Wind Farm Financial Feasibility Study Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Financial feasibility framework for understanding the economics of starting a wind turbine farm.

ENERGY INDUSTRY EXCEL DESCRIPTION

The economics of a wind farm involve various factors, including initial investment, operating costs, revenue generation, and externalities. Understanding these elements is crucial to evaluate the financial viability and overall impact of a wind farm project.

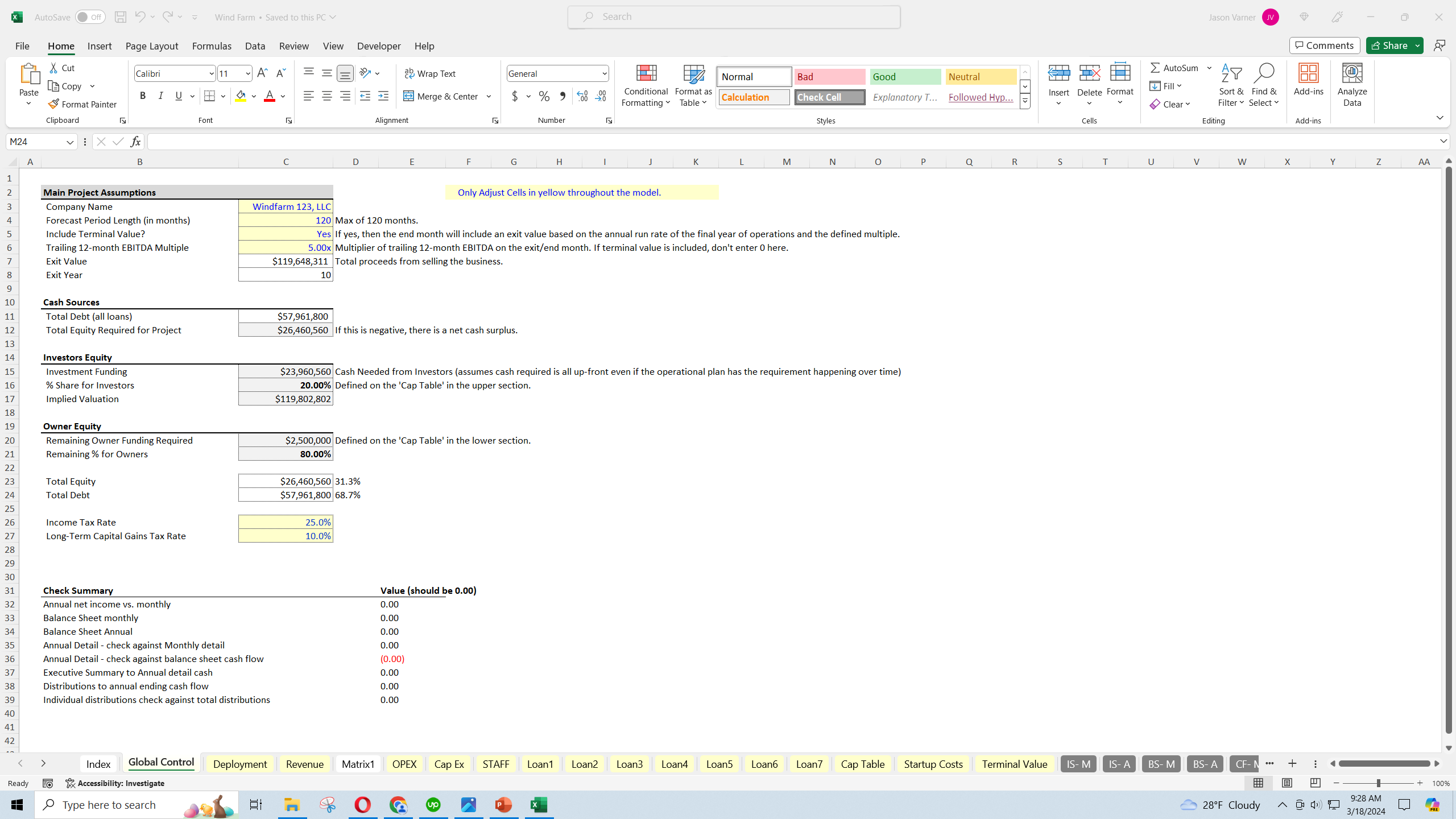

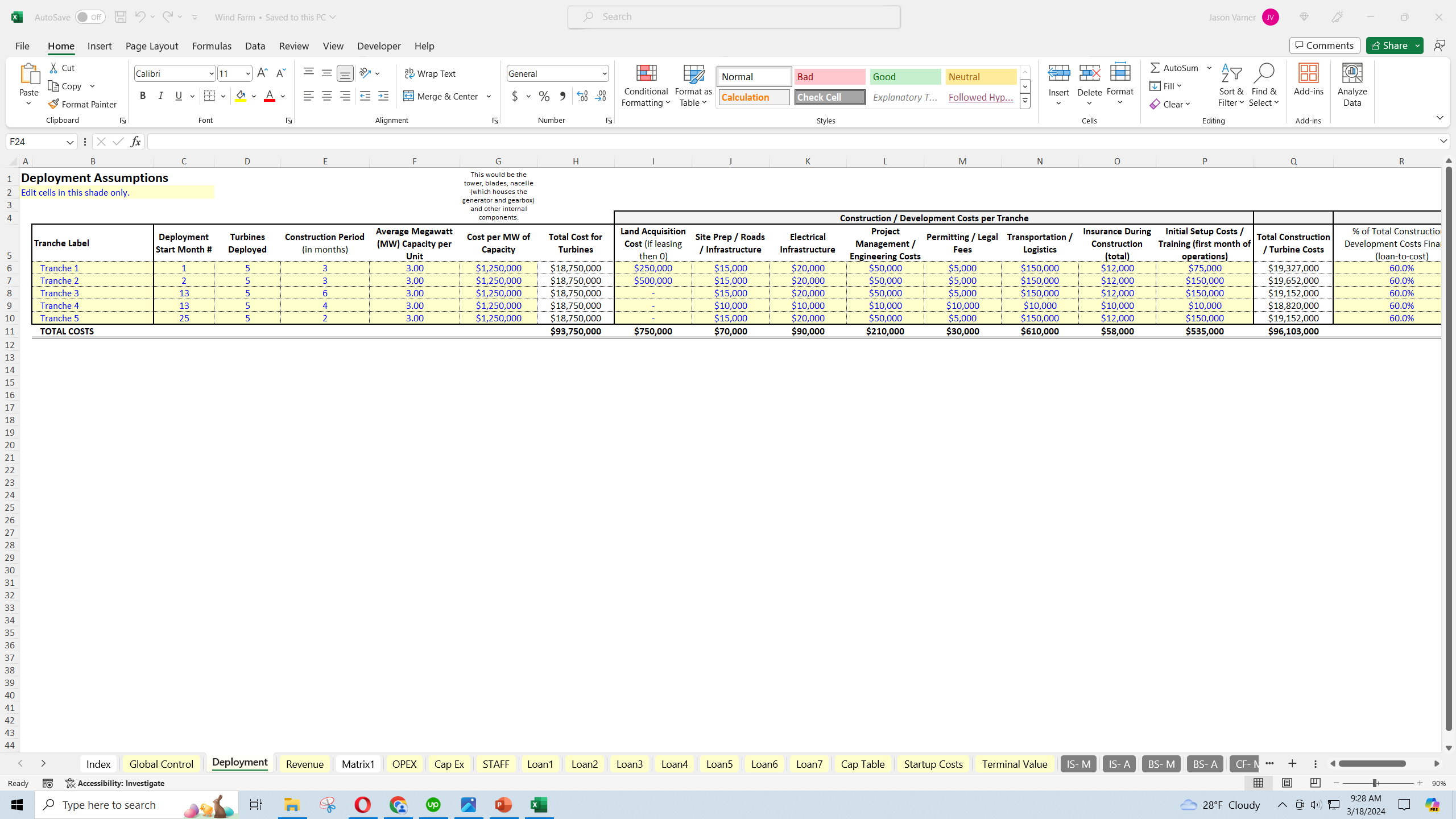

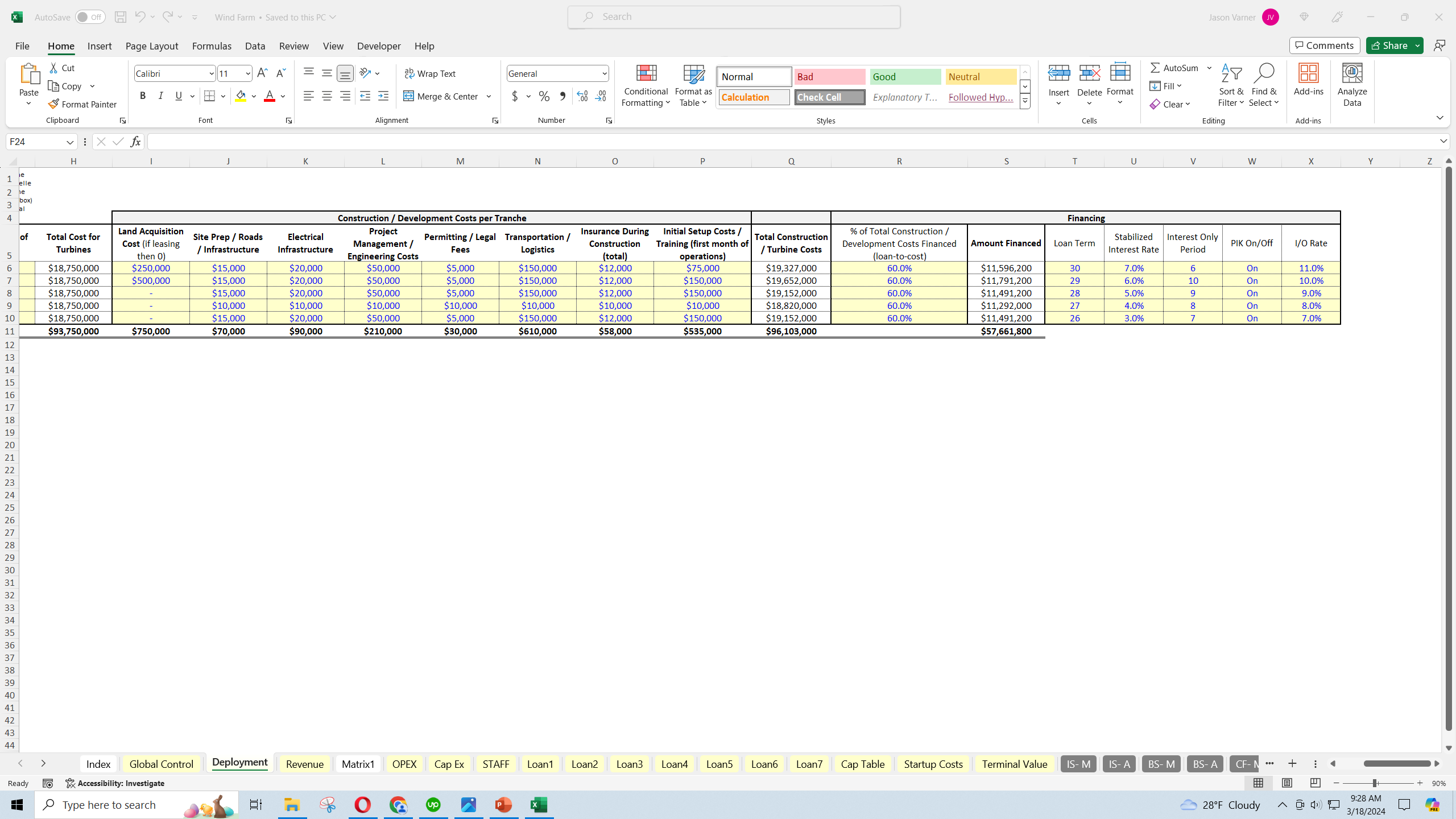

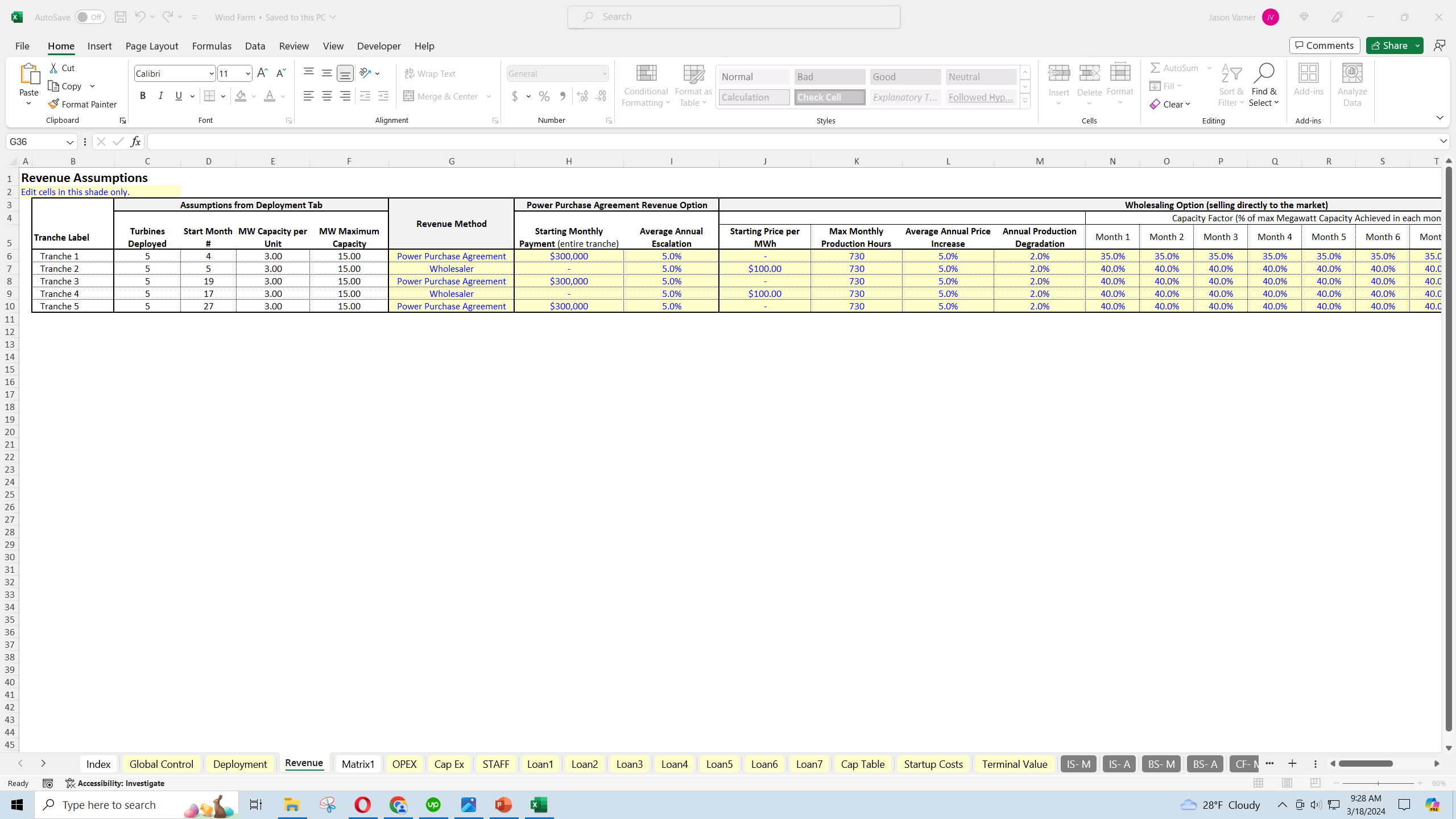

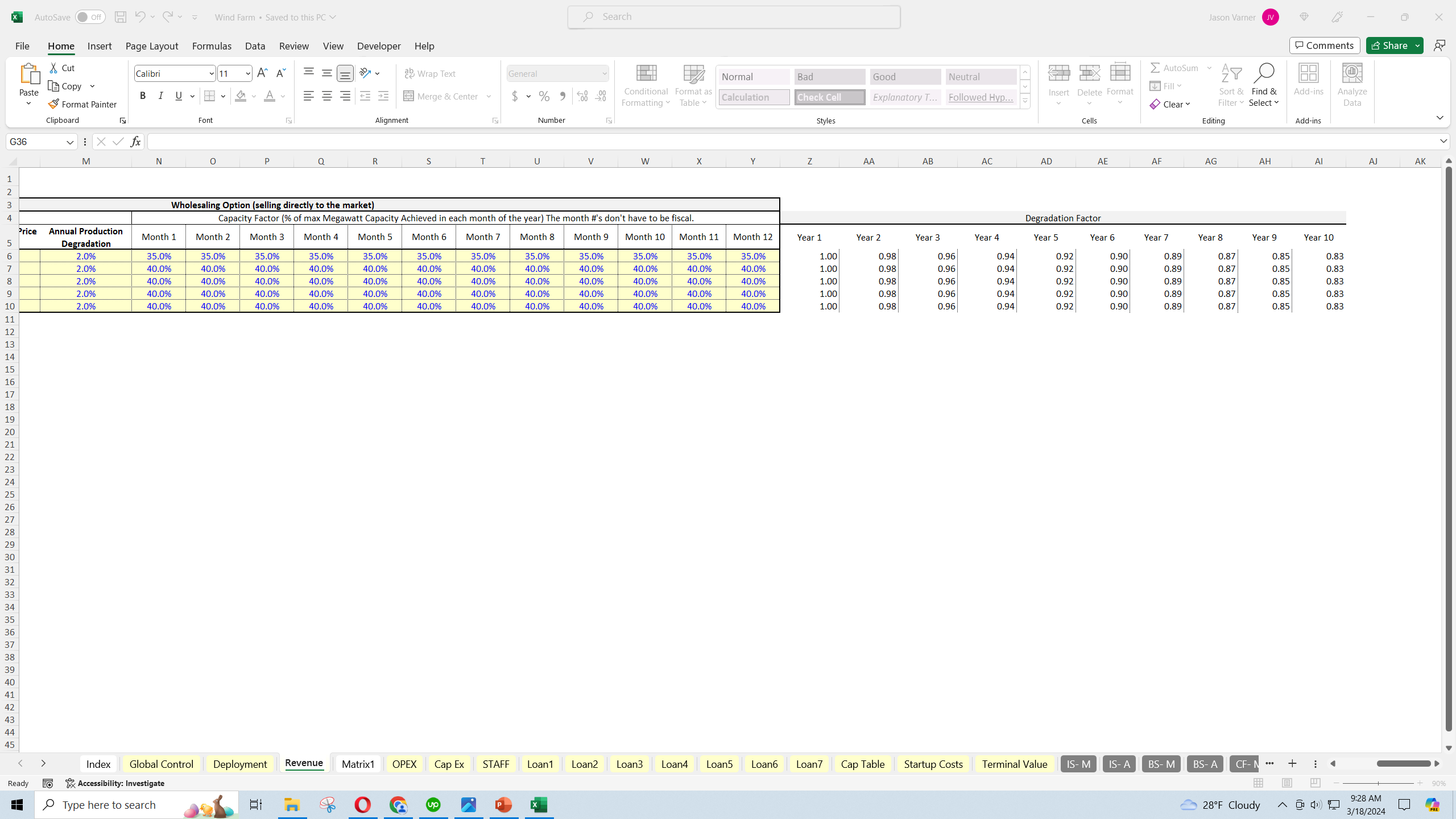

This template was designed to account for all the below aspects and runs for up to a 120 month period and has a terminal value option. It also allows for up to 5 wind turbine deployment tranches, each with their own specification inputs. Final output reports include a DCF Analysis, IRR, option for joint venture / investors, and a fully integrated 3 statement model.

Initial Investment and Capital Costs

Land Acquisition or Lease: Depending on the location, wind farms require significant land to ensure adequate spacing between turbines to prevent airflow disruption.

Turbines and Installation: The most substantial cost. The price of turbines varies based on size, manufacturer, and technology. Installation costs include transportation, construction, and electrical infrastructure to connect the turbines to the power grid.

Permitting and Legal Fees: Costs associated with obtaining necessary permits, environmental impact assessments, and any legal challenges that may arise.

Financing Costs: Interest on loans or the cost of raising capital through other means, which can vary significantly based on the project's perceived risk and economic conditions.

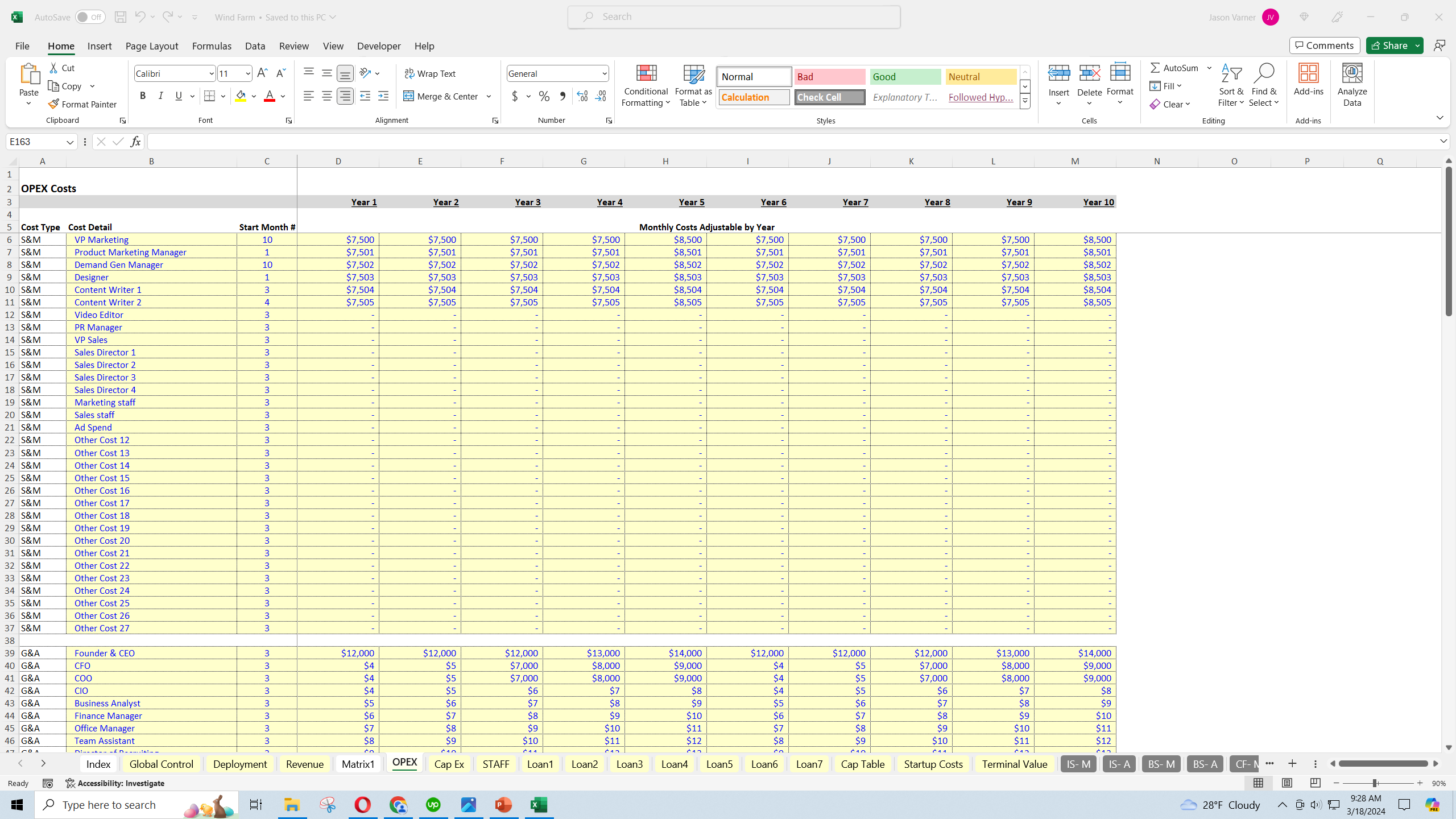

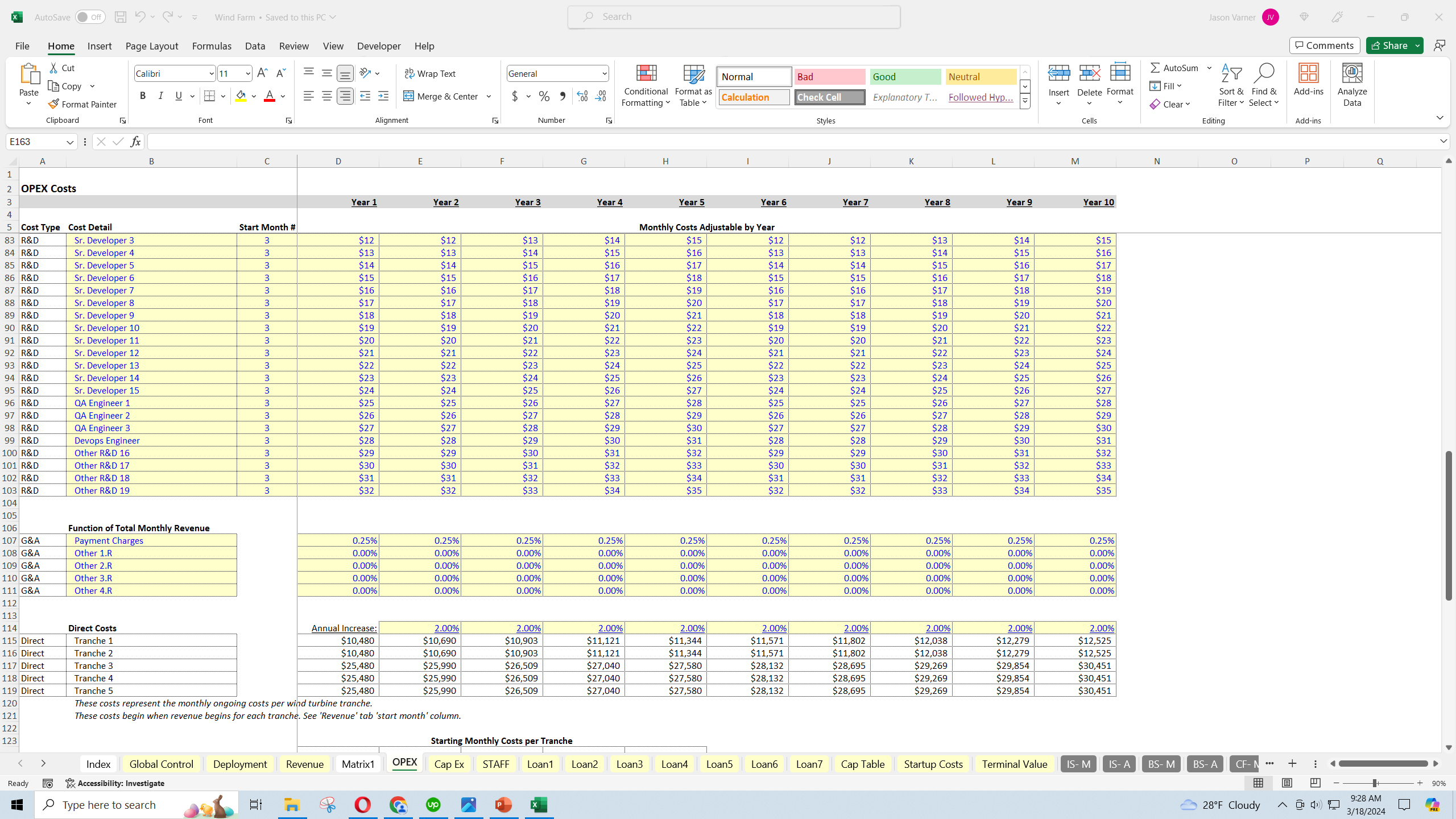

Operating and Maintenance Costs

Routine Maintenance and Repairs: Regular inspections, maintenance of moving parts, and occasional repairs. These costs tend to be relatively low per unit of electricity generated compared to fossil fuel plants.

Land Lease Payments: Ongoing payments if the land is leased rather than owned.

Insurance: Protection against potential damages from storms, lightning, or other risks.

Administration: Costs related to the management of the wind farm, including payroll, utilities, and office expenses.

Revenue Generation

Electricity Sales: Wind farms generate revenue by selling electricity. This can be through long-term power purchase agreements (PPAs) at a fixed price, selling into the wholesale electricity market at fluctuating prices, or a combination of both. This model has both options available to configure for each tranche.

Government Incentives: Many countries offer tax incentives, subsidies, or feed-in tariffs to encourage renewable energy production. These can significantly affect the economic viability of wind projects. I included 3 optional income streams that can be used for things like renewable energy credits, government subsidies, and other ancillary service revenue.

Externalities and Economic Benefits

Environmental Benefits: Wind energy produces no greenhouse gas emissions during operation, contributing to climate change mitigation efforts. These positive externalities, however, are often not directly accounted for in financial models but can influence government support.

Job Creation: The construction and operation of wind farms create jobs, contributing to local economies.

Energy Security: By diversifying the energy mix and using a local resource, wind energy can enhance a region's energy security and reduce dependence on imported fuels.

Challenges and Risks

Variability of Wind: The unpredictability of wind speeds can affect electricity generation and, consequently, revenue. Advanced forecasting methods and grid integration strategies are vital to managing this variability.

Technological Risk: The risk that newer, more efficient technologies could make existing turbines obsolete or less competitive.

Market Risk: Fluctuations in electricity prices can impact revenue, especially for projects selling into the wholesale market.

Conclusion

The economics of a wind farm are complex and influenced by a wide range of factors from upfront capital costs to market and regulatory environments. This template give the user a clear framework to quantify every aspect of the business. While the initial investment is high, the operational costs are relatively low, and the environmental benefits are significant. Economic viability often depends on the specific location, government policies, and technological advancements. As renewable energy technologies evolve and the global community continues to prioritize sustainability, the economics of wind farms are likely to become increasingly favorable.

Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Energy Industry, Renewable Energy, Wind Energy, Integrated Financial Model Excel: Wind Farm Financial Feasibility Study Template Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping