Seller Financing Amortization Schedule with Tax Logic (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Cash Flow Analysis

- User-friendly

- Includes Tax Impact

EXCEL DESCRIPTION

Seller financing, also known as owner financing, is a real estate transaction where the seller provides financing to the buyer rather than the buyer obtaining a traditional mortgage from a bank or other lending institution. In a seller financing arrangement, the seller acts as the lender and allows the buyer to make payments on the property over time.

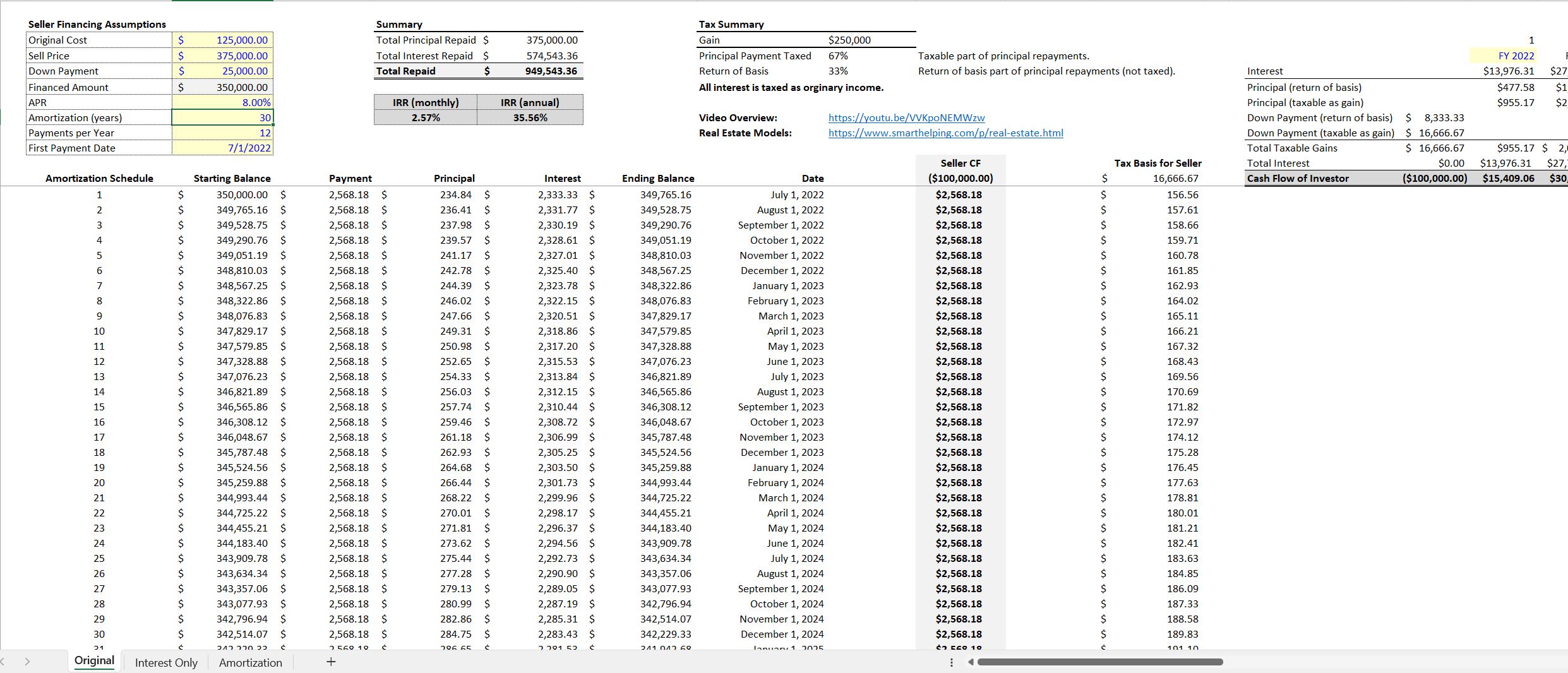

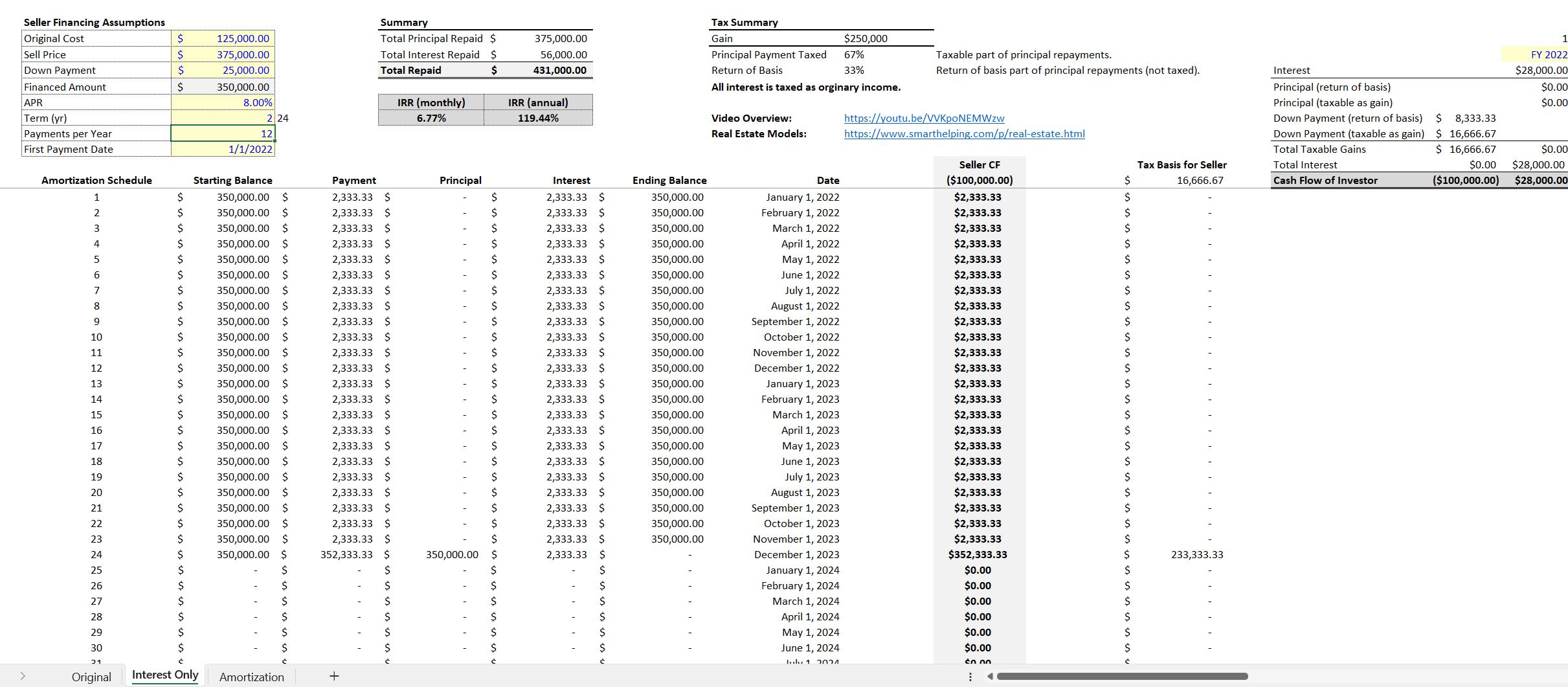

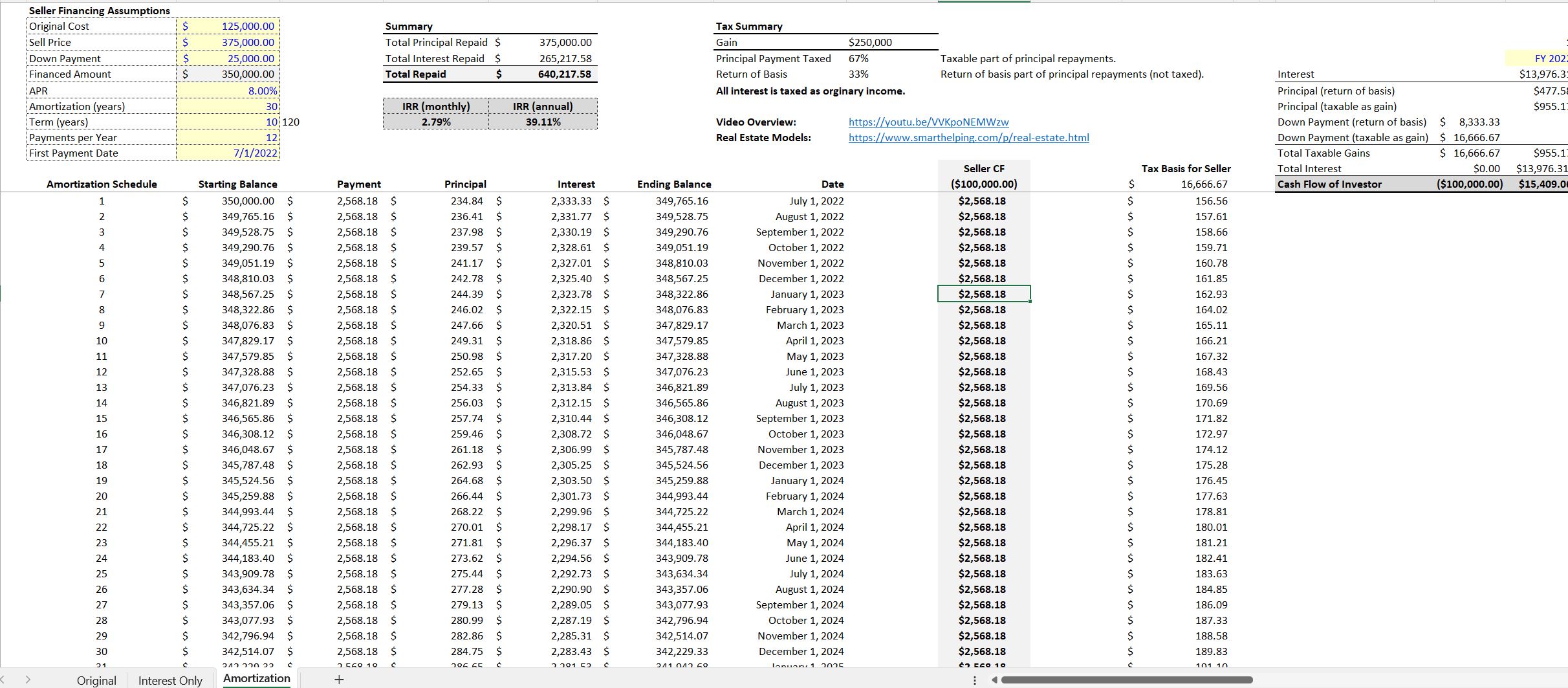

This model has three separate types of loans that can be analyzed: Interest-only with a bullet payment at the end of term, regular p+i amortization, and p+i amortization with an early term ending date.

The terms of seller financing are typically negotiated between the buyer and seller and can include the loan amount, interest rate, repayment period, and any other conditions of the loan. The seller may require a down payment from the buyer, and the buyer will typically make monthly payments to the seller until the loan is paid off.

One potential advantage of seller financing is that it can provide an option for buyers who may not qualify for traditional financing due to factors such as a low credit score or limited cash reserves. It can also benefit sellers by allowing them to sell their property more quickly and potentially at a higher price than if they were to sell through a traditional sale.

In terms of tax implications, both the buyer and seller should be aware of the potential tax consequences of a seller financing arrangement. The seller will need to report any interest income received from the buyer's payments as taxable income. The seller may also be subject to capital gains tax on the sale of the property, depending on how long they have owned the property and other factors.

For the buyer, the interest paid on the seller financing loan may be tax deductible as mortgage interest, similar to a traditional mortgage. However, the buyer should consult with a tax professional to understand their specific tax situation.

Overall, seller financing can be a viable option for both buyers and sellers in certain circumstances, but it is important to carefully consider the terms of the loan and understand the potential tax implications before entering into an agreement.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Seller Financing Amortization Schedule with Tax Logic Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Real Estate Underwriting Templates / Deal Analyzers

This bundle contains 31 total documents. See all the documents to the right.