Multifamily Acquisition Model: 10 Years & Joint Venture Capable (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

REAL ESTATE EXCEL DESCRIPTION

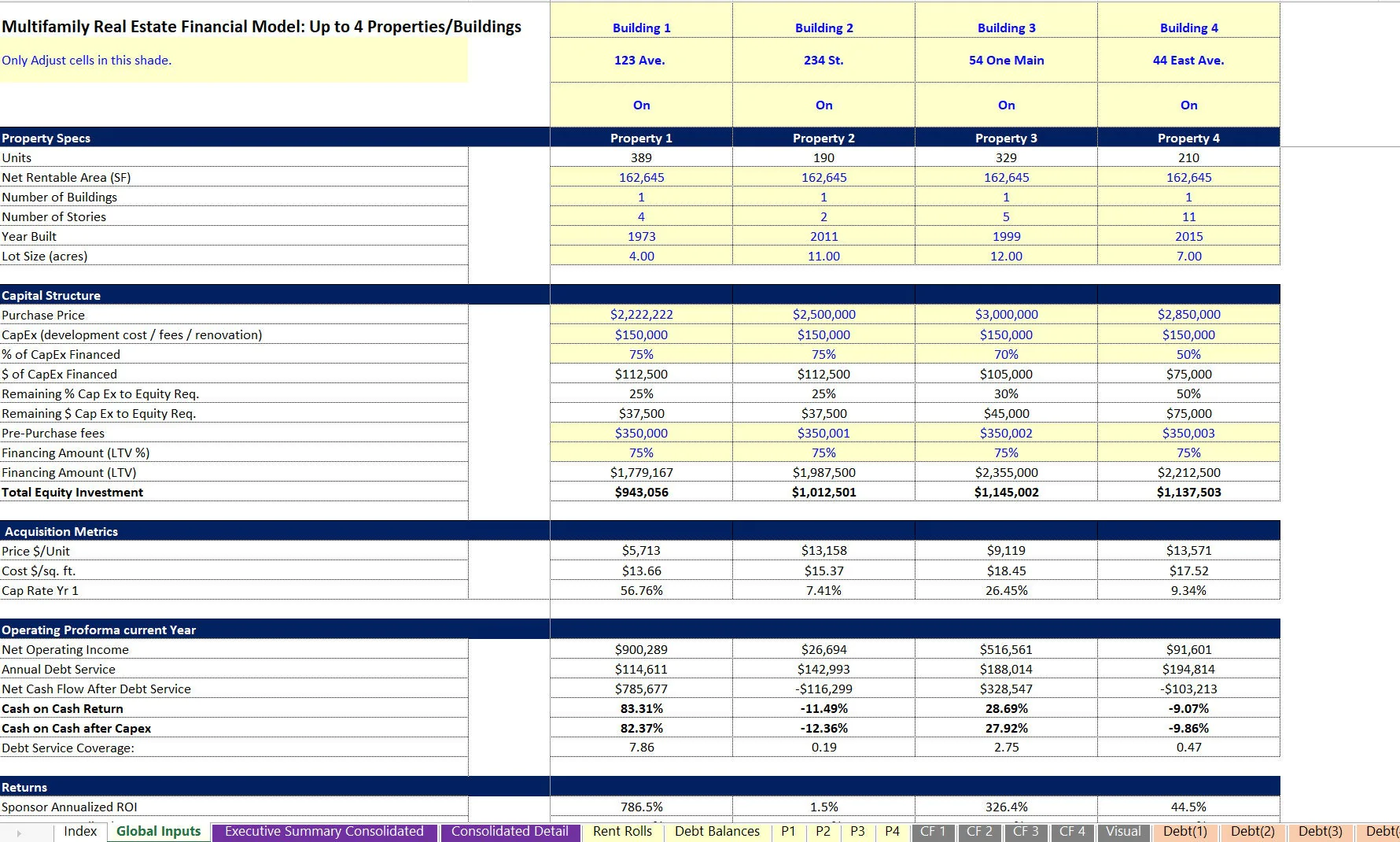

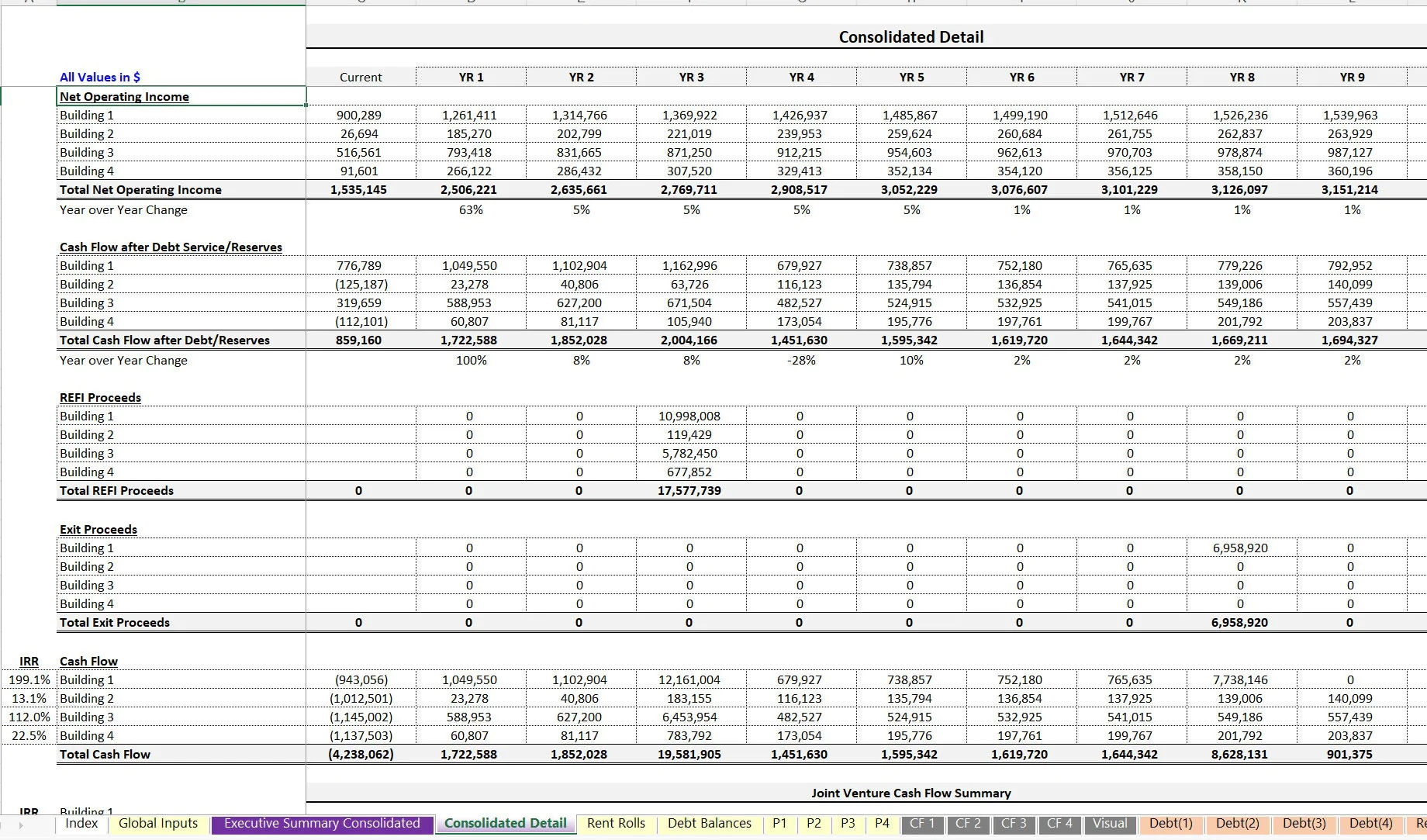

Recently updated to handle up to four properties at once and added a DCF Analysis with NPV (net present value) for both the Limited Partner and General Partner on a consolidated view and for each individual property. The single property version is also included in the download.

Investing in multifamily real estate will always start with a financial model. This is an annual only template designed for pure acquisitions, the operation of a given acquisition for up to 10 years, potential refinance, and potential exit.

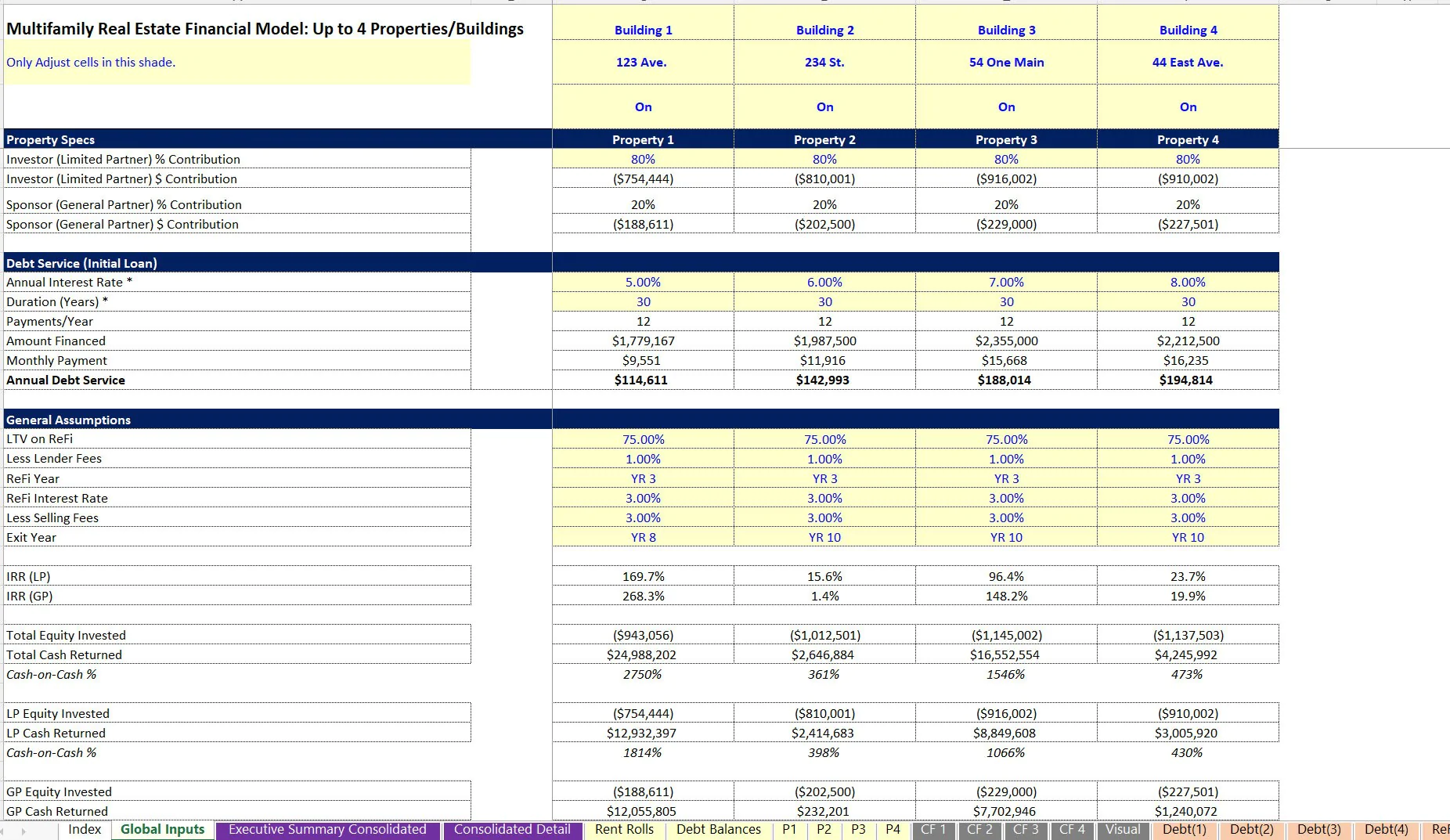

It has all the logic needed to plan out a joint venture with traditional Sponsor (GP) / Investor (LP) financing and distributions with an IRR Hurdle waterfall return schedule.

Assumptions Include:

• Capital Structure

• Purchase Price

• CapEx -

• % of CapEx Financed

• Remaining CapEx to Equity Requirement

• Pre-Purchase fees

• Financing Amount (LTV %)

• Equity Contribution by Sponsor / Investor

• Initial Loan Terms (if applicable)

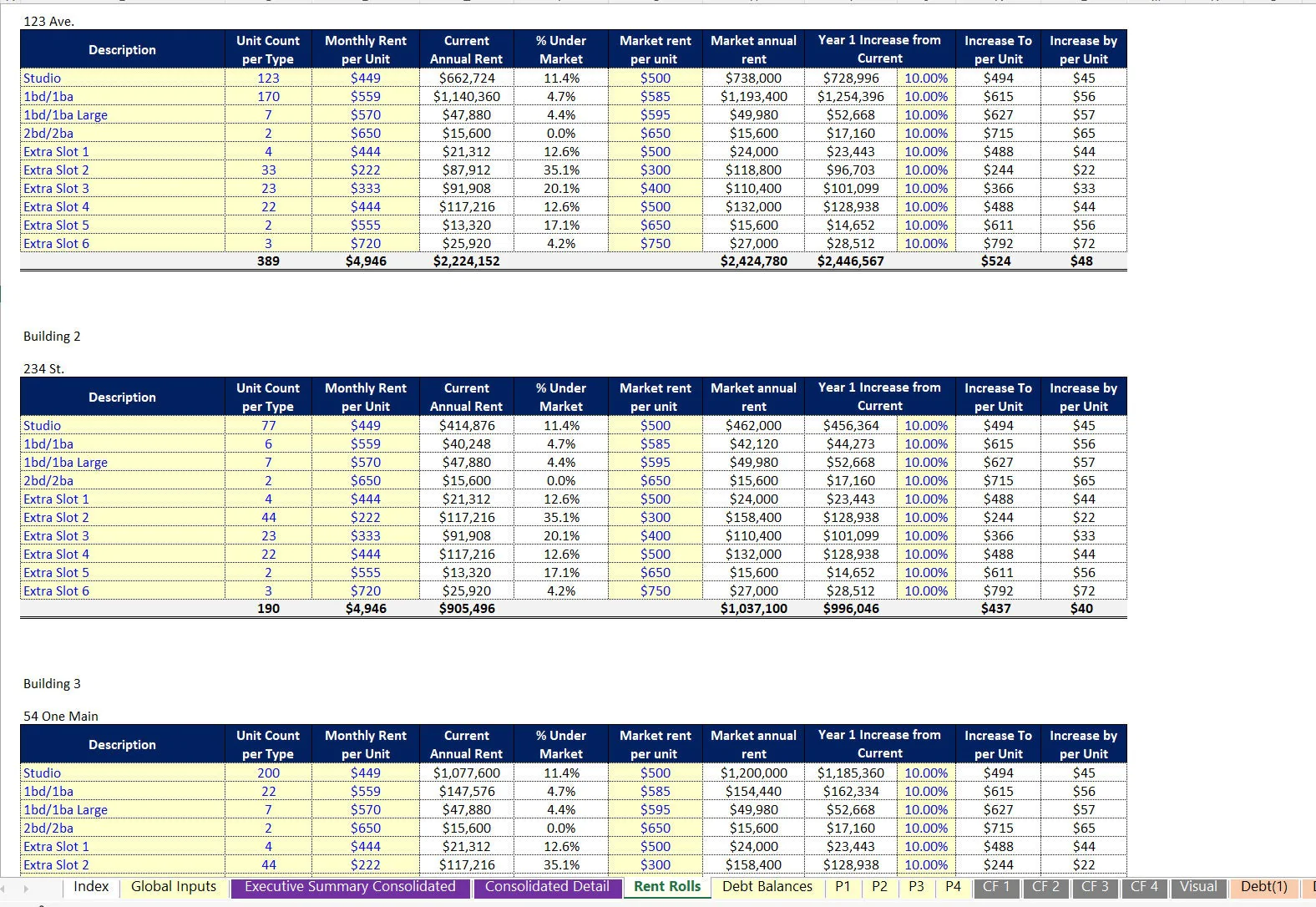

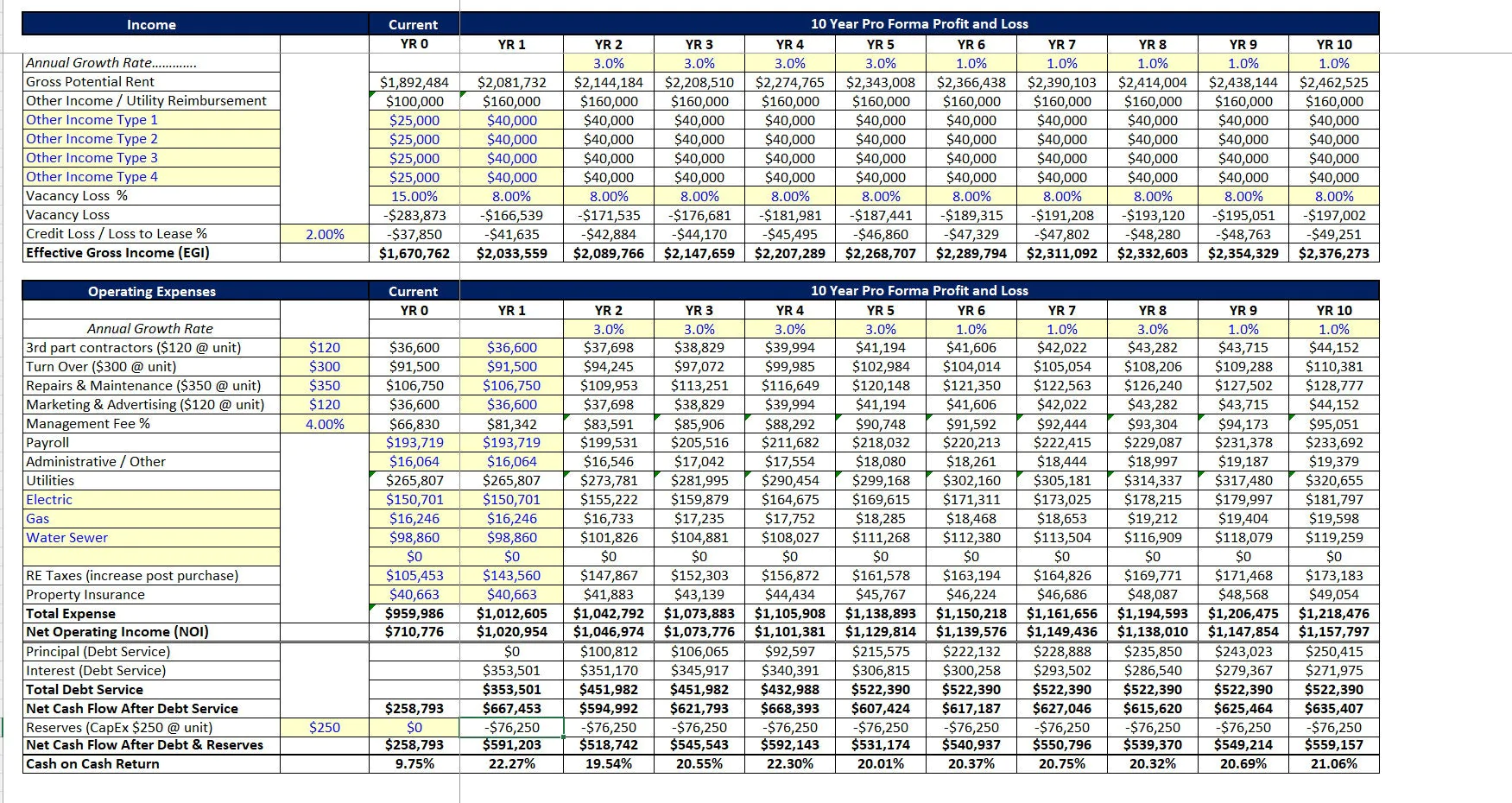

• Rent Rolls

Up to 5 bedroom types, each defined by…

• Unit count (Input)

• Monthly Rent per Unit (Input)

• Current Annual Rent

• % Under market

• Market Rent per Unit (Input)

• Market Annual Rent

• Year 1 Rent Increase from Current (Input)

• New Per Unit Rent

• Per Unit Increase Pro Forma

• Annual Rent growth rate (per year)

• Ancillary Income (up to 4 slots)

• Vacancy per Year

• Loss to Lease / Credit Loss

Starting OpEx and Yearly Growth...

• 3rd party contractors

• Turn Over

• Repairs & Maintenance

• Marketing & Advertising

• Management Fee %

• Payroll

• Admin / other

• Utilities (up to 4 slots)

• RE Taxes

• Property Insurance

• Reserve per unit Debt / Exit

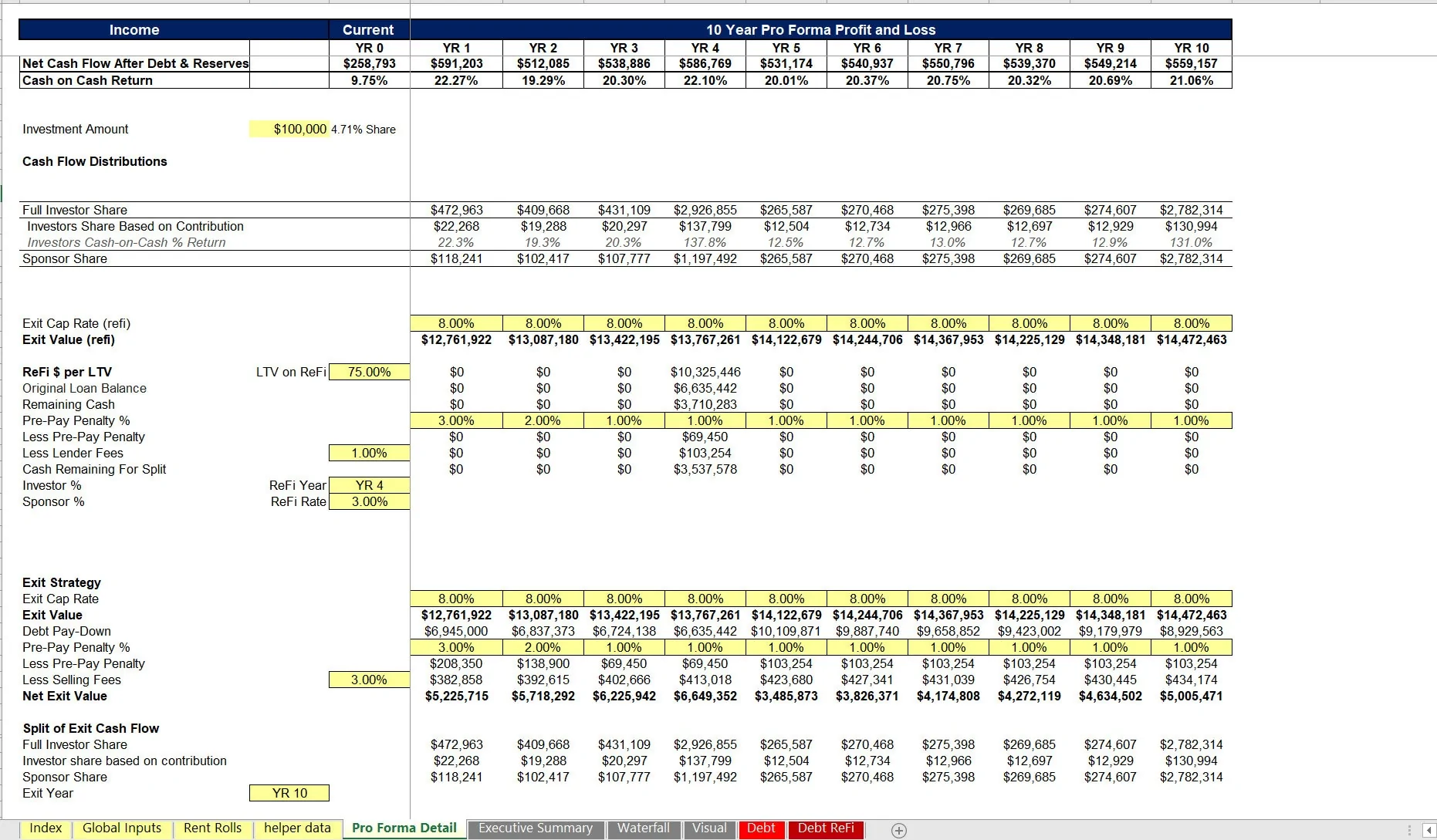

Loan Financing Assumptions

• Exit Cap Rate for Refi

• LTV on Refi

• Prepay penalty if applicable

• Lender Fees

• Refi year

• Refi amortization rate

• Interest Only Period for Initial Loan

• Interest Only Period for Initial Loan

Exit Assumptions

• Final Exit cap rate (selling)

• Exit year

• Interest Only Period for Initial Loan

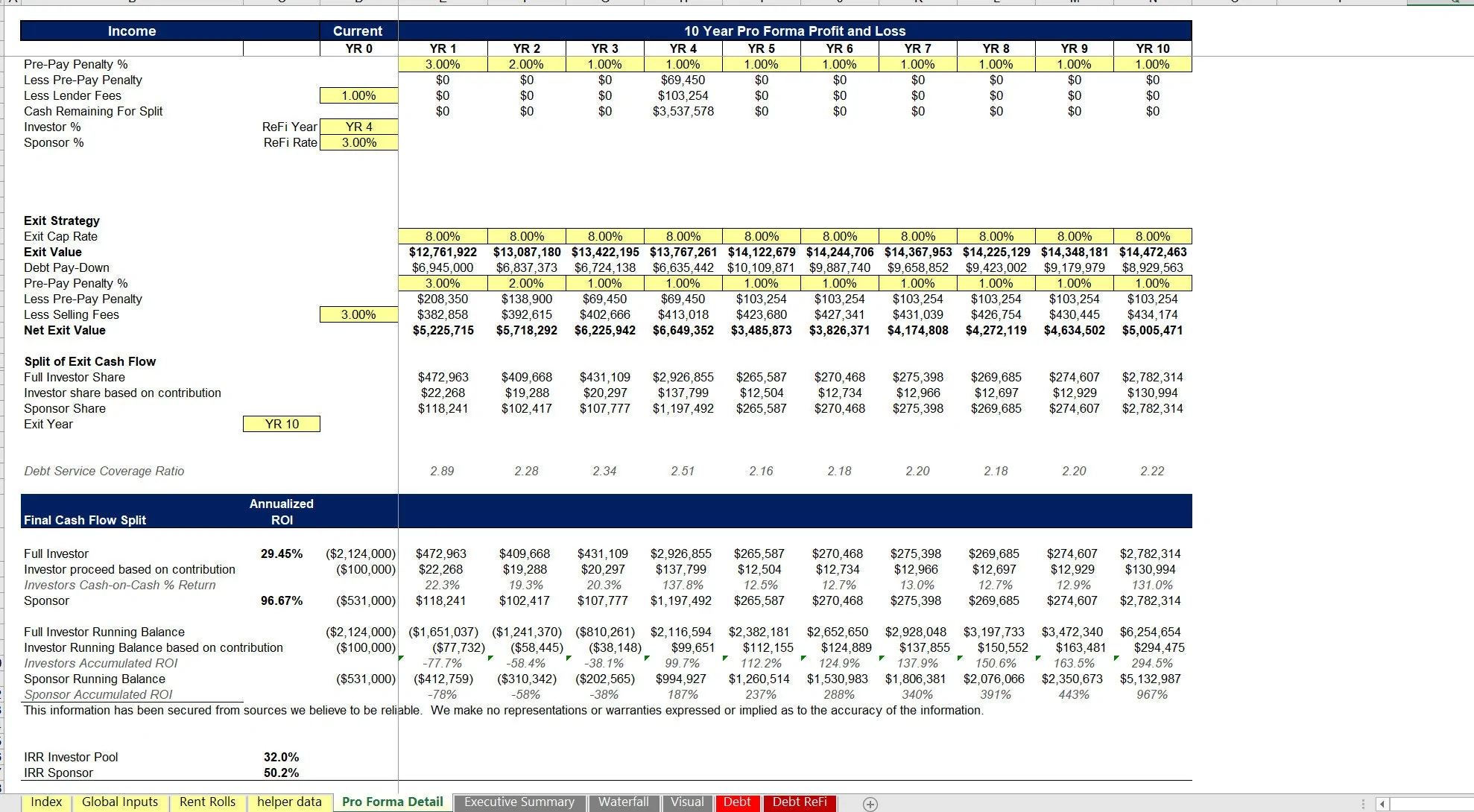

• Waterfall Distributions

• IRR Hurdle Rates

• Cash Distribution Splits per Hurdle

Final output report includes an annual Executive Summary showing key financial line items and investor / sponsor contributions / distributions per period. Also, there are a few switches that override the detailed income and expenses. This means if you want to do a quicker analysis, you don't have to define each of the rent rolls individually or expenses and rather just define the total rent / growth and total expenses / growth.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Multifamily Acquisition Model: 10 Years & Joint Venture Capable Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping