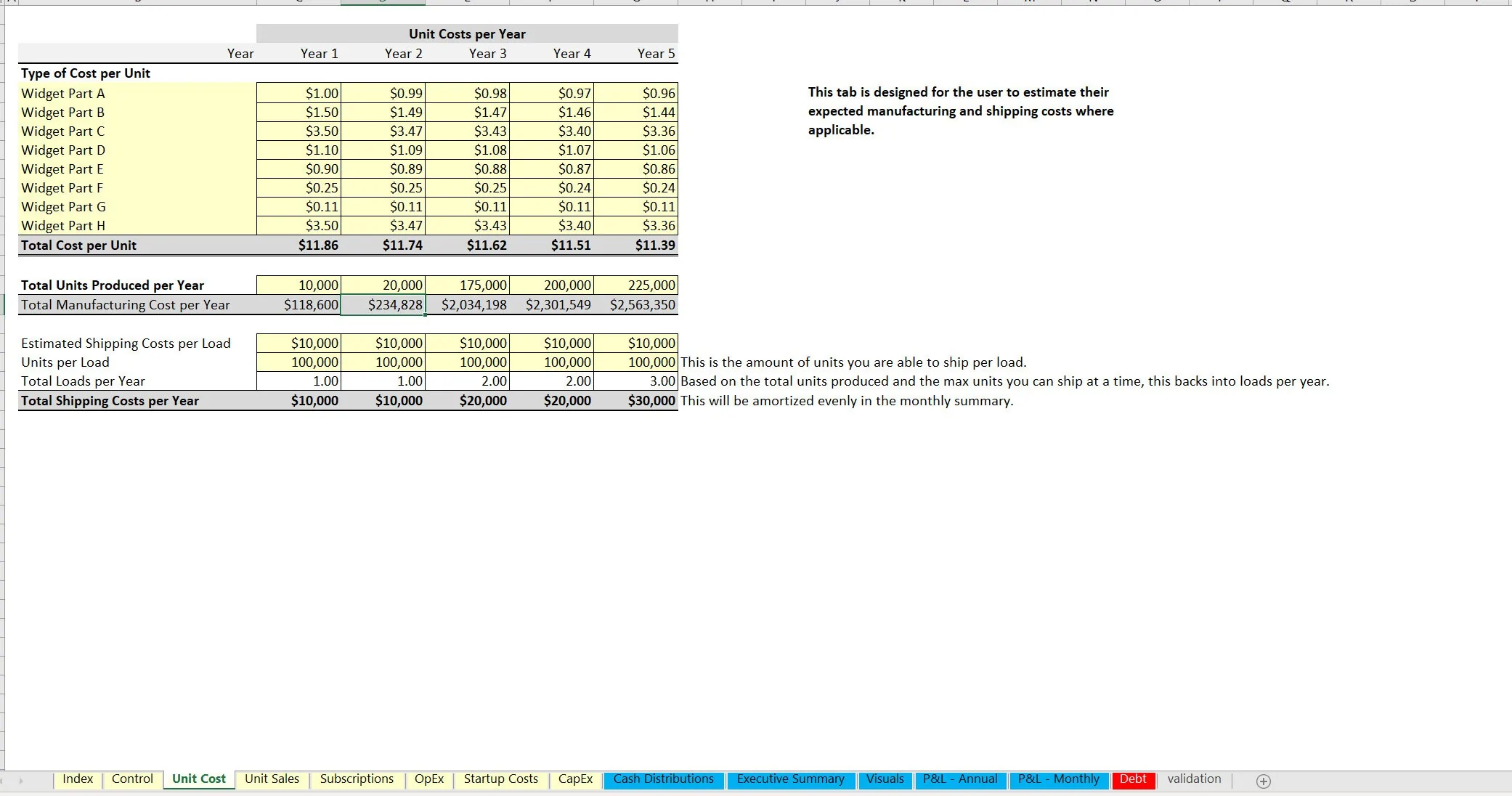

All kinds of strategies are used in this space and no matter what it is, this can be a powerful way to maximize growth and a financially healthy positioned organization. In this model, the user can configure up to 8 component costs per unit, as well as the maximum annual production.

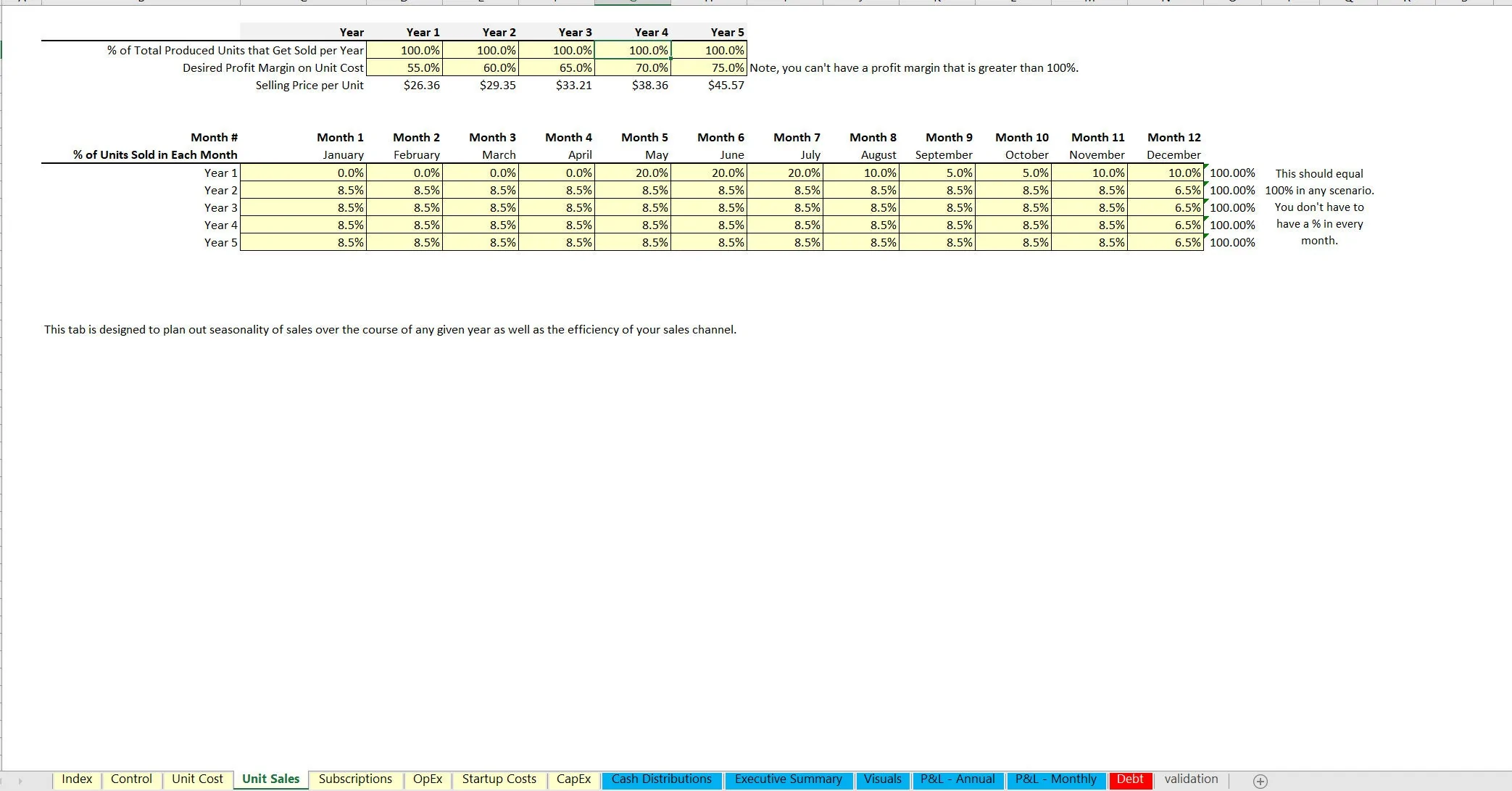

Shipping costs are also defined per year based on the number of shipments expected / cost per shipment. Finally, to arrive at a selling price for the product portion, simply define the desired profit margin per unit. This will back into selling price based on the predefined cost per unit.

Seasonality is also accounted for, and in the same logic, capacity attained. For each of the 5 years in the forecast, the user can configure the percentage of max annual sales that happened in each month as well as the percentage of produced units that get sold.

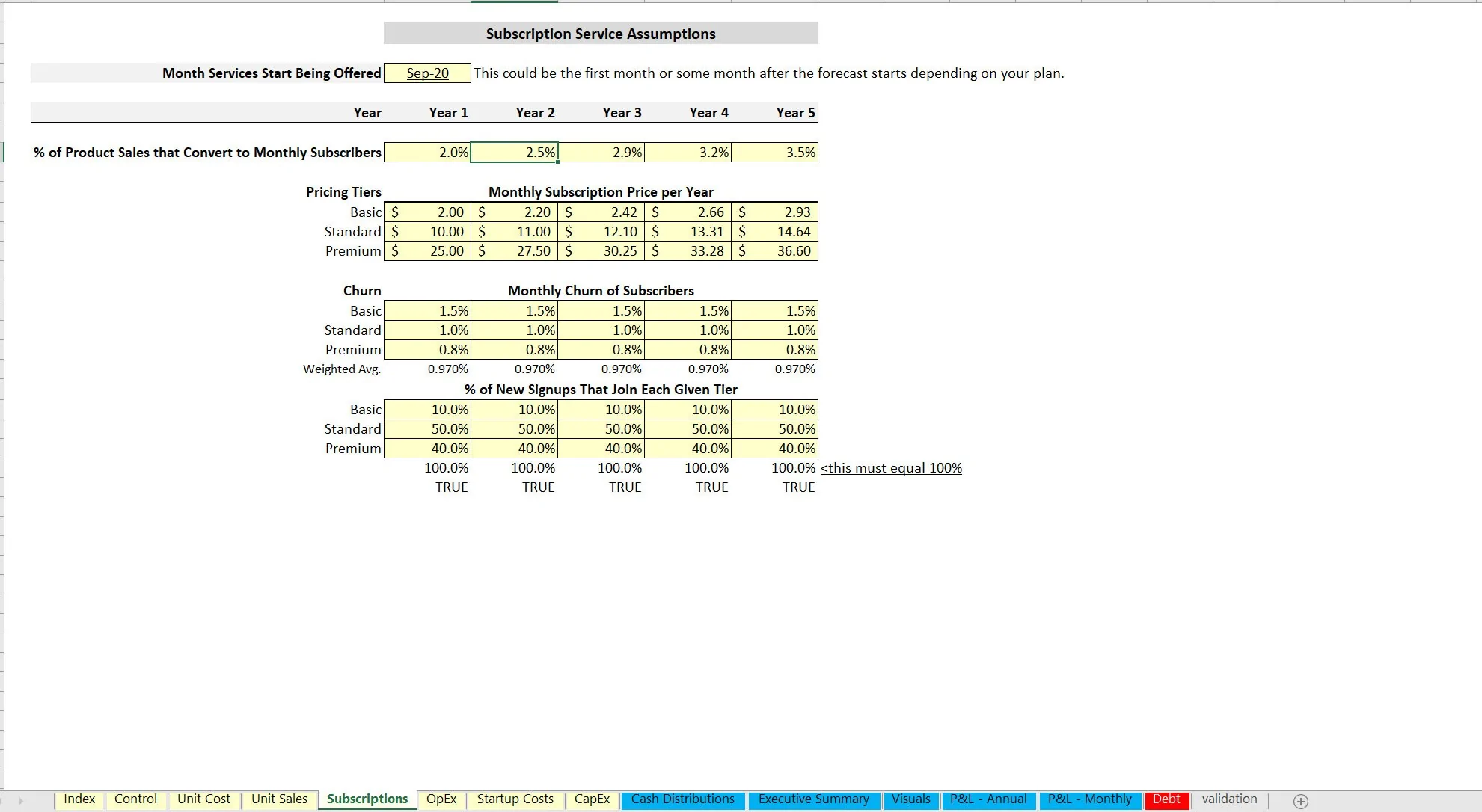

Based on all of the above, we know the total user acquisition stream that can happen based on the total units produced. This assumes a user can only sign up for the recurring revenue service if they have bought the product.

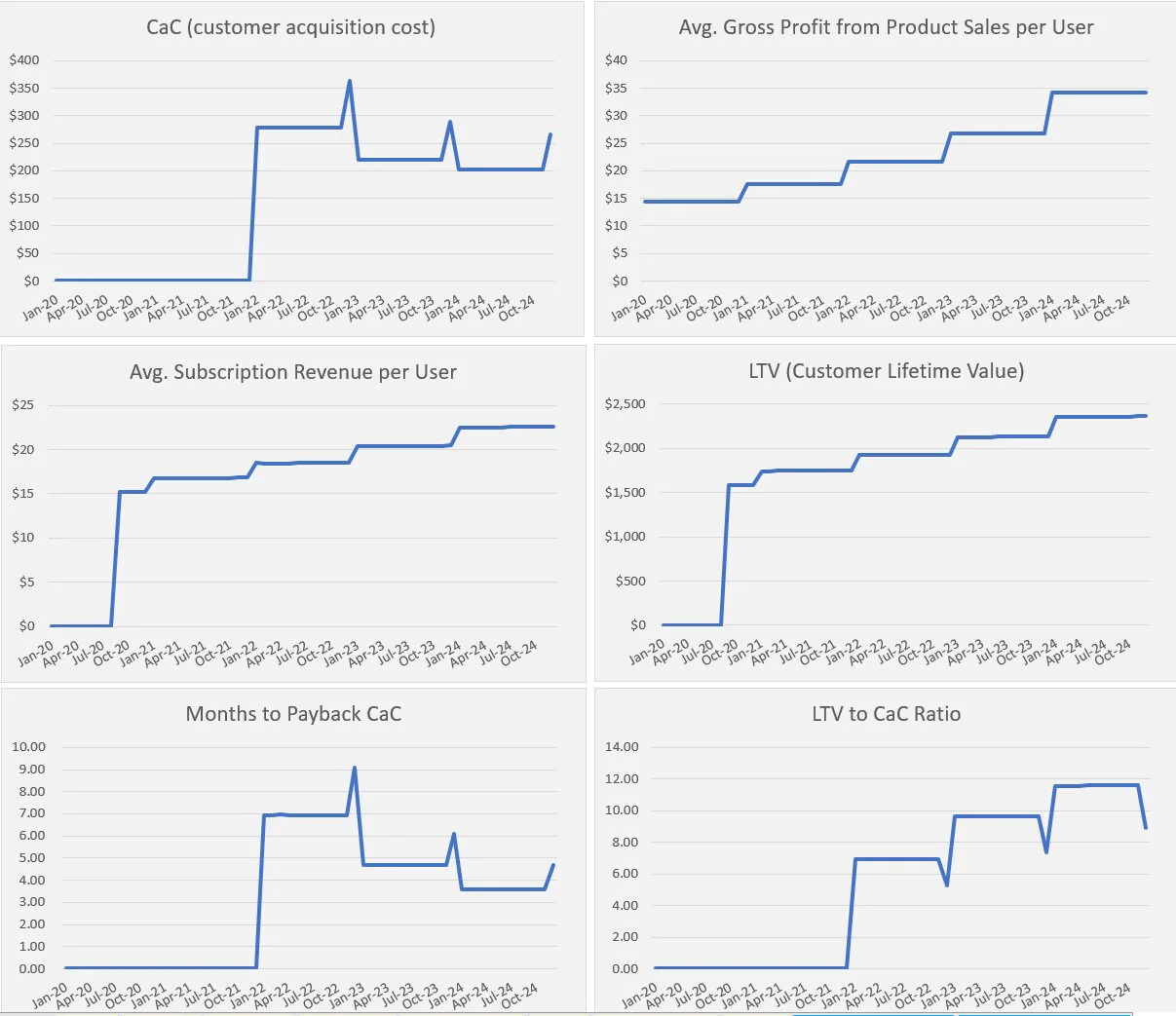

To determine how many customers that bought the product will sign up for the subscriptions service, a percentage is defined. Also, there is functionality to configure up to three pricing tiers and a percentage of signups that fall into each pricing tier as well as the average monthly churn of each tier.

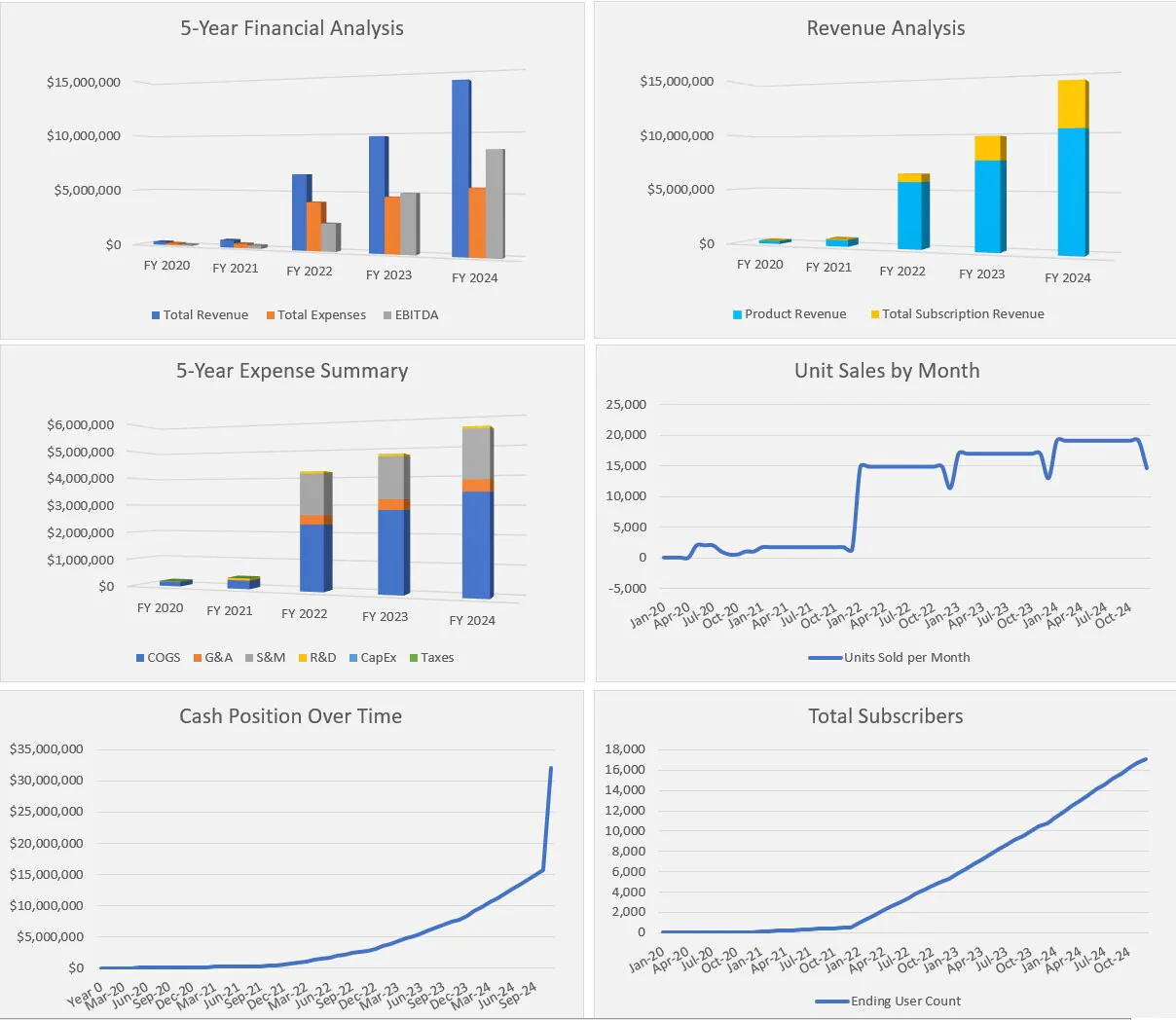

All of these assumptions can be adjusted in each of the five years. Final output summaries included a comprehensive pro forma on a monthly and annual basis that gets down to EBITDA and after-tax cash flow. Taxes are defined manually if so desired, or you can leave that blank to just get pre-tax cash flow.

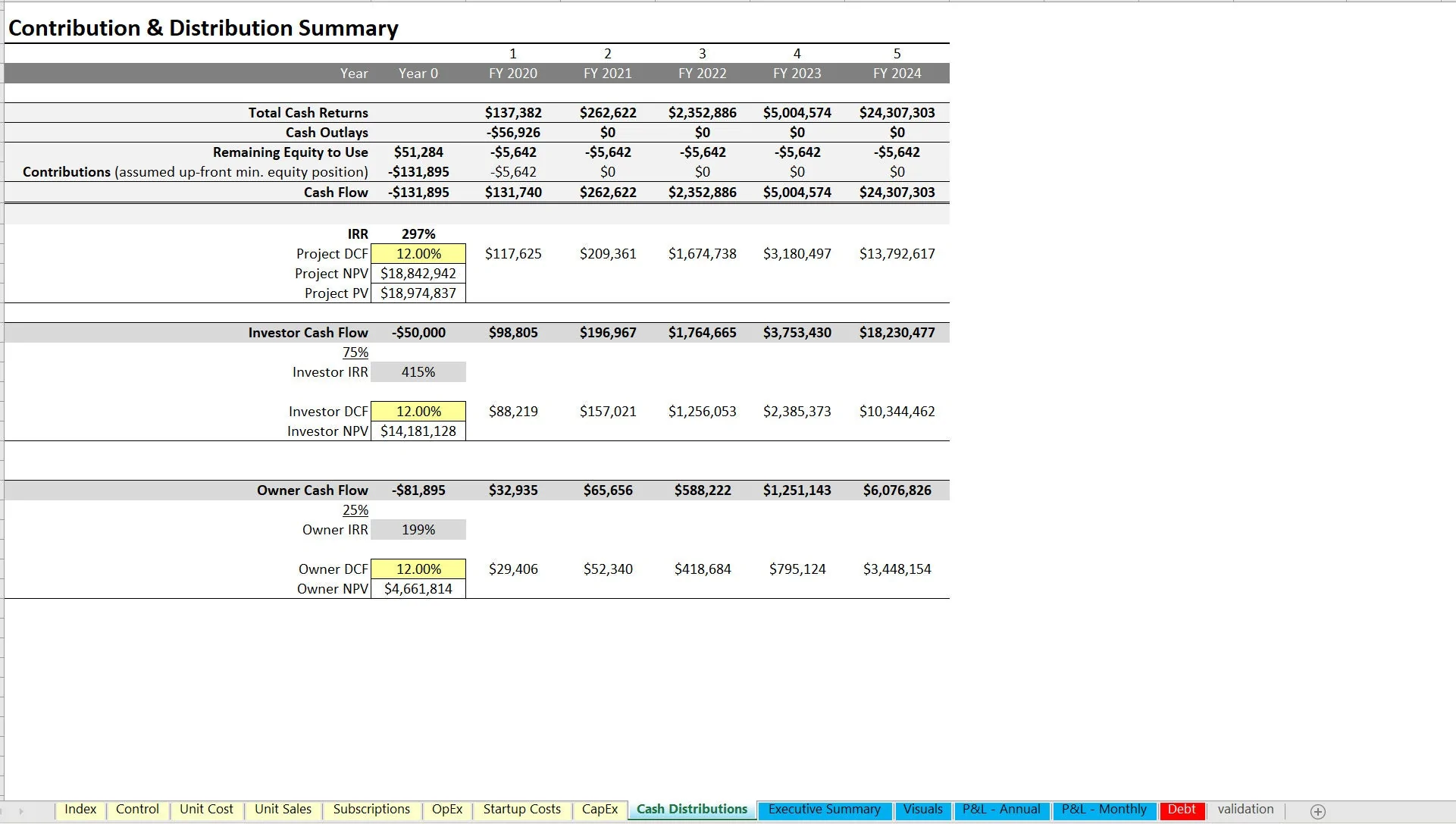

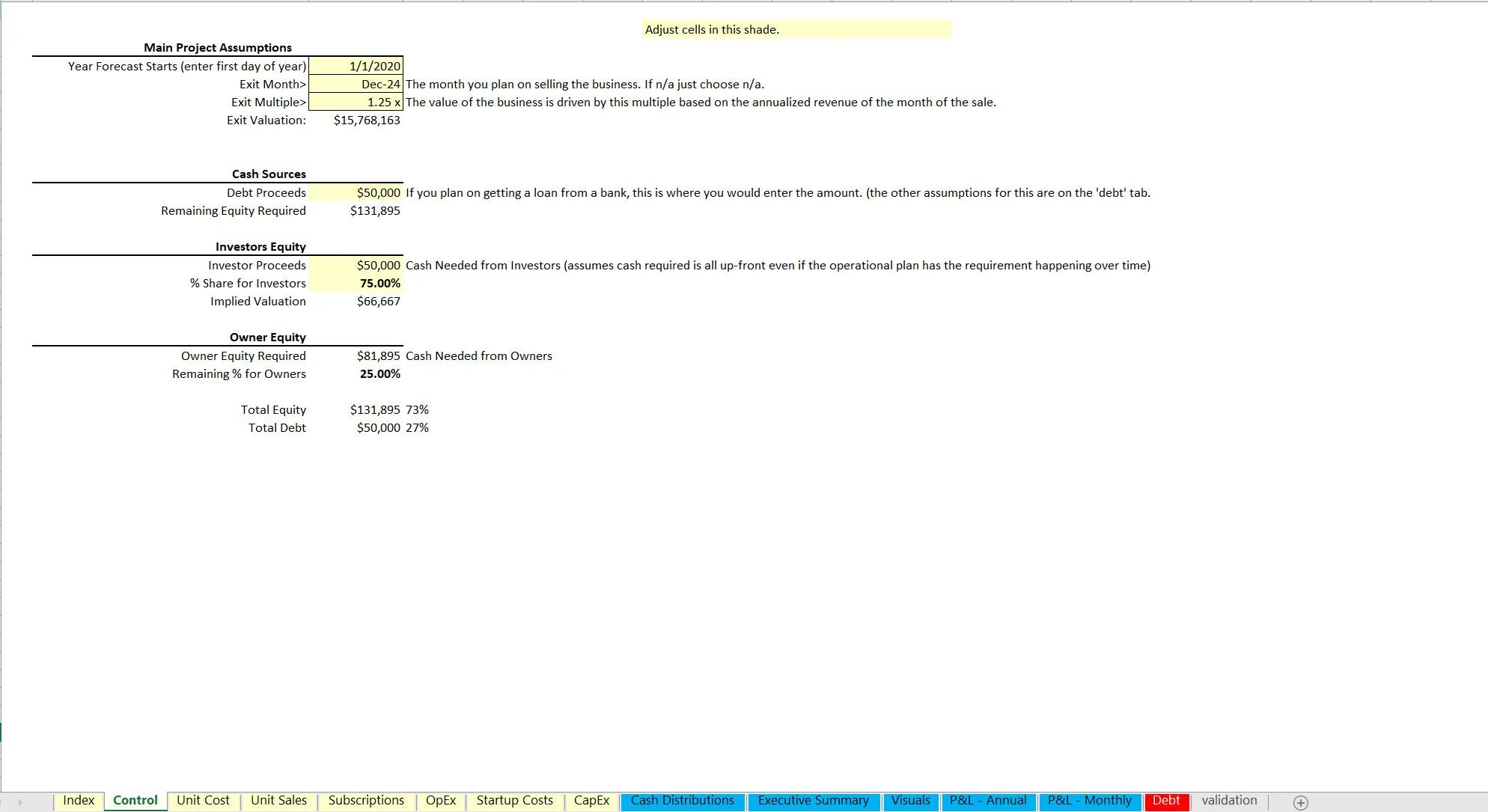

An Executive Summary shows all the high level financial line items on an annual basis as well as IRR/ROI/equity multiple on the project level / investor level / owner equity level, spending on how funding / exit were configured. A cash distribution / DCF Analysis also was built on its own tab for each. Lots of visuals and traditional SaaS KPIs are displayed.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Subscription, Integrated Financial Model Excel: Product & Service Subscription: Startup Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping